The Australia Healthcare Insurance Market size was valued at USD 26.51 Billion in 2023. The total Australian healthcare Insurance Market revenue is expected to grow at a CAGR of 9.2 % from 2023 to 2030, reaching nearly USD 49.09 Billion in 2030.Australia Healthcare Insurance Market

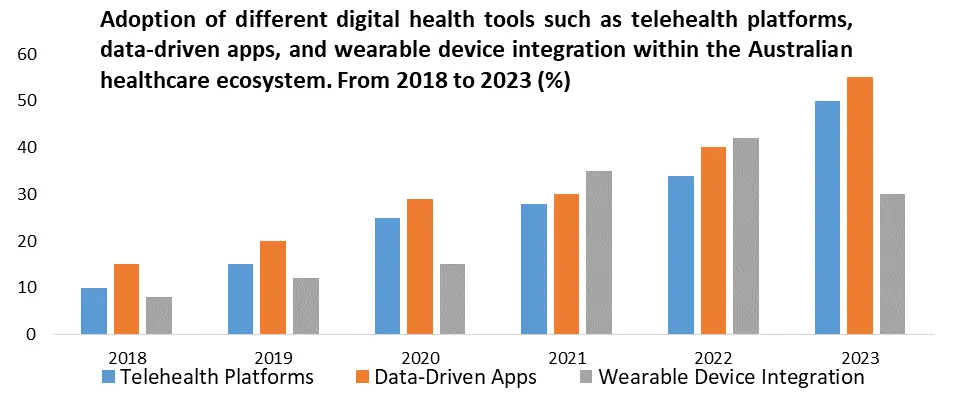

The MMR Comprehensive research report aims to offer a complete examination of significant factors influencing the Australia Healthcare Insurance Market landscape. In Australia, digital health technologies such as telemedicine, wearable devices, and data-driven health tools provide promising growth opportunities. The growing focus on preventative care and wellness initiatives creates opportunities for investing in related services and technologies. Designing specialty insurance policies based on certain demographics and health needs has the potential to attract new categories of customers. Prioritizing technology infrastructure updates, such as updating IT systems and improving data analytics capabilities, is crucial for increasing operational efficiency and maintaining a competitive advantage. Collaborations with healthcare providers, as well as the implementation of outcomes-based payment models in value-based care, offer new investment prospects in Australia's healthcare sector. The average profit margin in the healthcare insurance market is around 13%, with variances depending on provider and plan type. Insurance negotiates a turbulent investing environment, which affects profitability and demands smart investment methods. Rising healthcare expenses and regulatory changes put pressure on margins, leading to cost-cutting measures to retain profitability.

Private health funds invest heavily in preventative care initiatives, with over $500 million spent annually on wellness programs in Australia. Demand for coverage of complementary and alternative medicine (CAM) practices is growing, with over 50% of Australians using CAM therapies. Over 1 million Australians participate in employer-sponsored wellness programs. Over 260,000 people work directly in the healthcare insurance industry in Australia, with GKV funds and private insurers as major employers. To know about the Research Methodology :- Request Free Sample Report Rise of Alternative Insurance Models in Australia The Australian healthcare sector has begun to move towards innovative insurance models that aim at fixing cost concerns while improving health outcomes. Innovative healthcare models in Australia provide potential for cost savings by focusing on quality, efficiency, and preventive interventions while reducing unnecessary operations. These approaches, which prioritize collaborative care and data-driven insights, can improve health outcomes through the adoption of coordinated care plans and early intervention for chronic diseases. Telehealth and digital technologies help to enhance access to care, especially for people in distant places. Patient engagement empowers consumers, promotes health literacy, and supports responsible healthcare consumption, all of which contribute to Australia's healthy healthcare landscape. Australia is an industry leader in value-based care, with a 2030 goal of tying primary care funding to performance at XX%. Telehealth consultations increased by 300% during the COVID-19 epidemic and are anticipated to stay popular. Health Savings Accounts (HSAs) are expected to contribute XX% of total private health insurance premiums by 2030.

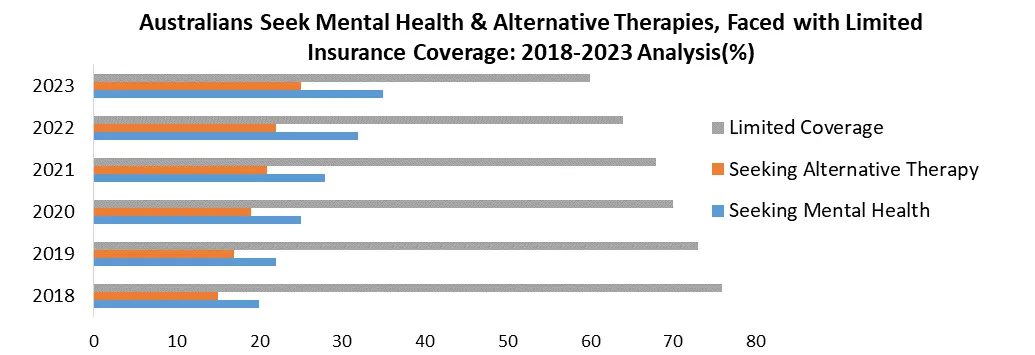

Challenges in Covering Mental Health in Australia

Consumer discontent stems from poor mental health coverage, which is expected to lead policyholders to seek alternative healthcare options and reevaluate their insurance selections. Ignoring mental health concerns exacerbates physical health issues, putting an additional strain on public healthcare resources and increasing hospital care demand. The lack of comprehensive mental health care leads to missed opportunities for prevention and early intervention, resulting in delayed diagnosis, increased symptoms, and lower effectiveness of therapy. Ultimately, these variables contribute to increased healthcare expenditures, underlining the critical need to address mental health coverage gaps in the Australian healthcare insurance environment. 1. According to MMR Analysis, one in four adults experiences mental illness in Australia. 2. The economic cost of mental illness in Australia is estimated to be over $60 billion annually

Australia Healthcare Insurance Market Segment Analysis

By Health Insurance Plans, the Health Maintenance Organization (HMO) segment accounts for an estimated XX% of the overall Australian Healthcare Insurance Market. Health Maintenance Organizations (HMOs) offer a low-cost option with competitive premiums, making them desirable to those with limited financial resources. HMOs encourage preventative care including mandating GP visits and coordinated care plans, which allows for early disease detection and cost-effective management. HMOs encourage primary care utilization, which streamlines services, reduces unnecessary specialist referrals, and relieves hospital burden. HMOs increase quality and efficiency by establishing criteria for network providers, increasing patient satisfaction while reducing the risk of unneeded operation.Australia Healthcare Insurance Market Scope: Inquiry Before Buying

Australia Healthcare Insurance Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 26.51 Bn. Forecast Period 2024 to 2030 CAGR: 9.2% Market Size in 2030: US $ 49.09 Bn. Segments Covered: by Provider Private Public by Health Insurance Plans Exclusive Provider Organization (EPO) Point of Service (POS) High Deductible Health Plan (HDHP) Health Maintenance Organization (HMO) by Demographics Adults Seniors Minors by End-Users Individuals Corporates Key Players in the Australia Healthcare Insurance Market

1. HBF 2. Westfund 3. HCF 4. Bupa 5. Medibank 6. Australian Unity. 7. Nib 8. Ahm 9. Australian Prudential Regulation AuthorityFAQs:

1. What does Medicare cover in Australia? Ans. Medicare covers essential medical services, including doctor visits, hospital stays in public hospitals, and some surgical procedures. However, it may not cover all medical costs, and individuals may still incur out-of-pocket expenses. 2. What does private health insurance cover in Australia? Ans. Private health insurance in Australia provides coverage for services not fully covered by Medicare, such as elective surgeries, dental care, and optical services. It also allows individuals to choose their preferred doctor and have shorter waiting times for certain treatments. 3. What is the projected market size & and growth rate of the Australian healthcare insurance Market? Ans. The Australian healthcare insurance Market size was valued at USD 26.51 Billion in 2023. The total Australian healthcare insurance market revenue is expected to grow at a CAGR of 9.2% from 2023 to 2030, reaching nearly USD 49.09 Billion by 2030.

1. Australia Healthcare Insurance Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Australia Healthcare Insurance Market: Dynamics 2.1. Australia Healthcare Insurance Market Trends 2.2. PORTER’s Five Forces Analysis 2.3. PESTLE Analysis 2.4. Value Chain Analysis 2.5. Regulatory Landscape of Australia Healthcare Insurance Market 2.6. Technological Advancements in the German Healthcare Insurance Market 2.7. Factors Driving the Growth of the Healthcare Insurance Market in Australia 2.8. Evolution of Healthcare Insurance in Australia 2.9. Digital Health Integration 2.10. Focus on Preventive Care 2.11. Shifting Insurance Models 2.12. Public Health Insurance Providers 2.13. Average Profit Margin Analysis of Australia health insurance market 2.14. Trends in Insurance Plan Selection 2.15. Impact of Digital Health Adoption 2.16. Key Opinion Leader Analysis for the German Healthcare Insurance Industry 2.17. Australia Healthcare Insurance Market Price Trend Analysis (2022-23) 3. Australia Healthcare Insurance Market: Market Size and Forecast by Segmentation for (by Value in USD Billion) (2023-2030) 3.1. Australia Healthcare Insurance Market Size and Forecast, by Provider (2023-2030) 3.1.1. Private 3.1.2. Public 3.2. Australia Healthcare Insurance Market Size and Forecast, by Health Insurance Plans (2023-2030) 3.2.1. Exclusive Provider Organization (EPO) 3.2.2. Point of Service (POS) 3.2.3. High Deductible Health Plan (HDHP) 3.2.4. Health Maintenance Organization (HMO) 3.3. Australia Healthcare Insurance Market Size and Forecast, by Demographics (2023-2030) 3.3.1. Adults 3.3.2. Seniors 3.3.3. Minors 3.4. Australia Healthcare Insurance Market Size and Forecast, by End-Users(2023-2030) 3.4.1. Individuals 3.4.2. Corporates 4. Australia Healthcare Insurance Market: Competitive Landscape 4.1. MMR Competition Matrix 4.2. Competitive Landscape 4.3. Key Players Benchmarking 4.3.1. Company Name 4.3.2. Product Segment 4.3.3. End-user Segment 4.3.4. Revenue (2023) 4.4. Market Analysis by Organized Players vs. Unorganized Players 4.4.1. Organized Players 4.4.2. Unorganized Players 4.5. Leading Australia Healthcare Insurance Market Companies, by market Capitalization 4.6. Market Trends and Challenges in Australia 4.6.1. Technological Advancements 4.6.2. Affordability and Accessibility 4.6.3. Shortage of Skilled Professionals 4.7. Market Structure 4.7.1. Market Leaders 4.7.2. Market Followers 4.7.3. Emerging Players in the Market 4.7.4. Challenges 4.7.5. Mergers and Acquisitions Details 5. Company Profile: Key Players 5.1. HBF 5.1.1. Company Overview 5.1.2. Business Portfolio 5.1.3. Financial Overview 5.1.4. SWOT Analysis 5.1.5. Strategic Analysis 5.1.6. Details on Partnership 5.1.7. Private Health Insurance Companies 5.1.8. Potential Impact of Emerging Technologies 5.1.9. Regulatory Accreditations and Certifications Received by Them 5.1.10. Strategies Adopted by Key Players 5.1.11. Recent Developments 5.2. Westfund 5.3. HCF 5.4. Bupa 5.5. Medibank 5.6. Australian Unity. 5.7. Nib 5.8. Ahm 5.9. Australian Prudential Regulation Authority 6. Industry Recommendations 7. Australia Healthcare Insurance Market: Research Methodology