System Integration Market was valued at USD 385.75 Bn in 2023 and is expected to reach USD 953.46 Bn by 2030, at a CAGR of 13.8 % during the forecast period.System Integration Market Overview

System integration is the process of combining different sub-systems or components into one larger system that functions as a whole. This involves ensuring that all the components work together seamlessly to achieve the intended functionality or purpose of the system. Bringing together hardware, software, and networking components to create a cohesive system. This involve integrating different software applications, databases, servers, and other IT infrastructure components. System integration is essential in various domains such as information technology, manufacturing, telecommunications, and healthcare, where complex systems with multiple components need to work together to achieve specific objectives. It requires careful planning, coordination, and testing to ensure that the integrated system meets the requirements and performs as expected.To know about the Research Methodology :- Request Free Sample Report The system integration market is growing, due to digital transformation initiatives, the adoption of cloud computing, the proliferation of IoT devices, and the need for seamless connectivity among various systems. The market size is substantial and is expected to continue growing as businesses seek to optimize their operations and enhance efficiency through integrated solutions. The market is competitive, with numerous players offering system integration services and solutions. Key players include large multinational corporations such as IBM, Accenture, Deloitte, Capgemini, and Accenture, as well as smaller regional players and specialized integrators focusing on specific industries or technologies. The system integration market shows regional variations in terms of market maturity, adoption rates, and regulatory environments. Developed economies such as North America and Europe have been early adopters of integrated solutions while emerging economies in Asia-Pacific and Latin America are experiencing rapid growth driven by increasing digitalization and infrastructure development.

System Integration Market Dynamics

Digital Transformation across various industries to boost System Integration Market growth Growth in digital technologies across industries, organizations are increasingly adopting digital transformation initiatives. System integration plays a important role in this process by enabling the seamless integration of disparate systems, applications, and data sources. Businesses are investing in system integration services to modernize their IT infrastructure, enhance operational efficiency, and deliver superior customer experiences, which significantly boosts the System Integration Market growth. The widespread adoption of cloud computing services is reshaping how businesses deploy and manage their IT resources. System integrators are in high demand to assist organizations in migrating to cloud platforms, integrating cloud-based applications with on-premises systems, and ensuring interoperability across hybrid IT environments. The scalability, flexibility, and cost-effectiveness of cloud solutions drive the need for robust system integration capabilities. The growth of data generated by businesses presents both opportunities and challenges for System Integration Market. System integration facilitates the aggregation, processing, and analysis of vast datasets from diverse sources, empowering organizations to derive actionable insights and make informed decisions. As the demand for advanced analytics, business intelligence, and predictive modeling increases, so does the demand for sophisticated system integration solutions. The proliferation of IoT devices across industries is generating vast streams of real-time data that require integration with existing IT systems and applications. System integrators play a crucial role in connecting IoT devices, sensors, and gateways with backend systems, enabling organizations to harness the full potential of IoT for improved asset monitoring, predictive maintenance, and operational efficiency, which boosts the System Integration Market growth. Complexity and Interoperability Challenges to limit System Integration Market growth Integrating disparate systems, applications, and data sources often entails navigating complex technical environments with varying architectures, protocols, and standards. Achieving seamless interoperability between legacy systems and modern platforms is daunting, leading to project delays, cost overruns, and performance issues, which limits the System Integration Market growth. The inherent complexity of integration developments poses a significant restraint for both service providers and their clients, which is expected to restrain System Integration Market growth. Many organizations grapple with legacy IT infrastructure characterized by outdated technologies, monolithic architectures, and accumulated technical debt. Retrofitting legacy systems for integration with modern cloud-based platforms or emerging technologies resource-intensive and time-consuming. Legacy constraints hinder agility, scalability, and innovation, limiting the effectiveness of system integration initiatives. System integration projects often entail substantial upfront investments in technology, resources, and expertise. Budgetary constraints and cost pressures limit organizations' ability to allocate sufficient funds for integration initiatives, leading to compromises in project scope, quality, or timelines. Random project costs and ROI uncertainties deter investment in system integration services, particularly for small and medium-sized enterprises (SMEs). Successful system integration depends not only on technical capabilities but also on organizational readiness, change management, and cultural alignment. Resistance to change, internal politics, and cultural barriers impede collaboration, communication, and stakeholder buy-in, undermining the success of integration projects. Overcoming organizational inertia and fostering a culture of innovation and agility are essential for realizing the full benefits of system integration initiatives.System Integration Market Segment Analysis

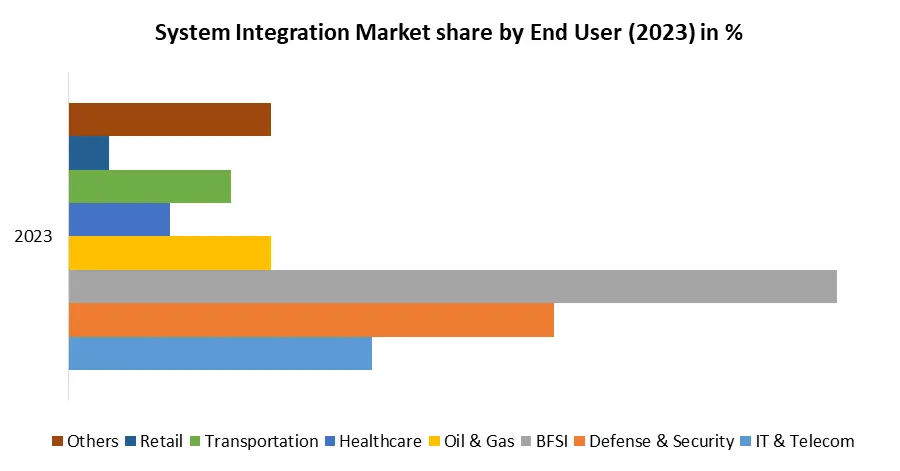

Based on Service Type, the market is segmented into Infrastructure Integration, Application Integration, and Consulting. Infrastructure Integration segment dominated the market in 2023 and is expected to hold the largest System Integration Market share over the forecast period. Software integration focuses on the seamless integration of diverse software applications, platforms, and systems to enable data sharing, process automation, and workflow optimization. It involves integrating enterprise software solutions such as ERP (Enterprise Resource Planning), CRM (Customer Relationship Management), SCM (Supply Chain Management), and BI (Business Intelligence) systems to streamline business processes and enhance decision-making capabilities. Infrastructure Integration is essential for organizations seeking to modernize their IT infrastructure, optimize resource utilization, and enhance operational efficiency, which significantly boosts the System Integration Market growth. By integrating hardware, software, networking, data center, cloud, and security components effectively, organizations create robust, scalable, and resilient IT environments that support their evolving business needs and drive digital transformation initiatives. Based on End User, the market is segmented into IT & Telecom, Defense & Security, BFSI, Oil & Gas, Healthcare, Transportation, Retail, and Others. BFSI segment dominated the market in 2023 and is expected to hold the largest System Integration Market share over the forecast period. Core banking systems serve as the backbone of banking operations, managing essential functions such as customer accounts, transactions, loans, and deposits. System integrators in the BFSI segment specialize in integrating core banking platforms with other banking applications, channels, and third-party systems to ensure seamless data flow, real-time processing, and enhanced customer experiences. Regulatory compliance is a top priority for BFSI institutions, given the stringent regulations governing the industry, such as Basel III, Dodd-Frank Act, GDPR, and PCI-DSS. System integrators help BFSI organizations integrate risk management, regulatory compliance, and reporting systems with core banking systems, customer databases, and transaction monitoring platforms to ensure adherence to regulatory requirements, mitigate compliance risks, and enhance transparency and accountability.

System Integration Market Regional Insight

North America held a market share of over 35% in 2022, owing to the rising use of IoT in industrial automation and the growing adoption of cloud-based services among large organizations. The BFSI sector in the region has embraced modern-day technology, which presents significant growth prospects for the system integration market in North America. To this end, banks are taking considerable care to ensure they meet every client’s requirement. For instance, according to Bank of America, 70% of its customers use digital services for their financial needs. It help the bank to develop its client base and stay competitive in the market. The migration of organizations to these services increase the demand for system integration services in the region during the forecast period. The growth of the system integration market in Europe is due to increased partnership/collaboration activities, which have enabled the companies operating in the European region to have access to advanced system integration solutions. For instance, in December 2023, Infosys and LKQ Europe, a European distributor of automobile aftermarket components, established a five-year cooperation. LKQ's recent strategic acquisitions, the Bengaluru-based strategic partnership seeks to improve product availability, expedite end-to-end delivery, and optimize business operations. When it comes to standardizing and integrating systems and procedures for effectiveness and advantages, Infosys set the standard. The development of the system integration market in France is credited to governmental initiatives aimed at fostering its growth. In September 2023 when the French government proposed mandates for B2B e-invoicing. This initiative involves the collaboration of two key entities: the Direction Générale des Finances Publiques (DGFIP), responsible for public finances, and the Agence pour l'informatique financière de l'Etat (AIFE), the state financial information agency. It's important to note that the proposed revised schedule by DGFIP and AIFE remains tentative until confirmed with the announcement of the 2024 Finance Act by the government, expected no later than October 2023.System Integration Market Scope :Inquire before buying

System Integration Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 385.75 Bn. Forecast Period 2024 to 2030 CAGR: 13.8% Market Size in 2030: USD 953.46 Bn. Segments Covered: by Service Type Infrastructure Integration Application Integration Consulting by Enterprise Size Large Enterprises Small & Medium Enterprises by End-user IT & Telecom Defense & Security BFSI Oil & Gas Healthcare Transportation Retail Others System Integration Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading System Integration key players include:

North America: 1. IBM Corporation: Armonk, New York, USA 2. Accenture plc: New York, USA) 3. Deloitte Touche Tohmatsu Limited: New York, USA) 4. Cognizant Technology Solutions Corporation: Teaneck, New Jersey, USA 5. Hewlett Packard Enterprise Company: San Jose, California, USA Europe: 6. Capgemini SE: Paris, France 7. Atos SE: Bezons, France 8. T-Systems International GmbH: Frankfurt, Germany Asia-Pacific: 9. Tata Consultancy Services Limited (TCS): Mumbai, Maharashtra, India 10. Infosys Limited: Bengaluru, Karnataka, India 11. NEC Corporation: Minato, Tokyo, Japan 12. HCL Technology Limited: Noida, Uttar Pradesh, India 13. Tech Mahindra Limited: Pune, Maharashtra, India 14. Wipro Limited: Bengaluru, Karnataka, India 15. Fujitsu Limited: Tokyo, Japan Frequently asked Questions: 1] What segments are covered in the Global System Integration Market report? Ans. The segments covered in the System Integration Market report are based on, Service Type, Enterprise Size, End User, and Regions. 2] Which region is expected to hold the highest share of the Global System Integration Market? Ans. The North America region is expected to hold the highest share of the System Integration Market. 3] What is the market size of the Global System Integration Market by 2030? Ans. The market size of the System Integration Market by 2030 is expected to reach USD 953.46 Bn. 4] What was the market size of the Global System Integration Market in 2023? Ans. The market size of the System Integration Market in 2023 was valued at USD 385.75 Bn. 5] Key players in the System Integration Market. Ans. Capgemini, Fujitsu, Deloitte Touche Tohmatsu Limited, Infosys, etc.

1. System Integration Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. System Integration Market: Dynamics 2.1. System Integration Market Trends by Region 2.1.1. North America System Integration Market Trends 2.1.2. Europe System Integration Market Trends 2.1.3. Asia Pacific System Integration Market Trends 2.1.4. Middle East and Africa System Integration Market Trends 2.1.5. South America System Integration Market Trends 2.2. System Integration Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America System Integration Market Drivers 2.2.1.2. North America System Integration Market Restraints 2.2.1.3. North America System Integration Market Opportunities 2.2.1.4. North America System Integration Market Challenges 2.2.2. Europe 2.2.2.1. Europe System Integration Market Drivers 2.2.2.2. Europe System Integration Market Restraints 2.2.2.3. Europe System Integration Market Opportunities 2.2.2.4. Europe System Integration Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific System Integration Market Drivers 2.2.3.2. Asia Pacific System Integration Market Restraints 2.2.3.3. Asia Pacific System Integration Market Opportunities 2.2.3.4. Asia Pacific System Integration Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa System Integration Market Drivers 2.2.4.2. Middle East and Africa System Integration Market Restraints 2.2.4.3. Middle East and Africa System Integration Market Opportunities 2.2.4.4. Middle East and Africa System Integration Market Challenges 2.2.5. South America 2.2.5.1. South America System Integration Market Drivers 2.2.5.2. South America System Integration Market Restraints 2.2.5.3. South America System Integration Market Opportunities 2.2.5.4. South America System Integration Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For System Integration Industry 2.8. Analysis of Government Schemes and Initiatives For System Integration Industry 2.9. System Integration Market Trade Analysis 2.10. The Global Pandemic Impact on System Integration Market 3. System Integration Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. System Integration Market Size and Forecast, by Service Type (2023-2030) 3.1.1. Infrastructure Integration 3.1.2. Application Integration 3.1.3. Consulting 3.2. System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 3.2.1. Large Enterprises 3.2.2. Small & Medium Enterprises 3.3. System Integration Market Size and Forecast, by End User (2023-2030) 3.3.1. IT & Telecom 3.3.2. Defense & Security 3.3.3. BFSI 3.3.4. Oil & Gas 3.3.5. Healthcare 3.3.6. Transportation 3.3.7. Retail 3.3.8. Others 3.4. System Integration Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America System Integration Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America System Integration Market Size and Forecast, by Service Type (2023-2030) 4.1.1. Infrastructure Integration 4.1.2. Application Integration 4.1.3. Consulting 4.2. North America System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 4.2.1. Large Enterprises 4.2.2. Small & Medium Enterprises 4.3. North America System Integration Market Size and Forecast, by End User (2023-2030) 4.3.1. IT & Telecom 4.3.2. Defense & Security 4.3.3. BFSI 4.3.4. Oil & Gas 4.3.5. Healthcare 4.3.6. Transportation 4.3.7. Retail 4.3.8. Others 4.4. North America System Integration Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States System Integration Market Size and Forecast, by Service Type (2023-2030) 4.4.1.1.1. Infrastructure Integration 4.4.1.1.2. Application Integration 4.4.1.1.3. Consulting 4.4.1.2. United States System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 4.4.1.2.1. Large Enterprises 4.4.1.2.2. Small & Medium Enterprises 4.4.1.3. United States System Integration Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. IT & Telecom 4.4.1.3.2. Defense & Security 4.4.1.3.3. BFSI 4.4.1.3.4. Oil & Gas 4.4.1.3.5. Healthcare 4.4.1.3.6. Transportation 4.4.1.3.7. Retail 4.4.1.3.8. Others 4.4.2. Canada 4.4.2.1. Canada System Integration Market Size and Forecast, by Service Type (2023-2030) 4.4.2.1.1. Infrastructure Integration 4.4.2.1.2. Application Integration 4.4.2.1.3. Consulting 4.4.2.2. Canada System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 4.4.2.2.1. Large Enterprises 4.4.2.2.2. Small & Medium Enterprises 4.4.2.3. Canada System Integration Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. IT & Telecom 4.4.2.3.2. Defense & Security 4.4.2.3.3. BFSI 4.4.2.3.4. Oil & Gas 4.4.2.3.5. Healthcare 4.4.2.3.6. Transportation 4.4.2.3.7. Retail 4.4.2.3.8. Others 4.4.3. Mexico 4.4.3.1. Mexico System Integration Market Size and Forecast, by Service Type (2023-2030) 4.4.3.1.1. Infrastructure Integration 4.4.3.1.2. Application Integration 4.4.3.1.3. Consulting 4.4.3.2. Mexico System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 4.4.3.2.1. Large Enterprises 4.4.3.2.2. Small & Medium Enterprises 4.4.3.3. Mexico System Integration Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. IT & Telecom 4.4.3.3.2. Defense & Security 4.4.3.3.3. BFSI 4.4.3.3.4. Oil & Gas 4.4.3.3.5. Healthcare 4.4.3.3.6. Transportation 4.4.3.3.7. Retail 4.4.3.3.8. Others 5. Europe System Integration Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe System Integration Market Size and Forecast, by Service Type (2023-2030) 5.2. Europe System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 5.3. Europe System Integration Market Size and Forecast, by End User (2023-2030) 5.4. Europe System Integration Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom System Integration Market Size and Forecast, by Service Type (2023-2030) 5.4.1.2. United Kingdom System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 5.4.1.3. United Kingdom System Integration Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France System Integration Market Size and Forecast, by Service Type (2023-2030) 5.4.2.2. France System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 5.4.2.3. France System Integration Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany System Integration Market Size and Forecast, by Service Type (2023-2030) 5.4.3.2. Germany System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 5.4.3.3. Germany System Integration Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy System Integration Market Size and Forecast, by Service Type (2023-2030) 5.4.4.2. Italy System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 5.4.4.3. Italy System Integration Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain System Integration Market Size and Forecast, by Service Type (2023-2030) 5.4.5.2. Spain System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 5.4.5.3. Spain System Integration Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden System Integration Market Size and Forecast, by Service Type (2023-2030) 5.4.6.2. Sweden System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 5.4.6.3. Sweden System Integration Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria System Integration Market Size and Forecast, by Service Type (2023-2030) 5.4.7.2. Austria System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 5.4.7.3. Austria System Integration Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe System Integration Market Size and Forecast, by Service Type (2023-2030) 5.4.8.2. Rest of Europe System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 5.4.8.3. Rest of Europe System Integration Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific System Integration Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific System Integration Market Size and Forecast, by Service Type (2023-2030) 6.2. Asia Pacific System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 6.3. Asia Pacific System Integration Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific System Integration Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China System Integration Market Size and Forecast, by Service Type (2023-2030) 6.4.1.2. China System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 6.4.1.3. China System Integration Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea System Integration Market Size and Forecast, by Service Type (2023-2030) 6.4.2.2. S Korea System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 6.4.2.3. S Korea System Integration Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan System Integration Market Size and Forecast, by Service Type (2023-2030) 6.4.3.2. Japan System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 6.4.3.3. Japan System Integration Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India System Integration Market Size and Forecast, by Service Type (2023-2030) 6.4.4.2. India System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 6.4.4.3. India System Integration Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia System Integration Market Size and Forecast, by Service Type (2023-2030) 6.4.5.2. Australia System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 6.4.5.3. Australia System Integration Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia System Integration Market Size and Forecast, by Service Type (2023-2030) 6.4.6.2. Indonesia System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 6.4.6.3. Indonesia System Integration Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia System Integration Market Size and Forecast, by Service Type (2023-2030) 6.4.7.2. Malaysia System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 6.4.7.3. Malaysia System Integration Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam System Integration Market Size and Forecast, by Service Type (2023-2030) 6.4.8.2. Vietnam System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 6.4.8.3. Vietnam System Integration Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan System Integration Market Size and Forecast, by Service Type (2023-2030) 6.4.9.2. Taiwan System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 6.4.9.3. Taiwan System Integration Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific System Integration Market Size and Forecast, by Service Type (2023-2030) 6.4.10.2. Rest of Asia Pacific System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 6.4.10.3. Rest of Asia Pacific System Integration Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa System Integration Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa System Integration Market Size and Forecast, by Service Type (2023-2030) 7.2. Middle East and Africa System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 7.3. Middle East and Africa System Integration Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa System Integration Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa System Integration Market Size and Forecast, by Service Type (2023-2030) 7.4.1.2. South Africa System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 7.4.1.3. South Africa System Integration Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC System Integration Market Size and Forecast, by Service Type (2023-2030) 7.4.2.2. GCC System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 7.4.2.3. GCC System Integration Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria System Integration Market Size and Forecast, by Service Type (2023-2030) 7.4.3.2. Nigeria System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 7.4.3.3. Nigeria System Integration Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A System Integration Market Size and Forecast, by Service Type (2023-2030) 7.4.4.2. Rest of ME&A System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 7.4.4.3. Rest of ME&A System Integration Market Size and Forecast, by End User (2023-2030) 8. South America System Integration Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America System Integration Market Size and Forecast, by Service Type (2023-2030) 8.2. South America System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 8.3. South America System Integration Market Size and Forecast, by End User(2023-2030) 8.4. South America System Integration Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil System Integration Market Size and Forecast, by Service Type (2023-2030) 8.4.1.2. Brazil System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 8.4.1.3. Brazil System Integration Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina System Integration Market Size and Forecast, by Service Type (2023-2030) 8.4.2.2. Argentina System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 8.4.2.3. Argentina System Integration Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America System Integration Market Size and Forecast, by Service Type (2023-2030) 8.4.3.2. Rest Of South America System Integration Market Size and Forecast, by Enterprise Size (2023-2030) 8.4.3.3. Rest Of South America System Integration Market Size and Forecast, by End User (2023-2030) 9. Global System Integration Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading System Integration Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. IBM Corporation: Armonk, New York, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Accenture plc: New York, USA) 10.3. Deloitte Touche Tohmatsu Limited: New York, USA) 10.4. Cognizant Technology Solutions Corporation: Teaneck, New Jersey, USA 10.5. Hewlett Packard Enterprise Company: San Jose, California, USA 10.6. Capgemini SE: Paris, France 10.7. Atos SE: Bezons, France 10.8. T-Systems International GmbH: Frankfurt, Germany 10.9. Tata Consultancy Services Limited (TCS): Mumbai, Maharashtra, India 10.10. Infosys Limited: Bengaluru, Karnataka, India 10.11. NEC Corporation: Minato, Tokyo, Japan 10.12. HCL Technologies Limited: Noida, Uttar Pradesh, India 10.13. Tech Mahindra Limited: Pune, Maharashtra, India 10.14. Wipro Limited: Bengaluru, Karnataka, India 10.15. Fujitsu Limited: Tokyo, Japan 11. Key Findings 12. Industry Recommendations 13. System Integration Market: Research Methodology 14. Terms and Glossary