Neuromorphic Chip Market size was valued at US$ 48.89 Mn. in 2022 and the total revenue is expected to grow at 47.42% through 2022 to 2029, reaching nearly US$ 739.92 Mn.Neuromorphic Chip Market Overview:

A neuromorphic chip is a microchip that is designed to mimic the nervous system and the human brain's functionality. It comprises simulating human thinking and recognition using software and VLSI (very-large-scale-integrated) systems. It also features silicon-based artificial synapses and neurons, which allow the system to mimic the functioning of a human brain. As a result, robotics and neurology have a lot of applications for it.To know about the Research Methodology:- Request Free Sample Report

Neuromorphic Chip Market Dynamics:

Significant growth in the information technology (IT) industry is driving the global market. Continuous technical improvements in the sector are also contributing to the market's favourable outlook. For example, the combination of artificial intelligence (AI), the Internet of Things (IoT), and advanced analytics with these microchips has boosted market growth all around the world. Also, the widespread use of neuromorphic chip-based computing systems to quickly and accurately manufacture coronavirus disease (COVID-19) antibodies has contributed to global market growth. Also, the market is being propelled forward by the increasing use of AI-powered neuromorphic chips in the construction of premium autos to build stage 5 luxury cars. The downsizing of neuromorphic circuits and the growing need for data governance are driving the global industry even further. Rapid digitization across numerous sectors and substantial research and development (R&D) operations done by key players to produce new product versions with increased features are some of the main factors driving market growth. On the other hand, analogue chips are less precise than digital chips. Their digital structure aids on-chip programming. This versatility, in comparison to GPUs, allows artificial intelligence researchers to accurately perform a wide range of algorithms while conserving energy. Mixed chips try to combine the advantages of analogue chips, such as lower energy use, with the benefits of digital processors, such as precision. High-power consumption, low speed, and other efficiency-related limitations that plague the von Neumann architecture are addressed by neuromorphic architectures. In contrast to classical von Neumann design, which uses binary encoding with abrupt highs and lows, neuromorphic devices use spiking signals to give a continuous analogue transition. Neuromorphic architectures combine storage and processing, eliminating the CPU-memory bus bottleneck.Neuromorphic Chip Market Segment Analysis:

Based on the Offering, the Neuromorphic Chip market is sub-segmented into Hardware and Software. The Software segment held the largest market share of xx% in 2022. Miniaturization of integrated circuits is driven by consumer demand for smaller, less expensive products. Smart phones, healthcare, and automotive are among the industries that use smart sensors and emergency smart technology. In recent years, miniaturisation technologies have increased the complexity of hardware design. Based on the Verticals, the Neuromorphic Chip market is sub-segmented into Aerospace and Defense, IT and Telecom, Automotive, Medical, Industrial and Others. The Automotive segment held the largest market share of xx% in 2022. All high-end automakers are investing heavily to achieve Level 5 of auto-driving cars, which in turn will generate a huge demand for artificial intelligence neuromorphic chips. The autonomous driving market needs to continuously improve AI algorithms to achieve high throughput and low power consumption requirements. Neuromorphic circuits are well suited to classification methods and can be applied to a range of autonomous driving scenarios. They're also more efficient in noisy contexts, like self-driving automobiles, as compared to static deep learning methods.

Neuromorphic Chip Market Regional Insights:

North America held the largest market share of 40% in 2022. Because significant producers of neuromorphic semiconductors are based in the United States, such as Qualcomm, IBM, and Intel, The inspiring measure of technological advancements in terms of product modernizations is likewise likely to push the provincial market. Furthermore, the growing use of neuromorphic semiconductors for enabling the Internet of Things (IoT) is likely to drive market growth in North America. The Canadian government is also concentrating on Artificial Intelligence technology, which will open up new opportunities for neuromorphic computing in the next years. For example, in June 2021, the governments of Canada and Quebec joined together to promote AI development responsibly. The conference will focus on a variety of topics, including future work and innovation, commercialization, data governance, and trustworthy AI. The objective of the report is to present a comprehensive analysis of the global Neuromorphic Chip Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also helps in understanding the global Neuromorphic Chip Market dynamic, structure by analyzing the market segments and project the global Neuromorphic Chip Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Neuromorphic Chip Market make the report investor’s guide.Neuromorphic Chip Market Scope: Inquire before buying

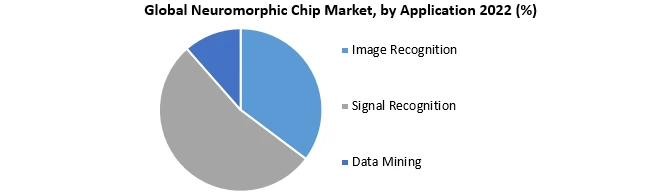

Neuromorphic Chip Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 48.89 Mn. Forecast Period 2023 to 2029 CAGR: 47.42 % Market Size in 2029: US $ 739.92 Mn. Segments Covered: by Offering Hardware Software by Application Image Recognition Signal Recognition Data Mining by Verticals Aerospace and Defence IT and Telecom Automotive Medical Industrial Others Neuromorphic Chip Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Neuromorphic Chip Market Key Players:

1. IBM Corp. 2. Intel Corp. 3. General Vision Inc. 4. Qualcomm Technologies Inc. 5. Hewlett Packard Labs. 6. HRL Laboratories 7. LLC 8. Brainchip Holdings Ltd. 9. Know Inc. 10.Samsung Electronics 11.HP Corporation 12.Lockheed Martin Corporation 13.Vicarious FPC Inc. 14.Applied Brain Research, Inc. 15.aiCTX AG 16.Applied Brain Research 17.Eta Compute 18.GyrFalcon 19.GrAI Matter Labs, 20.Nepes Corp. 21.Brain Corp Frequently Asked Questions: 1] What segments are covered in Neuromorphic Chip Market report? Ans. The segments covered in Neuromorphic Chip Market report are based on Offering, Application, and Verticals. 2] Which region is expected to hold the highest share in the Neuromorphic Chip Market? Ans. North America is expected to hold the highest share in the Neuromorphic Chip Market. 3] What is the market size of Market by 2029? Ans. The market size of Market is expected to reach US $ 739.92 Mn. by 2029. 4] Who are the top key players in the Neuromorphic Chip Market? Ans. IBM Corp., Intel Corp., General Vision Inc., Qualcomm Technologies Inc., Hewlett Packard Labs., HRL Laboratories and LLC are the top key players in the global Neuromorphic Chip Market. 5] What was the market size of Neuromorphic Chip Market in 2022? Ans. The market size of Neuromorphic Chip Market in 2022 was US $ 48.89 Mn.

1. Global Neuromorphic Chip Market: Research Methodology 2. Global Neuromorphic Chip Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Neuromorphic Chip Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global Neuromorphic Chip Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Global Neuromorphic Chip Market Segmentation 4.1 Global Neuromorphic Chip Market, by Offering (2022-2029) • Hardware • Software 4.2 Global Neuromorphic Chip Market, by Application (2022-2029) • Image Recognition • Signal Recognition • Data Mining 4.3 Global Neuromorphic Chip Market, by Verticals (2022-2029) • Aerospace and Defense • IT and Telecom • Automotive • Medical • Industrial • Others 5. North America Neuromorphic Chip Market(2022-2029) 5.1 Global Neuromorphic Chip Market, by Offering (2022-2029) • Hardware • Software 5.2 Global Neuromorphic Chip Market, by Application (2022-2029) • Image Recognition • Signal Recognition • Data Mining 5.3 Global Neuromorphic Chip Market, by Verticals (2022-2029) • Aerospace and Defense • IT and Telecom • Automotive • Medical • Industrial • Others 5.4 North America Neuromorphic Chip Market, by Country (2022-2029) • United States • Canada • Mexico 6. Asia Pacific Neuromorphic Chip Market (2022-2029) 6.1. Asia Pacific Neuromorphic Chip Market, by Offering (2022-2029) 6.2. Asia Pacific Neuromorphic Chip Market, by Application (2022-2029) 6.3. Asia Pacific Neuromorphic Chip Market, by Verticals (2022-2029) 6.4. Asia Pacific Neuromorphic Chip Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Middle East and Africa Neuromorphic Chip Market (2022-2029) 7.1 Middle East and Africa Neuromorphic Chip Market, by Offering (2022-2029) 7.2. Middle East and Africa Neuromorphic Chip Market, by Application (2022-2029) 7.3. Middle East and Africa Neuromorphic Chip Market, by Verticals (2022-2029) 7.4. Middle East and Africa Neuromorphic Chip Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America Neuromorphic Chip Market (2022-2029) 8.1. Latin America Neuromorphic Chip Market, by Offering (2022-2029) 8.2. Latin America Neuromorphic Chip Market, by Application (2022-2029) 8.3. Latin America Neuromorphic Chip Market, by Verticals (2022-2029) 8.4 Latin America Neuromorphic Chip Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 9. European Neuromorphic Chip Market (2022-2029) 9.1. European Neuromorphic Chip Market, by Offering (2022-2029) 9.2. European Neuromorphic Chip Market, by Application (2022-2029) 9.3. European Neuromorphic Chip Market, by Verticals (2022-2029) 9.4. European Neuromorphic Chip Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 10. Company Profile: Key players 10.1. IBM Corp. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Intel Corp. 10.3. General Vision Inc. 10.4. Qualcomm Technologies Inc. 10.5. Hewlett Packard Labs. 10.6. HRL Laboratories 10.7. LLC 10.8. Brainchip Holdings Ltd. 10.9. Know Inc. 10.10. Samsung Electronics 10.11. HP Corporation 10.12. Lockheed Martin Corporation 10.13. Vicarious FPC Inc. 10.14. Applied Brain Research, Inc. 10.15. aiCTX AG 10.16. Applied Brain Research 10.17. Eta Compute 10.18. GyrFalcon 10.19. GrAI Matter Labs, 10.20. Nepes Corp. 10.21. Brain Corp