The Surgical Robots Market size was valued at USD 71.94 Bn in 2022 and the total Insulation revenue is expected to grow by 8.11 % from 2023 to 2029, reaching nearly USD 124.18 Bn. Surgical robot is a self powered, computer controlled device that are programmed to aid in the positioning and manipulation of the surgical instruments, enabling the surgeons to carry out more complex tasks. Robotic surgery has effectively overcome the drawbacks of conventional laparoscopic and thoracoscopic techniques, enabling the completion of intricate and advanced surgical operations with higher precision and a smaller incision. The operating surgeon is given a 3-dimensional vision that improves depth perception in place of the flat, 2-dimensional image received by the standard laparoscopic camera; camera motion is steadily and conveniently controlled by the operating surgeon using voice-activated or manual master controls. Surgical robots are one of the growing sectors of the medical devise industry.The most popular Robotic application in medical services are durgical. From organ transplants to gastrointestinial surgeries to urological operations are performed using surgical robots. In the United states over 9000000 robot-assisted surgeries were performed in the year 2018 creating the market of $4.71 bilion. Electrosurgical hardware and instruments including Force TriVerse, and surgical AI, data and analytics are trained to support robotic assistaetd surgical platform.To know about the Research Methodology :- Request Free Sample Report Surgical Robotics industry sees great potential in both industrial collaborations with the new players intending to enter the market and in opportunities to further deepen its partnership with existing players. About 65% of the worlds surgical robots are installed in the US.Fuerthermore many medical device companies have business models whereby earnings correlate with the extent to which the product is used. In addition to the key players mentioned in the report, another 20 robotic surgery companies exist with the different niches in the terms of their geographies and application. At the forefront of the technology the robotic surgery is bridging between laproscopy and digital surgery.

Scope of the Report: The report provides a comprehensive analysis of the global Surgical Robots Market. This report estimates the Surgical Robots Market, in terms of USD value from 2023 to 2029. In order to identify potential investment pockets, this report gives an analytical representation of the Surgical Robots industry together with current trends and future forecasts. The report includes a thorough analysis of the market share for Surgical Robots as well as data on important drivers, restraints, and opportunities. A quantitative analysis of the existing market is done from 2023 to 2029 to show the potential for market growth across the globe. In addition, Porter's five forces study demonstrates the market power of both buyers and providers. The research offers a thorough analysis of the worldwide Surgical Robots market based on the level of competition and how it will develop over the forecast period.

Surgical Robots Market Dynamics:

Broadened customer base of Surgical Robot Market With several acquisition made in 2022, Surgical Science has gained a very strong position in the market for simulation for robotic surgery. The new groups of companies are holding a very strong position as the world leader in simulation for robotic surgery in the terms of both market share and technology. In the year 2022 several cpmpany’s goals of expanding the value content to the customner base, primarily in robotic surgery grew in Educational products during challenging times and were able to make several acquisitions according to the startegies. The offerings made by several Surgical Robot Market channels within implimatations in several hospitals are holding the strongest pillars in expanding the market. Additionaly hardware industry were characterized by the news from the largest medical devices suppling companies regarding continued major investments in robotic surgery and has contributed towards the growth of the Robotic Surgery market. In 2022,several companies opened a new-state-of-art in Robotic Suregry R&D center to support innovation and growth. Companies have acquired technologies and has integrated into the market. For Instance, CORI Surgical system, our next generation robotic platform launched in 2020 following the success of acquired NAVIO systems. Significant development and performance enhancmenets are implemented by Surgical Robotics teams in US, Germany, and several countries acorss world. Orthopaedics Franchise in Surgical Robotics Market Companies are having Orthapaedics franchise, which includes innovative range of knee and hip implants used to replace diseased,damaged or worn joints,surgical-robotics are assisting and enabling the technologies that are empowering surgeons and trauma products which are widely used to stabilize fractures and correct bone fractures and deformalities. This Franchise are continuously enhancing the knee portfolio pipeline of innovation.For Instance, in 2022 Smith + Nephew have paired with Retail intelligence suite of enabling technology solutions and the next generation robotic platform, CORI system.It is forecasted that a number of industrial strategic initiatives by leading worldwide firms is expected to speed up market growth of Surgical Robots over time. For instance, in 2019, the Johnson & Johnson subsidiary Ethicon purchased the robotic technology platform developer Auris Health. The goal of this acquisition is to boost the development of Ethion's digital surgical portfolio in order to fight lung cancer. Additionally, OrthoSpace, Ltd. was acquired by Stryker Corporation in 2019; this helped to expand the company's line of surgical supplies. Therefore, it is anticipated that such industrial initiatives would accelerate the uptake of robots and the market's expansion. The Recent FDA (Food and Drug Administration) warnings caution against using robotic surgery to treat cervical and breast cancer. The communication concerns regarding the epidemiologic data describing the application of robotic surgery in actual clinical settings and current projections based solely on single-center studies, device makers' financial statements, claims data, and poor claims coding are restraining the Surgical Robotic Market. The expense of robot maintenance is close to US $1,25,000 per year, which adds to the already steep expenditure of robotic surgery. The average price of a robotic surgical operation ranges from US $3,000 to US $6,000. As a result of the rising cost of procedures related to the usage of robotic systems, the surgical robots market is likely to hamper during the forecast period. The Robotic surgical device manfacturers financial statements procedure volumes are rapidly increasing with the largest and fastest growing contributor being the field of general surgery.According to MMR findings the clinical footprint for the robotic surgery will continue to increase in the forecasted period.Miniature in vIvo robots, are one of the novel approach with the whole MIS surgical platform being interested into the peritoneal cavity.New types of robots emerging in the fields of medicines for performing various types of surgeries are crating the growth opportunites for the surgical robot market. Surging Adoption of Surgical Robots In ASCs Ambulatory surgery centers (ASCs) are outpatient surgical, diagnostic, and preventative procedures that do not require hospitalization. Authorities, third-party payers, and patients all benefit from the cost-effectiveness of ASCs. According to research published by Healthcare BlueBook - a provider of healthcare data and HealthSmart - a provider of health plans for self-funded employers, ASCs reduced the cost of outpatient surgery by US $38 billion annually by offering a cheap site of care than hospitalized outpatient departments. Each year, Medicare and its beneficiaries save more than US $2.6 billion by paying much less for treatments performed in ASCs than for the identical procedures conducted in hospitals. When patients receive care in an ASC, their co-payments are also much lower. Because of the cost savings, the number of surgical procedures performed in ASCs and outpatient settings has increased rapidly, while hospital in-patient stays have decreased. Robotic surgery is a cutting-edge method that provides notable outcomes in a range of surgical operations. A combination of technological advancements, including the use of more efficient motors, compact and light materials, power backup, sophisticated controls, and safety mechanisms, as well as more affordable versions, have led to a rapid rise in the adoption of robotic surgery for minimally invasive procedures. Robotic surgery's high level of precision aids in precise implant placing and lowers the possibility of damaging nearby tissues. Less post-operative discomfort, bleeding, and hospital readmissions all benefit patients. Innovations in surgical robotic systems are driving the market for minimally invasive surgery to new heights. Due to the expanding complexity of operations to treat challenging diseases, robots are also playing a bigger role in the field of minimally invasive surgery. In the United States, over 900,000 treatments were carried out in 2020, and around 5,000 robotic platforms were installed in hospitals all over the nation. According to MMR findings, over the past two to three years, 35% of all colorectal surgeries in the Atlanta region of the United States have been carried out robotically.

Surgical Robots Market Segment Analysis:

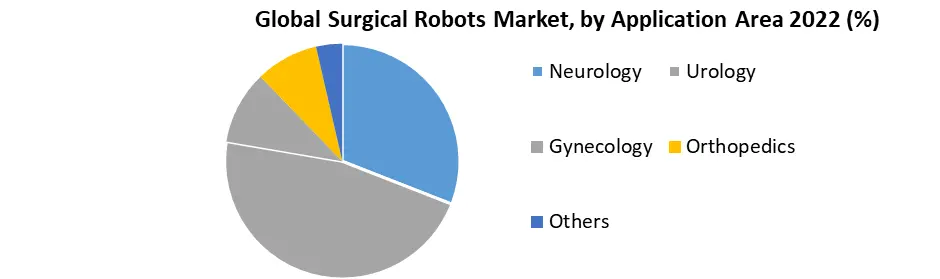

By New Approaches,the Surgical Robots Market is segmented into In-vivo robots, Nanobots, Capsule robots. In vivo robots are a major advancement in robotic surgery that allow the whole minimally invasive surgical platform to be implanted into the peritoneum. They were created by Virtual Incision and the Center for Advanced Surgical Technology (CAST). These types of robots have two flexible arms with many joints and a variety of purposes. They allow doctors to perform surgery locally or remotely while allowing them to examine the operating area from a number of angles. These are reasonably priced and portable, making it possible to do the operation at any time, whether it is in space, on the battlefield, or for far-off medical emergencies.By Application, the surgical robots’ market is segmented as follows, neurology, urology, gynecology, orthopedics, and others. In 2022, the others segment was dominant and held almost 36% of the overall market in terms of revenue. Oncology, laparoscopy, and a variety of other general operations are among the other applications. The segment's rise is being supported by rising demand for minimally invasive laparoscopic surgeries and an increase in the use of surgical robots in cancer-related procedures. Detailed information about each segment is covered in the MMR’s report. During the forecast period, the neurology segment is expected to grow at the fastest rate.The outstanding qualifications connected with neurosurgical operations provide effective outcomes while minimizing the drawbacks of standard neurosurgery approaches. The use of robots in this industry has increased as a result of these causes. Also, thanks to technical developments in robotic brain surgeries, the market is expected to grow in popularity for treating patients with tumors and other brain ailments over the forecast period. For example, according to an article published in the Robotics Industries Association (RIA), remote brain surgery was performed in 2019 using robotic aid and 5G technology. Such examples demonstrate the neurosurgery segment's tremendous potential for robotics.

Surgical Robots Market Regional Insights:

With a revenue share of over 52% in 2022, North America is likely to continue to lead the global market, over the forecast period. The existence of foreign players with a long list of products awaiting FDA approval, ongoing robotics innovations, and the demand for minimally invasive surgeries to shorten the recovery period are all driving factors in the regional market. During the forecast period, Asia Pacific is expected to be the fastest-growing regional market. Improvements in instrument development are anticipated to allow surgeons to work more efficiently, which will drive market development. Also, the market is anticipated to rise thanks to the increasing acceptance of robotic technology in the region, as well as increased awareness of the benefits of robotic procedures. According to MMR findings the global surgical robotics market is projected to double in size between 2022-2029 reaching 124.19 Mn by the year 2029.Recent Developments: 1. In January 2022, OrthoSensor and its Verasense intraoperative sensor technology were bought by Stryker to improve the Mako robots. 2. In January 2022, TransEnterix's Intelligent Surgical Unit, which adds AI-based capabilities and enables machine vision capabilities to TransEnterix's Senhance robotic surgery system, has achieved CE Mark clearance. 3. In January 2022, In Japan, Sytrker Corporation's Mako robotic surgery system gained regulatory approval for partial knee indication.

Surgical Robots Market Scope: Inquire before buying

Surgical Robots Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 71.94 Bn. Forecast Period 2023 to 2029 CAGR: 8.11% Market Size in 2029: US $ 124.18 Bn. Segments Covered: by New Approaches In-vivo robots Nanobots Capsule robots by Application Area Neurology Urology Gynecology Orthopedics Others by Product & Service Instruments & Accessories Robotic Systems Laparoscopy Robotic Systems Orthopedic Robotic Systems Neurosurgical Robotic Systems Other Systems Services Surgical Robots Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Surgical Robots Market, Key Players are:

1. Intuitive Surgical (US) 2. Stryker Corporation (US) 3. Medtronic (US) 4. Auris Health(US) 5. Medrobotics Corporation(US) 6. Think Surgical(US) 7. Verb Surgical(US) 8. OMNIlife Science(US) 9. Zimmer Biomet (US) 10. Asensus Surgical(US) 11. Corindus Vascular Robotics(US) 12. Renishaw(UK) 13. CMR Surgical (UK) 14. Smith & Nephew(UK) 15. China National Scientific Instruments and Materials Corporation(China) 16. Microsure(Netherlands) 17. Preceyes BV (Netherlands) 18. Titan Medical (Canada) 19. Avateramedical Gmbh ( Germany) 20. Medicaroid Corporation(Japan) 21. Others FAQs: 1. What is the study period of the market? Ans. The Global Surgical Robots Market is studied from 2022-2029. 2. What is the growth rate of Surgical Robots Market? Ans. The Surgical Robots Market is growing at a CAGR of 8.11% over forecast period. 3. What is the market size of the Surgical Robots Market by 2029? Ans. The market size of the Surgical Robotic Market by 2029 is expected to reach at USD 124.18 Bn. 4. What is the forecast period for the Surgical Robots Market? Ans. The forecast period for the Surgical Robots Market is 2023-2029. 5. What was the market size of the Surgical Robots Market in 2022? Ans. The market size of the Surgical Robots Market in 2022 was valued at USD 71.94 Bn.

1. Global ABC Market: Research Methodology 2. Global ABC Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global ABC Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global ABC Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global ABC Market Segmentation 4.1 Global ABC Market, by Approaches (2022-2029) • In-vivo robots • Nanobots • Capsule robots 4.2 Global ABC Market, by Application Area (2022-2029) • Urology • Gynecology • Orthopedics • Others 4.3 Global ABC Market, by Product & Service (2022-2029) • Robotic Systems • Laparoscopy Robotic Systems • Orthopedic Robotic Systems • Neurosurgical Robotic Systems • Other Systems • Services 5. North America ABC Market(2022-2029) 5.1 North America ABC Market, by Approaches (2022-2029) • In-vivo robots • Nanobots • Capsule robots 5.2 North America ABC Market, by Application Area (2022-2029) • Urology • Gynecology • Orthopedics • Others 5.3 North America ABC Market, by Product & Service (2022-2029) • Robotic Systems • Laparoscopy Robotic Systems • Orthopedic Robotic Systems • Neurosurgical Robotic Systems • Other Systems • Services 5.4 North America ABC Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe ABC Market (2022-2029) 6.1. European ABC Market, by Approaches (2022-2029) 6.2. European ABC Market, by Application Area (2022-2029) 6.3. European ABC Market, by Product & Service (2022-2029) 6.4. European ABC Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific ABC Market (2022-2029) 7.1. Asia Pacific ABC Market, by Approaches (2022-2029) 7.2. Asia Pacific ABC Market, by Application Area (2022-2029) 7.3. Asia Pacific ABC Market, by Product & Service (2022-2029) 7.4. Asia Pacific ABC Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa ABC Market (2022-2029) 8.1 Middle East and Africa ABC Market, by Approaches (2022-2029) 8.2. Middle East and Africa ABC Market, by Application Area (2022-2029) 8.3. Middle East and Africa ABC Market, by Product & Service (2022-2029) 8.4. Middle East and Africa ABC Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America ABC Market (2022-2029) 9.1. South America ABC Market, by Approaches (2022-2029) 9.2. South America ABC Market, by Application Area (2022-2029) 9.3. South America ABC Market, by Product & Service (2022-2029) 9.4 South America ABC Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Intuitive Surgical (US) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Stryker Corporation (US) 10.3 Medtronic (US) 10.4 Auris Health(US) 10.5 Medrobotics Corporation(US) 10.6 Think Surgical(US) 10.7 Verb Surgical(US) 10.8 OMNIlife Science(US) 10.9 Zimmer Biomet (US) 10.10 Asensus Surgical(US) 10.11 Corindus Vascular Robotics(US) 10.12 Renishaw(UK) 10.13 CMR Surgical (UK) 10.14 Smith & Nephew(UK) 10.15 China National Scientific Instruments and Materials Corporation(China) 10.16 Microsure(Netherlands) 10.17 Preceyes BV (Netherlands) 10.18 Titan Medical (Canada) 10.19 Avateramedical Gmbh ( Germany) 10.20 Medicaroid Corporation(Japan)