Global Optical Satellite Communication Market size was valued at USD 289 Mn in 2023 and is expected to reach USD 1156 Mn by 2030, at a CAGR of 29.8 %. The Optical Satellite Communication Market, leveraging advanced technology for data transmission through optical signals, has witnessed significant growth. Optical Satellite Communication involves using lasers to establish communication links between satellites, offering advantages such as high data transfer rates and secure communication. In the current scenario, the market is driven by the increasing demand for high-speed and secure satellite communication across various sectors, including defense, aerospace, and telecommunications. The growth of data-intensive applications and the need for reliable communication in satellite networks contribute to the market's expansion. Key growth factors include enhanced data transfer capabilities, resistance to interference, and the potential for quantum communication applications. Recent developments by market key players showcase the industry's dynamism.To know about the Research Methodology :- Request Free Sample Report For instance, advancements in free-space optical communication technology by major players like Mynaric AG have enabled high-capacity data transmission between satellites in space. Additionally, companies like Airbus are actively involved in developing optical communication payloads for satellites, aiming to enhance the overall efficiency and capabilities of satellite communication systems. These developments underscore the market's trajectory toward innovation and technological advancements, aligning with the increasing demands for efficient and secure satellite communication solutions. As the Optical Satellite Communication Market continues to evolve, driven by technological breakthroughs and strategic initiatives by key players, it is poised to play a crucial role in reshaping the landscape of satellite communication, meeting the escalating requirements for high-performance and secure data transfer in the space-based communication domain.

Optical Satellite Communication Market Driver

Securing the Future: Optical Satellite Communication Market Advances with Quantum-Secure Breakthroughs and Data-Driven Exploration As the Optical Satellite Communication Market accelerates, a revolutionary stride in secure communication takes center stage. The implementation of quantum key distribution (QKD) techniques represents a quantum leap in security, rendering interception virtually impossible. This unparalleled level of security positions optical satellite communication as a pivotal player in sectors demanding top-tier data protection, such as defense, finance, and sensitive industries. Recent groundbreaking developments, exemplified by Germany-based Mynaric AG, have propelled quantum communication to new heights. Mynaric AG's quantum communication breakthrough has opened doors to ultra-secure space data transfer, solidifying the Optical Satellite Communication Market's role as a guardian of impervious communication links. Catalysing Exploration: Exponential Data Demand in Space Exploration The Optical Satellite Communication Market finds a formidable driver in the burgeoning demand for real-time data within the realm of space exploration. As space missions become increasingly data-intensive, optical satellite communication emerges as a solution to the pressing need for high-speed, high-capacity communication links between satellites and ground stations. This surge in data requirements spans applications from Earth observation to deep-space exploration and the deployment of satellite constellations. A testament to this trajectory is Airbus, a key player advancing optical communication payloads. Airbus's continuous efforts in optimizing optical communication payloads underscore its commitment to elevating the efficiency and capabilities of satellite communication systems, steering the Optical Satellite Communication Market toward a data-driven future. Mynaric's Quantum Communication Breakthrough: In a significant stride towards quantum-secure communication, Mynaric AG, headquartered in Germany, achieved a breakthrough in quantum communication, amplifying the industry's capabilities for ultra-secure space data transfer. Airbus Advancing Optical Payloads: France-based Airbus maintains its forefront position in optical satellite communication, showcasing recent advancements in optical communication payloads. This commitment to innovation reinforces the market's potential in shaping the future of space-based data transfer. Optical Satellite Communication Market Restraint The Optical Satellite Communication Market encounters formidable challenges, notably in technological integration, as the industry navigates the intricacies of incorporating advanced optical communication systems into existing satellite infrastructures. This demands meticulous planning and retrofitting, exemplified by the complexities associated with introducing quantum communication, impacting compatibility and operational efficiency. Additionally, regulatory constraints and spectrum allocation challenges impede seamless integration, emphasizing the need for robust frameworks supporting optimal spectrum utilization. Instances of conflicting allocations underscore the necessity for effective regulations to foster the harmonious integration of optical communication technologies within the Optical Satellite Communication Market. Economic viability concerns pose hurdles for widespread adoption in the Optical Satellite Communication Market, where the implementation of advanced systems incurs substantial costs, limiting accessibility. The budgetary constraints observed in national space programs exemplify these challenges, hindering the deployment of cost-intensive optical communication technologies. As the industry grapples with economic considerations, addressing these challenges becomes pivotal for the sustained growth and accessibility of optical communication solutions in the Optical Satellite Communication Market. Optical Satellite Communication Market Opportunities In the realm of Optical Satellite Communication Market growth opportunities, embracing advancements in quantum communication stands as a paramount driver. The industry can harness the increasing maturity of quantum technologies, integrating quantum communication systems into existing infrastructures. This strategic move not only ensures unparalleled security in data transmission but also opens avenues for Quantum Key Distribution (QKD) applications, reinforcing data security in sectors managing sensitive information. Additionally, the proliferation of Low Earth Orbit (LEO) Satellite Constellations emerges as a significant growth frontier for the Optical Satellite Communication Market. The likes of SpaceX, with its Starlink deployment, showcase the immense potential for global broadband coverage. To seize this opportunity, industry players can foster collaborations and actively engage in the development of optical communication solutions tailored for emerging LEO projects. Positioning the industry as a key contributor to the demand for high-speed, low-latency connectivity in these constellations enhances its competitive edge in the evolving market landscape.Optical Satellite Communication Market Segment Analysis

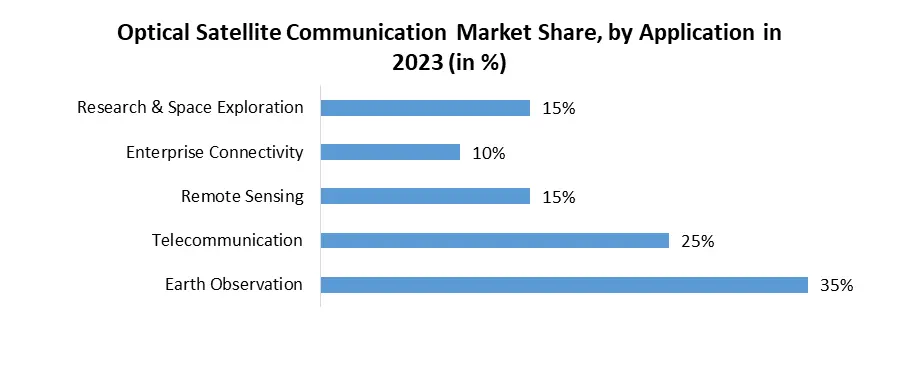

By Application, The Optical Satellite Communication Market exhibits diverse segmentations based on distinct applications, catering to a spectrum of industry needs. Earth Observation stands as a prominent segment, utilizing optical communication for high-resolution satellite imaging and data transmission from Earth observation satellites. Telecommunication emerges as a crucial sub-segment, leveraging optical communication technologies to support global broadband and high-speed, low-latency connectivity demands. Remote Sensing, another integral category, relies on advanced optical systems to transmit large volumes of data from satellites, enhancing applications like environmental monitoring and disaster response. Enterprise Connectivity represents a growing sub-segment, employing optical communication solutions for efficient and scalable connectivity, particularly in IoT ecosystems and smart city applications. Research & Space Exploration, a cutting-edge domain, utilizes optical communication to transmit data from space probes and rovers, contributing to scientific discoveries. Each sub-segment plays a unique role, highlighting the adaptability and versatility of optical satellite communication technologies across Earth observation, telecommunications, remote sensing, enterprise connectivity, and research & space exploration applications.

Optical Satellite Communication Market Regional Analysis

North America held the largest market share in 2023, in the competitive arena of Optical Satellite Communication Markets, North America asserts its dominance, securing over 50% of the global market share in 2023. This commanding position is underpinned by various factors, including the region's technological prowess embodied by companies like Ball Corporation and SpaceX. Renowned for advanced laser communication technology, North America benefits from substantial government and military spending, propelling research and development in defense applications and space programs. Moreover, the region's commercial appeal is evident in the increasing demand for high-bandwidth internet connectivity, driven by growing network infrastructure needs in remote areas and enterprise solutions. North America faces emerging challenges, such as rising research and development costs, regulatory hurdles, and global competition from burgeoning markets in regions like Asia Pacific. The latter, in particular, emerges as a rising star, projected to be the fastest-growing market Asia Pacific's growth is fueled by a booming economy across developing nations, increased government investments in space programs, and a rising demand for affordable and reliable connectivity solutions. Meanwhile, Europe, although holding a smaller market share, distinguishes itself with advanced technological capabilities, emphasizing research and development, and a burgeoning private sector in space startups. While North America presently holds the crown, the global landscape is dynamic. Asia Pacific's rapid ascension and Europe's technological strength signal potential shifts in regional leadership. As the optical satellite communication market evolves, understanding emerging challenges, opportunities, and the influence of new players will be pivotal in predicting future dominance across different regions. The Asia-Pacific region emerges as a robust manufacturing nucleus, propelled by the technological acumen of key players such as China and Japan. Notably, China's visionary endeavors, including the "Space Information Corridor" initiative, underscore its dedicated strides in advancing satellite communication technologies, thereby significantly augmenting the region's production capabilities. On the flip side of the equation, North America commands attention as a pivotal market, notably spearheaded by the United States. This region experiences a substantial demand surge for sophisticated communication solutions, fuelled by the prevalence of space exploration missions, military applications, and the flourishing commercial satellite industry. Delving into the import-export domain, Europe takes a prominent stance, leveraging its collective technological expertise. Countries like Germany and France, recognized for their aerospace prowess, not only contribute significantly to regional production but also actively engage in extensive global trade. Their exports, featuring advanced optical communication technologies, substantiate Europe's influential role in the international market. Collaborative initiatives within Europe, exemplified by projects like the European Data Relay System (EDRS), underscore the region's steadfast commitment to elevating satellite communication capabilities. These ventures not only enhance regional cooperation but also foster collaborative endeavors on the global stage. Collectively, these regional insights underscore the intricate interplay of production, consumption, and trade dynamics, molding the Optical Satellite Communication Market into a nuanced and interconnected industry landscape. Optical Satellite Communication Market Competitive Landscape The Optical Satellite Communication Market boasts a competitive landscape marked by technological innovation and strategic collaborations among key industry players. Leading global corporations, including Airbus SE, L3Harris Technologies, and Thales Group, exhibit dominance, leveraging their expertise in satellite communication technologies. Emerging stars like HawkEye 360 and GomSpace add dynamism to the market, introducing cutting-edge solutions in optical satellite communication. Strategic partnerships play a pivotal role, exemplified by collaborations between Boeing and ViaSat, enhancing optical backbone capabilities for satellite communication. The competitive sphere witnesses a convergence of AI and optical communication technologies, with companies like Lockheed Martin incorporating artificial intelligence for signal processing optimization. Innovative ventures like SpaceX's Starlink, focusing on low Earth orbit satellite constellations, contribute to the intense competition, shaping the market's future trajectory. The emphasis on quantum communication, as seen in projects by companies such as Mitsubishi Electric, introduces a new dimension of secure data transmission. As the Optical Satellite Communication Market evolves, players continually vie for market share through advancements in quantum technologies, strategic collaborations, and the development of novel communication solutions. This dynamic landscape encapsulates a quest for innovation, underlining the market's resilience and adaptability in the face of technological advancements and growing global connectivity demands.Scope of the Global Optical Satellite Communication Market Report: Inquire before buying

Global Optical Satellite Communication Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 289 Mn. Forecast Period 2024 to 2030 CAGR: 29.8% Market Size in 2030: US $ 1156 Mn. Segments Covered: by Application Earth Observation Telecommunication Remote Sensing Enterprise Connectivity Research & Space Exploration by Component Transmitters Receivers Modulators Demodulators Others by End User Commercial Civil Government Military & Defence Optical Satellite Communication Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A)Optical Satellite Communication Market Key players

North America 1. L3Harris Technologies, Inc. - Melbourne, Florida, USA 2. Northrop Grumman Corporation - Falls Church, Virginia, USA 3. Lockheed Martin Corporation - Bethesda, Maryland, USA 4. General Dynamics Corporation - Reston, Virginia, USA 5. Honeywell International Inc. - Charlotte, North Carolina, USA 6. ViaSat, Inc. - Carlsbad, California, USA 7. Boeing - Chicago, Illinois, USA 8. ST Engineering iDirect, Inc. - Herndon, Virginia, USA 9. Kratos Defense & Security Solutions, Inc. - San Diego, California, USA 10. Comtech EF Data Corporation - Tempe, Arizona, USA 11. Maxar Technologies Inc. - Westminster, Colorado, USA 12. Iridium Communications Inc. - McLean, Virginia, USA 13. Orbital Sciences Corporation (now part of Northrop Grumman) - Dulles, Virginia, USA 14. Astronics Corporation - East Aurora, New York, USA 15. HawkEye 360 - Herndon, Virginia, USA 16. Advantech Wireless - Montreal, Quebec, Canada Europe 1. Airbus SE - Leiden, Netherlands 2. Thales Group - Paris, France 3. Eutelsat Communications S.A. - Paris, France 4. Telesat Canada - Ottawa, Ontario, Canada 5. SSL (Space Systems Loral, now part of Maxar) - Palo Alto, California, USA Asia-Pacific 1. Mitsubishi Electric Corporation - Tokyo, Japan 2. Gilat Satellite Networks - Petah Tikva, Israel 3. GomSpace Group AB - Stockholm, Sweden 4. SES S.A. - Betzdorf, Luxembourg 5. Inmarsat plc - London, United Kingdom 6. Novelsat - Ra'anana, Israel 7. Kongsberg Satellite Services AS (KSAT) - Tromsø, Norway Frequently Asked Questions: 1] What is the growth rate of the Global Optical Satellite Communication Market? Ans. The Global Optical Satellite Communication Market is growing at a significant rate of 29.8 % during the forecast period. 2] Which region is expected to dominate the Global Optical Satellite Communication Market? Ans. The Global Optical Satellite Communication Market is anticipated to witness significant growth in North America. The region's dominance is attributed to a robust space industry, technological advancements, and increasing demand for high-speed and secure satellite communication. Additionally, key players in optical satellite communication technologies, such as L3Harris Technologies and Ball Aerospace, are based in North America. The region's emphasis on space exploration, coupled with strategic investments, positions it as a major contributor to the market's expansion. 3] What is the expected Global Optical Satellite Communication Market size by 2030? Ans. The Optical Satellite Communication Market size is expected to reach USD 1156 Mn by 2030. 4] Which are the top players in the Global Optical Satellite Communication Market? Ans. In the global optical satellite communication market, Key players include Mynaric AG, L3Harris Technologies, Inc., Analytical Space Inc., Airbus SE, Maxar Technologies, Ball Aerospace, Laser Light Communications, and BridgeSat Inc. These companies are at the forefront of developing and deploying optical satellite communication technologies, contributing significantly to advancements in high-speed, secure, and efficient data transmission via satellite systems. 5] What are the factors driving the Global Optical Satellite Communication Market growth? Ans. The Global Optical Satellite Communication Market is propelled by the escalating demand for high-bandwidth communication in space applications, providing faster and secure data transmission. Advancements in satellite technology and a surge in satellite launches for communication and Earth observation amplify market growth. Additionally, increasing investments in space-based infrastructure and the growing need for reliable and efficient communication solutions contribute to the expansion of the optical satellite communication market on a global scale. 6] Which country held the largest Global Optical Satellite Communication Market share in 2023? Ans. The United States held the largest Global Market share in 2023.

1. Optical Satellite Communication Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Optical Satellite Communication Market: Dynamics 2.1. Optical Satellite Communication Market Trends by Region 2.1.1. North America Optical Satellite Communication Market Trends 2.1.2. Europe Optical Satellite Communication Market Trends 2.1.3. Asia Pacific Optical Satellite Communication Market Trends 2.1.4. Middle East and Africa Optical Satellite Communication Market Trends 2.1.5. South America Optical Satellite Communication Market Trends 2.2. Optical Satellite Communication Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Optical Satellite Communication Market Drivers 2.2.1.2. North America Optical Satellite Communication Market Restraints 2.2.1.3. North America Optical Satellite Communication Market Opportunities 2.2.1.4. North America Optical Satellite Communication Market Challenges 2.2.2. Europe 2.2.2.1. Europe Optical Satellite Communication Market Drivers 2.2.2.2. Europe Optical Satellite Communication Market Restraints 2.2.2.3. Europe Optical Satellite Communication Market Opportunities 2.2.2.4. Europe Optical Satellite Communication Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Optical Satellite Communication Market Drivers 2.2.3.2. Asia Pacific Optical Satellite Communication Market Restraints 2.2.3.3. Asia Pacific Optical Satellite Communication Market Opportunities 2.2.3.4. Asia Pacific Optical Satellite Communication Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Optical Satellite Communication Market Drivers 2.2.4.2. Middle East and Africa Optical Satellite Communication Market Restraints 2.2.4.3. Middle East and Africa Optical Satellite Communication Market Opportunities 2.2.4.4. Middle East and Africa Optical Satellite Communication Market Challenges 2.2.5. South America 2.2.5.1. South America Optical Satellite Communication Market Drivers 2.2.5.2. South America Optical Satellite Communication Market Restraints 2.2.5.3. South America Optical Satellite Communication Market Opportunities 2.2.5.4. South America Optical Satellite Communication Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. North America 2.7.2. Europe 2.7.3. Asia Pacific 2.7.4. Middle East and Africa 2.7.5. South America 2.8. Analysis of Government Schemes and Initiatives For Optical Satellite Communication Industry 2.9. The Global Pandemic Impact on Optical Satellite Communication Market 2.10. Optical Satellite Communication Price Trend Analysis (2021-23) 3. Optical Satellite Communication Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2023-2030) 3.1. Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 3.1.1. Earth Observation 3.1.2. Telecommunication 3.1.3. Remote Sensing 3.1.4. Enterprise Connectivity 3.1.5. Research & Space Exploration 3.2. Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 3.2.1. Transmitters 3.2.2. Receivers 3.2.3. Modulators 3.2.4. Demodulators 3.2.5. Others 3.3. Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 3.3.1. Commercial 3.3.2. Civil Government 3.3.3. Military & Defence 3.4. Optical Satellite Communication Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Optical Satellite Communication Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 4.1.1. Earth Observation 4.1.2. Telecommunication 4.1.3. Remote Sensing 4.1.4. Enterprise Connectivity 4.1.5. Research & Space Exploration 4.2. North America Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 4.2.1. Transmitters 4.2.2. Receivers 4.2.3. Modulators 4.2.4. Demodulators 4.2.5. Others 4.3. North America Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 4.3.1. Commercial 4.3.2. Civil Government 4.3.3. Military & Defence 4.4. North America Optical Satellite Communication Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 4.4.1.1.1. Earth Observation 4.4.1.1.2. Telecommunication 4.4.1.1.3. Remote Sensing 4.4.1.1.4. Enterprise Connectivity 4.4.1.1.5. Research & Space Exploration 4.4.1.2. United States Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 4.4.1.2.1. Transmitters 4.4.1.2.2. Receivers 4.4.1.2.3. Modulators 4.4.1.2.4. Demodulators 4.4.1.2.5. Others 4.4.1.3. United States Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 4.4.1.3.1. Commercial 4.4.1.3.2. Civil Government 4.4.1.3.3. Military & Defence 4.4.2. Canada 4.4.2.1. Canada Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 4.4.2.1.1. Earth Observation 4.4.2.1.2. Telecommunication 4.4.2.1.3. Remote Sensing 4.4.2.1.4. Enterprise Connectivity 4.4.2.1.5. Research & Space Exploration 4.4.2.2. Canada Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 4.4.2.2.1. Transmitters 4.4.2.2.2. Receivers 4.4.2.2.3. Modulators 4.4.2.2.4. Demodulators 4.4.2.2.5. Others 4.4.2.3. Canada Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 4.4.2.3.1. Commercial 4.4.2.3.2. Civil Government 4.4.2.3.3. Military & Defence 4.4.3. Mexico 4.4.3.1.1. Mexico Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 4.4.3.1.1.1. Earth Observation 4.4.3.1.1.2. Telecommunication 4.4.3.1.1.3. Remote Sensing 4.4.3.1.1.4. Enterprise Connectivity 4.4.3.1.1.5. Research & Space Exploration 4.4.3.1.2. Mexico Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 4.4.3.1.2.1. Transmitters 4.4.3.1.2.2. Receivers 4.4.3.1.2.3. Modulators 4.4.3.1.2.4. Demodulators 4.4.3.1.2.5. Others 4.4.3.1.3. Mexico Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 4.4.3.1.3.1. Commercial 4.4.3.1.3.2. Civil Government 4.4.3.1.3.3. Military & Defence 5. Europe Optical Satellite Communication Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 5.2. Europe Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 5.3. Europe Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 5.4. Europe Optical Satellite Communication Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 5.4.1.2. United Kingdom Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 5.4.1.3. United Kingdom Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 5.4.2. France 5.4.2.1. France Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 5.4.2.2. France Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 5.4.2.3. France Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 5.4.3.2. Germany Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 5.4.3.3. Germany Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 5.4.4.2. Italy Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 5.4.4.3. Italy Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 5.4.5.2. Spain Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 5.4.5.3. Spain Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 5.4.6.2. Sweden Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 5.4.6.3. Sweden Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 5.4.7.2. Austria Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 5.4.7.3. Austria Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 5.4.8.2. Rest of Europe Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 5.4.8.3. Rest of Europe Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 6. Asia Pacific Optical Satellite Communication Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 6.2. Asia Pacific Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 6.3. Asia Pacific Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 6.4. Asia Pacific Optical Satellite Communication Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 6.4.1.2. China Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 6.4.1.3. China Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 6.4.2.2. S Korea Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 6.4.2.3. S Korea Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 6.4.3.2. Japan Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 6.4.3.3. Japan Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 6.4.4. India 6.4.4.1. India Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 6.4.4.2. India Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 6.4.4.3. India Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 6.4.5.2. Australia Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 6.4.5.3. Australia Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 6.4.6.2. Indonesia Optical Satellite Communication Market Size and Forecast, by T ype (2023-2030) 6.4.6.3. Indonesia Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 6.4.7.2. Malaysia Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 6.4.7.3. Malaysia Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 6.4.8.2. Vietnam Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 6.4.8.3. Vietnam Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 6.4.9.2. Taiwan Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 6.4.9.3. Taiwan Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 6.4.10.2. Rest of Asia Pacific Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 6.4.10.3. Rest of Asia Pacific Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 7. Middle East and Africa Optical Satellite Communication Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Middle East and Africa Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 7.2. Middle East and Africa Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 7.3. Middle East and Africa Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 7.4. Middle East and Africa Optical Satellite Communication Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 7.4.1.2. South Africa Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 7.4.1.3. South Africa Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 7.4.2.2. GCC Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 7.4.2.3. GCC Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 7.4.3.2. Nigeria Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 7.4.3.3. Nigeria Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 7.4.4.2. Rest of ME&A Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 7.4.4.3. Rest of ME&A Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 8. South America Optical Satellite Communication Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. South America Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 8.2. South America Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 8.3. South America Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 8.4. South America Optical Satellite Communication Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 8.4.1.2. Brazil Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 8.4.1.3. Brazil Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 8.4.2.2. Argentina Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 8.4.2.3. Argentina Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Optical Satellite Communication Market Size and Forecast, by Application (2023-2030) 8.4.3.2. Rest Of South America Optical Satellite Communication Market Size and Forecast, by Component (2023-2030) 8.4.3.3. Rest Of South America Optical Satellite Communication Market Size and Forecast, by End-User (2023-2030) 9. Global Optical Satellite Communication Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Optical Satellite Communication Market Companies, by Market Capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Novartis AG (Switzerland) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Awards Received by the Firm 10.1.6. Recent Developments 10.2. Airbus SE - Leiden, Netherlands 10.3. L3Harris Technologies, Inc. - Melbourne, Florida, USA 10.4. Mitsubishi Electric Corporation - Tokyo, Japan 10.5. Northrop Grumman Corporation - Falls Church, Virginia, USA 10.6. Thales Group - Paris, France 10.7. Lockheed Martin Corporation - Bethesda, Maryland, USA 10.8. General Dynamics Corporation - Reston, Virginia, USA 10.9. Honeywell International Inc. - Charlotte, North Carolina, USA 10.10. ViaSat, Inc. - Carlsbad, California, USA 10.11. Boeing - Chicago, Illinois, USA 10.12. ST Engineering iDirect, Inc. - Herndon, Virginia, USA 10.13. Kratos Defense & Security Solutions, Inc. - San Diego, California, USA 10.14. Comtech EF Data Corporation - Tempe, Arizona, USA 10.15. Gilat Satellite Networks - Petah Tikva, Israel 10.16. GomSpace Group AB - Stockholm, Sweden 10.17. Maxar Technologies Inc. - Westminster, Colorado, USA 10.18. SES S.A. - Betzdorf, Luxembourg 10.19. Iridium Communications Inc. - McLean, Virginia, USA 10.20. Eutelsat Communications S.A. - Paris, France 10.21. Inmarsat plc - London, United Kingdom 10.22. Orbital Sciences Corporation - Dulles, Virginia, USA 10.23. Telesat Canada - Ottawa, Ontario, Canada 10.24. SSL (Space Systems Loral, now part of Maxar) - Palo Alto, California, USA 10.25. Astronics Corporation - East Aurora, New York, USA 10.26. Novelsat - Ra'anana, Israel 10.27. Kongsberg Satellite Services AS - Tromsø, Norway 10.28. Advantech Wireless - Montreal, Quebec, Canada 10.29. HawkEye 360 - Herndon, Virginia, USA 11. Key Findings 12. Industry Recommendations 13. Optical Satellite Communication Market: Research Methodology