The Open-Source Intelligence Market size was valued at USD 9350.69 Million in 2025 and the total Open-Source Intelligence revenue is expected to grow at a CAGR of 20.63% from 2026 to 2032, reaching nearly USD 34756.12 Million by 2032. Open-source intelligence refers to publicly available data and information. It's not only the information that can get through a search engine. It may originate from a variety of sources and is a great tool for security professionals and intelligence agencies, but it's also crucial to remember that threat actors use OSINT to their advantage. Material available to the public does not have to be free; it can also include proprietary or subscription-based information, such as a news journal. It might also be information and data that can only be obtained upon request.To know about the Research Methodology :- Request Free Sample Report The primary goal of an open-source intelligence tool is to clean, reorganize, and enrich accessible raw data to allow informed and better decision-making in less time. The method has been altered by open-source intelligence technology, which has replaced arduous, time-consuming attempts to master numerous data sources. Among the several benefits given by the open source, intelligence is the ability to structure massive amounts of data and efficiently handle big volumes of data. The open-source intelligence market is growing due to the increased usage of open-source intelligence products across various companies and the increase in demand for cloud-based OSINT among SMEs. In addition, the growing demand for OSINT by various sectors to obtain insights for business planning drives the growth of the market. However, a lack of understanding regarding OSINT and concerns about data quality issues are restricting the market growth. Rising trends such as social media analytics are expected to result in significant opportunities for market growth during the forecast period. Report Scope: The report covers the overall structure of the Open-Source Intelligence Market and provides premium insights that can assist software vendors, network operators, telecom service providers, equipment manufacturers, third-party providers, and managed service providers in identifying the needs of large and small organizations (end users), as well as displaying the gaps for telecom service providers and network operators. The report investigated the growth rate and penetration in the key regions. The report analyses global adoption patterns, future growth potentials, major drivers, limitations, prospects, Challenges, and best practices in the Open-Source Intelligence Market. The report also investigates future demand sizes and revenue estimates across various geographies and user groups. The report further includes a PORTER and PESTEL analysis, as well as the possible influence of market microeconomic aspects. External and internal elements that are expected to affect the organization positively or adversely have been studied, providing decision-makers with a clear future vision of the industry. The report also helps report users in the comprehension of the market trends and structure by studying market segments and projecting the market size. The study is an investor's guide because of its clear depiction of competitive analysis of key competitors in the market by product, price, financial situation, product portfolio, growth plans, and geographical presence. Research Methodology: Primary and secondary research is used to create the Open-Source Intelligence market report. The Bottom-Up Approach is used to examine both secondary and primary data. Secondary data sources include nationalized and global data sources, annual and financial reports from major market participants, news announcements, and so on. Interviews, surveys, expert and trained professional opinions, and other methods were used to collect primary data. The research also includes information on current developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the effect of domestic and major & localized market players, changes in market regulations, and strategic market growth analysis. Government policy, market environment, competitive landscape, historical data, current market trends, technological innovation, upcoming technologies, and the technical progress in related industries, as well as market risks, opportunities, market barriers, and challenges, are all investigated during the qualitative research. All conceivable elements influencing the markets included in this research study have been considered, examined in depth, validated through primary research, and evaluated to provide the final quantitative and qualitative data. Market size is normalized for top-level markets and sub-segments, and the influence of inflation, economic downturns, regulatory & policy changes, and other variables is considered in the market forecast.

Open-Source Intelligence Market Dynamics:

Growing demand for defense applications. Given the paramount importance of national security, each state maintains authorized intelligence agencies tasked with gathering and analyzing crucial information. Operated clandestinely, these agencies play a pivotal role in informing governmental decisions, all the while conducting their activities discreetly to safeguard sensitive operations. In the Information Age of the 21st century, there's a growing comprehension within the Information Society regarding intelligence operations, leading to increased transparency and awareness concerning governmental actions, including those of specialized services. The advent of computerization and technological advancements not only reshape state security concerns but also foster the proliferation of security tools, entrusted with identifying and mitigating emerging threats effectively. Intelligence is carried out by functional, operational, and informational divisions, each of which has a distinct duty to play at different phases of the information cycle, including military reconnaissance. Military identification, despite its specificity and character, is congruent with strategic intelligence, with the distinction seen in the names and extended techniques of information gathering and analysis. It leverages open-source intelligence (OSINT) as a secret instrument for information collecting, which is not disclosed to the party executing the verification and verification operations. OSINT is referred to as an extra-informal method of gathering information, i.e. on a military issue. During the Cold War, British intelligence emphasized the importance of basic sources of information such as books, magazines, and the daily press, stating that "studying Soviet and daily newspapers and technical journals is very valuable as a source of intelligence and should be used at every opportunity." With the advancement of technology, the Internet has become the major source of OSINT (especially appreciated by the Federal Security Service of the Russian Federation -FSB). The rising requirement to utilize AI and big data capabilities for gathering security information is driving the increased deployment of OSINT technologies in the country's armed forces. The use of open-source data in conjunction with classified information allows for the successful optimization of battle intelligence, identification of appropriate tactical warfare plans, and maximum exploitation of military resources.Top 8 Social Media Intelligence (SOCMINT) Tools

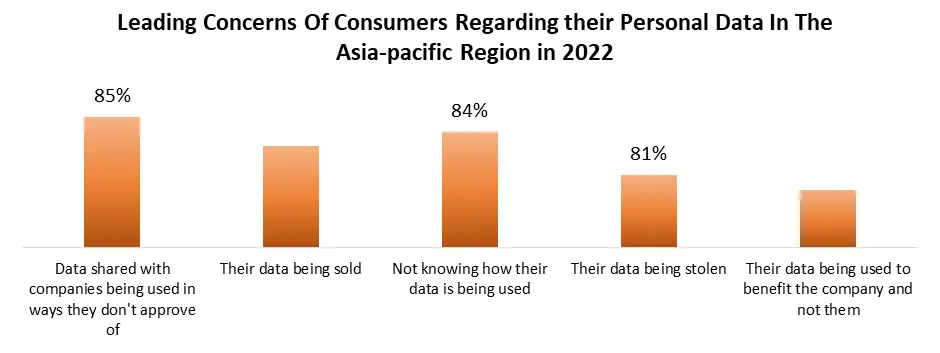

Increasing Government Initiatives to Protect Organizations Data. Data security is critical for both organizations and people. Several attempts have been launched by governments all over the globe in recent years to enact stringent data protection legislation in their respective areas. Noncompliance with the EU GDPR may result in significant fines of up to 4% of an organization's global sales. The duty to notify EU authorities within 72 hours after a breach and the ability to show that the organization's security strategy is state-of-the-art are two major components of the EU GDPR (SOTA). For efficient outcomes, Europe's data protection law enforcement committee is trained to utilize open-source intelligence (OISNT) in their investigations. The Australian government secures data in different forms by enforcing legislation such as the Australian Privacy Principles (APP), Cybercrime Act, Spam Act, and Telecommunication Act. This legislation governs the acquisition, use, and dissemination of personal information; prohibits unauthorized computer access; and prevents phishing emails from infiltrating personal and government networks across the country. As a result, rising government initiatives to protect both personal and organizational data from theft are increasing the adoption of open-source intelligence across government intelligence agencies, military and defense intelligence agencies, cybersecurity organizations, law enforcement agencies, and private specialized global businesses driving the market growth. Impact of the Artificial Intelligence Act on OSINT Security The open-source intelligence (OSINT) market contends with significant restraints stemming from cybersecurity vulnerabilities, particularly amidst the rising integration of AI technologies and reliance on open-source systems. A key concern revolves around the absence of a well-defined risk-based approach essential for identifying and mitigating potential security risks linked to AI systems. The European Commission's proposal for the Artificial Intelligence Act underscores the imperative of adopting such an approach to safeguard individuals' safety and fundamental rights. However, without effective implementation, there looms a heightened risk of security breaches, exemplified by incidents like the Apache Struts vulnerability, exposing numerous government and business entities to exploitation and unauthorized access to sensitive data. The challenges are further compounded by the nature of open-source software (OSS), which lacks dedicated technical support akin to proprietary software, resulting in delayed updates and security patches. Cyber threat actors exploit these vulnerabilities to infiltrate organizations' networks and compromise confidential information. Moreover, the public nature of open-source AI systems makes them susceptible to attacks from other AI applications, exacerbating the risk landscape. Privacy concerns also hinder the OSINT market, particularly concerning AI-driven behavioral monitoring, raising significant ethical and regulatory dilemmas regarding user privacy rights and compliance with AI regulations. These constraints underscore the critical need for robust cybersecurity measures, collaborative efforts among stakeholders, and investments in AI ethics and compliance training to navigate the complex OSINT landscape effectively while maximizing its value in bolstering national security. Increasing concerns of consumers regarding their personal data In the rapidly expanding Open-Source Intelligence (OSINT) market of the Asia-Pacific region, ensuring data quality is paramount, albeit challenging due to the high volume of rejected and invalid data points. Data scientists face substantial hurdles in validating and verifying information, particularly in data-rich countries like China and India, where extracting meaningful insights from vast datasets is daunting. Moreover, the pursuit of complex and precise data intensifies the effort needed to collect, process, and deliver insights, especially in cybersecurity intelligence, where distinguishing credible threat indicators from noise necessitates meticulous analysis and interpretation. Robust data validation processes and sophisticated analytical techniques thus become imperative in the Asia-Pacific OSINT landscape. The diverse and intricate array of data sources in the region adds complexity for OSINT practitioners, with varying languages, cultural nuances, and regulatory frameworks posing inherent challenges in aggregating and synthesizing data. For instance, in Japan, where traditional and modern communication channels coexist, extracting actionable intelligence demands specialized linguistic skills. Similarly, in Southeast Asian nations like Indonesia and Thailand, navigating evolving data privacy regulations amidst prevalent online information sharing complicates the ethical and legal landscape for OSINT practitioners. Additionally, the region's rapid technological advancement introduces complexities, with the proliferation of encrypted messaging apps and anonymized communication channels challenging surveillance efforts, particularly in countries like South Korea and Singapore, where digital innovation fuels economic growth, necessitating continuous adaptation of OSINT methodologies to counter emerging cyber threats and disinformation campaigns.

Tool Features Use Cases SL Crimewall Full-cycle OSINT platform Digital Footprinting, Due Diligence, Sentiment Analysis, Criminal Activity Monitoring NexVision Social Real-time monitoring Sentiment Analysis, Situational Awareness, Monitoring Boardreader Forum-focused solution Social Media Monitoring, Entity Analysis, Background Checks X1 Social Discovery Evidence collection and indexing Background Checks, Enhanced KYC Procedures, Due Diligence, Group Structure Identification

Open-Source Intelligence Market Segment Analysis:

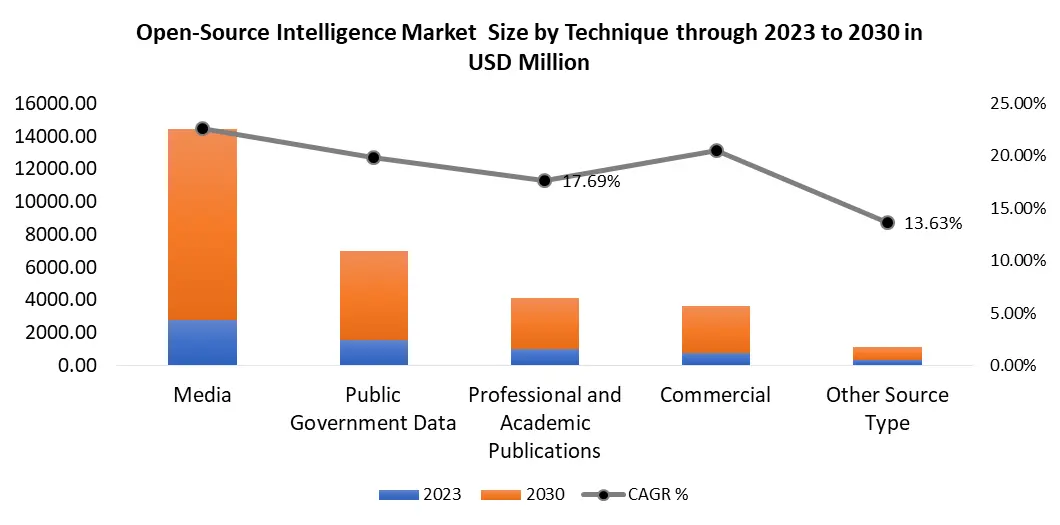

Based on Technique, Security Analytics dominated the Open-Source Intelligence Market in 2025 as it emerges as the most adopted technique, with a substantial market share of USD 22.05 %, owing to its critical role in detecting and mitigating cyber threats. Its widespread application across various sectors, including government, defense, and financial institutions, underscores its significance in bolstering cybersecurity posture. Text Analytics is fast growing segment in Open-Source Intelligence Market, primarily utilized for processing and analysing large volumes of textual data from diverse sources to extract actionable insights. Social Media Analytics gains traction for monitoring public sentiment, detecting emerging trends, and identifying potential threats across social media platforms. Meanwhile, Video Analytics and Geospatial Analytics witness moderate adoption levels, primarily employed for surveillance, threat detection, and spatial analysis. Other Techniques encompass a range of emerging analytics methods, showing promise for niche applications but currently experiencing limited adoption compared to the aforementioned techniques.

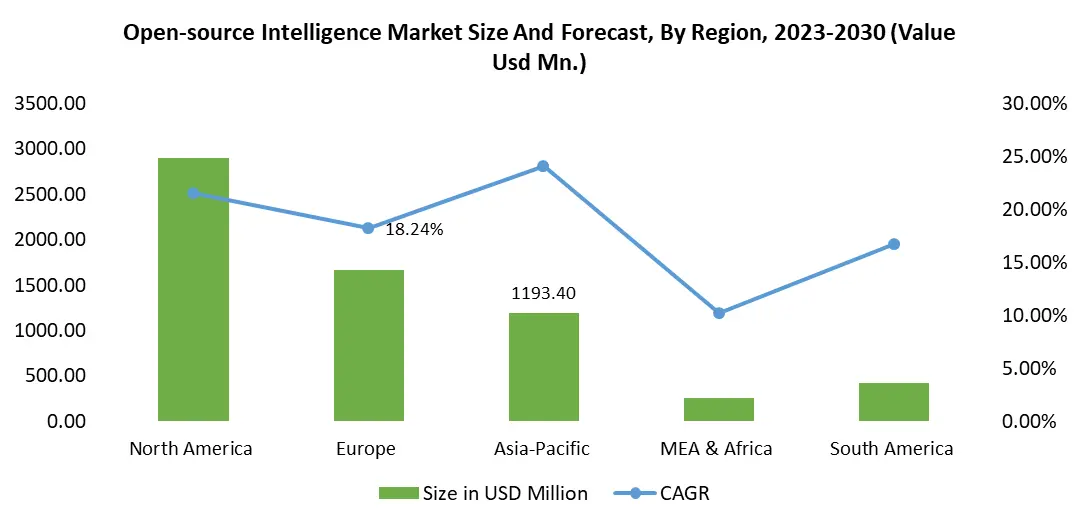

Open-Source Intelligence Market Regional Insights:

North America Dominance in the Open-Source Intelligence Market North America dominates the Open-Source Intelligence (OSINT) market with the highest market share in 2025 and is expected to maintain its dominance at the end of the forecast period. The United States and Canada are significant contributors to the market's growth. The surge may be attributed to an increase in the use of open-Source intelligence technology by a wide range of organizations, including government, intelligence, homeland security, military forces, and a variety of private and public specialized companies. The increasing use of open-Source intelligence by the US government for various open-Source activities such as internet research, media analysis, public surveys, and media monitoring, as well as the widespread adoption of open-Source intelligence by the US law enforcement OSINT community to predict, prevent, investigate, and prosecute criminals such as terrorists, are driving regional growth during the forecast period. The US government is increasingly focusing on improving cybersecurity since it is a primary concern. Mitigating the increasing severity of cyberattacks necessitates significant efforts and resources. The budget for cybersecurity in 2019 increased by 4.1% over 2018, with the Department of Defense (DoD) being the major contributor. The federal government intends to improve agency cybersecurity posture at all levels. As a result, information security products and services are expected to increase in demand in the United States. The number of smartphone users, as well as internet access, is increasing across the country. There is also an increasing number of social media users. Additionally, several organizations are embracing open-source intelligence and big data analytics to improve efficiency and revenue growth. North America's industrialized economies are the United States, Canada, and Mexico. The region's technological improvements have made it a highly competitive marketplace for all industries. To match consumer expectations for high-quality goods and services, companies in the region are constantly improving their entire business operations and adopting new media or channels. In recent decades, the use of digital technology in every sector and office has altered the US economy and workplace. This acceptance, however, is also driving a slew of negative effects, such as data breaches and illicit hacking, which result in the release of personal and corporate data. Individuals and corporations equally suffer significant financial losses as a result of data breaches. As a result, the need for enhanced data protection solutions is increasing. The rising need for data security among enterprises, as well as increased awareness about personal data breaches, are driving the growth of the open-source intelligence market in North America. During the COVID-19 pandemic, North America, particularly the United States, has been severely impacted. The unusual increase in the number of COVID-19 cases across the United States, and the consequent lockdown to battle the virus's spread across the country in the first two quarters of 2020, has prompted countless companies to be on alert. Technological investments fell in 2020 as a result of the aforementioned factors, weighing on market growth. However, the abrupt lockout has had an influence on how firms operate, leading to the emergence of digital platforms for conducting company activities from remote areas. For example, in July 2021, IBM Security's annual "Cost of a Data Breach" report estimates that an average data breach would cost $4.24 million per occurrence, up 10% from 2020 when 1,000 to 100,000 records are involved. The company's rapid operational adjustments due to the pandemic, stay-at-home orders, and the need to quickly turn operations remote resulted in greater expenses and increased challenges in managing a security event after it had happened, contributing to the rise in data breaching costs. To prevent such high expenditures, businesses are increasingly implementing technologies to encrypt all data on their private and public servers. As a result, new opportunities for the open-source intelligence industry emerged, substantially increasing the region's market growth.

Open-Source Intelligence Market Scope: Inquiry Before Buying

Open-Source Intelligence Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 9350.69 Mn. Forecast Period 2026 to 2032 CAGR: 20.63% Market Size in 2032: USD 34756.12 Mn. Segments Covered: by Source Type Media Public Government Data Professional and Academic Publications Commercial Other Source Type by Technique Text Analytics Video Analytics Social Media Analytics Geospatial Analytics Security Analytics Other Technique by End User Government Intelligence Agencies Military and Defense Intelligence Agencies Cyber Security Organizations Law Enforcement Agencies Financial Services Private Specialized Business Other End User Open-Source Intelligence Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Open-Source Intelligence Market, Key Players:

Major Contributors in the Open-Source Intelligence Industry in North America: 1. Babel Street 2. Cobwebs Technologies 3. Flashpoint Inc. 4. IBM 5. Palantir Technologies Inc. 6. Recorded Future 7. Sayari 8. ShadowDragon 9. Skopenow, Inc. 10. Social Links 11. TextOre, Inc. 12. ZeroFox Leading players in the Europe and Middle East Africa Open-Source Intelligence Market: 1. Neotas 2. CybelAngel 3. Thales Group 4. Hensoldt Analytics Gmbh 5. Maltego Technologies 6. rola Security Solutions GmbH 7. Check Point Software Technologies Ltd. 8. Kela 9. Expert System S.p.A. 10. IPS S.p.A Key players driving the Asia-Pacific Open-Source Intelligence Market: 1. Fivecast 2. OSINT Combine 3. Forward Defens FAQs: 1] What Major Key players in the Global Open-Source Intelligence Market report? Ans. The Major Key players covered in the Open-Source Intelligence Market report are Flashpoint Inc., Maltego Technologies, Recorded Future, Thales Group, CybelAngel, IPS S.p.A, Rola Security Solutions GmbH, Skopenow, ZeroFox., etc. 2] Which region is expected to hold the highest share in the Global Open-Source Intelligence Market? Ans. North America region is expected to hold the highest share in the Open-Source Intelligence Market. 3] What is the market size of the Global Open-Source Intelligence Market by 2032? Ans. The market size of the Open-Source Intelligence Market by 2032 is expected to reach USD 34756.12 Million. 4] What is the forecast period for the Global Open-Source Intelligence Market? Ans. The forecast period for the Open-Source Intelligence Market is 2026-2032. 5] What was the market size of the Global Open-Source Intelligence Market in 2025? Ans. The market size of the Open-Source Intelligence Market in 2025 was valued at US$ 6350.69 Million.

1. Open-Source Intelligence Market: Research Methodology 2. Open-Source Intelligence Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Product Segment 2.3.3. Ens User Segment 2.3.4. Revenue (2025) 2.3.5. Company Locations 2.4. Leading Open-Source Intelligence Market Companies, by Market Capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Open-Source Intelligence Market Introduction 3.1. Study Assumption and Market Definition 3.2. Scope of the Study 3.3. Executive Summary 4. Open-Source Intelligence Market: Dynamics 4.1. Open-Source Intelligence Market Trends by Region 4.1.1. North America Open-Source Intelligence Market Trends 4.1.2. Europe Open-Source Intelligence Market Trends 4.1.3. Asia Pacific Open-Source Intelligence Market Trends 4.1.4. Middle East and Africa Open-Source Intelligence Market Trends 4.1.5. South America Open-Source Intelligence Market Trends 4.2. Open-Source Intelligence Market Dynamics by Region 4.2.1. North America 4.2.1.1. North America Open-Source Intelligence Market Drivers 4.2.1.2. North America Open-Source Intelligence Market Restraints 4.2.1.3. North America Open-Source Intelligence Market Opportunities 4.2.1.4. North America Open-Source Intelligence Market Challenges 4.2.2. Europe 4.2.2.1. Europe Open-Source Intelligence Market Drivers 4.2.2.2. Europe Open-Source Intelligence Market Restraints 4.2.2.3. Europe Open-Source Intelligence Market Opportunities 4.2.2.4. Europe Open-Source Intelligence Market Challenges 4.2.3. Asia Pacific 4.2.3.1. Asia Pacific Open-Source Intelligence Market Drivers 4.2.3.2. Asia Pacific Open-Source Intelligence Market Restraints 4.2.3.3. Asia Pacific Open-Source Intelligence Market Opportunities 4.2.3.4. Asia Pacific Open-Source Intelligence Market Challenges 4.2.4. Middle East and Africa 4.2.4.1. Middle East and Africa Open-Source Intelligence Market Drivers 4.2.4.2. Middle East and Africa Open-Source Intelligence Market Restraints 4.2.4.3. Middle East and Africa Open-Source Intelligence Market Opportunities 4.2.4.4. Middle East and Africa Open-Source Intelligence Market Challenges 4.2.5. South America 4.2.5.1. South America Open-Source Intelligence Market Drivers 4.2.5.2. South America Open-Source Intelligence Market Restraints 4.2.5.3. South America Open-Source Intelligence Market Opportunities 4.2.5.4. South America Open-Source Intelligence Market Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Technology Roadmap 4.6. Regulatory Landscape by Region 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. Open-Source Intelligence Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 5.1. Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 5.1.1. Media 5.1.2. Public Government Data 5.1.3. Professional and Academic Publications 5.1.4. Commercial 5.1.5. Other Source Type 5.2. Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 5.2.1. Text Analytics 5.2.2. Video Analytics 5.2.3. Social Media Analytics 5.2.4. Geospatial Analytics 5.2.5. Security Analytics 5.2.6. Other Technique 5.3. Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 5.3.1. Government Intelligence Agencies 5.3.2. Military and Defense Intelligence Agencies 5.3.3. Cyber Security Organizations 5.3.4. Law Enforcement Agencies 5.3.5. Financial Services 5.3.6. Private Specialized Business 5.3.7. Other End User 5.4. Open-Source Intelligence Market Size and Forecast, by Region (2025-2032) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Open-Source Intelligence Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 6.1. North America Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 6.1.1. Media 6.1.2. Public Government Data 6.1.3. Professional and Academic Publications 6.1.4. Commercial 6.1.5. Other Source Type 6.2. North America Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 6.2.1. Text Analytics 6.2.2. Video Analytics 6.2.3. Social Media Analytics 6.2.4. Geospatial Analytics 6.2.5. Security Analytics 6.2.6. Other Technique 6.3. North America Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 6.3.1. Government Intelligence Agencies 6.3.2. Military and Defense Intelligence Agencies 6.3.3. Cyber Security Organizations 6.3.4. Law Enforcement Agencies 6.3.5. Financial Services 6.3.6. Private Specialized Business 6.3.7. Other End User 6.4. North America Open-Source Intelligence Market Size and Forecast, by Country (2025-2032) 6.4.1. United States 6.4.1.1. United States Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 6.4.1.1.1. Media 6.4.1.1.2. Public Government Data 6.4.1.1.3. Professional and Academic Publications 6.4.1.1.4. Commercial 6.4.1.1.5. Other Source Type 6.4.1.2. United States Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 6.4.1.2.1. Text Analytics 6.4.1.2.2. Video Analytics 6.4.1.2.3. Social Media Analytics 6.4.1.2.4. Geospatial Analytics 6.4.1.2.5. Security Analytics 6.4.1.2.6. Other Technique 6.4.1.3. United States Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 6.4.1.3.1. Government Intelligence Agencies 6.4.1.3.2. Military and Defense Intelligence Agencies 6.4.1.3.3. Cyber Security Organizations 6.4.1.3.4. Law Enforcement Agencies 6.4.1.3.5. Financial Services 6.4.1.3.6. Private Specialized Business 6.4.1.3.7. Other End User 6.4.2. Canada 6.4.2.1. Canada Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 6.4.2.1.1. Media 6.4.2.1.2. Public Government Data 6.4.2.1.3. Professional and Academic Publications 6.4.2.1.4. Commercial 6.4.2.1.5. Other Source Type 6.4.2.2. Canada Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 6.4.2.2.1. Text Analytics 6.4.2.2.2. Video Analytics 6.4.2.2.3. Social Media Analytics 6.4.2.2.4. Geospatial Analytics 6.4.2.2.5. Security Analytics 6.4.2.2.6. Other Technique 6.4.2.3. Canada Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 6.4.2.3.1. Government Intelligence Agencies 6.4.2.3.2. Military and Defense Intelligence Agencies 6.4.2.3.3. Cyber Security Organizations 6.4.2.3.4. Law Enforcement Agencies 6.4.2.3.5. Financial Services 6.4.2.3.6. Private Specialized Business 6.4.2.3.7. Other End User 6.4.3. Mexico 6.4.3.1. Mexico Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 6.4.3.1.1. Media 6.4.3.1.2. Public Government Data 6.4.3.1.3. Professional and Academic Publications 6.4.3.1.4. Commercial 6.4.3.1.5. Other Source Type 6.4.3.2. Mexico Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 6.4.3.2.1. Text Analytics 6.4.3.2.2. Video Analytics 6.4.3.2.3. Social Media Analytics 6.4.3.2.4. Geospatial Analytics 6.4.3.2.5. Security Analytics 6.4.3.2.6. Other Technique 6.4.3.3. Mexico Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 6.4.3.3.1. Government Intelligence Agencies 6.4.3.3.2. Military and Defense Intelligence Agencies 6.4.3.3.3. Cyber Security Organizations 6.4.3.3.4. Law Enforcement Agencies 6.4.3.3.5. Financial Services 6.4.3.3.6. Private Specialized Business 6.4.3.3.7. Other End User 7. Europe Open-Source Intelligence Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 7.1. Europe Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 7.2. Europe Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 7.3. Europe Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 7.4. Europe Open-Source Intelligence Market Size and Forecast, by Country (2025-2032) 7.4.1. United Kingdom 7.4.1.1. United Kingdom Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 7.4.1.2. United Kingdom Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 7.4.1.3. United Kingdom Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 7.4.2. France 7.4.2.1. France Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 7.4.2.2. France Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 7.4.2.3. France Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 7.4.3. Germany 7.4.3.1. Germany Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 7.4.3.2. Germany Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 7.4.3.3. Germany Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 7.4.4. Italy 7.4.4.1. Italy Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 7.4.4.2. Italy Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 7.4.4.3. Italy Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 7.4.5. Spain 7.4.5.1. Spain Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 7.4.5.2. Spain Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 7.4.5.3. Spain Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 7.4.6. Sweden 7.4.6.1. Sweden Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 7.4.6.2. Sweden Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 7.4.6.3. Sweden Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 7.4.7. Austria 7.4.7.1. Austria Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 7.4.7.2. Austria Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 7.4.7.3. Austria Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 7.4.8. Rest of Europe 7.4.8.1. Rest of Europe Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 7.4.8.2. Rest of Europe Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 7.4.8.3. Rest of Europe Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 8. Asia Pacific Open-Source Intelligence Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 8.1. Asia Pacific Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 8.2. Asia Pacific Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 8.3. Asia Pacific Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 8.4. Asia Pacific Open-Source Intelligence Market Size and Forecast, by Country (2025-2032) 8.4.1. China 8.4.1.1. China Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 8.4.1.2. China Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 8.4.1.3. China Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 8.4.2. S Korea 8.4.2.1. S Korea Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 8.4.2.2. S Korea Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 8.4.2.3. S Korea Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 8.4.3. Japan 8.4.3.1. Japan Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 8.4.3.2. Japan Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 8.4.3.3. Japan Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 8.4.4. India 8.4.4.1. India Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 8.4.4.2. India Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 8.4.4.3. India Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 8.4.5. Australia 8.4.5.1. Australia Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 8.4.5.2. Australia Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 8.4.5.3. Australia Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 8.4.6. Indonesia 8.4.6.1. Indonesia Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 8.4.6.2. Indonesia Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 8.4.6.3. Indonesia Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 8.4.7. Malaysia 8.4.7.1. Malaysia Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 8.4.7.2. Malaysia Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 8.4.7.3. Malaysia Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 8.4.8. Vietnam 8.4.8.1. Vietnam Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 8.4.8.2. Vietnam Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 8.4.8.3. Vietnam Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 8.4.9. Taiwan 8.4.9.1. Taiwan Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 8.4.9.2. Taiwan Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 8.4.9.3. Taiwan Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 8.4.10. Rest of Asia Pacific 8.4.10.1. Rest of Asia Pacific Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 8.4.10.2. Rest of Asia Pacific Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 8.4.10.3. Rest of Asia Pacific Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 9. Middle East and Africa Open-Source Intelligence Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 9.1. Middle East and Africa Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 9.2. Middle East and Africa Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 9.3. Middle East and Africa Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 9.4. Middle East and Africa Open-Source Intelligence Market Size and Forecast, by Country (2025-2032) 9.4.1. South Africa 9.4.1.1. South Africa Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 9.4.1.2. South Africa Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 9.4.1.3. South Africa Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 9.4.2. GCC 9.4.2.1. GCC Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 9.4.2.2. GCC Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 9.4.2.3. GCC Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 9.4.3. Nigeria 9.4.3.1. Nigeria Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 9.4.3.2. Nigeria Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 9.4.3.3. Nigeria Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 9.4.4. Rest of ME&A 9.4.4.1. Rest of ME&A Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 9.4.4.2. Rest of ME&A Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 9.4.4.3. Rest of ME&A Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 10. South America Open-Source Intelligence Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 10.1. South America Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 10.2. South America Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 10.3. South America Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 10.4. South America Open-Source Intelligence Market Size and Forecast, by Country (2025-2032) 10.4.1. Brazil 10.4.1.1. Brazil Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 10.4.1.2. Brazil Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 10.4.1.3. Brazil Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 10.4.2. Argentina 10.4.2.1. Argentina Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 10.4.2.2. Argentina Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 10.4.2.3. Argentina Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 10.4.3. Rest Of South America 10.4.3.1. Rest Of South America Open-Source Intelligence Market Size and Forecast, by Source Type (2025-2032) 10.4.3.2. Rest Of South America Open-Source Intelligence Market Size and Forecast, by Technique (2025-2032) 10.4.3.3. Rest Of South America Open-Source Intelligence Market Size and Forecast, by End-user (2025-2032) 11. Company Profile: Key Players 11.1. Babel Street 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Cobwebs Technologies 11.3. Flashpoint Inc. 11.4. IBM 11.5. Palantir Technologies Inc. 11.6. Recorded Future 11.7. Sayari 11.8. ShadowDragon 11.9. Skopenow, Inc. 11.10. Social Links 11.11. TextOre, Inc. 11.12. ZeroFox 11.13. Fivecast 11.14. OSINT Combine 11.15. Neotas 11.16. CybelAngel 11.17. Thales Group 11.18. Hensoldt Analytics Gmbh 11.19. Maltego Technologies 11.20. rola Security Solutions GmbH 11.21. Check Point Software Technologies Ltd. 11.22. Kela 11.23. Expert System S.p.A. 11.24. IPS S.p.A 11.25. Forward Defens 12. Key Findings 13. Industry Recommendations