Micronized PTFE Market size was valued at USD 1.17 Bn. in 2022 and the total Micronized PTFE Market revenue is expected to grow at 7 % from 2023 to 2029, reaching nearly USD 1.89 Bn.Micronized PTFE Market Overview:

A synthetic polymer is also known as micronized PTFE or micronized polytetrafluoroethylene. Tetrafluoroethylene is converted to PTFE by polymerizing it with purified water. A granular or suspension-grade product is produced by this procedure. The chemical and industrial processing, as well as the automotive sectors, are the main consumers of micronized polytetrafluoroethylene (PTFE). A fluorocarbon solid called polytetrafluoroethylene (PTFE) is produced when the tetrafluoroethylene monomer is polymerized (TFE). PTFE is frequently used in corrosive and reactive chemical piping and containers because it is non-reactive. Owing to its ability to decrease wear and fuel consumption, it is also used as a lubricant in machinery and as a graft material in the healthcare industry. Micronized PTFE has many advantages that make it suitable for usage in a range of industries, including chemical inertness, excellent heat resistance, low frictional coefficient, and optimum dielectric properties. Markets for micronized PTFE are being greatly benefited by growing car manufacturing. It is expected that more heavy commercial trucks, light commercial trucks, and passenger cars would increase OEM demand for protective automotive coatings.Report Scope:

The research provides a thorough examination of the Micronized PTFE market's drivers, restraints, trends, and projections. In order to make profitable decisions, networks of suppliers and customers can be built, according to research on Porter's five forces. The potential of the current Micronized PTFE Market is ascertained by extensive research, market size, and segmentation. The research provides investors with a comprehensive perspective of the industry's future and includes information on the elements that are expected to have an impact on the company either favourably or unfavourably. The rerpot is preparesd by keeping companies, which are currently in market and also the new plaeyers that are looking into getting in to market. For the Micronized PTFE industry, the report offers historical and forecasted market sizes. The report's thorough analysis of key competitors, including market leaders, followers, and new entrants, covers every element of the market. The research includes the strategic profiles of the leading industry participants as well as details on the company-specific plans for the launch of new products, growth, partnerships, joint ventures, and acquisitions. With its clear representation of competitive analysis of significant firms by Type, pricing, financial situation, product portfolio, growth strategies, and geographical presence in the domestic as well as the local market, the report provides a reference for investors.To Know About The Research Methodology :- Request Free Sample Report

Micronized PTFE Market Dynamics:

Growing demand for polytetrafluoroethylene across the different industry verticals

The automobile sector is well known for advancing technologies. For use in automotive applications, polytetrafluoroethylene offers resistance to temperatures up to 500°, improved lubrication and fuel resistance, great thermal stability, sealing at high rotational speeds, outstanding mechanical strengths, and low friction/wear qualities. Lithium-ion batteries, cables & cables for packing, and ongoing use as a semiconductor in the electronics industry are further driving the growth. Owing to the chemical industry's fast growth in areas such as specialty chemicals, agrochemicals, petrochemicals, and fertilizers, it is expected that product demand likewise see significant growth. In order to make better PTFE Fabrics, such as those with improved heat resistance, so that their uses can be broadened in the future, a number of manufacturers, including Taconic, are creating new factories.Growing demand for coatings from European and North American market

The market for paints and coatings is expected to be driven by the growing infrastructure. In 2019–20, the Indian government spend USD 64 billion on infrastructure, and during the forecast period, it plans to invest USD 1.4 trillion. Furthermore, the Chinese government approved 26 infrastructure projects in 2019, with an estimated investment of around USD 142.5 billion, with a target completion date of 2023, according to the National Development and Reform Commission of China. During the forecast period, the market for micronized PTFE is projected to be driven by the growing demand from inks and coatings applications from various sectors.High prices associated with PTFE

The cost of PTFE has increased significantly over the past few years owing to a combination of growing raw material costs for fluoropolymer resins, fillers, and colors, as well as an increase in demand for high-quality goods globally. Increased pricing pressure on PTFE manufacturers in other nations has been observed as a result of the entry of numerous Chinese items onto the global market at relatively low prices. On the other hand, a rise in PTFE's use in the medical field is expected to create a profitable market opportunity for the growth of polytetrafluoroethylene industry.Growing penetration in medical applications

Owing to its chemical inertness, which makes it biocompatible, PTFE is employed in medical applications. Additionally, chemical inertness prevents any negative responses when it comes in contact with the body. Additionally, it doesn't become wet by biological liquids and doesn't get chemically altered or damaged by medical fluids. One of the most popular materials in the healthcare sector, particularly in the form of membranes and grafts, is PTFE, which has qualities including biocompatibility and lubricity. Applications in the healthcare sector that utilize PTFE's outstanding qualities include peripheral vascular grafts, plastic surgery, orthopedics, ophthalmology, and dentistry procedures. The use of PTFE in the healthcare sector is currently growing quickly in the US and Europe. Owing to the fact that a sizable section of this market is still untapped, it is expected that PTFE demand continue to grow.Reprocessed PTFE Usage

The growing use of reprocessed PTFE poses a problem for the market's expansion because it changes the resin's essential characteristics. Porosity is introduced into the substance as a result, leading to problems with water absorption and dielectric strength. Additionally, weaker bonding between the molecules has a negative impact on the material's tensile strength and invariably results in crack lines that may not be visible but have an impact over time. Its significant water absorption renders the material vulnerable for applications where the weather-ability and hydrophobic qualities of pure PTFE are sought, despite the fact that the chemical inertness is still excellent (it is still 100% PTFE).Micronized PTFE Market Segment Analysis:

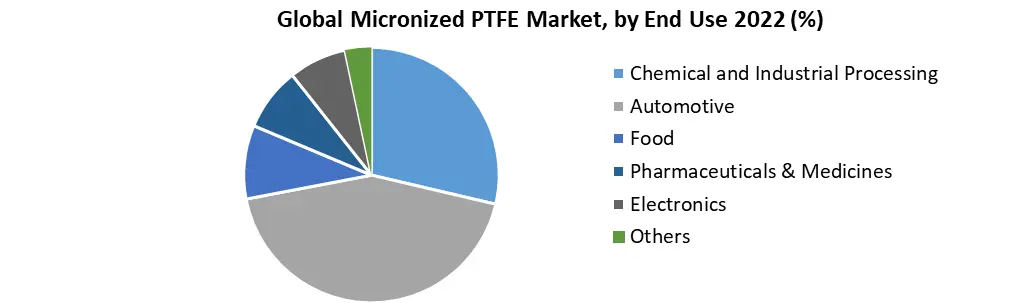

Based on Source, the virgin segment is expected to grow at the highest CAGR during the forecast period. Recycled micronized PTFE is utilized for coating applications; virgin micronized PTFE is widely employed in electronics owing to its exceptional chemical resistance, thermal stability, electrical insulation, and low friction coefficient. The global market for micronized PTFE has undergone extensive research with growing comprehension, taking into account both micro- and macroeconomic aspects. During the forecast period, demand for micronized PTFE is expected to be supported by an emphasis on innovative materials and enhanced methods, such as metal injection molding. Based on Application, the Inks & Coatings segment is expected to grow at the highest CAGR during the forecast period. Inks and coatings are in more demand. Polytetrafluoroethylene, or tetrafluoroethylene, is a synthetic fluoropolymer (PTFE). PTFE powder that has been micronized is the most widely used constituent in industrial coatings. Micronized PTFE offers better starch, wear, and rubbing resistance. Their matte surfaces and better abrasion are advantages. PTFE is also used to cover cookware with a nonstick surface.Based on End Use, the Inks & Coatings segment is expected to grow at the highest CAGR during the forecast period. The preferred material for gaskets, vessel linings, pump interiors, washers, rings, seals, spacers, dip tubes, and well-drilling components in the chemical and industrial processing sector is PTFE. PTFE works in harsh environments and is largely unaffected by acids and caustics. As a result, it is frequently used in this sector. Coatings for heat exchangers, pumps, diaphragms, impellers, tanks, reaction vessels, autoclaves, containers, etc. are additional uses for the chemical industry. The largest consumer of PTFE coatings is the oil and gas sector. The hardest applications for polymeric materials are those related to oil and gas exploration and recovery. The COVID-19 epidemic and the fluctuating price of raw materials have had a significant impact on demand in the worldwide oil and gas industry. Overall, it is anticipated that the world's oil consumption will increase by 5.7 mb/d (million barrels per day), with China and India contributing over half of the increase through 2025. The capacity for oil production around the globe is predicted to increase by 5.9 mb/d at the same time. While OPEC adds 1.4 mb/d of capacity for petroleum and natural gas liquids, non-OPEC production will increase by 4.5 mb/d.Premium, high-performance grades are necessary for these materials due to the pressures and temperatures they must withstand, the corrosive substances they are exposed to, and the expected operational life. It also facilitates the smooth operation of the machinery, reducing the amount of time needed for downtime, which is advantageous to the manufacturing and processing sector. The market for Micronized PTFE is expected to be dominated during the forecast period by the growing chemical and industrial processing sector.

Micronized PTFE Market Regional Insights:

Growing demand from nations like China and India has led the Asia-Pacific to dominate the market. To increase the growth of starch, heat, wear, and abrasion resistance of coatings, micronized PTFE is also added to plastics, printing inks, and inks. They make the surfaces impervious to water, protect them from different solvents, and make the surface inert. In the packaging sector, printing inks are mostly used. The market in China and India is expected to develop as e-commerce grows. According to the Plastics Industry Association of India, India has the fifth-largest global packaging market and is growing at a rate of roughly 25-28% annually. During the forecast period, the market for ink additives is expected to be driven by the growing demand for e-commerce in China and India. Alibaba holds a market share of about 59% in China's e-commerce industry. The company's annual revenue increased by 51.5 % year over year in FY 2019, and the packaging-dependent e-commerce business is expected to boost the market over the forecast period. Automobiles, industrial machinery, and a variety of heavy construction equipment all use lubricants. India and China are expected to dominate the industry because they are the top two producers of autos and construction materials. During the forecast period, it is expected that the aforementioned elements, together with government backing, would aid in boosting demand for micronized PTFE in Asia-Pacific.Micronized PTFE Market Scope: Inquire before buying

Micronized PTFE Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 1.17 Bn. Forecast Period 2023 to 2029 CAGR: 7% Market Size in 2029: USD 1.89 Bn. Segments Covered: by Source Virgin Recycled by Application Inks & Coatings Thermoplastics Paints Lubricants & Greases Elastomers by End Use Chemical and Industrial Processing Automotive Food Pharmaceuticals & Medicines Electronics Others Micronized PTFE Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Micronized PTFE Market, Key Players are

1. 3M 2. Apar Industries Ltd 3. BYK-CHEMIE GMBH 4. Clariant 5. DEUREX AG 6. Fluorez Technology Inc. 7. Micro Powders Inc. 8. Nanjing Tianshi New Material Technologies Co. Ltd 9. Shamrock Technologies Inc. 10. Solvay 11. HaloPolymer 12. The Chemours Company 13. Gujarat Fluorochemicals Ltd 14. Maflon S.p.aa 15. Daikin Industries Ltd 16. Shanghai 3F New Materials Company Ltd 17. Jiangxi Aidmer Seal & Packing Company Ltd 18. Asahi Glass Company 19. DuPont 20. Zhonghao Chenguang Research Institute of Chemical Industry Frequently Asked Questions: 1] What segments are covered in the Global Micronized PTFE Market report? Ans. The segments covered in the Micronized PTFE Market report are based on Source, Application, End Use, and Region. 2] Which region is expected to hold the highest share in the Global Micronized PTFE Market? Ans. The Asia - Pacific region is expected to hold the highest share in the Micronized PTFE Market. 3] What is the market size of the Global Micronized PTFE Market by 2029? Ans. The market size of the Micronized PTFE Market by 2029 is expected to reach USD 1.89 Bn. 4] What is the forecast period for the Global Micronized PTFE Market? Ans. The forecast period for the Micronized PTFE Market is 2023-2029. 5] What was the market size of the Global Micronized PTFE Market in 2022? Ans. The market size of the Micronized PTFE Market in 2022 was valued at USD 1.17 Bn.

1. Global Micronized PTFE Market Size: Research Methodology 2. Global Micronized PTFE Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Micronized PTFE Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Micronized PTFE Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Micronized PTFE Market Size Segmentation 4.1. Global Micronized PTFE Market Size, by Source (2022-2029) • Virgin • Recycled 4.2. Global Micronized PTFE Market Size, by Application (2022-2029) • Inks & Coatings • Thermoplastics • Paints • Lubricants & Greases • Elastomers 4.3. Global Micronized PTFE Market Size, by End Use (2022-2029) • Chemical and Industrial Processing • Automotive • Food • Pharmaceuticals & Medicines • Electronics • Others 5. North America Micronized PTFE Market (2022-2029) 5.1. North America Micronized PTFE Market Size, by Source (2022-2029) • Virgin • Recycled 5.2. North America Micronized PTFE Market Size, by Application (2022-2029) • Inks & Coatings • Thermoplastics • Paints • Lubricants & Greases • Elastomers 5.3. North America Micronized PTFE Market Size, by End Use (2022-2029) • Chemical and Industrial Processing • Automotive • Food • Pharmaceuticals & Medicines • Electronics • Others 5.4. North America Semiconductor Memory Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Micronized PTFE Market (2022-2029) 6.1. European Micronized PTFE Market , by Source (2022-2029) 6.2. European Micronized PTFE Market , by Application (2022-2029) 6.3. European Micronized PTFE Market , by End Use (2022-2029) 6.4. European Micronized PTFE Market , by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Micronized PTFE Market (2022-2029) 7.1. Asia Pacific Micronized PTFE Market , by Source (2022-2029) 7.2. Asia Pacific Micronized PTFE Market , by Application (2022-2029) 7.3. Asia Pacific Micronized PTFE Market , by End Use (2022-2029) 7.4. Asia Pacific Micronized PTFE Market , by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Micronized PTFE Market (2022-2029) 8.1. Middle East and Africa Micronized PTFE Market , by Source (2022-2029) 8.2. Middle East and Africa Micronized PTFE Market , by Application (2022-2029) 8.3. Middle East and Africa Micronized PTFE Market , by End Use (2022-2029) 8.4. Middle East and Africa Micronized PTFE Market , by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Micronized PTFE Market (2022-2029) 9.1. South America Micronized PTFE Market, by Source (2022-2029) 9.2. South America Micronized PTFE Market, by Application (2022-2029) 9.3. South America Micronized PTFE Market , by End Use (2022-2029) 9.4. South America Micronized PTFE Market , by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. 3M 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Apar Industries Ltd 10.3. BYK-CHEMIE GMBH 10.4. Clariant 10.5. DEUREX AG 10.6. Fluorez Technology Inc. 10.7. Micro Powders Inc. 10.8. Nanjing Tianshi New Material Technologies Co. Ltd 10.9. Shamrock Technologies Inc. 10.10. Solvay 10.11. HaloPolymer 10.12. The Chemours Company 10.13. Gujarat Fluorochemicals Ltd 10.14. Maflon S.p.aa 10.15. Daikin Industries Ltd 10.16. Shanghai 3F New Materials Company Ltd 10.17. Jiangxi Aidmer Seal & Packing Company Ltd 10.18. Asahi Glass Company 10.19. DuPont 10.20. Zhonghao Chenguang Research Institute of Chemical Industry