The Polyethylene Terephthalate (PET) Market size was valued at USD 31.76 Billion in 2023 and the total Polyethylene Terephthalate (PET) revenue is expected to grow at a CAGR of 5.48% from 2024 to 2030, reaching nearly USD 46.14 Billion by 2030.Polyethylene Terephthalate (PET) Market Overview:

Polyethylene terephthalate is the most popular thermoplastic polymer resin of the polyester family and is used in garment fibers, fluid and meal vessels, thermoforming for production, and specialty resins in conjunction with glass fiber. PET can appear as a transparent or semi-crystalline polymer based on its processing and heating history. PET is typically referred to as polyester in the area of textile applications, but the abbreviation PET is commonly used in the domain of packaging. Polyester accounts for approximately 20% of global polymer output and is the fourth most abundant polymer after polyethylene, polypropylene, and polyvinyl chloride.To know about the Research Methodology :- Request Free Sample Report Report Scope: The report includes comprehensive information on the strategies of the industry's top players, as well as an examination of the various market segments and geographies. The research report examines the global market size, growth tendencies, competitor analysis analyses, and regional economic situation. Initiatives, growth possibilities, manufacturing techniques, and cost structures are all assessed. Figures for import/export consumption, supply and demand, cost, price, revenue, and gross margins are also included in this report. The study focuses on significant breakthroughs in the industry, as well as organic and inorganic growth strategies. Multinational enterprises are emphasizing organic growth strategies such as new product releases, product approvals, and other items such as patents and events. Inorganic growth techniques found in the market analysed in the report included mergers, collaborations, and partnerships. These measures have paved the way for market participants to grow their businesses and customer base. Industry participants in the market are estimated to benefit from attractive growth prospects in the future due to rising demand in the global market. The research focuses on the key industry participants, including business profiles, components, and services provided, financial data from the preceding three years, and significant changes in the previous five years. In addition, important company profiles, SWOT analysis, and market strategies in the embedded software industry are included in the report. Research Methodology: The Polyethylene Terephthalate (PET) Market report is conducted with the help of both primary and secondary data sources. During the qualitative research, the government policy, market environment, competitive landscape, historical data, current market trends, technological innovation, upcoming technologies, and the technical progress in related industries, as well as market risks, opportunities, market barriers, and challenges, are all investigated. To provide the final quantitative and qualitative data, all potential influences on the markets covered by this research study were studied, extensively researched, confirmed by primary research, and assessed. Market size is balanced for top-level markets and sub-segments, and market forecasting takes into account the impact of inflation, economic downturns, policy changes, and other variables. Comprehensive primary research was carried out to gather information and validate and verify the essential facts arrived at after extensive market engineering and estimates for industry statistics; market size estimations; market forecasts segmentation; and data triangulation. To do market estimation and forecasting for the overall market segments and sub-segments included in this research, the bottom-up strategy is frequently used in the whole market engineering process, along with different data triangulation techniques. Secondary data sources include nationalized and global data sources, annual and financial reports from significant market participants, press releases, and so on, whereas primary data was collected through interviews, surveys, expert and trained professional opinions, etc.

Polyethylene Terephthalate (PET) Market Dynamics:

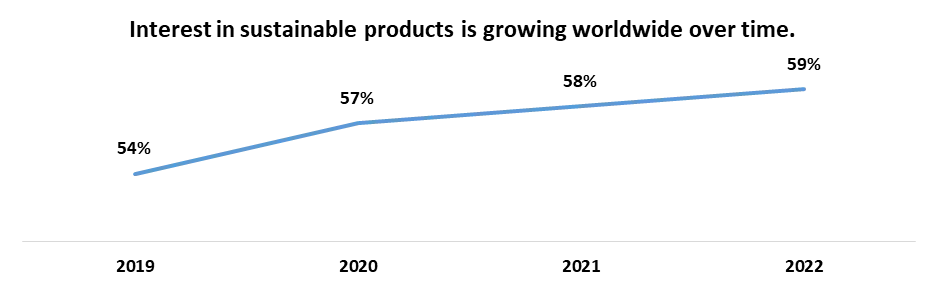

Exceptional recyclability propels polyethylene terephthalate (PET) market growth towards the north. Recycled PET fiber, prized for its exceptional recyclability, finds widespread applications across various industries, including carpeting, apparel, furnishings, and automotive components. With several major global beverage and consumer goods giants committing to integrate 50% recycled content into their plastic packaging by 2030, the demand for food-grade-certified recycled materials is poised to surge. However, the current scarcity of food-grade recyclable materials on the international market presents a significant challenge for these companies in sourcing sufficient quantities of high-quality food-grade recycled PET over the long term.In response, numerous enterprises specializing in recycled PET are seizing the opportunity to bolster their domestic and international production capabilities for food-grade rPET, recognizing it as a strategic avenue for growth. Price fluctuations of raw materials are a major restraint in the polyethylene terephthalate (PET) market growth. The supply of raw materials is one of the most important elements influencing the end-product industry. The rise in the price of petroleum and chemical products has greatly raised the cost of raw materials. Plastic prices are heavily influenced by the economy. The cost of PET resin is mostly governed by competitive pressures and is impacted by crude oil prices. Commodity price fluctuations raise operational costs, culminating in a pricier end product. Because PET resin is made from hydrocarbons, fluctuations in crude oil prices are anticipated to affect the price of PET resin. The increase in raw material costs has placed a stumbling block to the growth of the PET packaging sector. Plastics are also commonly utilized in other industries, like the textile sector. PET is known as polyester in the textile business. When demand for polyester increases in the textile sector, it uses a greater percentage of raw resources, lowering the supply of raw materials for the packaging industry. Growing demand for eco-friendly packaging solutions drives polyethylene terephthalate (PET) market growth. Growing environmental impacts have raised the demand for environmentally friendly and sustainable packaging products, such as recyclable materials. Packaging producers are concentrating on providing sustainable and environmentally friendly packaging that can be recirculated. These producers are spending on research and development efforts and technology to provide environmentally friendly, cost-effective solutions that do not jeopardize the degree of protection supplied to the packed goods. PepsiCo has declared that it would utilize 25 percent recycled material in all soft drink bottles by 2025, while Keurig Dr. Pepper has claimed that it would use 25 percent less virgin plastic by 2025. Soft drink businesses are looking for equipment that is flexible and easy to change, allowing them to withstand fluctuations in polyethylene terephthalate (PET) market quality.

Polyethylene Terephthalate Market Trends

1.Rising investments in infrastructural development have propelled industrial manufacturing, alongside the exponential expansion of the organized retail sector in emerging economies, positively influencing the overall polyethylene terephthalate (PET) market. 2.Increasing healthcare and cosmetics industries are expected to drive the demand for PET packaging in China, India, Brazil, Russia, and other emerging economies. 3. Improving standards of living and increasing personal disposable income in these and other developing regions are further expected to fuel the demand for PET in packaging applications. 4. Growing packaging demand in the food and beverage industry is another factor expected to spur polyethylene terephthalate market demand. 5. PET's wide application areas in different sectors of consumable goods are driving the demand for PET packaging. 6. Increasing investments in the packaging industry for the development of technologically advanced packaging solutions at economical prices are expected to propel polyethylene terephthalate market growth during the forecast period. 7. Future supply-demand shifts are expected to make PET prices in all worldwide markets highly volatile. 8. Political instability, supply-demand mismatches, and seasonal changes contribute to crude oil price volatility, affecting the PET market. 9. Volatility in petrochemical pricing is expected to pose a challenge to the global polyethylene terephthalate market's growth during the forecast period, as most of the ingredients used in plastic compounding rely heavily on petrochemicals.Polyethylene Terephthalate (PET) Market Segment Analysis

The Polyethylene Terephthalate (PET) market is segmented based on application, including Textiles, Rigid Packaging, Flexible Packaging, Photovoltaic Modules, Thermoplastic resins and other. Among these segments, Flexible packaging emerged as the largest in 2023, capturing over XX% of the market share. The robust growth of the packaging industry, fueled by heightened consumerism in emerging economies, is expected to drive demand for plastics like polyethylene and PET during the forecast period. Regulatory bodies have established various guidelines for the safe use of packaging materials in food contact applications, influencing the demand for PET within this sector. Concurrently, the rising consumption of food containers in emerging markets such as China and India is poised to significantly boost PET demand in films & sheets applications. These containers provide thermal insulation to stored products while enhancing aesthetic appeal. Moreover, the emergence of microwave-safe containers is propelling growth in the films & sheets segment. Consumers worldwide prefer microwave-compatible food containers to streamline meal preparation processes.Polyethylene Terephthalate (PET) Market Regional Analysis:

In 2023, the Asia Pacific region asserted its dominance in the Polyethylene Terephthalate market, securing a substantial market share of XX%. This stronghold is attributed to the region's escalating consumption of packaged food and the burgeoning demand for automobile films, particularly in countries like China, India, Indonesia, and Malaysia. As a result, the demand for polyethylene terephthalate in the Asia Pacific is expected to soar, with the region expected to contribute approximately 38% of the total market revenue by 2025. Such growth can be linked to the implementation of stringent environmental regulations by international bodies like the Environmental Protection Agency (EPA), International Union for Conservation of Nature (IUCN), and Intergovernmental Panel on Climate Change (IPCC), which are expected to shape demand patterns for polyethylene terephthalate in the region. China and India, the economic powerhouses of the region, offer significant growth opportunities in the consumer goods segment due to rising GDP per capita and an evolving domestic production landscape. Population growth, vibrant economic activity, and enhanced purchasing power in the Latin American and Asian markets are expected to drive consumer goods sales, consequently impacting the Polyethylene Terephthalate (PET) Market.Polyethylene Terephthalate (PET) Market Scope: Inquire before buying

Global Polyethylene Terephthalate (PET) Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 31.76 Bn. Forecast Period 2024 to 2030 CAGR: 5.48% Market Size in 2030: US $ 46.14 Bn. Segments Covered: by Production Process Dimethyl terephthalate (DMT) process Terephthalic acid (PTA) process by Application Textiles Rigid Packaging Flexible Packaging Photovoltaic Modules Thermoplastic resins Other by End Use Industry Food and Beverage Automotive Electrical and Electronics Healthcare Consumer Goods Other Polyethylene Terephthalate (PET) Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Polyethylene Terephthalate (PET) Market Key Players:

North America: 1. Alpek SAB de CV (Mexico) Europe: 2. CR Chemical Materials Technology Inc. (Germany) Asia-Pacific: 3. Reliance Industries Limited (India) 4. BY Sanfame Group (China) 5. Far Eastern New Century Corporation (Taiwan) 6. Hengli Group Co. Ltd (China) 7. Indorama Ventures Public Company Limited (Thailand) 8. JBF Industries Ltd (India) 9. Lotte Chemical Corporation (South Korea) 10. Sinopec Group (China) 11. Zhejiang Hengyi Group Co. Ltd (China) 12. Zhejiang Zhink Group Co. Ltd (China) MEA & Africa: 13. SABIC (Saudi Arabia) 14. OCTAL (Oman) FAQs: 1. Which region has the largest share in Global Polyethylene Terephthalate (PET) Market? Ans: North America region holds the highest share in 2023. 2. What is the growth rate of Global Polyethylene Terephthalate (PET) Market? Ans: The Global Polyethylene Terephthalate (PET) Market is growing at a CAGR of 5.48% during forecasting period 2024-2030. 3. What segments are covered in Global Polyethylene Terephthalate (PET) market? Ans: Global Polyethylene Terephthalate (PET) Market is segmented into Production Process, Application, End-Use Industry and region. 4. Who are the key players in Global Polyethylene Terephthalate (PET) market? Ans: The important key players in the Global Polyethylene Terephthalate (PET) Market are – Alpek SAB de CV (Mexico), OCTAL (Oman), Reliance Industries Limited (India), Sanfame Group (China). 5. What is the study period of this market? Ans: The Global Polyethylene Terephthalate (PET) Market is studied from 2023 to 2030.

1. Polyethylene Terephthalate (PET) Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Polyethylene Terephthalate (PET) Market: Dynamics 2.1. Polyethylene Terephthalate (PET) Market Trends by Region 2.1.1. North America Polyethylene Terephthalate (PET) Market Trends 2.1.2. Europe Polyethylene Terephthalate (PET) Market Trends 2.1.3. Asia Pacific Polyethylene Terephthalate (PET) Market Trends 2.1.4. Middle East and Africa Polyethylene Terephthalate (PET) Market Trends 2.1.5. South America Polyethylene Terephthalate (PET) Market Trends 2.2. Polyethylene Terephthalate (PET) Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Polyethylene Terephthalate (PET) Market Drivers 2.2.1.2. North America Polyethylene Terephthalate (PET) Market Restraints 2.2.1.3. North America Polyethylene Terephthalate (PET) Market Opportunities 2.2.1.4. North America Polyethylene Terephthalate (PET) Market Challenges 2.2.2. Europe 2.2.2.1. Europe Polyethylene Terephthalate (PET) Market Drivers 2.2.2.2. Europe Polyethylene Terephthalate (PET) Market Restraints 2.2.2.3. Europe Polyethylene Terephthalate (PET) Market Opportunities 2.2.2.4. Europe Polyethylene Terephthalate (PET) Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Polyethylene Terephthalate (PET) Market Drivers 2.2.3.2. Asia Pacific Polyethylene Terephthalate (PET) Market Restraints 2.2.3.3. Asia Pacific Polyethylene Terephthalate (PET) Market Opportunities 2.2.3.4. Asia Pacific Polyethylene Terephthalate (PET) Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Polyethylene Terephthalate (PET) Market Drivers 2.2.4.2. Middle East and Africa Polyethylene Terephthalate (PET) Market Restraints 2.2.4.3. Middle East and Africa Polyethylene Terephthalate (PET) Market Opportunities 2.2.4.4. Middle East and Africa Polyethylene Terephthalate (PET) Market Challenges 2.2.5. South America 2.2.5.1. South America Polyethylene Terephthalate (PET) Market Drivers 2.2.5.2. South America Polyethylene Terephthalate (PET) Market Restraints 2.2.5.3. South America Polyethylene Terephthalate (PET) Market Opportunities 2.2.5.4. South America Polyethylene Terephthalate (PET) Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Polyethylene Terephthalate (PET) Industry 2.8. Analysis of Government Schemes and Initiatives For Polyethylene Terephthalate (PET) Industry 2.9. Polyethylene Terephthalate (PET) Market Trade Analysis 2.10. The Global Pandemic Impact on Polyethylene Terephthalate (PET) Market 3. Polyethylene Terephthalate (PET) Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 3.1.1. Dimethyl terephthalate (DMT) process 3.1.2. Terephthalic acid (PTA) process 3.2. Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 3.2.1. Textiles 3.2.2. Rigid Packaging 3.2.3. Flexible Packaging 3.2.4. Photovoltaic Modules 3.2.5. Thermoplastic resins 3.2.6. Other 3.3. Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 3.3.1. Food and Beverage 3.3.2. Automotive 3.3.3. Electrical and Electronics 3.3.4. Healthcare 3.3.5. Consumer Goods 3.3.6. Other 3.4. Polyethylene Terephthalate (PET) Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Polyethylene Terephthalate (PET) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 4.1.1. Dimethyl terephthalate (DMT) process 4.1.2. Terephthalic acid (PTA) process 4.2. North America Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 4.2.1. Textiles 4.2.2. Rigid Packaging 4.2.3. Flexible Packaging 4.2.4. Photovoltaic Modules 4.2.5. Thermoplastic resins 4.2.6. Other 4.3. North America Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 4.3.1. Food and Beverage 4.3.2. Automotive 4.3.3. Electrical and Electronics 4.3.4. Healthcare 4.3.5. Consumer Goods 4.3.6. Other 4.4. North America Polyethylene Terephthalate (PET) Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 4.4.1.1.1. Dimethyl terephthalate (DMT) process 4.4.1.1.2. Terephthalic acid (PTA) process 4.4.1.2. United States Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Textiles 4.4.1.2.2. Rigid Packaging 4.4.1.2.3. Flexible Packaging 4.4.1.2.4. Photovoltaic Modules 4.4.1.2.5. Thermoplastic resins 4.4.1.2.6. Other 4.4.1.3. United States Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 4.4.1.3.1. Food and Beverage 4.4.1.3.2. Automotive 4.4.1.3.3. Electrical and Electronics 4.4.1.3.4. Healthcare 4.4.1.3.5. Consumer Goods 4.4.1.3.6. Other 4.4.2. Canada 4.4.2.1. Canada Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 4.4.2.1.1. Dimethyl terephthalate (DMT) process 4.4.2.1.2. Terephthalic acid (PTA) process 4.4.2.2. Canada Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Textiles 4.4.2.2.2. Rigid Packaging 4.4.2.2.3. Flexible Packaging 4.4.2.2.4. Photovoltaic Modules 4.4.2.2.5. Thermoplastic resins 4.4.2.2.6. Other 4.4.2.3. Canada Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 4.4.2.3.1. Food and Beverage 4.4.2.3.2. Automotive 4.4.2.3.3. Electrical and Electronics 4.4.2.3.4. Healthcare 4.4.2.3.5. Consumer Goods 4.4.2.3.6. Other 4.4.3. Mexico 4.4.3.1. Mexico Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 4.4.3.1.1. Dimethyl terephthalate (DMT) process 4.4.3.1.2. Terephthalic acid (PTA) process 4.4.3.2. Mexico Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Textiles 4.4.3.2.2. Rigid Packaging 4.4.3.2.3. Flexible Packaging 4.4.3.2.4. Photovoltaic Modules 4.4.3.2.5. Thermoplastic resins 4.4.3.2.6. Other 4.4.3.3. Mexico Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 4.4.3.3.1. Food and Beverage 4.4.3.3.2. Automotive 4.4.3.3.3. Electrical and Electronics 4.4.3.3.4. Healthcare 4.4.3.3.5. Consumer Goods 4.4.3.3.6. Other 5. Europe Polyethylene Terephthalate (PET) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 5.2. Europe Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 5.3. Europe Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 5.4. Europe Polyethylene Terephthalate (PET) Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 5.4.1.2. United Kingdom Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 5.4.2. France 5.4.2.1. France Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 5.4.2.2. France Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 5.4.3.2. Germany Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 5.4.4.2. Italy Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 5.4.5.2. Spain Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 5.4.6.2. Sweden Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 5.4.7.2. Austria Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 5.4.8.2. Rest of Europe Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 6. Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 6.2. Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 6.4. Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 6.4.1.2. China Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 6.4.2.2. S Korea Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 6.4.3.2. Japan Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 6.4.4. India 6.4.4.1. India Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 6.4.4.2. India Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 6.4.5.2. Australia Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 6.4.6.2. Indonesia Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 6.4.7.2. Malaysia Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 6.4.8.2. Vietnam Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 6.4.9.2. Taiwan Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 6.4.10.2. Rest of Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 7. Middle East and Africa Polyethylene Terephthalate (PET) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 7.2. Middle East and Africa Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 7.4. Middle East and Africa Polyethylene Terephthalate (PET) Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 7.4.1.2. South Africa Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 7.4.2.2. GCC Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 7.4.3.2. Nigeria Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 7.4.4.2. Rest of ME&A Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 8. South America Polyethylene Terephthalate (PET) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 8.2. South America Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 8.3. South America Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry(2023-2030) 8.4. South America Polyethylene Terephthalate (PET) Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 8.4.1.2. Brazil Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 8.4.2.2. Argentina Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2023-2030) 8.4.3.2. Rest Of South America Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Polyethylene Terephthalate (PET) Market Size and Forecast, by End User Industry (2023-2030) 9. Global Polyethylene Terephthalate (PET) Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Polyethylene Terephthalate (PET) Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Alpek SAB de CV (Mexico) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. CR Chemical Materials Technology Inc. (Germany) 10.3. Reliance Industries Limited (India) 10.4. BY Sanfame Group (China) 10.5. Far Eastern New Century Corporation (Taiwan) 10.6. Hengli Group Co. Ltd (China) 10.7. Indorama Ventures Public Company Limited (Thailand) 10.8. JBF Industries Ltd (India) 10.9. Lotte Chemical Corporation (South Korea) 10.10. Sinopec Group (China) 10.11. Zhejiang Hengyi Group Co. Ltd (China) 10.12. Zhejiang Zhink Group Co. Ltd (China) 10.13. SABIC (Saudi Arabia) 10.14. OCTAL (Oman) 11. Key Findings 12. Industry Recommendations 13. Polyethylene Terephthalate (PET) Market: Research Methodology 14. Terms and Glossary