Clinical Trial Imaging Market size reached USD 1.28 billion in 2022 and is expected to reach USD 2.09 billion by 2029 Clinical Trial Imaging, growing at a CAGR of 7.2% during the forecast period. A clinical trial is a process of discovering new drugs. It is designed for giving medical treatment and to analyze its effects on humans. Imaging plays an important role in clinical trials and approx. 50 % of clinical trials needed imagining. Medical imaging is helpful in the drug development process because it provides efficacy evaluation and safety monitoring information that is required in clinical trials for regulatory submission. Clinical Trial Imaging also provides insights into the drug mechanism of action (MOA) and drug effects, which can assist researchers in making scientifically sound decisions. The regulatory authority FDA has provided several guidance documents outlining the importance of imaging in clinical trials for cancer therapies as well as other indications. Asia Pacific has become a hotspot for clinical trial activity and is expected to account for nearly half of all global clinical trial activity in 2022. Almost half of the clinical trial locations are located in the APAC region. It becomes important for manufacturers to provide the best possible treatment or therapy to the end user owing to the increased competition amongst pharmaceutical and biotechnology companies all over the world. This factor is contributing to the development of clinical trials as a large number of novel drug discoveries are being done by these companies. Thus, the increasing number of biotechnology and pharmaceutical companies as well as Contract Research Organizations (CROs), the development of innovative imaging techniques, and rising R&D investment to develop new drugs and therapies are some of the key factors driving the global Clinical Trial Imaging market. The Clinical Trial Imaging Market report forecasts revenue growth at global, and country levels and provides an analysis of the latest industry trends in each of the sub-segments during the forecast period. MMR has segmented the global Clinical Trial Imaging Market report based on Product and Service, Modality, End-User, and region. The report contains strategic profiling of top key players in the market, a wide-ranging analysis of their core competencies, and their strategies like new product launches, growths, agreements, joint ventures, partnerships, and acquisitions that apply to the businesses. Our team of analysts can also provide you with data in excel files and pivot tables or can assist you in creating presentations from the data sets available in the report.To know about the Research Methodology : Request Free Sample Report

Clinical Trial Imaging Market Dynamics:

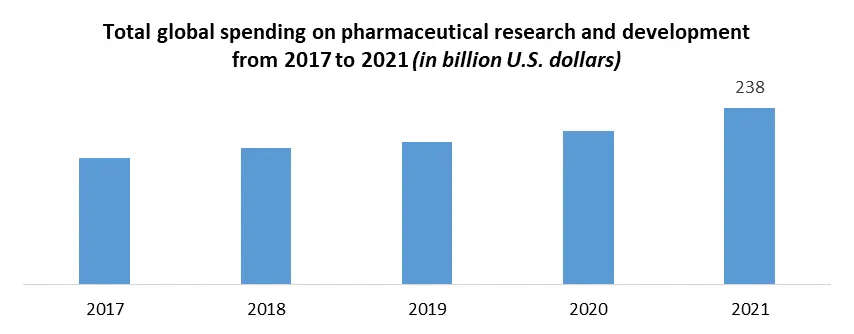

Benefits Associated with Clinical Trial Imaging increases Its Demand in the global market Imaging techniques provide various benefits to the difficult process of drug development. Some of them include the following:Increased R&D investments by pharmaceutical and biotechnology organizations and governments to boost market growth. Rising R&D spending in biotech and pharmaceutical companies is propelling the Clinical Trial Imaging industry growth. Imaging and pharmaceutical firms are constantly investing in R&D to provide customers with novel clinical trial imaging services and to strengthen their market position. Medical imaging plays a dynamic role in clinical development and is expected to grow owing to the introduction of new technology, increased investment in medical imaging firms, and mergers and acquisitions. According to the European Federation of Pharmaceutical Industries and Associations, the pharmaceutical sector in Europe has spent around USD 41,837 million on R&D in 2020. The government and private sector agencies have recognized the importance of research and have now increased the funding for interested research professionals. To keep up with current technological breakthroughs, the government is building new AIIMS, medical institutions, and diagnostic imaging facilities across many regions, as well as upgrading existing infrastructure to establish cutting-edge imaging facilities. Thus, increasing R & D investments in the healthcare and medical sectors throughout the world are likely to boost the global Clinical Trial Imaging market over the forecast period. Several countries in the Asia Pacific region are also focusing on life science research, particularly in the wake of the COVID-19 pandemic. In Japan, the Global Health Innovative Technology (GHIT) Fund supports a variety of R&D projects for drug development, including the screening of chemical libraries relevant to a number of infectious diseases.

Rising Number of Contract Research Organizations (CROs). Every year, the pharmaceutical industry creates a variety of new drugs that provide significant medical advantages. Developing new medicines is a costly and uncertain process, and many potential drugs never make it to market. As a result, in order to save money, companies outsource these tasks to CROs. CROs provide pharmaceutical and biotechnology industries with outsourced pharmaceutical research services. The CROs manage and complete the imaging process in accordance with all standards and regulatory requirements, ensuring smooth image acquisition, analysis, annotation, and transfer. In recent years, CRO services have helped companies in the early stages of developing novel medicines and therapies. Pharmaceutical firms are increasingly using clinical research, consultancy, and laboratory CRO services. Stakeholders in the existing contract research organization services market are expected to collaborate to develop open technology standards that will likely change clinical trial operations in the future. As a result, the growing number of CROs is expected to boost the clinical trial imaging market in the coming years. PAREXEL, PRA Health Sciences, LabCorp, PPD, Syneos Health, ICON plc, Envigo, Charles River, and SGS are among the various CROs involved in drug development monitoring. These are some CROs that provide clinical trials and other research services to the imaging and pharmaceutical industries. The growing number of CROs is likely to boost market expansion.

Clinical Trial Imaging Market Players' Strategic Initiatives

The major Clinical Trial Imaging market players have implemented a new strategies to increase business operations and profitability by developing new products and collaborating with other industry players. These market participants' strategic activities, such as acquisition, conferences, and focused segment product launches are assisting them in growing and improving the company's product portfolio, ultimately leading to increased revenue generation which may provide an opportunity for market growth. Market participants provide analytical testing, pharmacokinetic, reading, and pharmacodynamic services for improved clinical development. IXICO offers advanced technologies for accelerating clinical studies in neuroscience. The company's imaging biomarkers help to assess the safety and effectiveness of neuro-imaging therapies. Imaging biomarkers are helpful in radiological reads. This provides the reading of MRI scans for central neuro to enhance the assessment of ongoing monitoring of drug safety and subject eligibility. High cost associated with the implementation of the imagining system The healthcare sector is highly focused on reducing rising healthcare costs and most industry players are working on various strategies to achieve this goal. In such a scenario, imaging service providers find it challenging to allocate significant capital for the acquisition of high-cost equipment such as modern radiology and other imaging systems. The cost of an imaging system includes costs for purchasing, housing, and maintaining equipment. These high initial expenses, along with maintenance costs have an adverse impact on market growth. Imaging service companies should hire expert specialists such as experienced radiologists to make the best use of such technology. Therefore, the implementation cost of imaging systems is quite expensive and is expected to hamper the market growth during the forecast period.Clinical Trial Imaging Market Segment Analysis:

By Product and Service, the Operational imaging services segment is expected to grow at the highest CAGR during the forecast period had a sizable market share. Imaging modalities such as MRI, CT, ultrasound, OCT, PET, and SPECT for various therapeutic applications such as neurology, oncology, cardiovascular diseases, gastroenterology, and musculoskeletal disorders as well as medical devices to perform clinical trials are examples of operational imaging services. Imaging techniques are frequently utilized in clinical studies to give data for decision-making. The Food and Drug Administration Modernization Act permitted imaging modalities to be utilized as a product strategic instrument in medical devices or pharmaceutical clinical trials. By Modality, the Computed Tomography segment is expected to grow rapidly during the forecast period. Computed tomography is a non-invasive medical process that uses X-Rays to create cross-sectional images of the body and provides detailed information for the treatment and evaluation of abnormalities in children and adults. The growth of the computed tomography (CT) segment is attributed to the numerous benefits CT provides, such as the research of drug activity and screens for injuries, cancer (tumors), and abnormalities inside the body. Furthermore, rising financing and investment in clinical research and clinical trials are driving the segment growth. The substantial benefits of CT in screening for cancer (tumors) and injuries also make up a significant portion of this segment.By End Users, the pharmaceutical companies segment is expected to emerge as a significantly growing segment over the forecasted period. The need to develop new therapies and treatments to cure chronic illnesses is one factor contributing to this segment's rapid growth. The Contract Research Organizations (CROs) segment held the highest share of 43.2% in 2022. This significant market share can be attributed to the rising costs of drug development as well as rising R&D activity. Additionally, rising demand from biotechnology and pharmaceutical companies for the outsourcing of research and development activities to reduce costs is driving the market growth.

Regional Insights

The Clinical Trial Imaging Market is expected to be dominated by North America. North America is dominating the clinical trial imaging market due to the increased frequency of chronic diseases combined with an older population, which is expected to drive regional market growth. Advancements in healthcare infrastructure are allowing for faster diagnosis and treatment of chronic diseases. The United States dominates the North American area because it provides better reimbursement than any other medical provider, followed by an increase in R&D investment and an increase in the number of CROs for improved imaging modalities in the United States and Canada. However, the USFDA and other regulatory agencies have also played a major role in attaining trial registration accomplishments to date and are expected to be supported in addressing such problems in the near future. The regional market is expected to maintain its market position owing to all of these reasons during the forecast period. Asia Pacific's Clinical Trial Imaging market is expected to witness the highest growth during the forecast period. The Asia-Pacific region has become the hot spot for conducting clinical trials owing to the ease of regulatory compliance, the lower cost of conducting studies, the increasing patient population, and the presence of top clinical institutions acting as sites. The regulatory agencies in China are working towards enhanced clinical trial processes by reducing the overall review and approval process.The Europe clinical trial imaging market is driven by factors such as the rapidly growing geriatric population and the increasing incidence of chronic diseases such as Parkinson's, Huntington's, and Alzheimer's, which are driving clinical trial implementation in this region. Furthermore, research facilities are looking to cut operational costs, which is contributing to the use of imaging in clinical trials. In the European Union, over 4,000 clinical trials for drugs are approved each year (EU). The majority of these trials are performed in Western European countries. The Clinical Trial Imaging Market report forecasts revenue growth at global, and country levels and provides an analysis of the latest industry trends in each of the sub-segments during the forecast period. MMR has segmented the global Clinical Trial Imaging Market report based on Product and Service, Modality, End-User, and region. The report contains strategic profiling of top key players in the market, a wide-ranging analysis of their core competencies, and their strategies like new product launches, growths, agreements, joint ventures, partnerships, and acquisitions that apply to the businesses. Our team of analysts can also provide you with data in excel files and pivot tables or can assist you in creating presentations from the data sets available in the report.

Clinical Trial Imaging Market Scope: Inquire before buying

Clinical Trial Imaging Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 1.28 Bn. Forecast Period 2023 to 2029 CAGR: 7.2 % Market Size in 2029: US $ 2.09 Bn. Segments Covered: by Product and Service Trial Design Consulting Services Read Analysis Services Operational Imaging Services Imaging Software by Modality Magnetic Resonance Imaging Computed Tomography Ultrasound Positron Emission Tomography X-Ray Echocardiography Other Modalities by End-User Pharmaceutical Companies Medical Device Manufacturers Academic and Government Research Institutes Other End-Users by Application Nonalcoholic Steatohepatitis (NASH) Chronic Kidney Disease (CKD) Cardiovascular Diseases Others Clinical Trial Imaging Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players Are:

1. Worldcare Clinical, LLC 2. Radiant Sage LLC 3. Ixico PLC 4. Intrinsic Imaging LLC 5. Cardiovascular Imaging Technologies, LLC 6. Biotelemetry, Inc. 7. Biomedical Systems Corporation 8. Icon PLC 9. Parexel International Corporation 10.Bioclinica, Inc. 11.Resonance Health 12.Lyscaut Medical Imaging Company 13.Quotient Sciences 14.Navitas Life Sciences 15.Image Core Lab 16.ERT Clinical 17.Perspectum Diagnostics 18.Anagram 4 clinical trials 19.Prism Clinical Imaging FAQs: 1. Who are the key players in the Clinical Trial Imaging market? Ans. The Ixico PLC, Intrinsic Imaging LLC, Cardiovascular Imaging Technologies, LLC Biotelemetry, Inc., and Biomedical Systems Corporation are some of the market players in the Clinical Trial Imaging industry. 2. Which Modality segment dominates the Clinical Trial Imaging market? Ans. The Computed Tomography segment accounted for the largest share of the global Clinical Trial Imaging market in 2022. 3. Which end-user segment of the global Clinical Trial Imaging market is expected to witness the highest growth? Ans. The Pharmaceutical Companies segment accounted for the highest revenue share due to the need to develop new therapies and treatments to cure chronic illnesses. 4. How big is the Clinical Trial Imaging market? Ans. The global Clinical Trial Imaging market size reached USD 1.28 billion in 2022 and is expected to reach USD 2.09 billion by 2029 Clinical Trial Imaging, growing at a CAGR of 7.2% during the forecast period. 5. What are the key regions in the global Clinical Trial Imaging market? Ans. Based On the region, the market has been classified into North America, Europe, Asia Pacific, Middle, East and Africa, and Latin America. Asia Pacific dominates the global Clinical Trial Imaging market.

1. Global Clinical Trial Imaging Market: Research Methodology 2. Global Clinical Trial Imaging Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Clinical Trial Imaging Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Clinical Trial Imaging Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Clinical Trial Imaging Market Segmentation 4.1 Global Clinical Trial Imaging Market, by Product and Service (2021-2029) • Trial Design Consulting Services • Read Analysis Services • Operational Imaging Services • Imaging Software 4.2 Global Clinical Trial Imaging Market, by Modality (2021-2029) • Magnetic Resonance Imaging • Computed Tomography • Ultrasound • Positron Emission Tomography • X-Ray • Echocardiography • Other Modalities 4.3 Global Clinical Trial Imaging Market, by End-User (2021-2029) • Pharmaceutical Companies • Medical Device Manufacturers • Academic and Government Research Institutes • Other End-Users 4.4 Global Clinical Trial Imaging Market, by Application (2021-2029) • Nonalcoholic Steatohepatitis (NASH) • Chronic Kidney Disease (CKD) • Cardiovascular Diseases • Others 5. North America Clinical Trial Imaging Market(2021-2029) 5.1 North America Clinical Trial Imaging Market, by Product and Service (2021-2029) • Trial Design Consulting Services • Read Analysis Services • Operational Imaging Services • Imaging Software 5.2 North America Clinical Trial Imaging Market, by Modality (2021-2029) • Magnetic Resonance Imaging • Computed Tomography • Ultrasound • Positron Emission Tomography • X-Ray • Echocardiography • Other Modalities 5.3 North America Clinical Trial Imaging Market, by End-User (2021-2029) • Pharmaceutical Companies • Medical Device Manufacturers • Academic and Government Research Institutes • Other End-Users 5.4 North America Clinical Trial Imaging Market, by Application (2021-2029) • Nonalcoholic Steatohepatitis (NASH) • Chronic Kidney Disease (CKD) • Cardiovascular Diseases • Others 5.5 North America Clinical Trial Imaging Market, by Country (2021-2029) • United States • Canada • Mexico 6. Europe Clinical Trial Imaging Market (2021-2029) 6.1. European Clinical Trial Imaging Market, by Product and Service (2021-2029) 6.2. European Clinical Trial Imaging Market, by Modality (2021-2029) 6.3. European Clinical Trial Imaging Market, by End-User (2021-2029) 6.4. European Clinical Trial Imaging Market, by Application (2021-2029) 6.5. European Clinical Trial Imaging Market, by Country (2021-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Clinical Trial Imaging Market (2021-2029) 7.1. Asia Pacific Clinical Trial Imaging Market, by Product and Service (2021-2029) 7.2. Asia Pacific Clinical Trial Imaging Market, by Modality (2021-2029) 7.3. Asia Pacific Clinical Trial Imaging Market, by End-User (2021-2029) 7.4. Asia Pacific Clinical Trial Imaging Market, by Application (2021-2029) 7.5. Asia Pacific Clinical Trial Imaging Market, by Country (2021-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Clinical Trial Imaging Market (2021-2029) 8.1 Middle East and Africa Clinical Trial Imaging Market, by Product and Service (2021-2029) 8.2. Middle East and Africa Clinical Trial Imaging Market, by Modality (2021-2029) 8.3. Middle East and Africa Clinical Trial Imaging Market, by End-User (2021-2029) 8.4. Middle East and Africa Clinical Trial Imaging Market, by Application (2021-2029) 8.5. Middle East and Africa Clinical Trial Imaging Market, by Country (2021-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Clinical Trial Imaging Market (2021-2029) 9.1. South America Clinical Trial Imaging Market, by Product and Service (2021-2029) 9.2. South America Clinical Trial Imaging Market, by Modality (2021-2029) 9.3. South America Clinical Trial Imaging Market, by End-User (2021-2029) 9.4. South America Clinical Trial Imaging Market, by Application (2021-2029) 9.5. South America Clinical Trial Imaging Market, by Country (2021-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Worldcare Clinical, LLC 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Radiant Sage LLC 10.3 Ixico PLC 10.4 Intrinsic Imaging LLC 10.5 Cardiovascular Imaging Technologies, LLC 10.6 Biotelemetry, Inc. 10.7 Biomedical Systems Corporation 10.8 Icon PLC 10.9 Parexel International Corporation 10.10 Bioclinica, Inc. 10.11 Resonance Health 10.12 Lyscaut Medical Imaging Company 10.13 Quotient Sciences 10.14 Navitas Life Sciences 10.15 Image Core Lab 10.16 ERT Clinical 10.17 Perspectum Diagnostics 10.18 Anagram 4 clinical trials 10.19 Prism Clinical Imaging