Laboratory Informatics Market was valued at US$ 3.24 Bn. in 2021. Laboratory Informatics Market size is expected to grow at a CAGR of 5% through the forecast period.Laboratory Informatics Market Overview:

Laboratory informatics is a specific use of information technology designed to improve and grow laboratory operations. Data acquisition, instrument interface, laboratory networking, data processing, specialized data management systems (like a chromatography data system), a laboratory information management system, scientific data management (including data mining and data warehousing), and knowledge management are all included (including the use of an electronic lab notebook). As other "informatics" fields like bioinformatics, cheminformatics, and health informatics have grown in popularity, it has become increasingly widespread. Many graduate programs have some aspect of laboratory informatics as a focus, sometimes with a clinical emphasis. Laboratory automation is a subject that is closely connected to and, to some, even encompasses it. In the upcoming years, adoption is expected to be fueled by a rise in laboratory automation demand. Due to recent technological developments in molecular genomics and genetic testing methods, the amount of data produced by laboratories has greatly increased.To know about the Research Methodology :- Request Free Sample Report 2021 is considered as a base year to forecast the market from 2022 to 2029. 2021’s market size is estimated on real numbers and outputs of the key players and major players across the globe. The past five years' trends are considered while forecasting the market through 2029. 2021 is a year of exception and analysis, especially with the impact of lockdown by region.

COVID-19 Impact Insights on Laboratory Informatics Market:

In order to optimize processes, pharma and biotech businesses, researchers, and numerous diagnostic laboratories and testing facilities performing COVID-19 research have used cutting-edge technology and solutions outside conventional routes. For COVID-19 research, diagnostic or research laboratories must manage many processes (such as test management, sample handling, inventory control, and packaging and shipment). Additionally, research facilities working on COVID-19 therapies or vaccinations require a successful end-to-end solution to raise the standard, output, and speed of vaccine production. The use of laboratory informatics solutions, which improve research and testing processes, grow laboratory operations, and facilitate effective data management, is projected to rise as a result. Some industry participants are concentrating on developing LIMS solutions specifically for COVID-19 testing in an effort to boost the effectiveness and speed of COVID-19 testing.Laboratory Informatics Market Dynamics:

Increasing need for Laboratory Automation: The issues of a lack of laboratory specialists and strategies to eliminate manual involvement in lab operations are being effectively addressed through laboratory automation. By automating ordinary lab processes with the use of dedicated workstations and instrument-programming software, lab efficiency is increased, and individual researchers are free to concentrate on crucial tasks. High-quality data are produced via automation, which also makes for better documentation. The creation of standardized systems with reproducible outcomes is aided by the availability of supervisory standards and strict regulatory requirements for error-free results. The demand for effective data storage, processing, and sharing techniques has arisen because of the exponential increase in the amount of data generated by lab equipment. Due to its major facilitation, advancement, and improvement of the productivity and efficiency of laboratory procedures, laboratory informatics systems provide an efficient response to this requirement. Adaption of New Technology: Patients can recover more quickly thanks to medical innovations including more effective monitoring systems and comfortable scanning equipment. Adoption of technology in medical devices and telemedicine has resulted in the automation of operations since, in some circumstances, doctors do not even need to be present in the operating room with a patient while the operation is conducted. Health care technology has been evolving steadily, and as a result, laws and regulations have been put in place to control how it is used. As a result, new techniques for providing care can be used. High maintenance and service cost: One of the key issues limiting the growth of this market is the high maintenance and service expenses connected with laboratory informatics systems. Industry analysts claim that the maintenance costs of IT systems exceed the cost of the product itself. The cost of service and maintenance, which includes adapting the software to changing user needs, is recurrent and accounts for around 20 to 30 % of the overall cost of ownership. Additionally, the expenditures associated with training and implementation add up to around 15% of the final cost. Because of these reasons, many small and medium-sized laboratories find it challenging to invest in these systems, which restricts their acceptance. The impact of this restriction is expected to lessen in the upcoming years as cloud-based products gain popularity.Laboratory Informatics Market Segment Analysis:

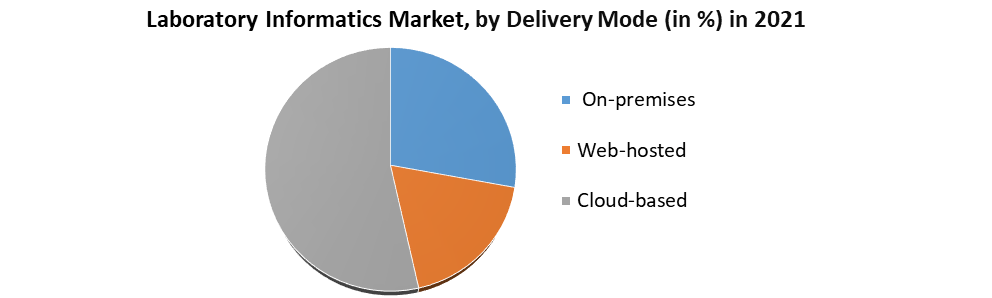

Based on Type, the Laboratory Informatics Market is segmented into Laboratory Information Management Systems (LIMS), Electronic Lab Notebooks (ELN), Scientific Data Management Systems (SDMS), Laboratory Execution Systems (LES), and Others. In 2021, the Laboratory Information Management Systems (LIMS) market category led with a revenue share of more than 45.0 %. Master data management, sample lifecycle reporting, stability studies, system and security administration, timetables, inventories, instruments, storage capacity, logistics, and analytical workflow are some of these systems. In the upcoming years, the need for completely integrated services to reduce data management mistakes and enhance the qualitative analysis of research findings is expected to drive the segment's growth. These reasons will likely allow the LIMS segment to hold its position during the forecast period. Additionally, due to the rising usage of superior Electronic Lab Notebooks (ELN) systems by laboratories, it is expected that this market would develop significantly over the course of the forecast period. During the forecast period, it is expected that the Enterprise Content Management (ECM) segment will see a CAGR of 3.3%. As ECM provides integrated and all-encompassing solutions to address the escalating issues in the healthcare business, its use is increasing with time. ECM provides a centralized method for gathering, creating, organizing, accessing, and analyzing the complete ecosystem of media, knowledge assets, and electronic documents inside a company. Based on the Delivery Mode, the Laboratory Informatics Market is segmented into On-Premises, Cloud-Based, and Web-based. It is expected that the cloud-based segment would continue to dominate the market and account for over 40.0 % of total revenue over the forecast period. By storing vast volumes of data remotely, cloud-based technology frees up space on devices and makes it easier to retrieve data as needed by clients. Platform as a Service (PaaS), Infrastructure as a Service (IaaS), and Software as a Service are the three services that make up the technology (SaaS). As SaaS-based services, the cloud-based analytics software is accessible. The SaaS platform is where IBM sells its Watson Analytic services. Cloud-based services for LIMS are provided by organizations like Core Informatics and LabVantage Solutions, Inc. Growth in the use of cloud-based platforms by CROs because of the benefits associated with them, including lower labor costs, less need for time, and space during system development, and secure access to clinical data. A simple ecology, remote data access, and real-time data tracking are some other advantages of cloud-based systems. These aforementioned elements should provide this market with fruitful potential.

Laboratory Informatics Market Regional Insights:

North America region dominated the market with a 40 % share in 2021. The North America region is expected to witness significant growth at a CAGR of 5.4 % through the forecast period. The availability of infrastructure with high levels of digital literacy and the regulations enabling the adoption of laboratory information systems are the main drivers of growth in this geographical market. Additionally, the rising cost of healthcare and the mounting need to bend the cost curve led to a rise in the use of LIMS in this region. The primary drivers of the regional market growth include also the existence of well-established pharmaceutical businesses and the rising need to control operational expenses associated with information management and analysis. Due to the rising number of CROs offering LIMS solutions in the Asia Pacific, the market for laboratory informatics is expected to experience rapid growth in the years to come. To cut the cost of LIMS support systems and boost operational effectiveness, major players outsource LIMS to these firms. Developing nations like China and India are becoming major outsourcing centers. The high frequency of infectious and cardiovascular disorders in India has also significantly contributed to the rise of clinical services. Over the forecast period, this is estimated to result in a rise in demand for laboratory informatics. The objective of the report is to present a comprehensive analysis of the global Laboratory Informatics Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Laboratory Informatics Market dynamic, and structure by analyzing the market segments and forecasting the Laboratory Informatics Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the Laboratory Informatics Market make the report investor’s guide.Laboratory Informatics Market Scope: Inquire before buying

Global Laboratory Informatics Market Report Coverage Details Base Year: 2021 Forecast Period: 2022-2029 Historical Data: 2017 to 2021 Market Size in 2021: US $ 3.24 Bn. Forecast Period 2022 to 2029 CAGR: 5% Market Size in 2029: US $ 4.79 Bn. Segments Covered: by Product Type • Laboratory Information Management Systems (LIMS) • Electronic Lab Notebooks (ELN) • Scientific Data Management Systems (SDMS) • Laboratory Execution Systems (LES) • Others by Delivery Mode • On-premises • Web-hosted • Cloud-based by Component • Software • Services Laboratory Informatics Market by Region

• North America • Europe • Asia Pacific • South America • Middle East and AfricaLaboratory Informatics Market Key Players

• Thermo Fisher Scientific, Inc. • Core Informatics • LabWare • PerkinElmer, Inc. • LabVantage Solutions, Inc. • LabLynx, Inc. • Agilent Technologies • ID Business Solutions Ltd. • McKesson Corporation • Waters Corporation • Abbott Informatics • Oracle Corporation • Siemens • IDBS • Novatek International Frequently Asked Questions: 1] What segments are covered in the Global Laboratory Informatics Market report? Ans. The segments covered in the Laboratory Informatics Market report are based on Product Type, Delivery mode, and Component. 2] Which region is expected to hold the highest share in the Global Laboratory Informatics Market? Ans. The North America region is expected to hold the highest share in the Laboratory Informatics Market. 3] What is the market size of the Global Laboratory Informatics Market by 2029? Ans. The market size of the Laboratory Informatics Market by 2029 is expected to reach US$ 4.79 Bn. 4] What is the forecast period for the Global Laboratory Informatics Market? Ans. The forecast period for the Laboratory Informatics Market is 2022-2029. 5] What was the market size of the Global Laboratory Informatics Market in 2021? Ans. The market size of the Laboratory Informatics Market in 2021 was valued at US$ 3.24 Bn.

1. Global Laboratory Informatics Market Size: Research Methodology 2. Global Laboratory Informatics Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Laboratory Informatics Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Laboratory Informatics Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Laboratory Informatics Market Size Segmentation 4.1. Global Laboratory Informatics Market Size, by Product Type (2021-2029) 4.1.1. Laboratory Information Management Systems (LIMS) 4.1.2. Electronic Lab Notebooks (ELN) 4.1.3. Scientific Data Management Systems (SDMS) 4.1.4. Laboratory Execution Systems (LES) 4.1.5. Others 4.2. Global Laboratory Informatics Market Size, by Component (2021-2029) 4.2.1. On-premises 4.2.2. Web-hosted 4.2.3. Cloud-based 4.3. Global Laboratory Informatics Market Size, by Delivery Mode (2021-2029) 4.3.1. Hardware 4.3.2. Software 5. North America Laboratory Informatics Market (2021-2029) 5.1. North America Laboratory Informatics Market Size, by Product Type (2021-2029) 5.1.1. Laboratory Information Management Systems (LIMS) 5.1.2. Electronic Lab Notebooks (ELN) 5.1.3. Scientific Data Management Systems (SDMS) 5.1.4. Laboratory Execution Systems (LES) 5.1.5. Others 5.2. North America Laboratory Informatics Market Size, by Delivery Mode (2021-2029) 5.2.1. On-premises 5.2.2. Web-hosted 5.2.3. Cloud-based 5.3. North America Laboratory Informatics Market Size, by Component (2021-2029) 5.3.1. Hardware 5.3.2. Software 5.4. North America Laboratory Informatics Market, by Country (2021-2029) • United States • Canada • Mexico 6. European Laboratory Informatics Market (2021-2029) 6.1. European Laboratory Informatics Market, by Delivery Mode (2021-2029) 6.2. European Laboratory Informatics Market, by Product Type (2021-2029) 6.3. European Laboratory Informatics Market, by Component (2021-2029) 6.4. European Laboratory Informatics Market, by Country (2021-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest of Europe 7. Asia Pacific Laboratory Informatics Market (2021-2029) 7.1. Asia Pacific Laboratory Informatics Market, by Delivery Mode (2021-2029) 7.2. Asia Pacific Laboratory Informatics Market, by Product Type (2021-2029) 7.3. Asia Pacific Laboratory Informatics Market, by Component (2021-2029) 7.4. Asia Pacific Laboratory Informatics Market, by Country (2021-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest of APAC 8. Middle East and Africa Laboratory Informatics Market (2021-2029) 8.1. Middle East and Africa Laboratory Informatics Market, by Delivery Mode (2021-2029) 8.2. Middle East and Africa Laboratory Informatics Market, by Product Type (2021-2029) 8.3. Middle East and Africa Laboratory Informatics Market, by Component (2021-2029) 8.4. Middle East and Africa Laboratory Informatics Market, by Country (2021-2029) • South Africa • GCC • Egypt • Nigeria • Rest of ME&A 9. South America Laboratory Informatics Market (2021-2029) 9.1. South America Laboratory Informatics Market, by Delivery Mode (2021-2029) 9.2. South America Laboratory Informatics Market, by Product Type (2021-2029) 9.3. South America Laboratory Informatics Market, by Component (2021-2029) 9.4. South America Laboratory Informatics Market, by Country (2021-2029) • Brazil • Argentina • Rest of South America 10. Company Profile: Key players 10.1. Thermo Fisher Scientific, Inc. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Core Informatics 10.3. LabWare 10.4. PerkinElmer, Inc. 10.5. LabVantage Solutions, Inc. 10.6. LabLynx, Inc. 10.7. Agilent Technologies 10.8. ID Business Solutions Ltd. 10.9. McKesson Corporation 10.10. Waters Corporation 10.11. Abbott Informatics 10.12. Oracle Corporation 10.13. Siemens 10.14. IDBS 10.15. Novatek International