The Addiction Treatment Market size was valued at USD 9.05 Billion in 2023 and the total Addiction Treatment Market size is expected to grow at a CAGR of 7.15 % from 2023 to 2030, reaching nearly USD 14.46 Billion in 2030. Addiction is a mental health condition, that occurs when an individual consumes legal or illegal substances and is unable to control their use of drugs or other substances. Addiction treatment purposes to help patients limit their use of drugs. when an individual fails to discontinue the consumption of these drugs. The rising prevalence of substance abuse disorders, Increasing awareness of addiction and its treatment options, and government support for addiction treatment programs are the driving factors of the Addiction Treatment Market. The report from Maximize Market Research presents a thorough analysis of the Addiction Treatment Market, focusing on expecting market growth trends and offering valuable insights into the supply chain dynamics. The market scope includes opportunities in new product development and advancements in drug formulation technologies, which drive market growth and innovation. • According to MMR, about 32 million Americans aged 12 or older were addicted to drugs. Among them, about 27.6 million people used marijuana, 2.8 million people abused prescription pain relievers, and 1.9 million people used cocaine IN 2019. Some of the major Key companies that are present in the addiction treatment systems market are Cipla Inc., Allergan, Alkermes, Pfizer Inc., Orexo AB, GlaxoSmithKline pic., Sandoz International GmbH, Reckitt Benckiser Group plc and other prominent players. These companies develop and manufacture medications used in addiction treatment,for Instance, methadone for opioid dependence or buprenorphine for opioid and alcohol use disorders. Asia Pacific has been the fastest-growing region in the Addiction Treatment Market with a large market share of about 20.1 % in 2023 and is expected to grow at a CAGR of 7.15 % during the forecast period and maintain its dominance by 2030. The Asia Pacific region boasts a huge population, which includes a significant youth population. the addiction rates are on the rise in many parts of Asia Pacific. Factors like social pressures, economic anxieties, and easier access to substances contribute to this increase. with developing nations such as China and India experiencing an increase in substance addiction cases. With the growth of the market, there is a focus on providing cost-effective treatment choices to patients.To know about the Research Methodology :- Request Free Sample Report

Addiction Treatment Market Dynamics:

Rising prevalence of addiction The rising rates of addiction particularly to substances such as tobacco, alcohol, and drugs, have been a significant driver for the addiction treatment market. The rising rate of addiction occurred because of Various factors, including education, social and economic environment, the flexibility of healthcare systems and societies, as well as individual factors such as genetics, mental health, and trauma, all play a role in determining overall health. There has been a significant rise in the number of people globally who are struggling with addiction to substances like alcohol, opioids, and stimulants Because of social pressures, mental health problems, and the easy availability of addictive substances. People with mental health conditions, such as depression, anxiety, or PTSD, often turn to these substances as a way of coping with their symptoms. The easily available substances including alcohol, tobacco, and illicit drugs, also contribute to addiction rates. For instance, the increasing availability and accessibility of opioids, both prescription and illicit, have led to a greater rise in opioid addiction and overdose deaths in the near future. • Drug overdose deaths involving stimulants, cocaine, or psychostimulants with abuse potential (primarily methamphetamine) have significantly increased since 2015 from 12,122 to 53,495 in 2021. Changes in drug policies, such as the legalization of cannabis in some regions and stricter regulations on opioid prescriptions, impact the dynamics of addiction treatment markets and outline demand patterns. Many Governments are investing more money in addiction treatment programs, supported by funding, policies because of addressing addiction and improving access to treatments are significantly driving the market, and The addiction treatment market is seeing a significant development with the growing demand for real-time data collection. This data is used to curate personalized treatment programs and streamline addiction treatment.Lack of Physical and mental stability of patients during the treatment is hampering the market growth The lack of physical and mental stability of patients hamper the effectiveness of addiction treatment programs. Patients struggling with addiction face difficulties in maintaining consistent engagement with treatment because of the withdrawal symptoms, cravings, and psychological challenges associated with substance dependence. It requires an individualized approach that considers the complex interplay of physical, mental, and emotional factors involved in addiction recovery. Mental health issues and disorders, such as depression, anxiety, and trauma complicate the treatment process. these underlying mental health conditions are important for successful addiction treatment results. The uncertainty leads to non-compliance with treatment regimens, premature treatment discontinuation, and a higher risk of relapse. • In February 2023, Sesh+, a smoking cessation company with the motive of preventing addiction and providing treatment, developed NRT products in flavors, such as cinnamon, pomegranate, and wintergreen, to enhance the adoption of treatment. The industry growth is being restrained by the relapse of addiction oues to the discontinuation of therapies.

Addiction Treatment Market Segment Analysis:

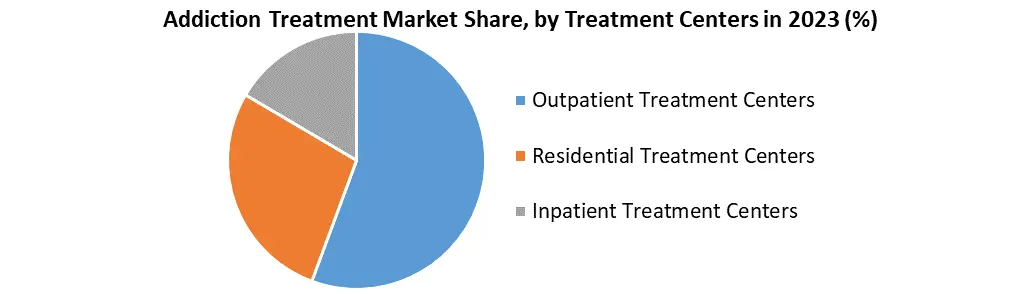

Based on the Treatment Type, the Tobacco/ Nicotine Addiction treatment segment helds the largest market share of about 34.01% in the Addiction Treatment Market in 2023. According to the MMR analysis, the segment is expected to grow at a CAGR of 9.02% during the forecast period and maintain its dominance till 2030. Tobacco/ Nicotine Addiction treatments are dominant because Tobacco use, particularly smoking remains a major global public health concern. High numbers of tobacco users and the active clinical trials of tobacco/nicotine addiction therapies. Ongoing research and innovation in treatment methods specific to tobacco and nicotine addiction contribute to growing the segments. • According to MMR, there are over 1.3 billion tobacco users globally, with millions dying from tobacco-related diseases each year. Nicotine replacement therapy (NRT) products like patches, gums, and lozenges are widely available over-the-counter, and prescription medications like varenicline are also an option. The availability makes it easier for people to seek help quitting. A growing public awareness about the dangers of tobacco use and the benefits of quitting. Public health campaigns, graphic warning labels on cigarette packs, and media coverage have all contributed shift. The increased awareness fuels the demand for cessation treatments as people become motivated to quit. The alcohol segment is expected to register the fastest growth rate over the forecast period owing to its high consumption, easy availability, and heightened social acceptance, resulting in its increasing consumption globally Based on the Treatment Centers, the outpatient treatment centers segment helds the largest market share in the Addiction Treatment Market in 2023 and is expected to maintain its dominance till 2030. outpatient treatment centers segment is dominating because allow individuals to maintain work, school, and family commitments while receiving addiction treatment. It is suitable for various levels of addiction recovery. Outpatient treatment is more likely to be covered by insurance compared to residential or inpatient programs, making it a more realistic option for many individuals. Outpatient treatment is more likely to be covered by insurance compared to residential or inpatient programs, making it a more realistic option for many individuals.

Addiction Treatment Market of Regional Analysis:

North America dominates the Addiction Treatment Market, which helds the largest market share accounting for 46.17% in 2023, the region is expected to grow during the forecast period and maintain its dominance by 2030. North America is a dominating region oues to the huge number of people who are addicted to substances like alcohol, tobacco, opioids, and others. increased consumption of illicit drugs, the penetration of insurance plans for costly diagnosis tests, and the region's significant revenue contribution to the market. Increasing drug awareness campaigns and prevention programs in North America have contributed to the growth of the addiction treatment market. These initiatives have helped to increase awareness about the negative effects of substance abuse, leading to a higher demand for addiction treatment services and products • According to MMR, In 2023, around 14 out of every 100 adults aged 18 years or older in the United States smoked cigarettes, which accounts for 14.0% of the total adult population. Around 34.1 million adults in the US are currently smoking cigarettes, and an estimated 16 million people suffer from smoking-related illnesses and their associated effects. With such a significant population of smokers in the country, there is a growing demand for addiction treatments, which is driving the market growth for such treatments in the United States. • The US has a well-developed medical system, which is supported by investment in research and efforts to control substance abuse. As a result, many Americans can access the necessary care they need. For example, in February 2022, Texas and some of its largest counties received $1.17 billion as part of a national settlement from three major drug distribution companies to help combat opioid addiction.Europe represents a mature market for the Addiction Treatment industry, holding a market share of XX% and experiencing significant growth during its forecast period. Many European countries have high rates of addiction treatment compared to other regions. It represents a strong existing infrastructure and public awareness around addiction issues. Regulations about treatment modalities and insurance reimbursement for addiction treatment are well in Europe. So it limits the adoption of entirely new treatment methods.

Competitive Landscape for the Addiction Treatment Market:

A key Company's strategy is its constant commitment to research and development (R&D) to maintain a leading position in drug development. The competitive landscape of the Addiction Treatment Market includes a mix of established companies focusing on research and development to enhance efficiency and performance. Product launches have been an important strategic step for the major key players in the Addiction Treatment Market to remain competitive in the global market. The market is characterized by technological advancements, government regulations, and consumer demand for products, driving the Addiction Treatment industry's growth. • In June 2021, AELIS FARMA, a biotechnology organization working on the ailment of cerebrum issues, declared essential cooperation and choice permit concurrence with INDIVIOR PLC to address the serious results of weed use problems (CUD), including marijuana-prompted psychosis (CIP). • In June 2021, Terveystalo Healthcare procured 72% of the shareholding in Feelgood Svenska AB and unveiled a suggested required deal of SEK 5.7/share. • June 2021 - The Ridge is opening a new office that will provide comprehensive, private treatment for individuals suffering from drug and alcohol addiction. • In 2022, Pfizer, Inc. announced a new strategic partnership with Alex Therapeutics to customize treatment through digital therapeutics and use AI-based platform of the latter company for providing Cognitive Behavioral Therapy (CBT) and Acceptance and Commitment Therapy (ACT) to patients of nicotine addiction. • On 2022, Indivior PLC. entered into a collaborative agreement with Addex Therapeutics, a clinical-stage pharmaceutical company, for discovery and development of novel oral gamma-aminobutyric acid subtype B (GABAB) Positive Allosteric modulator (PAM) drug candidates. Under this agreement, Indivior will provide the latter company with round USD 900,000 as additional research funding.Addiction Treatment Market Scope: Inquiry Before Buying

Addiction Treatment Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 9.05 Bn. Forecast Period 2024 to 2030 CAGR: 7.15% Market Size in 2030: US $ 14.46 Bn. Segments Covered: by Treatment Type Alcohol Addiction Treatment Tobacco/Nicotine Addiction Treatment Opioid Addiction Treatment Other Substance Addiction Treatment by Drug Type Bupropion Varenicline Acamprosate Disulfiram Others by Treatment Centers Outpatient Treatment Centers Residential Treatment Centers Inpatient Treatment Centers by Distribution Channel Hospital Pharmacies Medical Stores Others Addiction Treatment Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Russia, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Addiction Treatment Market Key Players:

North America: 1. Pfizer Inc. (New York) 2. Alkermes Plc. (Ireland) 3. Titan Pharmaceuticals (California) 4. Indivor PLC. (U.S.) 5. Allergan (U.S) 6. Lupin Pharmaceuticals (U.S) 7. Mylan Laboratories (Pennsylvania) 8. Apotex (Canada) 9. Amphastar Pharmaceuticals (California) 10. Glenmark Pharmaceuticals (U.S.) Europe: 1. GlaxoSmithKline Plc. (U.K.) 2. Teva Pharmaceuticals (Europe) 3. Hikma Pharmaceuticals (London) 4. Mallinckrodt (U.K.) 5. Orexo AB (Sweden) 6. Sanofi Aventis (France) 7. Reckitt Benckiser Pharmaceuticals (England) Asia Pacific Region: 1. Cipla Ltd. (India) 2. Par Pharmaceuticals (India) 3. Sun Pharmaceuticals (India)Frequently Asked Questions:

1] What is the growth rate of the Addiction Treatment Market? Ans. The Addiction Treatment Market is expected to grow at a CAGR of 7.15 % during the forecast period of 2023 to 2030. 2] Which region is expected to hold the highest share of the Addiction Treatment Market? Ans. North America is expected to hold the highest share of the Addiction Treatment Market. 3] What is the market size of the Addiction Treatment Market? Ans. The Addiction Treatment Market size was valued at USD 9.05 billion in 2023 reaching nearly USD 14.46 billion in 2030. 4] What is the forecast period for the Addiction Treatment Market? Ans. The forecast period for the Addiction Treatment Market is 2024-2030. 5] What segments are covered in the Addiction Treatment Market report? Ans. The segments covered in the Addiction Treatment Market report are based on Treatment Type, Drug Type, Treatment Centres and Distribution Channels.

1. Addiction Treatment Market: Research Methodology 2. Addiction Treatment Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Addiction Treatment Market: Dynamics 3.1. Addiction Treatment Market Trends by Region 3.1.1. North America Addiction Treatment Market Trends 3.1.2. Europe Addiction Treatment MarketTrends 3.1.3. Asia Pacific Addiction Treatment Market Trends 3.1.4. Middle East and Africa Addiction Treatment Market Trends 3.1.5. South America Addiction Treatment Market Trends 3.2. Addiction Treatment Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Addiction Treatment Market Drivers 3.2.1.2. North America Addiction Treatment Market Restraints 3.2.1.3. North America Addiction Treatment Market Opportunities 3.2.1.4. North America Addiction Treatment Market Challenges 3.2.2. Europe 3.2.2.1. Europe Addiction Treatment Market Drivers 3.2.2.2. Europe Addiction Treatment Market Restraints 3.2.2.3. Europe Addiction Treatment Market Opportunities 3.2.2.4. Europe Addiction Treatment Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Addiction Treatment Market Drivers 3.2.3.2. Asia Pacific Addiction Treatment Market Restraints 3.2.3.3. Asia Pacific Addiction Treatment Market Opportunities 3.2.3.4. Asia Pacific Addiction Treatment Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Addiction Treatment Market Drivers 3.2.4.2. Middle East and Africa Addiction Treatment Market Restraints 3.2.4.3. Middle East and Africa Addiction Treatment Market Opportunities 3.2.4.4. Middle East and Africa Addiction Treatment Market Challenges 3.2.5. South America 3.2.5.1. South America Addiction Treatment Market Drivers 3.2.5.2. South America Addiction Treatment Market Restraints 3.2.5.3. South America Addiction Treatment Market Opportunities 3.2.5.4. South America Addiction Treatment Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Value Chain Analysis 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For the Addiction Treatment Industry 3.8. Analysis of Government Schemes and Initiatives For the Addiction Treatment Industry 4. Addiction Treatment Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion ) (2023-2030) 4.1. Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 4.1.1. Alcohol Addiction Treatment 4.1.2. Tobacco/ Nicotine Addiction Treatment 4.1.3. Opioid Addiction Treatment 4.1.4. Other Substance Addiction Treatment 4.2. Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 4.2.1. Bupropion 4.2.2. Varenicline 4.2.3. Acamprosate 4.2.4. Disulfiram 4.2.5. Others 4.3. Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 4.3.1. Outpatient Treatment Centers 4.3.2. Residential Treatment Centers 4.3.3. Inpatient Treatment Centers 4.4. Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.1. Hospital Pharmacies 4.4.2. Medical Stores 4.4.3. Others 4.5. Addiction Treatment Market Size and Forecast, by Region (2023-2030) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North American Addiction Treatment Market Size and Forecast by Segmentation (by Value in USD Billion ) (2023-2030) 5.1. North America Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 5.1.1. Alcohol Addiction Treatment 5.1.2. Tobacco/ Nicotine Addiction Treatment 5.1.3. Opioid Addiction Treatment 5.1.4. Other Substance Addiction Treatment 5.2. North America Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 5.2.1. Bupropion 5.2.2. Varenicline 5.2.3. Acamprosate 5.2.4. Disulfiram 5.2.5. Others 5.3. North America Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 5.3.1. Outpatient Treatment Centers 5.3.2. Residential Treatment Centers 5.3.3. Inpatient Treatment Centers 5.4. North America Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.1. Hospital Pharmacies 5.4.2. Medical Stores 5.4.3. Others 5.5. North America Addiction Treatment Market Size and Forecast, by Country (2023-2030) 5.5.1. United States 5.5.1.1. United States Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 5.5.1.1.1. Alcohol Addiction Treatment 5.5.1.1.2. Tobacco/ Nicotine Addiction Treatment 5.5.1.1.3. Opioid Addiction Treatment 5.5.1.1.4. Other Substance Addiction Treatment 5.5.1.2. United States Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 5.5.1.2.1. Bupropion 5.5.1.2.2. Varenicline 5.5.1.2.3. Acamprosate 5.5.1.2.4. Disulfiram 5.5.1.2.5. Others 5.5.1.3. United States Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 5.5.1.3.1. Outpatient Treatment Centers 5.5.1.3.2. Residential Treatment Centers 5.5.1.3.3. Inpatient Treatment Centers 5.5.1.4. United States Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 5.5.1.4.1. Hospital Pharmacies 5.5.1.4.2. Medical Stores 5.5.1.4.3. Others 5.5.2. Canada 5.5.2.1. Canada Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 5.5.2.1.1. Alcohol Addiction Treatment 5.5.2.1.2. Tobacco/ Nicotine Addiction Treatment 5.5.2.1.3. Opioid Addiction Treatment 5.5.2.1.4. Other Substance Addiction Treatment 5.5.2.2. Canada Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 5.5.2.2.1. Bupropion 5.5.2.2.2. Varenicline 5.5.2.2.3. Acamprosate 5.5.2.2.4. Disulfiram 5.5.2.2.5. Others 5.5.2.3. Canada Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 5.5.2.3.1. Outpatient Treatment Centers 5.5.2.3.2. Residential Treatment Centers 5.5.2.3.3. Inpatient Treatment Centers 5.5.2.4. Canada Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 5.5.2.4.1. Hospital Pharmacies 5.5.2.4.2. Medical Stores 5.5.2.4.3. Others 5.5.3. Mexico 5.5.3.1. Mexico Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 5.5.3.1.1. Alcohol Addiction Treatment 5.5.3.1.2. Tobacco/ Nicotine Addiction Treatment 5.5.3.1.3. Opioid Addiction Treatment 5.5.3.1.4. Other Substance Addiction Treatment 5.5.3.2. Mexico Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 5.5.3.2.1. Bupropion 5.5.3.2.2. Varenicline 5.5.3.2.3. Acamprosate 5.5.3.2.4. Disulfiram 5.5.3.2.5. Others 5.5.3.3. Mexico Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 5.5.3.3.1. Outpatient Treatment Centers 5.5.3.3.2. Residential Treatment Centers 5.5.3.3.3. Inpatient Treatment Centers 5.5.3.4. Mexico Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 5.5.3.4.1. Hospital Pharmacies 5.5.3.4.2. Medical Stores 5.5.3.4.3. Others 6. Europe Addiction Treatment Market Size and Forecast by Segmentation (by Value in USD Billion ) (2023-2030) 6.1. Europe Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 6.2. Europe Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 6.3. Europe Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 6.4. Europe Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 6.5. Europe Addiction Treatment Market Size and Forecast, by Country (2023-2030) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 6.5.1.2. United Kingdom Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 6.5.1.3. United Kingdom Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 6.5.1.4. United Kingdom Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.2. France 6.5.2.1. France Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 6.5.2.2. France Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 6.5.2.3. France Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 6.5.2.4. France Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.3. Germany 6.5.3.1. Germany Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 6.5.3.2. Germany Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 6.5.3.3. Germany Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 6.5.3.4. Germany Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.4. Italy 6.5.4.1. Italy Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 6.5.4.2. Italy Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 6.5.4.3. Italy Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 6.5.4.4. Italy Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.5. Spain 6.5.5.1. Spain Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 6.5.5.2. Spain Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 6.5.5.3. Spain Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 6.5.5.4. Spain Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.6. Sweden 6.5.6.1. Sweden Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 6.5.6.2. Sweden Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 6.5.6.3. Sweden Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 6.5.6.4. Sweden Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.7. Russia 6.5.7.1. Russia Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 6.5.7.2. Russia Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 6.5.7.3. Russia Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 6.5.7.4. Russia Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 6.5.8.2. Rest of Europe Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 6.5.8.3. Rest of Europe Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 6.5.8.4. Rest of Europe Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 7. Asia Pacific Addiction Treatment Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 7.1. Asia Pacific Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 7.2. Asia Pacific Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 7.3. Asia Pacific Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 7.4. Asia Pacific Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 7.5. Asia Pacific Addiction Treatment Market Size and Forecast, by Country (2023-2030) 7.5.1. China 7.5.1.1. China Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 7.5.1.2. China Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 7.5.1.3. China Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 7.5.1.4. China Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.2. S Korea 7.5.2.1. S Korea Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 7.5.2.2. S Korea Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 7.5.2.3. S Korea Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 7.5.2.4. S Korea Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.3. Japan 7.5.3.1. Japan Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 7.5.3.2. Japan Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 7.5.3.3. Japan Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 7.5.3.4. Japan Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.4. India 7.5.4.1. India Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 7.5.4.2. India Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 7.5.4.3. India Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 7.5.4.4. India Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.5. Australia 7.5.5.1. Australia Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 7.5.5.2. Australia Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 7.5.5.3. Australia Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 7.5.5.4. Australia Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.6. ASEAN 7.5.6.1. ASEAN Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 7.5.6.2. ASEAN Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 7.5.6.3. ASEAN Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 7.5.6.4. ASEAN Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.7. Rest of Asia Pacific 7.5.7.1. Rest of Asia Pacific Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 7.5.7.2. Rest of Asia Pacific Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 7.5.7.3. Rest of Asia Pacific Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 7.5.7.4. Rest of Asia Pacific Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 8. Middle East and Africa Addiction Treatment Market Size and Forecast by Segmentation (by Value in USD Billion ) (2023-2030) 8.1. Middle East and Africa Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 8.2. Middle East and Africa Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 8.3. Middle East and Africa Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 8.4. Middle East & Africa Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 8.5. Middle East and Africa Addiction Treatment Market Size and Forecast, by Country (2023-2030) 8.5.1. South Africa 8.5.1.1. South Africa Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 8.5.1.2. South Africa Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 8.5.1.3. South Africa Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 8.5.1.4. South Africa Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 8.5.2. GCC 8.5.2.1. GCC Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 8.5.2.2. GCC Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 8.5.2.3. GCC Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 8.5.2.4. GCC Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 8.5.3. Rest of ME&A 8.5.3.1. Rest of ME&A Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 8.5.3.2. Rest of ME&A Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 8.5.3.3. Rest of ME&A Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 8.5.3.4. Rest of ME&A Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 9. South America Addiction Treatment Market Size and Forecast by Segmentation (by Value in USD Billion ) (2023-2030) 9.1. South America Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 9.2. South America Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 9.3. South America Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 9.4. South America Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 9.5. South America Addiction Treatment Market Size and Forecast, by Country (2023-2030) 9.5.1. Brazil 9.5.1.1. Brazil Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 9.5.1.2. Brazil Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 9.5.1.3. Brazil Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 9.5.1.4. Brazil Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 9.5.2. Argentina 9.5.2.1. Argentina Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 9.5.2.2. Argentina Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 9.5.2.3. Argentina Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 9.5.2.4. Argentina Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Addiction Treatment Market Size and Forecast, by Treatment Type (2023-2030) 9.5.3.2. Rest Of South America Addiction Treatment Market Size and Forecast, by Drug Type (2023-2030) 9.5.3.3. Rest Of South America Addiction Treatment Market Size and Forecast, by Treatment Centers (2023-2030) 9.5.3.4. Rest Of South America Addiction Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 10. Global Addiction Treatment Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Product Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Payment Methods 10.4. Market Analysis by Organized Players vs. Unorganized Players 10.4.1. Organized Players 10.4.2. Unorganized Players 10.5. Leading Addiction Treatment Market Companies, by Market Capitalization 10.6. Market Structure 10.6.1. Market Leaders 10.6.2. Market Followers 10.6.3. Emerging Players 10.7. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Pfizer Inc. (New York) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (small, medium, and large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Alkermes Plc. (Ireland) 11.3. GlaxoSmithKline Plc. (U.K.) 11.4. Cipla Ltd. (India) 11.5. Teva Pharmaceuticals (Europe) 11.6. Hikma Pharmaceuticals (London) 11.7. Titan Pharmaceuticals (California) 11.8. Indivor PLC. (U.S.) 11.9. Mallinckrodt (U.K.) 11.10. Orexo AB (Sweden) 11.11. Allergan (U.S) 11.12. Lupin Pharmaceuticals (U.S) 11.13. Mylan Laboratories (Pennsylvania) 11.14. Sanofi Aventis (France) 11.15. Par Pharmaceuticals (India) 11.16. Apotex (Canada) 11.17. Sun Pharmaceuticals (India) 11.18. master Pharmaceuticals (California) 11.19. Glenmark Pharmaceuticals (U.S.) 11.20. Reckitt Benckiser Pharmaceuticals (England) 12. Key Findings 13. Industry Recommendations 14. Addiction Treatment Market: Research Methodology