The Patient Monitoring Device Market size was valued at USD 45.13 Billion in 2023 and the total Patient Monitoring Device Market revenue is expected to grow at a CAGR of 5.01 % from 2024 to 2030, reaching nearly USD 63.56 Billion by 2030.Patient Monitoring Device Market Overview:

Vital signs monitoring devices monitor crucial medical parameters of a patient, such as heart rate, blood pressure, oxygen saturation, and body temperature. Examples of these devices include at-home blood pressure monitors, pulse oximeters, and remote ECG devices. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Patient Monitoring Device Market.To know about the Research Methodology :- Request Free Sample Report

Patient Monitoring Device Market Dynamics:

Patient monitoring devices are getting more attention in the market due to the growing demand for continue monitoring devices and the convenes due to no. technical expertise. As the devices are digital and allow the monitor to access the information easily. The device majorly used in the market are Accu-chek for glucometer tests, ECG, oxy-meter, temperature monitoring, blood pressure monitor, and smart implants. Due to growing chronic diseases like Obesity, Diabetes, Hypertension, Cardiovascular Diseases are further boosting the growth of the patient monitoring device market.In addition, the demand for a sensor-based wearable device like ECG and continuous glucose monitoring is further proliferating the growth of the market. These devices are widely used in hospitals and healthcare units for the continuous monitoring of patients. For example, the Garden Spot Communities launched a Somatic AI-Powered remote patient monitoring device to advance the consumes and offer caregiver safety during the COVID-19 pandemic. In addition, development in product portfolio and investments in technologies are likely to boost the market growth of the market. For example, Accu-check is an Indian-based company that launched their new product Active blood glucose meter for personalized diabetes coaching Accurate, no coding, easy. Further, this newly updated product has benefits like accuracy, ease to use, safe, smart, convenient testing. This factor is likely to boost the market growth of patient monitoring devices. The Approvals by the government authorities are further boosting the growth of the market like Abbott company received the authorization for clearance of the FreeStyle Libre 2 integrated Continues glucose monitoring device for the patient convenience for the patient suffering from diabetes. This device is responsible to measure the glucose level of the patient every minute. The Patient Monitoring Device Market is positioned for expansion, propelled by ongoing technological breakthroughs. Innovations like AI-driven analytics, remote monitoring capabilities, and mobile application integration present promising avenues for market development. A noticeable uptick in the adoption of wearable patient monitoring devices characterizes the market. Wearables, including smartwatches and fitness trackers with health monitoring features, furnish real-time health data, opening up opportunities for market growth. A discernible shift towards home-based healthcare solutions is underway, spurred by factors such as an aging population, cost-effectiveness, and the convenience of remote patient monitoring. This trend provides a fertile ground for patient monitoring device manufacturers to meet the demand for home healthcare solutions. The substantial opportunity lies in the integration of Internet of Things (IoT) technologies within patient monitoring devices. IoT facilitates seamless connectivity, enabling real-time monitoring by healthcare providers and thereby enhancing overall healthcare outcomes. A prominent trend is the escalating adoption of telehealth services and remote patient monitoring. Recognizing the advantages of virtual healthcare delivery, both patients and healthcare providers are contributing to the opportunities for patient monitoring device manufacturers to augment remote monitoring capabilities.

Patient Monitoring Device Market Segment Analysis

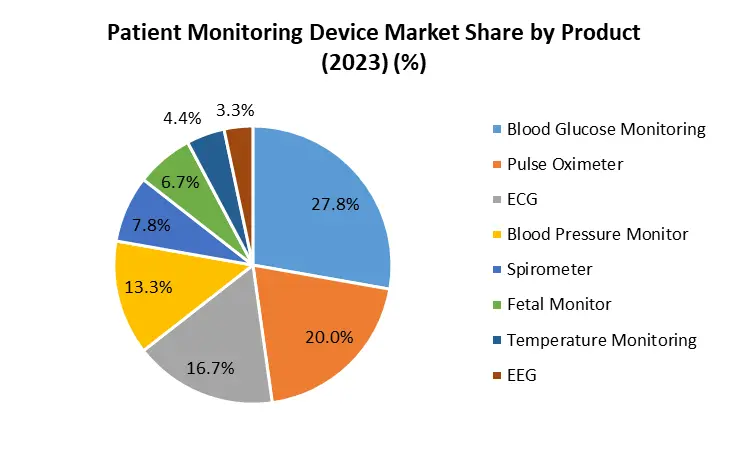

The Blood Glucose monitor segment is supplementing the growth of the Global Patient Monitoring Device Market. Diabetes is one of the most crucial lifestyle conditions and monitoring is a must hence it is responsible to create demand for blood glucose monitoring devices. The Blood Glucose monitor segment is likely to gain more attention in the market due to the high rate of diabetic patients. The growth of the market is attributed to the rising occurrence of diabetes patients and cardiac patients. Moreover, rising product launches and digital machines are likely to boost the market growth in the forecast period. Further, patient convenience is a major factor responsible to boost the growth of the market in the forecast period. Moreover, new product launches, and rising adoption blood glucose monitors device in developing countries is likely to boost the growth of the market. Further, the diabetes management market is likely to grow at a high pace. As per the survey carried out by the Global Diabetes Community report around 30 million people in India are suffering from diabetes and India has been marked as one of the leading countries in terms of diabetes globally. Due to these factors market players are focusing on inventing products with new devices with advanced features. The top 5 glucometers in the market are- 1. Accu Chek Active Blood Glucose Meter Kit 2. Dr. Morepen Gluco One Glucometer 3. Bayer Contour Plus One Glucometer 4. Beato Smartphone Glucometer 5. OneTouch Select Simple Glucometer The Hospital segment is Trending in the Product Segment of the Global Patient Monitoring Device Market. Hospital Segment is dominating the global patient monitoring devices market with 69.4% in the forecast period. The growth in the region is attributed to the high consumption of patient monitoring devices by healthcare facilities. Moreover, high exposure to the patient and regular patient monitoring in hospitals is a factor likely to fuel the growth of the market. Further, growing healthcare facilities in the market together with advancement are the factors likely to proliferate the growth of the market during the forecast period. The home care setting segment is gaining significant attention in the market due to consumers' preferences and self-care treatment. Moreover, companies have offered a wide range of products with less professional expertise and involvement. And this factor is likely to boost the growth of the market in the coming future due to rising diseases and rapid testing.

Patient Monitoring Device Market Regional Analysis

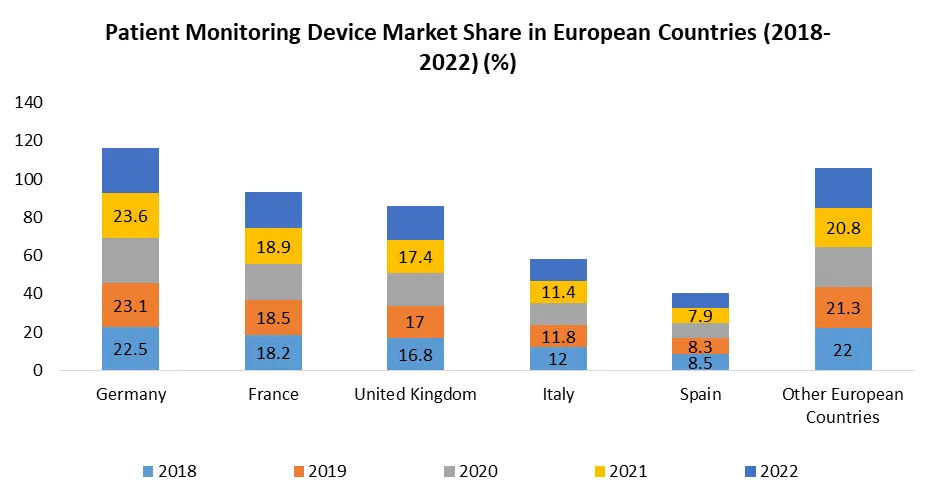

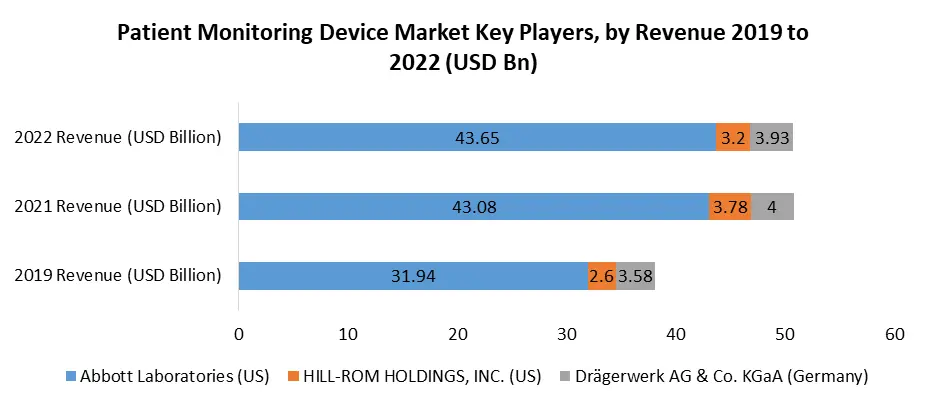

North America emerges as the dominant force in the global Patient Monitoring Device market, commanding 40.9% of the market share. The region's growth is propelled by the presence of domestic manufacturers such as Masimo Corporation, GE Healthcare, Edward Lifesciences, and Natus Medical, contributing significantly to Patient Monitoring Device Market regional growth in the US. This growth generates consumer awareness regarding digital monitoring machines for organ actions. The prevalence of diabetes, with approximately 34 million cases in the US, further amplifies market attention, with diabetes ranking as the 7th leading cause of death. Ongoing developments and technological investments by market players not only fuel the growth of the Patient Monitoring Device market but also solidify its market share in the US. Government approvals play a pivotal role in attracting new entrants and fostering market expansion. Notably, in 2022, Medtronic received FDA clearance for the LINQ II insertable cardiac monitors, enhancing long-term monitoring capabilities and emphasizing the Patient Monitoring Device Market potential in North America. The Asia Pacific region is poised for rapid growth, during the forecast period. The surge in diabetes and cardiac illness patients propels the sales volume of patient monitoring devices, with the region accounting for 69% of the global market share in 20232. India, China, Japan, and Indonesia stand out as dominant countries in the Asia Pacific, driven by the presence of key players in the Patient Monitoring Device market. The increasing prevalence of diabetes and cardiac illnesses contributes to the region's robust market growth, reflecting significant Patient Monitoring Device Market regional growth factors. Europe represents a significant market segment for Patient Monitoring Devices, with precise growth figures not provided in the current data. The region experiences notable traction in the market due to factors such as technological advancements, government approvals, and the increasing prevalence of chronic diseases. Renowned players in Europe further propel the growth of the Patient Monitoring Device market, contributing to the region's substantial market share and solidifying its Patient Monitoring Device Market share in Europe. Patient Monitoring Device Market Competitive Landscape In response to the critical healthcare challenges faced by rural communities in Rwanda, where over 80 percent of the population resides in areas with limited access to primary healthcare, Abbott collaborates with the Rwandan Ministry of Health and the non-profit Society for Family Health (SFH) Rwanda. The initiative, launched in 2019, aims to enhance healthcare accessibility within a 30-minute walk from homes. The collaborative effort introduced "second-generation health posts" (SGHPs) in the Bugesera District, delivering expanded services such as outpatient diagnosis, child immunizations, and maternity care. Building on the success of the SGHP model in Bugesera, the collaborative effort expanded with the launch of two new health posts in Nyaruguru District. Situated in Mishungero and Cyanyirankora, these health posts contribute to improved patient outcomes and reduced referral times to upper-level health facilities. UNICEF and SC Johnson supported the initiative, enhancing the capacity of health post operators and facilitating program monitoring. The introduction of rapid diagnostic tests is crucial for providing timely diagnoses, especially in rural areas where multiple visits to healthcare facilities pose challenges. The dedication of a new SGHP in the Nyaruguru district signifies a milestone in providing accessible, affordable, and enhanced healthcare services to rural communities in Rwanda. With a focus on improving health outcomes, the SGHP model addresses healthcare service delivery gaps, promoting health-seeking behavior in rural areas. The collaboration recognizes the significance of innovative healthcare solutions in overcoming challenges and enhancing the overall well-being of communities. Abbott's commitment to collaboration and innovation extends beyond regional initiatives. The company's scientists and engineers played a pivotal role in responding to the global need for fast and reliable COVID-19 testing during the pandemic. The BinaxNOW rapid COVID-19 test and its companion app, NAVICA, have received acclaim, with Abbott's collaborative efforts recognized by Fast Company as one of the publication's Innovative Teams of the Year. Abbott's collaborative ethos extends to cross-industry partnerships. The collaboration with Fiat Chrysler Automobiles (FCA) and Honeywell has been instrumental in increasing the production of Hillrom’s Life2000 non-invasive ventilator, Progressa ICU bed, and Centrella Smart+ hospital bed. FCA's engineering expertise and Honeywell's supply chain capabilities played a crucial role in meeting the heightened demand for critical medical devices during the global pandemic.

Global Patient Monitoring Device Market Scope: Inquire before buying

Global Patient Monitoring Device Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 45.13 Bn. Forecast Period 2023 to 2030 CAGR: 5.01% Market Size in 2030: US $ 63.56 Bn. Segments Covered: by Product EEG MEG TCD Pulse Oximeter Spirometer Fetal Monitor Temperature Monitoring MCOT ECG ICP ILRs Blood Glucose Monitoring Blood Pressure Monitor by Application Hospitals ASCs Home care setting Other Patient Monitoring Device Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Patient Monitoring Device Market Key Players:

Global: 1. OMRON Corporation (Japan) 2. Compumedics Limited (Australia) North America: 1. Abbott Laboratories (US) 2. HILL-ROM HOLDINGS, INC. (US) 3. Edwards Lifesciences Corporation (US) 4. OMRON Corporation (Japan) - *Global Presence* 5. Masimo Corporation (US) 6. Natus Medical (US) 7. Medtronic plc (Ireland) 8. GE Healthcare (US) 9. Boston Scientific Corporation (US) 10. Dexcom, Inc. (US) 11. Nonin (US) 12. BioTelemetry, Inc. (US) Europe: 1. Drägerwerk AG & Co. KGaA (Germany) 2. Compumedics Limited (Australia) - *Global Presence* 3. Koninklijke Philips N.V. (Netherlands) 4. Getinge AB (Sweden) 5. BIOTRONIK (Germany) 6. SCHILLER (Switzerland) Asia Pacific: 1. OMRON Corporation (Japan) - *Global Presence* 2. Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China) 3. Nihon Kohden Corporation (Japan) 4. Compumedics Limited (Australia) - *Global Presence* FAQ’s: 1. What is the Patient Monitoring Devices Market? Ans: The Patient Monitoring Devices Market refers to the industry that provides devices and technologies for continuous monitoring of patient health parameters, facilitating remote tracking and management of medical conditions. 2. What are the Key Drivers of Market Growth? Ans: The market is driven by factors such as the increasing demand for continuous monitoring devices, technological advancements, rising prevalence of chronic diseases, and the expansion of product portfolios by key market players. 3. Which Regions Dominate the Patient Monitoring Devices Market? Ans: North America holds a significant market share, driven by the presence of key players and government approvals. The Asia Pacific region is experiencing rapid growth, fueled by an increasing patient population and rising healthcare awareness. 4. How Do Second-Generation Health Posts Impact the Market? Ans: Initiatives like second-generation health posts, as seen in Rwanda, contribute to enlarging healthcare access in rural areas. These models offer a broader range of services, including outpatient diagnosis, maternal care, and immunizations. 5. What Role Does Technology Play in Patient Monitoring Devices? Ans: Technology, such as rapid diagnostic tests, plays a critical role by providing quick results during the same healthcare visit. This efficiency is especially beneficial in rural areas, enabling timely diagnosis and treatment.

1. Patient Monitoring Devices Market: Research Methodology 2. Patient Monitoring Devices Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Patient Monitoring Devices Market: Dynamics 3.1. Patient Monitoring Devices Market Trends by Region 3.1.1. North America Patient Monitoring Devices Market Trends 3.1.2. Europe Patient Monitoring Devices Market Trends 3.1.3. Asia Pacific Patient Monitoring Devices Market Trends 3.1.4. Middle East and Africa Patient Monitoring Devices Market Trends 3.1.5. South America Patient Monitoring Devices Market Trends 3.2. Patient Monitoring Devices Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Patient Monitoring Devices Market Drivers 3.2.1.2. North America Patient Monitoring Devices Market Restraints 3.2.1.3. North America Patient Monitoring Devices Market Opportunities 3.2.1.4. North America Patient Monitoring Devices Market Challenges 3.2.2. Europe 3.2.2.1. Europe Patient Monitoring Devices Market Drivers 3.2.2.2. Europe Patient Monitoring Devices Market Restraints 3.2.2.3. Europe Patient Monitoring Devices Market Opportunities 3.2.2.4. Europe Patient Monitoring Devices Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Patient Monitoring Devices Market Drivers 3.2.3.2. Asia Pacific Patient Monitoring Devices Market Restraints 3.2.3.3. Asia Pacific Patient Monitoring Devices Market Opportunities 3.2.3.4. Asia Pacific Patient Monitoring Devices Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Patient Monitoring Devices Market Drivers 3.2.4.2. Middle East and Africa Patient Monitoring Devices Market Restraints 3.2.4.3. Middle East and Africa Patient Monitoring Devices Market Opportunities 3.2.4.4. Middle East and Africa Patient Monitoring Devices Market Challenges 3.2.5. South America 3.2.5.1. South America Patient Monitoring Devices Market Drivers 3.2.5.2. South America Patient Monitoring Devices Market Restraints 3.2.5.3. South America Patient Monitoring Devices Market Opportunities 3.2.5.4. South America Patient Monitoring Devices Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For the Patient Monitoring Devices Market 3.8. Analysis of Government Schemes and Initiatives For the Patient Monitoring Devices Market 3.9. The Global Pandemic Impact on the Patient Monitoring Devices Market 4. Patient Monitoring Devices Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 4.1. Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 4.1.1. EEG 4.1.2. MEG 4.1.3. TCD 4.1.4. Pulse Oximeter 4.1.5. Spirometer 4.1.6. Fetal Monitor 4.1.7. Temperature Monitoring 4.1.8. MCOT 4.1.9. ECG 4.1.10. ICP 4.1.11. ILRs 4.1.12. Blood Glucose Monitoring 4.1.13. Blood Pressure Monitor 4.2. Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 4.2.1. Hospitals 4.2.2. ASCs 4.2.3. Home care setting 4.2.4. Other 4.3. Patient Monitoring Devices Market Size and Forecast, by Region (2023-2030) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Patient Monitoring Devices Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 5.1. North America Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 5.1.1. EEG 5.1.2. MEG 5.1.3. TCD 5.1.4. Pulse Oximeter 5.1.5. Spirometer 5.1.6. Fetal Monitor 5.1.7. Temperature Monitoring 5.1.8. MCOT 5.1.9. ECG 5.1.10. ICP 5.1.11. ILRs 5.1.12. Blood Glucose Monitoring 5.1.13. Blood Pressure Monitor 5.2. North America Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 5.2.1. Hospitals 5.2.2. ASCs 5.2.3. Home care setting 5.2.4. Other 5.3. North America Patient Monitoring Devices Market Size and Forecast, by Country (2023-2030) 5.3.1. United States 5.3.1.1. United States Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 5.3.1.1.1. EEG 5.3.1.1.2. MEG 5.3.1.1.3. TCD 5.3.1.1.4. Pulse Oximeter 5.3.1.1.5. Spirometer 5.3.1.1.6. Fetal Monitor 5.3.1.1.7. Temperature Monitoring 5.3.1.1.8. MCOT 5.3.1.1.9. ECG 5.3.1.1.10. ICP 5.3.1.1.11. ILRs 5.3.1.1.12. Blood Glucose Monitoring 5.3.1.1.13. Blood Pressure Monitor 5.3.1.2. United States Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 5.3.1.2.1. Hospitals 5.3.1.2.2. ASCs 5.3.1.2.3. Home care setting 5.3.1.2.4. Other 5.3.2. Canada 5.3.2.1. Canada Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 5.3.2.1.1. EEG 5.3.2.1.2. MEG 5.3.2.1.3. TCD 5.3.2.1.4. Pulse Oximeter 5.3.2.1.5. Spirometer 5.3.2.1.6. Fetal Monitor 5.3.2.1.7. Temperature Monitoring 5.3.2.1.8. MCOT 5.3.2.1.9. ECG 5.3.2.1.10. ICP 5.3.2.1.11. ILRs 5.3.2.1.12. Blood Glucose Monitoring 5.3.2.1.13. Blood Pressure Monitor 5.3.2.2. Canada Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 5.3.2.2.1. Hospitals 5.3.2.2.2. ASCs 5.3.2.2.3. Home care setting 5.3.2.2.4. Other 5.3.3. Mexico 5.3.3.1. Mexico Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 5.3.3.1.1. EEG 5.3.3.1.2. MEG 5.3.3.1.3. TCD 5.3.3.1.4. Pulse Oximeter 5.3.3.1.5. Spirometer 5.3.3.1.6. Fetal Monitor 5.3.3.1.7. Temperature Monitoring 5.3.3.1.8. MCOT 5.3.3.1.9. ECG 5.3.3.1.10. ICP 5.3.3.1.11. ILRs 5.3.3.1.12. Blood Glucose Monitoring 5.3.3.1.13. Blood Pressure Monitor 5.3.3.2. Mexico Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 5.3.3.2.1. Hospitals 5.3.3.2.2. ASCs 5.3.3.2.3. Home care setting 5.3.3.2.4. Other 6. Europe Patient Monitoring Devices Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 6.1. Europe Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 6.2. Europe Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 6.3. Europe Patient Monitoring Devices Market Size and Forecast, by Country (2023-2030) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 6.3.1.2. United Kingdom Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 6.3.2. France 6.3.2.1. France Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 6.3.2.2. France Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 6.3.3. Germany 6.3.3.1. Germany Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 6.3.3.2. Germany Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 6.3.4. Italy 6.3.4.1. Italy Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 6.3.4.2. Italy Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 6.3.5. Spain 6.3.5.1. Spain Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 6.3.5.2. Spain Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 6.3.6. Sweden 6.3.6.1. Sweden Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 6.3.6.2. Sweden Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 6.3.7. Austria 6.3.7.1. Austria Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 6.3.7.2. Austria Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 6.3.8.2. Rest of Europe Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 7. Asia Pacific Patient Monitoring Devices Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 7.1. Asia Pacific Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 7.2. Asia Pacific Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 7.3. Asia Pacific Patient Monitoring Devices Market Size and Forecast, by Country (2023-2030) 7.3.1. China 7.3.1.1. China Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 7.3.1.2. China Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 7.3.2. S Korea 7.3.2.1. S Korea Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 7.3.2.2. S Korea Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 7.3.3. Japan 7.3.3.1. Japan Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 7.3.3.2. Japan Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 7.3.4. India 7.3.4.1. India Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 7.3.4.2. India Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 7.3.5. Australia 7.3.5.1. Australia Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 7.3.5.2. Australia Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 7.3.6. Indonesia 7.3.6.1. Indonesia Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 7.3.6.2. Indonesia Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 7.3.7. Malaysia 7.3.7.1. Malaysia Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 7.3.7.2. Malaysia Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 7.3.8. Vietnam 7.3.8.1. Vietnam Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 7.3.8.2. Vietnam Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 7.3.9. Taiwan 7.3.9.1. Taiwan Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 7.3.9.2. Taiwan Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 7.3.10. Rest of Asia Pacific 7.3.10.1. Rest of Asia Pacific Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 7.3.10.2. Rest of Asia Pacific Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 8. Middle East and Africa Patient Monitoring Devices Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030 8.1. Middle East and Africa Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 8.2. Middle East and Africa Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 8.3. Middle East and Africa Patient Monitoring Devices Market Size and Forecast, by Country (2023-2030) 8.3.1. South Africa 8.3.1.1. South Africa Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 8.3.1.2. South Africa Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 8.3.2. GCC 8.3.2.1. GCC Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 8.3.2.2. GCC Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 8.3.3. Nigeria 8.3.3.1. Nigeria Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 8.3.3.2. Nigeria Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 8.3.4.2. Rest of ME&A Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 9. South America Patient Monitoring Devices Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030 9.1. South America Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 9.2. South America Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 9.3. South America Patient Monitoring Devices Market Size and Forecast, by Country (2023-2030) 9.3.1. Brazil 9.3.1.1. Brazil Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 9.3.1.2. Brazil Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 9.3.2. Argentina 9.3.2.1. Argentina Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 9.3.2.2. Argentina Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 9.3.3. Rest Of South America 9.3.3.1. Rest Of South America Patient Monitoring Devices Market Size and Forecast, By Product (2023-2030) 9.3.3.2. Rest Of South America Patient Monitoring Devices Market Size and Forecast, By Application (2023-2030) 10. Global Patient Monitoring Devices Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Patient Monitoring Devices Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Abbott Laboratories (US) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. HILL-ROM HOLDINGS, INC. (US) 11.3. Edwards Lifesciences Corporation (US) 11.4. OMRON Corporation (Japan) - *Global Presence* 11.5. Masimo Corporation (US) 11.6. Natus Medical (US) 11.7. Medtronic plc (Ireland) 11.8. GE Healthcare (US) 11.9. Boston Scientific Corporation (US) 11.10. Dexcom, Inc. (US) 11.11. Nonin (US) 11.12. BioTelemetry, Inc. (US) 11.13. Drägerwerk AG & Co. KGaA (Germany) 11.14. Compumedics Limited (Australia) - *Global Presence* 11.15. Koninklijke Philips N.V. (Netherlands) 11.16. Getinge AB (Sweden) 11.17. BIOTRONIK (Germany) 11.18. SCHILLER (Switzerland) 11.19. Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China) 11.20. Nihon Kohden Corporation (Japan) 11.21. Compumedics Limited (Australia) - 11.22. Compumedics Limited (Australia) 12. Key Findings 13. Industry Recommendations