Automated Suturing Devices Market is anticipated to reach US$ 223.54 Mn by 2029 from US$ 158.86 Mn in 2022 at a CAGR of 5% during a forecast period. An automated suturing device is a tool that helps surgeons do suture operations during minimally invasive and open surgery. These gadgets are utilized in a variety of procedures and do not need to be discarded as medical waste once the treatment is over. The market is expected to see profitable growth during the forecast period, due to rising demand for automated sutures and more public awareness.To know about the Research Methodology :- Request Free Sample Report

Automated Suturing Devices Market Dynamics

One of the key factors driving the growth of the automated suturing device market is the rising prevalence of chronic illnesses. According to the Centers for Illness Control and Prevention, chronic disease affects 6 out of 10 individuals in the United States. As a result of the rise in chronic conditions, minimally invasive operations such as endoscopic surgery, laparoscopic surgery, arthroscopy, bronchoscopy, and hysteroscopy have become more popular. The market is expected to grow as the elderly population grows, as the number of surgical operations is performed. According to research issued by the World Health Organization in 2017, the global surgical rate was projected to be 4,469 operations per 100,000 persons per year. More individuals are opting for bariatric surgery as the obesity prevalence rises. Automated suturing devices are utilized in bariatric and gastrointestinal operations. As a result, growing obesity rates are expected to drive demand growth during the forecast period. In India, the prevalence of overweight, obesity, hypertension, and diabetes were 14.6 percent, 3.4 percent, 5.2 percent, and 7.1 percent, according to a report published in the International Journal of Environmental Research and Public Health in October 2021. 33 percent of adults worldwide stated that obesity was the biggest health issue for people within their country. In 2022, over 30 percent of both male and female adults in the United States reported themselves as obese, making it the country with the highest percentage of obese adults. In addition, growing accidents are expected to accelerate the number of surgical procedures, and thereby the growth of the market during the forecast period. As per the WHO Global Report on Road Safety 2018, India accounts for almost 11% of the accident-related deaths in the World. A total of 4,67,044 road accidents have been reported by States and Union Territories in the year 2018, claiming 1,51,417 lives and causing injuries to 4,69,418 persons. This type of huge number is bound to increase the automated suturing devices market. According to the Ministry of Road Transport and Highways, India ranks first among the 199 countries listed in the World Road Statistics 2018, in terms of road accident mortality, followed by China and the United States. Restraints: poor product availability, expensive device costs, and a scarcity of experienced professionals are expected to hamper the markets growth during the forecast period.Market Trends:

A key trend in the worldwide automated suturing devices market is the increased usage of automated suturing devices in laparoscopic operations. Automated suturing devices can be used in laparoscopic surgery to apply knots in a fraction of the time it takes with traditional suturing. Similarly, the market is also expected to grow due to a growing preference for automated suturing devices over automated staplers. This is due to the advancement of combined needle and suture technology. Staplers are metallic and can cause bleeding and infection after surgery. Sutures used in such devices can be absorbable or non-absorbable.Automated Suturing Devices Market Segmentation Analysis

By Type, the reusable segment held 33% of the market share in 2022. These reusable automated suturing devices are unaffected from infection through sterilization procedures and cause minimal tissue injury. In addition, a reusable device is cost-effective and easily available, which has spur customer preference and thereby the growth of the segment. The increasing accidents and trauma, which need suturing and the doctors preferring automated suturing devices are boosting the segment's growth.

Automated Suturing Devices Market Regional Insights

In 2022, North America dominated the global automated suturing devices market, with 36 percent market revenue. The growth in the region is attributed to the growing surgeries and well-developed healthcare infrastructure. In addition, an increase in healthcare spending, adoption of automated equipment, rising incidence of surgeries and accidents, and industrial injuries are expected to positively impact regional growth. In 2022, the United States accounted xx% of the market share due to helpful healthcare policies, the high number of patients, and a developed healthcare market. According to the Association for Safe International Road Travel, around 4.5 million people are injured every year in the U.S. This is expected to drive the demand for automated sutures to perform efficient surgeries. The objective of the report is to present a comprehensive analysis of the global Automated Suturing Devices Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global Automated Suturing Devices Market dynamics, structure by analyzing the market segments and project the global Automated Suturing Devices Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Automated Suturing Devices Market make the report investor’s guide.Global Automated Suturing Devices Market Scope: Inquire before buying

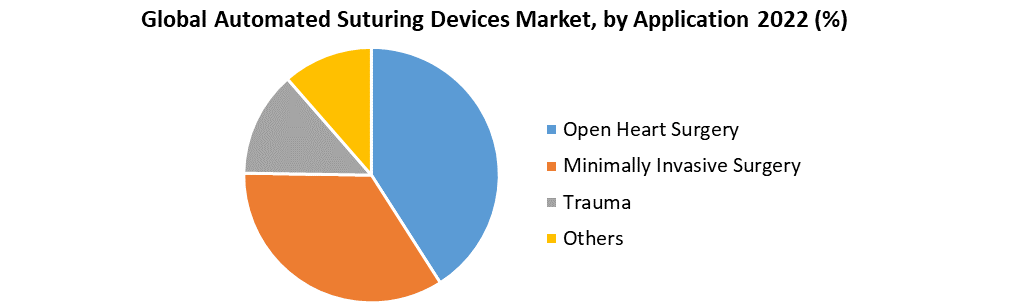

Global Automated Suturing Devices Market Base Year 2022 Forecast Period 2023-2029 Historical Data CAGR Market Size in 2022 Market Size in 2029 2018 to 2022 5% US$ 158.86 Mn US$ 223.54 Mn Segments Covered by Type Reusable Disposable by Application Open Heart Surgery Minimally Invasive Surgery Trauma Others by End User Hospitals Ambulatory Surgery Centers Others Regions Covered North America United States Canada Mexico Europe UK France Germany Italy Spain Sweden Austria Rest of Europe Asia Pacific China S Korea Japan India Australia Indonesia Malaysia Vietnam Taiwan Bangladesh Pakistan Rest of APAC Middle East and Africa South Africa GCC Egypt Nigeria Rest of ME&A South America Brazil Argentina Rest of South America Automated Suturing Devices Market Key Players are:

1.Medtronic 2.Smith & Nephew, Inc. 3.Apollo Endosurgery, Inc 4.B. Braun Melsungen AG 5.Ethicon, Inc. (Johnson & Johnson) 6.Becton, Dickinson & Company 7.LSI Solutions, Inc. 8.C. R. Bard, Inc., LLC 9.SuturTek Inc. 10.Boston Scientific 11.Baxter International, Inc. 12.EndoEvolutionFrequently Asked Questions

1. What is the projected market size & growth rate of Global Automated Suturing Devices Market? Ans- Automated Suturing Devices Market was valued at USD 158.86 million in 2022 and is projected to reach USD 223.54 million by 2029, growing at a CAGR of 5% during the forecast period. 2. What is the key driving factor for the growth of Global Automated Suturing Devices Market? Ans- One of the key factors driving the growth of the automated suturing device market is the rising prevalence of chronic illnesses. 3. Which Region accounted for the largest Global Automated Suturing Devices Market share? Ans- In 2019, North America dominated the global automated suturing devices market, with 36 percent market revenue. 4. What makes United States a Lucrative Market for Global Automated Suturing Devices Market? Ans- In the region the United States has xx% of the market share due to helpful healthcare policies, the high number of patients, and a developed healthcare market. 5. What are the top players operating in Global Automated Suturing Devices Market? Ans- Medtronic, Smith & Nephew, Inc., Apollo Endosurgery, Inc, B. Braun Melsungen AG, Ethicon, Inc. (Johnson & Johnson), Becton, Dickinson & Company, and LSI Solutions, Inc.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Automated Suturing Devices Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2022 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Automated Suturing Devices Market 3.4. Geographical Snapshot of the Automated Suturing Devices Market, By Manufacturer share 4. Global Automated Suturing Devices Market Overview, 2022-2029 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Automated Suturing Devices Market 5. Supply Side and Demand Side Indicators 6. Global Automated Suturing Devices Market Analysis and Forecast, 2022-2029 6.1. Global Automated Suturing Devices Market Size & Y-o-Y Growth Analysis. 7. Global Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 7.1. Market Size (Value) Estimates & Forecast By Type , 2022-2029 7.1.1. Reusable 7.1.2. Disposable 7.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 7.2.1. Open Heart Surgery 7.2.2. Minimally Invasive Surgery 7.2.3. Trauma 7.2.4. Others 7.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 7.3.1. Hospitals 7.3.2. Ambulatory Surgery Centers 7.3.3. Others 8. Global Automated Suturing Devices Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2022-2029 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 9.1. Market Size (Value) Estimates & Forecast By Type , 2022-2029 9.1.1. Reusable 9.1.2. Disposable 9.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 9.2.1. Open Heart Surgery 9.2.2. Minimally Invasive Surgery 9.2.3. Trauma 9.2.4. Others 9.3. Market Size (Value) Estimates & Forecast By End-use , 2022-2029 9.3.1. Hospitals 9.3.2. Ambulatory Surgery Centers 9.3.3. Others 10. North America Automated Suturing Devices Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 11.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 11.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 11.3. Market Size (Value) Estimates & Forecast By End-use , 2022-2029 12. Canada Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 12.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 12.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 12.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 13. Mexico Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 13.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 13.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 13.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 14. Europe Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 14.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 14.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 14.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 15. Europe Automated Suturing Devices Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 16.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 16.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 16.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 17. France Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 17.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 17.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 17.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 18. Germany Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 18.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 18.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 18.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 19. Italy Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 19.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 19.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 19.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 20. Spain Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 20.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 20.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 20.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 21. Sweden Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 21.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 21.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 21.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 22. CIS Countries Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 22.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 22.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 22.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 23. Rest of Europe Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 23.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 23.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 23.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 24. Asia Pacific Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 24.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 24.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 24.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 25. Asia Pacific Automated Suturing Devices Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 26.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 26.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 26.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 27. India Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 27.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 27.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 27.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 28. Japan Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 28.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 28.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 28.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 29. South Korea Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 29.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 29.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 29.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 30. Australia Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 30.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 30.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 30.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 31. ASEAN Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 31.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 31.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 31.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 32. Rest of Asia Pacific Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 32.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 32.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 32.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 33. Middle East Africa Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 33.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 33.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 33.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 34. Middle East Africa Automated Suturing Devices Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 35.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 35.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 35.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 36. GCC Countries Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 36.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 36.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 36.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 37. Egypt Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 37.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 37.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 37.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 38. Nigeria Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 38.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 38.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 38.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 39. Rest of ME&A Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 39.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 39.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 39.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 40. South America Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 40.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 40.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 40.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 41. South America Automated Suturing Devices Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 42.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 42.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 42.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 43. Argentina Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 43.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 43.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 43.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 44. Rest of South America Automated Suturing Devices Market Analysis and Forecasts, 2022-2029 44.1. Market Size (Value) Estimates & Forecast By Type ,2022-2029 44.2. Market Size (Value) Estimates & Forecast By Application ,2022-2029 44.3. Market Size (Value) Estimates & Forecast By End-use ,2022-2029 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Automated Suturing Devices Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 45.3. Company Profile: Key Players 45.3.1. Medtronic 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.4. Medtronic 45.5. Smith & Nephew, Inc. 45.6. Apollo Endosurgery, Inc 45.7. B. Braun Melsungen AG 45.8. Ethicon, Inc. (Johnson & Johnson) 45.9. Becton, Dickinson & Company 45.10. LSI Solutions, Inc., Medtronic Plc. 45.11. C. R. Bard, Inc., LLC 45.12. SuturTek Inc. 45.13. Boston Scientific 45.14. Baxter International, Inc. 45.15. EndoEvolution 46. Primary Key Insights