Agricultural Biotechnology Market size was valued at US$ 112.29 Bn. in 2022 and the total revenue is expected to grow at 7.7% through 2023 to 2029, reaching nearly US$ 188.74 Bn.Agricultural Biotechnology Market Overview:

Agriculture Biotechnology is a range of tools, include traditional breeding techniques, that alter living organisms or particular parts of the organism to modify products and to improve plant and animals breeding. Moreover, biotechnology plays a vital role in agriculture to control disease and increase the strength and capacity of plants to withstand drought and flooding, and harsh climate.To know about the Research Methodology :- Request Free Sample Report The report has covered the market trends from 2017 to forecast the market through 2029. 2021 is considered a base year however 2021's numbers are on the real output of the companies in the market. Special attention is given to 2021 and the effect of lockdown on the demand and supply, and also the impact of lockdown for the next two years on the market. Some companies have done good in lockdown also and specific strategic analysis of those companies is done in the report.

Agricultural Biotechnology Market Dynamics:

Rising genetically modified (GM) crops globally is estimated to drive the growth of the market in the forecast period. As genetically modified allows the growth of crops with higher characteristics like high nutritional content, increased food processing characteristics such as high nutritional food processing quality increased resistance against pest control and diseases, high yield, nitrogen fixation, and improved strength to withstand any harsh climatic condition. Besides, the genetically modified food market is gaining more attention globally, which is further estimated to stimulate market growth. Moreover, the agriculture industry is highly adopting genetically modified products due to high demand in the market and increased sustainability of crops. As per International Service for the Acquisition of Agri-biotech Application (ISAAA) around 2.14 billion hectares of biotechnology crops have been developed commercially from 1996 to 2016. This includes 0.13 billion hectares of biotechnology canola, 1.04 billion of biotechnology soybean, and 0.34 billion of biotechnology cotton. Further, this factor is estimated to stimulate the growth of the market in the forecast period. In addition, market players are investing a huge amount in developing their product portfolio to sustain in the market and to grab more attraction in the market. For instance, in 2019, KWS SAAT SE and CO. KGaA launched new hybrid corn varieties in the Brazilian market with good yield potential and high resistance to a broad range of pests. Hence, market players are further estimated to increase the agriculture biotechnology market in the forecast period.Agricultural Biotechnology Market Segment Analysis:

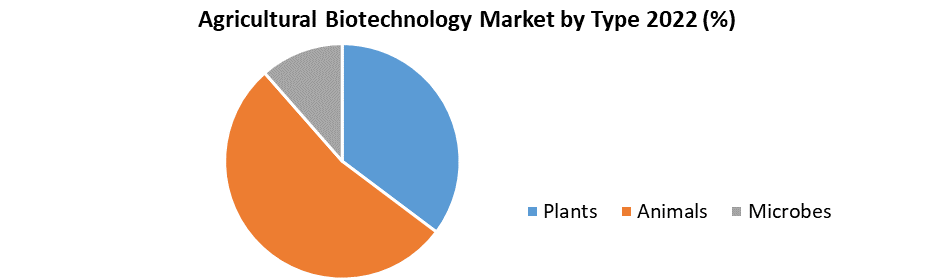

The Plant is dominating the Organism segment of the Global Agricultural Biotechnology Market: The plant segment is estimated to gain a larger market share in the global Agriculture biotechnology market. Plant segment is further classified into conventional techniques, established genetic modification, and new breeding techniques. The conventional technique is estimated to dominate the market with a larger market share in the forecast period as huge alteration activities are carried out to alter genomics in plants and animals. Moreover, genetic engineering plays an important role in agriculture biotechnology, due to the development of genetically modified plants and has controlled genetic changes produced in the organism. In addition, genetic modification, and tools used in biotechnology have enabled the transfer of a gene from one species to another species to generate more output in the agriculture sector as genetic engineering is widely performed on new crops to increase crop potency. This factor is estimated to create more demand in the forecast period. The Transgenic Crops & Animals segment is considered to supplement the growth of the Global Agricultural Biotechnology Market. The transgenic crop segment is dominating the application segment of the global agricultural biotechnology market. The key factors attributing to the growth of the market are improvement of nutrients in plants, increase crop yield, reduce cost for food production, low pesticides application, enhanced nutrient composition and food quality, greater, food security, and medical benefits together with resistance to pest and disease control. Transgenic technologies are likely to increase nutritionally beneficial qualities, with high-yield crops and these factors are likely to increase the genetic modification in plants and animals. In addition, transgenic animals include benefits like enhanced prolificacy and reproductive performance, increase feed utilization, and growth rate, together with improved carcass composition, improved milk products, and composition. These factors are likely to gain a larger market share in the market and boost the application of biotechnology in the agriculture sector.

Regional Insights:

North America is dominating the Global Agricultural Biotechnology Market with the largest market share of 37.7% in the forecast period. The growth is dominated by the increasing agro-climate zone and crops with a wider global genetically modified plant area. The dominating countries of North America are US., Canada, Mexico. Moreover, around, 50% of the genetically modified (GM) plant area is concerned by the US, and Mexico and 10% is planted area. Major crops cultivated in North America are corn, soybean, and wheat, and various others. Further, high technological investment in the agriculture sector due to increase crop yield and high strengthen crop capacity to survive the harsh climate is likely to grab more attention in the market. Henceforward, biotechnology plays an important role in the agriculture sector. The Asia Pacific is estimated to gain significant market share of xx% in the forecast period. The growth in the sector is attributed to the presence of different political and economic systems, cultural backgrounds, and languages. Moreover, increasing the adoption of higher technologies in the agriculture sector due to growing modernization and industrialization, Asia Pacific is estimated to generate a significant amount of revenue in the forecast period. Also, the region holds around 90% of the total crop area for rice and of which 20% is in China and 29% in India. The objective of the report is to present a comprehensive analysis of the Global Agricultural Biotechnology Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Global Agricultural Biotechnology Market dynamics, structure by analyzing the market segments and project the Global Agricultural Biotechnology Market size. Clear representation of competitive analysis of key players by Grade, price, financial position, Grade portfolio, growth strategies, and regional presence in the Global Agricultural Biotechnology Market make the report investor’s guide.Agricultural Biotechnology Market Scope: Inquire before buying

Global Agricultural Biotechnology Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 112.29 Bn. Forecast Period 2022 to 2029 CAGR: 7.70% Market Size in 2029: US $ US$ 188.74 Bn. Segments Covered: by Organism Plants Conventional Techniques Established Genetic Modification New Breeding Techniques Animals Conventional Techniques Established Genetic Modification New Breeding Techniques Microbes Conventional Techniques Established Genetic Modification New Breeding Techniques by Application Vaccine Development Transgenic Crops & Animals Antibiotic Development Nutritional Supplements Flower Culturing Biofuels Agricultural Biotechnology Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest)Key Player

1.KWS SAAT SE & Co. KGaA 2.ChemChina 3.Limagrain 4.Nufarm 5.Marrone Bio Innovations 6.Performance Plants Inc. 7.Corteva 8.ADAMA Ltd 9.MITSUI & CO., LTD 10.Evogene Ltd. 11.Valent BioSciences LLC 12.Bayer AG. Frequently Asked Questions: 1. Which region has the largest share in Global Agricultural Biotechnology Market Market? Ans: Asia Pacific region held the highest share in 2022. 2. What is the growth rate of Global Agricultural Biotechnology Market Market? Ans: The Global Agricultural Biotechnology Market Market is growing at a CAGR of 7.7% during forecasting period 2023-2029. 3. What is scope of the Global Agricultural Biotechnology Market Market report? Ans: Global Agricultural Biotechnology Market Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. What is the study period of this Market? Ans: The Global Agricultural Biotechnology Market Market is studied from 2022 to 2029.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Agricultural Biotechnology Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2021 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Agricultural Biotechnology Market 3.4. Geographical Snapshot of the Agricultural Biotechnology Market, By Manufacturer share 4. Global Agricultural Biotechnology Market Overview, 2022-2029 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porter Five Forces Analysis 4.1.6.1. The threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. The threat of Substitute Grades 4.1.6.5. The intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Agricultural Biotechnology Market 5. Supply Side and Demand Side Indicators 6. Global Agricultural Biotechnology Market Analysis and Forecast, 2022-2029 6.1. Global Agricultural Biotechnology Market Size & Y-o-Y Growth Analysis. 7. Global Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 7.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 7.1.1. Plants 7.1.1.1. Conventional Techniques 7.1.1.2. Established Genetic Modification 7.1.1.3. New Breeding Techniques 7.1.2. Animals 7.1.2.1. Conventional Techniques 7.1.2.2. Established Genetic Modification 7.1.2.3. New Breeding Techniques 7.1.3. Microbes 7.1.3.1. Conventional Techniques 7.1.3.2. Established Genetic Modification 7.1.3.3. New Breeding Techniques 7.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 7.2.1. Vaccine Development 7.2.2. Transgenic Crops & Animals 7.2.3. Antibiotic Development 7.2.4. Nutritional Supplements 7.2.5. Flower Culturing 7.2.6. Biofuels 8. Global Agricultural Biotechnology Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2022-2029 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 9.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 9.1.1. Plants 9.1.1.1. Conventional Techniques 9.1.1.2. Established Genetic Modification 9.1.1.3. New Breeding Techniques 9.1.2. Animals 9.1.2.1. Conventional Techniques 9.1.2.2. Established Genetic Modification 9.1.2.3. New Breeding Techniques 9.1.3. Microbes 9.1.3.1. Conventional Techniques 9.1.3.2. Established Genetic Modification 9.1.3.3. New Breeding Techniques 9.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 9.2.1. Vaccine Development 9.2.2. Transgenic Crops & Animals 9.2.3. Antibiotic Development 9.2.4. Nutritional Supplements 9.2.5. Flower Culturing 9.2.6. Biofuels 10. North America Agricultural Biotechnology Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 11.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 11.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 12. Canada Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 12.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 12.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 13. Mexico Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 13.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 13.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 14. Europe Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 14.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 14.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 15. Europe Agricultural Biotechnology Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 16.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 16.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 17. France Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 17.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 17.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 18. Germany Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 18.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 18.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 19. Italy Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 19.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 19.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 20. Spain Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 20.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 20.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 21. Sweden Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 21.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 21.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 22. CIS Countries Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 22.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 22.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 23. Rest of Europe Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 23.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 23.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 24. Asia Pacific Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 24.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 24.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 25. Asia Pacific Agricultural Biotechnology Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 26.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 26.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 27. India Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 27.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 27.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 28. Japan Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 28.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 28.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 29. South Korea Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 29.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 29.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 30. Australia Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 30.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 30.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 31. ASEAN Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 31.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 31.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 32. Rest of Asia Pacific Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 32.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 32.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 33. Middle East Africa Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 33.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 33.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 34. Middle East Africa Agricultural Biotechnology Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 35.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 35.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 36. GCC Countries Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 36.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 36.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 37. Egypt Textile Reinforced Concrete e-Market Analysis and Forecasts, 2022-2029 37.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 37.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 38. Nigeria Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 38.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 38.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 39. Rest of ME&A Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 39.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 39.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 40. South America Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 40.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 40.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 41. South America Agricultural Biotechnology Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 42.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 42.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 43. Argentina Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 43.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 43.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 44. Rest of South America Agricultural Biotechnology Market Analysis and Forecasts, 2022-2029 44.1. Market Size (Value) Estimates & Forecast By Organism, 2022-2029 44.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Agricultural Biotechnology Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Fiber Grades, and R&D Investment 45.2.2. New Grade Launches and Grade Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment, and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures, and Strategic Alliances/ Sales Agreements 45.3. Company Profile: Key Players 45.3.1. Pfizer 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Grade Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Development 45.3.2. KWS SAAT SE & Co. KGaA 45.3.3. ChemChina 45.3.4. Limagrain 45.3.5. Nufarm 45.3.6. Marrone Bio Innovations 45.3.7. Performance Plants Inc. 45.3.8. Corteva 45.3.9. ADAMA Ltd 45.3.10. MITSUI & CO., LTD 45.3.11. Evogene Ltd. 45.3.12. Valent BioSciences LLC 45.3.13. Bayer AG. 46. Primary Key Insights