The Frozen Meat Market size was valued at USD 58.7 Billion in 2022 and the total Frozen Meat Market revenue is expected to grow at a CAGR of 4.65 % from 2023 to 2029, reaching nearly USD 80.69 Billion. Frozen meat refers to meat that has undergone the process of freezing, preserving it by reducing its internal temperature below its freezing point, typically -18 degrees Celsius, to extend its shelf life and maintain its quality for consumption. The frozen meat market is experiencing growth globally, with an increasing demand for convenient and preserved food products. Factors contributing to this growth include changing consumer lifestyles, urbanization, and the need for convenient yet nutritious meal solutions. The market's expansion is also fueled by evolving dietary preferences, a growing focus on food safety and quality, and rising disposable incomes. Key players in this market continue to innovate, focusing on product diversification, improved packaging technologies for prolonged shelf life, and expanding distribution networks to cater to a broader consumer base.To know about the Research Methodology :- Request Free Sample Report Recent developments involve strategic collaborations, acquisitions, and the launch of new product lines, including organic and specialty cuts, to tap into evolving consumer preferences for healthier and specialized options. Key players in this market, such as Tyson Foods, Inc., Cargill Incorporated, JBS S.A., BRF S.A., and Kerry Group, have been pivotal in shaping its trajectory. These companies have continually invested in research and development to introduce new frozen meat products, expand their product portfolios, and improve processing techniques, catering to evolving consumer preferences for convenience and quality. For instance, Tyson Foods, a leading global producer of meat and poultry, announced strategic investments in technological advancements to enhance its cold chain infrastructure, ensuring better preservation and distribution of frozen meat products. Advancements in freezing techniques and eco-friendly packaging solutions are being adopted to address consumer demands for freshness, taste, and sustainability.

Market Dynamics:

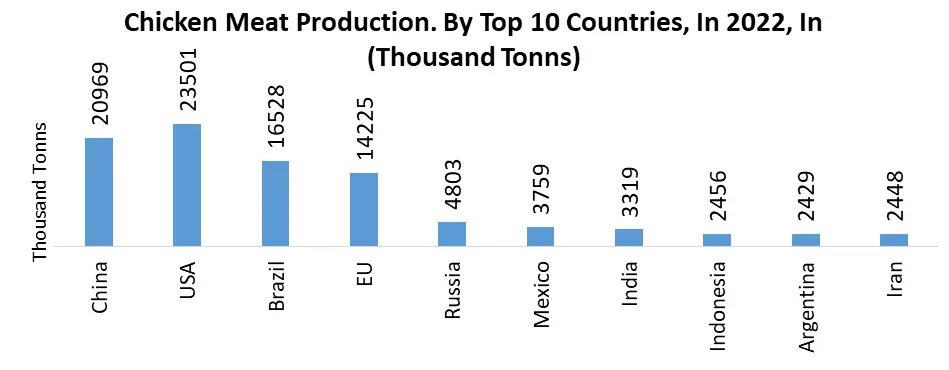

Rising demand for hassle-free frozen chicken indicates a shift toward time-saving meal solutions: Evolving consumer preferences for convenience and time-saving options drive the frozen meat market. For instance, the rising demand for ready-to-cook frozen chicken products, like marinated chicken strips or pre-seasoned chicken breasts, reflects consumers' inclination towards hassle-free meal solutions, catering to busy lifestyles. Increasing globalization and ease of trade contribute to market growth. For instance, the growth of international trade agreements facilitates the accessibility of various frozen meat products globally, fostering market growth and diversity in product offerings. Innovations in freezing technologies, such as quick freezing methods, ensure the preservation of meat quality. For instance, advancements in Individual Quick Freezing (IQF) technology maintain the texture and freshness of meats, bolstering consumer trust and market growth. Prime Factors Driving the Frozen Meat Market Globally: 1. Change in Lifestyle 2. Demand for Ready-to-Eat Food 3. Global Pandemic Crisis 4. Issue of Seasonality 5.Issue of Food Wastage 6. Growing Working Population 7. Rising penetration of Online Food Delivery Services 8. Shopping Trends of Millennial Growing health awareness among consumers leads to a demand for healthier frozen meat options. Examples include the introduction of low-fat or preservative-free frozen meat products to cater to health-conscious consumers seeking nutritious options within the frozen meat category. The growth of retail channels and the rise of e-commerce platforms offer wider accessibility to frozen meat products. For instance, the increasing availability of diverse frozen meat selections online and in supermarkets amplifies consumer reach, spurring market growth. Continuous product innovation drives market growth. Examples include the introduction of plant-based or meat-alternative frozen products, meeting the demands of vegetarian or flexitarian consumers seeking plant-based protein sources. Frozen meat is often considered to be an excellent source of protein, with 100 grams providing up to 15.8g of protein, 0.7g of fat, and 1.4g of carbohydrate. It also contains a variety of vitamins, such as vitamin B2 and vitamin B6, as well as essential minerals like zinc and phosphorus. Frozen meat's high levels of omega-3 fatty acids make it an ideal choice for people looking for a healthier option when incorporating meats into their diet. Shifting demographics and urbanization drive market growth by influencing consumption patterns. For instance, the growing urban population's preference for convenient, pre-packaged frozen meat items like burgers or sausages fuels market growth. Consolidation through strategic mergers and acquisitions contributes to market growth. Notable examples include companies acquiring businesses specializing in niche frozen meat categories to diversify their product portfolios and expand their market presence. Increasing concerns about environmental sustainability drive market growth through the introduction of eco-friendly packaging for frozen meat products. For instance, companies utilizing recyclable or biodegradable packaging materials align with consumer preferences for sustainable choices. Evolving dietary habits and culinary trends influence the market. For example, the increasing popularity of international cuisines prompts the demand for various frozen meat options, like pre-marinated ethnic cuts, catering to diverse culinary preferences.Rising Popularity of Plant-Based Alternatives Impacts Frozen Meat Sales: Substitute products for frozen meat encompass a wide range of alternatives that consumers increasingly consider as replacements for traditional frozen meat options. These substitute products pose a restraint on the frozen meat market, and plant-based alternatives are gaining popularity. Plant-based meats, such as veggie burgers, tofu-based products, or plant-derived protein sources like seitan, mimicking the taste and texture of traditional meats, have garnered traction among consumers seeking healthier, environmentally sustainable options. Innovations in plant-based burgers, sausages, and meatballs cater to shifting dietary preferences, appealing to a growing demographic adopting flexitarian or vegetarian diets. These alternatives, often perceived as healthier due to their lower saturated fat content and sustainability benefits, directly compete with frozen meat products. Their rising availability, coupled with consumers' increasing inclination towards plant-centric diets, presents a substantial challenge to the frozen meat market's growth and market share. Growing health consciousness has led to concerns about the consumption of processed meats due to their potential links to health issues like cardiovascular diseases and cancer. Increasing production costs, including energy-intensive freezing processes and storage expenses, often lead to higher prices for frozen meats, impacting consumer affordability and purchasing decisions. Despite freezing methods, frozen meats may suffer from quality degradation over time, potentially affecting taste, texture, and overall quality upon thawing, raising concerns among consumers regarding freshness. The surge in popularity of plant-based meat alternatives presents a substantial threat, with products like plant-based burgers and sausages increasingly appealing to consumers seeking healthier and sustainable protein sources. Frozen meat production processes have environmental implications, including energy consumption and packaging waste, which might not align with the preferences of environmentally conscious consumers. Compliance with stringent regulatory standards for frozen meat production and storage poses challenges, especially concerning maintaining quality, safety, and hygiene standards throughout the supply chain. Limited space for frozen meat products in retail stores or supermarkets can restrict the visibility and availability of products, impacting consumer choices and purchases. Maintaining the cold chain and ensuring uninterrupted frozen product delivery can be challenging, especially in regions with inadequate infrastructure or transportation facilities.

Growing diversification in the healthier frozen meat varieties and Innovative Freezing Techniques: Introducing new product lines, such as organic or specialty cuts, taps into evolving consumer preferences for healthier and specialized options, stimulating market growth. For instance, the launch of organic frozen meat products, like grass-fed beef or antibiotic-free poultry, caters to health-conscious consumers seeking premium quality meats. Embracing cutting-edge freezing techniques like blast freezing or cryogenic freezing ensures improved product quality and shelf life, meeting consumer expectations for freshness and taste. For example, implementing quick freezing methods preserves the natural texture and flavor of frozen meats, elevating consumer satisfaction and market demand. Penetrating untapped markets in emerging economies presents vast growth potential. For instance, targeting regions with rising disposable incomes, like Asia-Pacific or Latin America, opens avenues for increased consumption and market growth. Leveraging online platforms for direct-to-consumer sales amplifies market reach. Enhancing e-commerce platforms with diverse frozen meat selections provides convenient access for consumers, fostering market growth through increased accessibility and convenience. Collaborating with retailers or food service providers enables broader distribution and exposure. For example, partnerships with supermarkets or restaurant chains increase product visibility, driving market penetration and sales. Addressing the growing demand for healthier options by introducing innovative, low-sodium, or preservative-free frozen meat selections resonates with health-conscious consumers, enhancing market prospects. Incorporating eco-friendly packaging solutions, such as recyclable or biodegradable materials, aligns with environmentally conscious consumer preferences, fostering market growth by appealing to sustainability-driven buyers. Introducing ready-to-eat or pre-seasoned frozen meat products caters to consumers seeking convenient meal solutions. For instance, offering pre-marinated frozen chicken or seasoned beef cuts resonates with time-strapped consumers, driving market demand. Emphasizing transparency in sourcing and processing, such as highlighting quality certifications or ethical practices, builds consumer trust and credibility, leading to increased market share and brand loyalty. Tailoring frozen meat options to changing consumer lifestyles, like offering single-serve or portion-controlled packaging for smaller households or on-the-go options for busy professionals, addresses evolving preferences, propelling market growth.

Frozen Meat Market Segment Analysis:

Based on Type, The frozen meat market is segmented into Frozen Processed Meat and Frozen Whole Cuts. Frozen Processed Meat holds a dominant position due to its higher adoption rates compared to Frozen Whole Cuts. Processed meats undergo specific treatments, such as smoking, curing, or adding preservatives, enhancing their shelf life and convenience, and appealing to consumers seeking ready-to-cook options. This segment, comprising sausages, bacon, and pre-seasoned cuts, caters extensively to the demand for quick meal solutions, aligning with the fast-paced lifestyles of modern consumers. Frozen whole cuts, which hold a small market share presently, are expected to gain momentum in the coming years. These products, including unprocessed or minimally processed cuts like steaks and chops, target consumers looking for more natural and unaltered meat choices. The adoption of frozen whole cuts is anticipated to rise due to a growing preference for fresher and less processed food options among health-conscious consumers.

Frozen Meat Market Regional Insights:

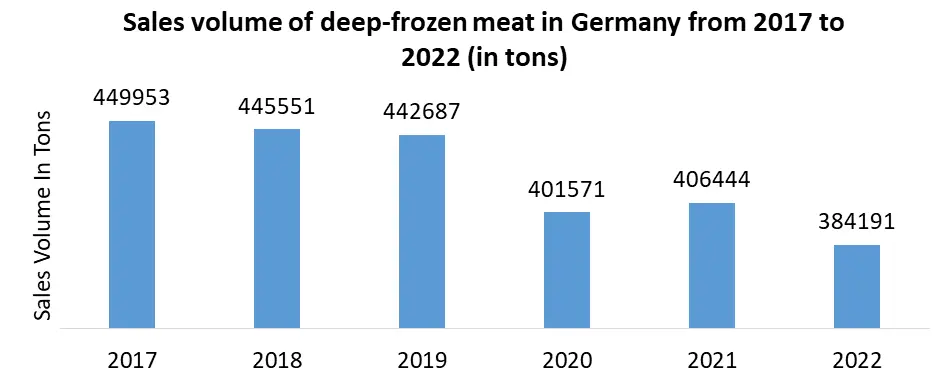

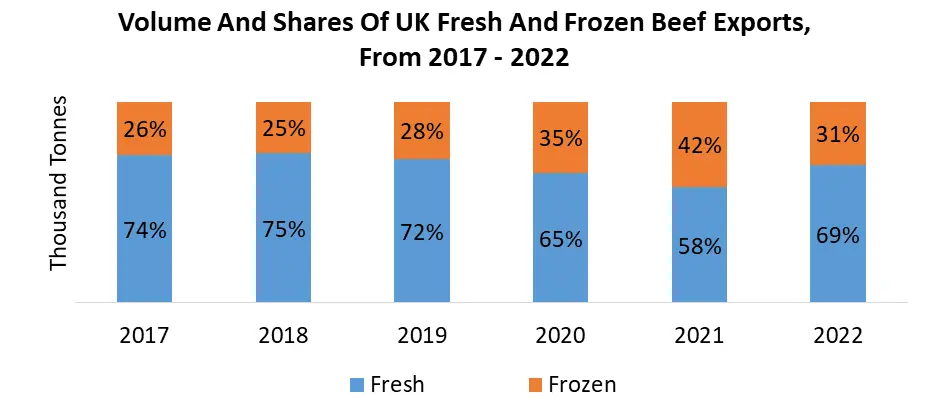

North America stands as a significant dominator in the global frozen meat market. The region's dominance is propelled by the United States and Canada, leveraging advanced infrastructure, technological innovations, and shifting consumer preferences. The presence of established players, efficient distribution networks, and a high demand for convenient food options contribute to North America's market leadership. For instance, in the United States, frozen meat consumption has been steadily rising due to evolving consumer lifestyles, wherein individuals seek time-saving meal solutions without compromising on quality. Major cities like New York and Los Angeles witness high demand for frozen meat products, including ready-to-cook chicken strips, seasoned beef, and various processed meat items. Additionally, the growth of online retail and delivery services further boosts market accessibility and consumer reach. Europe emerges as another prominent region dominating the frozen meat market. Countries like Germany, the United Kingdom, France, and Italy drive the region's frozen meat market with their established food processing industries, evolving food habits, and a growing inclination toward convenience foods. For instance, in Germany, a nation with a rich tradition in meat consumption, the Frozen Meat Market experiences substantial growth. Consumers increasingly opt for frozen meat due to its convenience, long shelf life, and wide range of options. Popular frozen meat products in Europe include pre-marinated cuts, sausages, and specialty frozen meat items, catering to diverse culinary preferences across the continent. Asia Pacific has emerged as a rapidly growing region in the frozen meat market. The market's growth is driven by countries such as China, Japan, India, and South Korea, owing to increasing urbanization, rising disposable incomes, and a burgeoning middle-class population with changing dietary preferences. For instance, in China, a significant contributor to the regional market, urbanization, and lifestyle changes have led to an upsurge in the demand for frozen meat products. Rapidly expanding e-commerce platforms and the adoption of Western eating habits among the younger demographic have further fueled the market. Popular frozen meat choices include various chicken cuts, pork, and seafood, meeting the demands of a diverse consumer base. As these regions continue to evolve, the Frozen Meat Market is expected to witness further growth and diversification, with innovative product offerings tailored to meet regional demands and preferences.

Competitive Landscape

The recent developments have significantly impacted the frozen food market by fostering expansion and diversification. Prasuma's foray into the frozen food segment in India, alongside Seara Foods targeting the Middle Eastern and Latin American poultry markets, indicates a growing focus on regional demands. Préval AG's acquisition of J&G Foods and Armand Agra's takeover of Seattle Fish Company underline the industry's consolidation drive, enhancing product diversity and global market presence. Agthia Group's investment in Ismailia Investments denotes an increasing interest in expanding product portfolios across borders. These moves collectively signal a dynamic shift towards catering to diverse consumer preferences and expanding market footholds across continents. In April 2022, Prasuma expanded its product range by introducing a frozen food segment in India. The new portfolio includes items like Chicken Nuggets, Frozen Veg and Chicken Spring Rolls, Veg and Chicken Mini Samosas, Mutton and Chicken Shammi Kababs, Mutton and Chicken Seekh Kababs, and Bacon. This expansion aims to widen Prasuma's market reach across Indian territories. In February 2022, Seara Foods, a Brazilian meat processing company, launched 'Seara Shawata' frozen marinated whole chicken targeting the Middle Eastern and Latin American markets due to substantial poultry product demand in these regions. In November 2021, Préval AG acquired the assets of J&G Foods to diversify its global presence in the frozen meat business. J&G Foods specializes in organic and grass-fed beef, natural chicken, pork, marinated, and value-added meats. In November 2021, Seattle Fish Company was sold to Armand Agra, a subsidiary of the Founders Group of Food Companies, expanding the latter's foothold in the seafood industry across different locations in the United States. pril 2021, Agthia Group acquired a 75.02% stake in Ismailia Investments, an Egyptian processed meat company dealing with frozen chicken and beef products under brands like Atyab, Meatland, Shiketita, and Furat.Frozen Meat Market Scope: Inquire Before Buying

Global Frozen Meat Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 58.7 Bn. Forecast Period 2023 to 2029 CAGR: 4.65% Market Size in 2029: US $ 80.69 Bn. Segments Covered: by Product Chicken Beef Pork Venison Seafood Others by Type Frozen Processed Meat Frozen Whole Cut by End User Food Service Retail Customers by Distribution Channel Hypermarkets/Supermarkets Specialty Stores Convenience Stores Online Channels Others Frozen Meat Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Frozen Meat Market Key Players:

1. Allanasons Pvt Ltd 2. Ajinomoto Foods 3. Astral Foods 4. Austevoll Seafood ASA 5. Cargill Inc 6. Conagra Brands, Inc 7. General Mills Inc 8. Green Farms LLC 9. Hormel Foods Corporation 10. JBS SA 11. Kellogg Co 12. Kerry Group Plc 13. Kraft Heinz Company 14. LantmännenUnibake 15. M&J Seafood Holdings Limited 16. m. Morrison Supermarkets Limited 17. Marfrig Global Foods SA 18. McCain Foods Ltd. 19. Nestlé SA 20. Nomad Foods Limited 21. Pilgrim`s Pride Corporation 22. Samworth Brothers 23. Tyson Foods, Inc 24. Unilever 25. Verde Farms LLC 26. VH Group 27. Waitrose & Partners 28. Xiamen Yinxiang Group Co., Ltd. FAQs: 1. What are the growth drivers for the Frozen Meat Market? Ans. Rising demand for hassle-free frozen chicken indicates a shift toward time-saving meal solutions and is expected to be the major driver for the Frozen Meat Market. 2. What is the major opportunity for the Frozen Meat Market growth? Ans. Growing diversification in healthier frozen meat varieties and Innovative Freezing Techniques is expected to be a major Opportunity in the Frozen Meat Market. 3. Which country is expected to lead the global Frozen Meat Market during the forecast period? Ans. North America is expected to lead the Frozen Meat Market during the forecast period. 4. What is the projected market size and growth rate of the Frozen Meat Market? Ans. The Frozen Meat Market size was valued at USD 58.7 Billion in 2022 and the total Frozen Meat Market revenue is expected to grow at a CAGR of 4.65 % from 2023 to 2029, reaching nearly USD 80.69 Billion. 5. What segments are covered in the Frozen Meat Market report? Ans. The segments covered in the Frozen Meat Market report are by Product, Type, End User, Distribution Channel, and Region.

1. Frozen Meat Market: Research Methodology 2. Frozen Meat Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Frozen Meat Market: Dynamics 3.1 Frozen Meat Market Trends by Region 3.1.1 North America Frozen Meat Market Trends 3.1.2 Europe Frozen Meat Market Trends 3.1.3 Asia Pacific Frozen Meat Market Trends 3.1.4 Middle East and Africa Frozen Meat Market Trends 3.1.5 South America Frozen Meat Market Trends 3.2 Frozen Meat Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Frozen Meat Market Drivers 3.2.1.2 North America Frozen Meat Market Restraints 3.2.1.3 North America Frozen Meat Market Opportunities 3.2.1.4 North America Frozen Meat Market Challenges 3.2.2 Europe 3.2.2.1 Europe Frozen Meat Market Drivers 3.2.2.2 Europe Frozen Meat Market Restraints 3.2.2.3 Europe Frozen Meat Market Opportunities 3.2.2.4 Europe Frozen Meat Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Frozen Meat Market Drivers 3.2.3.2 Asia Pacific Frozen Meat Market Restraints 3.2.3.3 Asia Pacific Frozen Meat Market Opportunities 3.2.3.4 Asia Pacific Frozen Meat Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Frozen Meat Market Drivers 3.2.4.2 Middle East and Africa Frozen Meat Market Restraints 3.2.4.3 Middle East and Africa Frozen Meat Market Opportunities 3.2.4.4 Middle East and Africa Frozen Meat Market Challenges 3.2.5 South America 3.2.5.1 South America Frozen Meat Market Drivers 3.2.5.2 South America Frozen Meat Market Restraints 3.2.5.3 South America Frozen Meat Market Opportunities 3.2.5.4 South America Frozen Meat Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power of Suppliers 3.3.2 Bargaining Power of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives for the Frozen Meat Industry 3.8 The Global Pandemic and Redefining of The Frozen Meat Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 4. Global Frozen Meat Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2022-2029) 4.1 Global Frozen Meat Market Size and Forecast, By Product (2022-2029) 4.1.1 Chicken 4.1.2 Beef 4.1.3 Pork 4.1.4 Venison 4.1.5 Seafood 4.1.6 Others 4.2 Global Frozen Meat Market Size and Forecast, By Type (2022-2029) 4.2.1 Frozen Processed Meat 4.2.2 Frozen Whole Cut 4.3 Global Frozen Meat Market Size and Forecast, By End User (2022-2029) 4.3.1 Food Service 4.3.2 Retail Customers 4.4 Global Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 4.4.1 Hypermarkets/Supermarkets 4.4.2 Specialty Stores 4.4.3 Convenience Stores 4.4.4 Online Channels 4.4.5 Others 4.5 Global Frozen Meat Market Size and Forecast, by Region (2022-2029) 4.5.1 North America 4.5.2 Europe 4.5.3 Asia Pacific 4.5.4 Middle East and Africa 4.5.5 South America 5. North America Frozen Meat Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2022-2029) 5.1 North America Frozen Meat Market Size and Forecast, By Product (2022-2029) 5.1.1 Chicken 5.1.2 Beef 5.1.3 Pork 5.1.4 Venison 5.1.5 Seafood 5.1.6 Others 5.2 North America Frozen Meat Market Size and Forecast, By Type (2022-2029) 5.2.1 Frozen Processed Meat 5.2.2 Frozen Whole Cut 5.3 North America Frozen Meat Market Size and Forecast, By End User (2022-2029) 5.3.1 Food Service 5.3.2 Retail Customers 5.4 North America Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 5.4.1 Hypermarkets/Supermarkets 5.4.2 Specialty Stores 5.4.3 Convenience Stores 5.4.4 Online Channels 5.4.5 Others 5.5 North America Frozen Meat Market Size and Forecast, by Country (2022-2029) 5.5.1 United States 5.5.1.1 United States Frozen Meat Market Size and Forecast, By Product (2022-2029) 5.5.1.1.1 Chicken 5.5.1.1.2 Beef 5.5.1.1.3 Pork 5.5.1.1.4 Venison 5.5.1.1.5 Seafood 5.5.1.1.6 Others 5.5.1.2 United States Frozen Meat Market Size and Forecast, By Type (2022-2029) 5.5.1.2.1 Frozen Processed Meat 5.5.1.2.2 Frozen Whole Cut 5.5.1.3 United States Frozen Meat Market Size and Forecast, By End User (2022-2029) 5.5.1.3.1 Food Service 5.5.1.3.2 Retail Customers 5.5.1.4 United States Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 5.5.1.4.1 Hypermarkets/Supermarkets 5.5.1.4.2 Specialty Stores 5.5.1.4.3 Convenience Stores 5.5.1.4.4 Online Channels 5.5.1.4.5 Others 5.5.2 Canada 5.5.2.1 Canada Frozen Meat Market Size and Forecast, By Product (2022-2029) 5.5.2.1.1 Chicken 5.5.2.1.2 Beef 5.5.2.1.3 Pork 5.5.2.1.4 Venison 5.5.2.1.5 Seafood 5.5.2.1.6 Others 5.5.2.2 Canada Frozen Meat Market Size and Forecast, By Type (2022-2029) 5.5.2.2.1 Frozen Processed Meat 5.5.2.2.2 Frozen Whole Cut 5.5.2.3 Canada Frozen Meat Market Size and Forecast, By End User (2022-2029) 5.5.2.3.1 Food Service 5.5.2.3.2 Retail Customers 5.5.2.4 Canada Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 5.5.2.4.1 Hypermarkets/Supermarkets 5.5.2.4.2 Specialty Stores 5.5.2.4.3 Convenience Stores 5.5.2.4.4 Online Channels 5.5.2.4.5 Others 5.5.3 Mexico 5.5.3.1 Mexico Frozen Meat Market Size and Forecast, By Product (2022-2029) 5.5.3.1.1 Chicken 5.5.3.1.2 Beef 5.5.3.1.3 Pork 5.5.3.1.4 Venison 5.5.3.1.5 Seafood 5.5.3.1.6 Others 5.5.3.2 Mexico Frozen Meat Market Size and Forecast, By Type (2022-2029) 5.5.3.2.1 Frozen Processed Meat 5.5.3.2.2 Frozen Whole Cut 5.5.3.3 Mexico Frozen Meat Market Size and Forecast, By End User (2022-2029) 5.5.3.3.1 Food Service 5.5.3.3.2 Retail Customers 5.5.3.4 Mexico Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 5.5.3.4.1 Hypermarkets/Supermarkets 5.5.3.4.2 Specialty Stores 5.5.3.4.3 Convenience Stores 5.5.3.4.4 Online Channels 5.5.3.4.5 Others 6. Europe Frozen Meat Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2022-2029) 6.1 Europe Frozen Meat Market Size and Forecast, By Product (2022-2029) 6.2 Europe Frozen Meat Market Size and Forecast, By Type (2022-2029) 6.3 Europe Frozen Meat Market Size and Forecast, By End User (2022-2029) 6.4 Europe Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 6.5 Europe Frozen Meat Market Size and Forecast, by Country (2022-2029) 6.5.1 United Kingdom 6.5.1.1 United Kingdom Frozen Meat Market Size and Forecast, By Product (2022-2029) 6.5.1.2 United Kingdom Frozen Meat Market Size and Forecast, By Type (2022-2029) 6.5.1.3 United Kingdom Frozen Meat Market Size and Forecast, By End User (2022-2029) 6.5.1.4 United Kingdom Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 6.5.2 France 6.5.2.1 France Frozen Meat Market Size and Forecast, By Product (2022-2029) 6.5.2.2 France Frozen Meat Market Size and Forecast, By Type (2022-2029) 6.5.2.3 France Frozen Meat Market Size and Forecast, By End User (2022-2029) 6.5.2.4 France Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 6.5.3 Germany 6.5.3.1 Germany Frozen Meat Market Size and Forecast, By Product (2022-2029) 6.5.3.2 Germany Frozen Meat Market Size and Forecast, By Type (2022-2029) 6.5.3.3 Germany Frozen Meat Market Size and Forecast, By End User (2022-2029) 6.5.3.4 Germany Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 6.5.4 Italy 6.5.4.1 Italy Frozen Meat Market Size and Forecast, By Product (2022-2029) 6.5.4.2 Italy Frozen Meat Market Size and Forecast, By Type (2022-2029) 6.5.4.3 Italy Frozen Meat Market Size and Forecast, By End User (2022-2029) 6.5.4.4 Italy Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 6.5.5 Spain 6.5.5.1 Spain Frozen Meat Market Size and Forecast, By Product (2022-2029) 6.5.5.2 Spain Frozen Meat Market Size and Forecast, By Type (2022-2029) 6.5.5.3 Spain Frozen Meat Market Size and Forecast, By End User (2022-2029) 6.5.5.4 Spain Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 6.5.6 Sweden 6.5.6.1 Sweden Frozen Meat Market Size and Forecast, By Product (2022-2029) 6.5.6.2 Sweden Frozen Meat Market Size and Forecast, By Type (2022-2029) 6.5.6.3 Sweden Frozen Meat Market Size and Forecast, By End User (2022-2029) 6.5.6.4 Sweden Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 6.5.7 Austria 6.5.7.1 Austria Frozen Meat Market Size and Forecast, By Product (2022-2029) 6.5.7.2 Austria Frozen Meat Market Size and Forecast, By Type (2022-2029) 6.5.7.3 Austria Frozen Meat Market Size and Forecast, By End User (2022-2029) 6.5.7.4 Austria Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 6.5.8 Rest of Europe 6.5.8.1 Rest of Europe Frozen Meat Market Size and Forecast, By Product (2022-2029) 6.5.8.2 Rest of Europe Frozen Meat Market Size and Forecast, By Type (2022-2029). 6.5.8.3 Rest of Europe Frozen Meat Market Size and Forecast, By End User (2022-2029) 6.5.8.4 Rest of Europe Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 7. Asia Pacific Frozen Meat Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2022-2029) 7.1 Asia Pacific Frozen Meat Market Size and Forecast, By Product (2022-2029) 7.2 Asia Pacific Frozen Meat Market Size and Forecast, By Type (2022-2029) 7.3 Asia Pacific Frozen Meat Market Size and Forecast, By End User (2022-2029) 7.4 Asia Pacific Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 7.5 Asia Pacific Frozen Meat Market Size and Forecast, by Country (2022-2029) 7.5.1 China 7.5.1.1 China Frozen Meat Market Size and Forecast, By Product (2022-2029) 7.5.1.2 China Frozen Meat Market Size and Forecast, By Type (2022-2029) 7.5.1.3 China Frozen Meat Market Size and Forecast, By End User (2022-2029) 7.5.1.4 China Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.2 South Korea 7.5.2.1 S Korea Frozen Meat Market Size and Forecast, By Product (2022-2029) 7.5.2.2 S Korea Frozen Meat Market Size and Forecast, By Type (2022-2029) 7.5.2.3 S Korea Frozen Meat Market Size and Forecast, By End User (2022-2029) 7.5.2.4 S Korea Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.3 Japan 7.5.3.1 Japan Frozen Meat Market Size and Forecast, By Product (2022-2029) 7.5.3.2 Japan Frozen Meat Market Size and Forecast, By Type (2022-2029) 7.5.3.3 Japan Frozen Meat Market Size and Forecast, By End User (2022-2029) 7.5.3.4 Japan Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.4 India 7.5.4.1 India Frozen Meat Market Size and Forecast, By Product (2022-2029) 7.5.4.2 India Frozen Meat Market Size and Forecast, By Type (2022-2029) 7.5.4.3 India Frozen Meat Market Size and Forecast, By End User (2022-2029) 7.5.4.4 India Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.5 Australia 7.5.5.1 Australia Frozen Meat Market Size and Forecast, By Product (2022-2029) 7.5.5.2 Australia Frozen Meat Market Size and Forecast, By Type (2022-2029) 7.5.5.3 Australia Frozen Meat Market Size and Forecast, By End User (2022-2029) 7.5.5.4 Australia Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.6 Indonesia 7.5.6.1 Indonesia Frozen Meat Market Size and Forecast, By Product (2022-2029) 7.5.6.2 Indonesia Frozen Meat Market Size and Forecast, By Type (2022-2029) 7.5.6.3 Indonesia Frozen Meat Market Size and Forecast, By End User (2022-2029) 7.5.6.4 Indonesia Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.7 Malaysia 7.5.7.1 Malaysia Frozen Meat Market Size and Forecast, By Product (2022-2029) 7.5.7.2 Malaysia Frozen Meat Market Size and Forecast, By Type (2022-2029) 7.5.7.3 Malaysia Frozen Meat Market Size and Forecast, By End User (2022-2029) 7.5.7.4 Malaysia Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.8 Vietnam 7.5.8.1 Vietnam Frozen Meat Market Size and Forecast, By Product (2022-2029) 7.5.8.2 Vietnam Frozen Meat Market Size and Forecast, By Type (2022-2029) 7.5.8.3 Vietnam Frozen Meat Market Size and Forecast, By End User (2022-2029) 7.5.8.4 Vietnam Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.9 Taiwan 7.5.9.1 Taiwan Frozen Meat Market Size and Forecast, By Product (2022-2029) 7.5.9.2 Taiwan Frozen Meat Market Size and Forecast, By Type (2022-2029) 7.5.9.3 Taiwan Frozen Meat Market Size and Forecast, By End User (2022-2029) 7.5.9.4 Taiwan Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.10 Bangladesh 7.5.10.1 Bangladesh Frozen Meat Market Size and Forecast, By Product (2022-2029) 7.5.10.2 Bangladesh Frozen Meat Market Size and Forecast, By Type (2022-2029) 7.5.10.3 Bangladesh Frozen Meat Market Size and Forecast, By End User (2022-2029) 7.5.10.4 Bangladesh Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.11 Pakistan 7.5.11.1 Pakistan Frozen Meat Market Size and Forecast, By Product (2022-2029) 7.5.11.2 Pakistan Frozen Meat Market Size and Forecast, By Type (2022-2029) 7.5.11.3 Pakistan Frozen Meat Market Size and Forecast, By End User (2022-2029) 7.5.11.4 Pakistan Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.12 Rest of Asia Pacific 7.5.12.1 Rest of Asia Pacific Frozen Meat Market Size and Forecast, By Product (2022-2029) 7.5.12.2 Rest of Asia Pacific Frozen Meat Market Size and Forecast, By Type (2022-2029) 7.5.12.3 Rest of Asia Pacific Frozen Meat Market Size and Forecast, By End User (2022-2029) 7.5.12.4 Rest of Asia Pacific Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 8. Middle East and Africa Frozen Meat Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2022-2029) 8.1 Middle East and Africa Frozen Meat Market Size and Forecast, By Product (2022-2029) 8.2 Middle East and Africa Frozen Meat Market Size and Forecast, By Type (2022-2029) 8.3 Middle East and Africa Frozen Meat Market Size and Forecast, By End User (2022-2029) 8.4 Middle East and Africa Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 8.5 Middle East and Africa Frozen Meat Market Size and Forecast, by Country (2022-2029) 8.5.1 South Africa 8.5.1.1 South Africa Frozen Meat Market Size and Forecast, By Product (2022-2029) 8.5.1.2 South Africa Frozen Meat Market Size and Forecast, By Type (2022-2029) 8.5.1.3 South Africa Frozen Meat Market Size and Forecast, By End User (2022-2029) 8.5.1.4 South Africa Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 8.5.2 GCC 8.5.2.1 GCC Frozen Meat Market Size and Forecast, By Product (2022-2029) 8.5.2.2 GCC Frozen Meat Market Size and Forecast, By Type (2022-2029) 8.5.2.3 GCC Frozen Meat Market Size and Forecast, By End User (2022-2029) 8.5.2.4 GCC Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 8.5.3 Egypt 8.5.3.1 Egypt Frozen Meat Market Size and Forecast, By Product (2022-2029) 8.5.3.2 Egypt Frozen Meat Market Size and Forecast, By Type (2022-2029) 8.5.3.3 Egypt Frozen Meat Market Size and Forecast, By End User (2022-2029) 8.5.3.4 Egypt Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 8.5.4 Nigeria 8.5.4.1 Nigeria Frozen Meat Market Size and Forecast, By Product (2022-2029) 8.5.4.2 Nigeria Frozen Meat Market Size and Forecast, By Type (2022-2029) 8.5.4.3 Nigeria Frozen Meat Market Size and Forecast, By End User (2022-2029) 8.5.4.4 Nigeria Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 8.5.5 Rest of ME&A 8.5.5.1 Rest of ME&A Frozen Meat Market Size and Forecast, By Product (2022-2029) 8.5.5.2 Rest of ME&A Frozen Meat Market Size and Forecast, By Type (2022-2029) 8.5.5.3 Rest of ME&A Frozen Meat Market Size and Forecast, By End User (2022-2029) 8.5.5.4 Rest of ME&A Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 9. South America Frozen Meat Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2022-2029) 9.1 South America Frozen Meat Market Size and Forecast, By Product (2022-2029) 9.2 South America Frozen Meat Market Size and Forecast, By Type (2022-2029) 9.3 South America Frozen Meat Market Size and Forecast, By End User (2022-2029) 9.4 South America Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 9.5 South America Frozen Meat Market Size and Forecast, by Country (2022-2029) 9.5.1 Brazil 9.5.1.1 Brazil Frozen Meat Market Size and Forecast, By Product (2022-2029) 9.5.1.2 Brazil Frozen Meat Market Size and Forecast, By Type (2022-2029) 9.5.1.3 Brazil Frozen Meat Market Size and Forecast, By End User (2022-2029) 9.5.1.4 Brazil Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 9.5.2 Argentina 9.5.2.1 Argentina Frozen Meat Market Size and Forecast, By Product (2022-2029) 9.5.2.2 Argentina Frozen Meat Market Size and Forecast, By Type (2022-2029) 9.5.2.3 Argentina Frozen Meat Market Size and Forecast, By End User (2022-2029) 9.5.2.4 Argentina Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 9.5.3 Rest Of South America 9.5.3.1 Rest Of South America Frozen Meat Market Size and Forecast, By Product (2022-2029) 9.5.3.2 Rest Of South America Frozen Meat Market Size and Forecast, By Type (2022-2029) 9.5.3.3 Rest Of South America Frozen Meat Market Size and Forecast, By End User (2022-2029) 9.5.3.4 Rest Of South America Frozen Meat Market Size and Forecast, By Distribution Channel (2022-2029) 10. Global Frozen Meat Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Type Segment 10.3.3 End-user Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Frozen Meat Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Ajinomoto Foods 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Allanasons Pvt Ltd. 11.3 Astral Foods 11.4 Austevoll Seafood ASA 11.5 Cargill Inc 11.6 Conagra Brands, Inc 11.7 General Mills Inc 11.8 Green Farms LLC 11.9 Hormel Foods Corporation 11.10 JBS SA 11.11 Kellogg Co 11.12 Kerry Group Plc 11.13 Kraft Heinz Company 11.14 LantmännenUnibake 11.15 M&J Seafood Holdings Limited 11.16 m. Morrison Supermarkets Limited 11.17 Marfrig Global Foods SA 11.18 McCain Foods Ltd. 11.19 Nestlé SA 11.20 Nomad Foods Limited 11.21 Pilgrim`s Pride Corporation 11.22 Samworth Brothers 11.23 Tyson Foods, Inc 11.24 Unilever 11.25 Verde Farms LLC 11.26 VH Group 11.27 Waitrose & Partners 11.28 Xiamen Yinxiang Group Co., Ltd. 12. Key Findings 13. Industry Recommendations