The Frozen Food Market size was valued at USD 3.14 Billion in 2022 and the total Military Land Vehicles revenue is expected to grow at a CAGR of 3.9 % from 2023 to 2029, reaching nearly USD 4.26 Billion. The growing popularity of frozen food products like Momos, Spring Roll, Ready to Eat Meals and more. These products appeal to today’s working professionals with improved living standards and growing disposable income. Changing lifestyle and food culture is transforming the food habits of the young generation, which drive the market demand globally. Apart from consumer preferences and demands, market and supply chain evaluation have also contributed to the growth of the Frozen Food Market. For example with increasing urbanization and the growth of organized retail, modern grocery stores are now equipped with state-of-art cold chain facilities. This, in turn, has led to the availability of various frozen food products in the market. The popularity of the e-commerce industry has penetrated the Frozen Food Market players and their brands. Also, these platforms offer high product visibility and listing at a nominal cost compared to traditional retails, which creates an opportunity for market players in the industry. The Frozen Food Market has also witnessed a shift towards healthier alternatives. Market players are combining natural and organic ingredients, reducing sodium and artificial additives, and providing dietary preferences such as vegan, gluten-free, and plant-based options. This shift supports the growing customer focus on health and wellness. Technological innovations have played a key role in the growth of the industry. Innovations in freezing techniques, processing technologies and packaging have improved the quality and convenience of frozen food products. Quick freezing methods, such as flash freezing, help to preserve the texture and taste of food, making them more attractive to consumers.Frozen Food Market: A Comprehensive Analysis of the Top Players, Key Drivers, Trends, and Opportunities bundle reports

1. North America Frozen Food Market (Single User $ 2600) 2. Asia Pacific Frozen Food Market (Single User $ 2600) 3. Europe Frozen Food Market (Single User $ 2900) 4. Middle East and Africa Frozen Food Market (Single User $ 2900) 5. South America Frozen Food Market (Single User $ 2600) To know about the Research Methodology :- Request Free Sample ReportWhat does a bundle report provide?

1. Accessing the in-depth insight from the ‘Frozen Food Market report will provide customers with a comprehensive understanding of the market dynamics, key trends, and future prospects in the military land vehicles industry. It offers detailed analysis during the forecast period, including demand, drivers, growth stimulators, spending patterns, and modernization trends across different regions. The report also covers recent developments, industry challenges, regional highlights, and major programs, providing a holistic view of the market. 2. The ‘Frozen Food Market’ report stands out from other reports in the market due to several factors: • Exclusive Market Insights: The report provides exclusive and in-depth insights into the Frozen Food Market, presenting a comprehensive analysis of market trends, growth drivers, challenges, and opportunities. It delves into specific aspects of the market, offering valuable information not readily available in other reports. • Unbiased and Objective Analysis: The report maintains an unbiased and objective approach to analyzing the Frozen Food Market. It avoids promotional or biased content, ensuring that the information and conclusions presented are based solely on rigorous research and analysis. • Extensive Primary Research: The report incorporates extensive primary research, including interviews and surveys with industry experts, key stakeholders, and market participants. This primary research adds depth and credibility to the report's findings and enhances its uniqueness in comparison to reports relying solely on secondary research. • Emerging Market Trends: The report identifies and explores emerging trends and developments within the Frozen Food Market. It highlights innovative products, packaging solutions, distribution channels, and consumer preferences that are shaping the industry. These insights provide a forward-looking perspective that sets the report apart from others. • Regional and Global Perspective: The report offers a comprehensive analysis of the Frozen Food Market at both regional and global levels. It assesses market dynamics, consumer behavior, and regulatory frameworks across different regions, providing a nuanced understanding of the market's regional variations and global impact. • Impact of COVID-19: The report addresses the specific impact of the COVID-19 pandemic on the Frozen Food Market. It examines the changing consumer behavior, supply chain disruptions, and evolving industry strategies during the pandemic. This analysis sets the report apart by providing timely and relevant insights for businesses navigating the post-pandemic landscape. • Strategic Recommendations: The report goes beyond data analysis by providing strategic recommendations and actionable insights for businesses operating in or entering the Frozen Food Market. These recommendations offer practical guidance for market players to optimize their operations, capitalize on growth opportunities, and overcome challenges. • Visual Representation and Data Visualization: The report utilizes visual elements such as charts, graphs, and infographics to enhance data presentation and interpretation. This visual representation not only improves the overall readability of the report but also facilitates a better understanding of complex market trends and statistical data. • Customizable Format: The report offers customizable options to cater to specific client requirements. It can be tailored to focus on specific market segments, regions, or other variables of interest. This flexibility sets it apart by providing clients with tailored insights aligned with their business objectives.Report 1: North America Frozen Food Market Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts.

The North America Frozen Food Market size was valued at USD 1360.876 Million in 2022 and the total Anime revenue is expected to grow at a CAGR of 3.62 % from 2023 to 2029, reaching nearly USD 1808.70 Million. The growing popularity of healthy and more nutritive frozen food options drives the market demand in North American countries. Customers in North America are increasingly focused on producing healthier food adoptions and are looking for convenient options that support their dietary preferences. To cater to this trend, frozen food manufacturers in North America are introducing new products that feature natural and organic ingredients, with a reduction of artificial additives and no sodium. There is also an increase in the availability of frozen food alternatives that provide specific dietary needs, such as vegetarian, vegan, and gluten-free, offerings. These healthier alternatives provide customers with the convenience of frozen food while addressing their desire for nutritious preferences. There is a growing interest in globally-inspired and ethnologically diverse frozen food alternatives. North American customers are becoming more excited about their food choices and seeking new and unique flavours. Frozen Food Market players are responding to this trend by introducing a wide range of international cuisines and flavours, such as Asian, Mediterranean, and Latin American-inspired frozen meals and snacks with their exclusive flavours. These offerings provide customers with the opportunity to explore different culinary experiences suitably from their own homes, which creates demand for Frozen Food Market players in North American countries.

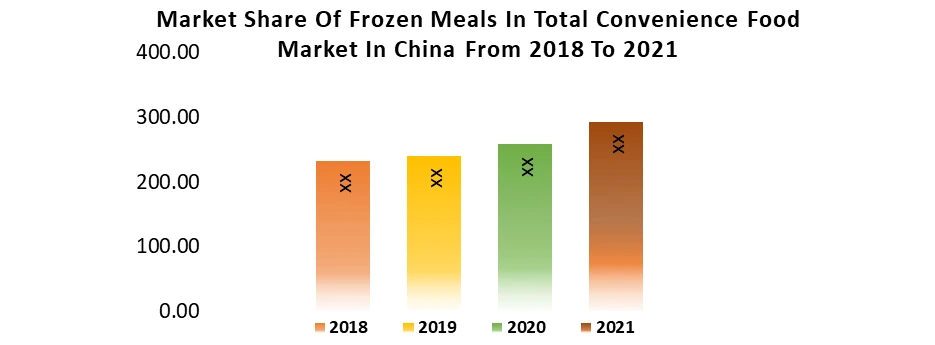

Report 2: Asia Pacific Frozen Food Market Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts.

The growing demand for plant-based and vegan frozen food options derives Asia Pacific Frozen Food Market. As customers in the Asian countries become more health-conscious and environmentally aware, there is an increasing popularity for meat-free alternatives. Plant-based frozen food products offer an easy to get way for customers to incorporate more plant-based alternatives and convenience into their diets. The market players are introducing a wide range of plant-based frozen meat alternatives, including ready-to-eat meals, sausages, nuggets, burgers and pizza to drive the market trend. Another significant trend in the Asia Pacific Frozen Food Market is the focus on local and Asian regional flavours. The different cuisines and culinary traditions in the Asian country provide a rich foundation of inspiration for frozen food manufacturers. They are introducing new frozen food products that showcase authentic Asian flavours and traditional dishes. This trend allows consumers to enjoy the convenience of frozen food while experiencing the unique tastes of their local cuisine.

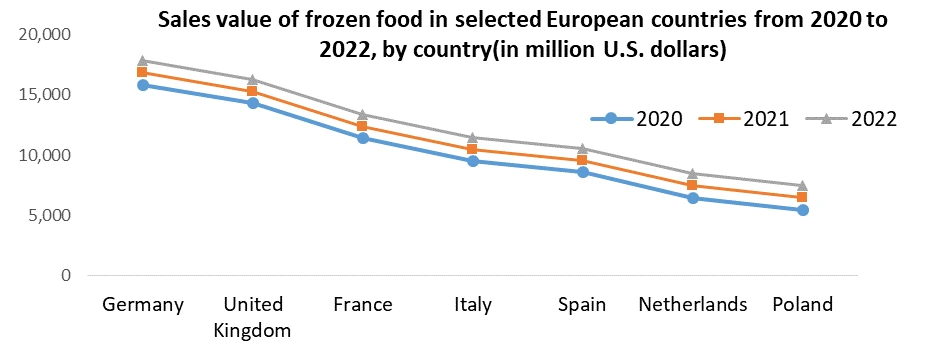

Report 3: Europe Frozen Food Market Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts.

Unique and Innovative cooking techniques for frozen food drive the Europe Frozen Food Market demand. European Manufacturers are introducing products that provide preserve the nutritional value of the ingredients and restaurant-quality experience, all while offering time-saving and convenience benefits. The Asian emerging trend for the Frozen Food Industry is the use of sous vides cooking in frozen food, which drives the market demand during the forecast period. Sous vide involves vacuum-sealing food in a bag and cooking it at an accurate, low temperature in a water bath. This technique ensures that the food retains its flavours, nutrients and moisture. Frozen sous vide meals have gained popularity among customers looking for high-quality, ready-to-eat options with minimal effort. Another innovative and unique technique is blast freezing, which involves quickly freezing food at extremely low temperatures. This method preserves the texture, taste, and nutritional content of the ingredients, certifying that the final product maintains its quality even after thawing. Blast freezing is commonly used for seafood, vegetables, fruits, and prepared meals, allowing consumers to enjoy fresh-tasting frozen food at their convenience.

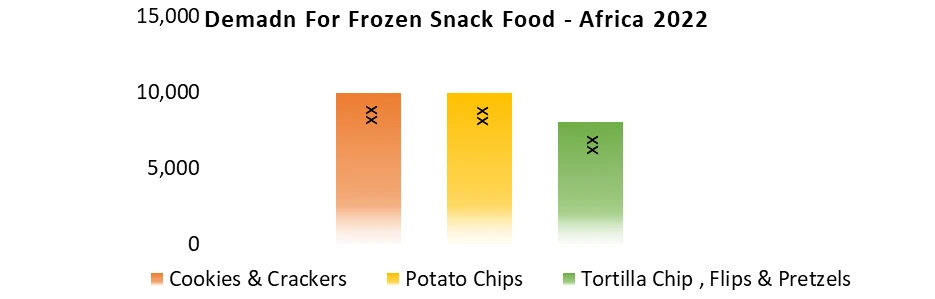

Report 4: Middle East and Africa Frozen Food Market Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts.

The Middle East and Africa Frozen Food Market size was valued at USD 193.74 Million in 2022 and the total Middle East and Africa Frozen Food Market revenue is expected to grow at a CAGR of 6.17 % from 2023 to 2029, reaching nearly USD 294.60 Million. Private label brands in the MEA countries are experiencing a increase in popularity, particularly in the frozen food industry. Retailers are take advantage of on this trend by introducing their own frozen food brands that compete in terms of quality and pricing with established national or international frozen food brands in Middle East and Africa. This growing trend benefits customers by increasing their choices and contributes to the overall growth of the Frozen Food Industry. Frozen food brands in the Middle East and Africa have recognized the importance of offering products with localized flavours. They have presented frozen food items that align with the traditional tastes and preferences of their locals. This includes frozen meals inspired by local recipes, traditional ingredients, spices, and providing consumers with a taste of their cultural heritage.

Report 5: South America Frozen Food Market Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts.

The South America Frozen Food Market size was valued at USD 121.83 Million in 2022 and the total South America Frozen Food Market revenue is expected to grow at a CAGR of 3.88 % from 2023 to 2029, reaching nearly USD 159.03 Million. South America is known for its ironic biodiversity and unique culinary heritage, and Frozen Food Industry players have been including traditional ingredients such as yucca, açaí berries, quinoa, various Amazonian fruits, and purple corn into their frozen food offerings. This trend not only promotes and preserves local flavors but also provides customers with a taste of authentic South American cuisine conveniently, which increases demand for Frozen Food Industry. South America boasts a diverse cooking background, with each country having its unique flavours and traditional dishes. A significant trend in the region's Frozen Food Industry is the representation of distinct regional cuisines. Frozen Food Industry players are offering frozen meals that authentically capture the essence of popular regional dishes, such as Brazilian feijoada, Peruvian ceviche, and Argentine empanadas. This trend allows customers to experience the culinary diversity of South America conveniently and provides a taste of local specialties.

Frozen Food Market Scope: Inquire before buying

Frozen Food Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 3.14 Bn. Forecast Period 2023 to 2029 CAGR: 3.9% Market Size in 2029: US $ 4.26 Bn. Segments Covered: by Offering Fruits Vegetables Potato Products Frozen Potato Products Seafood by End-User Food Service Industry Retail Customers by Product Category Ready-to-eat Ready-to-cook Ready-to-drink Other Product Categories by Freezing Technique Individual Quick Freezing (IQF) Blast Freezing Belt Freezing Other Freezing Techniques Frozen Food Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Frozen Food Market Key Players:

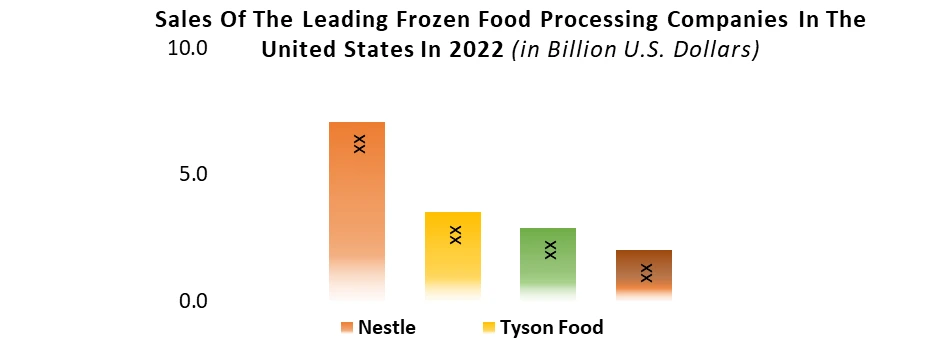

1. Nestle 2. General Mills Inc. 3. Ajinomoto Co., Inc. 4. Iceland Foods Ltd. 5. Mc Cain foods 6. ConAgra Foods Inc. 7. Maple Leaf Foods Inc. 8. BRF SA 9. Tyson Foods Inc. 10. Mother Dairy Fruit & Vegetable Pvt. Ltd. 11. Pinnacle Foods Inc. 12. Kraft Foods Inc. 13. Unilever PLC 14. Amy's Kitchen, Inc. 15. H. J. Heinz Company. 16. The Schwan Food Company 17. Quirch Foods Company 18. Rich Products Corporation 19. Kellogg Company 20. Mccain Foods Limited 21. Vandemoortele Nv 22. Kuppies 23. Bubba Foods 24. Cargill 25. Aryzta

1. Frozen Food Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Frozen Food Market: Dynamics 2.1. Frozen Food Market Trends by Region 2.1.1. North America Frozen Food Market Trends 2.1.2. Europe Frozen Food Market Trends 2.1.3. Asia Pacific Frozen Food Market Trends 2.1.4. Middle East and Africa Frozen Food Market Trends 2.1.5. South America Frozen Food Market Trends 2.2. Frozen Food Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Frozen Food Market Drivers 2.2.1.2. North America Frozen Food Market Restraints 2.2.1.3. North America Frozen Food Market Opportunities 2.2.1.4. North America Frozen Food Market Challenges 2.2.2. Europe 2.2.2.1. Europe Frozen Food Market Drivers 2.2.2.2. Europe Frozen Food Market Restraints 2.2.2.3. Europe Frozen Food Market Opportunities 2.2.2.4. Europe Frozen Food Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Frozen Food Market Drivers 2.2.3.2. Asia Pacific Frozen Food Market Restraints 2.2.3.3. Asia Pacific Frozen Food Market Opportunities 2.2.3.4. Asia Pacific Frozen Food Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Frozen Food Market Drivers 2.2.4.2. Middle East and Africa Frozen Food Market Restraints 2.2.4.3. Middle East and Africa Frozen Food Market Opportunities 2.2.4.4. Middle East and Africa Frozen Food Market Challenges 2.2.5. South America 2.2.5.1. South America Frozen Food Market Drivers 2.2.5.2. South America Frozen Food Market Restraints 2.2.5.3. South America Frozen Food Market Opportunities 2.2.5.4. South America Frozen Food Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Frozen Food Industry 2.8. Analysis of Government Schemes and Initiatives For Frozen Food Industry 2.9. Frozen Food Market price trend Analysis (2021-22) 2.10. Frozen Food Market Trade Analysis 2.10.1. Global Import Analysis 2.10.1.1. Top Importer of Frozen Food 2.10.2. Global Export Analysis 2.10.2.1. Top Exporter of Frozen Food 2.11. Frozen Food Production Analysis 2.12. The Global Pandemic Impact on Frozen Food Market 3. Frozen Food Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) 2022-2029 3.1. Frozen Food Market Size and Forecast, by Offering (2022-2029) 3.1.1. Fruits 3.1.2. Vegetables 3.1.3. Potato Products 3.1.4. Frozen Potato Products 3.1.5. Seafood 3.2. Frozen Food Market Size and Forecast, by End-User (2022-2029) 3.2.1. Food Service Industry 3.2.2. Retail Customers 3.2.3. 3.2.4. 3.3. Frozen Food Market Size and Forecast, by Product Category (2022-2029) 3.3.1. Ready-to-eat 3.3.2. Ready-to-cook 3.3.3. Ready-to-drink 3.3.4. Other Product Categories 3.4. Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 3.4.1. Individual Quick Freezing (IQF) 3.4.2. Blast Freezing 3.4.3. Belt Freezing 3.4.4. Other Freezing Techniques 3.5. Frozen Food Market Size and Forecast, by Region (2022-2029) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Frozen Food Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 4.1. North America Frozen Food Market Size and Forecast, by Offering (2022-2029) 4.1.1. Fruits 4.1.2. Vegetables 4.1.3. Potato Products 4.1.4. Frozen Potato Products 4.1.5. Seafood 4.2. North America Frozen Food Market Size and Forecast, by End-User (2022-2029) 4.2.1. Food Service Industry 4.2.2. Retail Customers 4.2.3. 4.2.4. 4.3. North America Frozen Food Market Size and Forecast, by Product Category (2022-2029) 4.3.1. Ready-to-eat 4.3.2. Ready-to-cook 4.3.3. Ready-to-drink 4.3.4. Other Product Categories 4.4. North America Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 4.4.1. Individual Quick Freezing (IQF) 4.4.2. Blast Freezing 4.4.3. Belt Freezing 4.4.4. Other Freezing Techniques 4.7. North America Frozen Food Market Size and Forecast, by Country (2022-2029) 4.5.1. United States 4.5.1.1. United States Frozen Food Market Size and Forecast, by Offering (2022-2029) 4.5.1.1.1. Fruits 4.5.1.1.2. Vegetables 4.5.1.1.3. Potato Products 4.5.1.1.4. Frozen Potato Products 4.5.1.1.5. Seafood 4.5.1.2. United States Frozen Food Market Size and Forecast, by End-User (2022-2029) 4.5.1.2.1. Food Service Industry 4.5.1.2.2. Retail Customers 4.5.1.2.3. 4.5.1.2.4. 4.5.1.3. United States Frozen Food Market Size and Forecast, by Product Category (2022-2029) 4.5.1.3.1. Ready-to-eat 4.5.1.3.2. Ready-to-cook 4.5.1.3.3. Ready-to-drink 4.5.1.3.4. Other Product Categories 4.5.1.4. United States Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 4.5.1.4.1. Individual Quick Freezing (IQF) 4.5.1.4.2. Blast Freezing 4.5.1.4.3. Belt Freezing 4.5.1.4.4. Other Freezing Techniques 4.5.2. Canada 4.5.2.1. Canada Frozen Food Market Size and Forecast, by Offering (2022-2029) 4.5.2.1.1. Fruits 4.5.2.1.2. Vegetables 4.5.2.1.3. Potato Products 4.5.2.1.4. Frozen Potato Products 4.5.2.1.5. Seafood 4.5.2.2. Canada Frozen Food Market Size and Forecast, by End-User (2022-2029) 4.5.2.2.1. Food Service Industry 4.5.2.2.2. Retail Customers 4.5.2.2.3. 4.5.2.2.4. 4.5.2.3. Canada Frozen Food Market Size and Forecast, by Product Category (2022-2029) 4.5.2.3.1. Ready-to-eat 4.5.2.3.2. Ready-to-cook 4.5.2.3.3. Ready-to-drink 4.5.2.3.4. Other Product Categories 4.5.2.4. Canada Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 4.5.2.4.1. Individual Quick Freezing (IQF) 4.5.2.4.2. Blast Freezing 4.5.2.4.3. Belt Freezing 4.5.2.4.4. Other Freezing Techniques 4.5.3. Mexico 4.5.3.1. Mexico Frozen Food Market Size and Forecast, by Offering (2022-2029) 4.5.3.1.1. Fruits 4.5.3.1.2. Vegetables 4.5.3.1.3. Potato Products 4.5.3.1.4. Frozen Potato Products 4.5.3.1.5. Seafood 4.5.3.2. Mexico Frozen Food Market Size and Forecast, by End-User (2022-2029) 4.5.3.2.1. Food Service Industry 4.5.3.2.2. Retail Customers 4.5.3.2.3. 4.5.3.2.4. 4.5.3.3. Mexico Frozen Food Market Size and Forecast, by Product Category (2022-2029) 4.5.3.3.1. Ready-to-eat 4.5.3.3.2. Ready-to-cook 4.5.3.3.3. Ready-to-drink 4.5.3.3.4. Other Product Categories 4.5.3.4. Mexico Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 4.5.3.4.1. Individual Quick Freezing (IQF) 4.5.3.4.2. Blast Freezing 4.5.3.4.3. Belt Freezing 4.5.3.4.4. Other Freezing Techniques 5. Europe Frozen Food Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 5.1. Europe Frozen Food Market Size and Forecast, by Offering (2022-2029) 5.2. Europe Frozen Food Market Size and Forecast, by End-User (2022-2029) 5.3. Europe Frozen Food Market Size and Forecast, by Product Category (2022-2029) 5.4. Europe Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 5.5. Europe Frozen Food Market Size and Forecast, by Country (2022-2029) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Frozen Food Market Size and Forecast, by Offering (2022-2029) 5.5.1.2. United Kingdom Frozen Food Market Size and Forecast, by End-User (2022-2029) 5.5.1.3. United Kingdom Frozen Food Market Size and Forecast, by Product Category(2022-2029) 5.5.1.4. United Kingdom Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 5.5.2. France 5.5.2.1. France Frozen Food Market Size and Forecast, by Offering (2022-2029) 5.5.2.2. France Frozen Food Market Size and Forecast, by End-User (2022-2029) 5.5.2.3. France Frozen Food Market Size and Forecast, by Product Category(2022-2029) 5.5.2.4. France Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 5.5.3. Germany 5.5.3.1. Germany Frozen Food Market Size and Forecast, by Offering (2022-2029) 5.5.3.2. Germany Frozen Food Market Size and Forecast, by End-User (2022-2029) 5.5.3.3. Germany Frozen Food Market Size and Forecast, by Product Category (2022-2029) 5.5.3.4. Germany Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 5.5.4. Italy 5.5.4.1. Italy Frozen Food Market Size and Forecast, by Offering (2022-2029) 5.5.4.2. Italy Frozen Food Market Size and Forecast, by End-User (2022-2029) 5.5.4.3. Italy Frozen Food Market Size and Forecast, by Product Category(2022-2029) 5.5.4.4. Italy Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 5.5.5. Spain 5.5.5.1. Spain Frozen Food Market Size and Forecast, by Offering (2022-2029) 5.5.5.2. Spain Frozen Food Market Size and Forecast, by End-User (2022-2029) 5.5.5.3. Spain Frozen Food Market Size and Forecast, by Product Category (2022-2029) 5.5.5.4. Spain Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 5.5.6. Sweden 5.5.6.1. Sweden Frozen Food Market Size and Forecast, by Offering (2022-2029) 5.5.6.2. Sweden Frozen Food Market Size and Forecast, by End-User (2022-2029) 5.5.6.3. Sweden Frozen Food Market Size and Forecast, by Product Category (2022-2029) 5.5.6.4. Sweden Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 5.5.7. Austria 5.5.7.1. Austria Frozen Food Market Size and Forecast, by Offering (2022-2029) 5.5.7.2. Austria Frozen Food Market Size and Forecast, by End-User (2022-2029) 5.5.7.3. Austria Frozen Food Market Size and Forecast, by Product Category (2022-2029) 5.5.7.4. Austria Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Frozen Food Market Size and Forecast, by Offering (2022-2029) 5.5.8.2. Rest of Europe Frozen Food Market Size and Forecast, by End-User (2022-2029) 5.5.8.3. Rest of Europe Frozen Food Market Size and Forecast, by Product Category (2022-2029) 5.5.8.4. Rest of Europe Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 6. Asia Pacific Frozen Food Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 6.1. Asia Pacific Frozen Food Market Size and Forecast, by Offering (2022-2029) 6.2. Asia Pacific Frozen Food Market Size and Forecast, by End-User (2022-2029) 6.3. Asia Pacific Frozen Food Market Size and Forecast, by Product Category (2022-2029) 6.4. Asia Pacific Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 6.5. Asia Pacific Frozen Food Market Size and Forecast, by Country (2022-2029) 6.7.1. China 6.5.1.1. China Frozen Food Market Size and Forecast, by Offering (2022-2029) 6.5.1.2. China Frozen Food Market Size and Forecast, by End-User (2022-2029) 6.5.1.3. China Frozen Food Market Size and Forecast, by Product Category (2022-2029) 6.5.1.4. China Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 6.5.2. S Korea 6.5.2.1. S Korea Frozen Food Market Size and Forecast, by Offering (2022-2029) 6.5.2.2. S Korea Frozen Food Market Size and Forecast, by End-User (2022-2029) 6.5.2.3. S Korea Frozen Food Market Size and Forecast, by Product Category (2022-2029) 6.5.2.4. S Korea Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 6.5.3. Japan 6.5.3.1. Japan Frozen Food Market Size and Forecast, by Offering (2022-2029) 6.5.3.2. Japan Frozen Food Market Size and Forecast, by End-User (2022-2029) 6.5.3.3. Japan Frozen Food Market Size and Forecast, by Product Category (2022-2029) 6.5.3.4. Japan Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 6.5.4. India 6.5.4.1. India Frozen Food Market Size and Forecast, by Offering (2022-2029) 6.5.4.2. India Frozen Food Market Size and Forecast, by End-User (2022-2029) 6.5.4.3. India Frozen Food Market Size and Forecast, by Product Category (2022-2029) 6.5.4.4. India Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 6.5.5. Australia 6.5.5.1. Australia Frozen Food Market Size and Forecast, by Offering (2022-2029) 6.5.5.2. Australia Frozen Food Market Size and Forecast, by End-User (2022-2029) 6.5.5.3. Australia Frozen Food Market Size and Forecast, by Product Category (2022-2029) 6.5.5.4. Australia Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 6.5.6. Indonesia 6.5.6.1. Indonesia Frozen Food Market Size and Forecast, by Offering (2022-2029) 6.5.6.2. Indonesia Frozen Food Market Size and Forecast, by End-User (2022-2029) 6.5.6.3. Indonesia Frozen Food Market Size and Forecast, by Product Category (2022-2029) 6.5.6.4. Indonesia Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 6.5.7. Malaysia 6.5.7.1. Malaysia Frozen Food Market Size and Forecast, by Offering (2022-2029) 6.5.7.2. Malaysia Frozen Food Market Size and Forecast, by End-User (2022-2029) 6.5.7.3. Malaysia Frozen Food Market Size and Forecast, by Product Category (2022-2029) 6.5.7.4. Malaysia Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 6.5.8. Vietnam 6.5.8.1. Vietnam Frozen Food Market Size and Forecast, by Offering (2022-2029) 6.5.8.2. Vietnam Frozen Food Market Size and Forecast, by End-User (2022-2029) 6.5.8.3. Vietnam Frozen Food Market Size and Forecast, by Product Category(2022-2029) 6.5.8.4. Vietnam Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 6.5.9. Taiwan 6.5.9.1. Taiwan Frozen Food Market Size and Forecast, by Offering (2022-2029) 6.5.9.2. Taiwan Frozen Food Market Size and Forecast, by End-User (2022-2029) 6.5.9.3. Taiwan Frozen Food Market Size and Forecast, by Product Category (2022-2029) 6.5.9.4. Taiwan Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Frozen Food Market Size and Forecast, by Offering (2022-2029) 6.5.10.2. Rest of Asia Pacific Frozen Food Market Size and Forecast, by End-User (2022-2029) 6.5.10.3. Rest of Asia Pacific Frozen Food Market Size and Forecast, by Product Category (2022-2029) 6.5.10.4. Rest of Asia Pacific Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 7. Middle East and Africa Frozen Food Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 7.1. Middle East and Africa Frozen Food Market Size and Forecast, by Offering (2022-2029) 7.2. Middle East and Africa Frozen Food Market Size and Forecast, by End-User (2022-2029) 7.3. Middle East and Africa Frozen Food Market Size and Forecast, by Product Category (2022-2029) 7.4. Middle East and Africa Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 7.5. Middle East and Africa Frozen Food Market Size and Forecast, by Country (2022-2029) 7.5.1. South Africa 7.5.1.1. South Africa Frozen Food Market Size and Forecast, by Offering (2022-2029) 7.5.1.2. South Africa Frozen Food Market Size and Forecast, by End-User (2022-2029) 7.5.1.3. South Africa Frozen Food Market Size and Forecast, by Product Category (2022-2029) 7.5.1.4. South Africa Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 7.5.2. GCC 7.5.2.1. GCC Frozen Food Market Size and Forecast, by Offering (2022-2029) 7.5.2.2. GCC Frozen Food Market Size and Forecast, by End-User (2022-2029) 7.5.2.3. GCC Frozen Food Market Size and Forecast, by Product Category (2022-2029) 7.5.2.4. GCC Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 7.5.3. Nigeria 7.5.3.1. Nigeria Frozen Food Market Size and Forecast, by Offering (2022-2029) 7.5.3.2. Nigeria Frozen Food Market Size and Forecast, by End-User (2022-2029) 7.5.3.3. Nigeria Frozen Food Market Size and Forecast, by Product Category (2022-2029) 7.5.3.4. Nigeria Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Frozen Food Market Size and Forecast, by Offering (2022-2029) 7.5.4.2. Rest of ME&A Frozen Food Market Size and Forecast, by End-User (2022-2029) 7.5.4.3. Rest of ME&A Frozen Food Market Size and Forecast, by Product Category (2022-2029) 7.5.4.4. Rest of ME&A Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 8. South America Frozen Food Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 8.1. South America Frozen Food Market Size and Forecast, by Offering (2022-2029) 8.2. South America Frozen Food Market Size and Forecast, by End-User (2022-2029) 8.3. South America Frozen Food Market Size and Forecast, by Product Category(2022-2029) 8.4. South America Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 8.5. South America Frozen Food Market Size and Forecast, by Country (2022-2029) 8.5.1. Brazil 8.5.1.1. Brazil Frozen Food Market Size and Forecast, by Offering (2022-2029) 8.5.1.2. Brazil Frozen Food Market Size and Forecast, by End-User (2022-2029) 8.5.1.3. Brazil Frozen Food Market Size and Forecast, by Product Category (2022-2029) 8.5.1.4. Brazil Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 8.5.2. Argentina 8.5.2.1. Argentina Frozen Food Market Size and Forecast, by Offering (2022-2029) 8.5.2.2. Argentina Frozen Food Market Size and Forecast, by End-User (2022-2029) 8.5.2.3. Argentina Frozen Food Market Size and Forecast, by Product Category (2022-2029) 8.5.2.4. Argentina Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Frozen Food Market Size and Forecast, by Offering (2022-2029) 8.5.3.2. Rest Of South America Frozen Food Market Size and Forecast, by End-User (2022-2029) 8.5.3.3. Rest Of South America Frozen Food Market Size and Forecast, by Product Category (2022-2029) 8.5.3.4. Rest Of South America Frozen Food Market Size and Forecast, by Freezing Technique (2022-2029) 9. Global Frozen Food Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Production of 2022 9.3.6. Company Locations 9.4. Leading Frozen Food Market Companies, by market capitalization 9.5. Analysis of Organized and Unorganized Key Players in Frozen Food Industry 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Nestle 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. General Mills Inc. 10.3. Ajinomoto Co., Inc. 10.4. Iceland Foods Ltd. 10.5. Mc Cain foods 10.6. ConAgra Foods Inc. 10.7. Maple Leaf Foods Inc. 10.8. BRF SA 10.9. Tyson Foods Inc. 10.10. Mother Dairy Fruit & Vegetable Pvt. Ltd. 10.11. Pinnacle Foods Inc. 10.12. Kraft Foods Inc. 10.13. Unilever PLC 10.14. Amy's Kitchen, Inc. 10.15. H. J. Heinz Company. 10.16. The Schwan Food Company 10.17. Quirch Foods Company 10.18. Rich Products Corporation 10.19. Kellogg Company 10.20. Mccain Foods Limited 10.21. Vandemoortele Nv 10.22. Kuppies 10.23. Bubba Foods 10.24. Cargill 10.25. Aryzta 11. Key Findings 12. Industry Recommendations 13. Frozen Food Market: Research Methodology 14. Terms and Glossary