The Surimi Market was valued at USD 4.10 billion in 2023 and is expected to grow to USD 6.26 billion by 2030, at a CAGR of 6.2%.Surimi Market Overview

The Surimi Market is one of the fastest-growing segment in the global seafood sector. Surimi is a type of seafood that composed of minced fish or molluscs. It is used in variety of cuisines as an ingredient. The growth of the surimi market driven by various factors such as changing dietary trends, Growing demand for seafood products, and Growing popularity of processed seafood products. Surimi is utilized as a raw material for imitation seafood products, including crab sticks, shrimps, and lobsters. It can be employed as a substitute for high-priced seafood and is widely consumed in various cuisines worldwide. Food companies typically use protease inhibitors in many surimi products to preserve the stability of the gel. Restaurants are increasingly choosing surimi as an ingredient in a variety of seafood & meat products because of superior gelling properties, fat emulsifying properties and water-binding properties. Some of the end user segments in the market are residential & commercial consumers. The key B2C channel in the market for surimi are modern trade, online retailers and specialty stores.To know about the Research Methodology :- Request Free Sample Report The major key players of surimi market are American Seafood’s Group, Apitoon Group, Aquamar Inc (Lm Foods LLC), Gadre Marine Pvt. Ltd., Glacier Fish Company LLC, Ocean Food Company Ltd., OceanFood Sales Ltd., Pacific Seafood Group, Russian Fishery Company LLC, Seaprimexco Vietnam, Thong Siek Global, Trident Seafood’s Corporation, Viciunai Group, etc. and others. These companies produce, sell, and distribute surimi to different markets worldwide. They sell a variety of surimi items, such as imitation crab sticks and fish cakes and fish balls, as well as other processed seafood items.

Surimi Market Scope and Research Methodology

The report highlights the competitive market view, segment analysis based on the Type, Source, Distribution Channel and Region. First, the market overview describes the market trends, key market drivers, market restraints, opportunities, and challenges for the Surimi Market. The Market is segmented by the type such as frozen surimi, chilled surimi and fresh surimi. It is segmented by Source such as Tropical and Cold Water. Market also segmented by Distribution Channel including B2B and B2C. The market size and trends for the Surimi Market were analysed by using both primary and secondary data. Top down approach is used to estimate market size of the Surimi Market. Market projections were based on historical data, present sector developments, and future market opportunities and challenges. The SWOT analysis of the major market players, which included their strengths, weaknesses, opportunities, and threats, was also included in the research to provide a thorough knowledge of the market dynamics. By employing the PESTLE analysis, the operating environment of an organization can be assessed. Porter's analysis were used to identify crucial factors that directly affect market profitability.Surimi Market Dynamics

Market Drivers

Growing demand for seafood products The market for surimi is experiencing a surge due to the growing demand for seafood products. As people strive for healthier and more convenient sources of protein. Surimi is a versatile seafood product that provides a lean protein substitute to traditional seafood, while also catering to dietary needs and allergies. Its versatility in various cuisines, especially Asian cuisine, and its enhanced flavor and texture have made it a popular choice. In addition, sustainability, convenience and availability in emerging markets have contributed to its growth, reflecting the global demand for seafood alternatives. Growing popularity of processed seafood products Due to increasing demand for processed seafood products, the popularity of surimi products increases due to its versatility and affordability. Surimi is an essential ingredient in processed seafood products like imitation crab stick, seafood salads and seafood spreads due to its unique texture and flavor. Consumers are increasingly looking for edible and convenient seafood, and surimi-based products offer the perfect balance between cost and convenience. Surimi’s ability to replicate the flavor and texture of high-end seafood products makes it an attractive option for manufacturers and consumers alike, which is why it is driving the demand for processed seafood in the market. Changing dietary trends Surimi products are in high demand due to changing dietary trends. Health-conscious consumers are looking for alternatives to high-fat and high-calorie sources. People are increasingly aware of the need to reduce saturated fats and maintain a balanced diet. Surimi offers a delicious, guilt-free options for seafood that can be added to a variety of dishes. Its low fat, high protein content resonates well with people who are looking for healthier options. Surimi’s versatility also makes it suitable for a variety of dietary plans. For example if you are on gluten-free diet or following low-carb diet, then surimi is a great option to add to your diet. Consumers are increasingly looking for healthier eating habits combined with a desire for delicious, convenient seafood option. As a result, surimi products are thriving in today’s dietary landscape. Market Trends Introduction of new surimi products The introduction of new surimi products is a notable trend in the surimi market. To meet changing consumer preferences and lifestyles, manufacturers and food industries are constantly launching unique surimi-based products. Surimi producers are constantly innovating and diversifying their products to meet changing consumer needs. For example Surimi-based hamburgers and patties are becoming more popular due to increasing demand for plant and seafood based options I the fast food industry. Additionally, flavoured surimi sticks are being introduced to meet the needs of consumers who are looking for a unique and convenient snack option. Surimi noodles, which are similar to traditional pasta, are becoming more popular among health-conscious and dietary restrictions alike due to their lower-carbohydrates and high-protein content. These new surimi products are not only expanding the market’s appeal, but also demonstrating the versatility and ability of surimi to meet a wide range of culinary and dietary requirements. Convenience of surimi products Convenience is one of the most popular trends in the Surimi market. Surimi products are easy to use and easy to prepare, making them popular with consumers looking for quick and easy meal solutions. Sushi-grade surimi products like pre-cooked crab stick, seafood salad kits and more make it much easier to prepare seafood at home. Ready-to-eat surimi products also cater to the modern lifestyle where you can enjoy seafood flavors on the go without having to spend hours cooking and planning meals. This convenience trend has resulted in the development of surimi snacks, wraps and meal kits that cater to the need for quick and easy dining options in today’s fast-paced world.Market Opportunities

The diversification of products on the surimi market offers companies the opportunity to expand their product range and respond to even wider consumer preferences. By developing a variety of surimi-based products beyond the traditional imitation crab sticks, such as surimi burgers, seafood salads, sushi-grade surimi, or flavored surimi snacks, companies can tap into different market segments and culinary applications. This diversification not only attracts consumers seeking novel and convenient seafood options but also allows companies to differentiate themselves in a competitive market, driving consumer engagement and potentially increasing market share. Furthermore, it enables companies to adapt to evolving dietary trends, making surimi a versatile and adaptable ingredient in various cuisines and culinary contexts. One of the advantage of surimi is that it is low in fat and high in protein. As people become healthier, there will be an opportunity to promote surimi as a better source of protein. Companies can create and sell surimi products to meet the nutritional needs of consumers who want to eat a balanced diet. Company can create surimi product line of vegan and gluten-free surimi products. This would cater to increasing number of people on these diets. Companies can expand into new areas, such as emerging markets or online food delivery. In emerging markets, the economy is growing at a faster rate and disposable income is increasing which is increasing the demand for surimi products. Online food delivery is also growing. Surimi is an affordable and convenient seafood product that is perfect for online food delivery. Market Restraints/Challenges High production costs Surimi production is one of the most competitive in the market due to high production costs. Surimi production requires a lot of labour and resources, such as fish sourcing, washing and deboning, and surimi paste extraction, which requires high-tech equipment and skilled labour. Furthermore, the production of surimi often involves the use of certain fish species, which may fluctuate in availability and price. Environmental and sustainability issues, such as overexploitation, can also increase production costs when using sustainable sourcing practices. Companies need to invest in technology and quality control, as well as sustainable sourcing, in order to effectively manage high production costs while maintaining competitive prices in the market. Competition from other seafood products Surimi is in direct competition with other seafood products such as fresh, frozen, and canned. Surimi manufacturers need to differentiate their products and make them more appealing to consumers. Consumers are offered a variety of choices, each with its own unique taste, texture and health benefits. Furthermore, some customers prefer the natural taste of seafood over the processed nature of surimi. To remain competitive, surimi companies must remain innovative and emphasize the advantages of their products, such as convenience, versatility and affordability, in order to remain ahead of the competition in the wider seafood market. Fluctuations in fish prices Surimi production depends on certain types of fish such as Alaskan Pollock. Fish prices can vary due to a number of factors such as the environment, fishing quotas and demand. If prices increases it will increase surimi production cost. If prices rise, this may increase surimi production costs. This can affect profit margins and in turn increase the prices of surimi products. In today's market, fluctuating fish prices are a big challenge for dying companies.Surimi Market Segmentation

By Type On the basis of type Surimi Market is segmented into Frozen surimi, chilled surimi and fresh surimi. The Frozen surimi segment dominates the Surimi Market with 70% market share and expected to increase at 7% CAGR during forecasted period. Frozen surimi has longer shelf life than Fresh and Chilled surimi, which makes it more convenient for consumers who prefer to store frozen products for future consumption. Additionally frozen surimi is widely available than others in many locations, and more accessible for customers. Advancement in freezing and packaging technology has also contributed to the preservation of the quality and flavour of frozen surimi products, which will help the growth of the surimi market in next years. By Source Based on the source Surimi market is segmented into Tropical and Cold Water. The tropical segment dominated the market in 2023 and is projected to remain the most prominent during the forecast period. This segment attracts consumers who are looking for a cost-effective way to enjoy seafood because it is cheaper than other seafood. Additionally, tropical surimi utilizes fish species that are abundant in tropical regions, thus providing a more sustainable alternative to traditional seafood. Therefore, the total amount of tropical fish is likely to contribute to the higher market share of this segment.By Distribution Channel On the basis of Distribution channel Surimi Market is segmented into Business to Business (B2B) and Business to Customer (B2C). The Business to Business (B2B) segment accounted for more than half of the global market and expected to maintain its dominance during forecasted period. This is because of growing demand from food processing industry, increasing popularity of surimi in HoReCa Sectorand growing demand from the developing market. Surimi is widely used in various industries, such as food services and animal feed, as well as food processing. Surimi is cost-effective and versatile and used in various types of seafood dishes such as sushi, seafood salads and soups. On the other hand, B2C segment is expected grow during forecasted period. B2C is divided into Hypermarkets & Supermarkets, Convenience Stores, Online, and Others. In 2023, the hypermarkets & supermarket segment accounted for approximately 30% of the B2C market. This is due to a larger product range than other retail outlets and the inclusion of frozen surimi in the frozen seafood section of their stores. The online segment is projected to have the highest CAGR at 8% during the same period.

Regional Insights

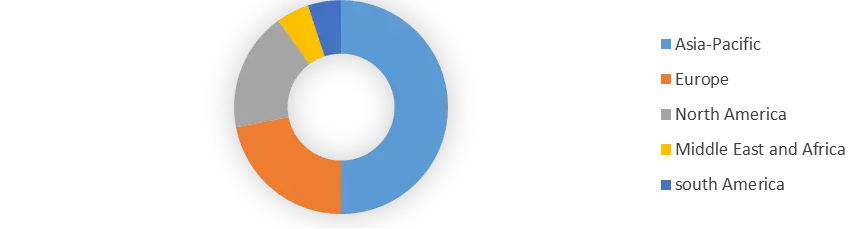

In 2023, Asia Pacific region dominates the surimi market with 50% of market share and expected to maintain its dominance during forecasted period. Surimi is extremely popular product in Asia-Pacific due to its cost-effectiveness, adoptability and taste. Surimi products get widespread acceptance in this region because, seafood industry has actively promoted and marketed surimi products in Asia-Pacific region. Surimi based snacks such as fish balls, crab sticks and kamaboko are frequently added to meals as a source of protein in many parts of Asia. The Asia-Pacific area is dominated by China, which is a major consumer of surimi due to its vast population, rising standard of living, and increasing urbanization. Other major markets in this region are Japan, Korea and Southeast Asia are also significant consumers of surimi. Europe has emerged as the second largest region in the market for surimi Europe is increasingly health conscious and surimi is seen as a healthy source of protein as it is low in fat and high in protein. The demand for seafood based dishes and sushi is high in European countries, where surimi is often used in the form of sushi rolls or seafood salads. The need for convenience is high in Europe, where people are looking for ready to eat and quick meals solutions. Lastly, Europe’s diverse culinary landscape means that surimi is used in a wide variety of dishes, such as sandwiches, wraps and appetizers. All of these factors combine to make Europe the second largest region for surimi after Asia-pacific.Surimi Market, By Region in 2023 (in %)

Competitive landscape

Surimi is one of the most competitive products in the market. There are many players in the market, ranging from global seafood companies to food manufacturers and regional players. The main players in the market compete through product innovation, quality improvement, and geographic expansion. Many players aim to develop surimi products with better texture, taste and nutritional value to meet the changing preferences of consumers for healthier and authentic alternatives. Key market players frequently depend on partnerships, collaborations, and acquisitions to expand their market presence. They invest in effective supply chain management to maintain a stable supply of raw material for the production of surimi. Marketing and promotional activities play an essential role in increasing customer awareness and acceptance of surimi-based products. The major key players are Viciunai Group (Lithuania), Trans-Ocean Products (USA), Seaprimexco Vietnam (Vietnam), Thong Siek Global (Thailand), Gadre Marine (India), Ocean More Foods Co., Ltd. (China), APITOON (Thailand), Luck Union Foods (Thailand), Sugiyo Co., Ltd. (Japan), Aquamar Inc. (Canada), Fujimitsu Corporation (Japan), SeaPak (USA). These companies produce and sell surimi products all over the world. They sell various types of surimi, including frozen, chilled, and fresh. They also sell different types of surimi in different flavorings and textures. These companies produce and sell surimi products all over the world. They sell various types of surimi, including frozen, chilled, and fresh. They also sell different types of surimi in different flavorings and textures. The Vicinai Group is renowned for its surimi production and distribution, with products being exported to more than 60 countries worldwide. Additionally, the company is well-known for its superior quality surimi and its capacity to develop innovative products. Other prominent players in the Surimi market include Seaprimexco Vietnam, which exports surimi to more than 30 countries worldwide, and ThongSiek Global, which is a leading surimi producer in Thailand. Both of these companies are renowned for their affordability and comprehensive product offerings.Scope Of Surimi Market: Inquire Before Buying

Global Surimi Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2024: US $ 4.10 Bn. Forecast Period 2024 to 2030 CAGR: 6.2% Market Size in 2030: US $ 6.26 Bn. Segments Covered: by Type Frozen surimi Chilled surimi Fresh surimi by Source Tropical Cold Water by Distribution Channel B2B B2C Surimi Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Surimi Market, Key Players are

1. Viciunai Group (Lithuania) 2. Trans-Ocean Products (USA) 3. Seaprimexco Vietnam (Vietnam) 4. Thong Siek Global (Thailand) 5. Gadre Marine (India) 6. Ocean More Foods Co., Ltd. (China) 7. APITOON (Thailand) 8. Luck Union Foods (Thailand) 9. Sugiyo Co., Ltd. (Japan) 10. Aquamar Inc. (Canada) 11. Fujimitsu Corporation (Japan) 12. SeaPak (USA)Frequently Asked Questions:

1] What segments are covered in the Global Surimi Market report? Ans. The segments covered in the Surimi Market report are based on Type, Distribution channel, Source and Region. 2] Which region dominated the Global Surimi Market in 2023? Ans. The Asia Pacific region dominated the global Surimi Market in 2023. 3] What is the market size of the Global Surimi Market by 2030? Ans. The market size of the Surimi Market by 2030 is expected to reach USD 6.26 Billion. 4] What is the forecast period for the Global Surimi Market? Ans. The forecast period for the Surimi Market is 2024-2030. 5] What was the market size of the Global Surimi Market in 2023? Ans. The market size of the Surimi Market in 2023 was valued at USD 4.10 Billion

1. Surimi Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Surimi Market: Dynamics 2.1. Surimi Market Trends by Region 2.1.1. Global Surimi Market Trends 2.1.2. North America Surimi Market Trends 2.1.3. Europe Surimi Market Trends 2.1.4. Asia Pacific Surimi Market Trends 2.1.5. Middle East and Africa Surimi Market Trends 2.1.6. South America Surimi Market Trends 2.1.7. Preference Analysis 2.2. Surimi Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Surimi Market Drivers 2.2.1.2. North America Surimi Market Restraints 2.2.1.3. North America Surimi Market Opportunities 2.2.1.4. North America Surimi Market Challenges 2.2.2. Europe 2.2.2.1. Europe Surimi Market Drivers 2.2.2.2. Europe Surimi Market Restraints 2.2.2.3. Europe Surimi Market Opportunities 2.2.2.4. Europe Surimi Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Surimi Market Drivers 2.2.3.2. Asia Pacific Surimi Market Restraints 2.2.3.3. Asia Pacific Surimi Market Opportunities 2.2.3.4. Asia Pacific Surimi Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Surimi Market Drivers 2.2.4.2. Middle East and Africa Surimi Market Restraints 2.2.4.3. Middle East and Africa Surimi Market Opportunities 2.2.4.4. Middle East and Africa Surimi Market Challenges 2.2.5. South America 2.2.5.1. South America Surimi Market Drivers 2.2.5.2. South America Surimi Market Restraints 2.2.5.3. South America Surimi Market Opportunities 2.2.5.4. South America Surimi Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. Global 2.7.2. North America 2.7.3. Europe 2.7.4. Asia Pacific 2.7.5. Middle East and Africa 2.7.6. South America 2.8. Key Opinion Leader Analysis For Allogeneic Cell Therapy Industry 2.9. Analysis of Government Schemes and Initiatives For Surimi Industry 2.10. The Global Pandemic Impact on Surimi Market 2.11. Surimi Price Trend Analysis (2021-22) 2.12. Global Surimi Market Trade Analysis (2017-2022) 2.12.1. Global Import of Surimi 2.12.1.1. Ten Largest Importer 2.12.2. Global Export of Surimi 2.12.3. Ten Largest Exporter 2.13. Production Capacity Analysis 2.13.1. Chapter Overview 2.13.2. Key Assumptions and Methodology 2.13.3. Surimi Manufacturers: Global Installed Capacity 3. Surimi Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2023-2030) 3.1. Surimi Market Size and Forecast, by Type (2023-2030) 3.1.1. Frozen surimi 3.1.2. Chilled surimi 3.1.3. Fresh surimi 3.2. Surimi Market Size and Forecast, by Source (2023-2030) 3.2.1. Tropical 3.2.2. Cold Water 3.3. Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 3.3.1. B2B 3.3.2. B2C 3.4. Surimi Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Surimi Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 4.1. North America Surimi Market Size and Forecast, by Type (2023-2030) 4.1.1. Frozen surimi 4.1.2. Chilled surimi 4.1.3. Fresh surimi 4.2. North America Surimi Market Size and Forecast, by Source (2023-2030) 4.2.1. Tropical 4.2.2. Cold Water 4.3. North America Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1. B2B 4.3.2. B2C 4.4. North America Surimi Market Size and Forecast, by Country (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 4.4.6. United States 4.4.6.1. United States Surimi Market Size and Forecast, by Type (2023-2030) 4.4.6.1.1. Frozen surimi 4.4.6.1.2. Chilled surimi 4.4.6.1.3. Fresh surimi 4.4.6.2. United States Surimi Market Size and Forecast, by Source (2023-2030) 4.4.6.2.1. Tropical 4.4.6.2.2. Cold Water 4.4.6.3. United States Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.6.3.1. B2B 4.4.6.3.2. B2C 4.4.7. Canada 4.4.7.1. Canada Surimi Market Size and Forecast, by Type (2023-2030) 4.4.7.1.1. Frozen surimi 4.4.7.1.2. Chilled surimi 4.4.7.1.3. Fresh surimi 4.4.7.2. Canada Surimi Market Size and Forecast, by Source (2023-2030) 4.4.7.2.1. Tropical 4.4.7.2.2. Cold Water 4.4.7.3. Canada Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.7.3.1. B2B 4.4.7.3.2. B2C 4.4.8. Mexico 4.4.8.1. Mexico Surimi Market Size and Forecast, by Type (2023-2030) 4.4.8.1.1. Frozen surimi 4.4.8.1.2. Chilled surimi 4.4.8.1.3. Fresh surimi 4.4.8.2. Mexico Surimi Market Size and Forecast, by Source (2023-2030) 4.4.8.2.1. Tropical 4.4.8.2.2. Cold Water 4.4.8.3. Mexico Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.8.3.1. B2B 4.4.8.3.2. B2C 5. Europe Surimi Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 5.1. Europe Surimi Market Size and Forecast, by Type (2023-2030) 5.2. Europe Surimi Market Size and Forecast, by Source (2023-2030) 5.3. Europe Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 5.4. Europe Surimi Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Surimi Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Surimi Market Size and Forecast, by Source (2023-2030) 5.4.1.3. United Kingdom Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.2. France 5.4.2.1. France Surimi Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Surimi Market Size and Forecast, by Source (2023-2030) 5.4.2.3. France Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Surimi Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Surimi Market Size and Forecast, by Source (2023-2030) 5.4.3.3. Germany Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Surimi Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Surimi Market Size and Forecast, by Source (2023-2030) 5.4.4.3. Italy Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Surimi Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Surimi Market Size and Forecast, by Source (2023-2030) 5.4.5.3. Spain Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Surimi Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Surimi Market Size and Forecast, by Source (2023-2030) 5.4.6.3. Sweden Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Surimi Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Surimi Market Size and Forecast, by Source (2023-2030) 5.4.7.3. Austria Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Surimi Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Surimi Market Size and Forecast, by Source (2023-2030) 5.4.8.3. Rest of Europe Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Surimi Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Surimi Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Surimi Market Size and Forecast, by Source (2023-2030) 6.3. Asia Pacific Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 6.4. Asia Pacific Surimi Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Surimi Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Surimi Market Size and Forecast, by Source (2023-2030) 6.4.1.3. China Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Surimi Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Surimi Market Size and Forecast, by Source (2023-2030) 6.4.2.3. S Korea Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Surimi Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Surimi Market Size and Forecast, by Source (2023-2030) 6.4.3.3. Japan Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.4. India 6.4.4.1. India Surimi Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Surimi Market Size and Forecast, by Source (2023-2030) 6.4.4.3. India Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Surimi Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Surimi Market Size and Forecast, by Source (2023-2030) 6.4.5.3. Australia Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Surimi Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Surimi Market Size and Forecast, by Source (2023-2030) 6.4.6.3. Indonesia Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Surimi Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Surimi Market Size and Forecast, by Source (2023-2030) 6.4.7.3. Malaysia Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Surimi Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Surimi Market Size and Forecast, by Source (2023-2030) 6.4.8.3. Vietnam Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.8.4. Vietnam Surimi Market Size and Forecast, by Industry Vertical(2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Surimi Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Surimi Market Size and Forecast, by Source (2023-2030) 6.4.9.3. Taiwan Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Surimi Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Surimi Market Size and Forecast, by Source (2023-2030) 6.4.10.3. Rest of Asia Pacific Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Surimi Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 7.1. Middle East and Africa Surimi Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Surimi Market Size and Forecast, by Source (2023-2030) 7.3. Middle East and Africa Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 7.4. Middle East and Africa Surimi Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Surimi Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Surimi Market Size and Forecast, by Source (2023-2030) 7.4.1.3. South Africa Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Surimi Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Surimi Market Size and Forecast, by Source (2023-2030) 7.4.2.3. GCC Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Surimi Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Surimi Market Size and Forecast, by Source (2023-2030) 7.4.3.3. Nigeria Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Surimi Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Surimi Market Size and Forecast, by Source (2023-2030) 7.4.4.3. Rest of ME&A Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Surimi Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 8.1. South America Surimi Market Size and Forecast, by Type (2023-2030) 8.2. South America Surimi Market Size and Forecast, by Source (2023-2030) 8.3. South America Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 8.4. South America Surimi Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Surimi Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Surimi Market Size and Forecast, by Source (2023-2030) 8.4.1.3. Brazil Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Surimi Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Surimi Market Size and Forecast, by Source (2023-2030) 8.4.2.3. Argentina Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Surimi Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Surimi Market Size and Forecast, by Source (2023-2030) 8.4.3.3. Rest Of South America Surimi Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Surimi Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Type Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.3.6. SKU Details 9.3.7. Production Capacity 9.3.8. Production for 2022 9.3.9. No. of Stores 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Surimi Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Viciunai Group (Lithuania) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Trans-Ocean Products (USA) 10.3. Seaprimexco Vietnam (Vietnam) 10.4. Thong Siek Global (Thailand) 10.5. Gadre Marine (India) 10.6. Ocean More Foods Co., Ltd. (China) 10.7. APITOON (Thailand) 10.8. Luck Union Foods (Thailand) 10.9. Sugiyo Co., Ltd. (Japan) 10.10. Aquamar Inc. (Canada) 10.11. Fujimitsu Corporation (Japan) 10.12. SeaPak (USA) 11. Key Findings 12. Industry Recommendations 13. Surimi Market: Research Methodology 14. Terms and Glossary