Global Organic Eggs Market size was valued at USD 3.9 Bn. in 2022 and the total revenue of Organic Eggs is expected to grow by 12.3% from 2023 to 2029, reaching nearly USD 8.78 Bn.Organic Eggs Market Overview:

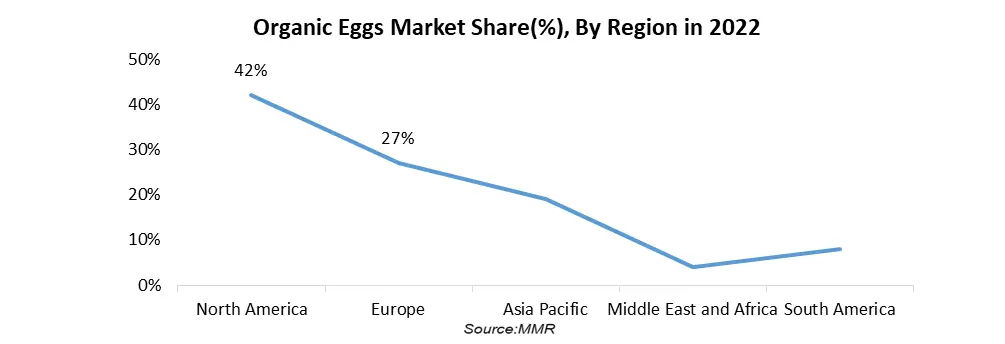

Eggs classified as organic are laid by hens with the freedom to roam outdoors during the day, and they are securely housed in sheds at night. The primary distinction between organic and free-range eggs lies in the fact that organic eggs are produced without the use of any chemicals. The demand for organic eggs is increasing due to the pervasive shift towards health-conscious lifestyles. As consumers actively seek organic and natural food alternatives, organic eggs emerge as a preferred choice. The market benefits from the widespread perception that organic eggs offer a healthier option, characterized by lower pesticide residues and a higher nutrient content. This consumer health awareness is a pivotal driver influencing purchasing decisions and contributing to the market's overall growth.To know about the Research Methodology :- Request Free Sample Report North America region is leading the organic eggs market in the year 2022 with a market share of 42%. The adoption of organic farming methods is seen as a pivotal response to the increasing emphasis on sustainability and eco-friendly agricultural practices. The hypermarkets and Supermarkets category in distribution channel segment dominated the market. Major market players such as DQY Ecological, Michael Foods Inc., Plunkon Food Group, etc are the major contributor and prominent player in the organic eggs market, known for its commitment to ecological and sustainable practices. Increasing Consumer Demand for Organic Products, and Health Consciousness among consumers drive the market Economic factors and heightened environmental consciousness are propelling consumers towards organic alternatives, contributing to the organic eggs market's growth. The market growth factors include the perceived health benefits of organic eggs, such as lower pesticide residues and higher nutrient content. The market is driven by health-conscious consumers seeking superior food options. The premium price of organic eggs reflects factors like their nutritional superiority, contributing to the organic eggs market potential. This trend is evident in the US, China, and Europe. Ethical treatment of animals influences market shifts, with consumers preferring organic eggs associated with improved living conditions for hens. Market growth factors include consumer sentiment towards human practices, positioning organic eggs favorably in the marketplace. Economic factors and market growth factors align as consumers prioritize sustainable and eco-friendly practices, favoring organic eggs. The market share in Europe, where environmental considerations play a crucial role, indicates the strong appeal of organic eggs. Collaboration with Retail Chains, Online Retailing, and Invention in Product Offerings to create opportunities for market growth The organic eggs market has significant potential in the US, Canada, and Mexico, with market penetration expected to grow as demand rises. Collaborations with large retail chains create opportunities for expanded distribution channels and increased market share. Innovation in Product Offerings: Market potential in the US and Europe lies in diversifying organic egg products. Innovations such as omega-3-enriched eggs cater to evolving consumer preferences, presenting opportunities for differentiation. Online Retailing: Economic factors and the rise of e-commerce provide an avenue for organic egg producers to capitalize on the online retailing trend. This offers accessibility and convenience for consumers, contributing to market growth. Collaboration with Retail Chains: Collaborations present opportunities for market expansion and increased market share. Organic egg producers can tap into mainstream markets through partnerships with large retail chains, enhancing product visibility. Limited Awareness and Supply Chain Challenges hampers the market growth The organic eggs market faces constraints due to the higher cost associated with organic farming practices. Economic factors influencing organic eggs price may deter price-sensitive consumers from widespread adoption. Market constraints arise from scalability challenges in organic farming methods, leading to fluctuations in availability. Effective supply chain management is crucial to meet demand while maintaining product quality. Limited awareness in certain regions hampers market growth. Market penetration strategies, including targeted marketing and educational initiatives, are essential to broaden consumer understanding. Stringent organic certification requirements pose challenges for small-scale producers. Regulatory compliance complexities influence market shifts, demanding effective navigation to thrive in the organic eggs market.

Organic Eggs Market Segment Analysis

Based on the Distribution Channel, The hypermarkets and Supermarkets category dominated the market in the year 2022 and is expected to dominate the market during the forecast period. These large-format retail establishments play a pivotal role in distributing organic eggs, strategically positioning themselves for wide-scale accessibility and enhanced product visibility. Their influence extends across diverse consumer demographics, as Hypermarkets and Supermarkets offer convenience and a variety of organic egg products, effectively penetrating the market.The Online channel is growing rapidly in the industry segmentation for organic eggs distribution. The surge of e-commerce platforms has transformed the distribution landscape, providing consumers with convenient access to organic eggs. Producers leverage online platforms to reach a broader target market, enabling direct product delivery to consumers' doorsteps. The Online channel's prominence underscores its relevance in reaching tech-savvy consumers seeking hassle-free organic egg purchases. In the target market analysis of the organic eggs industry, Hypermarkets & Supermarkets, along with the Online channel, take center stage as primary distribution channels. These channels strategically cater to the preferences of a diverse consumer base. Convenience Stores also play a notable role by providing quick and accessible organic egg purchases, targeting consumers with on-the-go lifestyles. This diversified approach aligns with the varied needs of different consumer demographics. Consumer demographics and product segmentation play a crucial role in the distribution landscape of organic eggs.

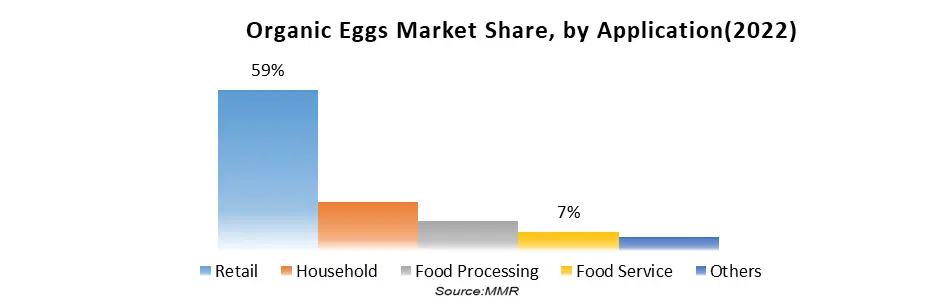

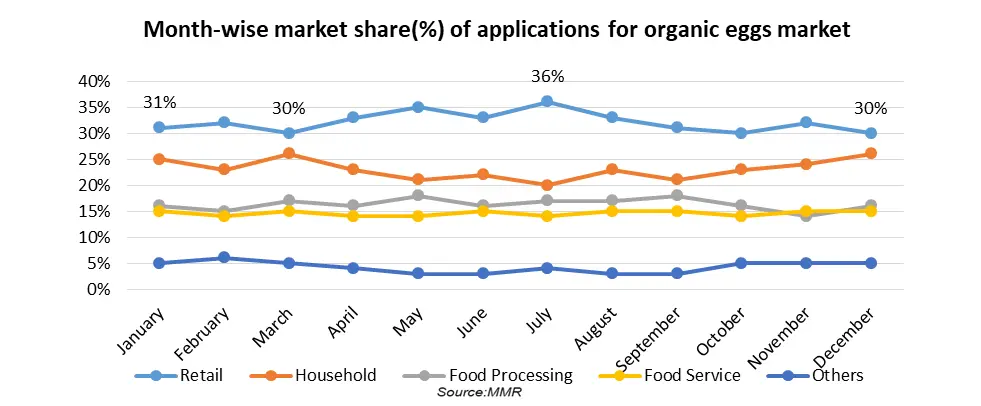

Based on the Application, The retail sector in the organic eggs market holds a significant market share by segment. Consumers frequently opt to purchase organic eggs directly from retail outlets, such as supermarkets, grocery stores, and specialty organic food stores. This segment's growth analysis reveals a consistent demand for organic eggs in the retail space, driven by consumer preferences for sustainable and high-quality food products. The retail application's segment attractiveness lies in its direct accessibility to individual consumers, providing a diverse array of choices and packaging options for organic eggs. The household segment not only represents individual consumers seeking organic eggs for personal consumption but also contributes significantly to market share by segment. Consumers within this segment often make direct purchases from local markets, farmer’s markets, or through subscription services, reflecting a consistent demand for high-quality, organic eggs for daily consumption at home. The segment growth analysis indicates a stable and ongoing preference for organic eggs in the household application. The food processing application, while serving a distinct market need, contributes to market share by segment in the organic eggs market. Food processing companies play a pivotal role in incorporating organic eggs into various products, responding to the segment growth analysis that highlights the demand for organic ingredients in processed foods. The food service application holds a notable market share by segment in the organic eggs market, driven by its presence in restaurants, cafes, hotels, and other hospitality establishments. The segment growth analysis reveals a consistent demand for organic eggs in the food service industry, reflecting the increasing consumer preference for organic and sustainable ingredients in dining experiences.

Organic Eggs Market Regional Insights:

North America dominated the organic eggs market in the year 2022 with a 42% market share and is expected to dominate the market during the forecast period. Awareness about the health and environmental benefits of organic food is increasing in North America which drives the demand for Organic Eggs Market. The adoption of organic eggs in North America is more, especially in the United States. Hence, the Organic Eggs Market demand in the U.S. is increasing. This region has a well-developed developed organic farming infrastructure which makes it easier for producers to supply organic eggs to the market. Governments in North America have implemented policies that support organic agriculture, such as subsidies and tax breaks. Europe with a 27% market share is the second region that is expected to dominate the market throughout the forecast period. The presence of numerous food producers and the wide availability of prepared organic food in this region has increased the demand for the market in Europe. The Organic Eggs Market in the U.K. is growing rapidly but the German Organic Eggs market holds the largest market share European region. Asia Pacific region is expected to register substantial growth during the forecast period. The advantages of organic eggs related to health are increasing. The market in the emerging countries such as China and India is growing fast for organic eggs. South Korea is also a developing market for organic eggs, which attributes to consumer’s growing purchasing power, and their growing interest in healthy food options, and their rising level of life.Competitive Landscape:

DQY Ecological is a prominent player in the market, known for its commitment to ecological and sustainable practices. The company's emphasis on organic farming methods and transparency in production contributes to its competitive edge. Plukon Food Group has established a strong presence in the organic eggs market with a focus on quality and innovation. The company's diverse product offerings and strategic partnerships position it as a key player in the competitive landscape. Michael Foods Inc. is a major contributor to the organic eggs market, recognized for its comprehensive approach to sustainable and responsible egg production. The company's commitment to animal welfare and quality standards enhances its competitive position. LDC is a noteworthy participant in the organic eggs market, offering a global perspective and expertise in sustainable agriculture. The company's commitment to environmental responsibility and market growth contributes to its competitive stature. The objective of the report is to present a comprehensive analysis of the Market including all the stakeholders of the Application. The past and current status of the Application with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the Application with a dedicated study of key players that includes market leaders, followers, and new entrants By Region. PORTER, SVOR, and PESTEL analysis with the potential impact of micro-economic factors By Region on the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the Application to the decision-makers. The report also helps in understanding the Market dynamics, and structure by analyzing the market segments and projecting the Organic Eggs Industry size. Clear representation of competitive analysis of key players By Type, price, financial position, product portfolio, growth strategies, and regional presence in the Market makes the report an investor’s guide.

Organic Eggs Market Scope:Inquire Before Buying

Global Organic Eggs Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 3.9 Bn. Forecast Period 2023 to 2029 CAGR: 12.3% Market Size in 2029: US $ 8.78 Bn. Segments Covered: by Type Brown Color White Color by Size Small Medium and Large Extra Large and Jumbo by Distribution Channel Hypermarket & Supermarket Convenience Stores Online Others by End-User Retail Household Food Processing Food Service Others Organic Eggs Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Organic Eggs Market Key Players

1. DQY Ecological [China] 2. Plukon Food Group [Netherlands] 3. Michael Foods Inc. [United States] 4. Hickman’s Egg Ranch [United States] 5. Sisters Food Group [United Kingdom] 6. Cal-Maine Foods Inc. [United States] 7. LDC [Netherlands] 8. Thehappyhensfarm.com [India] 9. Organic Valley [United States] 10. Pete and Gerry's Organic Eggs [United States] 11. Vital Farms [United States] 12. Happy Egg Co [United Kingdom] Frequently Asked Questions: 1] What segments are covered in the Global Market report? Ans. The segments covered in the Market report are based on Type, Size, Distribution Channel, Application, and Region. 2] Which region is expected to hold the highest share of the Global Market? Ans. The North America region is expected to hold the highest share of the Market. The demand for Market in the United States is increasing. 3] What is the market size of the Global Market by 2029? Ans. The market size of the Market by 2029 is expected to reach US$ 8.78 Bn. 4] What is the forecast period for the Global Market? Ans. The forecast period for the Market is 2023-2029. 5] What was the market size of the Global Market in 2022? Ans. The market size of the Market in 2022 was valued at US$ 3.9 Bn.

1. Organic Eggs Market: Research Methodology 2. Organic Eggs Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Organic Eggs Market: Dynamics 3.1. Organic Eggs Market Trends By Region 3.1.1. North America Organic Eggs Market Trends 3.1.2. Europe Organic Eggs Market Trends 3.1.3. Asia Pacific Organic Eggs Market Trends 3.1.4. Middle East and Africa Organic Eggs Market Trends 3.1.5. South America Organic Eggs Market Trends 3.2. Organic Eggs Market Dynamics By Region 3.2.1. North America 3.2.1.1. North America Organic Eggs Market Drivers 3.2.1.2. North America Organic Eggs Market Restraints 3.2.1.3. North America Organic Eggs Market Opportunities 3.2.1.4. North America Organic Eggs Market Challenges 3.2.2. Europe 3.2.2.1. Europe Organic Eggs Market Drivers 3.2.2.2. Europe Organic Eggs Market Restraints 3.2.2.3. Europe Organic Eggs Market Opportunities 3.2.2.4. Europe Organic Eggs Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Organic Eggs Market Drivers 3.2.3.2. Asia Pacific Organic Eggs Market Restraints 3.2.3.3. Asia Pacific Organic Eggs Market Opportunities 3.2.3.4. Asia Pacific Organic Eggs Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Organic Eggs Market Drivers 3.2.4.2. Middle East and Africa Organic Eggs Market Restraints 3.2.4.3. Middle East and Africa Organic Eggs Market Opportunities 3.2.4.4. Middle East and Africa Organic Eggs Market Challenges 3.2.5. South America 3.2.5.1. South America Organic Eggs Market Drivers 3.2.5.2. South America Organic Eggs Market Restraints 3.2.5.3. South America Organic Eggs Market Opportunities 3.2.5.4. South America Organic Eggs Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape By Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis For Organic Eggs Industry 3.7. Analysis of Government Schemes and Initiatives Organic Eggs Industry 3.8. The Global Pandemic Impact on Organic Eggs Market 4. Organic Eggs Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2022-2029) 4.1. Organic Eggs Market Size and Forecast, By Type (2022-2029) 4.1.1. Brown Color 4.1.2. White Color 4.2. Organic Eggs Market Size and Forecast, By Size (2022-2029) 4.2.1. Small 4.2.2. Medium and Large 4.2.3. Extra Large and Jumbo 4.3. Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 4.3.1. Hypermarket & Supermarket 4.3.2. Convenience Stores 4.3.3. Online 4.3.4. Others 4.4. Organic Eggs Market Size and Forecast, By Application (2022-2029) 4.4.1. Retail 4.4.2. Household 4.4.3. Food Processing 4.4.4. Food Service 4.4.5. Others 4.5. Organic Eggs Market Size and Forecast, By Region (2022-2029) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Organic Eggs Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2022-2029) 5.1. North America Organic Eggs Market Size and Forecast, By Type (2022-2029) 5.1.1. Brown Color 5.1.2. White Color 5.2. North America Organic Eggs Market Size and Forecast, By Size (2022-2029) 5.2.1. Small 5.2.2. Medium and Large 5.2.3. Extra Large and Jumbo 5.3. North America Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 5.3.1. Hypermarket & Supermarket 5.3.2. Convenience Stores 5.3.3. Online 5.3.4. Others 5.4. North America Organic Eggs Market Size and Forecast, By Application (2022-2029) 5.4.1. Retail 5.4.2. Household 5.4.3. Food Processing 5.4.4. Food Service 5.4.5. Others 5.5. North America Organic Eggs Market Size and Forecast, by Country (2022-2029) 5.5.1. United States 5.5.1.1. United States Organic Eggs Market Size and Forecast, By Type (2022-2029) 5.5.1.1.1. Brown Color 5.5.1.1.2. White Color 5.5.1.2. United States Organic Eggs Market Size and Forecast, By Size (2022-2029) 5.5.1.2.1. Small 5.5.1.2.2. Medium and Large 5.5.1.2.3. Extra Large and Jumbo 5.5.1.3. United States Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 5.5.1.3.1. Hypermarket & Supermarket 5.5.1.3.2. Convenience Stores 5.5.1.3.3. Online 5.5.1.3.4. Others 5.5.1.4. United States Organic Eggs Market Size and Forecast, By Application (2022-2029) 5.5.1.4.1. Retail 5.5.1.4.2. Household 5.5.1.4.3. Food Processing 5.5.1.4.4. Food Service 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Organic Eggs Market Size and Forecast, By Type (2022-2029) 5.5.2.1.1. Brown Color 5.5.2.1.2. White Color 5.5.2.2. Canada Organic Eggs Market Size and Forecast, By Size (2022-2029) 5.5.2.2.1. Small 5.5.2.2.2. Medium and Large 5.5.2.2.3. Extra Large and Jumbo 5.5.2.3. Canada Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 5.5.2.3.1. Hypermarket & Supermarket 5.5.2.3.2. Convenience Stores 5.5.2.3.3. Online 5.5.2.3.4. Others 5.5.2.4. Canada Organic Eggs Market Size and Forecast, By Application (2022-2029) 5.5.2.4.1. Retail 5.5.2.4.2. Household 5.5.2.4.3. Food Processing 5.5.2.4.4. Food Service 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico Organic Eggs Market Size and Forecast, By Type (2022-2029) 5.5.3.1.1. Brown Color 5.5.3.1.2. White Color 5.5.3.2. Mexico Organic Eggs Market Size and Forecast, By Size (2022-2029) 5.5.3.2.1. Small 5.5.3.2.2. Medium and Large 5.5.3.2.3. Extra Large and Jumbo 5.5.3.3. Mexico Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 5.5.3.3.1. Hypermarket & Supermarket 5.5.3.3.2. Convenience Stores 5.5.3.3.3. Online 5.5.3.3.4. Others 5.5.3.4. Mexico Organic Eggs Market Size and Forecast, By Application (2022-2029) 5.5.3.4.1. Retail 5.5.3.4.2. Household 5.5.3.4.3. Food Processing 5.5.3.4.4. Food Service 5.5.3.4.5. Others 6. Europe Organic Eggs Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2022-2029) 6.1. Europe Organic Eggs Market Size and Forecast, By Type (2022-2029) 6.2. Europe Organic Eggs Market Size and Forecast, By Size (2022-2029) 6.3. Europe Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 6.4. Europe Organic Eggs Market Size and Forecast, By Application (2022-2029) 6.5. Europe Organic Eggs Market Size and Forecast, by Country (2022-2029) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Organic Eggs Market Size and Forecast, By Type (2022-2029) 6.5.1.2. United Kingdom Organic Eggs Market Size and Forecast, By Size (2022-2029) 6.5.1.3. United Kingdom Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 6.5.1.4. United Kingdom Organic Eggs Market Size and Forecast, By Application (2022-2029) 6.5.2. France 6.5.2.1. France Organic Eggs Market Size and Forecast, By Type (2022-2029) 6.5.2.2. France Organic Eggs Market Size and Forecast, By Size (2022-2029) 6.5.2.3. France Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 6.5.2.4. France Organic Eggs Market Size and Forecast, By Application (2022-2029) 6.5.3. Germany 6.5.3.1. Germany Organic Eggs Market Size and Forecast, By Type (2022-2029) 6.5.3.2. Germany Organic Eggs Market Size and Forecast, By Size (2022-2029) 6.5.3.3. Germany Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 6.5.3.4. Germany Organic Eggs Market Size and Forecast, By Application (2022-2029) 6.5.4. Italy 6.5.4.1. Italy Organic Eggs Market Size and Forecast, By Type (2022-2029) 6.5.4.2. Italy Organic Eggs Market Size and Forecast, By Size (2022-2029) 6.5.4.3. Italy Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 6.5.4.4. Italy Organic Eggs Market Size and Forecast, By Application (2022-2029) 6.5.5. Spain 6.5.5.1. Spain Organic Eggs Market Size and Forecast, By Type (2022-2029) 6.5.5.2. Spain Organic Eggs Market Size and Forecast, By Size (2022-2029) 6.5.5.3. Spain Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 6.5.5.4. Spain Organic Eggs Market Size and Forecast, By Application (2022-2029) 6.5.6. Sweden 6.5.6.1. Sweden Organic Eggs Market Size and Forecast, By Type (2022-2029) 6.5.6.2. Sweden Organic Eggs Market Size and Forecast, By Size (2022-2029) 6.5.6.3. Sweden Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 6.5.6.4. Sweden Organic Eggs Market Size and Forecast, By Application (2022-2029) 6.5.7. Austria 6.5.7.1. Austria Organic Eggs Market Size and Forecast, By Type (2022-2029) 6.5.7.2. Austria Organic Eggs Market Size and Forecast, By Size (2022-2029) 6.5.7.3. Austria Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 6.5.7.4. Austria Organic Eggs Market Size and Forecast, By Application (2022-2029) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Organic Eggs Market Size and Forecast, By Type (2022-2029) 6.5.8.2. Rest of Europe Organic Eggs Market Size and Forecast, By Size (2022-2029) 6.5.8.3. Rest of Europe Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 6.5.8.4. Rest of Europe Organic Eggs Market Size and Forecast, By Application (2022-2029) 7. Asia Pacific Organic Eggs Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume in Units) (2022-2029) 7.1. Asia Pacific Organic Eggs Market Size and Forecast, By Type (2022-2029) 7.2. Asia Pacific Organic Eggs Market Size and Forecast, By Size (2022-2029) 7.3. Asia Pacific Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 7.4. Asia Pacific Organic Eggs Market Size and Forecast, By Application (2022-2029) 7.5. Asia Pacific Organic Eggs Market Size and Forecast, by Country (2022-2029) 7.5.1. China 7.5.1.1. China Organic Eggs Market Size and Forecast, By Type (2022-2029) 7.5.1.2. China Organic Eggs Market Size and Forecast, By Size (2022-2029) 7.5.1.3. China Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.1.4. China Organic Eggs Market Size and Forecast, By Application (2022-2029) 7.5.2. S Korea 7.5.2.1. S Korea Organic Eggs Market Size and Forecast, By Type (2022-2029) 7.5.2.2. S Korea Organic Eggs Market Size and Forecast, By Size (2022-2029) 7.5.2.3. S Korea Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.2.4. S Korea Organic Eggs Market Size and Forecast, By Application (2022-2029) 7.5.3. Japan 7.5.3.1. Japan Organic Eggs Market Size and Forecast, By Type (2022-2029) 7.5.3.2. Japan Organic Eggs Market Size and Forecast, By Size (2022-2029) 7.5.3.3. Japan Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.3.4. Japan Organic Eggs Market Size and Forecast, By Application (2022-2029) 7.5.4. India 7.5.4.1. India Organic Eggs Market Size and Forecast, By Type (2022-2029) 7.5.4.2. India Organic Eggs Market Size and Forecast, By Size (2022-2029) 7.5.4.3. India Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.4.4. India Organic Eggs Market Size and Forecast, By Application (2022-2029) 7.5.5. Australia 7.5.5.1. Australia Organic Eggs Market Size and Forecast, By Type (2022-2029) 7.5.5.2. Australia Organic Eggs Market Size and Forecast, By Size (2022-2029) 7.5.5.3. Australia Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.5.4. Australia Organic Eggs Market Size and Forecast, By Application (2022-2029) 7.5.6. Indonesia 7.5.6.1. Indonesia Organic Eggs Market Size and Forecast, By Type (2022-2029) 7.5.6.2. Indonesia Organic Eggs Market Size and Forecast, By Size (2022-2029) 7.5.6.3. Indonesia Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.6.4. Indonesia Organic Eggs Market Size and Forecast, By Application (2022-2029) 7.5.7. Malaysia 7.5.7.1. Malaysia Organic Eggs Market Size and Forecast, By Type (2022-2029) 7.5.7.2. Malaysia Organic Eggs Market Size and Forecast, By Size (2022-2029) 7.5.7.3. Malaysia Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.7.4. Malaysia Organic Eggs Market Size and Forecast, By Application (2022-2029) 7.5.8. Vietnam 7.5.8.1. Vietnam Organic Eggs Market Size and Forecast, By Type (2022-2029) 7.5.8.2. Vietnam Organic Eggs Market Size and Forecast, By Size (2022-2029) 7.5.8.3. Vietnam Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.8.4. Vietnam Organic Eggs Market Size and Forecast, By Application (2022-2029) 7.5.9. Taiwan 7.5.9.1. Taiwan Organic Eggs Market Size and Forecast, By Type (2022-2029) 7.5.9.2. Taiwan Organic Eggs Market Size and Forecast, By Size (2022-2029) 7.5.9.3. Taiwan Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.9.4. Taiwan Organic Eggs Market Size and Forecast, By Application (2022-2029) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Organic Eggs Market Size and Forecast, By Type (2022-2029) 7.5.10.2. Rest of Asia Pacific Organic Eggs Market Size and Forecast, By Size (2022-2029) 7.5.10.3. Rest of Asia Pacific Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 7.5.10.4. Rest of Asia Pacific Organic Eggs Market Size and Forecast, By Application (2022-2029) 8. Middle East and Africa Organic Eggs Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume in Units) (2022-2029 8.1. Middle East and Africa Organic Eggs Market Size and Forecast, By Type (2022-2029) 8.2. Middle East and Africa Organic Eggs Market Size and Forecast, By Size (2022-2029) 8.3. Middle East and Africa Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 8.4. Middle East and Africa Organic Eggs Market Size and Forecast, By Application (2022-2029) 8.5. Middle East and Africa Organic Eggs Market Size and Forecast, by Country (2022-2029) 8.5.1. South Africa 8.5.1.1. South Africa Organic Eggs Market Size and Forecast, By Type (2022-2029) 8.5.1.2. South Africa Organic Eggs Market Size and Forecast, By Size (2022-2029) 8.5.1.3. South Africa Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 8.5.1.4. South Africa Organic Eggs Market Size and Forecast, By Application (2022-2029) 8.5.2. GCC 8.5.2.1. GCC Organic Eggs Market Size and Forecast, By Type (2022-2029) 8.5.2.2. GCC Organic Eggs Market Size and Forecast, By Size (2022-2029) 8.5.2.3. GCC Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 8.5.2.4. GCC Organic Eggs Market Size and Forecast, By Application (2022-2029) 8.5.3. Nigeria 8.5.3.1. Nigeria Organic Eggs Market Size and Forecast, By Type (2022-2029) 8.5.3.2. Nigeria Organic Eggs Market Size and Forecast, By Size (2022-2029) 8.5.3.3. Nigeria Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 8.5.3.4. Nigeria Organic Eggs Market Size and Forecast, By Application (2022-2029) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Organic Eggs Market Size and Forecast, By Type (2022-2029) 8.5.4.2. Rest of ME&A Organic Eggs Market Size and Forecast, By Size (2022-2029) 8.5.4.3. Rest of ME&A Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 8.5.4.4. Rest of ME&A Organic Eggs Market Size and Forecast, By Application (2022-2029) 9. South America Organic Eggs Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume in Units) (2022-2029 9.1. South America Organic Eggs Market Size and Forecast, By Type (2022-2029) 9.2. South America Organic Eggs Market Size and Forecast, By Size (2022-2029) 9.3. South America Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 9.4. South America Organic Eggs Market Size and Forecast, By Application (2022-2029) 9.5. South America Organic Eggs Market Size and Forecast, by Country (2022-2029) 9.5.1. Brazil 9.5.1.1. Brazil Organic Eggs Market Size and Forecast, By Type (2022-2029) 9.5.1.2. Brazil Organic Eggs Market Size and Forecast, By Size (2022-2029) 9.5.1.3. Brazil Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 9.5.1.4. Brazil Organic Eggs Market Size and Forecast, By Application (2022-2029) 9.5.2. Argentina 9.5.2.1. Argentina Organic Eggs Market Size and Forecast, By Type (2022-2029) 9.5.2.2. Argentina Organic Eggs Market Size and Forecast, By Size (2022-2029) 9.5.2.3. Argentina Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 9.5.2.4. Argentina Organic Eggs Market Size and Forecast, By Application (2022-2029) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Organic Eggs Market Size and Forecast, By Type (2022-2029) 9.5.3.2. Rest Of South America Organic Eggs Market Size and Forecast, By Size (2022-2029) 9.5.3.3. Rest Of South America Organic Eggs Market Size and Forecast, By Distribution Channel (2022-2029) 9.5.3.4. Rest Of South America Organic Eggs Market Size and Forecast, By Application (2022-2029) 10. Global Organic Eggs Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Organic Eggs Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. DQY Ecological [China] 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Plukon Food Group [Netherlands] 11.3. Michael Foods Inc. [United States] 11.4. Hickman’s Egg Ranch [United States] 11.5. Sisters Food Group [United Kingdom] 11.6. Cal-Maine Foods Inc. [United States] 11.7. LDC [Netherlands] 11.8. Thehappyhensfarm.com [India] 11.9. Organic Valley [United States] 11.10. Pete and Gerry's Organic Eggs [United States] 11.11. Vital Farms [United States] 11.12. Happy Egg Co [United Kingdom] . Industry Recommendations 13. Key Findings