The Fantasy Sports Market size was valued at USD 25.97 Billion in 2023 and the total Fantasy Sports revenue is expected to grow at a CAGR of 7.8% from 2024 to 2030, reaching nearly USD 57.4 Billion by 2030. A fantasy sport is a game that's frequently played online in which players put together fictional or virtual teams made up of substitutes for real players in a professional sport (also known less widely as rotisserie or roto). Over the past few years, fantasy sports have developed into a powerful platform for sports enthusiasts to test their knowledge of their favorite sports. A fantasy sports market with established leaders, the influx of new brands into the market remains relentless, which is propelled due to the introduction of innovative games aimed at captivating their customer base.To know about the Research Methodology :- Request Free Sample Report Monkey Knife Fight stands out as an example, having made a significant impact within the last two NFL seasons with the challenging dominance of industry giants. Particularly, Monkey Knife Fight diverges from the conventional DFS model by providing a unique variation—simple prop games played against the house, diverging from the traditional format involving a pool of experts. Presently, it stands as a thriving industry fueled by technological advancements, shifting consumer preferences, and strategic innovations by key players. The market's current scenario reflects a burgeoning user base globally, driven by the ease of access to online platforms and the escalating enthusiasm for various sports leagues. Growth factors influencing the fantasy sports market include heightened smartphone penetration, augmented internet accessibility, and the industry's concerted efforts to enhance user experience and engagement. Furthermore, recent developments by key market players have revolved around diversifying offerings, integrating advanced analytics, and tapping into emerging sports segments, demonstrating a commitment to meet evolving consumer demands while exploring untapped market niches. This amalgamation of innovation, technology, and strategic maneuvers by market players is poised to drive the fantasy sports market to newer heights during the forecast period.

Fantasy Sports Market Dynamics:

Fantasy Sports Market Engagement Platform:The Symbiotic Rise of Fantasy Sports and Technology in a Global Landscape Propel the Fantasy Sports Market Growth The sports have a strong basis for bringing forward growth, employment, and innovation in fantasy sports due to its sports enthusiasts, rapidly growing internet infrastructure, and blooming engineering talent. The creation of both direct and indirect employment opportunities as well as innovation and growth in the fields of technology, sports, and entertainment are all going to be supported by the government's efforts to create an enabling regulatory framework, which is going to be advantageous to a variety of stakeholders, including the government and consumers. The number of internet subscribers has increased over the past two years, from 3.2 billion in September 2016 to 5.18 billion in September 2022, of which 64.6 % of the global population. Additionally, at that time, average data consumption per subscriber increased significantly as a result of the affordability of smartphones and smart feature phones, as well as the sharply declining cost of data. The expansion of the digital infrastructure has made high-speed internet accessible to the majority of users, which has fueled the growth of the fantasy sports market. The ability to play the game on a handheld device at any time, regardless of location or time, has greatly increased consumer involvement with fantasy sports. The fantasy sports industry is undeniably worth billions of dollars. It's like a whole world of its own, with aspects similar to regular sports like branding, sponsorships, and merchandise. Interestingly, fantasy sports players also play a big role in making real sports more popular, and these two markets support and influence each other. The sustained investor interest in some of the top businesses in the sector has contributed significantly to the quick growth of the global fantasy sports market size.

Beyond the Quantitative Impact, the Fantasy Sports (FS) Industry Plays a Key Role in Seeding a Culture of Sports

Fantasy Sports Market Trends: Fantasy sports have experienced a significant transformation over the years, is trending due to the integration of cutting-edge technologies that have reshaped the industry and created new avenues for growth and engagement. The infusion of AI technology into fantasy sports has revolutionized the way fans engage with their favourite sports. AI-powered chatbots, for instance, have emerged as valuable tools for sports marketing. These chatbots provide users with quick and accurate information, enhancing their overall experience. Through AI, data presentation in fantasy sports has become more precise and efficient, delivering real-time updates and insights to users, thereby deepening their connection to the game. The integration of Augmented Reality (AR), Virtual Reality (VR), and Mixed Reality (MR) technologies has propelled fantasy sports to new heights. Once considered expensive and complex, AR and VR are now ubiquitous in the sports and gaming industry. These immersive technologies have enhanced user engagement by offering unique and captivating experiences. For instance, AR allows users to virtually try on sports merchandise, like shoes, through smart glasses or smartphones, enabling them to make more informed purchase decisions. As users increasingly transition between different devices and screens, cross-platform app development has become a crucial strategy in the fantasy sports market. To meet the demands of this diverse user base, businesses are developing apps that seamlessly function across various platforms, providing a consistent and user-friendly experience.

Fantasy Sports League

Cloud gaming services have emerged as a game-changer in the fantasy sports market. Startups in this space leverage public cloud service providers such as Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure to deliver scalable and cost-effective solutions. Cloud platforms enable businesses to scale their services as they grow, offering reliability and accessibility. While security concerns persist, cloud providers are continually improving their security measures to protect user data, instilling confidence in users. Big Data analytics has empowered fantasy sports operators to manage vast databases efficiently. These platforms gather extensive user data, and through data mining techniques, operators gain insights into user behavior and preferences. Smart analytics enable operators to make data-driven decisions, enhancing user experiences and creating new revenue opportunities. Personalization, operational efficiency, and effective marketing strategies are just a few of the benefits derived from harnessing big data. Blockchain technology has ushered in a new era of security and trust in the fantasy sports industry. Its decentralized nature eliminates the need for intermediaries, ensuring data integrity and security. Blockchain's robust framework supports cryptocurrency integration, enabling secure and transparent payment methods. This technology enhances user confidence, as it mitigates the risks associated with fraud and money laundering. However, users must be mindful of the irreversibility of cryptocurrency transactions, as they offer unparalleled security at the expense of anonymity.

Fantasy Football League Names Fantasy Basketball League Names Fantasy Baseball League Names General Fantasy League Names Pigskin Pundits Hoops Dynasty Bat Flip Battalion Sports Fanatics League Gridiron Glory Dunk Dynasty Grand Slam Gang All-Star Fantasy Alliance Touchdown Titans Basket Brawlers Diamond Dynasty Fantasy Fever League End Zone Elite Court Kings Home Run Heroes Victory Vortex League Fantasy Gridiron Gang Rim Rockers Fastball Fanatics Championship Chasers League Fantasy Football Fiends Swish Squad Curveball Crusaders Fantasy Phenoms Association Gridiron Gurus Hoopsters United Fantasy Diamond Divas Ultimate Fantasy Showdown Victory Formation Net Ninjas Bullpen Bandits Pro Sports Pursuit League Blitz Brigade B-ball Warriors Triple Play Titans Elite Fantasy Fraternity Hail Mary Heroes Alley-Oop Alliance Strikeout Kings Mega Matchup League

Fantasy Sport Market Growth:

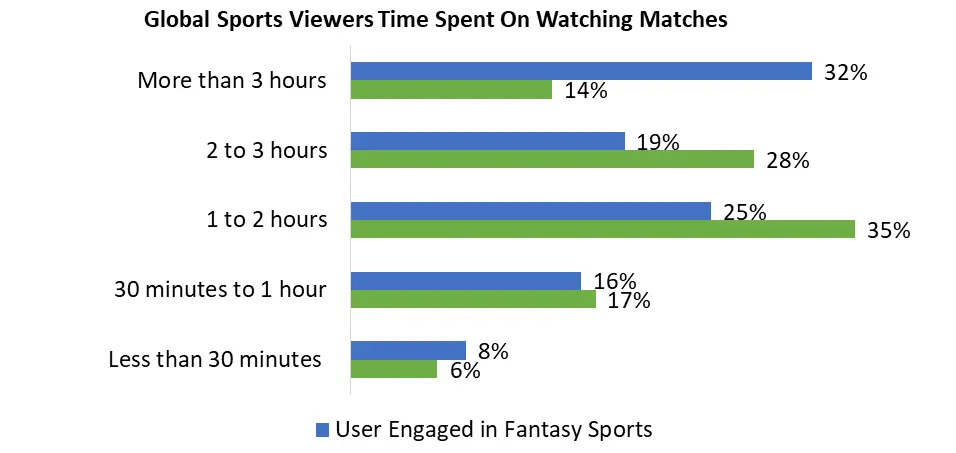

A significant 65 percent of the survey respondents expressed a preference for receiving 'Live match tickets for sporting events,' while 'Meeting their favorite sportspersons' and 'Acquiring autographed merchandise from their favorite players' were also highly desired by participants. These aspects represent potential opportunities that fantasy sports operators is to be explore in the future to enhance user engagement and bring fans closer to the sports they adore. The fantasy sports 32 percent of respondents who equated with sports betting, nearly 67 percent cited the involvement of money in the game as the primary reason for this association. Additionally, among this subset of respondents, 55 percent believed that fantasy games are purely reliant on luck and chance, indicating a lack of awareness about the format. Furthermore, 26 percent of these respondents mentioned that fantasy games provide a similar thrill to sports betting. This finding is noteworthy as it suggests that fantasy sports is position itself as a significant and legal alternative to sports betting in the future.

Fantasy Sports Market Segment Analysis:

Based on Sports Type: the market has been divided into football, baseball, basketball, hockey, cricket, and others. Among these, the football sub-segment witnessed the highest market share in the global fantasy sports market in 2023. The favor for football is timeless, and the fervor for this sport knows no boundaries Fantasy football is a captivating intersection of sports and gaming, allowing enthusiasts to immerse themselves in the excitement of the sport in a unique way. Participants create virtual teams comprised of real NFL players, managing their roster throughout the season. Points are earned based on the actual performance of these players during NFL games, creating a dynamic and interactive experience. Fantasy football has gained immense popularity, with millions of fans worldwide participating in leagues, whether among friends, coworkers, or through online platforms. It adds an extra layer of engagement to the sport, as participants strategize, analyze player statistics, and engage in friendly competition to build the ultimate fantasy team. These factors are anticipated to boost the growth of the football sub-segment of the fantasy sports market during the forecast timeframe.Table: Fantasy Sports Industry Investment Plans

Key Points Details Company Name Underdog- Date: July 27, 2022 Location New York Funding Round Series B Funds Raised $35 million Valuation $485 million Future Plans Building "innovative" licensed sports betting products and hiring over 100 new employees over the next year. Notable Investors - BlackRock - Acies Investment - Mark Cuban - Kevin Durant - Trae Young - Odell Beckham Jr. - Breon Corcoran (ex-CEO Paddy Power Betfair/Flutter) - Mitch Garber - Eilers & Krejcik - Liontree Partners - Kevin Carter - Mark Pincus (founder of Zynga) - SV Angel - The Chainsmokers - Kygo - Steve Aoki - Nas - Future, among others. Investor Insights - Underdog's exceptional success in customer acquisition and retention, bringing in new users at a fraction of the cost compared to typical sportsbooks. - Belief that Underdog's focus on product and customer experience will reshape the industry. Fantasy Sports Market Regional Analysis:

North America Dominates the Fantasy Sports Industry is a Booming Success Story The fantasy sports industry is predominantly growing in North America, particularly the United States, where it enjoys a dominant position largely due to supportive legislation. In contrast to online gambling, the U.S. government views fantasy sports as a game of skill, further bolstering its prominence. Fantasy football holds a preeminent position within the United States, boasting over 35 million players. Its popularity surged even higher when the NFL forged partnerships with fantasy sports providers. Given the deep-rooted affection for American football in the U.S., this collaboration significantly expanded the reach of fantasy football. North America has the potential to become a global hub for fantasy sports, given its already substantial presence. Over 60 million people in the United States and Canada participate in fantasy sports, and the trend is on an upward trajectory. Baseball ranks as the second most popular fantasy sport but lags significantly with a mere 39% popularity rating. Fantasy basketball, hockey, and soccer follow with popularity ratings of 19%, 18%, and 14%, respectively. Companies offering fantasy sports services have witnessed substantial growth in tandem with the increasing number of players. In 2011, approximately 264 companies catered to around 30 million players. These figures have steadily risen, and by 2022, it is projected that over 750 companies will be servicing more than 45 million players in the United States. In the United States, the daily fantasy sports industry saw the dominance of two rival services such as FanDuel, headquartered in New York, and DraftKings based in Boston. Both companies emerged as venture capital-backed startups, securing funding from investment firms, sports broadcasters, leagues, and team owners. Renowned for their aggressive marketing strategies, DraftKings reported $1.296 billion in revenue, while FanDuel reported $1.9 billion. They primarily competed with smaller DFS platforms like Fantasy Aces and Yahoo! Sports. The surge in popularity of the daily fantasy format is attributed to its convenience compared to season-long games and its emphasis on substantial cash prizes in promotional activities. Daily fantasy sports were also acknowledged for their role in enhancing television viewership and engaging audiences with various sports. Recent Developments: On 6 Sept 2023, Mojo, a tech company specializing in cutting-edge live sports gaming products, revealed its opening daily fantasy platform, Mojo Fantasy. This new offering allows participants to engage with the same choices, odds, and liquidity found in Mojo's licensed New Jersey sportsbook, effectively replicating the thrill of real-time markets within fantasy skill-based competitions. Notably, this release marks Mojo's entry into 20 additional states and territories, expanding its reach beyond New Jersey for the first time. This expansion is expected to bring the excitement of Mojo's sports gaming expertise to a wider audience, capitalizing on the growing popularity of daily fantasy sports in the United States. Mojo Fantasy is poised to enhance the gaming experience for sports enthusiasts across these newly accessible regions. On Feb. 2, 2022, ASX Sports, the leading next-generation virtual sports exchange offering fans the opportunity for live, free-to-play in-game 'trading,' has announced the inclusion of rugby on its platform, powered by data sourced from Rugby Analytics. This development precedes the highly anticipated kick-off of the annual Six Nations Championships on February 5, featuring the opening game between Ireland and Wales. ASX Sports will provide coverage for all 15 matches throughout the five-week tournament, granting fans an innovative way to engage with and immerse themselves in the excitement of the games. Notably, in the United States, NBC Sports and its Peacock streaming service will broadcast the Six Nations, to the estimated 1.3 million active rugby participants and an additional 8.8 million passionate fans, as reported by sports and entertainment insights and analytics firm Gemba. ASX Sports continues to expand its offerings, enhancing the sports experience for enthusiasts across various regions.Fantasy Sports Market Scope: Inquire before buying

Global Fantasy Sports Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 25.97 Bn. Forecast Period 2024 to 2030 CAGR: 7.8% Market Size in 2030: US $ 57.4 Bn. Segments Covered: by Sports Type Football Baseball Basketball Hockey Cricket Others by Platform Website Mobile Application by Demographics Under 25 years 25 - 40 years Above 40 years Fantasy Sports Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Fantasy Sports Market Key Players:

1. Dream Sports Group 2. CBS Sports Digital 3. Realtime Fantasy Sports Inc. 4. Flutter Entertainment plc 5. Vauntek Inc. (Fantrax) 6. DraftKings 7. Pure Win (Sweetspot N.V.) 8. FanDuel 9. FantasyPros.com 10. MY11Circle 11. FANTACALCIO (Quandronica Srl) 12. RotoWire (GDC Media Limited) 13. NBC Sports Edge (NBC Sports Group) 14. MyFantasyLeague (Sideline Software Inc.) 15. Office Football Pool (OFP Hosting Inc.) FAQs: 1. What are the growth drivers for the Fantasy Sports Market? Ans. The growth of the fantasy sports market is primarily driven by several key factors. The increasing accessibility of high-speed internet and mobile devices has expanded the user base, allowing more sports enthusiasts to participate in fantasy leagues. Continuous innovation in fantasy sports platforms, including augmented reality and real-time data integration, keeps users engaged and contributes to sustained market growth. 2. What is the major Opportunity for the Fantasy Sports Market growth? Ans. One major opportunity in the fantasy sports market is the unexploited potential for international expansion, as regions outside North America show growing interest in fantasy sports. Additionally, the convergence of fantasy sports with emerging technologies like virtual reality and blockchain presents a promising avenue for innovation and market growth. 3. Which Region is expected to lead the global Fantasy Sports Market during the forecast period? Ans. North America is expected to lead the Fantasy Sports Market during the forecast period. 4. What is the projected market size and growth rate of the Fantasy Sports Market? Ans. The Fantasy Sports Market size was valued at USD 25.97 Billion in 2023 and the total Fantasy Sports revenue is expected to grow at a CAGR of 7.8% from 2024 to 2030, reaching nearly USD 57.4 Billion by 2030. 5. What segments are covered in the Fantasy Sports Market report? Ans. The segments covered in the Fantasy Sports Market report are by sports type, platform, demographics, and Region.

1. Fantasy Sports Market: Research Methodology 2. Fantasy Sports Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Fantasy Sports Market: Dynamics 3.1 Fantasy Sports Market Trends by Region 3.1.1 North America Fantasy Sports Market Trends 3.1.2 Europe Fantasy Sports Market Trends 3.1.3 Asia Pacific Fantasy Sports Market Trends 3.1.4 Middle East and Africa Fantasy Sports Market Trends 3.1.5 South America Fantasy Sports Market Trends 3.2 Fantasy Sports Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Fantasy Sports Market Drivers 3.2.1.2 North America Fantasy Sports Market Restraints 3.2.1.3 North America Fantasy Sports Market Opportunities 3.2.1.4 North America Fantasy Sports Market Challenges 3.2.2 Europe 3.2.2.1 Europe Fantasy Sports Market Drivers 3.2.2.2 Europe Fantasy Sports Market Restraints 3.2.2.3 Europe Fantasy Sports Market Opportunities 3.2.2.4 Europe Fantasy Sports Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Fantasy Sports Market Drivers 3.2.3.2 Asia Pacific Fantasy Sports Market Restraints 3.2.3.3 Asia Pacific Fantasy Sports Market Opportunities 3.2.3.4 Asia Pacific Fantasy Sports Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Fantasy Sports Market Drivers 3.2.4.2 Middle East and Africa Fantasy Sports Market Restraints 3.2.4.3 Middle East and Africa Fantasy Sports Market Opportunities 3.2.4.4 Middle East and Africa Fantasy Sports Market Challenges 3.2.5 South America 3.2.5.1 South America Fantasy Sports Market Drivers 3.2.5.2 South America Fantasy Sports Market Restraints 3.2.5.3 South America Fantasy Sports Market Opportunities 3.2.5.4 South America Fantasy Sports Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power of Suppliers 3.3.2 Bargaining Power of Buyers 3.3.3 Threat of New Entrants 3.3.4 Threat of Substitutes 3.3.5 Intensity of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives for the Fantasy Sports Industry 3.8 The Global Pandemic and Redefining of The Fantasy Sports Industry Landscape 3.9 Technological Roadmap 4. Global Fantasy Sports Market: Global Market Size and Forecast (Value) (2023-2030) 4.1 Global Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 4.1.1 Football 4.1.2 Baseball 4.1.3 Basket Ball 4.1.4 Hockey 4.1.5 Cricket 4.1.6 Others 4.2 Global Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 4.2.1 Website 4.2.2 Mobile Application 4.3 Global Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 4.3.1 Under 25 Years 4.3.2 25 - 40 Years 4.3.3 Above 40 Years 4.4 Global Fantasy Sports Market Size and Forecast, by Region (2023-2030) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Fantasy Sports Market Size and Forecast by Segmentation (Value) (2023-2030) 5.1 North America Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 5.1.1 Football 5.1.2 Baseball 5.1.3 Basket Ball 5.1.4 Hockey 5.1.5 Cricket 5.1.6 Others 5.2 North America Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 5.2.1 Website 5.2.2 Mobile Application 5.3 North America Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 5.3.1 Under 25 Years 5.3.2 25 - 40 Years 5.3.3 Above 40 Years 5.4 North America Fantasy Sports Market Size and Forecast, by Country (2023-2030) 5.4.1 United States 5.4.1.1 United States Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 5.4.1.1.1 Football 5.4.1.1.2 Baseball 5.4.1.1.3 Basket Ball 5.4.1.1.4 Hockey 5.4.1.1.5 Cricket 5.4.1.1.6 Others 5.4.1.2 United States Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 5.4.1.2.1 Website 5.4.1.2.2 Mobile Application 5.4.1.3 United States Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 5.4.1.3.1 Under 25 Years 5.4.1.3.2 25 - 40 Years 5.4.1.3.3 Above 40 Years 5.4.2 Canada 5.4.2.1 Canada Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 5.4.2.1.1 Football 5.4.2.1.2 Baseball 5.4.2.1.3 Basket Ball 5.4.2.1.4 Hockey 5.4.2.1.5 Cricket 5.4.2.1.6 Others 5.4.2.2 Canada Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 5.4.2.2.1 Website 5.4.2.2.2 Mobile Application 5.4.2.3 Canada Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 5.4.2.3.1 Under 25 Years 5.4.2.3.2 25 - 40 Years 5.4.2.3.3 Above 40 Years 5.4.3 Mexico 5.4.3.1 Mexico Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 5.4.3.1.1 Football 5.4.3.1.2 Baseball 5.4.3.1.3 Basket Ball 5.4.3.1.4 Hockey 5.4.3.1.5 Cricket 5.4.3.1.6 Others 5.4.3.2 Mexico Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 5.4.3.2.1 Website 5.4.3.2.2 Mobile Application 5.4.3.3 Mexico Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 5.4.3.3.1 Under 25 Years 5.4.3.3.2 25 - 40 Years 5.4.3.3.3 Above 40 Years 6. Europe Fantasy Sports Market Size and Forecast by Segmentation (Value) (2023-2030) 6.1 Europe Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 6.2 Europe Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 6.3 Europe Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 6.4 Europe Fantasy Sports Market Size and Forecast, by Country (2023-2030) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 6.4.1.2 United Kingdom Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 6.4.1.3 United Kingdom Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 6.4.2 France 6.4.2.1 France Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 6.4.2.2 France Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 6.4.2.3 France Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 6.4.3 Germany 6.4.3.1 Germany Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 6.4.3.2 Germany Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 6.4.3.3 Germany Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 6.4.4 Italy 6.4.4.1 Italy Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 6.4.4.2 Italy Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 6.4.4.3 Italy Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 6.4.5 Spain 6.4.5.1 Spain Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 6.4.5.2 Spain Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 6.4.5.3 Spain Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 6.4.6 Sweden 6.4.6.1 Sweden Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 6.4.6.2 Sweden Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 6.4.6.3 Sweden Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 6.4.7 Austria 6.4.7.1 Austria Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 6.4.7.2 Austria Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 6.4.7.3 Austria Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 6.4.8.2 Rest of Europe Fantasy Sports Market Size and Forecast, By Platform (2023-2030). 6.4.8.3 Rest of Europe Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 7. Asia Pacific Fantasy Sports Market Size and Forecast by Segmentation (Value) (2023-2030) 7.1 Asia Pacific Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 7.2 Asia Pacific Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 7.3 Asia Pacific Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 7.4 Asia Pacific Fantasy Sports Market Size and Forecast, by Country (2023-2030) 7.4.1 China 7.4.1.1 China Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 7.4.1.2 China Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 7.4.1.3 China Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 7.4.2 South Korea 7.4.2.1 S Korea Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 7.4.2.2 S Korea Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 7.4.2.3 S Korea Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 7.4.3 Japan 7.4.3.1 Japan Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 7.4.3.2 Japan Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 7.4.3.3 Japan Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 7.4.4 India 7.4.4.1 India Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 7.4.4.2 India Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 7.4.4.3 India Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 7.4.5 Australia 7.4.5.1 Australia Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 7.4.5.2 Australia Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 7.4.5.3 Australia Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 7.4.6 Indonesia 7.4.6.1 Indonesia Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 7.4.6.2 Indonesia Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 7.4.6.3 Indonesia Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 7.4.7 Malaysia 7.4.7.1 Malaysia Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 7.4.7.2 Malaysia Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 7.4.7.3 Malaysia Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 7.4.8 Vietnam 7.4.8.1 Vietnam Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 7.4.8.2 Vietnam Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 7.4.8.3 Vietnam Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 7.4.9 Taiwan 7.4.9.1 Taiwan Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 7.4.9.2 Taiwan Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 7.4.9.3 Taiwan Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 7.4.10.2 Bangladesh Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 7.4.10.3 Bangladesh Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 7.4.11 Pakistan 7.4.11.1 Pakistan Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 7.4.11.2 Pakistan Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 7.4.11.3 Pakistan Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 7.4.12.2 Rest of Asia Pacific Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 7.4.12.3 Rest of Asia Pacific Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 8. Middle East and Africa Fantasy Sports Market Size and Forecast by Segmentation (Value) (2023-2030) 8.1 Middle East and Africa Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 8.2 Middle East and Africa Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 8.3 Middle East and Africa Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 8.4 Middle East and Africa Fantasy Sports Market Size and Forecast, by Country (2023-2030) 8.4.1 South Africa 8.4.1.1 South Africa Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 8.4.1.2 South Africa Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 8.4.1.3 South Africa Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 8.4.2 GCC 8.4.2.1 GCC Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 8.4.2.2 GCC Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 8.4.2.3 GCC Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 8.4.3 Egypt 8.4.3.1 Egypt Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 8.4.3.2 Egypt Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 8.4.3.3 Egypt Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 8.4.4 Nigeria 8.4.4.1 Nigeria Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 8.4.4.2 Nigeria Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 8.4.4.3 Nigeria Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 8.4.5.2 Rest of ME&A Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 8.4.5.3 Rest of ME&A Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 9. South America Fantasy Sports Market Size and Forecast by Segmentation (Value) (2023-2030) 9.1 South America Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 9.2 South America Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 9.3 South America Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 9.4 South America Fantasy Sports Market Size and Forecast, by Country (2023-2030) 9.4.1 Brazil 9.4.1.1 Brazil Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 9.4.1.2 Brazil Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 9.4.1.3 Brazil Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 9.4.2 Argentina 9.4.2.1 Argentina Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 9.4.2.2 Argentina Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 9.4.2.3 Argentina Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Fantasy Sports Market Size and Forecast, By Sports Type (2023-2030) 9.4.3.2 Rest Of South America Fantasy Sports Market Size and Forecast, By Platform (2023-2030) 9.4.3.3 Rest Of South America Fantasy Sports Market Size and Forecast, By Demographics (2023-2030) 10. Global Fantasy Sports Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Fantasy Sports Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Dream Sports Group 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Recent Developments 11.2 CBS Sports Digital 11.3 Realtime Fantasy Sports Inc. 11.4 Flutter Entertainment plc 11.5 Vauntek Inc. (Fantrax) 11.6 DraftKings 11.7 Pure Win (Sweetspot N.V.) 11.8 FanDuel 11.9 FantasyPros.com 11.10 MY11Circle 11.11 FANTACALCIO (Quandronica Srl) 11.12 RotoWire (GDC Media Limited) 11.13 NBC Sports Edge (NBC Sports Group) 11.14 MyFantasyLeague (Sideline Software Inc.) 11.15 Office Football Pool (OFP Hosting Inc.) 12. Key Findings 13. Industry Recommendations