Content Delivery Network (CDN) Market was valued at US$ 15.91 Bn. in 2022 and is expected to reach US$ 63.30 Bn. by 2029, at a CAGR of 21.8% during a forecast period.Content Delivery Network (CDN) Market Overview:

The Content Delivery Network (CDN) Market was valued at US$ 15.91 Bn. in 2022. A content delivery network (CDN) is a server-based platform that reduces the physical distance between the user and the server, hence decreasing delays and losing time in the web pages and content loading. Users will be able to view and access high-quality data and web pages without having to wait for them to load. If there is no content delivery network, the server must respond to each and every user request ticket. This will generate a lot of traffic at the origin and raise the possibilities of a server failure; however, the content delivery network protects internet traffic quite well.To know about the Research Methodology :- Request Free Sample Report

COVID-19 Impact on Content Delivery Network (CDN) Market:

The COVID-19 pandemic has wreaked havoc on organizations of all sizes, including those in the manufacturing, industrial, and government sectors. Businesses in many industrial sectors are restarting operations in recent times, as lockdown restrictions have been removed in practically every location around the world. Many enterprises, notably software firms and others in a variety of industries, have made work-from-home options available to their employees, resulting in an alarming increase in network traffic. Multiple enterprises are using CDNs to reduce content load time as a result of this factor.Content Delivery Network (CDN) Market Dynamics:

Rising need for effective solutions to enable live and uninterrupted content delivery over high-speed data network: End users can access static, dynamic, and interactive material via CDN at a faster rate and with less bandwidth. Users' content requests are sent to the network's closest servers automatically. The content is then given to users by speeding up the page loading process and making use of all available bandwidth. The length of time it takes for the content to buffer has an impact on customer interest. In order for internet businesses to succeed, customers must be engaged until they check out and place orders, for example. Businesses can use content optimization and better distribution to keep customers and turn them into prospects for as long as possible. As a result, an essential factor supporting the growth of the CDN market is the demand for effective CDN solutions that optimize the live and uninterrupted distribution of material as well as its loading at the end-users' location. Data security and privacy concerns: Viruses and cyber-attacks are on the rise as more people utilize video streaming solutions to watch movies and advertising. Users frequently share and receive various video links, which are occasionally damaged by malware. Finally, these infections have the ability to disclose recipients' private information to malicious hackers and affect all recipients' devices. Video content security has become critical. Users need safe video streaming solutions, which video streaming solution providers must develop. The security and privacy of video footage transferred across many platforms are one of the major problems. Simultaneously, there are concerns about copyright and digital rights mismanagement, which can emerge as a result of data misuse and information leakage. To address these issues, businesses must rethink their video deployment techniques before implementing them. Complex architecture and concern about Quality of Service (QoS): The monitoring of infrastructure components such as servers, routers, and network traffic is referred to as Quality of Service (QoS). Managing these components on a regular basis is tough because it takes a lot of time, money, and effort from the solution providers. To provide better QoS to end-users, site administrators and mobile carriers must guarantee that these components are effectively implemented. To continuously monitor, manage, and recover the system from faults, a full-fledged decentralized protocol is required. Because of the lack of centralized administration, P2P CDN's main problems are system security and management.Content Delivery Network (CDN) Market segment analysis:

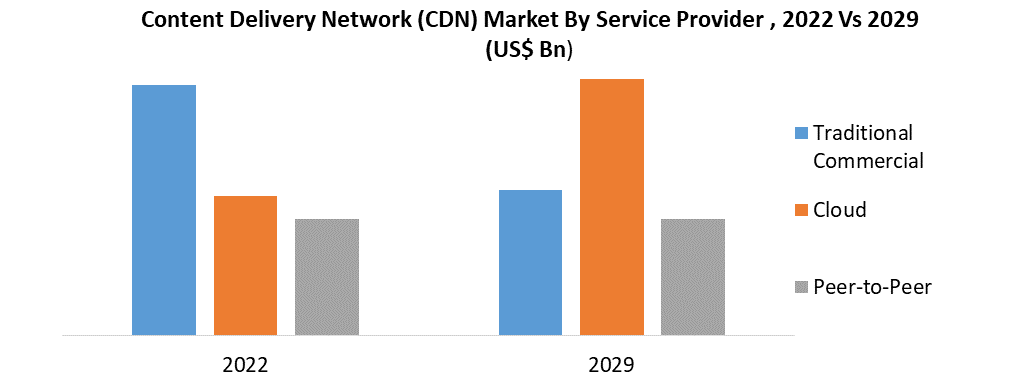

Based on Solution, in 2022, the media delivery segment led the market, accounting for more than 40% of total revenue. From 2023 to 2029, the segment will grow at the fastest CAGR. The growth of the segment is expected to be fueled by the spread of smartphones and other smart & connected devices capable of supporting digital media. Customers now have the option of accessing needed data anywhere and at any time, thanks to the constant growth of high-speed networks, particularly in emerging nations. The demand for CDN systems that can provide media without latency is projected to boost segment growth.Based on Service, in 2022, the traditional commercial CDN segment led the market, accounting for more than half of all revenue. The many network optimization, content acceleration, and media delivery solutions supplied by service providers are likely to boost this segment's growth. As the world's data consumption grows, CDNs are introducing solutions for usable content and network delivery optimization. Traditional CDN, on the other hand, is gradually proving insufficient to meet the challenges created by the introduction of new technologies. Mobile users are increasingly demanding content that is not optimized for their devices and is located further away from the origin servers. Over the forecast period, these disadvantages are expected to limit segment growth. Based on Content Type, in 2022, the dynamic CDN sector led the global market, accounting for almost 63% of sales. The increased demand for CDN solutions to support real-time Voice over IP (VoIP), video streaming, and online gaming can be contributed to the segment's rise. Data that changes on a regular basis as part of customized online services is referred to as dynamic content. Customers desire to receive all of their services from a single supplier, and operators respond to this demand by optimizing their networks and delivery.

Regional Insight:

The Asia Pacific region held the largest market share of 39% in 2022. The regional market, which is defined by the presence of rising nations such as India and China, and is also one of the fastest-growing consumer markets, will grow at the quickest CAGR from 2023 to 2029. Furthermore, as the world's population grows, so does the necessity for technological breakthroughs in networking infrastructure to meet the demands of online media consumption. Various regional government programmers, such as Digital India, have enabled quick and secure data delivery management, resulting in a growth in the use of CDN systems. Over the forecast period, North America is expected to increase significantly. The region's strong internet penetration and increasing adoption of 4K resolution displays are the main drivers of regional market growth. For efficient data delivery, a 4K resolution display demands a strong CDN infrastructure. In addition, the fast adoption of cloud-based services and the deployment of high-speed data networks are likely to boost the regional market growth. Other factors driving the usage of CDN solutions in the region include an increase in leisure spending and a high smartphone penetration rate.Recent Developments:

Origin Shield, a centralised caching layer that helps enhance cache hit ratio and reduces stress on the origin, was launched by Amazon CloudFront in October 2021. Origin Shield reduces origin operation expenses by collapsing requests across regions, such that only one request per item is sent to the origin. Limelight Networks improved its edge capabilities in September 2021 with the debut of EdgeFunctions, a new serverless computing solution that allows developers to tap into the company's worldwide network and offers them the flexibility to deploy and run their applications. EdgeFunctions provides a programmable network edge environment for speeding content operations, making time-sensitive decisions, and personalising user experiences. Furthermore, EdgeFunctions can be used for tailored streaming, content protection, dynamic ad insertion, and image manipulation, among other things. The objective of the report is to present a comprehensive analysis of the market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Content Delivery Network (CDN) Market dynamics, structure by analyzing the market segments and projects the market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the market make the report investor’s guide.Content Delivery Network (CDN) Market Scope: Inquire before buying

Content Delivery Network Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 15.91 Bn. Forecast Period 2023 to 2029 CAGR: 21.8 % Market Size in 2029: US $ 63.30 Bn. Segments Covered: by Content Type Static Dynamic by Solution Web Performance Optimization Media Delivery Cloud Security by Service Provider Traditional Commercial Cloud Peer-to-Peer Telecom by End-User Advertising E-commerce Media & Entertainment Gaming Others Content Delivery Network (CDN) Market , by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players are:

1. Akamai (US) 2. Google (US) 3. Level 3 Communications (US) 4. Limelight Networks (US) 5. Amazon Web Services (US) 6. Internap (US) 7. Verizon (US) 8. CDNetworks (Korea) 9. Tata Communications (India and Singapore) 10. StackPath (US) 11. Microsoft Corporation (US) 12. IBM Corporation (US) 13. Cloudflare, Inc. (US), 14. Rackspace Technology (US), 15. Lumen Technologies (US), 16. Internap (US) 17. Imperva (US) 18. CDNetworks (Korea) 19. Deutsche Telekom AG (Germany), 20. Broadpeak (France)Frequently Asked Questions:

1. Which region has the largest share in Content Delivery Network (CDN) Market? Ans: Asia pacific region holds the highest share in 2022. 2. What is the growth rate of Content Delivery Network (CDN) Market? Ans: The Content Delivery Network (CDN) Market is growing at a CAGR of 21.8 % during forecasting period 2023-2029. 3. What segments are covered in Content Delivery Network (CDN) Market? Ans: Content Delivery Network (CDN) Market is segmented into type, solution, service provider, end-user and region. 4. Who are the key players in Content Delivery Network (CDN) Market? Ans: The important key players in the Content Delivery Network (CDN) Market are – Akamai (US), Google (US), Level 3 Communications (US), Limelight Networks (US), Amazon Web Services (US), Internap (US), Verizon (US), CDNetworks (Korea), Tata Communications (India and Singapore), StackPath (US), Microsoft Corporation (US), IBM Corporation (US), Cloudflare, Inc. (US), Rackspace Technology (US), Lumen Technologies (US), Internap (US) 5. What is the study period of this market? Ans: The Content Delivery Network (CDN) Market is studied from 2022 to 2029.

1. Global Content Delivery Network Market: Research Methodology 2. Global Content Delivery Network Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Content Delivery Network Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Content Delivery Network Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12. COVID-19 Impact 4. Global Content Delivery Network Market Segmentation 4.1. Global Content Delivery Network Market, by Content Type (2022-2029) • Static • Dynamic 4.2. Global Content Delivery Network Market, by Solution (2022-2029) • Web Performance Optimization • Media Delivery • Cloud Security 4.3. Global Content Delivery Network Market, by Service(2022-2029) • Traditional Commercial • Cloud • Peer-to-Peer • Telecom 4.4. Global Content Delivery Network Market, by End-user(2022-2029) • Advertising • E-commerce • Media & Entertainment • Gaming • Others 5. North America Content Delivery Network Market(2022-2029) 5.1. North America Content Delivery Network Market, by Content Type (2022-2029) • Static • Dynamic 5.2. North America Content Delivery Network Market, by Solution (2022-2029) • Web Performance Optimization • Media Delivery • Cloud Security 5.3. North America Content Delivery Network Market, by Service(2022-2029) • Traditional Commercial • Cloud • Peer-to-Peer • Telecom 5.4. North America Content Delivery Network Market, by End-user(2022-2029) • Advertising • E-commerce • Media & Entertainment • Gaming • Others 5.5. North America Content Delivery Network Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Content Delivery Network Market (2022-2029) 6.1. European Content Delivery Network Market, by Content Type (2022-2029) 6.2. European Content Delivery Network Market, by Solution (2022-2029) 6.3. European Content Delivery Network Market, by Service(2022-2029) 6.4. European Content Delivery Network Market, by End-user(2022-2029) 6.5. European Content Delivery Network Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Content Delivery Network Market (2022-2029) 7.1. Asia Pacific Content Delivery Network Market, by Content Type (2022-2029) 7.2. Asia Pacific Content Delivery Network Market, by Solution (2022-2029) 7.3. Asia Pacific Content Delivery Network Market, by Service(2022-2029) 7.4. Asia Pacific Content Delivery Network Market, by End-user(2022-2029) 7.5. Asia Pacific Content Delivery Network Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Content Delivery Network Market (2022-2029) 8.1. Middle East and Africa Content Delivery Network Market, by Content Type (2022-2029) 8.2. Middle East and Africa Content Delivery Network Market, by Solution (2022-2029) 8.3. Middle East and Africa Content Delivery Network Market, by Service(2022-2029) 8.4. Middle East and Africa Content Delivery Network Market, by End-user(2022-2029) 8.5. Middle East and Africa Content Delivery Network Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. Latin America Content Delivery Network Market (2022-2029) 9.1. Latin America Content Delivery Network Market, by Content Type (2022-2029) 9.2. Latin America Content Delivery Network Market, by Solution (2022-2029) 9.3. Latin America Content Delivery Network Market, by Service(2022-2029) 9.4. Latin America Content Delivery Network Market, by vertical(2022-2029) 9.5. Latin America Content Delivery Network Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 10. Company Profile: Key players 10.1. Akamai (US) 10.1.1. Financial Overview 10.1.2. Global Presence 10.1.3. Capacity Portfolio 10.1.4. Business Strategy 10.1.5. Recent Developments 10.2. Google (US) 10.3. Level 3 Communications (US) 10.4. Limelight Networks (US) 10.5. Amazon Web Services (US) 10.6. Internap (US) 10.7. Verizon (US) 10.8. CDNetworks (Korea) 10.9. Tata Communications (India and Singapore) 10.10. StackPath (US) 10.11. Microsoft Corporation (US) 10.12. IBM Corporation (US) 10.13. Cloudflare, Inc. (US), 10.14. Rackspace Technology (US), 10.15. Lumen Technologies (US), 10.16. Internap (US) 10.17. Imperva (US) 10.18. CDNetworks (Korea) 10.19. Deutsche Telekom AG (Germany), 10.20. Broadpeak (France)