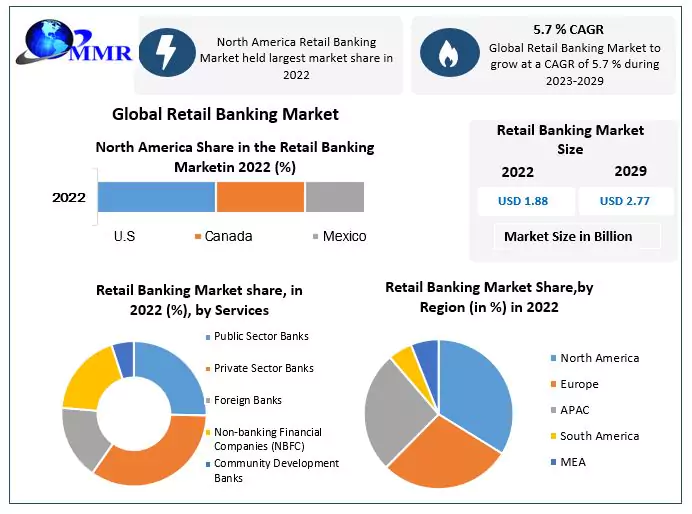

Global Retail Banking Market size was valued at USD 1.88 Bn in 2022 and is expected to reach USD 2.77 Bn by 2029, at a CAGR of 5.7 %.Retail Banking Market Overview

Retail banking serves as the primary interface between individuals and the banking system, which provides convenient access to accounts, secure transactions, and personalized financial advice. The retail banking market is analysed through both established financial institutions and innovative fintech companies. Traditional banks, such as JPMorgan Chase, Bank of America, and HSBC, continue to dominate the market with their extensive branch networks, established customer base, and diverse product offerings. However, fintech disruptors, including PayPal, Square, and Revolut, are challenging traditional banks by leveraging technology to provide user-friendly interfaces, quick transactions, and personalized services.To know about the Research Methodology :- Request Free Sample Report

Retail Banking Market Dynamics:

1. Driver: The market growth is driven by various drivers, which have transformed the industry expansion across the world Digital Transformation to Drive the Retail Banking Market: Digital technology evolution has changed the retail banking sector. With the proliferation of smartphones, internet connectivity, and user-friendly banking apps, customers now expect seamless and convenient digital banking experiences to support digitalization. This shift has helped to drive banks to invest heavily in digital infrastructure, offering features such as mobile banking, online transactions, and 24/7 customer support. This transformation improved operational efficiency for banks and also enabled them to reach a broader customer base. The integration of artificial intelligence (AI) and machine learning (ML) technologies is expected to allow banks to offer tailored financial products, personalized recommendations, and automated customer service, further enhancing the overall customer experience. Presence of the Financial Industry to Influence Market Growth: In emerging markets, the pursuit of financial inclusion has played a crucial role in driving the growth of retail banking. Many individuals previously excluded from traditional banking services are now gaining access to basic financial products through mobile banking and digital platforms. Retail banks are expanding their technology to offer affordable and accessible banking solutions. The increase of mobile payment apps, contactless payments, and digital wallets is key evolution of payment systems and the introduction of new payment solutions has significantly impacted the retail banking market. Regulatory reforms and stricter compliance measures are expected to drive the retail banking industry: financial crisis, regulatory authorities have implemented measures to enhance transparency, strengthen risk management, and protect consumer rights. While these regulations have imposed additional compliance costs on banks, they have also instilled trust and confidence in the banking system, leading to greater customer loyalty and Retail Banking Market growth. 2. Regulatory Compliance and Increased Compliance Costs to Restrain the Market Growth Regulatory authorities of stringent guidelines and regulations to ensure consumer protection, prevent money laundering, and maintain the stability of the financial system are expected to restrain the Retail Banking Market growth. These regulations are crucial for maintaining trust and integrity in the industry, they often require banks to allocate significant resources and investments toward compliance measures. Also, compliance costs are required for hiring compliance officers, know-your-customer (KYC) procedures and implementation for robust anti-money laundering (AML). Another, non-bank financial institutions including payment processors, online lenders, and digital wallets, are gaining importance in providing alternative financial services. These all factors are expected to pose challenges for market growth during the forecast period. 3. Important Growth Trend for Retail Banking Market a. More Data Incorporated into Retail Banking Marketing b. Open Banking and API Integration c. Enhanced Security and Fraud Prevention d. Search Engine Optimization e. Improved Monitoring capabilities f. Sustainability and Responsible Banking g. Content Creation Integral to Retail Bank Marketing h. Artificial Intelligence i. Hiring & Partnering to Strengthen Retail Banking Marketing Strategies 4. Technology Adoption in Retail Banking to Create Lucrative Opportunity for the Market Technology helps retail banks gather vast data of customers and analyze them properly way as well as provide insights into individual preferences, behaviors, and needs. Based on this information banks offer personalized products, services, and recommendations to customers. As a result, technological advancements have transformed the retail banking landscape and created opportunities for banks to innovate, improve customer experiences, expand their reach, and optimize their operations. Retail Banking Market Regional Analysis North American banks dominated the largest market share in 2022 The well-established banking systems, technological innovation and high level of digital adoption are key driving factors for the market growth. The region is home to some of the world's largest banks and financial institutions, and it has been at the forefront of digital banking innovations. The presence of advanced infrastructure, high smartphone penetration, and a growing population are expected to drive the market growth of digital banking services. Focus on improving customer knowledge through user-friendly interfaces, personalized services, and convenient access to banking services as well as regulatory compliance are expected to create lucrative opportunities for regional Retail Banking Market growth. Asia Pacific Retail Savings and Investment Growth Boost the Regional Market Growth In APAC, retail investors allocated 69.7 % of their liquid assets deposited in the banks. Population growth, increasing disposable income, and technology penetration are expected to drive regional Retail Banking Market growth. Digital wallets, online banking, and peer-to-peer lending platforms have gained popularity, and artificial intelligence, blockchain, and biometric authentication influenced factors for regional growth. For example, over 80 percent of banking consumers in Asia are already using multiple channels, with an average of six touchpoints per customer in play. The proliferation of distribution channels has, however, entailed greater complexity and a lack of coordination than is expected often leading to poor customer experience. It is not surprising, therefore, that McKinsey analysis has revealed that around 60 percent of Asian banking consumers believe that “shopping around” for financial products is worth the effort. For retail banks in emerging Asia, distribution architecture, including branches, automatic teller machines, call centers, and IT, account for 50 to 70 percent of non-people costs. These investments, furthermore, have a longer breakeven timeline in new markets.Retail Banking Market Segment Analysis

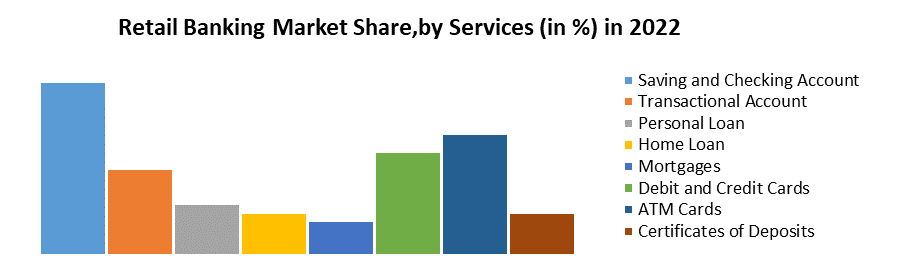

The market is segmented into Type, Services and region. Based on region, the market is analyzed into North America, Asia Pacific, South America, MEA and Europe. By Type, the private retail banking segment dominated the Retail Banking Market share in 2022. This segment growth is due to the adapting flexibility and agility of market conditions. The private sector includes a large number of banks and financial institutions that actively compete for market share. Increasing high competition within the private sector drives banks to continuously improve their offerings, customer experiences, and overall value proposition, which contributes to their dominance in the market. However, the public sector banks segment is expected to increase its market share in the forecast period. State-owned banks often receive major support from the government, such as capital injections, regulatory advantages, and preferential treatment. All such factors are expected to drive the market growth over the forecast period. By Services The savings and checking accounts segment held the largest Retail Banking Market share in 2022. The savings and checking account segment depends on personal banking, which provides a secure place for deposits and manages funds and essential transactions for their everyday goals. Checking accounts, a popular type of bank account within this segment, serve as a means to cover day-to-day expenses. With no restrictions on withdrawals, these accounts provide convenient accessibility. On the other hand, savings accounts offer individuals an opportunity to accumulate wealth by making regular deposits. They serve as a secure repository for funds that are not immediately required, allowing individuals to save and increase their financial resources over time.

Competitive Landscape

The retail banking market includes financial services provided to individual customers and small businesses. Key trends include digital transformation, open banking, personalization, and fintech collaborations. Challenges include increased competition, evolving regulations, cybersecurity risks, and changing customer expectations. However, these challenges also create huge opportunities for differentiation, revenue growth, efficiency improvements, and customer-centric solutions. Retail banking serves as the primary interface between individuals and the banking system, providing convenient access to accounts, secure transactions, and personalized financial advice. Also, the market offers various collections of products and services, including checking and savings accounts, credit and debit cards, mortgages, personal loans, investment products, insurance, and wealth management services. This all factors are expected to sustain the industry expansion in the global Retail Banking Market during the forecast period.Retail Banking Market Scope: Inquire before buying

Retail Banking Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 1.88 Bn Forecast Period 2023 to 2029 CAGR: 5.7 % Market Size in 2029: USD 2.77 Bn Segments Covered: by Type Public Sector Banks Private Sector Banks Foreign Banks Community Development Banks Non-banking Financial Companies (NBFC) by Services Saving and Checking Account Transactional Account Personal Loan Home Loan Mortgages Debit and Credit Cards ATM Cards Certificates of Deposits Retail Banking Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A)Key Palyers

1. Wells Fargo 2. Mitsubishi UFJ Financial Group 3. Bank of America 4. Barclays 5. ICBC 6. China Construction Bank Deutsche Bank 7. HSBC 8. JPMorgan Chase 9. Citigroup 10. NP Paribas 11. BNP Paribas 12. Banco Santander, S.A. 13. The Royal Bank of Scotland Group plc (RBS) 14. Société Générale S.A. 15. ING Groep N.V. 16. BBVA (Banco Bilbao Vizcaya Argentaria) 17. UBS Group AG 18. Standard Chartered PLC Frequently Asked Questions: 1] What is the growth rate of the Global Retail Banking Market? Ans. The Global Retail Banking Market is growing at a significant rate of 5.7 % during the forecast period. 2] Which region is expected to dominate the Global Retail Banking Market? Ans. North America is expected to dominate the Retail Banking Market during the forecast period. 3] What is the expected Global Retail Banking Market size by 2029? Ans. The Retail Banking Market size is expected to reach USD 2.77 Bn by 2029. 4] Which are the top players in the Global Retail Banking Market? Ans. The major top players in the Global Retail Banking Market are Wells Fargo, JPMorgan Chase and others. 5] What are the factors driving the Global Retail Banking Market growth? Ans. The increasing technology adoption in retail banking is expected to drive the market growth.

1. Retail Banking Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Retail Banking Market: Dynamics 2.1. Retail Banking Market Trends by Region 2.1.1. North America Retail Banking Market Trends 2.1.2. Europe Retail Banking Market Trends 2.1.3. Asia Pacific Retail Banking Market Trends 2.1.4. Middle East and Africa Retail Banking Market Trends 2.1.5. South America Retail Banking Market Trends 2.2. Retail Banking Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Retail Banking Market Drivers 2.2.1.2. North America Retail Banking Market Restraints 2.2.1.3. North America Retail Banking Market Opportunities 2.2.1.4. North America Retail Banking Market Challenges 2.2.2. Europe 2.2.2.1. Europe Retail Banking Market Drivers 2.2.2.2. Europe Retail Banking Market Restraints 2.2.2.3. Europe Retail Banking Market Opportunities 2.2.2.4. Europe Retail Banking Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Retail Banking Market Drivers 2.2.3.2. Asia Pacific Retail Banking Market Restraints 2.2.3.3. Asia Pacific Retail Banking Market Opportunities 2.2.3.4. Asia Pacific Retail Banking Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Retail Banking Market Drivers 2.2.4.2. Middle East and Africa Retail Banking Market Restraints 2.2.4.3. Middle East and Africa Retail Banking Market Opportunities 2.2.4.4. Middle East and Africa Retail Banking Market Challenges 2.2.5. South America 2.2.5.1. South America Retail Banking Market Drivers 2.2.5.2. South America Retail Banking Market Restraints 2.2.5.3. South America Retail Banking Market Opportunities 2.2.5.4. South America Retail Banking Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Retail Banking Industry 2.8. Analysis of Government Schemes and Initiatives For Retail Banking Industry 2.9. Retail Banking Market Trade Analysis 2.10. The Global Pandemic Impact on Retail Banking Market 3. Retail Banking Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Retail Banking Market Size and Forecast, by Type (2022-2029) 3.1.1. Public Sector Banks 3.1.2. Private Sector Banks 3.1.3. Foreign Banks 3.1.4. Community Development Banks 3.1.5. Non-banking Financial Companies (NBFC) 3.2. Retail Banking Market Size and Forecast, by Services (2022-2029) 3.2.1. Saving and Checking Account 3.2.2. Transactional Account 3.2.3. Personal Loan 3.2.4. Home Loan 3.2.5. Mortgages 3.2.6. Debit and Credit Cards 3.2.7. ATM Cards 3.2.8. Certificates of Deposits 3.3. Retail Banking Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Retail Banking Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Retail Banking Market Size and Forecast, by Type (2022-2029) 4.1.1. Public Sector Banks 4.1.2. Private Sector Banks 4.1.3. Foreign Banks 4.1.4. Community Development Banks 4.1.5. Non-banking Financial Companies (NBFC) 4.2. North America Retail Banking Market Size and Forecast, by Services (2022-2029) 4.2.1. Saving and Checking Account 4.2.2. Transactional Account 4.2.3. Personal Loan 4.2.4. Home Loan 4.2.5. Mortgages 4.2.6. Debit and Credit Cards 4.2.7. ATM Cards 4.2.8. Certificates of Deposits 4.3. North America Retail Banking Market Size and Forecast, by Country (2022-2029) 4.3.1. United States 4.3.1.1. United States Retail Banking Market Size and Forecast, by Type (2022-2029) 4.3.1.1.1. Public Sector Banks 4.3.1.1.2. Private Sector Banks 4.3.1.1.3. Foreign Banks 4.3.1.1.4. Community Development Banks 4.3.1.1.5. Non-banking Financial Companies (NBFC) 4.3.1.2. United States Retail Banking Market Size and Forecast, by Services (2022-2029) 4.3.1.2.1. Saving and Checking Account 4.3.1.2.2. Transactional Account 4.3.1.2.3. Personal Loan 4.3.1.2.4. Home Loan 4.3.1.2.5. Mortgages 4.3.1.2.6. Debit and Credit Cards 4.3.1.2.7. ATM Cards 4.3.1.2.8. Certificates of Deposits 4.3.2. Canada 4.3.2.1. Canada Retail Banking Market Size and Forecast, by Type (2022-2029) 4.3.2.1.1. Public Sector Banks 4.3.2.1.2. Private Sector Banks 4.3.2.1.3. Foreign Banks 4.3.2.1.4. Community Development Banks 4.3.2.1.5. Non-banking Financial Companies (NBFC) 4.3.2.2. Canada Retail Banking Market Size and Forecast, by Services (2022-2029) 4.3.2.2.1. Saving and Checking Account 4.3.2.2.2. Transactional Account 4.3.2.2.3. Personal Loan 4.3.2.2.4. Home Loan 4.3.2.2.5. Mortgages 4.3.2.2.6. Debit and Credit Cards 4.3.2.2.7. ATM Cards 4.3.2.2.8. Certificates of Deposits 4.3.3. Mexico 4.3.3.1. Mexico Retail Banking Market Size and Forecast, by Type (2022-2029) 4.3.3.1.1. Public Sector Banks 4.3.3.1.2. Private Sector Banks 4.3.3.1.3. Foreign Banks 4.3.3.1.4. Community Development Banks 4.3.3.1.5. Non-banking Financial Companies (NBFC) 4.3.3.2. Mexico Retail Banking Market Size and Forecast, by Services (2022-2029) 4.3.3.2.1. Saving and Checking Account 4.3.3.2.2. Transactional Account 4.3.3.2.3. Personal Loan 4.3.3.2.4. Home Loan 4.3.3.2.5. Mortgages 4.3.3.2.6. Debit and Credit Cards 4.3.3.2.7. ATM Cards 4.3.3.2.8. Certificates of Deposits 5. Europe Retail Banking Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Retail Banking Market Size and Forecast, by Type (2022-2029) 5.1. Europe Retail Banking Market Size and Forecast, by Services (2022-2029) 5.3. Europe Retail Banking Market Size and Forecast, by Country (2022-2029) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Retail Banking Market Size and Forecast, by Type (2022-2029) 5.3.1.2. United Kingdom Retail Banking Market Size and Forecast, by Services (2022-2029) 5.3.2. France 5.3.2.1. France Retail Banking Market Size and Forecast, by Type (2022-2029) 5.3.2.2. France Retail Banking Market Size and Forecast, by Services (2022-2029) 5.3.3. Germany 5.3.3.1. Germany Retail Banking Market Size and Forecast, by Type (2022-2029) 5.3.3.2. Germany Retail Banking Market Size and Forecast, by Services (2022-2029) 5.3.4. Italy 5.3.4.1. Italy Retail Banking Market Size and Forecast, by Type (2022-2029) 5.3.4.2. Italy Retail Banking Market Size and Forecast, by Services (2022-2029) 5.3.5. Spain 5.3.5.1. Spain Retail Banking Market Size and Forecast, by Type (2022-2029) 5.3.5.2. Spain Retail Banking Market Size and Forecast, by Services (2022-2029) 5.3.6. Sweden 5.3.6.1. Sweden Retail Banking Market Size and Forecast, by Type (2022-2029) 5.3.6.2. Sweden Retail Banking Market Size and Forecast, by Services (2022-2029) 5.3.7. Austria 5.3.7.1. Austria Retail Banking Market Size and Forecast, by Type (2022-2029) 5.3.7.2. Austria Retail Banking Market Size and Forecast, by Services (2022-2029) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Retail Banking Market Size and Forecast, by Type (2022-2029) 5.3.8.2. Rest of Europe Retail Banking Market Size and Forecast, by Services (2022-2029) 6. Asia Pacific Retail Banking Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Retail Banking Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Retail Banking Market Size and Forecast, by Services (2022-2029) 6.3. Asia Pacific Retail Banking Market Size and Forecast, by Country (2022-2029) 6.3.1. China 6.3.1.1. China Retail Banking Market Size and Forecast, by Type (2022-2029) 6.3.1.2. China Retail Banking Market Size and Forecast, by Services (2022-2029) 6.3.2. S Korea 6.3.2.1. S Korea Retail Banking Market Size and Forecast, by Type (2022-2029) 6.3.2.2. S Korea Retail Banking Market Size and Forecast, by Services (2022-2029) 6.3.3. Japan 6.3.3.1. Japan Retail Banking Market Size and Forecast, by Type (2022-2029) 6.3.3.2. Japan Retail Banking Market Size and Forecast, by Services (2022-2029) 6.3.4. India 6.3.4.1. India Retail Banking Market Size and Forecast, by Type (2022-2029) 6.3.4.2. India Retail Banking Market Size and Forecast, by Services (2022-2029) 6.3.5. Australia 6.3.5.1. Australia Retail Banking Market Size and Forecast, by Type (2022-2029) 6.3.5.2. Australia Retail Banking Market Size and Forecast, by Services (2022-2029) 6.3.6. Indonesia 6.3.6.1. Indonesia Retail Banking Market Size and Forecast, by Type (2022-2029) 6.3.6.2. Indonesia Retail Banking Market Size and Forecast, by Services (2022-2029) 6.3.7. Malaysia 6.3.7.1. Malaysia Retail Banking Market Size and Forecast, by Type (2022-2029) 6.3.7.2. Malaysia Retail Banking Market Size and Forecast, by Services (2022-2029) 6.3.8. Vietnam 6.3.8.1. Vietnam Retail Banking Market Size and Forecast, by Type (2022-2029) 6.3.8.2. Vietnam Retail Banking Market Size and Forecast, by Services (2022-2029) 6.3.9. Taiwan 6.3.9.1. Taiwan Retail Banking Market Size and Forecast, by Type (2022-2029) 6.3.9.2. Taiwan Retail Banking Market Size and Forecast, by Services (2022-2029) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Retail Banking Market Size and Forecast, by Type (2022-2029) 6.3.10.2. Rest of Asia Pacific Retail Banking Market Size and Forecast, by Services (2022-2029) 7. Middle East and Africa Retail Banking Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Retail Banking Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Retail Banking Market Size and Forecast, by Services (2022-2029) 7.3. Middle East and Africa Retail Banking Market Size and Forecast, by Country (2022-2029) 7.3.1. South Africa 7.3.1.1. South Africa Retail Banking Market Size and Forecast, by Type (2022-2029) 7.3.1.2. South Africa Retail Banking Market Size and Forecast, by Services (2022-2029) 7.3.2. GCC 7.3.2.1. GCC Retail Banking Market Size and Forecast, by Type (2022-2029) 7.3.2.2. GCC Retail Banking Market Size and Forecast, by Services (2022-2029) 7.3.3. Nigeria 7.3.3.1. Nigeria Retail Banking Market Size and Forecast, by Type (2022-2029) 7.3.3.2. Nigeria Retail Banking Market Size and Forecast, by Services (2022-2029) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Retail Banking Market Size and Forecast, by Type (2022-2029) 7.3.4.2. Rest of ME&A Retail Banking Market Size and Forecast, by Services (2022-2029) 8. South America Retail Banking Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Retail Banking Market Size and Forecast, by Type (2022-2029) 8.2. South America Retail Banking Market Size and Forecast, by Services (2022-2029) 8.3. South America Retail Banking Market Size and Forecast, by Country (2022-2029) 8.3.1. Brazil 8.3.1.1. Brazil Retail Banking Market Size and Forecast, by Type (2022-2029) 8.3.1.2. Brazil Retail Banking Market Size and Forecast, by Services (2022-2029) 8.3.2. Argentina 8.3.2.1. Argentina Retail Banking Market Size and Forecast, by Type (2022-2029) 8.3.2.2. Argentina Retail Banking Market Size and Forecast, by Services (2022-2029) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Retail Banking Market Size and Forecast, by Type (2022-2029) 8.3.3.2. Rest Of South America Retail Banking Market Size and Forecast, by Services (2022-2029) 9. Global Retail Banking Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Retail Banking Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Wells Fargo 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Mitsubishi UFJ Financial Group 10.3. Bank of America 10.4. Barclays 10.5. ICBC 10.6. China Construction Bank Deutsche Bank 10.7. HSBC 10.8. JPMorgan Chase 10.9. Citigroup 10.10. NP Paribas 10.11. BNP Paribas 10.12. Banco Santander, S.A. 10.13. The Royal Bank of Scotland Group plc (RBS) 10.14. Société Générale S.A. 10.15. ING Groep N.V. 10.16. BBVA (Banco Bilbao Vizcaya Argentaria) 10.17. UBS Group AG 10.18. Standard Chartered PLC 11. Key Findings 12. Industry Recommendations 13. Retail Banking Market: Research Methodology 14. Terms and Glossary