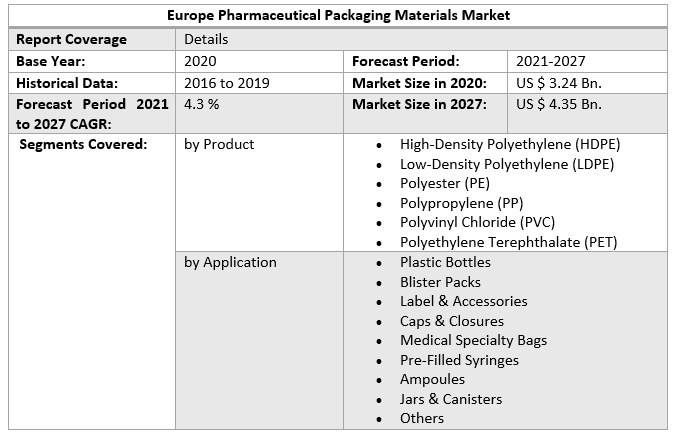

Europe Pharmaceutical Packaging Materials Market size was valued at US$ 3.24 Bn. in 2020 and the total revenue is expected to grow at 4.3% through 2021 to 2027, reaching nearly US$ 4.35 Bn.Europe Pharmaceutical Packaging Materials Market Overview:

From the time of manufacture until usage, packaging is the collection of many components (e.g., bottle, vial, closure, cap, ampoule, blister) that surround the pharmaceutical product. Packaging is mainly done to protect the main pharmaceutical ingredient from the external environment such as light, moisture, oxygen, biological contamination, and counterfeiting.To know about the Research Methodology :- Request Free Sample Report The report has covered the market trends from 2015 to forecast the market through 2027. 2020 is considered a base year however 2020's numbers are on the real output of the companies in the market. Special attention is given to 2020 and the effect of lockdown on the demand and supply, and also the impact of lockdown for the next two years on the market. Some companies have done good in lockdown also and specific strategic analysis of those companies is done in the report

Europe Pharmaceutical Packaging Materials Market Dynamics:

Recent technical breakthroughs, like as smart packaging, are expected to fuel the industry's expansion. Increased usage of environmentally friendly pharmaceuticals and energy-saving packaging is also predicted to have a favorable impact on the market. Continued research and development in recycled plastic-based pharmaceutical packaging materials are expected to enhance market growth since they provide a low-cost raw material that can help reduce plastic pollution. Rising awareness of the need for high-quality pharmaceutical packaging, particularly during transit and storage, is projected to boost the market growth shortly. In the future years, increased use of High-Density Polypropylene (HDPE) in plastic bottles, caps and closures, pre-filled syringes, and ampoules is expected to push manufacturers to backward integration in the value chain. Increased participation in the value chain is likely to result in a reduction in the time it takes to transform pharmaceutical packaging materials into completed products, as well as a cost advantage.Europe Pharmaceutical Packaging Materials Market Segment Analysis:

The Polyvinyl Chloride (PVC) segment is dominating the Product segment of the Europe Pharmaceutical Packaging Materials Market:

Polyvinyl Chloride (PVC) was the largest product segment in terms of sales in 2019, accounting for 24.36 % of the market. Its features, including low cost, chemical stability, flexibility, durability, and chemical stress crack resistance, among others, make it appropriate for a wide range of packing applications. Plastic bottles, caps and closures, ampoules, jars, and canisters are just a few of the many uses for HDPE. HDPE is in high demand in pharmaceutical packaging because of properties such as strong solvent resistance, high tensile strength, relative transparency, flexibility, and toughness. The Plastic bottles segment is considered to supplement the growth of the European Pharmaceutical Packaging Materials Market. In 2019, the most popular application sector for pharmaceutical packaging materials in Europe was plastic bottles. Due to their features such as high temperature and impact resistance, the superior barrier to gas and moisture, and transparency and opacity required for the bottles, high-density polyethylene (HDPE) and polyethylene terephthalate (PET) are commonly used in the fabrication of plastic bottles. Further, Plastic packaging can withstand harsh settings during transportation and does not disintegrate quickly in hot or cold climates, retaining the freshness of the food or beverage inside. Also, pharmaceutical products are protected from moisture, oxygen, dust, light, and smells. Hence, these benefits are likely to boost the growth of the market.The objective of the report is to present a comprehensive analysis of the European Pharmaceutical Packaging Materials Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Europe Pharmaceutical Packaging Materials Market dynamics, structure by analyzing the market segments and projecting the Europe Pharmaceutical Packaging Materials Market size. Clear representation of competitive analysis of key players by Grade, price, financial position, Grade portfolio, growth strategies, and regional presence in the Europe Pharmaceutical Packaging Materials Market make the report investor’s guide.

Europe Pharmaceutical Packaging Materials Market Scope: Inquire before buying

Europe Pharmaceutical Packaging Materials Market, by Region

• Germany • The U.K. • France • Italy • RussiaEurope Pharmaceutical Packaging Materials Market Key Player

• Amcor • CCL Industries • Intrapac • Rexam Plc • Schott AG Sumitomo Chemical Co., Ltd. • Arkema • MOL GROUP • Eastman Chemical Company • Dow • Exxon Mobil Corporation • Formosa Plastics Corporation • Covestro AG • CCl Industries Inc • Intrapac GoupFAQs:

1. What is the Europe Pharmaceutical Packaging Materials market value in 2020? Ans: Europe Pharmaceutical Packaging Materials market value in 2020 was estimated as 3.24 Billion USD. 2. What is the Europe Pharmaceutical Packaging Materials market growth? Ans: The Europe Pharmaceutical Packaging Materials market is anticipated to grow with a CAGR of 4.3% in the forecast period and is likely to reach USD 4.35 Billion by the end of 2027. 3. Which Application segment is expected to dominate the Europe Pharmaceutical Packaging Materials market during the forecast period? Ans: The Plastic bottles was the dominant application segment in the Europe pharmaceutical packaging materials market in 2019. Plastics bottles are majorly manufactured using high-density polyethylene (HDPE) and polyethylene terephthalate (PET) owing to their properties such as high temperature and impact resistance, excellent barrier to gas and moisture, and transparency and opacity required for the bottles. 4. Who are the key players in the Europe Pharmaceutical Packaging Materials market? Ans: Some key players operating in the Europe Pharmaceutical Packaging Materials market include Sumitomo Chemical Co., Ltd., Arkema, MOL GROUP, Eastman Chemical Company, Dow, Exxon Mobil Corporation, Formosa Plastics Corporation, and Covestro AG. 5. What is the key driving factor for the growth of the Europe Pharmaceutical Packaging Materials market? Ans: Increasing use of environment-friendly pharmaceutical and energy saving packing products is also expected to influence the market positively.

1.Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Europe Pharmaceutical Packaging Materials Market Size, by Market Value (US$ Bn) 3.1. Europe Market Segmentation 3.2. Europe Market Segmentation Share Analysis, 2020 3.2.1. Europe 3.2.2. By Region (Europe) 3.3. Geographical Snapshot of the Europe Pharmaceutical Packaging Materials Market 3.4. Geographical Snapshot of the Europe Pharmaceutical Packaging Materials Market, By Manufacturer share 4. Europe Pharmaceutical Packaging Materials Market Overview, 2020-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. By Region (Europe) 4.1.2. Restraints 4.1.2.1. By Region (Europe) 4.1.3. Opportunities 4.1.3.1. By Region (Europe) 4.1.4. Challenges 4.1.4.1. By Region (Europe) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porter Five Forces Analysis 4.1.6.1. The threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. The threat of Substitute Grades 4.1.6.5. The intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Europe Pharmaceutical Packaging Materials Market 5. Supply Side and Demand Side Indicators 6. Europe Pharmaceutical Packaging Materials Market Analysis and Forecast, 2020-2027 6.1. Europe Pharmaceutical Packaging Materials Market Size & Y-o-Y Growth Analysis. 7. Europe Pharmaceutical Packaging Materials Market Analysis and Forecasts, 2020-2027 7.1. Market Size (Value) Estimates & Forecast By Product, 2020-2027 7.1.1. High-Density Polyethylene (HDPE) 7.1.2. Low-Density Polyethylene (LDPE) 7.1.3. Polyester (PE) 7.1.4. Polypropylene (PP) 7.1.5. Polyvinyl Chloride (PVC) 7.1.6. Polyethylene Terephthalate (PET) 7.2. Market Size (Value) Estimates & Forecast By Application, 2020-2027 7.2.1. Plastic Bottles 7.2.2. Blister Packs 7.2.3. Label & Accessories 7.2.4. Caps & Closures 7.2.5. Medical Specialty Bags 7.2.6. Pre-Filled Syringes 7.2.7. Ampoules 7.2.8. Jars & Canisters 7.2.9. Others 8. Europe Pharmaceutical Packaging Materials Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2020-2027 8.1.1. Germany 8.1.2. The U.K. 8.1.3. France 8.1.4. Italy 8.1.5. Russia 9. Germany Pharmaceutical Packaging Materials Market Analysis and Forecasts, 2020-2027 9.1. Market Size (Value) Estimates & Forecast By Product, 2020-2027 9.1.1. High-Density Polyethylene (HDPE) 9.1.2. Low-Density Polyethylene (LDPE) 9.1.3. Polyester (PE) 9.1.4. Polypropylene (PP) 9.1.5. Polyvinyl Chloride (PVC) 9.1.6. Polyethylene Terephthalate (PET) 9.2. Market Size (Value) Estimates & Forecast By Application, 2020-2027 9.2.1. Plastic Bottles 9.2.2. Blister Packs 9.2.3. Label & Accessories 9.2.4. Caps & Closures 9.2.5. Medical Specialty Bags 9.2.6. Pre-Filled Syringes 9.2.7. Ampoules 9.2.8. Jars & Canisters 9.2.9. Others 10. Competitive Landscape 10.1. Geographic Footprint of Major Players in the Europe Pharmaceutical Packaging Materials Market 10.2. Competition Matrix 10.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Fiber Grades, and R&D Investment 10.2.2. New Grade Launches and Grade Enhancements 10.2.3. Market Consolidation 10.2.3.1. M&A by Regions, Investment, and Verticals 10.2.3.2. M&A, Forward Integration and Backward Integration 10.2.3.3. Partnership, Joint Ventures, and Strategic Alliances/ Sales Agreements 10.3. Company Profile: Key Players 10.3.1. Novartis AG 10.3.1.1. Company Overview 10.3.1.2. Financial Overview 10.3.1.3. Geographic Footprint 10.3.1.4. Grade Portfolio 10.3.1.5. Business Strategy 10.3.1.6. Recent Development 10.3.2. Sumitomo Chemical Co., Ltd. 10.3.3. Arkema 10.3.4. MOL GROUP 10.3.5. Eastman Chemical Company 10.3.6. Dow 10.3.7. Exxon Mobil Corporation 10.3.8. Formosa Plastics Corporation 10.3.9. Covestro AG. 10.3.10. Amcor 10.3.11. CCL Industries 10.3.12. Intrapac 10.3.13. Rexam Plc 10.3.14. Schott AG 46. Primary Key Insights