The Orphan Drug Market size was valued at USD 254.63 Billion in 2024 and the total Orphan Drug revenue is expected to grow at a CAGR of 9.7% from 2025 to 2032, reaching nearly USD 534.03 Billion.Orphan Drug Market Overview

Orphan medicines are medications created to address uncommon illnesses that only a small percentage of individuals suffer and frequently have few therapeutic choices. Laws like the Orphan Drug Act (ODA) in the US, which offer incentives to businesses to discover therapies for uncommon diseases, are the primary forces behind the creation of orphan drugs. However, developing orphan drugs is challenging thanks to small patient populations, high development costs, and complex regulatory requirements. Despite these challenges, the orphan drug market is growing rapidly, driven by increasing awareness of rare diseases, advances in personalized medicine, and the expansion of regulatory incentives globally. The market is segmented based on the type of disease, type of product, and region, with biologics being a significant segment due to their effectiveness in treating many rare diseases.To know about the Research Methodology :- Request Free Sample Report 1. According to an MMR study in 2024, 37.6% of respondents were unaware of what constitutes a rare disease, 48.4% were unaware of the number of rare diseases in India, 57.2% were unaware of the patient population, and 66% were unaware of the number of orphan medications that are commercially accessible.

Orphan Drug Market Dynamics

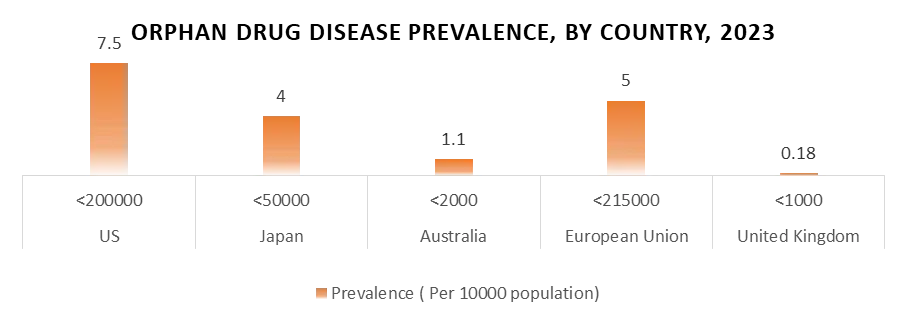

Emerging Technologies Accelerating the Orphan Drug Market The Orphan drug market is driven by technologies such as Gene editing, AI, and advanced drug delivery systems making it a prominent impact. Treatment possibilities are growing through innovations such as antibody therapy, enzyme replacement therapy, gene therapy, small molecule medications, and drug repositioning are some of the processes used to treat diseases. For instance, mutations in the CFTR (Cystic Fibrosis Transmembrane Conductance Regulator) gene produce the rare genetic disease cystic fibrosis, which results in respiratory failure and recurrent lung infections. current medications that alter CFTR activity through the use of AI algorithms, opening up a more effective route for medicinal development. 1. For instance, in 2024, an AI-driven biotech company received the FDA's inaugural Orphan Drug Designation for INS018_055, a small molecule inhibitor for treating idiopathic pulmonary fibrosis. Gene therapy for orphan pharmaceuticals corrects a rare condition caused by a genetic deficiency by inserting a functioning gene copy into the patient's cells via modified viruses. Although regulating immune reactions and getting the gene into the correct cells present hurdles, this therapy delivers long-lasting or permanent relief. Table 1. Technologies In Orphan Drug MarketHigh Expenses Related to Medication Advancement The development of orphan drugs faces several significant restraints. High expenses related to medication advancement are a primary challenge, primarily thanks to the limited patient populations associated with rare diseases. The small market size reduces the potential return on investment for pharmaceutical companies, making it less attractive to develop orphan drugs compared to more common diseases. This financial constraint hinders the availability of effective treatments for many rare diseases. Additionally, the lack of awareness and diagnosis of rare diseases poses a significant barrier. Many rare diseases are poorly understood, leading to delays in diagnosis or misdiagnosis. This not only affects patients' access to appropriate treatments but also complicates the development of orphan drugs for these conditions. Additionally, competition and market exclusivity issues impact orphan drug development. While orphan drug status provides incentives such as market exclusivity for a period, the limited market size and the potential for generic competition after exclusivity periods expire thus impact the financial viability of developing and marketing orphan drugs. These challenges highlight the need for innovative approaches and collaborations to overcome the restraints in orphan drug development and ensure timely access to treatments for rare diseases. 1. Soliris, a costly medication produced by Alexion Pharmaceuticals, is a significant treatment for paroxysmal nocturnal hemoglobinuria (PNH), with each patient's yearly cost exceeding $500,000. However, its high cost raises concerns about treatment accessibility and affordability. 2. In the United States, orphan drugs have an average annual cost of $32,000, and over a third of drugs with orphan indications cost more than $100,000 annually. 3. For example, the cost of treatment with enzyme replacement therapies may reach more than US$150,000 per treatment year. 4. Orphan drug development is characterized by high costs per patient, with per-trial costs that exceed $100 Billion. The out-of-pocket clinical costs per approved orphan drug are $166 Billion, compared to $291 Billion for non-orphan drugs. Low Prevalence Complicates Treatment Development The low prevalence of orphan drug disease that targets orphan medicines is one of their main concerns. Compared to medications for more prevalent disorders, the potential market for orphan pharmaceuticals is less since these diseases only impact a small proportion of people. Because the return on investment for orphan pharmaceuticals is unpredictable, pharmaceutical corporations find it financially difficult to invest in research and development for these drugs. Thus, it is challenging to carry out clinical trials, obtain enough information for regulatory approval, and demonstrate the treatment's efficacy thanks to the small patient groups. Orphan medications are essential for treating unmet medical needs in rare illnesses despite these obstacles, underscoring the need for ongoing research and development in this field. 1. Orphan drugs are therapeutic options for rare diseases that have few or no prior treatments. Orphan drugs account for 0.3% of all drugs, but 7.9% of total drug costs in the U.S. 39% of orphan drugs cost more than $100,000 per year, but these are used to treat only 23% of patients with rare diseases. Advancing the Treatment of Rare Diseases and Promoting Innovation Orphan drugs, designed for rare diseases, offer several key opportunities. Medication addresses unmet medical needs, often providing the only treatment or significantly improving patients' lives. For example, Soliris by Alexion Pharmaceuticals treats paroxysmal nocturnal hemoglobinuria. Orphan drugs also be financially lucrative due to regulatory incentives, encouraging investment in rare disease research. Additionally, these drugs drive innovation, leading to advancements in personalized medicine and therapy development, as seen with Kalydeco by Vertex Pharmaceuticals for cystic fibrosis. Overall, orphan drugs play a vital role in addressing rare diseases, benefiting both patients and the pharmaceutical industry. 1. In , the FDA's Center for Drug Evaluation and Research (CDER) approved 54% of orphan drugs, the highest yet. 2. The National Institutes of Health (NIH) estimates that 25–30 billion Americans are impacted by around 7,000 uncommon illnesses. That makes around one in ten Americans. 3. In December Casgevy became the first CRISPR-based drug approved by the FDA.

Technology Description Impact Gene editing Gene editing technology such as CRISPR is reforming the treatment of genetic diseases including rare disorders. Targets the genetic cause of the disease. Artificial Intelligence AI and machine learning algorithms hold the potential to profoundly influence the development of orphan drugs. Discovering Drug Target Interactions Advanced drug delivery systems Advanced drug delivery systems (DDS) are formulated to deliver drugs to specific target sites, maximizing therapeutic efficacy and minimizing off-target accumulation in the body. Enhances the therapeutic efficacy, reducing side effects by targeting the drug specifically to the affected cells

Orphan Drug Market Segment Analysis:

By product type, the biologicals segment held the largest Orphan Drug Market share in 2024 and is expected to grow at a 9.6% CAGR during the forecast period of 2032. Biologicals are driving market growth in the treatment of rare diseases. These drugs offer targeted therapies for conditions like genetic disorders and rare cancers. Advancements in biotechnology have led to more effective and complex biological treatments, while regulatory incentives have encouraged their development. With growing awareness and prevalence of rare diseases, biologics are playing a key role in meeting the needs of patients in this market. By disease type, the oncology disease segment is a leading area for orphan drug development, driven by several factors. One of the key drivers is the increasing understanding of the genetic and molecular basis of cancer, leading to the identification of rare subtypes of cancer that can be targeted with precision therapies. Another driver is the significant unmet medical need in oncology, where patients with rare cancers often have limited treatment options and poor outcomes. Orphan drugs offer the potential to provide these patients with new, targeted therapies that improve outcomes and quality of life. Additionally, regulatory incentives, such as market exclusivity and accelerated approval pathways, have encouraged pharmaceutical companies to invest in orphan drug development in oncology 1. For example, Vitrakvi (larotrectinib), developed by Bayer and Loxo Oncology, is an orphan drug approved for the treatment of solid tumors with NTRK gene fusions, which are rare but occur across various cancer types. 2. Trastuzumab and Gleevec, two orphan medications, have demonstrated promise in treating uncommon cancer subtypes, indicating their clinical and business viability. Because of the ongoing need for novel medicines and developments in precision medicine, the oncology disease sector continues to be a primary priority for orphan drug development.Orphan Drug Market Regional Insights:

North America dominated the Orphan drug market with the highest share in 2024. The region is expected to grow at a CAGR of 6.5% during the forecast period and maintain its dominance by 2024 and this trend is to continue for a few years. The United States is the country with the most market share in North America. The fact that an FDA-approved orphan medicine enjoys seven years of advertising exclusivity, tax deductions, and user fee reduction upon approval for a particular indication is one of the factors contributing to the market's growth in the US. There has been a rise in the number of orphan pharmaceuticals authorized in the region as a result of these incentives encouraging pharmaceutical companies to participate in orphan drug research. 1. In the United States, orphan drugs have an average annual cost of $32,000, and over a third of drugs with orphan indications cost more than $100,000 annually. 2. Over 7,000 rare diseases affect more than 30 billion people in the United States. Europe has also shown significant growth potential in the Orhan drug market, The Increasing prevalence of rare diseases and the recognition of their importance by healthcare systems is driving growth in Europe. The EU has taken steps to improve access to orphan drugs through initiatives such as the European Reference Networks (ERNs), which aim to improve the diagnosis and treatment of rare diseases across member states. 1. Successful orphan drugs in Europe include Soliris (eculizumab) for paroxysmal nocturnal hemoglobinuria (PNH) and atypical hemolytic uremic syndrome (aHUS), which has been granted orphan drug status in the EU and has seen significant growth in sales. 2. The European Medicines Agency (EMA) reports that 36 million individuals in the EU suffer from more than 6,000 different uncommon illnesses. Diseases that impact less than one in 100,000 persons affect the majority of people. Thus, Europe's commitment to supporting orphan drug development, along with the increasing prevalence of rare diseases, has made it a leading region for growth in this sector. Asia Pacific Orphan drug issues have become an increasing concern for patients and healthcare policy authorities in China in recent years. The pricing and availability of orphan pharmaceuticals for rare diseases have already been regulated in China, Australia, Singapore, Japan, Taiwan, and Korea equivalent regulatory frameworks are now being established in India and New Zealand. These countries have already put laws in place to support orphan drug development. 1. In China, rare or orphan diseases affected at least 10 billion people and 350 billion globally Orphan Drug Market Competitive Landscapes The Orphan Drug industry's competitive landscape is characterized by a dynamic interplay among key players, each contributing distinct strengths to shape the global market. Notable companies include Takeda Pharmaceutical Company Limited, Novartis AG Johnson & Johnson, F. Hoffmann-La Roche Ltd, Bristol-Myers Squibb Company (Celgene Corporation) Amgen Inc., Bayer AG, Alexion Pharmaceutical Inc., Novo Nordisk A/S, Pfizer Inc. The analysts examine the effect, strengths, and geographical impacts of every firm, acknowledging the complex dynamics of the sector and the crucial role these organizations play in propelling innovation and managing all of the obstacles present in the orphan drug landscape 1. On 31st January Takeda and the protagonist confirmed the signing of a worldwide license and collaboration agreement for the development and marketing of this product. Rusfertide is an experimental injectable hepcidin mimetic peptide of the natural hormone hepcidin, which is presently being studied in the pivotal Phase 3 trial VERIFY for the treatment of Polycythemia Vera (PV). 2. On 17th July Novartis expands its strengths in the neuroscience pipelines and xRNA platform by acquiring DTx Pharma.Orphan Drugs Market Scope: Inquire before buying

Global Orphan Drugs Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 254.63 Bn. Forecast Period 2025 to 2032 CAGR: 9.7% Market Size in 2032: USD 534.03 Bn. Segments Covered: by Product Biological Non-Biological by Disease Type Oncology Pancreatic Cancer Ovarian cancer Multiple Myeloma Renal Cell Carcinoma Others Hematology Hereditary Angioedema (HAE) Hemophilia Others Neurology Duchenne Muscular Dystrophy Alzheimer's Disease Huntington's Disease Others Cardiovascular by Therapy Type Oncology Neuromuscular Respiratory Hematology Others by Distribution Channel Hospital pharmacies Retail pharmacies Online pharmacies others Orphan Drugs Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Orpah Drug Market, Key Players:

1. Takeda Pharmaceutical Company Limited 2. Novartis AG 3. Johnson & Johnson 4. F. Hoffmann-La Roche Ltd 5. Bristol-Myers Squibb Company (Celgene Corporation) 6. Amgen Inc. 7. Bayer AG 8. Alexion Pharmaceutical Inc. 9. Novo Nordisk A/S 10. Pfizer Inc. 11. Eli Lilly and Company 12. Merck KGaA 13. Bristol-Myers Squibb Company 14. Amgen Inc., 15. Alexion Pharmaceutical Inc 16. Bayer AG 17. Bristol Myers Squibb Co 18. Celegne Corporation 19. DAIICHI SANKYO Company Ltd 20. F. Hoffmann La-Roche 21. GlaxoSmithKline PLC 22. Sawai Pharmaceutical (Japan) 23. LG Chem (South Korea) 24. Chia Tai Tianqing Pharmaceutical Group (China) 25. Cipla (India) 26. Dr. Reddy's Laboratories (India) 27. Sun Pharmaceutical Industries (India) FAQs: 1. What are the growth drivers for the Orphan Drug Market? Ans. The growth drivers of the Orphan Drugs Market are driven by a combination of medical, regulatory, and economic factors. Medical advancements and genetic research have led to a deeper understanding of rare diseases, enabling the identification of potential drug targets and treatment approaches. 2. What is the major restraint on the Orphan Drug Market growth? Ans. High treatment costs and stringent government regulations are expected to be the major restraining factors for the Orphan Drug Market growth. 3. Which region is expected to lead the global Orphan Drug Market during the forecast period? Ans. North America is expected to lead the global Orphan Drug Market during the forecast period. 4. What was the Global Orphan Drug Market size in 2024? Ans: The Global Orphan Drug Market size was USD 254.63 Billion in 2024. 5. What segments are covered in the Orphan Drug Market report? Ans. The segments covered in the Orphan Drug Market report are product, Disease, Therapy Type, and Distribution channel

1. Orphan Drug Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Orphan Drug Market: Dynamics 2.1. Orphan Drug Market Trends by Region 2.1.1. North America Orphan Drug Market Trends 2.1.2. Europe Orphan Drug Market Trends 2.1.3. Asia Pacific Orphan Drug Market Trends 2.1.4. Middle East and Africa Orphan Drug Market Trends 2.1.5. South America Orphan Drug Market Trends 2.2. Orphan Drug Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Orphan Drug Market Drivers 2.2.1.2. North America Orphan Drug Market Restraints 2.2.1.3. North America Orphan Drug Market Opportunities 2.2.1.4. North America Orphan Drug Market Challenges 2.2.2. Europe 2.2.2.1. Europe Orphan Drug Market Drivers 2.2.2.2. Europe Orphan Drug Market Restraints 2.2.2.3. Europe Orphan Drug Market Opportunities 2.2.2.4. Europe Orphan Drug Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Orphan Drug Market Drivers 2.2.3.2. Asia Pacific Orphan Drug Market Restraints 2.2.3.3. Asia Pacific Orphan Drug Market Opportunities 2.2.3.4. Asia Pacific Orphan Drug Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Orphan Drug Market Drivers 2.2.4.2. Middle East and Africa Orphan Drug Market Restraints 2.2.4.3. Middle East and Africa Orphan Drug Market Opportunities 2.2.4.4. Middle East and Africa Orphan Drug Market Challenges 2.2.5. South America 2.2.5.1. South America Orphan Drug Market Drivers 2.2.5.2. South America Orphan Drug Market Restraints 2.2.5.3. South America Orphan Drug Market Opportunities 2.2.5.4. South America Orphan Drug Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technological Road Map 2.6. Key Opinion Leader Analysis for the Orphan Drug Industry 2.7. Government Investments and Initiatives for the Orphan Drug Industry 2.8. Regulatory Landscape by Region 2.8.1. North America 2.8.2. Europe 2.8.3. Asia Pacific 2.8.4. Middle East and Africa 2.8.5. South America 3. Orphan Drug Market: Market Size and Forecast by Segmentation (By Value in USD Billion) (2024 to 2030) 3.1. Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 3.1.1. Biological 3.1.2. Non-Biological 3.2. Orphan Drug Market Size and Forecast, By Disease (2024-2030) 3.2.1. Oncology 3.2.1.1. Pancreatic Cancer 3.2.1.2. Ovarian cancer 3.2.1.3. Multiple Myeloma 3.2.1.4. Renal Cell Carcinoma 3.2.1.5. Others 3.2.2. Hematology 3.2.2.1. Hereditary Angioedema (HAE) 3.2.2.2. Hemophilia 3.2.2.3. Others 3.2.3. Neurology 3.2.3.1. Duchenne Muscular Dystrophy 3.2.3.2. Alzheimer's Disease 3.2.3.3. Huntington's Disease 3.2.3.4. Others 3.2.4. Cardiovascular 3.3. Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 3.3.1. Oncology 3.3.2. Neuromuscular 3.3.3. Respiratory 3.3.4. Hematology 3.3.5. Others 3.4. Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 3.4.1. Hospital pharmacies 3.4.2. Retail pharmacies 3.4.3. Online pharmacies 3.4.4. Others 3.5. Orphan Drug Market Size and Forecast, By Region (2024-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Orphan Drug Market Size and Forecast By Segmentation (By Value in USD Billion) (2024-2030) 4.1. North America Orphan Drug Market Size and Forecast, By Product Type (2024 to 2030) 4.1.1. Biological 4.1.2. Non-Biological 4.2. North America Orphan Drug Market Size and Forecast, By Disease (2024-2030) 4.2.1. Oncology 4.2.1.1. Pancreatic Cancer 4.2.1.2. Ovarian cancer 4.2.1.3. Multiple Myeloma 4.2.1.4. Renal Cell Carcinoma 4.2.1.5. Others 4.2.2. Hematology 4.2.2.1. Hereditary Angioedema (HAE) 4.2.2.2. Hemophilia 4.2.2.3. Others 4.2.3. Neurology 4.2.3.1. Duchenne Muscular Dystrophy 4.2.3.2. Alzheimer's Disease 4.2.3.3. Huntington's Disease 4.2.3.4. Others 4.2.4. Cardiovascular 4.3. North America Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 4.3.1. Oncology 4.3.2. Neuromuscular 4.3.3. Respiratory 4.3.4. Hematology 4.3.5. Others 4.4. North America Others Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 4.4.1. Hospital pharmacies 4.4.2. Retail pharmacies 4.4.3. Online pharmacies 4.4.4. others 4.5. North America Orphan Drug Market Size and Forecast, By Region (2024-2030) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.6. North America Orphan Drug Market Size and Forecast, By Country (2024-2030) 4.6.1. United States 4.6.1.1. United States Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 4.6.1.1.1. Biological 4.6.1.1.2. Non-Biological 4.6.1.2. United States Orphan Drug Market Size and Forecast, By Disease (2024-2030) 4.6.1.2.1. Oncology 4.6.1.2.1.1. Pancreatic Cancer 4.6.1.2.1.2. Ovarian cancer 4.6.1.2.1.3. Multiple Myeloma 4.6.1.2.1.4. Renal Cell Carcinoma 4.6.1.2.1.5. Others 4.6.1.2.2. Hematology 4.6.1.2.2.1. Hereditary Angioedema (HAE) 4.6.1.2.2.2. Hemophilia 4.6.1.2.2.3. Others 4.6.1.2.3. Neurology 4.6.1.2.3.1. Duchenne Muscular Dystrophy 4.6.1.2.3.2. Alzheimer's Disease 4.6.1.2.3.3. Huntington's Disease 4.6.1.2.3.4. Others 4.6.1.2.4. Cardiovascular 4.6.1.3. United States Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 4.6.1.3.1. Oncology 4.6.1.3.2. Neuromuscular 4.6.1.3.3. Respiratory 4.6.1.3.4. Hematology 4.6.1.3.5. Others 4.6.1.4. United States Others Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 4.6.1.4.1. Hospital pharmacies 4.6.1.4.2. Retail pharmacies 4.6.1.4.3. Online pharmacies 4.6.1.4.4. Others 4.6.1.5. United States Orphan Drug Market Size and Forecast, By Region (2024-2030) 4.6.1.5.1. North America 4.6.1.5.2. Europe 4.6.1.5.3. Asia Pacific 4.6.1.5.4. Middle East and Africa 4.6.2. Canada 4.6.2.1. Canada Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 4.6.2.1.1. Biological 4.6.2.1.2. Non-Biological 4.6.2.2. Canada Orphan Drug Market Size and Forecast, By Disease (2024-2030) 4.6.2.2.1. Oncology 4.6.2.2.1.1. Pancreatic Cancer 4.6.2.2.1.2. Ovarian cancer 4.6.2.2.1.3. Multiple Myeloma 4.6.2.2.1.4. Renal Cell Carcinoma 4.6.2.2.1.5. Others 4.6.2.2.2. Hematology 4.6.2.2.2.1. Hereditary Angioedema (HAE) 4.6.2.2.2.2. Hemophilia 4.6.2.2.2.3. Others 4.6.2.2.3. Neurology 4.6.2.2.3.1. Duchenne Muscular Dystrophy 4.6.2.2.3.2. Alzheimer's Disease 4.6.2.2.3.3. Huntington's Disease 4.6.2.2.3.4. Others 4.6.2.2.4. Cardiovascular 4.6.2.3. Canada Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 4.6.2.3.1. Oncology 4.6.2.3.2. Neuromuscular 4.6.2.3.3. Respiratory 4.6.2.3.4. Hematology 4.6.2.3.5. Others 4.6.2.4. Canada Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 4.6.2.4.1. Hospital pharmacies 4.6.2.4.2. Retail pharmacies 4.6.2.4.3. Online pharmacies 4.6.2.4.4. Others 4.6.2.5. Canada Orphan Drug Market Size and Forecast, By Region (2024-2030) 4.6.2.5.1. North America 4.6.2.5.2. Europe 4.6.2.5.3. Asia Pacific 4.6.2.5.4. Middle East and Africa 4.6.3. Mexico 4.6.3.1. Mexico Orphan Drug Market Size and Forecast, By Product Type (2024-2032) 4.6.3.1.1. Biological 4.6.3.1.2. Non-Biological 4.6.3.2. Mexico Orphan Drug Market Size and Forecast, By Disease (2024-2030) 4.6.3.2.1. Oncology 4.6.3.2.1.1. Pancreatic Cancer 4.6.3.2.1.2. Ovarian cancer 4.6.3.2.1.3. Multiple Myeloma 4.6.3.2.1.4. Renal Cell Carcinoma 4.6.3.2.1.5. Others 4.6.3.2.2. Hematology 4.6.3.2.2.1. Hereditary Angioedema (HAE) 4.6.3.2.2.2. Hemophilia 4.6.3.2.2.3. Others 4.6.3.2.3. Neurology 4.6.3.2.3.1. Duchenne Muscular Dystrophy 4.6.3.2.3.2. Alzheimer's Disease 4.6.3.2.3.3. Huntington's Disease 4.6.3.2.3.4. Others 4.6.3.2.4. Cardiovascular 4.6.3.3. Mexico Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 4.6.3.3.1. Oncology 4.6.3.3.2. Neuromuscular 4.6.3.3.3. Respiratory 4.6.3.3.4. Hematology 4.6.3.3.5. Others 4.6.3.4. Mexico Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 4.6.3.4.1. Hospital pharmacies 4.6.3.4.2. Retail pharmacies 4.6.3.4.3. Online pharmacies 4.6.3.4.4. Others 4.6.3.5. Mexico Orphan Drug Market Size and Forecast, By Region (2024-2030) 4.6.3.5.1. North America 4.6.3.5.2. Europe 4.6.3.5.3. Asia Pacific 4.6.3.5.4. Middle East and Africa 5. Europe Orphan Drug Market Size and Forecast by Segmentation (By Value in USD Billion) (2024-2030) 5.1. Europe Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 5.2. Europe Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 5.3. Europe Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 5.4. Europe Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 5.5. Europe Orphan Drug Market Size and Forecast, By Country (2024-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 5.5.1.2. United Kingdom Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 5.5.1.3. United Kingdom Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 5.5.1.4. United Kingdom Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 5.5.2. France 5.5.2.1. France Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 5.5.2.2. France Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 5.5.2.3. France Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 5.5.2.4. France Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 5.5.3. Germany 5.5.3.1. Germany Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 5.5.3.2. Germany Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 5.5.3.3. Germany Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 5.5.3.4. Germany Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 5.5.4. Italy 5.5.4.1. Italy Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 5.5.4.2. Italy Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 5.5.4.3. Italy Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 5.5.4.4. Italy Orphan Drug Market Size and Forecast, By Distribution channel (2024-2030) 5.5.5. Spain 5.5.5.1. Spain Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 5.5.5.2. Spain Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 5.5.5.3. Spain Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 5.5.5.4. Spain Orphan Drug Market Size and Forecast, By Distribution channel (2024-2030) 5.5.6. Sweden 5.5.6.1. Sweden Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 5.5.6.2. Sweden Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 5.5.6.3. Sweden Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 5.5.6.4. Sweden Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 5.5.7. Austria 5.5.7.1. Austria Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 5.5.7.2. Austria Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) (2024-2030) 5.5.7.3. Austria Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 5.5.7.4. Austria Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 5.5.8.2. Rest of Europe Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 5.5.8.3. Rest of Europe Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 5.5.8.4. Rest of Europe Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 6. Asia Pacific Orphan Drug Market Size and Forecast by Segmentation (By Value in USD Billion) (2024-2030) 6.1. Asia Pacific Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 6.2. Asia Pacific Orphan Drug Market Size and Forecast, By Disease (2024-2030) 6.3. Asia Pacific Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 6.4. Asia Pacific Orphan Drug Market Size and Forecast, By Distribution (2024-2030) 6.5. Asia Pacific Orphan Drug Market Size and Forecast, By Country (2024-2030) 6.5.1. China 6.5.1.1. China Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 6.5.1.2. China Orphan Drug Market Size and Forecast, By Disease (2024-2030) 6.5.1.3. China Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 6.5.1.4. China Orphan Drug Market Size and Forecast, By Distribution (2024-2030) 6.5.2. South Korea 6.5.2.1. South Korea Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 6.5.2.2. South Korea Orphan Drug Market Size and Forecast, By Disease (2024-2030) 6.5.2.3. South Korea Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 6.5.2.4. South Korea Orphan Drug Market Size and Forecast, By Distribution Channel 2024-2032) 6.5.3. Japan 6.5.3.1. Japan Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 6.5.3.2. Japan Orphan Drug Market Size and Forecast, By Disease (2024-2030) 6.5.3.3. Japan Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 6.5.3.4. Japan Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 6.5.4. India 6.5.4.1. India Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 6.5.4.2. India Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 6.5.4.3. India Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 6.5.4.4. India Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2032 6.5.5. Australia 6.5.5.1. Australia Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 6.5.5.2. Australia Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 6.5.5.3. Australia Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 6.5.5.4. Australia Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 6.5.6.2. Indonesia Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 6.5.6.3. Indonesia Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 6.5.6.4. Indonesia Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 6.5.7.2. Malaysia Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 6.5.7.3. Malaysia Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 6.5.7.4. Malaysia Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 6.5.8.2. Vietnam Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 6.5.8.3. Vietnam Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 6.5.8.4. Vietnam Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 6.5.9.2. Taiwan Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 6.5.9.3. Taiwan Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 6.5.9.4. Taiwan Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 6.5.10.2. Rest of Asia Pacific Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 6.5.10.3. Rest of Asia Pacific Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 6.5.10.4. Rest of Asia Pacific Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 7. Middle East and Africa Orphan Drug Market Size and Forecast by Segmentation (By Value in USD Billion) (2024-2030) 7.1. Middle East and Africa Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 7.2. Middle East and Africa Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 7.3. Middle East and Africa Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 7.4. Middle East and Africa Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 7.5. Middle East and Africa Orphan Drug Market Size and Forecast, By Country (2024-2030) 7.5.1. South Africa 7.5.1.1. South Africa Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 7.5.1.2. South Africa Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 7.5.1.3. South Africa Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 7.5.1.4. South Africa Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 7.5.2. GCC 7.5.2.1. GCC Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 7.5.2.2. GCC Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 7.5.2.3. GCC Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 7.5.2.4. GCC Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 7.5.3.2. Nigeria Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 7.5.3.3. Nigeria Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 7.5.3.4. Nigeria Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 7.5.4.2. Rest of ME&A Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 7.5.4.3. Rest of ME&A Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 7.5.4.4. Rest of ME&A Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 8. South America Orphan Drug Market Size and Forecast by Segmentation (By Value in USD Billion) (2024-2032 8.1. South America Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 8.2. South America Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 8.3. South America Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 8.4. South America Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 8.5. South America Orphan Drug Market Size and Forecast, By Country (2024-2030) 8.5.1. Brazil 8.5.1.1. Brazil Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 8.5.1.2. Brazil Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 8.5.1.3. Brazil Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 8.5.1.4. Brazil Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 8.5.2. Argentina 8.5.2.1. Argentina Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 8.5.2.2. Argentina Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 8.5.2.3. Argentina Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 8.5.2.4. Argentina Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Orphan Drug Market Size and Forecast, By Product Type (2024-2030) 8.5.3.2. Rest Of South America Orphan Drug Market Size and Forecast, By Disease Type (2024-2030) 8.5.3.3. Rest Of South America Orphan Drug Market Size and Forecast, By Therapy (2024-2030) 8.5.3.4. Rest Of South America Orphan Drug Market Size and Forecast, By Distribution Channel (2024-2030) 9. Orphan Drug Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2024) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Orphan Drug Market Companies, By market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Pfizer (United States) 10.1.1.1. Company Overview 10.1.1.2. Business Portfolio 10.1.1.3. Financial Overview 10.1.1.4. SWOT Analysis 10.1.1.5. Strategic Analysis 10.1.1.6. Scale of Operation (small, medium, and large) 10.1.1.7. Details on Partnership 10.1.1.8. Regulatory Accreditations and Certifications Received By Them 10.1.1.9. Awards Received by the Firm 10.1.1.10. Recent Developments 10.2. Alexion Pharmaceuticals (United States) 10.3. Vertex Pharmaceuticals (United States) 10.4. Biogen (United States) 10.5. Amgen (United States) 10.6. Regeneron Pharmaceuticals (United States) 10.7. Horizon Therapeutics (United States) 10.8. Sarepta Therapeutics (United States) 10.9. Novartis (Switzerland) 10.10. Roche (Switzerland) 10.11. Sanofi (France) 10.12. Shire (Takeda Pharmaceutical) (Republic of Ireland) 10.13. BioMarin Pharmaceutical (United Kingdom) 10.14. Ipsen (France) 10.15. Genzyme (Sanofi) (France) 10.16. Actelion Pharmaceuticals (Johnson & Johnson) (Switzerland) 10.17. Orphan Europe (Recordati) (France) 10.18. Takeda Pharmaceutical (Japan) 10.19. Eisai (Japan) 10.20. Kyowa Kirin (Japan) 10.21. Chugai Pharmaceutical (Japan) 10.22. Sawai Pharmaceutical (Japan) 10.23. LG Chem (South Korea) 10.24. Chia Tai Tianqing Pharmaceutical Group (China) 10.25. Cipla (India) 10.26. Dr. Reddy's Laboratories (India) 10.27. Sun Pharmaceutical Industries (India) 11. Key Findings 12. Industry Recommendations 13. Orphan Drug: Research Methodology