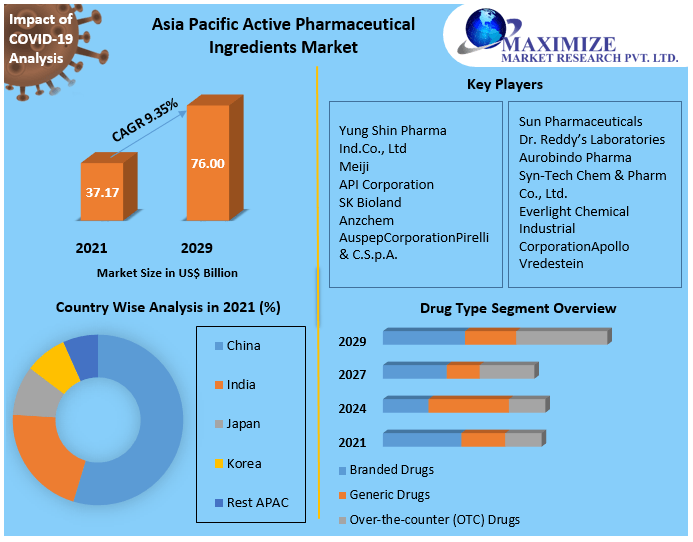

Asia Pacific Active Pharmaceutical Ingredients Market size is expected to reach US$ 76.00 Bn. by 2029, at a CAGR of 9.35% during the forecast period. The report includes an analysis of the impact of COVID-19 lockdown on the revenue of market leaders, followers, and disruptors. Since the lockdown was implemented differently in various regions and countries; the impact of the same is also seen differently by regions and segments. The report has covered the current short-term and long-term impact on the market, and it would help the decision-makers to prepare the outline and strategies for companies by region.To know about the Research Methodology:-Request Free Sample Report

Asia Pacific Active Pharmaceutical Ingredients Market Dynamics:

An active ingredient or AI is that component of the pharmaceutical drug that is biologically active and is also synonymously known as an active pharmaceutical ingredient (API) or bulk active. The amount of API depends on the manufacturers and differs from one brand to another where at times more than one API chemical compound is used within drugs. In distinction with the active components, the inactive elements are called excipients in pharmaceutical backgrounds. Excipients are chemically inactive constituents that do not react directly with API that in turn preserves the precise drug composition. The main excipient serving as an intermediate for transmission of the active ingredient is known as the vehicle. Petroleum jelly and mineral oil are some of the most frequently used vehicles that are required for drug composition.Asia Pacific Active Pharmaceutical Ingredients Market Segment Analysis:

Drug type, manufacturer type, synthesis type, therapeutic area, and geography are the several sections based on, which the active pharmaceutical ingredient market for the Asia Pacific is separated. Biotech and synthetic are the various division for the synthesis type segment of the API market. Biotech is one of the fastest-growing segments due to the shift in focus of traditional manufacturers towards biological drugs and high R&D cost for novel biosimilar drugs. Branded, generic, and over-the-counter (OTC) drugs are the three core segments for drug types in the active pharmaceutical ingredients market. Certain aspects to positively affect the growth of branded drugs is the escalation in prices of drug coupled with higher spending on R&D activities that have improved market growth. By manufacturer type, the market has diverged into captive and merchant manufacturers where the merchant manufacturers are the highest growing segment. The rise in drug molecule formulation outsourcing by diverse drug manufacturers to eliminate the heavy investment requirement in the manufacturing process is pretty common nowadays. All these factors are together responsible for the upsurge of merchant manufacturers in the active pharmaceutical ingredients market.Asia Pacific Active Pharmaceutical Ingredients Market Country Insights:

China, India, Japan, and South Korea are some of the chief countries that have helped in the growing demand for active pharmaceuticals ingredients in the Asia Pacific. Pharmaceutical companies are manufacturing low-priced drugs and are making changes in chemical composition for delivering the exact chemical composition of drugs. Higher government grants for boosting R&D activities related to the healthcare sector coupled with multiple subsidies and investments have helped in the growth of API in the Asia Pacific region.Active Pharmaceutical Ingredients Market, Key Highlights:

• Asia Pacific Active Pharmaceutical Ingredients market size analysis and forecast • Comprehensive study and analysis of market drivers, restraints, and opportunities influencing the growth of the Asia Pacific Active Pharmaceutical Ingredients Market • Active Pharmaceutical Ingredients market segmentation on the basis of synthesis type, drug type, manufacturer type, therapeutic area, and geography. • Active Pharmaceutical Ingredients market strategic analysis with respect to individual growth trends, future prospects along with a contribution of various sub-market stakeholders have been considered under the scope of a study • Active Pharmaceutical Ingredients market analysis and forecast for major countries have been provided. • Profiling of key industry players, their strategic perspective, market positioning and analysis of core competencies • Competitive landscape of the key players operating in the Active Pharmaceutical Ingredients market including competitive developments, investments, and strategic expansionActive Pharmaceutical Ingredients Market, Research Methodology

The market is estimated by triangulation of data points obtained from various sources and feeding them into a simulation model created individually for each market. The data points are obtained from paid and unpaid sources along with paid primary interviews with key opinion leaders (KOLs) in the market. KOLs from both, demand and supply sides were considered while conducting interviews to get an unbiased idea of the market. This exercise was done at a country level to get a fair idea of the market in countries considered for this study. Later this country-specific data was accumulated to come up with regional numbers and then arrive at the market value for Asia Pacific Active Pharmaceutical Ingredients Market.Active Pharmaceutical Ingredients Market, Key Target Audience:

• Healthcare companies • Corporate healthcare entities • Government agencies • Market research and consulting firms • Venture capitalists • Technical StudentsScope of the Active Pharmaceutical Ingredients Market Report: Inquire before buying

Active Pharmaceutical Ingredients Market, By Synthesis Type

• Biotech • Monoclonal Antibodies • Recombinant Proteins • Vaccines • SyntheticActive Pharmaceutical Ingredients Market, By Drug Type

• Branded Drugs • Generic Drugs • Over-the-counter (OTC) DrugsActive Pharmaceutical Ingredients Market, By Manufacturer Type

• Captive Manufacturers • Merchant ManufacturersActive Pharmaceutical Ingredients Market, By Therapeutic Area

• Cardiology • Pulmonology • Oncology • Neurology • Ophthalmology • Orthopedics • OthersActive Pharmaceutical Ingredients Market, By Region:

• Asia Pacific • China • Japan • India • South Korea • Australia • Taiwan • OthersAsia Pacific Active Pharmaceutical Ingredients Market Key Players:

• Sun Pharmaceuticals • Dr. Reddy’s Laboratories • Aurobindo Pharma • Syn-Tech Chem & Pharm Co., Ltd. • Everlight Chemical Industrial Corporation • Yung Shin Pharma Ind.Co., Ltd • Meiji • API Corporation • SK Bioland • Anzchem • Auspep Frequently Asked Questions: 1. Which region has the largest share in Asia Pacific Active Pharmaceutical Ingredients Market? Ans: Asia Pacific region holds the highest share in 2021. 2. What is the growth rate of Asia Pacific Active Pharmaceutical IngredientsMarket? Ans: The Asia Pacific Active Pharmaceutical IngredientsMarket is growing at a CAGR of 9.35% during forecasting period 2022-2029. 3. What is scope of the Asia Pacific Active Pharmaceutical Ingredientsmarket report? Ans: Asia Pacific Active Pharmaceutical IngredientsMarket report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Asia Pacific Active Pharmaceutical Ingredientsmarket? Ans: The important key players in the Asia Pacific Active Pharmaceutical IngredientsMarket are – Sun Pharmaceuticals, Dr. Reddy’s Laboratories, Aurobindo Pharma, Syn-Tech Chem & Pharm Co., Ltd., Everlight Chemical Industrial Corporation, Yung Shin Pharma Ind.Co., Ltd, Meiji, API Corporation, SK Bioland, Anzchem, Auspep, and 5. What is the study period of this market? Ans: The Asia Pacific Active Pharmaceutical IngredientsMarket is studied from 2021 to 2029.

1. EXECUTIVE SUMMARY 2. RESEARCH METHODOLOGY 2.1. Market Definition 2.2. Market Scope 2.3. Data Sources 3. MARKET VARIABLES & SCOPE 3.1. Market Segmentation & Scope 3.2. Market Driver Analysis 3.3. Market Restraint Analysis 3.4. Penetration &Growth Prospect Mapping 3.5. Market SWOT Analysis, By Factor (political & legal, economic and technological) 3.6. Porter’s Five Forces Industry Analysis 3.7. Market Value Chain Analysis 4. SYNTHESIS TYPE ESTIMATES & TREND ANALYSIS (2021-2029) 4.1. Active Pharmaceutical Ingredients Market: Synthesis Type Movement Analysis 4.2. Biotech 4.2.1. Biotech market, 2021-2029 (USD billion) 4.2.2. Monoclonal antibodies 4.2.2.1. Monoclonal antibodies market, 2021-2029 (USD billion) 4.2.3. Recombinant proteins 4.2.3.1. Recombinant proteins market, 2021-2029 (USD billion) 4.2.4. Vaccines 4.2.4.1. Vaccines market, 2021-2029 (USD billion) 4.3. Synthetic 4.3.1. Synthetic market, 2021-2029 (USD billion) 5. DRUG TYPE ESTIMATES & TREND ANALYSIS (2021-2029) 5.1. Active Pharmaceutical Ingredients Market: Drug Type Movement Analysis 5.2. Branded/Innovative Drugs 5.2.1. Branded/Innovative drugs market, 2021-2029 (USD billion) 5.3. Generic Drugs 5.3.1. Generic drugs market, 2021-2029 (USD billion) 5.4. Over-the-counter (OTC) Drugs 5.4.1. Over-the-counter market, 2021-2029 (USD billion) 6. MANUFACTURER TYPE ESTIMATES & TREND ANALYSIS (2021-2029) 6.1. Active Pharmaceutical Ingredients Market: Manufacturer Type Movement Analysis 6.2. Captive Manufacturers 6.2.1. Captive manufacturers market, 2021-2029 (USD billion) 6.3. Merchant Manufacturers 6.3.1. Merchant manufacturers market, 2021-2029 (USD billion) 7. THERAPEUTIC AREA ESTIMATES & TREND ANALYSIS (2021-2029) 7.1. Active Pharmaceutical Ingredients Market: Therapeutic Area Movement Analysis 7.2. Cardiology 7.2.1. Cardiology market, 2021-2029 (USD billion) 7.3. Pulmonology 7.3.1. Pulmonology market, 2021-2029 (USD billion) 7.4. Oncology 7.4.1. Oncology market, 2021-2029 (USD billion) 7.5. Neurology 7.5.1. Neurology market, 2021-2029 (USD billion) 7.6. Ophthalmology 7.6.1. Ophthalmology market, 2021-2029 (USD billion) 7.7. Orthopedics 7.7.1. Orthopedics market, 2021-2029 (USD billion) 7.8. Others 7.8.1. Others market, 2021-2029 (USD billion) 8. REGIONAL ESTIMATES & TREND ANALYSIS BY SYNTHESIS TYPE, DRUG TYPE, MANUFACTURER TYPE, AND THERAPEUTIC AREA (2021-2029) 8.1. Active Pharmaceutical Ingredients Market Share By Region, 2021 & 2029 8.2. Asia Pacific 8.2.1. Asia Pacific active pharmaceutical ingredients market, 2021-2029 (USD billion) 8.2.2. China 8.2.2.1. China active pharmaceutical ingredients market, 2021-2029 (USD billion) 8.2.3. Japan 8.2.3.1. Japan active pharmaceutical ingredients market, 2021-2029 (USD billion) 8.2.4. India 8.2.4.1. India active pharmaceutical ingredients market, 2021-2029 (USD billion) 8.2.5. South Korea 8.2.5.1. South Korea active pharmaceutical ingredients market, 2021-2029 (USD billion) 8.2.6. Australia 8.2.6.1. Australia active pharmaceutical ingredients market, 2021-2029 (USD billion) 8.2.7. Taiwan 8.2.7.1. Taiwan active pharmaceutical ingredients market, 2021-2029 (USD billion) 8.2.8. Others 8.2.8.1. Others active pharmaceutical ingredients market, 2021-2029 (USD billion) 9. MARKET COMPETITION ANALYSIS 9.1. Strategy Framework 9.2. Company Profiles 9.2.1. Sun Pharmaceuticals 9.2.1.1. Company Overview 9.2.1.2. Financial Performance 9.2.1.3. Product Benchmarking 9.2.1.4. Strategic Initiatives 9.2.2. Auspep 9.2.2.1. Company Overview 9.2.2.2. Financial Performance 9.2.2.3. Product Benchmarking 9.2.2.4. Strategic Initiatives 9.2.3. Dr. Reddy’s Laboratories 9.2.3.1. Company Overview 9.2.3.2. Financial Performance 9.2.3.3. Product Benchmarking 9.2.3.4. Strategic Initiatives 9.2.4. Aurobindo Pharma 9.2.4.1. Company Overview 9.2.4.2. Financial Performance 9.2.4.3. Product Benchmarking 9.2.4.4. Strategic Initiatives 9.2.5. Syn-Tech Chem & Pharm Co., Ltd. 9.2.5.1. Company Overview 9.2.5.2. Financial Performance 9.2.5.3. Product Benchmarking 9.2.5.4. Strategic Initiatives 9.2.6. Everlight Chemical Industrial Corporation 9.2.6.1. Company Overview 9.2.6.2. Financial Performance 9.2.6.3. Product Benchmarking 9.2.6.4. Strategic Initiatives 9.2.7. Yung Shin Pharma Ind.Co., Ltd 9.2.7.1. Company Overview 9.2.7.2. Financial Performance 9.2.7.3. Product Benchmarking 9.2.7.4. Strategic Initiatives 9.2.8. Meiji 9.2.8.1. Company Overview 9.2.8.2. Financial Performance 9.2.8.3. Product Benchmarking 9.2.8.4. Strategic Initiatives 9.2.9. API Corporation 9.2.9.1. Company Overview 9.2.9.2. Financial Performance 9.2.9.3. Product Benchmarking 9.2.9.4. Strategic Initiatives 9.2.10. SK Bioland 9.2.10.1. Company Overview 9.2.10.2. Financial Performance 9.2.10.3. Product Benchmarking 9.2.10.4. Strategic Initiatives 9.2.11. Anzchem 9.2.11.1. Company Overview 9.2.11.2. Financial Performance 9.2.11.3. Product Benchmarking 9.2.11.4. Strategic Initiatives