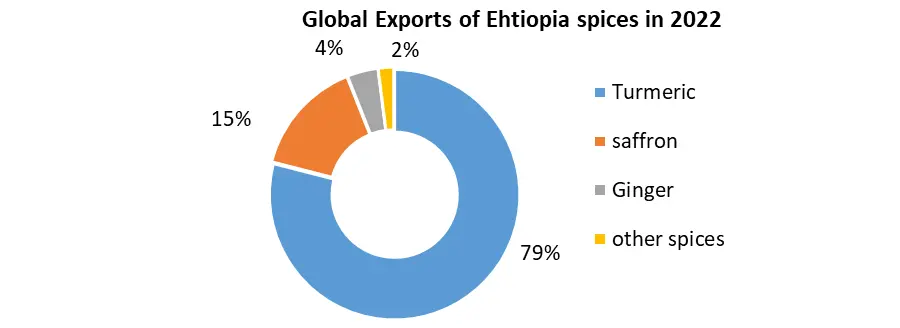

The Ethiopia Spices Market size was valued at 23.54 million Tons in 2023 and the total Ethiopia Spices Market revenue is expected to grow at a CAGR of 9.5 % from 2024 to 2030, reaching nearly 44.43 million Tons by 2030. Ethiopian cuisine has a collection of spices that help bring its unique flavor to the table. From fresh ginger to garam masala, Ethiopian dishes combine these flavorful herbs and spices to create some of the most exciting and delicious flavors in East African cooking. The foundation for all Ethiopian recipes lies within its diverse mix of herbs and spices. Common spices used in Ethiopian cuisine include ginger, turmeric, paprika, korerima, koseret, besobela, fenugreek seeds, rosemary, garlic, cumin, cloves, cinnamon, and timiz.To know about the Research Methodology :- Request Free Sample Report Chilli was the most commonly produced spice, with a total production of 7.89 million tons in the year 2021(32%) according to Titus and Wojtek (2022). The top five spices producer countries in the world are India, China, Turkey, Bangladesh, and Indonesia in Ethiopia Spices Market 2022. With a long history of spices production, Ethiopia is one of the East African countries that produce and export various spices (2020) with production reaching 244,000 tons per year. Spices production in Ethiopia was expanded between 1995 and 2025 from 107,000 to 213,980 tons with an annual growth rate of 9.5% Europe is the largest market for spice and herb extracts. European production potential is very limited and the most part dependent on the import of spices, herbs, and their extracts from emerging economies in the Asia-Pacific region, the Middle East, and Africa. The Ethiopia Spices Market for spices in Western economies, such as Europe and North America, continues to grow but slower than in other regions such as Asia, where general economic growth is higher and markets are growing rapidly. Asia-Pacific has the fastest-growing spices market. Spice consumption in Ethiopia is set to reach 425,700 metric tons by 2030. This is up from 277,000 metric tons in 2021, a growth rate of 2.7% year-on-year. Since 2017, demand for spices in Ethiopia has increased by 1.4% on average each year. As of 2021, Ethiopia ranked ninth in the world for spice consumption, with Pakistan ahead of it at 277,000 metric tons. Bangladesh, Indonesia, and China came in second, third, and fourth respectively. Pimento pepper (290K tons), spices except pepper and ginger (232K tons), and (10K tons), were the main products of spice consumption in Ethiopia Spices Market, together accounting for 80-90 % of the total volume. Piper pepper, cinnamon Anise, fennel and coriander, clove, nutmeg, mace, cardamoms, and vanilla are together accounting for 10-15 %. The value of exports of commodity group 0910 "Ginger, saffron, turmeric (curcuma), thyme, bay leaves, curry, and other spices" from Ethiopia total $ 3.22 million in 2022. Sales of commodity group 0910 from Ethiopia decreased by 55% in value terms compared to 2021. Exports of commodity group 0910 "Ginger, saffron, turmeric (curcuma), thyme, bay leaves, curry, and other spices" decreased by $ 3.98 million (cumulative exports of commodity group 0910 from Ethiopia amounted to $7.21 million in 2021) In 2022, Ethiopia Spices Market exported $4.2M in Spices, making it the 59th largest exporter of Spices in the world. In the same year, Spices was the 65th most exported product in Ethiopia. The main destinations of Spices exports from Ethiopia are India ($1.34M), Egypt ($619k), the United States ($419k), the United Arab Emirates ($273k), and Canada ($225k). In 2022, Ethiopia imported $827k in Spices, becoming the 140th largest importer of Spices in the world. At the same year, Spices was the 568th most imported product in Ethiopia. Ethiopia imports Spices primarily from: India ($306k), United Arab Emirates ($202k), Egypt ($115k), China ($112k), and Costa Rica ($60.6k). The fastest-growing import markets in Spices for Ethiopia between 2021 and 2022 were Egypt ($61.9k), Costa Rica ($15.2k), and Turkey ($3.01k). Ethiopia Spices Market has favorable or conducive environments for various spices production due to the presence of varied climatic and agro-ecological conditions, abundant cultivable and irrigable land, with encouraging government policy environment.

Ethiopia Spices Market Trends:

Consumers worldwide have shown a growing preference for organic and sustainably sourced products, including spices. This trend is likely to influence the Ethiopia Spices Market, with an emphasis on environmentally friendly and socially responsible practices. There is an increasing demand for ethnic and exotic flavors in the food industry. Ethiopia, with its rich culinary traditions and unique spices, may benefit from the growing interest in diverse and authentic flavors. Health-conscious consumers are seeking spices not only for their flavor but also for their potential health benefits. Spices are often recognized for their antioxidant and anti-inflammatory properties, contributing to the overall health and wellness trend. Consumers are increasingly interested in knowing the origin and production methods of the products they purchase. Supply chain traceability and transparency have become important factors in consumer decision-making. Innovative and sustainable packaging solutions have gained importance. Ethiopia Spices Market trend aims to reduce environmental impact and enhance the overall appeal of spice products. Modernizing processing facilities and adopting advanced technologies for spice production and processing enhance efficiency and quality, potentially boosting the competitiveness of Ethiopian spice products. Considering the one spice, the production trend of ginger in Ethiopia is fluctuating and declining due to various factors such as pests and diseases, lack of improved varieties, poor agronomic practices, and market constraints. The price of ginger in Ethiopia is also volatile and influenced by seasonal and international market dynamics. The domestic and export of Ethiopia Spices Market contribution of ginger in Ethiopia is significant. It is among the most important spices for domestic consumption in addition to its contribution to agricultural export and plays an important role in providing income and employment opportunities for many smallholder farmers and traders. Ethiopia exported ginger to 48 countries in the world and only six destinations mainly to neighbouring and the Gulf countries but increased rapidly to 17 countries extending to Europe, North and Latin America, South Asia, and the Gulf countries From 2014 onwards, however, the number of countries importing ginger from Ethiopia started to decline. In 2023, Ethiopia exported ginger to only 11 countries of the world because of inadequate domestic production. The largest proportion of ginger was sent to neighboring countries Kenya (41.7%) followed by Canada (23.3%), Taiwan (15%), and the United States (13.8%). These four countries alone accounted for 94% of Ethiopia’s ginger exports in 2023.sThe major opportunities for spices, herbs, and aromatic crops in Ethiopia include the appropriate or suitable environment for the introduction and cultivation of different spice crop varieties, increasing local markets, and demand by international hotels, medicinal factories, spa, and massage services (EMI (Ethiopian Ministry of Industry), Ethiopia has a suitable and helpful environment for spice crop production due to presence of varied climatic conditions and agro-ecologies, vast cultivable and irrigable land and encouraging government policy environment. For instance, suitable agroecological conditions permit the highest advantage in the Wolayitta Zone, SNNPRS to grow ginger. In addition, the emergence of new market opportunities in Middle Eastern countries, like the United Arab Emirates (UAE, Dubai) and Yemen, will encourage increased production and result in benefits from this spice crop. Ethiopia is currently one of the largest consumers of spices in Africa since over 90% of spice crops produced in the country are consumed domestically. Domestic consumption is growing fast because of increases in income, rapid population growth, and greater urbanization (ENTAG (Ethiopia-Netherlands Trade for Agricultural Growth).

Ethiopia Spices Market Dynamics:

Opportunities for spices production and marketing in Ethiopia: The agriculture sector is the pillar of the Ethiopia Spices Market and Ethiopian economy as it contributes 34.1% to the gross domestic product (GDP) offers about 79% of foreign exchange earnings and creates job opportunities for about 79% of the population. Next to coffee, the Ethiopian pulses, oilseeds, and spices sectors are among the critical components of the agricultural sector contributing to high foreign exchange revenue as reported by the Ethiopian Ministry of Industry (EMI (Ethiopian Ministry of Industry). The major opportunities for spices, herbs, and aromatic crops in Ethiopia include the appropriate or suitable environment for the introduction and cultivation of different spice crop varieties, increasing local markets and demand by international hotels, medicinal factories, spa and massage services (EMI (Ethiopian Ministry of Industry), 2015). Ethiopia Spices Market has a suitable and conducive environment for spice crop production due to the presence of varied climatic conditions and agro-ecologies, vast cultivable and irrigable land, and an encouraging government policy environment. Spice crops have huge potential for income generation for the farming communities in Ethiopia. Spices are one of the traditional promising horticultural crops of Ethiopia. Indicated that spice crops are small in size and so cheap to transport and of high value per unit area although most of the spice works are labor intensive. Hence, spice crops provide a special opportunity to hasten both the rural and the urban community development. The country is geographically better located towards the EU than India or Indonesia, which supports spices export ambitions and feasibility ITC (International Trade Centre). The government of Ethiopia is promoting agro-industrial projects and has declared spice crops as a focus area for development as spices have a wide possibility of being cultivated in diverse agro-ecological zones of the country and have also a high potential for expansion and diversification of export earnings of Ethiopia Spices Market. The Ethiopian government has developed a package of incentives under Regulations No. 84/2003 for investors to encourage private investment engaged in new enterprises and expansions, across a range of sectors, including the spice subsector. Hence, spice crops provide a special opportunity to hasten both the rural and the urban community development.

Ethiopia Spices Market Regional Insights:

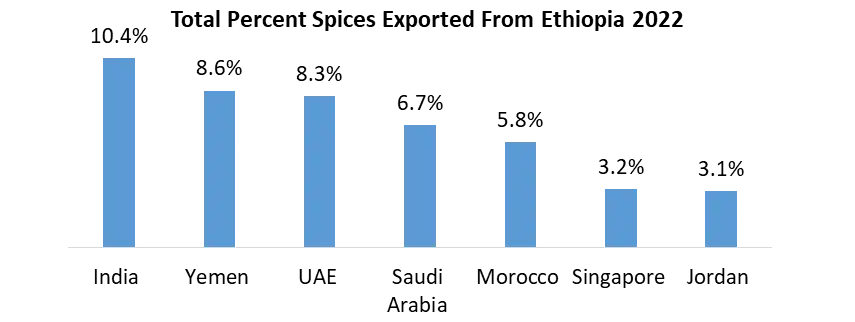

The spices produced under smallholder in Ethiopia Spices Market are korarima (Aframonum Korarima), long red pepper, ginger, turmeric, cardamom, black pepper, black cumin, white cumin/ Bishops weed (Nech azmud), coriander, fenugreek, c, sage, and cinnamon. However, korarima, pepper, black cumin and cardamom are the four most important spices produced in Ethiopia. The SNNP, Oromiya and Amhara regions contributed respectively 37%, 32%, and 25% to the average annual spice production during the period 2020-2022. The SNNP region is the main producer of ginger, turmeric, and black cardamom, while the Oromiya and Amhara regions are chiefly responsible for the production of chilies and black cumin. Ethiopian food is spicy and the demand is high, the supply is low because of the low level of production and productivity as well as the minimum area coverage of the crops in Ethiopia as compared to other major producing countries. For instance, the area under spice cultivation in Ethiopia varied between 330,000 ha and 500,000 ha in the period 2005–2013 while 3,529,000 hectares of land is covered by spice production in India. In three major spice-producing regions of Ethiopia Spices Market, the area coverage, production, and productivity of some of the spices are 6,742.99ha, 37,736.4MT, 5.6ton/ha of ginger, 1002.2ha, 3962.03MT, 3.95ton/ha of turmeric and 9233.30ha, 5,625.25MT, 0.61ton/ha of cardamom, respectively. Sudan is the leading importer of spices from Ethiopia with a 38.4% share of the value of total spices exported from Ethiopia, followed by India 10.4%, and Yemen 8.6%. Other important importers of spices from Ethiopia are UAE 8.3%, Saudi Arabia 6.7%, and Morocco 5.8%, while Singapore and Jordan have a share of 3.2% and 3.1% respectively. Spice exports in 2021 and 2022 amounted to 19,890 MT per annum, representing a value of US$ 56.25 million in Ethiopia Spices Market.

Ethiopia Spices Market Scope: Inquire Before Buying

Ethiopia Spices Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 23.54 MnTons Forecast Period 2024 to 2030 CAGR: 9.5% Market Size in 2030: US $ 43.44 Mn Tons Segments Covered: by Product Mitmita Berbere Niter Kibbeh Awaze Turmeric Cardamom Fenugreek Bayleaf Others by Form Powder Whole Ethiopia Spices Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of MEA) South America (Brazil, Argentina Rest of South America)Leading Ethiopia Spices Market Key Players:

1. Adikap Exports., Addis Ababa Ethiopia. 2. Daniel Desalegn., Addis Ababa Ethiopia. 3. Sametha Trading., Addis Ababa Ethiopia. 4. Zowe Trading PLC. Addis Ababa, Ethiopia. 5. YEKUNENI PLC. Addis Ababa Ethiopia. 6. Abki Spice, Addis Ababa Ethiopia. 7. Trade key, Ethiopia 8. Feed Green Ethiopia, Ethiopia 9. Tradeford, Ethiopia FAQs: 1. What are the factors affecting the Ethiopia Spices Market? Ans. Low output price, poor market access and imperfect market information, capital constraints, limited processing of spices, adulteration, mismatch between demand and spices, transportation problems, unlicensed traders, theft, low government support, lack of value addition, and price volatility, this factors affecting the Ethiopia Spices Market. 2. What are the major spices in the Ethiopia Spices Market growth? Ans. Turmeric, Ginger, and Cardamom are major spices for Ethiopia Spices market growth. 3. What is the projected market size and growth rate of the Ethiopia Spices Market? Ans. The Ethiopia Spices Market size was valued at 23.54 Million Tons in 2023 and the total Ethiopia Spices Market revenue is expected to grow at a CAGR of 5.4% from 2024 to 2030, reaching nearly 44.43 Million Tons by 2030. 4. What segments are covered in the Ethiopia Spices Market report? Ans. The segments covered in the Ethiopia Spices Market report are Product, Form, and region.

1. Ethiopia Spices Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Ethiopia Spices Market: Dynamics 2.1. Ethiopia Spices Market Trends by Region 2.1.1. North America Ethiopia Spices Market Trends 2.1.2. Europe Ethiopia Spices Market Trends 2.1.3. Asia Pacific Ethiopia Spices Market Trends 2.1.4. Middle East and Africa Ethiopia Spices Market Trends 2.1.5. South America Ethiopia Spices Market Trends 2.2. Ethiopia Spices Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Ethiopia Spices Market Drivers 2.2.1.2. North America Ethiopia Spices Market Restraints 2.2.1.3. North America Ethiopia Spices Market Opportunities 2.2.1.4. North America Ethiopia Spices Market Challenges 2.2.2. Europe 2.2.2.1. Europe Ethiopia Spices Market Drivers 2.2.2.2. Europe Ethiopia Spices Market Restraints 2.2.2.3. Europe Ethiopia Spices Market Opportunities 2.2.2.4. Europe Ethiopia Spices Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Ethiopia Spices Market Drivers 2.2.3.2. Asia Pacific Ethiopia Spices Market Restraints 2.2.3.3. Asia Pacific Ethiopia Spices Market Opportunities 2.2.3.4. Asia Pacific Ethiopia Spices Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Ethiopia Spices Market Drivers 2.2.4.2. Middle East and Africa Ethiopia Spices Market Restraints 2.2.4.3. Middle East and Africa Ethiopia Spices Market Opportunities 2.2.4.4. Middle East and Africa Ethiopia Spices Market Challenges 2.2.5. South America 2.2.5.1. South America Ethiopia Spices Market Drivers 2.2.5.2. South America Ethiopia Spices Market Restraints 2.2.5.3. South America Ethiopia Spices Market Opportunities 2.2.5.4. South America Ethiopia Spices Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Ethiopia Spices Industry 2.8. Analysis of Government Schemes and Initiatives For Ethiopia Spices Industry 2.9. Ethiopia Spices Market Trade Analysis 2.10. The Global Pandemic Impact on Ethiopia Spices Market 3. Ethiopia Spices Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 3.1.1. Mitmita 3.1.2.Berbere 3.1.3.Niter Kibbeh 3.1.4.Awaze 3.1.5.Turmeric 3.1.6.Cardamom 3.1.7.Fenugreek 3.1.8.Bayleaf 3.1.9.Others 3.2. Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 3.2.1. Powder 3.2.2. Whole 3.3. Ethiopia Spices Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Ethiopia Spices Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 4.1.1. Mitmita 4.1.2.Berbere 4.1.3.Niter Kibbeh 4.1.4.Awaze 4.1.5.Turmeric 4.1.6.Cardamom 4.1.7.Fenugreek 4.1.8.Bayleaf 4.1.9.Others 4.2. North America Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 4.2.1. Powder 4.2.2. Whole 4.3. North America Ethiopia Spices Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 4.3.1.1.1. Mitmita 4.3.1.1.2.Berbere 4.3.1.1.3.Niter Kibbeh 4.3.1.1.4.Awaze 4.3.1.1.5.Turmeric 4.3.1.1.6.Cardamom 4.3.1.1.7.Fenugreek 4.3.1.1.8.Bayleaf 4.3.1.1.9.Others 4.3.1.2. United States Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 4.3.1.2.1. Powder 4.3.1.2.2. Whole 4.3.2. Canada 4.3.2.1. Canada Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 4.3.2.1.1. Mitmita 4.3.2.1.2.Berbere 4.3.2.1.3.Niter Kibbeh 4.3.2.1.4.Awaze 4.3.2.1.5.Turmeric 4.3.2.1.6.Cardamom 4.3.2.1.7.Fenugreek 4.3.2.1.8.Bayleaf 4.3.2.1.9.Others 4.3.2.2. Canada Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 4.3.2.2.1. Powder 4.3.2.2.2. Whole 4.3.3. Mexico 4.3.3.1. Mexico Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 4.3.3.1.1. Mitmita 4.3.3.1.2.Berbere 4.3.3.1.3.Niter Kibbeh 4.3.3.1.4.Awaze 4.3.3.1.5.Turmeric 4.3.3.1.6.Cardamom 4.3.3.1.7.Fenugreek 4.3.3.1.8.Bayleaf 4.3.3.1.9.Others 4.3.3.2. Mexico Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 4.3.3.2.1. Powder 4.3.3.2.2. Whole 5. Europe Ethiopia Spices Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 5.2. Europe Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 5.3. Europe Ethiopia Spices Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 5.3.1.2. United Kingdom Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 5.3.2. France 5.3.2.1. France Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 5.3.2.2. France Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 5.3.3.2. Germany Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 5.3.4.2. Italy Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 5.3.5.2. Spain Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 5.3.6.2. Sweden Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 5.3.7.2. Austria Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 5.3.8.2. Rest of Europe Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 6. Asia Pacific Ethiopia Spices Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 6.3. Asia Pacific Ethiopia Spices Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 6.3.1.2. China Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 6.3.2.2. S Korea Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 6.3.3.2. Japan Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 6.3.4. India 6.3.4.1. India Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 6.3.4.2. India Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 6.3.5.2. Australia Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 6.3.6.2. Indonesia Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 6.3.7.2. Malaysia Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 6.3.8.2. Vietnam Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 6.3.9.2. Taiwan Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 6.3.10.2. Rest of Asia Pacific Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 7. Middle East and Africa Ethiopia Spices Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 7.3. Middle East and Africa Ethiopia Spices Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 7.3.1.2. South Africa Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 7.3.2.2. GCC Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 7.3.3.2. Nigeria Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 7.3.4.2. Rest of ME&A Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 8. South America Ethiopia Spices Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 8.2. South America Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 8.3. South America Ethiopia Spices Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 8.3.1.2. Brazil Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 8.3.2.2. Argentina Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Ethiopia Spices Market Size and Forecast, by Product (2023-2030) 8.3.3.2. Rest Of South America Ethiopia Spices Market Size and Forecast, by Form (2023-2030) 9. Global Ethiopia Spices Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Ethiopia Spices Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Adikap Exports., Addis Ababa Ethiopia. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Daniel Desalegn., Addis Ababa Ethiopia. 10.3. Sametha Trading., Addis Ababa Ethiopia. 10.4. Zowe Trading PLC. Addis Ababa, Ethiopia. 10.5. YEKUNENI PLC. Addis Ababa Ethiopia. 10.6. Abki Spice, Addis Ababa Ethiopia. 10.7. Trade key, Ethiopia 10.8. Feed Green Ethiopia, Ethiopia 10.9. Tradeford, Ethiopia 11. Key Findings 12. Industry Recommendations 13. Ethiopia Spices Market: Research Methodology 14. Terms and Glossary