The Natural Cheese Market size was valued at USD 145.26 Billion in 2022 and the total Natural Cheese revenue is expected to grow at a CAGR of 4.8% from 2023 to 2029, reaching nearly USD 201.68 Billion By 2029. Natural Cheese is a significant segment within the dairy industry, characterized by its unprocessed and traditional production methods, distinct from processed cheese alternatives. Natural Cheese is the pure and healthy option in the diet compared to its conventional products. It is produced from milk curd obtained by natural fermentation processes, often involving bacterial cultures and enzymes. The demand for Natural cheese has witnessed a rapid surge in recent years all across the world. People prioritizing healthier and more sustainable food choices are driving the demand for the natural cheese market.To know about the Research Methodology :- Request Free Sample Report Moreover, the growing demand for a diverse range of varieties, each exhibiting unique flavors, textures, and characteristics attributed to uplifting the market’s value. Additionally, the rise in small dairy farmers transitioning to Natural practices has expanded the availability of Natural cheese varieties, offering unique flavors and textures that resonate with consumers seeking diverse culinary experiences. The increasing demand for the Natural Cheese market has steadily grown due to shifting dietary preferences towards minimally processed and natural food choices. As a result, the Natural cheese market is experiencing robust growth, driven by shifting consumer preferences towards healthier, ethically sourced food options. From traditional varieties like cheddar and mozzarella to innovative specialty flavors and artisanal creations, Natural Cheese Market producers continuously diversify their product lines to meet consumer demands. This factor is further supporting the Natural cheese market growth. Regions such as Europe, North America, and parts of Asia-Pacific exhibit high consumption rates for the natural cheese market globally. While natural Cheese remains a staple in many cuisines globally, market trends indicate a growing interest in premium, artisanal, and specialty varieties.

Natural Cheese Market Dynamics:

Increasing Consumer’s Demand For Healthy and Natural Foods The growing consumer demand for healthy and natural foods is expected to be the major factor driving the global Natural cheese market. As Consumers are increasingly prioritizing food products that are minimally processed, and free from artificial ingredients, there’s a notable shift towards Natural cheese and perceived as being more wholesome and nutritious. This trend is evident in the rising popularity of organic cheese, and raw cheese made with traditional methods. Several factors are contributing to the growing demand for healthy and natural cheese, consumers are becoming more aware of the health benefits of cheese, such as its high protein content, calcium, and essential vitamins. They are seeking out cheese options that align with their health goals and dietary preferences, which led to grow the Natural cheese market. Consumers are seeking transparency in ingredient labeling and prefer products that are made with natural ingredients and minimal processing. Similarly, in many countries, where Natural food consumption has increased rapidly, the demand for Natural cheese has surged significantly. Thanks to consumer's preference for products free from synthetic additives and produced using environmentally friendly practices. As Europe is the largest producer of Natural Cheese they tend to have a traditional practice for natural cheese, which attracts the consumers, and sales in Europe upsurge. This growing health-conscious mindset is influencing purchasing decisions, contributing to the growth of the Natural cheese market globally. As a result, manufacturers and retailers are responding by expanding their Natural cheese offerings, capitalizing on this trend, and meeting the evolving demands of health-conscious consumers.Growing Popularity of Natural Cheese Tourism The growing popularity of Natural cheese tourism in emerging economies presents a significant growth opportunity for Natural cheese manufacturers during the forecast period. As these economies experience rising urbanization, evolving consumer preferences, and heightened awareness about healthier food choices, there's a notable shift towards Natural products, including cheese. By offering firsthand experiences of the cheese-making process, it promotes a thoughtful appreciation for artisanal and specialty cheeses, emphasizing the craftsmanship, tradition, and quality associated with these products. This heightened appreciation often translates into a consumer preference for high-quality, distinctive cheeses, consequently propelling sales of premium varieties. These emerging economies present untapped markets where Natural cheese manufacturers capitalize on the growing consumer interest in healthier and environmentally friendly options. The increasing disposable incomes in these regions are enabling consumers to prioritize premium-quality food products, including naturally produced cheese, further increasing the product demand, and there by driving the Natural cheese market size.,

Natural Cheese Market Segment Analysis:

Based on Product Type, the Cheddar segment held the largest market share of about 28.78% in the global Natural cheese market in 2022. According to the MMR analysis, the segment is further expected to grow at a CAGR of xx during the forecast period and maintain its dominance till 2029. Cheddar’s versatile application caters to diverse consumer preferences and its emerging interest in a variety of dishes, such as pasta, pizza, and salad maintaining a significant portion of the regular consumption rate among cheese consumers, supporting the segment to grow in a forecast period.The surge in demand for Cheddar cheese is supported by its remarkable adaptability and versatile appeal, resonating with a vast spectrum of culinary preferences. This increasing popularity stems from its ability to seamlessly integrate into diverse dishes, ranging from everyday snacks to complex culinary creations like burgers, sandwiches, and pasta. Cheddar's acclaim excels in geographical boundaries, enjoying global recognition and appreciation across continents. Its availability in various formats, facilitated by modern manufacturing methods, caters to evolving consumer needs. From traditional large loaves to easily manageable rectangular blocks, Cheddar's accessibility in the market has bolstered its widespread consumption. The cheese's presence in an array of retail outlets, spanning supermarkets, specialty stores, and online platforms, further amplifies its accessibility, enabling consumers to procure it with ease.

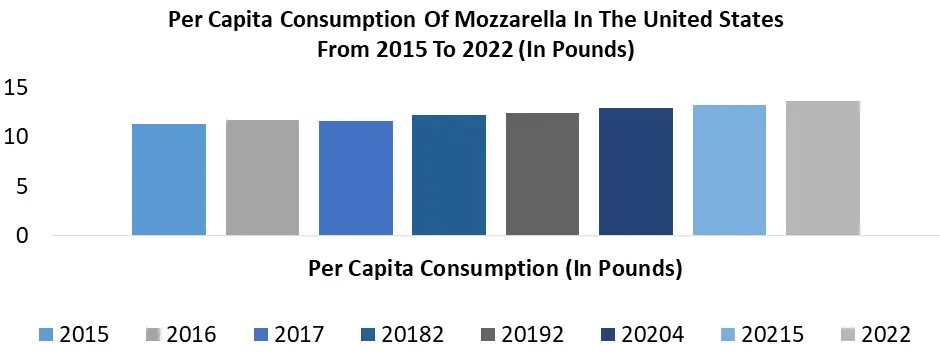

Additionally, the increasing awareness surrounding healthier dietary choices has driven the demand for cheddar cheese to be produced naturally with health-oriented aspects further increasing the Natural cheese market’s growth. The optimization of Cheddar cheese to align with consumer expectations poses a significant challenge and opportunity for manufacturers. After COVID people are becoming more health conscious, which leads to consuming healthy sources. Cheddar cheese is a good source of protein, calcium, and vitamin D and also it is beneficial for gut health driving the cheddar's natural cheese market. Besides that, the Mozzarella cheese segment is expected to grow at a rapid CAGR and offer lucrative growth opportunities for Natural cheese manufacturers all across the world during the forecast period. The rising popularity and increasing consumer demand is expected to be the primary factor driving the segment growth. Its versatile nature and adaptable characteristics make it a sought-after choice not only in traditional dishes but also in contemporary culinary trends, such as pizzas, salads, sandwiches, and various global cuisines. With consumers increasingly valuing Natural products due to health and environmental considerations, Natural Mozzarella cheese is expected to witness heightened demand during the forecast period. This versatility positions Mozzarella as a cheese of choice across a diverse range of culinary applications, contributing significantly to its rapid growth.

Natural Cheese Market Regional Insights:

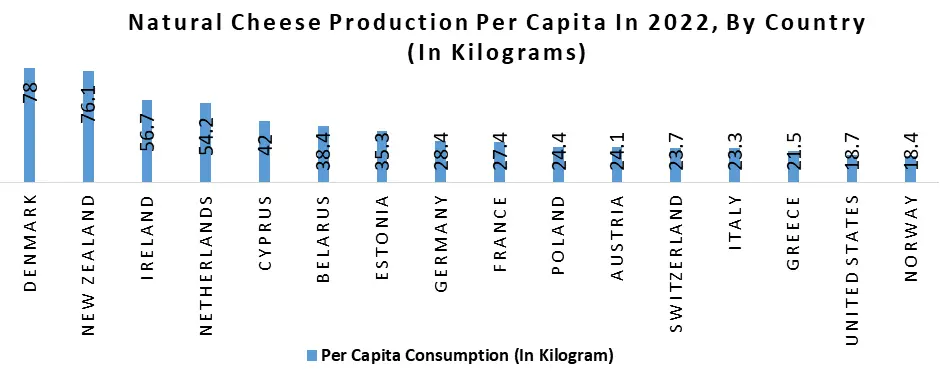

Europe dominates the global Natural Cheese Market with the highest market share accounting for 52.3% in 2022, the region is expected to grow during the forecast period and maintain its dominance by 2029. As the rich texture and variety of new products with creams and go-to packs have been introduced in the market, the European market has seen increasing demand for sales in many European countries. Italy, Germany, Spain, and the Netherlands have been major producers of Natural cheese in recent years. France, known globally for its cheese heritage, boasts an impressive array of over 400 to over 1000 distinct types of cheese varieties. Europe remains the ideal destination for the Natural Cheese Market. In addition, the rising consumer consciousness regarding health, environmental impact, and animal welfare has propelled the demand for Natural cheese across Europe. This demand surge aligns with the European Union's stringent regulations, ensuring that Natural cheeses meet specific standards in farming techniques, animal feed, and the exclusion of synthetic additives or pesticides. North America is the largest market for natural cheese market accounting for over 26.2 % market share in 2022, the region is expected to grow in the forecast while maintaining its dominance in 2029. The United States has been the major producer of natural cheese Market in the region. Wisconsin is the official cheese capital producing 3,467 million pounds of cheese each year (1573 thousand metric tons) which amounts to 588.3 pounds per capita. The United States Natural cheese market is growing thanks to Wisconsin it produces 26% of the country’s cheese and has 1300 licensed cheese makers, which is more than any other US state. Idaho produces 526.8 pounds of cheese per capita and is in high demand for cheddar, mozzarella, cream cheese, cottage cheese, etc. New Mexico, churns out 956 million pounds of cheese each year and 452.4 pounds per capita followed by Vermont at 222 pounds of cheese produced yearly per capita. The emphasis on sustainability contributes to the overall appeal and marketability of Natural cheeses within the region.

Cheese Producers In The United States In 2022

Natural Cheese Market Competitive Landscapes: Several Natural cheese manufacturers are focused on enhancing and expanding their core business through the launch of additional efficient products to keep up with conventional cheese sales. Several Natural cheese firms are broadening their product portfolios beyond traditional cheese varieties. For instance, Companies such as Saputo Inc. a Canadian multinational dairy company specialize in a variety of cheese products, including cheddar, mozzarella, and parmesan. By diversifying their product lines, they are offering a new line of flavored cheddar cheeses and a line of handcrafted cheeses. Producers are further concentrating on introducing new flavors and variations within cream cheese, a segment witnessing notable innovation. Brands such as Arla Foods have launched a strategic way to boost their natural cream cheese product by bringing a collection of Arla cheesemakers infused with diverse flavors like sharp, tangy flavor, slightly sweet flavor, or nutty flavor. This innovation in the natural cheese market proves to be an important aspect of market growth by enhancing product appeal and market competitiveness. Recognizing the demand for on-to-go snack options, major brands have been creating Natural cheese snack pack options, such as small portion natural cheese, cheese straws, cheese bites, and string cheese. Brands such as Bel Group have introduced its new go-to snack option which is portable and catered for busy lifestyles and snaking occasions. These snack packs include a variety of Flavors, and textures and seek health benefits by tapping into a growing Natural Cheese Market. As consumer preferences evolve, these proactive strategies position Natural cheese manufacturers for sustained growth and competitiveness in the dairy market.

United States Country Cheese Production (Million Pounds) in 2022 Wisconsin 3,468 Idaho 1,001 New Mexico 957 Vermont 143 Denmark 1003 New Zealand 860 Minnesota 765 Natural Cheese Market Scope: Inquire Before Buying

Global Natural Cheese Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 145.26 Bn. Forecast Period 2023 to 2029 CAGR: 4.8% Market Size in 2029: US $ 201.68 Bn. Segments Covered: by Product Cheddar Mozzarella Parmesan Others by Form Cubes & Blocks Slices Spread by Distribution Channel Offline Hypermarket/Supermarket Grocery Stores Others Online store E-commerce Platforms Company Owned Websites Natural Cheese Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Natural Cheese Market Key Players:

1. Almarai Co. Ltd 2. Calabro Cheese Corporation 3. Yili 4. Emmi 5. Mengniu Dairy 6. BONGARDS 7. Dupont Cheese 8. Bletsoe Cheese 9. Brunkow Cheese Factory 10. Fonterra 11. Beijing Sanyuan 12. Mother Dairy 13. Bright Dairy 14. Bega Cheese 15. The Kraft Heinz Co 16. Leprino Foods 17. Parag Milk Foods 18. Cady Cheese Factory 19. Saputo Inc 20. Friesland Campina 21. Shandong Tianjiao Biotech 22. Sargento Foods 23. Burnett Dairy 24. Hook’S Cheese Company 25. Groupe Lactalis S.A 26. Devondale Murray Goulburn 27. Inner Mongolia Licheng 28. Knight Dairy 29. Joint stock company 30. Arla foods Amba 31. Associated Milk Producers, Inc 32. Lactosan A S 33. Mondelez International, Inc 34. Savencia S A 35. Borden Dairy Company 36. Parag Milk Foods Lts 37. Royal FrieslandCampina N.V 38. Old Fashioned Foods, Inc FAQs: 1. What are the growth drivers for the Natural Cheese market? Ans. Increasing Health Awareness, Rising Environmental Concerns, Shifting Consumer Preferences, etc. are expected to be the major drivers for the Natural Cheese market. 2. What is the major restraint for the Natural Cheese market growth? Ans. Strong Competition with Conventional Products is expected to be the major restraining factor for the Natural Cheese market growth. 3. Which region is expected to lead the global Natural Cheese market during the forecast period? Ans. Europe is expected to lead the global Natural Cheese market during the forecast period. 4. What is the projected market size & and growth rate of the Natural Cheese Market? Ans. The Natural Cheese Market size was valued at USD 145.26 Billion in 2022 and the total Natural Cheese revenue is expected to grow at a CAGR of 4.8% from 2023 to 2029, reaching nearly USD 1201.68 Billion By 2029. 5. What segments are covered in the Natural Cheese Market report? Ans. The segments covered in the Natural Cheese market report are Product Type, Form, Distribution Channel, and Region.

1. Natural Cheese Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Natural Cheese Market: Dynamics 2.1. Preference Analysis 2.2. Natural Cheese Market Trends by Region 2.2.1. North America Natural Cheese Market Trends 2.2.2. Europe Natural Cheese Market Trends 2.2.3. Asia Pacific Natural Cheese Market Trends 2.2.4. Middle East and Africa Natural Cheese Market Trends 2.2.5. South America Natural Cheese Market Trends 2.3. Natural Cheese Market Dynamics by Region 2.3.1. North America 2.3.1.1. North America Natural Cheese Market Drivers 2.3.1.2. North America Natural Cheese Market Restraints 2.3.1.3. North America Natural Cheese Market Opportunities 2.3.1.4. North America Natural Cheese Market Challenges 2.3.2. Europe 2.3.2.1. Europe Natural Cheese Market Drivers 2.3.2.2. Europe Natural Cheese Market Restraints 2.3.2.3. Europe Natural Cheese Market Opportunities 2.3.2.4. Europe Natural Cheese Market Challenges 2.3.3. Asia Pacific 2.3.3.1. Asia Pacific Natural Cheese Market Drivers 2.3.3.2. Asia Pacific Natural Cheese Market Restraints 2.3.3.3. Asia Pacific Natural Cheese Market Opportunities 2.3.3.4. Asia Pacific Natural Cheese Market Challenges 2.3.4. Middle East and Africa 2.3.4.1. Middle East and Africa Natural Cheese Market Drivers 2.3.4.2. Middle East and Africa Natural Cheese Market Restraints 2.3.4.3. Middle East and Africa Natural Cheese Market Opportunities 2.3.4.4. Middle East and Africa Natural Cheese Market Challenges 2.3.5. South America 2.3.5.1. South America Natural Cheese Market Drivers 2.3.5.2. South America Natural Cheese Market Restraints 2.3.5.3. South America Natural Cheese Market Opportunities 2.3.5.4. South America Natural Cheese Market Challenges 2.4. PORTER’s Five Forces Analysis 2.5. PESTLE Analysis 2.6. Value Chain - Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. North America 2.7.2. Europe 2.7.3. Asia Pacific 2.7.4. Middle East and Africa 2.7.5. South America 2.8. Key Opinion Leader Analysis For the Natural Cheese Industry 2.9. Analysis of Government Schemes and Initiatives For the Natural Cheese Industry 2.10. The Global Pandemic's Impact on Natural Cheese Market 2.11. Natural Cheese Price Trend Analysis (2021-22) 3. Natural Cheese Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume Units) (2022-2029) 3.1. Natural Cheese Market Size and Forecast, by Product (2022-2029) 3.1.1. Cheddar 3.1.2. Mozzarella 3.1.3. Parmesan 3.1.4. Others 3.2. Natural Cheese Market Size and Forecast, by Form (2022-2029) 3.2.1. Cubes & Blocks 3.2.2. Slices 3.2.3. Spread 3.3. Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 3.3.1. Offline 3.3.1.1. Hypermarket/Supermarket 3.3.1.2. Grocery Stores 3.3.1.3. Others 3.3.2. Online store 3.3.2.1. E-commerce Platforms 3.3.2.2. Company Owned Websites 3.4. Natural Cheese Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Natural Cheese Market Size and Forecast by Segmentation (by Value in USD Billion) (2022-2029) 4.1. North America Natural Cheese Market Size and Forecast, by Product (2022-2029) 4.1.1. Cheddar 4.1.2. Mozzarella 4.1.3. Parmesan 4.1.4. Others 4.2. North America Natural Cheese Market Size and Forecast, by Form (2022-2029) 4.2.1. Cubes & Blocks 4.2.2. Slices 4.2.3. Spread 4.3. North America Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.1. Offline 4.3.1.1. Hypermarket/Supermarket 4.3.1.2. Grocery Stores 4.3.1.3. Others 4.3.2. Online store 4.3.2.1. E-commerce Platforms 4.3.2.2. Company Owned Websites 4.4. North America Natural Cheese Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Natural Cheese Market Size and Forecast, by Product (2022-2029) 4.4.1.1.1. Cheddar 4.4.1.1.2. Mozzarella 4.4.1.1.3. Parmesan 4.4.1.1.4. Others 4.4.1.2. United States Natural Cheese Market Size and Forecast, by Form (2022-2029) 4.4.1.2.1. Cubes & Blocks 4.4.1.2.2. Slices 4.4.1.2.3. Spread 4.4.1.3. United States Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.1.3.1. Offline 4.4.1.3.1.1. Hypermarket/Supermarket 4.4.1.3.1.2. Grocery Stores 4.4.1.3.1.3. Others 4.4.1.3.2. Online store 4.4.1.3.2.1. E-commerce Platforms 4.4.1.3.2.2. Company Owned Websites 4.4.2. Canada 4.4.2.1. Canada Natural Cheese Market Size and Forecast, by Product (2022-2029) 4.4.2.1.1. Cheddar 4.4.2.1.2. Mozzarella 4.4.2.1.3. Parmesan 4.4.2.1.4. Others 4.4.2.2. Canada Natural Cheese Market Size and Forecast, by Form (2022-2029) 4.4.2.2.1. Cubes & Blocks 4.4.2.2.2. Slices 4.4.2.2.3. Spread 4.4.2.3. Canada Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.2.3.1. Offline 4.4.2.3.1.1. Hypermarket/Supermarket 4.4.2.3.1.2. Grocery Stores 4.4.2.3.1.3. Others 4.4.2.3.2. Online store 4.4.2.3.2.1. E-commerce Platforms 4.4.2.3.2.2. Company Owned Websites 4.4.3. Mexico 4.4.3.1. Mexico Natural Cheese Market Size and Forecast, by Product (2022-2029) 4.4.3.1.1. Cheddar 4.4.3.1.2. Mozzarella 4.4.3.1.3. Parmesan 4.4.3.1.4. Others 4.4.3.2. Mexico Natural Cheese Market Size and Forecast, by Form (2022-2029) 4.4.3.2.1. Cubes & Blocks 4.4.3.2.2. Slices 4.4.3.2.3. Spread 4.4.3.3. Mexico Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.3.3.1. Offline 4.4.3.3.1.1. Hypermarket/Supermarket 4.4.3.3.1.2. Grocery Stores 4.4.3.3.1.3. Others 4.4.3.3.2. Online store 4.4.3.3.2.1. E-commerce Platforms 4.4.3.3.2.2. Company Owned Websites 5. Europe Natural Cheese Market Size and Forecast by Segmentation (by Value in USD Billion) (2022-2029) 5.1. Europe Natural Cheese Market Size and Forecast, by Product (2022-2029) 5.2. Europe Natural Cheese Market Size and Forecast, by Form (2022-2029) 5.3. Europe Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 5.4. Europe Natural Cheese Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Natural Cheese Market Size and Forecast, by Product (2022-2029) 5.4.1.2. United Kingdom Natural Cheese Market Size and Forecast, by Form (2022-2029) 5.4.1.3. United Kingdom Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.2. France 5.4.2.1. France Natural Cheese Market Size and Forecast, by Product (2022-2029) 5.4.2.2. France Natural Cheese Market Size and Forecast, by Form (2022-2029) 5.4.2.3. France Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Natural Cheese Market Size and Forecast, by Product (2022-2029) 5.4.3.2. Germany Natural Cheese Market Size and Forecast, by Form (2022-2029) 5.4.3.3. Germany Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Natural Cheese Market Size and Forecast, by Product (2022-2029) 5.4.4.2. Italy Natural Cheese Market Size and Forecast, by Form (2022-2029) 5.4.4.3. Italy Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Natural Cheese Market Size and Forecast, by Product (2022-2029) 5.4.5.2. Spain Natural Cheese Market Size and Forecast, by Form (2022-2029) 5.4.5.3. Spain Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Natural Cheese Market Size and Forecast, by Product (2022-2029) 5.4.6.2. Sweden Natural Cheese Market Size and Forecast, by Form (2022-2029) 5.4.6.3. Sweden Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Natural Cheese Market Size and Forecast, by Product (2022-2029) 5.4.7.2. Austria Natural Cheese Market Size and Forecast, by Form (2022-2029) 5.4.7.3. Austria Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Natural Cheese Market Size and Forecast, by Product (2022-2029) 5.4.8.2. Rest of Europe Natural Cheese Market Size and Forecast, by Form (2022-2029) 5.4.8.3. Rest of Europe Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6. Asia Pacific Natural Cheese Market Size and Forecast by Segmentation (by Value in USD Billion) (2022-2029) 6.1. Asia Pacific Natural Cheese Market Size and Forecast, by Product (2022-2029) 6.2. Asia Pacific Natural Cheese Market Size and Forecast, by Form (2022-2029) 6.3. Asia Pacific Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4. Asia Pacific Natural Cheese Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Natural Cheese Market Size and Forecast, by Product (2022-2029) 6.4.1.2. China Natural Cheese Market Size and Forecast, by Form (2022-2029) 6.4.1.3. China Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Natural Cheese Market Size and Forecast, by Product (2022-2029) 6.4.2.2. S Korea Natural Cheese Market Size and Forecast, by Form (2022-2029) 6.4.2.3. S Korea Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Natural Cheese Market Size and Forecast, by Product (2022-2029) 6.4.3.2. Japan Natural Cheese Market Size and Forecast, by Form (2022-2029) 6.4.3.3. Japan Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.4. India 6.4.4.1. India Natural Cheese Market Size and Forecast, by Product (2022-2029) 6.4.4.2. India Natural Cheese Market Size and Forecast, by Form (2022-2029) 6.4.4.3. India Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Natural Cheese Market Size and Forecast, by Product (2022-2029) 6.4.5.2. Australia Natural Cheese Market Size and Forecast, by Form (2022-2029) 6.4.5.3. Australia Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Natural Cheese Market Size and Forecast, by Product (2022-2029) 6.4.6.2. Indonesia Natural Cheese Market Size and Forecast, by Form (2022-2029) 6.4.6.3. Indonesia Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Natural Cheese Market Size and Forecast, by Product (2022-2029) 6.4.7.2. Malaysia Natural Cheese Market Size and Forecast, by Form (2022-2029) 6.4.7.3. Malaysia Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Natural Cheese Market Size and Forecast, by Product (2022-2029) 6.4.8.2. Vietnam Natural Cheese Market Size and Forecast, by Form (2022-2029) 6.4.8.3. Vietnam Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.8.4. Vietnam Natural Cheese Market Size and Forecast, by Industry Vertical(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Natural Cheese Market Size and Forecast, by Product (2022-2029) 6.4.9.2. Taiwan Natural Cheese Market Size and Forecast, by Form (2022-2029) 6.4.9.3. Taiwan Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Natural Cheese Market Size and Forecast, by Product (2022-2029) 6.4.10.2. Rest of Asia Pacific Natural Cheese Market Size and Forecast, by Form (2022-2029) 6.4.10.3. Rest of Asia Pacific Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 7. Middle East and Africa Natural Cheese Market Size and Forecast by Segmentation (by Value in USD Billion) (2022-2029 7.1. Middle East and Africa Natural Cheese Market Size and Forecast, by Product (2022-2029) 7.2. Middle East and Africa Natural Cheese Market Size and Forecast, by Form (2022-2029) 7.3. Middle East and Africa Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 7.4. Middle East and Africa Natural Cheese Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Natural Cheese Market Size and Forecast, by Product (2022-2029) 7.4.1.2. South Africa Natural Cheese Market Size and Forecast, by Form (2022-2029) 7.4.1.3. South Africa Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Natural Cheese Market Size and Forecast, by Product (2022-2029) 7.4.2.2. GCC Natural Cheese Market Size and Forecast, by Form (2022-2029) 7.4.2.3. GCC Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Natural Cheese Market Size and Forecast, by Product (2022-2029) 7.4.3.2. Nigeria Natural Cheese Market Size and Forecast, by Form (2022-2029) 7.4.3.3. Nigeria Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Natural Cheese Market Size and Forecast, by Product (2022-2029) 7.4.4.2. Rest of ME&A Natural Cheese Market Size and Forecast, by Form (2022-2029) 7.4.4.3. Rest of ME&A Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 8. South America Natural Cheese Market Size and Forecast by Segmentation (by Value in USD Billion) (2022-2029 8.1. South America Natural Cheese Market Size and Forecast, by Product (2022-2029) 8.2. South America Natural Cheese Market Size and Forecast, by Form (2022-2029) 8.3. South America Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 8.4. South America Natural Cheese Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Natural Cheese Market Size and Forecast, by Product (2022-2029) 8.4.1.2. Brazil Natural Cheese Market Size and Forecast, by Form (2022-2029) 8.4.1.3. Brazil Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Natural Cheese Market Size and Forecast, by Product (2022-2029) 8.4.2.2. Argentina Natural Cheese Market Size and Forecast, by Form (2022-2029) 8.4.2.3. Argentina Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Natural Cheese Market Size and Forecast, by Product (2022-2029) 8.4.3.2. Rest Of South America Natural Cheese Market Size and Forecast, by Form (2022-2029) 8.4.3.3. Rest Of South America Natural Cheese Market Size and Forecast, by Distribution Channel (2022-2029) 9. Global Natural Cheese Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Natural Cheese Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Almarai Co. Ltd. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Calabro Cheese Corporation 10.3. Yili 10.4. Emmi 10.5. Mengniu Dairy 10.6. Bongrads 10.7. Dupont Cheese 10.8. Bletsoe Cheese 10.9. Brunkow Cheese Factory 10.10. Fonterra 10.11. Beijing Sanyuan 10.12. Mother Dairy 10.13. Bright Dairy 10.14. Bega Cheese 10.15. The Kraft Heinz Co 10.16. Leprino Foods 10.17. Parag Milk Foods 10.18. Cady Cheese Factory 10.19. Saputo 10.20. Friesland Campina 10.21. Shandong Tianjiao Biotech 10.22. Sargento Foods 10.23. Burnett Dairy 10.24. Hook’s Cheese Company 11. Key Findings 12. Industry Recommendations 13. Natural Cheese Market: Research Methodology