Cream Powder Market size was valued at USD 4.9 Bn in 2022 and is expected to reach USD 8.7 Bn by 2029, at a CAGR of 6.4 % The Cream Powder Market Cream powder is a versatile ingredient used in the food processing industry to create various products such as ice creams, chocolates, desserts, baked goods, and biscuits. It is made from a blend of fresh cream and milk that has been pasteurized and spray-dried to create a rich, natural powder. For lactose intolerant consumers, coconut cream powder is an excellent non-dairy alternative, made from mature coconuts and offering a mild coconut flavor. The cream powder has several unique characteristics that make it an ideal ingredient for food production. It is highly soluble, easily dispersed, and has a rich, creamy flavor. Compared to ultra-heat treated milk and fresh cream, the cream powder is easier to handle and store, with a longer shelf life. Additionally, it is a cost-effective solution as it reduces the need for refrigeration and is simple to store.To know about the Research Methodology :- Request Free Sample Report

Cream Powder Market Scope and Research Methodology

The Cream Powder Market report shows analytical data that briefly contribute to key aspects such as trends, targets, market position, and market value in forecast years. The competitive analysis covers the leading market companies and their production capacity, product, and services demand and supply. The report includes key players and aspirant companies in the Cream Powder Market. Segment analysis helps to understand the different datasets together. It provides behavioral and geographical analysis to capture major changes in the forecast period. It also shows opportunities and revenue generation of leading Cream Powder Market players. SWOT analysis is performed for a strategic planning and strategic management technique used to help the organization identify Strengths, Weaknesses, Opportunities, and Threats related to business competition or project planning. Porter’s analysis is conducted to analyze an organization's strengths and weaknesses and to identify critical factors that affect your profitability. PESTALS analysis strategic framework that is used to evaluate the environment in which an organization operates.Cream Powder Market Dynamics

Drivers: The demand for convenience food and ready-to-eat products is on the rise due to the busy lifestyle of consumers. The cream powder has become an essential ingredient in the production of these products because of its versatility and ability to be used in a variety of applications such as whipped cream, ice cream, and pastry cream. Additionally, the growing popularity of bakery and confectionery products is driving the demand for a cream powder since it is a crucial component in these products production. Furthermore, the trend of home cooking is increasing, with numerous food channels producing cooking shows based on baked goods that constantly use cream powder for frosting, decorating, innovation, and more. This has led to an increase in the demand for cream powder as an ingredient in various recipes. Moreover, increasing disposable income and urbanization of consumers are driving the demand for a cream powder since consumers are willing to spend more on high-quality food products. The HoReCa market's growth worldwide is also contributing to the demand for cream powder, as it is connected to tourism and leads to an increase in the potential impact on a variety of food products, desserts, and sweets. Additionally, the development of low-fat and fat-free cream powder products is driving the demand for cream powder, as consumers are becoming more health-conscious and looking for healthier alternatives in their food choices. Overall, the demand for cream powder is increasing due to several factors, and it is likely to continue to grow in the future. The development of low-fat and fat-free cream powder products is driving the demand for cream powder. Consumers are becoming more health-conscious, which has led to the development of these products, which appeal to a wider range of consumers. Restraints: The cream powder market faces restraints such as price fluctuations of raw materials, health concerns associated with dairy products, and competition from substitutes. The volatility of milk and cream prices affects cream powder production and pricing. Health concerns about dairy products impact consumer perception and demand for cream powder. Additionally, substitutes like fresh cream and other dairy-based products compete with cream powder.Cream Powder Market Segment Analysis:

By Application Based on application, the cream powder market can be segmented into bakery & confectionery, soups & sauces, dairy products, beverages, and others. The bakery & confectionery segment is expected to dominate the cream powder market during the forecast period. The rising demand for baked goods such as cakes, pastries, and cookies is driving the demand for cream powder in the bakery & confectionery segment. Furthermore, the increasing popularity of ready-to-eat and packaged bakery products is driving the demand for cream powder in the bakery & confectionery segment.By Distribution Channel Based on the distribution channel, the cream powder market can be segmented into supermarkets/hypermarkets, online retail, specialty stores, and others. The supermarkets/ hypermarkets segment is expected to dominate the cream powder market during the forecast period. The increasing number of supermarkets and hypermarkets globally is driving the demand for cream powder in the supermarkets/hypermarkets segment. Furthermore, the availability of a wide range of cream powder products in supermarkets and hypermarkets is driving the demand for cream powder in the segment. By Source On the basis of source, the cream powder market is further segmented into Dairy-Based cream powder and Plant-Based cream powder. The dairy-based cream powder market has dominated the market by its health benefits and less cost in comparison to plat-based cream powder. The plant-Based cream powder market is expected to grow during the forecast period since the vegan population has increased and consumers are becoming conscious regarding their eating habits and intake of calories as a plant-based cream powder is less in calories as well as contains less sugar as consumers prefer to use plant-based products. By Type The cream powder market is divided into two types such as sweet cream powder and sour cream powder. Each type is further categorized based on its fat content, with less than 30%, 30% to 60%, and above 60% fat. The sour cream powder segment is anticipated to experience the highest growth due to its easy storage and distribution, leading consumers to prefer sour cream powder over regular sour cream. The food service industry is also utilizing sour cream powder due to its lack of unusual taste or odor, making it more appealing to incorporate into dishes. Furthermore, the cost-effectiveness of sour cream powder is expected to drive market growth.

Cream Powder Market Competitive Landscape Analysis

The cream powder market has been witnessing various developments in recent years. Some of the notable developments in the market are: The cream powder market is experiencing several trends, including the launch of new and innovative products, partnerships and collaborations to expand product portfolios, heavy investment in research and development, acquisitions and mergers, and a focus on sustainable production and packaging. These trends are driven by changing consumer preferences for healthy, sustainable, and convenient products, and the market players aim to cater to these preferences and expand their customer base. Several players in the cream powder market are launching new and innovative products to cater to the changing consumer demands. For instance, in March 2021, FrieslandCampina Kievit launched a new creamer range, which includes a high-fat creamer, a clean-label creamer, and a vegan creamer. The new creamer range is aimed at catering to the changing consumer preferences for healthy and sustainable products. Leading players in the cream powder market are collaborating with other companies to expand their product portfolio and customer base. For instance, in May 2020, Fonterra, a leading dairy company, partnered with Elopak, a packaging company, to launch new cream packaging solutions in Southeast Asia. The partnership is aimed at providing convenient and sustainable cream packaging solutions to consumers in the region. Leading players in the cream powder market are investing heavily in research and development to develop new and innovative products that cater to changing consumer demands. For instance, in September 2020, Nestle invested CHF 120 million in a new plant-based research and development center in China. The investment is aimed at developing new plant-based products, including cream powders, to cater to the growing demand for plant-based products in the region. Leading players in the cream powder market are acquiring or merging with other companies to expand their product portfolio and customer base. For instance, in March 2021, Kerry Group, a leading player in the cream powder market, acquired Niacet Corporation, a leading provider of food safety and preservation solutions. The acquisition is aimed at expanding Kerry Group's product portfolio and customer base in the food and beverage industry. The cream powder market is witnessing a growing trend toward sustainable production and packaging. Leading players in the market are adopting sustainable practices to reduce their environmental footprint and cater to the changing consumer preferences for sustainable products. For instance, in September 2020, FrieslandCampina announced its commitment to using 100% recyclable and reusable packaging for its dairy products by 2025. The company is also working towards reducing its carbon footprint by adopting sustainable production practices.Cream Powder Market’s Regional Insights

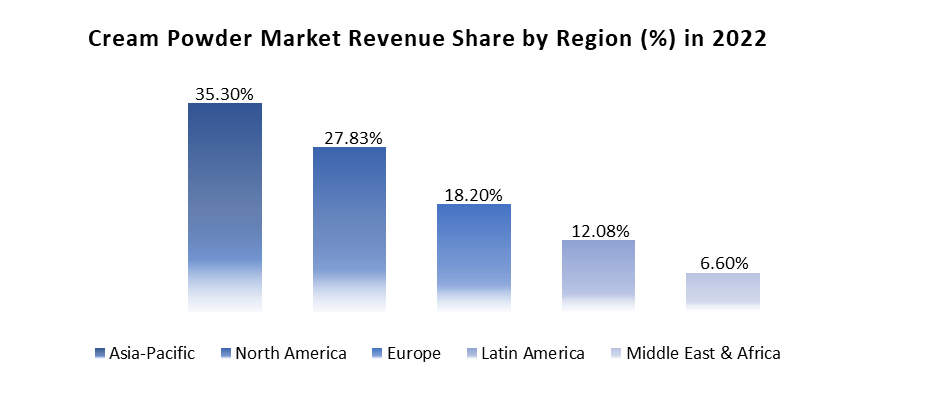

The cream powder market is segmented into various regions, including North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Understanding the regional dynamics is crucial for businesses operating in the cream-powder market. North America: North America is expected to hold a significant share of the cream powder market during the forecast period. The increasing demand for convenience food and ready-to-eat products is driving the demand for cream powder in the region. The growing trend of home cooking is also driving the demand for cream powder as an essential ingredient in various recipes. Furthermore, the increasing popularity of bakery and confectionery products is driving the demand for cream powder in the region. Europe: Europe is expected to hold a significant share of the cream powder market during the forecast period. The rising popularity of bakery and confectionery products is also driving the demand for cream powder in the region. Additionally, the increasing disposable income of consumers in the region is driving the demand for cream powder. Asia Pacific region: The Asia Pacific region is expected to dominate the cream powder market during the forecast period. The increasing demand for bakery and confectionery products in the region is driving the demand for cream powder. The growing trend of home cooking is also driving the demand for cream powder as an essential ingredient in various recipes. Furthermore, the increasing disposable income and urbanization of consumers in the region are driving the demand for cream powder. Latin America: Latin America is expected to hold a significant share of the cream powder market during the forecast period. The rising popularity of bakery and confectionery products is driving the demand for cream powder in the region. Furthermore, the increasing disposable income of consumers in the region is driving the demand for cream powder. Middle East & Africa: The Middle East & Africa region is expected to hold a significant share of the cream powder market during the forecast period. The growing trend of home cooking is also driving the demand for cream powder as an essential ingredient in various recipes. Furthermore, the increasing disposable income of consumers in the region is driving the demand for cream powder.Cream Powder Market Scope: Inquire before buying

Cream Powder Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 4.9 Bn Forecast Period 2023 to 2029 CAGR: 6.4 % Market Size in 2029: USD 8.7 Bn Segments Covered: by Application 1. Bakery 1. Cakes 2. Cookies 3. Muffins 4. Biscuits 5. Other 2. Soups & Sauces 3. Dairy Products 4.Beverages 5.Confectionaries 6.Desserts 1. Ice-Cream 2. Pudding 7. Others by Distribution Channel 1. Supermarkets/Hypermarkets 2. Online Retail 3. Speciality Stores 4. Others by Source 1. Dairy-Based Cream Powder 2. Plat-Based Cream Powder by Type 1. Sweet Cream Powder 2. Sour Cream Powder Cream Powder Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Cream Powder Market’s Key Players

1. Commercial Creamery Company. 2. The Food Source International Inc. 3. Bluegrass Dairy and Food Inc. 4. Dr. Otto SuwelackNachf. GmbH & Co. 5. Tsukuba Dairy Products Co., Ltd. 6. Varesco Group. 7. Barry Family Farm. 8. Rogers and Company Foods. 9. Thrive Life LLC, Walton Feed Inc. 10. Frieslandcampina Kievit 11. Java House 12. CDO Food Sphere 13. GODIVA 14. Warburtons 15. Elopak 16. Fonterra 17. Dairy Works 18. Open Country Dairy 19. Origin Earth 20. Milkio 21. Nestle 22. Niacet Corporation 23. KERRYFrequently Asked Questions about Cream Powder Market

1. What are the market forms of cream? Ans: Heavy Cream, Double Cream, Clotted Cream, Crème Fraiche, Flavored creams, Manufacturing Cream. 2. What is a cream powder made from? Ans: The cream powder is made of fresh milk that has been pasteurized, adjusted to a standardized fat content, concentrated and dried. The cream powder is available with a fat content ranging from 42 % to 60 % fat. 3. What is a cream powder for? Ans: Its many uses include the manufacture of instant soups, sauces, chocolate, bakery products, and frozen desserts including ice creams. 4. What is the CAGR of the Cream Powder Market? Ans: The global cream powder market registered a CAGR of 6.4% from 2022 to 2031. 5. What is the total market value of the Cream powder market? Ans: The global cream powder market size was valued at $4,785.0 million in 2021.

1. Cream Powder Market: Research Methodology 2. Cream Powder Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Cream Powder Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Cream Powder Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Cream Powder Market Segmentation 4.1 Cream Powder Market, by Application (2021-2029) 6. Bakery o Cakes o Cookies o Muffins o Biscuits o Other 7. Soups & Sauces 8. Dairy Products 9. Beverages 10. Confectionaries 11. Desserts o Ice-Cream o Pudding o Other 12. Other 4.2 Cream Powder Market, by Distribution Channel (2021-2029) • Supermarkets/Hypermarkets • Online Retail • Speciality Stores • Other 4.3 Cream Powder Market, by Source (2021-2029) • Dairy-Based Cream Powder • Plant-Based Cream Powder 4.4 Cream Powder Market, by Type (2021-2029) • Sweet Cream Powder • Sour Cream Powder 5. North America Cream Powder Market(2021-2029) 5.1 North America Cream Powder Market, by Application (2021-2029) 13. Bakery o Cakes o Cookies o Muffins o Biscuits o Other 14. Soups & Sauces 15. Dairy Products 16. Beverages 17. Confectionaries 18. Desserts o Ice-Cream o Pudding o Other 19. Other 5.2 North America Cream Powder Market, by Distribution Channel (2021-2029) • Supermarkets/Hypermarkets • Online Retail • Speciality Stores • Other 5.3 North America Cream Powder Market, by Source (2021-2029) • Dairy-Based Cream Powder • Plant-Based Cream Powder 5.4 North America Cream Powder Market, by Type (2021-2029) • Sweet Cream Powder • Sour Cream Powder 5.5 North America Cream Powder Market, by Country (2021-2029) • United States • Canada • Mexico 6. Europe Cream Powder Market (2021-2029) 6.1. European Cream Powder Market, by Application (2021-2029) 6.2. European Cream Powder Market, by Distribution Channel (2021-2029) 6.3. European Cream Powder Market, by Source (2021-2029) 6.4. European Cream Powder Market, by Type (2021-2029) 6.5. European Cream Powder Market, by Country (2021-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Cream Powder Market (2021-2029) 7.1. Asia Pacific Cream Powder Market, by Application (2021-2029) 7.2. Asia Pacific Cream Powder Market, by Distribution Channel (2021-2029) 7.3. Asia Pacific Cream Powder Market, by Source (2021-2029) 7.4. Asia Pacific Cream Powder Market, by Type (2021-2029) 7.5. Asia Pacific Cream Powder Market, by Country (2021-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Cream Powder Market (2021-2029) 8.1 Middle East and Africa Cream Powder Market, by Application (2021-2029) 8.2. Middle East and Africa Cream Powder Market, by Distribution Channel (2021-2029) 8.3. Middle East and Africa Cream Powder Market, by Source (2021-2029) 8.4. Middle East and Africa Cream Powder Market, by Type (2021-2029) 8.5. Middle East and Africa Cream Powder Market, by Country (2021-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Cream Powder Market (2021-2029) 9.1. South America Cream Powder Market, by Application (2021-2029) 9.2. South America Cream Powder Market, by Distribution Channel (2021-2029) 9.3. South America Cream Powder Market, by Source (2021-2029) 9.4. South America Cream Powder Market, by Type (2021-2029) 9.5. South America Cream Powder Market, by Country (2021-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Sinopec Corp. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.1 Commercial Creamery Company. 10.2 The Food Source International Inc. 10.3 Bluegrass Dairy and Food Inc. 10.4 Dr. Otto SuwelackNachf. GmbH & Co. 10.5 Tsukuba Dairy Products Co., Ltd. 10.6 Varesco Group. 10.7 Barry Family Farm. 10.8 Rogers and Company Foods. 10.9 Thrive Life LLC, Walton Feed Inc. 10.10 Frieslandcampina Kievit 10.11 Java House 10.12 CDO Food Sphere 10.13 GODIVA 10.14 Warburtons 10.15 Elopak 10.16 Fonterra 10.17 Dairy Works 10.18 Open Country Dairy 10.19 Origin Earth 10.20 Milkio 10.21 Nestle 10.22 Niacet Corporation 10.23 KERRY 11. Key Findings 12. Industry Recommendation