Energy firms are operating in a volatile environment. They are under increasing public pressure and regulation to minimize fossil-fuel consumption, which is primarily defined by a reliance on transportation fuels, plastics, and other refining and petrochemical products. In these circumstances, companies are looking to improve the health and resilience of downstream operations—particularly in the oil and gas and chemicals industries—by implementing new automation and digital technologies that enable increased data usage, performance transparency, and faster decision loops.To know about the Research Methodology:-Request Free Sample Report Many of these changes were already taking place, but the COVID-19 pandemic has hastened them, creating a new sense of urgency. However, keeping up with rising decarbonization initiatives, workforce shifts, and accelerated technological advances remains a challenge for the energy sector's digital plans. Many businesses have responded with short-term remedies, but many are still undecided about how to set priorities for the coming years. Autonomous plants appear to be a viable option. Future plants like these will connect technology, data, and advanced visualizations with operations to ensure that assets learn from each action they do, as well as from past data and derived insights. These plants respond to asset health and economic conditions by gradually improving their operations over time to reduce their carbon footprint while also operating more safely and profitably.

Challenges and Opportunities in the Energy Transition:

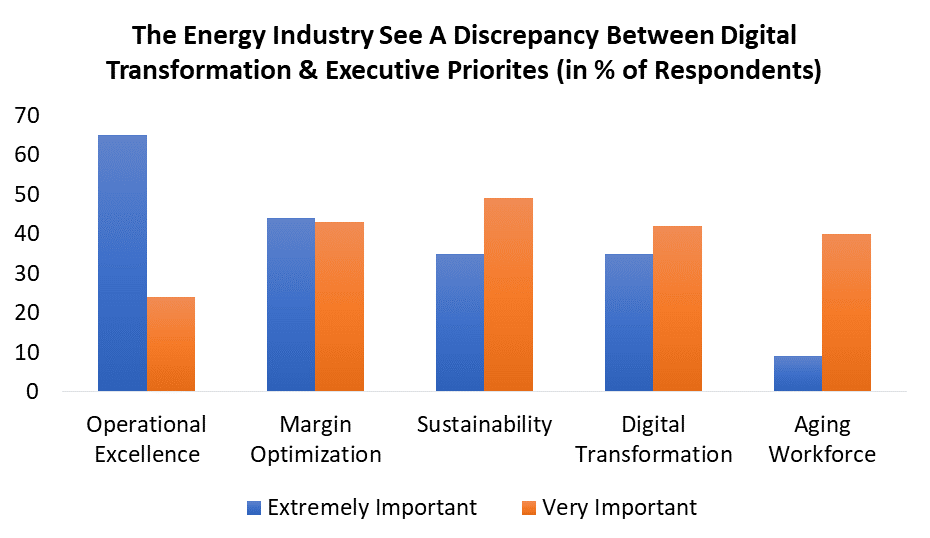

Although the energy transition forces businesses to improve their operational resilience, it also creates significant challenges for the industry. In reality, some companies have redoubled their efforts to achieve cost competitiveness through operational excellence and value-chain extensions, while others have redoubled their efforts to organically hedge against market risk through portfolio diversification. In either case, these businesses want to enhance cash flow from operations to protect against long-term market volatility and to improve the desirability of assets that might be sold. As an example, one of Asia's major energy and chemical companies recently responded to the energy transition's uncertainty by launching a multiyear digitalization and automation effort with aggressive efficiency, sustainability, and competitive advantage goals. They now have a clear vision to deliver autonomous operations in the years ahead, with incremental progress beginning in 2025, starting with broad value-chain and digital-twin efforts that will immediately use digital technology to reduce production cost structure, reduce carbon intensity, and increase resilience. Such actions show how businesses can take the first steps toward autonomy and automation in the short term, to reap long-term benefits. The following trends indicate the challenges and opportunities that businesses should anticipate facing when they begin their digital transformations: 1. Changes in the workforce The early 2020 oil price fall has a disproportionately negative impact on highly experienced knowledge workers with critical subject expertise. Large-scale layoffs in energy and chemicals, the early retirement of older, highly experienced personnel, and a cyclical reduction in the number of university applicants interested in joining asset-intensive businesses are all now commonplace cliches. Due to the present market slump, energy companies are evaluating digital alternatives to meet the shortage of technically trained people at a faster rate. And, as the previous year of remote work has shown, establishing operational excellence requires a combination of technology and technically trained employees. 2. Technological innovation at a faster pace The rate of adoption in the energy sector will continue to rise as digital technologies advance and become more affordable and easier to deploy. Recent infrastructure advancements, such as secure 5G site-level networks, have transformed data management capabilities and reduced cybersecurity threats, allowing for the deployment of integrated, automated solutions. Also, these modifications have considerably lowered the cost of connecting geographically scattered assets to control rooms via the network rather than hard wiring, as many of them are being physically relocated due to facility-siting considerations.

3. Attempts to reduce carbon emissions The environmental, social, and governance (ESG) imperative for downstream oil and gas and petrochemicals is continuing to shift as a result of increased societal pressure and regulation. Recent legislation, such as the European Green Deal, aims to cut carbon emissions while also improving economic sustainability. Such law encourages higher investment in non-carbon energy sources while also reducing net demand for fossil-fuel-derived goods. It also encourages technological advancement and innovation. As a result, low-carbon and renewable energy sources are becoming more cost-effective and appealing. The autonomous plant becomes a must for existing capital-intensive assets to stay up with decarbonization.

An Overview of Autonomous Plant: Inquire before buying

The autonomous plant uses recent technological advancements in connectivity and computing power—as well as access to Industrial Internet of Things (IIoT) data—to improve performance over time using data analytics, artificial intelligence (AI), and first-principle models without requiring significant human intervention.When making operational decisions, a carefully calculated blend of traditional technologies, AI, omnipresent data, connectivity, and cooperation merge to analyze probable future states of refineries or petrochemical plants. Prescriptive analytics, when applied to operational data and traditional models, provides greater information to technical employees and can suggest alternate tactics, such as advising operators or taking autonomous control in closed-loop systems. This level of control not only adds value but also allows knowledge workers to concentrate on the plant's future state. The increasingly autonomous can ensure that companies have a resilient and adaptable set of assets that can react and be adjusted to survive in changing economic, operational, or demand-volatile markets by carefully blending technology and procedure. The ability of the autonomous plant to collapse and complete feedback loops between planning and scheduling and operational optimization technologies will be a key feature. This ensures that pertinent information is exchanged and that suitable actions are selected and implemented. Many plants faced problems running at minimal permitted rates during low-demand periods, as demonstrated during the current pandemic-induced slowdowns. Many facilities were unable to arrange the many restrictions and process units in a way that met production goals while maintaining safety because their planning and control systems were not designed to optimize at low through puts in the absence of closed feedback loops. This closed feedback and feed forward loops also enable the plant to run closer to its limitations in a safe way when operating under so-called normal operating conditions, and in certain shown cases, raise overall plant throughput limits by 5% to 10%. Workers' ability to make tactical decisions that are associated with strategic goals for increased operational integrity, sustainability, and productivity can be enhanced as part of the journey toward the autonomous plant. Also, technology solutions can be built to facilitate more effective communication between enterprises and better decision-making coordination. From a systems perspective, early adopters of important autonomous components have shed light on the shockingly high amount of value accessible through thorough implementations—or, by contrast, the amount of margin value being lost by running ineffectively. In the refining industry, for example, digital twins are frequently used to update planning models and monitor crucial equipment. Dynamic multi unit optimization synchronized with planning is worth 15 to 30 cents per barrel; integrated planning and scheduling are worth 20 to 50 cents per barrel, and adaptive multivariate control is worth 12 to 20 cents per barrel. Also, the value of AI agents that are tightly connected with digital systems could be worth more than an additional US $1 per barrel. As long as oil prices remain in the US $60 to US $80 range, crack spreads will certainly widen and the benefits of digitalization will become more apparent. Getting Started: While more autonomy can benefit all energy companies, the amount of benefit depends on the underlying structural and macroeconomic factors of the markets in which they operate. Individual businesses must utilize this data to determine where they should begin their journey and how far they should travel. Energy firms will need to select their priorities based on their demands, depending on the degree of the headwinds they face and the regional and local market dynamics. With this in mind, four archetypes can assist businesses inappropriately scaling their investments.

These archetypes span the technology adoption continuum, from early adopters through businesses altering their business models to those with a raw-materials advantage. Each archetype has a distinct reason for progressing toward autonomous plants in the future, with possibilities ranging from simple control-system improvements to modular integration of bespoke digital solutions. Furthermore, as players focus on preserving cash flow based on market dynamics, it's worth noting that many of these solutions can be implemented utilizing "soft sensors," or algorithms that maximize throughput and yield, rather than requiring a large upfront investment. We mapped five separate stages that apply to all archetypes, spanning from basic operations to the autonomous company, because different plants can be at varying levels of digital maturity. The time required to install new technology, convert management processes, enhance workforce competencies, and embed new behaviours is shown in this maturity model. However, as the amount of automation rises, the value of the plant and company ecosystem rises in tandem.

1. Basic digital adoption: This maturity level reflects the widest adoption level today, with the simple application of control systems in operations, site-by-site basic refinery planning, spreadsheet-based scheduling, ad-hoc troubleshooting-induced process modeling, and maintenance work orders. The trip began in the 1980s, but many organizations remained bogged down during this time. Companies at this stage typically lack any semblance of a digital organization and see their next digital frontier as bringing their present systems up to date with current best practices and implementing some level of business-process cooperation. 2. Selective advanced analytics adoption: A handful of firms took the first steps toward this next level five to ten years ago, beginning with the limited application of APCs, advanced linear programming–modeling approaches, and enterprise resource planning (ERP) programs. To further orchestrate and increase value, firms that have fully embraced this stage are employing advanced analytics for value-creating use cases such as data analytics-based predictive maintenance for uptime, adaptive advanced process control, and online optimization of individual units. While these are important steps to take, individual leaders must continue to support digital solution pilots rather than a broad, cultural receptivity to disruptive technologies. In addition, many businesses have failed to build a future-proof edge-to-enterprise sensor and data strategy. Finally, the majority of financing is based on "prove-it" trials. 3. Cross-discipline optimization: This stage sees firms researching cross-discipline optimization for which several digital solutions are implemented and connected, although it is much less prevalent and often displayed exclusively by today's leaders. These businesses have mostly solved the problem of scaling and hence have a good idea of where digital deployments might provide value. Fully integrated planning and scheduling solutions, well-designed ERP systems that create the organizational effect, multi-unit process efficiencies, and asset-wide digital twins for emissions monitoring are just a few examples. They also have digital organizations, albeit in their infancy, as well as cultural enthusiasm and momentum for the potential of technology solutions. Paying attention to the edge-to-enterprise data strategy is a crucial first step. If solutions are implemented appropriately and the organization sees a beneficial benefit, digital programs can frequently become "self-funding," lowering adoption hurdles. This is a crucial milestone to achieve, and increased adoption should be a top goal right now to prepare for the next maturity level. 4. Autonomous plant: To get to this point, you'll need a lot more trust in digital technologies, organizational risk alignment, and fully-fledged digital companies that drive constant change. This means organizations look into closed-loop process optimization, connect processes across sites, and save money overall thanks to lower personnel costs, enhanced process stability, and increased reliability. Front-line employees are fully immersed in the adoption culture, and they push technical support staff to maintain the digital approach. Several sites are taking considerable steps to deploy integrated solutions in that direction, even though there are currently no autonomous plants. At this stage, hybrid solutions that incorporate AI are critical. 5. Autonomous enterprise: Only in the context of the enterprise value chain does an asset or plant create value. The value chain must become intelligent to fully realize the autonomous plant's potential. This means it can prioritize which assets create which products across the corporate network, as well as what objectives are being optimized for each product and manufacturing line at each site. As the name implies, this is the pinnacle of the road to independence. Solutions are fully integrated at this point, real-time data visualizations allow for continuous cross-plant optimization, and site-level processes are linked to similarly powerful back-office workflows. Although many are creating parts of an autonomous future, there are essentially no organizations that qualify as "autonomous enterprises." A company's trading organization, for example, could enable real-time (or near-real-time) visibility into operations and logistics to continuously detect the current relative value of crudes or the cost of making various goods to guide commercial decisions. The main takeaway from the digital-maturity model is that every organization, regardless of their position or development on the road to autonomy, has steps available to them. Plants and businesses across the board have the opportunity to deploy digitalization and continue to transform their cost base. We advocate those businesses first define their goals before charting a course to whatever level of autonomy they desire—but ultimately, the possibilities are numerous and sometimes cost little or no capital expenditure. Plants can become more autonomous and self-optimizing with the continued adoption of digitalization across the plant and the company, creating the groundwork for the autonomous enterprise. Following Questions Will Be Addressed: 1. Are autonomous plants future of process industries? 2. What does this shift to fully autonomous plants mean for human workforce? 3. How manufacturers will respond to this autonomous trend? 4. Are autonomous plants are making process industries safe? 5. Which technologies are adopted to make plants autonomous? 6. How to improve operational agility & increase supply chain resiliency?

Following Questions Will Be Addressed: 1. Are autonomous plants future of process industries? 2. What does this shift to fully autonomous plants mean for human workforce? 3. How manufacturers will respond to this autonomous trend? 4. Are autonomous plants are making process industries safe? 5. Which technologies are adopted to make plants autonomous? 6. How to improve operational agility & increase supply chain resiliency?