Global Petrochemicals Market size was valued at USD 636.75 Bn in 2023 and Petrochemical Feedstock market revenue is expected to reach USD 989.50 Bn by 2030, at a CAGR of 6.5% over the forecast period.Petrochemicals Market Overview

Petrochemicals are derived from petroleum or natural gas. Petrochemicals are important part of the chemical industry as the demand for synthetic materials is increasing continually and plays a major role in the growth of the economy. They are used in petrochemical products plastics, medicines, cosmetics, furniture, appliances, electronics, solar power panels, and wind turbines. The automotive industry's growth, including the shift toward electric vehicles, impacts the demand for petrochemical materials used in vehicle production. Changing consumer preferences for convenience, durability, and lightweight materials contribute to the demand for petrochemical-based products. The Petrochemicals Market is highly competitive, leading to price pressures and thinner profit margins. Companies need to invest in innovation to stay ahead.To know about the Research Methodology :- Request Free Sample Report

Petrochemicals Market Dynamics

Economic Development and Emerging Markets to boost the Petrochemical Industry growth Robust economic growth, prominently observed within emerging economies, with a focal emphasis on the Asian markets, manifests as a pivotal driver behind the escalated consumer expenditure and heightened industrial activities, which, in turn, propel the demand for petrochemical products. As nations such as China and India continue their developmental trajectory, petrochemical consumption within these regions experiences a concurrent upswing. As the global population continues its steady expansion, paralleled by the ongoing urbanization trend, the concomitant surge in demand for consumer goods, housing, and infrastructure, particularly within urban and metropolitan zones, underscores the indispensable role of petrochemicals in facilitating the production of essential urban requisites like plastics, construction materials, and electronic components. The petrochemical industry's reliance on hydrocarbons, which exhibit an intrinsic linkage with the energy sector, stipulates that the prevailing growth in energy consumption, encompassing the domains of oil and natural gas, significantly influences the availability and pricing of feedstocks fundamental to the petrochemical sector. The progressive march of technological innovations has bestowed upon the industry an arsenal of new and more efficient petrochemical production processes. These innovations have broadened the spectrum of producible petrochemical products, fostering enhancements in overall industry efficiency and sustainability. The burgeoning traction of the circular economy model, characterized by the recycling, reutilization, and repurposing of products and materials, is permeating the petrochemical landscape. Petrochemical enterprises are actively exploring avenues to engender materials that are more sustainable and amenable to recycling, aligning with the core tenets of the circular economy. The petrochemical industry is highly interconnected globally, with complex supply chains that can be affected by trade policies, geopolitical tensions, and logistics disruptions. Changes in international trade agreements and global economic dynamics influence Petrochemicals Market dynamics. The availability and cost of feedstocks, such as crude oil and natural gas, significantly influence the Petrochemicals Market growth. Shale gas and other unconventional sources have altered the feedstock landscape, impacting the competitiveness of various regions. Consumer preferences for sustainable and environmentally friendly products have prompted companies to adapt their offerings. Increased consumer awareness of environmental and health-related issues influence the development of petrochemical products. Changing regulations related to chemical safety, emissions, and environmental protection can significantly impact the petrochemical industry. Compliance with evolving regulations often requires investments in technology and process improvements. The ascendancy of plastics as a pivotal product category within the petrochemical domain is irrefutable. The burgeoning global demand for food necessitates a concurrent surge in the need for agricultural chemicals, sustaining the petrochemical industry's prominence. The transportation sector, particularly the automotive industry, relies substantially on petrochemical products. Petrochemicals are integral to the production of plastics, synthetic rubber, and an array of chemicals employed in vehicle manufacturing. The trajectory of the automotive sector wields a direct and profound influence on the Petrochemicals Market growth. Volatility in Oil Price to restrain the Petrochemicals Market growth The petrochemical industry maintains an intricate nexus with crude oil prices, as a substantial proportion of its raw materials are derived from oil. Oscillations in oil prices can exert profound influences on the cost of production for petrochemical companies. When oil prices surge, it translates into elevated operating expenses and diminished profit margins. Conversely, during periods of low oil prices, investments in exploration and production often decline, precipitating supply chain disruptions. The imposition of trade barriers and tariffs can exert a pronounced impact on the industry's global supply chains and profitability. Prolonged trade disputes and tariff conflicts can disrupt established trade routes and inflate costs for petrochemical enterprises. The perception of the Petrochemicals Market within the public sphere can serve as a significant restraint. The petrochemical sector exhibits a pronounced dependence on a limited set of key raw materials, including ethylene and propylene. This reliance on a constrained array of feedstocks renders the supply chain vulnerable and accentuates susceptibility to price fluctuations. Opportunities in Petrochemical Manufacturers' mounting environmental concerns fuels market growth. Policymakers have pushed businesses to take action and run the production process responsibly and environmentally friendly in response to growing environmental concerns. In order to comply with new pollution control requirements, a number of significant businesses are updating their operations. This is because reducing pollution from manufacturing facilities have essentials for reducing overall pollution and the effects of climate change. For instance, Dow stated in October 2022 that it build Alberta, Canada's first integrated net-zero carbon ethylene cracker and derivatives plant. Through 2030, Dow estimates that the new brownfield ethylene cracker gradually increase capacity by about 1.9 million tonnes. This allow the company to produce and supply roughly 3.3 million tonnes of certified low-to-zero-carbon emissions polyethylene and ethylene derivatives for clients and joint venture partners around the world. This made possible by additional derivatives capacity and site retrofit investments. In September 2022, MEGlobal Americas Inc. announced that starting in 2023, it buy renewable energy from Calpine Energy Solutions LLC to meet 100% of the expected power demands for its petrochemical plant in Texas, United States. This was another instance of an industry player taking the initiative to go green. The agreement underlines EQUATE Petrochemical Group, of which MEGlobal is a part steadfast dedication to sustainability. Advanced petrochemical products with more inventive applications and greater environmental friendliness are required by numerous end-user industries, which is expected to boost the Petrochemicals Market growth. The quickly developing base chemical field is no different in this regard. Aviation, building and construction, agriculture, food and beverage, electrical and electronics, healthcare, and automotive are a few end-use industries that have a greater need for enhanced petrochemical products. This has prompted numerous petrochemical producers to create new technologies to better turn the petrochemicals into newer goods that are more eco-friendly and have more creative and practical uses.Petrochemicals Market Segment Analysis

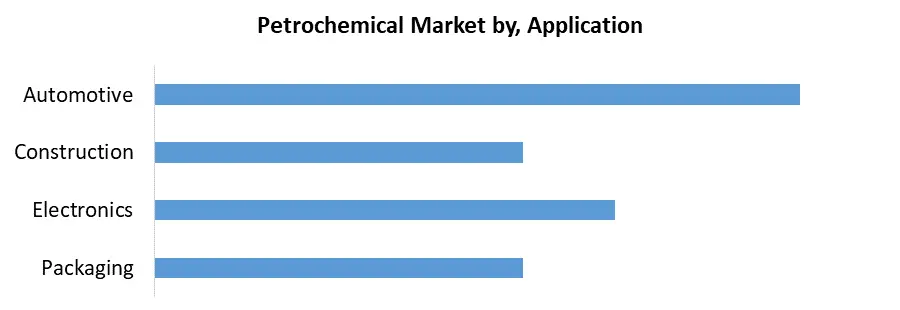

Based on Type, the market is segmented into Ethylene, Propylene, Methanol, Xylene, and Others. Ethylene, and Propylene segment dominated the market in 2023 and is expected to hold the largest Petrochemical share over the forecast period. In the Petrochemicals Market, ethylene and propylene stand out as two of the most pivotal and dominant segments. They are fundamental building blocks for a diverse array of products, finding extensive applications across a multitude of industries. Ethylene holds a pivotal role within the petrochemical industry, central to the production of plastics and a diverse array of chemical compounds. Its versatility and wide-ranging applications solidify its status as a dominant segment in the market. Propylene is instrumental in the creation of diverse chemical intermediates. It plays a key role in the manufacture of propylene oxide (used in polyurethane foam and glycol production), acrylonitrile (employed in acrylic fibers and plastics), and cumene (utilized in the production of phenol and acetone). Propylene constitutes a critical segment in the Petrochemicals Market, closely following ethylene in importance. Its adaptability in the production of plastics, chemicals, and synthetic materials renders it indispensable across various industries.Based on Application, the market is segmented into Packaging, Electronics, Construction, and Automotive. The automotive segment held the largest Petrochemicals Market share in 2023 and is expected to dominate the market over the forecast period. Petrochemical-derived plastics find extensive applications in the production of various automotive components, including interior elements, bumpers, dashboards, and external panels. These plastics are esteemed for their advantageous properties, such as lightweight characteristics, durability, and design flexibility. Synthetic rubber, produced from Petrochemicals, assumes a pivotal role as a fundamental constituent of tires. The demand for tires within the automotive industry is substantial, influenced by vehicle manufacturing and the necessity for tire replacements, thus making a noteworthy contribution to the Petrochemicals Market growth. The automotive industry's endeavors to enhance fuel efficiency and reduce emissions have stimulated the employment of lightweight materials derived from petrochemicals. These materials encompass advanced polymers and composites, thereby further consolidating the significance of petrochemicals in this sector.

Petrochemicals Market Regional Analysis

Investment in Research and Development sector in Asia Pacific to boost the Market growth Governments and corporate entities alike are directing resources toward research and development endeavors aimed at the creation of innovative petrochemical products and processes. This encompasses the development of novel materials characterized by enhanced properties and reduced environmental impact. Evolving consumer lifestyles and the increased prevalence of product packaging for convenience and preservation have spurred the demand for petrochemical-based materials such as plastics and flexible packaging. These materials are integral to food packaging, beverage containers, and various other consumer products. The textile industry in the Asia-Pacific region reaps the benefits of synthetic fibers produced from petrochemicals. These fibers, encompassing polyester and nylon, facilitate the production of clothing and textiles that are both cost-effective and widely accessible, satisfying the needs of a burgeoning population. Several countries, including China, have undertaken measures to amplify domestic petrochemical production capacity. This often entails investments in new production facilities and the expansion of existing ones. The establishment of petrochemical manufacturing zones and industrial parks has attracted foreign direct investment, thereby contributing to the growth of the petrochemical industry in the region.Petrochemicals Market Competitive Landscape

The competitive landscape of the petrochemicals market is characterized by intense competition among a wide range of players, from global giants to regional and specialized companies. Understanding the competition insights in this dynamic market is essential for both established and emerging players. Specialized petrochemical companies like LyondellBasell Industries, INEOS, and Celanese Corporation focus on specific niche areas within the petrochemical industry. They often excel in innovation, producing high-performance materials and specialty chemicals. Technological innovation is a critical competitive factor. Companies that invest in research and development to create novel materials, improve production processes, and enhance sustainability are better positioned to meet market demands. Adherence to stringent environmental and safety regulations is a key competitive factor. Companies that proactively address regulatory challenges and invest in compliance measures demonstrate a commitment to responsible operations. Mergers and acquisitions are common strategies to strengthen market position. Companies acquire competitors or complementary businesses to expand their product portfolios and geographic reach.Petrochemicals Market Scope: Inquiry Before Buying

Petrochemicals Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 636.75 Bn. Forecast Period 2024 to 2030 CAGR: 6.5% Market Size in 2030: US $ 989.50 Bn. Segments Covered: by Type Ethylene Propylene Methanol Xylene Others by Application Packaging Electronics Construction Automotive by End Use Industry Chemical Industry Plastics Industry Textile and Apparel Industry Automotive Industry Agriculture Petrochemicals Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Petrochemicals Key Players Include

1. Pampa Energía S.A. 2. BASF SE 3. Chevron Corporation 4. Exxon Mobil Corporation 5. INEOS Group Ltd. 6. Royal Dutch Shell PLC 7. SABIC 8. TotalEnergies 9. Formosa Petrochemical Corporation 10. Reliance Industries Limited 11. Mitsubishi Chemical Holdings 12. Lotte Chemical Corporation 13. Braskem 14. LG Chem 15. Saudi AramcoFrequently Asked Questions:

1] What is the growth rate of the Global Petrochemicals Market? Ans. The Global Petrochemicals Market is growing at a significant rate of 6.5 % over the forecast period. 2] Which region is expected to dominate the Global Petrochemicals Market? Ans. Asia Pacific region is expected to dominate the Petrochemicals Market over the forecast period. 3] What is the expected Global Petrochemicals Market size by 2030? Ans. The market size of the Petrochemicals Market is expected to reach USD 636.75 Bn by 2030. 4] Who are the top players in the Global Petrochemical Industry? Ans. The major key players in the Global Petrochemicals Market are Pampa Energía S.A. , BASF SE, and Chevron Corporation. 5] Which factors are expected to drive the Global Petrochemicals Market growth by 2030? Ans. Technological advancement in Petrochemical manufacturing is expected to drive the Petrochemicals Market growth over the forecast period (2024-2030).

1. Petrochemicals Market Introduction 1.1 Study Assumption and Market Definition 1.2 Scope of the Study 1.3 Executive Summary 2. Petrochemicals Market: Dynamics 2.1 Petrochemicals Market Trends by Region 2.1.1 Global 2.1.2 North America 2.1.3 Europe 2.1.4 Asia Pacific 2.1.5 Middle East and Africa 2.1.6 South America 2.2 Petrochemicals Market Drivers by Region 2.2.1 Global 2.2.2 North America 2.2.3 Europe 2.2.4 Asia Pacific 2.2.5 Middle East and Africa 2.2.6 South America 2.3 Petrochemicals Market Restraints 2.4 Petrochemicals Market Opportunities 2.5 Petrochemicals Market Challenges 2.6 PORTER’s Five Forces Analysis 2.6.1 Bargaining Power Of Suppliers 2.6.2 Bargaining Power Of Buyers 2.6.3 Threat Of New Entrants 2.6.4 Threat Of Substitutes 2.6.5 Intensity Of Rivalry 2.7 PESTLE Analysis 2.8 Value Chain Analysis 2.9 Regulatory Landscape by Region 2.9.1 Global 2.9.2 North America 2.9.3 Europe 2.9.4 Asia Pacific 2.9.5 Middle East and Africa 2.9.6 South America 2.10 Analysis of Government Schemes and Initiatives For Petrochemical Industry 2.11 The Global Pandemic and Redefining of The Petrochemical Industry Landscape 2.12 Price Trend Analysis 2.13 Technological Road Map 2.14 Global Petrochemical Trade Analysis (2018-2023) 2.14.1 Global Import of Petrochemical 2.14.1.1 Ten largest Importer 2.14.2 Global Export of Petrochemical 2.14.2.1 Ten largest Exporter 2.15 Petrochemical Production Capacity Analysis 2.15.1 Chapter Overview 2.15.2 Key Assumptions and Methodology 2.15.3 Petrochemical Manufacturers: Global Installed Capacity 2.15.4 Analysis by Size of Manufacturer 2.15.5 Analysis by Demand Side 2.15.6 Analysis by Supply Side 3. Petrochemicals Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 3.1 Global Petrochemicals Market, by Type (2023-2030) 3.1.1 Ethylene 3.1.2 Propylene 3.1.3 Methanol 3.1.4 Xylene 3.1.5 Others 3.2 Global Petrochemicals Market, by Application (2023-2030) 3.2.1 Packaging 3.2.2 Electronics 3.2.3 Construction 3.2.4 Automotive 3.3 Global Petrochemicals Market, by End-Use Industry (2023-2030) 3.3.1 Chemical Industry 3.3.2 Plastics Industry 3.3.3 Textile and Apparel Industry 3.3.4 Automotive Industry 3.3.5 Agriculture 3.4 Global Petrochemicals Market, by Region (2023-2030) 3.4.1 North America 3.4.2 Europe 3.4.3 Asia Pacific 3.4.4 Middle East and Africa 3.4.5 South America 4. North America Petrochemicals Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 4.1 North America Petrochemicals Market, by Type (2023-2030) 4.1.1 Ethylene 4.1.2 Propylene 4.1.3 Methanol 4.1.4 Xylene 4.1.5 Others 4.2 North America Petrochemicals Market, by Application (2023-2030) 4.2.1 Packaging 4.2.2 Electronics 4.2.3 Construction 4.2.4 Automotive 4.3 North America Petrochemicals Market, by End-Use Industry(2023-2030) 4.3.1 Chemical Industry 4.3.2 Plastics Industry 4.3.3 Textile and Apparel Industry 4.3.4 Automotive Industry 4.3.5 Agriculture 4.4 North America Petrochemicals Market, by Country (2023-2030) 4.4.1 United States 4.4.1.1 United States Petrochemicals Market, by Type (2023-2030) 4.4.1.1.1 Ethylene 4.4.1.1.2 Propylene 4.4.1.1.3 Methanol 4.4.1.1.4 Xylene 4.4.1.1.5 Others 4.4.1.2 United States Petrochemicals Market, by Application (2023-2030) 4.4.1.2.1 Packaging 4.4.1.2.2 Electronics 4.4.1.2.3 Construction 4.4.1.2.4 Automotive 4.4.1.3 United States Petrochemicals Market, by End-Use Industry (2023-2030) 4.4.1.3.1 Chemical Industry 4.4.1.3.2 Plastics Industry 4.4.1.3.3 Textile and Apparel Industry 4.4.1.3.4 Automotive Industry 4.4.1.3.5 Agriculture 4.4.2 Canada 4.4.2.1 Canada Petrochemicals Market, by Type (2023-2030) 4.4.2.1.1 Ethylene 4.4.2.1.2 Propylene 4.4.2.1.3 Methanol 4.4.2.1.4 Xylene 4.4.2.1.5 Others 4.4.2.2 Canada Petrochemicals Market, by Application (2023-2030) 4.4.2.2.1 Packaging 4.4.2.2.2 Electronics 4.4.2.2.3 Construction 4.4.2.2.4 Automotive 4.4.2.3 Canada Petrochemicals Market, by End-Use Industry (2023-2030) 4.4.2.3.1 Chemical Industry 4.4.2.3.2 Plastics Industry 4.4.2.3.3 Textile and Apparel Industry 4.4.2.3.4 Automotive Industry 4.4.2.3.5 Agriculture 4.4.3 Mexico 4.4.3.1 Mexico Petrochemicals Market, by Type (2023-2030) 4.4.3.1.1 Ethylene 4.4.3.1.2 Propylene 4.4.3.1.3 Methanol 4.4.3.1.4 Xylene 4.4.3.1.5 Others 4.4.3.2 Mexico Petrochemicals Market, by Application (2023-2030) 4.4.3.2.1 Packaging 4.4.3.2.2 Electronics 4.4.3.2.3 Construction 4.4.3.2.4 Automotive 4.4.3.3 Mexico Petrochemicals Market, by End-Use Industry (2023-2030) 4.4.3.3.1 Chemical Industry 4.4.3.3.2 Plastics Industry 4.4.3.3.3 Textile and Apparel Industry 4.4.3.3.4 Automotive Industry 4.4.3.3.5 Agriculture 5. Europe Petrochemicals Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 5.1 Europe Petrochemicals Market, by Type (2023-2030) 5.2 Europe Petrochemicals Market, by Application (2023-2030) 5.3 Europe Petrochemicals Market, by End-Use Industry (2023-2030) 5.4 Europe Petrochemicals Market, by Country (2023-2030) 5.4.1 United Kingdom 5.4.1.1 United Kingdom Petrochemicals Market, by Type (2023-2030) 5.4.1.2 United Kingdom Petrochemicals Market, by Application (2023-2030) 5.4.1.3 United Kingdom Petrochemicals Market, by End-Use Industry (2023-2030) 5.4.2 France 5.4.2.1 France Petrochemicals Market, by Type (2023-2030) 5.4.2.2 France Petrochemicals Market, by Application (2023-2030) 5.4.2.3 France Petrochemicals Market, by End-Use Industry (2023-2030) 5.4.3 Germany 5.4.3.1 Germany Petrochemicals Market, by Type (2023-2030) 5.4.3.2 Germany Petrochemicals Market, by Application (2023-2030) 5.4.3.3 Germany Petrochemicals Market, by End-Use Industry (2023-2030) 5.4.4 Italy 5.4.4.1 Italy Petrochemicals Market, by Type (2023-2030) 5.4.4.2 Italy Petrochemicals Market, by Application (2023-2030) 5.4.4.3 Italy Petrochemicals Market, by End-Use Industry (2023-2030) 5.4.5 Spain 5.4.5.1 Spain Petrochemicals Market, by Type (2023-2030) 5.4.5.2 Spain Petrochemicals Market, by Application (2023-2030) 5.4.5.3 Spain Petrochemicals Market, by End-Use Industry (2023-2030) 5.4.6 Sweden 5.4.6.1 Sweden Petrochemicals Market, by Type (2023-2030) 5.4.6.2 Sweden Petrochemicals Market, by Application (2023-2030) 5.4.6.3 Sweden Petrochemicals Market, by End-Use Industry (2023-2030) 5.4.7 Austria 5.4.7.1 Austria Petrochemicals Market, by Type (2023-2030) 5.4.7.2 Austria Petrochemicals Market, by Application (2023-2030) 5.4.7.3 Austria Petrochemicals Market, by End-Use Industry (2023-2030) 5.4.8 Rest of Europe 5.4.8.1 Rest of Europe Petrochemicals Market, by Type (2023-2030) 5.4.8.2 Rest of Europe Petrochemicals Market, by Application (2023-2030) 5.4.8.3 Rest of Europe Petrochemicals Market, by End-Use Industry (2023-2030). 6. Asia Pacific Petrochemicals Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 6.1 Asia Pacific Petrochemicals Market, by Type (2023-2030) 6.2 Asia Pacific Petrochemicals Market, by Application (2023-2030) 6.3 Asia Pacific Petrochemicals Market, by End-Use Industry (2023-2030) 6.4 Asia Pacific Petrochemicals Market, by Country (2023-2030) 6.4.1 China 6.4.1.1 China Petrochemicals Market, by Type (2023-2030) 6.4.1.2 China Petrochemicals Market, by Application (2023-2030) 6.4.1.3 China Petrochemicals Market, by End-Use Industry (2023-2030) 6.4.2 South Korea 6.4.2.1 S Korea Petrochemicals Market, by Type (2023-2030) 6.4.2.2 S Korea Petrochemicals Market, by Application (2023-2030) 6.4.2.3 S Korea Petrochemicals Market, by End-Use Industry (2023-2030) 6.4.3 Japan 6.4.3.1 Japan Petrochemicals Market, by Type (2023-2030) 6.4.3.2 Japan Petrochemicals Market, by Application (2023-2030) 6.4.3.3 Japan Petrochemicals Market, by End-Use Industry (2023-2030) 6.4.4 India 6.4.4.1 India Petrochemicals Market, by Type (2023-2030) 6.4.4.2 India Petrochemicals Market, by Application (2023-2030) 6.4.4.3 India Petrochemicals Market, by End-Use Industry (2023-2030) 6.4.5 Australia 6.4.5.1 Australia Petrochemicals Market, by Type (2023-2030) 6.4.5.2 Australia Petrochemicals Market, by Application (2023-2030) 6.4.5.3 Australia Petrochemicals Market, by End-Use Industry (2023-2030) 6.4.6 Indonesia 6.4.6.1 Indonesia Petrochemicals Market, by Type (2023-2030) 6.4.6.2 Indonesia Petrochemicals Market, by Application (2023-2030) 6.4.6.3 Indonesia Petrochemicals Market, by End-Use Industry (2023-2030) 6.4.7 Malaysia 6.4.7.1 Malaysia Petrochemicals Market, by Type (2023-2030) 6.4.7.2 Malaysia Petrochemicals Market, by Application (2023-2030) 6.4.7.3 Malaysia Petrochemicals Market, by End-Use Industry (2023-2030) 6.4.8 Vietnam 6.4.8.1 Vietnam Petrochemicals Market, by Type (2023-2030) 6.4.8.2 Vietnam Petrochemicals Market, by Application (2023-2030) 6.4.8.3 Vietnam Petrochemicals Market, by End-Use Industry (2023-2030) 6.4.9 Taiwan 6.4.9.1 Taiwan Petrochemicals Market, by Type (2023-2030) 6.4.9.2 Taiwan Petrochemicals Market, by Application (2023-2030) 6.4.9.3 Taiwan Petrochemicals Market, by End-Use Industry (2023-2030) 6.4.10 Bangladesh 6.4.10.1 Bangladesh Petrochemicals Market, by Type (2023-2030) 6.4.10.2 Bangladesh Petrochemicals Market, by Application (2023-2030) 6.4.10.3 Bangladesh Petrochemicals Market, by End-Use Industry (2023-2030) 6.4.11 Pakistan 6.4.11.1 Pakistan Petrochemicals Market, by Type (2023-2030) 6.4.11.2 Pakistan Petrochemicals Market, by Application (2023-2030) 6.4.11.3 Pakistan Petrochemicals Market, by End-Use Industry (2023-2030) 6.4.12 Rest of Asia Pacific 6.4.12.1 Rest of Asia Pacific Petrochemicals Market, by Type (2023-2030) 6.4.12.2 Rest of Asia Pacific Petrochemicals Market, by Application (2023-2030) 6.4.12.3 Rest of Asia PacificPetrochemicals Market, by End-Use Industry (2023-2030) 7. Middle East and Africa Petrochemicals Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 7.1 Middle East and Africa Petrochemicals Market, by Type (2023-2030) 7.2 Middle East and Africa Petrochemicals Market, by Application (2023-2030) 7.3 Middle East and Africa Petrochemicals Market, by End-Use Industry (2023-2030) 7.4 Middle East and Africa Petrochemicals Market, by Country (2023-2030) 7.4.1 South Africa 7.4.1.1 South Africa Petrochemicals Market, by Type (2023-2030) 7.4.1.2 South Africa Petrochemicals Market, by Application (2023-2030) 7.4.1.3 South Africa Petrochemicals Market, by End-Use Industry (2023-2030) 7.4.2 GCC 7.4.2.1 GCC Petrochemicals Market, by Type (2023-2030) 7.4.2.2 GCC Petrochemicals Market, by Application (2023-2030) 7.4.2.3 GCC Petrochemicals Market, by End-Use Industry (2023-2030) 7.4.3 Egypt 7.4.3.1 Egypt Petrochemicals Market, by Type (2023-2030) 7.4.3.2 Egypt Petrochemicals Market, by Application (2023-2030) 7.4.3.3 Egypt Petrochemicals Market, by End-Use Industry (2023-2030) 7.4.4 Nigeria 7.4.4.1 Nigeria Petrochemicals Market, by Type (2023-2030) 7.4.4.2 Nigeria Petrochemicals Market, by Application (2023-2030) 7.4.4.3 Nigeria Petrochemicals Market, by End-Use Industry (2023-2030) 7.4.5 Rest of ME&A 7.4.5.1 Rest of ME&A Petrochemicals Market, by Type (2023-2030) 7.4.5.2 Rest of ME&A Petrochemicals Market, by Application (2023-2030) 7.4.5.3 Rest of ME&A Petrochemicals Market, by End-Use Industry (2023-2030) 8. South America Petrochemicals Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 8.1 South America Petrochemicals Market, by Type (2023-2030) 8.2 South America Petrochemicals Market, by Application (2023-2030) 8.3 South America Petrochemicals Market, by End-Use Industry (2023-2030) 8.4 South America Petrochemicals Market, by Country (2023-2030) 8.4.1 Brazil 8.4.1.1 Brazil Petrochemicals Market, by Type(2023-2030) 8.4.1.2 Brazil Petrochemicals Market, by Application (2023-2030) 8.4.1.3 Brazil Petrochemicals Market, by End-Use Industry (2023-2030) 8.4.2 Argentina 8.4.2.1 Argentina Petrochemicals Market, by Type (2023-2030) 8.4.2.2 Argentina Petrochemicals Market, by Application (2023-2030) 8.4.2.3 Argentina Petrochemicals Market, by End-Use Industry (2023-2030) 8.4.3 Rest Of South America 8.4.3.1 Rest Of South America Petrochemicals Market, by Type (2023-2030) 8.4.3.2 Rest Of South America Petrochemicals Market, by Application (2023-2030) 8.4.3.3 Rest Of South America Petrochemicals Market, by End-Use Industry (2023-2030) 9. Global Petrochemicals Market: Competitive Landscape 9.1 MMR Competition Matrix 9.2 Competitive Landscape 9.3 Key Players Benchmarking 9.3.1 Company Name 9.3.2 Product Segment 9.3.3 End-user Segment 9.3.4 Revenue (2022) 9.3.5 Manufacturing Locations 9.4 Market Analysis by Organized Players vs. Unorganized Players 9.4.1 Organized Players 9.4.2 Unorganized Players 9.5 Leading Petrochemical Global Companies, by market capitalization 9.6 Market Structure 9.6.1 Market Leaders 9.6.2 Market Followers 9.6.3 Emerging Players 9.7 Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1 Pampa Energía S.A. 10.1.1 Company Overview 10.1.2 Business Portfolio 10.1.3 Financial Overview 10.1.4 SWOT Analysis 10.1.5 Strategic Analysis 10.1.6 Scale of Operation (small, medium, and large) 10.1.7 Details on Partnership 10.1.8 Regulatory Accreditations and Certifications Received by Them 10.1.9 Awards Received by the Firm 10.1.10 Recent Developments 10.2 BASF SE 10.3 Chevron Corporation 10.4 Exxon Mobil Corporation 10.5 INEOS Group Ltd. 10.6 Royal Dutch Shell PLC 10.7 SABIC 10.8 TotalEnergies 10.9 Formosa Petrochemical Corporation 10.10 Reliance Industries Limited 10.11 Mitsubishi Chemical Holdings 10.12 Lotte Chemical Corporation 10.13 Braskem 10.14 LG Chem 10.15 Saudi Aramco 11. Key Findings 12. Industry Recommendations 13. Petrochemicals Market: Research Methodology 14. Terms and Glossary