The Global X-linked hypophosphatemia Market size was valued at USD 1.3 Bn in 2022 and market revenue is growing at a CAGR of 9.2% from 2023 to 2029, reaching nearly USD 2.41 Bn by 2029.X-Linked Hypophosphatemia Market

X-linked hypophosphatemia (XLH) is a rare genetic disorder, affecting 1 in 20,000 individuals, characterized by low blood phosphorus levels due to kidney abnormalities. It causes bone and teeth issues, fractures, hearing loss, joint problems, and enthesopathies, resembling vitamin D deficiency but not responding to supplementation. The XLH market is witnessing significant growth due to increased awareness, advancements in diagnostic techniques, as well as expanding research initiatives. Phosphate supplements and emerging targeted therapies are key treatment modalities that address the underlying molecular pathways. With a focus on improving patients' quality of life, ongoing clinical trials and collaborations among pharmaceutical companies are driving innovation. Also, the X-Linked Hypophosphatemia Market’s future potential enhanced therapeutic options, personalized medicine approaches, and a holistic patient-centric ecosystem, emphasizing comprehensive disease management. The XLH market anticipates sustained growth and improved outcomes for affected individuals.To know about the Research Methodology :- Request Free Sample Report

X-Linked Hypophosphatemia Trends:

Latest advancements in x-linked hypophosphatemia treatment options The latest breakthrough in the treatment of X-linked hypophosphatemia (XLH) involves the development of an innovative therapy called burosumab. Burosumab, functioning as a monoclonal antibody, specifically targets fibroblast growth factor 23 (FGF23), which is elevated in XLH and contributes to phosphate wasting and impaired vitamin D metabolism. Clinical trials have unequivocally demonstrated the effectiveness and safety of burosumab, particularly in pediatric patients with XLH, resulting in its official approval for treating XLH in this demographic. This signifies a significant advancement in XLH management, providing a targeted and precise intervention that directly addresses the underlying pathophysiological processes of the disease. The expected market growth further underscores the increasing focus on and investment in addressing the needs of individuals with XLH.X-Linked Hypophosphatemia Dynamics:

Increase in the prevalence of X-linked hypophosphatemia (XLH) drives Market Growth. Increase in the prevalence of XLH, drawing attention to the urgent need for effective treatments. As awareness about this rare genetic disorder grows among healthcare professionals and the general public, there is a corresponding rise in early diagnoses and interventions. Also, advancements in treatment options, including innovative therapies and targeted interventions, are contributing to the growth of the XLH market. Research and development efforts have helped the exploration of novel therapeutic approaches, such as gene therapies, addressing the underlying genetic abnormalities associated with XLH. These advancements offer hope for more tailored and effective treatments, enhancing patient outcomes and quality of life. The convergence of a higher disease prevalence, increased awareness, and the continuous evolution of treatment modalities collectively propel market growth for XLH. As pharmaceutical companies, research institutions, and patient advocacy groups collaborate to address the unmet medical needs of XLH patients, the market is composed to witness further growth with the goal of providing improved and accessible therapeutic solutions.Limited Awareness and Diagnosis of X-linked hypophosphatemia (XLH) limits the Market Growth. The Limited awareness and diagnosis of X-linked hypophosphatemia (XLH) significantly hinder market growth for treatments related to this genetic disorder. XLH is a rare and often underdiagnosed condition, characterized by low phosphate levels that lead to skeletal abnormalities. The lack of awareness among healthcare professionals and the general public contributes to delayed or missed diagnoses, preventing timely intervention and treatment initiation. Healthcare providers are not sufficiently informed about the manifestations of XLH, and patients experiencing symptoms do not seek medical attention or receive accurate diagnoses promptly. This delay in identification impacts patient outcomes and poses challenges for pharmaceutical companies and treatment developers in establishing a strong market presence. The limited awareness of XLH extends beyond the healthcare community to the broader public, resulting in a lack of understanding of the disease's prevalence and severity. This impedes advocacy efforts, reducing the urgency for improved diagnostics and therapeutic options. To overcome this challenge, education and awareness initiatives are crucial. Increased medical education programs for healthcare professionals enhance diagnostic capabilities, ensuring that XLH is considered in the differential diagnosis for patients presenting with relevant symptoms. Simultaneously, public awareness campaigns empower individuals to recognize potential signs of XLH, promoting proactive healthcare-seeking behavior.

Market Growth Opportunity

Technological Advancements in Diagnosis create lucrative growth opportunities for the X-linked hypophosphatemia Market growth Technological advancements in the diagnosis of X-linked hypophosphatemia (XLH) offer significant growth prospects for the market by revolutionizing patient identification and disease management. Advanced diagnostic tools, including genetic testing, molecular diagnostics, and high-resolution imaging, enable early and accurate detection of XLH, facilitating timely intervention and improved patient outcomes. The integration of artificial intelligence (AI) further enhances diagnostic precision by analyzing complex datasets and identifying subtle patterns associated with the disorder. These innovations streamline the diagnostic process and contribute to personalized medicine approaches, tailoring treatments to individual patient profiles. The discovery of specific biomarkers associated with XLH aids in prognosis and treatment monitoring. Additionally, point-of-care testing and telemedicine platforms improve accessibility, allowing for remote consultations and monitoring. As technology continues to evolve, the synergy of these advancements creates a dynamic landscape for the XLH market, fostering increased awareness, efficient diagnosis, and a foundation for the development of targeted and effective therapies. The market stands to benefit from the improved diagnostic capabilities, driving overall growth and addressing unmet needs in the treatment of X-linked hypophosphatemia.X-linked hypophosphatemia Market Segment Analysis

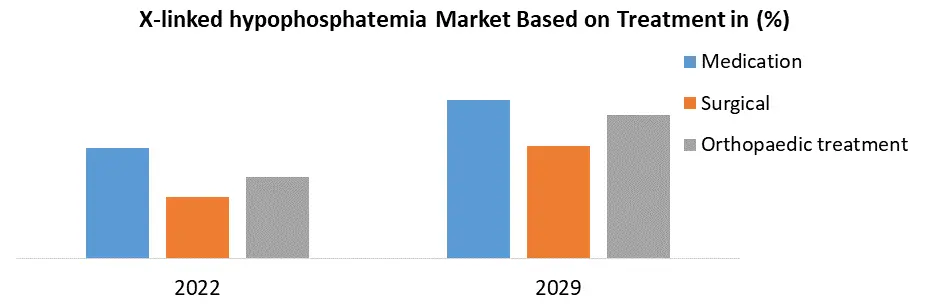

Based on Treatment, The medication sub-segment dominates the global X-linked hypophosphatemia Market in the year 2022. Due to the limited treatment options for this rare genetic disorder. XLH, characterized by low blood phosphate levels, often requires pharmacological interventions to manage symptoms. Ongoing research and development efforts in the pharmaceutical industry focus on developing medications to regulate phosphate levels and address the disease's pathology. Patient preference, compliance, and the regulatory approval of medications also contribute to the dominance of this sub-segment. The pharmaceutical industry's ability to provide effective and accessible medications plays an important role in shaping the XLH market, reflecting the emphasis on drug-based interventions in managing this rare condition.

X-linked hypophosphatemia Market Regional Analysis

North America region dominates the X-linked hypophosphatemia Market in the year 2022. North America holds a dominant position in the X-linked hypophosphatemia (XLH) market, driven by the rising prevalence of the condition, well-established healthcare infrastructure, a supportive regulatory environment, and the accessibility of diverse treatment options.

North America Prevalence and Diagnosis In North America, XLH is a relatively rare disorder, but the prevalence varies among different ethnic groups. The United States has a well-established healthcare system, which facilitates early diagnosis and management of rare diseases. The presence of specialized medical centers and genetic testing facilities contributes to the accurate identification of XLH cases. However, challenges such as underdiagnoses and delayed diagnosis may still exist. Treatment Landscape The North American XLH market has witnessed significant advancements in recent years. Conventional treatments, including phosphate and active vitamin D supplements, remain standard, but emerging therapies, such as burosumab, have gained traction. Burosumab, a monoclonal antibody targeting fibroblast growth factor 23 (FGF23), has shown promising results in improving phosphate metabolism and bone health in XLH patients. The availability of such innovative therapies reshaped the treatment landscape. Regulatory Environment The regulatory landscape in North America is robust, with the U.S. Food and Drug Administration (FDA) playing a central role. Burosumab received FDA approval for the treatment of XLH, underscoring the regulatory support for novel therapies. The presence of orphan drug designations and incentives for rare disease drug development has stimulated research and development activities in the region.

Europe Prevalence and Diagnosis XLH prevalence in Europe varies by country including the United Kingdom, Italy and France , and regional healthcare disparities impact the timely diagnosis of the condition. European nations with robust healthcare systems, like Germany and the United Kingdom, typically boast superior diagnostic capabilities. Nevertheless, certain regions may face limitations in accessing genetic testing and specialized care, potentially resulting in delays in the diagnostic process. Treatment Landscape Similar to North America, conventional treatments are widely used in Europe, but the landscape is evolving with the introduction of innovative therapies. Burosumab has also received approval from the European Medicines Agency (EMA), expanding treatment options for XLH patients. The uptake of novel therapies depends on factors such as reimbursement policies and healthcare infrastructure in individual European countries. Regulatory Environment The EMA's regulatory framework provides a pathway for orphan drug designation and approval, facilitating the development and commercialization of therapies for rare diseases like XLH. Harmonization of regulatory processes across European countries streamlines market access for new treatments. Competitive Landscape

The Competitive Landscape of X-Linked Hypophosphatemia covers the number of key companies, company size, strengths, weaknesses, barriers, and threats. It also focuses on the power of the company’s competitive rivals, potential, new market entrants, customers, suppliers, and substitute products that drive the profitability of the companies in the X-linked hypophosphatemia industry. The global X-linked hypophosphatemia Market includes several market players at the country, regional, and global levels. Some of the X-Linked Hypophosphatemia companies are Ultragenyx Pharmaceutical Inc, Kyowa Kirin Co., Ltd, Novartis AG, Bayer AG, BioMarin Pharmaceutical Inc, Pharmacosmos A/S. Many companies have conducted research and development activities to fulfill consumer demand and increase their portfolio. The company focuses on strategic partnerships mergers and acquisitions to expand the global reach and maintain the brand name.X-linked hypophosphatemia Market Scope: Inquiry Before Buying

X-linked hypophosphatemia Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 1.3 Bn. Forecast Period 2023 to 2029 CAGR: 9.2% Market Size in 2029: US $ 2.41 Bn. Segments Covered: by Treatment Medication Surgical Orthopaedic Treatment by End User Hospitals and Clinics Research Centers X-Linked Hypophosphatemia Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)X-Linked Hypophosphatemia Key Players

1. Ultragenyx Pharmaceutical Inc (California, USA) 2. Kyowa Kirin Co., Ltd (Tokyo, Japan) 3. Novartis AG (Basel, Switzerland) 4. Bayer AG (Leverkusen, Germany) 5. BioMarin Pharmaceutical Inc.( California, USA) 6. Pharmacosmos A/S (Holbaek, Denmark) 7. Merck & Co., Inc. (New Jersey, USA) 8. Amgen Inc.( California, USA) 9. Ipsen Biopharmaceuticals, Inc.( Paris, France) 10. F. Hoffmann-La Roche Ltd (Basel, Switzerland) 11. Radius Health, Inc.( Massachusetts, USA) 12. Mitsubishi Tanabe Pharma Corporation (Osaka, Japan) 13. Chugai Pharmaceutical Co., Ltd.( Tokyo, Japan) 14. Takeda Pharmaceutical 15. Ascendis Pharma A/S 16. Radius Health, Inc. ( Massachusetts, USA)FAQ

1] What segments are covered in the Global X-Linked Hypophosphatemia report? Ans. The segments covered in the X-Linked Hypophosphatemia report are based on Treatment,End User, and Region. 2] Which region is expected to hold the highest share in the Global X-Linked Hypophosphatemia Market? Ans. The North American region is expected to hold the highest share of the X X-linked hypophosphatemia Market. 3] What is the market size of the Global X-Linked Hypophosphatemia by 2029? Ans. The market size of the X-Linked Hypophosphatemia by 2029 is expected to reach US$ 2.41 Bn. 4] What is the forecast period for the Global X-Linked Hypophosphatemia Market? Ans. The forecast period for the X X-linked hypophosphatemia Market is 2023-2029. 5] What was the market size of the Global X-Linked Hypophosphatemia in 2022? Ans. The market size of the X-Linked Hypophosphatemia in 2022 was valued at US$ 1.3 Bn.

1. X-linked hypophosphatemia Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. X-linked hypophosphatemia Market: Dynamics 2.1. X-linked hypophosphatemia Market Trends by Region 2.1.1. North America X-linked hypophosphatemia Market Trends 2.1.2. Europe X-linked hypophosphatemia Market Trends 2.1.3. Asia Pacific X-linked hypophosphatemia Market Trends 2.1.4. Middle East and Africa X-linked hypophosphatemia Market Trends 2.1.5. South America X-linked hypophosphatemia Market Trends 2.2. X-linked hypophosphatemia Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America X-linked Hypophosphatemia Market Drivers 2.2.1.2. North America X-linked hypophosphatemia Market Restraints 2.2.1.3. North America X-linked hypophosphatemia Market Opportunities 2.2.1.4. North America X-linked hypophosphatemia Market Challenges 2.2.2. Europe 2.2.2.1. Europe X-linked hypophosphatemia Market Drivers 2.2.2.2. Europe X-linked hypophosphatemia Market Restraints 2.2.2.3. Europe X-linked hypophosphatemia Market Opportunities 2.2.2.4. Europe X-linked hypophosphatemia Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific X-linked hypophosphatemia Market Drivers 2.2.3.2. Asia Pacific X-linked hypophosphatemia Market Restraints 2.2.3.3. Asia Pacific X-linked hypophosphatemia Market Opportunities 2.2.3.4. Asia Pacific X-linked hypophosphatemia Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa X-linked hypophosphatemia Market Drivers 2.2.4.2. Middle East and Africa X-linked hypophosphatemia Market Restraints 2.2.4.3. Middle East and Africa X-linked hypophosphatemia Market Opportunities 2.2.4.4. Middle East and Africa X-linked hypophosphatemia Market Challenges 2.2.5. South America 2.2.5.1. South America X-linked hypophosphatemia Market Drivers 2.2.5.2. South America X-linked hypophosphatemia Market Restraints 2.2.5.3. South America X-linked hypophosphatemia Market Opportunities 2.2.5.4. South America X-linked hypophosphatemia Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. X-linked hypophosphatemia Clinical Trial Analysis for X-linked hypophosphatemia 2.8. Key Opinion Leader Analysis For X-linked Hypophosphatemia Industry 2.9. Analysis of Government Schemes and Initiatives For X-linked hypophosphatemia Industry 2.10. The Global Pandemic Impact on X-linked hypophosphatemia Market 2.11. X-linked hypophosphatemia Price Trend Analysis (2021-22) 3. X-linked hypophosphatemia Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 3.1. X-linked hypophosphatemia Market Size and Forecast, by Treatment (2022-2029) 3.1.1. Medication 3.1.2. Surgical 3.1.3. Orthopaedic Treatment 3.2. X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 3.2.1. Hospitals and Clinics 3.2.2. Research Centers 3.3. X-linked hypophosphatemia Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America X-linked hypophosphatemia Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 4.1. North America X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 4.1.1. Haematological disorders 4.1.2. Surgical 4.1.3. Orthopaedic Treatment 4.2. North America X-linked Hypophosphatemia Market Size and Forecast, by End User (2022-2029) 4.2.1. Hospitals and Clinics 4.2.2. Research Centers 4.3. North America X-linked hypophosphatemia Market Size and Forecast, by Country (2022-2029) 4.3.1. United States 4.3.1.1. United States X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 4.3.1.1.1. Haematological disorders 4.3.1.1.2. Surgical 4.3.1.1.3. Orthopaedic Treatment 4.3.1.2. United States X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 4.3.1.2.1. Hospitals and Clinics 4.3.1.2.2. Research Centers 4.3.2. Canada 4.3.2.1. Canada X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 4.3.2.1.1. Haematological disorders 4.3.2.1.2. Surgical 4.3.2.1.3. Orthopaedic Treatment 4.3.2.2. Canada X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 4.3.2.2.1. Hospitals and Clinics 4.3.2.2.2. Research Centers 4.3.3. Mexico 4.3.3.1. Mexico X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 4.3.3.1.1. Haematological disorders 4.3.3.1.2. Surgical 4.3.3.1.3. Orthopaedic Treatment 4.3.3.2. Mexico X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 4.3.3.2.1. Hospitals and Clinics 4.3.3.2.2. Research Centers 5. Europe X-linked hypophosphatemia Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 5.1. Europe X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 5.2. Europe X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 5.3. Europe X-linked hypophosphatemia Market Size and Forecast, by Country (2022-2029) 5.3.1. United Kingdom 5.3.1.1. United Kingdom X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 5.3.1.2. United Kingdom X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 5.3.2. France 5.3.2.1. France X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 5.3.2.2. France X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 5.3.3. Germany 5.3.3.1. Germany X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 5.3.3.2. Germany X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 5.3.4. Italy 5.3.4.1. Italy X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 5.3.4.2. Italy X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 5.3.5. Spain 5.3.5.1. Spain X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 5.3.5.2. Spain X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 5.3.6. Sweden 5.3.6.1. Sweden X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 5.3.6.2. Sweden X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 5.3.7. Austria 5.3.7.1. Austria X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 5.3.7.2. Austria X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 5.3.8.2. Rest of Europe X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 6. Asia Pacific X-linked hypophosphatemia Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 6.1. Asia Pacific X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 6.2. Asia Pacific X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 6.3. Asia Pacific X-linked hypophosphatemia Market Size and Forecast, by Country (2022-2029) 6.3.1. China 6.3.1.1. China X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 6.3.1.2. China X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 6.3.2. S Korea 6.3.2.1. S Korea X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 6.3.2.2. S Korea X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 6.3.3. Japan 6.3.3.1. Japan X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 6.3.3.2. Japan X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 6.3.4. India 6.3.4.1. India X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 6.3.4.2. India X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 6.3.5. Australia 6.3.5.1. Australia X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 6.3.5.2. Australia X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 6.3.6. Indonesia 6.3.6.1. Indonesia X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 6.3.6.2. Indonesia X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 6.3.7. Malaysia 6.3.7.1. Malaysia X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 6.3.7.2. Malaysia X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 6.3.8. Vietnam 6.3.8.1. Vietnam X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 6.3.8.2. Vietnam X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 6.3.9. Taiwan 6.3.9.1. Taiwan X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 6.3.9.2. Taiwan X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 6.3.10.2. Rest of Asia Pacific X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 7. Middle East and Africa X-linked hypophosphatemia Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 7.1. Middle East and Africa X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 7.2. Middle East and Africa X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 7.3. Middle East and Africa X-linked hypophosphatemia Market Size and Forecast, by Country (2022-2029) 7.3.1. South Africa 7.3.1.1. South Africa X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 7.3.1.2. South Africa X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 7.3.2. GCC 7.3.2.1. GCC X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 7.3.2.2. GCC X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 7.3.3. Nigeria 7.3.3.1. Nigeria X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 7.3.3.2. Nigeria X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 7.3.4.2. Rest of ME&A X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 8. South America X-linked hypophosphatemia Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 8.1. South America X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 8.2. South America X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 8.3. South America X-linked hypophosphatemia Market Size and Forecast, by Country (2022-2029) 8.3.1. Brazil 8.3.1.1. Brazil X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 8.3.1.2. Brazil X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 8.3.2. Argentina 8.3.2.1. Argentina X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 8.3.2.2. Argentina X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America X-linked hypophosphatemia Market Size and Forecast, by Treatment(2022-2029) 8.3.3.2. Rest Of South America X-linked hypophosphatemia Market Size and Forecast, by End User (2022-2029) 9. Global X-linked hypophosphatemia Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading X-linked hypophosphatemia Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Ultragenyx Pharmaceutical Inc (California, USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Kyowa Kirin Co., Ltd (Tokyo, Japan) 10.3. Novartis AG (Basel, Switzerland) 10.4. Bayer AG (Leverkusen, Germany) 10.5. BioMarin Pharmaceutical Inc.( California, USA) 10.6. Pharmacosmos A/S (Holbaek, Denmark) 10.7. Merck & Co., Inc. (New Jersey, USA) 10.8. Amgen Inc.( California, USA) 10.9. Ipsen Biopharmaceuticals, Inc.( Paris, France) 10.10. F. Hoffmann-La Roche Ltd (Basel, Switzerland) 10.11. Radius Health, Inc.( Massachusetts, USA) 10.12. Mitsubishi Tanabe Pharma Corporation (Osaka, Japan) 10.13. Chugai Pharmaceutical Co., Ltd.( Tokyo, Japan) 10.14. Takeda Pharmaceutical 10.15. Ascendis Pharma A/S 10.16. Radius Health, Inc. ( Massachusetts, USA) 11. Key Findings 12. Industry Recommendations 13. X-linked hypophosphatemia Market: Research Methodology