Vascular Access Device Market size was US$ 5.78 Bn in 2023 and is expected to reach US$ 9.40 Bn by 2030 at a CAGR of 7.2% during the forecast period.Vascular Access Device Market Overview

A vascular access is where the dialysis machine connects to the bloodstream. During dialysis treatments, the dialysis machine cleans blood and then moves it back into the body. Vascular access devices, such as PICCs and ports, enable repeated and prolonged access to the bloodstream. This facilitates the frequent or regular administration of drugs, including intravenous (IV) antibiotics. As per the study, the Vascular Access Device Market is expected to grow at a rapid rate during the forecast period. This is major because vascular access devices play a crucial role in providing healthcare professionals with the means to access the bloodstream for various medical purposes.To know about the Research Methodology:-Request Free Sample Report Vascular Access Device Market Competitive Landscape This section of the Vascular Access Device Market report provides a detailed analysis of the competitors and information provided by the competitors. A secondary research method was used to provide detailed information on Vascular Access Device key competitors while the primary research method included interviews of the market players. The investments by key players in research and development, revenue, sales, production capacities and company overview are all included in the report. SWOT analysis was used to provide the strengths and weaknesses of the Vascular Access Device Market key players. In November 2023, BD (Becton, Dickinson, and Company), one of the leading global medical technology companies, launched a new, advanced ultrasound system designed to help improve clinician efficiency when placing peripherally inserted central catheters (PICCs), central venous catheters, IV lines, and other vascular access devices. In November 2023, Access Vascular Inc. (AVI) successfully concluded a Series C funding round, securing $22 million in investment. The primary objective for utilizing these funds is to expand production capacity, specifically focusing on the Mimix hydrophilic biomaterial vascular access devices. Access Vascular's catheters are strategically engineered to avoid recognition as foreign bodies, minimize bacterial adhesion, and eliminate the development of catheter-related thrombus.

Vascular Access Device Market Dynamics

Growing Demand for Ambulatory Care Driving the Vascular Access Device Market Utilizing vascular access devices for ambulatory care offers a notable enhancement in the quality of life for patients, especially those managing chronic illnesses or undergoing cancer treatment. This is one of the key drivers of the Vascular Access Device Market. Patients requiring regular and continuous medication and fluid delivery receive these therapies in the comfort of their homes, eliminating the necessity of frequent hospital or clinic visits. This not only heightens patient satisfaction but also promotes treatment adherence, thereby lowering the risk of hospital-acquired infections. Additionally, the cost-effectiveness of employing vascular access devices in ambulatory care is a significant advantage. By facilitating home-based care, these devices reduce the frequency of hospital visits and the associated financial burdens. This approach not only streamlines care efficiency but also ensures timely administration of treatments, contributing to overall cost savings. Device-Related Thrombosis Restraining the Vascular Access Device Market Growth Device-related thrombosis is the potential complication, which involves the formation of blood clots around or within the device. Thrombosis impedes blood flow. This causes device malfunction and increases the risk of embolism. To manage and prevent thrombotic events are the ongoing challenges in the use of vascular access devices, resulting in a major restraint for the vascular access device market. For example - The primary functional complication encountered during the off-treatment period with Totally Implantable Venous Access Devices (TIVADs) is occlusion. This occlusion results from various factors, such as the precipitation of medications or parenteral nutrition, mechanical obstructions, or thrombotic occurrences. Thrombotic occlusion, specifically, stems from the formation of a fibrin sheath around the catheter tip or the development of intraluminal thrombosis caused by the accumulation of blood clots within the catheter. These thrombotic events manifest independently or in combination. Focus on Pediatric Applications Creating Opportunities for the Vascular Access Device Market Growth Children often necessitate vascular access for various purposes such as hydration, the infusion of parenteral nutrition, medication administration, and the collection of blood samples for laboratory analysis. However, it is crucial to acknowledge that performing phlebotomy in children is an invasive and anxiety-inducing procedure, typically eliciting fear, anxiety, and a sense of insecurity. Therefore, specialized vascular access devices are being designed for pediatric patients, which represents an opportunity for vascular access device market growth. The customized devices for the unique needs of children are improving their treatment experience and overall well-being. Prospective research is anticipated to concentrate on the composition of materials employed in Central Venous Access Devices (CVADs), as well as strategies for preventing infection and occlusion. The utility of Ultrasonography (US) is gaining prominence as a valuable adjunct in the placement of central lines. Incorporating ultrasound techniques into the training programs for pediatric and emergency medicine is expected to be advantageous, particularly in the context of central line placements. There is a growing emphasis on preserving central access in children with chronic illnesses, a population often requiring prolonged or recurrent venous access and susceptible to complications related to venous catheters. These complications are frequently linked to deliberate decisions made during catheter insertion and subsequent care.Vascular Access Device Market Segment Analysis

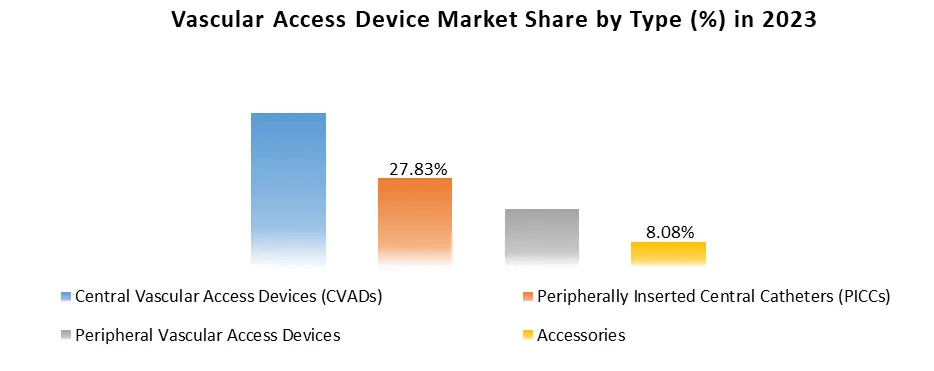

Based on Type: The market is segmented into Central vascular access devices (CVADs), Tunneled catheters, Non-tunneled catheters, Implanted ports, Peripherally inserted central catheters (PICCs), Peripheral vascular access devices, Peripheral midlines devices, Peripheral short devices, Butterfly/winged steel needles and Accessories. The Central vascular access devices (CVADs) segment held the largest vascular access device market share in 2023. This is attributed to the benefits associated with the use of central vascular access devices, which is increasing their demand across the world. These benefits include secure access to large veins and reduced risk of infection.

Vascular Access Device Market Regional Insights

The North American Vascular Access Device Market dominated the global market in 2023. The rising incidence of chronic diseases, such as cancer, diabetes, and cardiovascular disorders, in the region is significantly contributing to the demand for vascular access devices. Patients with chronic conditions require long-term access to the vascular system for treatment. The US is the major market for the Vascular Access Devices in the region. Hemodialysis continues to be the predominant treatment modality for kidney failure in the United States, selected by nearly 90% of newly diagnosed patients. The establishment of functional vascular access is crucial for ensuring effective hemodialysis therapy. In recent times, significant advancements in devices and technology dedicated to the care of hemodialysis vascular access have swiftly transformed the landscape. Asia Pacific Vascular Access Device Market is expected to grow rapidly at a CAGR of 7.5% during the forecast period. China is the key market for Vascular Access Devices in the region. Hospitals routinely serve millions of patients undergoing procedures involving peripheral intravenous catheters. The venous system can be accessed through both short-term and long-term venous access devices (VADs). Crucial elements in this domain include peripherally placed central catheters, implantable ports, and tunnel catheters. Notably, shifts in biocompatibility, flexibility, and the adoption of innovative materials are exerting a significant impact on the dynamics of demand in the market. Recent remarkable advancements in catheter distal tips have empowered healthcare professionals to plan and execute intricate surgeries with greater precision. Consequently, the utilization of VADs has seen a notable rise, contributing to an enhanced quality of life for patients and improved overall patient survival.Vascular Access Device Market Scope: Inquire before buying

Vascular Access Device Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.78 Bn. Forecast Period 2024 to 2030 CAGR: 7.2% Market Size in 2030: US $ 9.40 Bn. Segments Covered: by Type Central vascular access devices (CVADs) Tunneled catheters Non-tunneled catheters Implanted ports Peripherally inserted central catheters (PICCs) Peripheral vascular access device Peripheral midlines devices Peripheral short devices Butterfly/winged steel needles Accessories by Application Medication Administration Administration of Fluids and Nutrients Blood Transfusion Diagnostics and Testing Hemodynamic Monitoring Chemotherapy by End User Hospital Ambulatory Surgical Centers (ASCs) Clinics Home Healthcare Settings Diagnostic Centers Vascular Access Device Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Vascular Access Device Key Players

Global 1. Becton, Dickinson, and Company (BD) (U.S.) 2. B. Braun SE (Germany) 3. Medtronic plc (U.S) 4. Edwards Lifesciences Corporation (U.S.) 5. Siemens Healthineers (Germany) 6. W. L. Gore & Associates, Inc. (U.S.) North America 1. Baxter International (U.S.) 2. Cook Medical (U.S.) 3. Teleflex Incorporated (U.S.) 4. AngioDynamics (U.S.) Europe 1. Fresenius Medical Care (Germany) 2. Smiths Medical, Inc. (U.K.) 3. Vygon Ltd. (U.K.) 4. PRODIMED (France) Asia Pacific 1. NIPRO Medical Corporation (Japan) 2. Terumo Corporation (Japan) 3. Romsons Scientific & Surgical Pvt. Ltd. (India) Middle East and Africa 1. Ameco Medical (Egypt) Frequently Asked Questions: 1. Which region held the largest Vascular Access devices market share in 2023? Ans: North American region held the largest Vascular Access Devises Market share in 2023. 2. What is the expected growth rate of the Global Vascular Access Devises Market during the forecast period? Ans: The Vascular Access Devises Market is expected to grow at a CAGR of 7.2% during forecasting period 2024-2030. 3. What is scope of the Global Vascular Access Devises market report? Ans: The Global Vascular Access Devises Market report includes PESTLE, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Vascular Access devices industry? Ans: The important key players in the Vascular Access Devises Industry are – B.Braun Melsungen AG, Baxter International, Becton, Dickinson, and Company, Cook Medical, Edwards Lifesciences Corporation, Fresenius Medical Care, Medtronic plc, NIPRO Medical Corporation, Siemens Healthineers, Smiths Medical, Inc., Teleflex Incorporated, Terumo Corporation, Vygon Ltd, Ameco Medical, AngioDynamics, Romsons Scientific & Surgical Pvt. Ltd., PRODIMED, W. L. Gore & Associates, Inc., and Cook Medical 5. What is the forecast period of the Vascular Access Devises Market research? Ans: The forecast period of the Vascular Access Devises Market research is from 2024 to 2030.

1. Vascular Access Device Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Vascular Access Device Market: Dynamics 2.1. Vascular Access Device Market Trends by Region 2.1.1. North America Vascular Access Device Market Trends 2.1.2. Europe Vascular Access Device Market Trends 2.1.3. Asia Pacific Vascular Access Device Market Trends 2.1.4. Middle East and Africa Vascular Access Device Market Trends 2.1.5. South America Vascular Access Device Market Trends 2.2. Vascular Access Device Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Vascular Access Device Market Drivers 2.2.1.2. North America Vascular Access Device Market Restraints 2.2.1.3. North America Vascular Access Device Market Opportunities 2.2.1.4. North America Vascular Access Device Market Challenges 2.2.2. Europe 2.2.2.1. Europe Vascular Access Device Market Drivers 2.2.2.2. Europe Vascular Access Device Market Restraints 2.2.2.3. Europe Vascular Access Device Market Opportunities 2.2.2.4. Europe Vascular Access Device Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Vascular Access Device Market Drivers 2.2.3.2. Asia Pacific Vascular Access Device Market Restraints 2.2.3.3. Asia Pacific Vascular Access Device Market Opportunities 2.2.3.4. Asia Pacific Vascular Access Device Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Vascular Access Device Market Drivers 2.2.4.2. Middle East and Africa Vascular Access Device Market Restraints 2.2.4.3. Middle East and Africa Vascular Access Device Market Opportunities 2.2.4.4. Middle East and Africa Vascular Access Device Market Challenges 2.2.5. South America 2.2.5.1. South America Vascular Access Device Market Drivers 2.2.5.2. South America Vascular Access Device Market Restraints 2.2.5.3. South America Vascular Access Device Market Opportunities 2.2.5.4. South America Vascular Access Device Market Challenges 2.3. PORTER’s Five Products Analysis 2.4. PESTLE Analysis 2.5. Regulatory Landscape by Region 2.5.1. North America 2.5.2. Europe 2.5.3. Asia Pacific 2.5.4. Middle East and Africa 2.5.5. South America 2.6. Key Opinion Leader Analysis For the Vascular Access Device Industry 2.7. Analysis of Government Schemes and Initiatives For the Vascular Access Device Industry 2.8. The Global Pandemic Impact on the Vascular Access Device Market 3. Vascular Access Device Market: Global Market Size and Forecast (by Value and Volume) (2023-2030) 3.1. Vascular Access Device Market Size and Forecast, by Type (2023-2030) 3.1.1. Central vascular access device 3.1.1.1. Tunneled catheters 3.1.1.2. Non-tunneled catheters 3.1.1.3. Implanted ports 3.1.2. Peripherally inserted central catheters 3.1.3. Peripheral vascular access device 3.1.3.1. Peripheral midlines devices 3.1.3.2. Peripheral short devices 3.1.3.3. Butterfly/winged steel needles 3.1.4. Accessories 3.2. Vascular Access Device Market Size and Forecast, by Application (2023-2030) 3.2.1. Medication Administration 3.2.2. Administration of Fluids and Nutrients 3.2.3. Blood Transfusion 3.2.4. Diagnostics and Testing 3.2.5. Hemodynamic Monitoring 3.2.6. Chemotherapy 3.3. Vascular Access Device Market Size and Forecast, by End User (2023-2030) 3.3.1. Hospital 3.3.2. Ambulatory Surgical Centers (ASCs) 3.3.3. Clinics 3.3.4. Home Healthcare Settings 3.3.5. Diagnostic Centers 3.4. Vascular Access Device Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Vascular Access Device Market Size and Forecast (by Value and Volume) (2023-2030) 4.1. North America Vascular Access Device Market Size and Forecast, by Type (2023-2030) 4.1.1. Central vascular access device 4.1.1.1. Tunneled catheters 4.1.1.2. Non-tunneled catheters 4.1.1.3. Implanted ports 4.1.2. Peripherally inserted central catheters 4.1.3. Peripheral vascular access device 4.1.3.1. Peripheral midlines devices 4.1.3.2. Peripheral short devices 4.1.3.3. Butterfly/winged steel needles 4.1.4. Accessories 4.2. North America Vascular Access Device Market Size and Forecast, by Application (2023-2030) 4.2.1. Medication Administration 4.2.2. Administration of Fluids and Nutrients 4.2.3. Blood Transfusion 4.2.4. Diagnostics and Testing 4.2.5. Hemodynamic Monitoring 4.2.6. Chemotherapy 4.3. North America Vascular Access Device Market Size and Forecast, by End User (2023-2030) 4.3.1. Hospital 4.3.2. Ambulatory Surgical Centers (ASCs) 4.3.3. Clinics 4.3.4. Home Healthcare Settings 4.3.5. Diagnostic Centers 4.4. North America Vascular Access Device Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Vascular Access Device Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Central vascular access device 4.4.1.1.1.1. Tunneled catheters 4.4.1.1.1.2. Non-tunneled catheters 4.4.1.1.1.3. Implanted ports 4.4.1.1.2. Peripherally inserted central catheters 4.4.1.1.3. Peripheral vascular access device 4.4.1.1.3.1. Peripheral midlines devices 4.4.1.1.3.2. Peripheral short devices 4.4.1.1.3.3. Butterfly/winged steel needles 4.4.1.1.4. Accessories 4.4.1.2. United States Vascular Access Device Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Medication Administration 4.4.1.2.2. Administration of Fluids and Nutrients 4.4.1.2.3. Blood Transfusion 4.4.1.2.4. Diagnostics and Testing 4.4.1.2.5. Hemodynamic Monitoring 4.4.1.2.6. Chemotherapy 4.4.1.3. United States Vascular Access Device Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Hospital 4.4.1.3.2. Ambulatory Surgical Centers (ASCs) 4.4.1.3.3. Clinics 4.4.1.3.4. Home Healthcare Settings 4.4.1.3.5. Diagnostic Centers 4.4.2. Canada 4.4.2.1. Canada Vascular Access Device Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Central vascular access device 4.4.2.1.1.1. Tunneled catheters 4.4.2.1.1.2. Non-tunneled catheters 4.4.2.1.1.3. Implanted ports 4.4.2.1.2. Peripherally inserted central catheters 4.4.2.1.3. Peripheral vascular access device 4.4.2.1.3.1. Peripheral midlines devices 4.4.2.1.3.2. Peripheral short devices 4.4.2.1.3.3. Butterfly/winged steel needles 4.4.2.1.4. Accessories 4.4.2.2. Canada Vascular Access Device Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Medication Administration 4.4.2.2.2. Administration of Fluids and Nutrients 4.4.2.2.3. Blood Transfusion 4.4.2.2.4. Diagnostics and Testing 4.4.2.2.5. Hemodynamic Monitoring 4.4.2.2.6. Chemotherapy 4.4.2.3. Canada Vascular Access Device Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Hospital 4.4.2.3.2. Ambulatory Surgical Centers (ASCs) 4.4.2.3.3. Clinics 4.4.2.3.4. Home Healthcare Settings 4.4.2.3.5. Diagnostic Centers 4.4.3. Mexico 4.4.3.1. Mexico Vascular Access Device Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Central vascular access device 4.4.3.1.1.1. Tunneled catheters 4.4.3.1.1.2. Non-tunneled catheters 4.4.3.1.1.3. Implanted ports 4.4.3.1.2. Peripherally inserted central catheters 4.4.3.1.3. Peripheral vascular access device 4.4.3.1.3.1. Peripheral midlines devices 4.4.3.1.3.2. Peripheral short devices 4.4.3.1.3.3. Butterfly/winged steel needles 4.4.3.1.4. Accessories 4.4.3.2. Mexico Vascular Access Device Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Medication Administration 4.4.3.2.2. Administration of Fluids and Nutrients 4.4.3.2.3. Blood Transfusion 4.4.3.2.4. Diagnostics and Testing 4.4.3.2.5. Hemodynamic Monitoring 4.4.3.2.6. Chemotherapy 4.4.3.3. Mexico Vascular Access Device Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Hospital 4.4.3.3.2. Ambulatory Surgical Centers (ASCs) 4.4.3.3.3. Clinics 4.4.3.3.4. Home Healthcare Settings 4.4.3.3.5. Diagnostic Centers 5. Europe Vascular Access Device Market Size and Forecast (by Value and Volume) (2023-2030) 5.1. Europe Vascular Access Device Market Size and Forecast, by Type (2023-2030) 5.2. Europe Vascular Access Device Market Size and Forecast, by Application (2023-2030) 5.3. Europe Vascular Access Device Market Size and Forecast, by End User (2023-2030) 5.4. Europe Vascular Access Device Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Vascular Access Device Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Vascular Access Device Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Vascular Access Device Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Vascular Access Device Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Vascular Access Device Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Vascular Access Device Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Vascular Access Device Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Vascular Access Device Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Vascular Access Device Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Vascular Access Device Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Vascular Access Device Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Vascular Access Device Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Vascular Access Device Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Vascular Access Device Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Vascular Access Device Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Vascular Access Device Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Vascular Access Device Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Vascular Access Device Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Vascular Access Device Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Vascular Access Device Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Vascular Access Device Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Vascular Access Device Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Vascular Access Device Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Vascular Access Device Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Vascular Access Device Market Size and Forecast (by Value and Volume) (2023-2030) 6.1. Asia Pacific Vascular Access Device Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Vascular Access Device Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Vascular Access Device Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Vascular Access Device Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Vascular Access Device Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Vascular Access Device Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Vascular Access Device Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Vascular Access Device Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Vascular Access Device Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Vascular Access Device Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Vascular Access Device Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Vascular Access Device Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Vascular Access Device Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Vascular Access Device Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Vascular Access Device Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Vascular Access Device Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Vascular Access Device Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Vascular Access Device Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Vascular Access Device Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Vascular Access Device Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Vascular Access Device Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Vascular Access Device Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Vascular Access Device Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Vascular Access Device Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Vascular Access Device Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Vascular Access Device Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Vascular Access Device Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Vascular Access Device Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Vascular Access Device Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Vascular Access Device Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Vascular Access Device Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Vascular Access Device Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Vascular Access Device Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Vascular Access Device Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Vascular Access Device Market Size and Forecast (by Value and Volume) (2023-2030) 7.1. Middle East and Africa Vascular Access Device Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Vascular Access Device Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Vascular Access Device Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Vascular Access Device Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Vascular Access Device Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Vascular Access Device Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Vascular Access Device Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Vascular Access Device Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Vascular Access Device Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Vascular Access Device Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Vascular Access Device Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Vascular Access Device Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Vascular Access Device Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Vascular Access Device Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Vascular Access Device Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Vascular Access Device Market Size and Forecast, by End User (2023-2030) 8. South America Vascular Access Device Market Size and Forecast (by Value and Volume) (2023-2030) 8.1. South America Vascular Access Device Market Size and Forecast, by Type (2023-2030) 8.2. South America Vascular Access Device Market Size and Forecast, by Application (2023-2030) 8.3. South America Vascular Access Device Market Size and Forecast, by End User (2023-2030) 8.4. South America Vascular Access Device Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Vascular Access Device Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Vascular Access Device Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Vascular Access Device Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Vascular Access Device Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Vascular Access Device Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Vascular Access Device Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Vascular Access Device Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Vascular Access Device Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Vascular Access Device Market Size and Forecast, by End User (2023-2030) 9. Global Vascular Access Device Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Vascular Access Device Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. B.Braun Melsungen AG 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Recent Developments 10.2. Baxter International 10.3. Becton, Dickinson, and Company 10.4. Braun Melsungen AG 10.5. C. R. Bard, Inc. 10.6. Cook Medical 10.7. Edwards Lifesciences Corporation 10.8. Fresenius Medical Care 10.9. Medtronic plc 10.10. NIPRO Medical Corporation 10.11. Siemens Healthineers 10.12. Smiths Medical, Inc. 10.13. Teleflex Incorporated 10.14. Terumo Corporation 10.15. Vygon Ltd. 10.16. Ameco Medical 10.17. AngioDynamics 10.18. Romsons Scientific & Surgical Pvt. Ltd. 10.19. PRODIMED 10.20. W. L. Gore & Associates, Inc. 10.21. Cook Medical 11. Key Findings 12. Industry Recommendations 13. Vascular Access Device Market: Research Methodology 14. Terms and Glossary