Global Wireless Connectivity Market size was valued at USD 95.29 Bn. in 2023 and the total Wireless Connectivity revenue is expected to grow by 13.10% from 2024 to 2030, reaching nearly USD 225.57 Bn.Wireless Connectivity Market Overview:

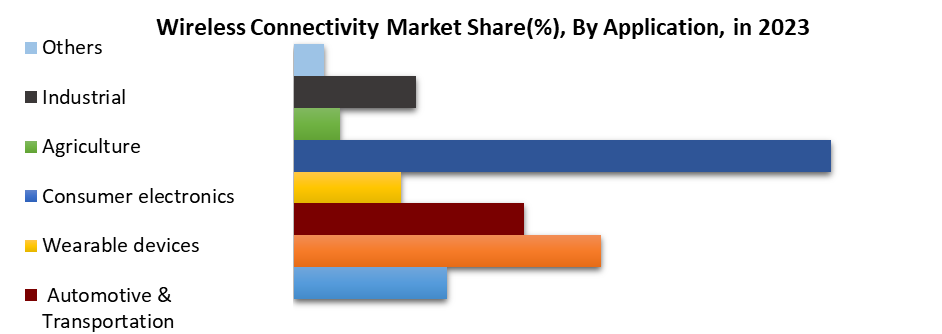

Wireless connectivity is a term for the technology that lets devices link and talk to each other without needing physical cables or wires. Instead, it uses electromagnetic waves to send data between these devices. This kind of tech is very important in today's communication systems as it makes possible smooth transfer of data and internet connection on many different types of tools and platforms. The Wireless Connectivity Market is growing rapidly due to many main factors. Advancements in technology, especially the creation of 5G networks, greatly improve data speed and lessen latency while enhancing overall connection. This technological jump is matching the rising need for quicker and more dependable wireless communication. Furthermore, the increasing use of Internet of Things (IoT) devices in different sectors like smart homes, healthcare, and industrial automation is driving the market growth. These fields need smooth wireless connection solutions to integrate and make devices work well together. Market segmentation based on application divides the Wireless Connectivity Market into various categories like Healthcare, IT and Telecommunication, Automotive & Transportation, Wearable Devices, Consumer Electronics, Agriculture, and Industrial. In the year 2023, the consumer electronics segment had the highest market share because of the large usage of wireless-enabled devices by people. The main industries that participate in the Wireless Connectivity Market are the consumer electronics industry; automotive sector; healthcare field; industrial automation division and IT & telecommunications area. Every one of these sectors depends on wireless connectivity for different applications. It could be in-car entertainment systems, smart medical devices like wearables and monitors, industrial IoT solutions, or quick internet service accessed by both businesses and people. The Wireless Connectivity Market in the Asia-Pacific area, where China, Japan, and South Korea are among the main participants, has turned into a powerful force. China takes the lead because it is a big center for making electronics. The picture of competition in the Wireless Connectivity Market is shown by strong activity and creation. As of April 2024, a new assortment of products has been unveiled by Qualcomm that includes the QCC730 ultra-low-power Wi-Fi SoC. This system possesses the ability to reduce power usage by 88%, making it suitable for competing with Bluetooth in sectors involving battery-operated IoT devices. During January 2024, Ceva Inc. continued its partnership with Sunplus Technology Co. Ltd., integrating RivieraWaves Bluetooth audio solution into Sunplus's Airlyra family of HD audio processors. These processors are designed for high-end wireless audio devices, including wireless speakers and soundbars.To know about the Research Methodology:-Request Free Sample Report

Global Wireless Connectivity Market Dynamics:

Drivers of the Wireless Connectivity Market Technological advancements & Growing Demand for IoT Devices: The large-scale use of Internet of Things (IoT) things, like smart homes to healthcare, automotive, and industrial automation is greatly helping to grow the Wireless Connectivity Market. These industries need wireless connectivity solutions for easy device integration and functioning which leads to significant market expansion. Technology improvements, especially the arrival of 5G networks, are making data quicker, lessening latency, and bettering total connection. These advancements are important factors for the Wireless Connectivity Industry as they satisfy the growing need of people who want faster and dependable wireless communication. Increased Use of Mobile Devices and Rising Adoption of Wireless Communication in Automotive: The increase in the use of smartphones, tablets, and other mobile devices is creating a higher requirement for wireless connection. People who use these gadgets along with businesses all want constant access to the internet as well as transferring data at fast speeds. This has led to an increase in the Wireless Connectivity Market. The growing use of wireless technologies in vehicles, like for in-car entertainment, navigation, and V2X communication is an important force behind the Wireless Connectivity industry. This development speeds up how much wireless solutions are being taken up by the automotive field. Restraints of the Wireless Connectivity Market Security Concerns and High Initial Costs: As wireless connections are growing more, the worries related to data safety and personal privacy are increasing. Cybersecurity dangers could stop the use of wireless technologies, making it tricky for Wireless Connectivity Manufacturers and suppliers to find success. Establishing advanced wireless networks, like 5G, needs big first-time expenditures in structure. These costly steps might stop certain groups or areas from growing, limiting the opportunity of the Wireless Connectivity Market. Interoperability Issues and Regulatory Challenges: The existence of many wireless standards and technologies can cause problems with compatibility. These issues, known as interoperability difficulties, might slow down the smooth connection between devices which would limit the market growth for wireless connectivity solutions. Different rules and standards for wireless connectivity in various countries might create difficulty in global deployment and usage. These regulatory difficulties are a considerable obstacle for the Wireless Connectivity Export and Import activities. Opportunities for Wireless Connectivity Market Development of 5G Technology and Emergence of New Applications: The Wireless Connectivity Market has continuous chances for growth due to the ongoing deployment and advancements of 5G networks. The development of 5G technology brings about new applications in areas like autonomous vehicles, telemedicine, and industrial automation which help to push market growth. Inventions such as augmented reality (AR), virtual reality (VR), and the metaverse are making fresh prospects in the Wireless Connectivity Industry. These users need quick speed, low delay connections that keep increasing demand for advanced wireless solutions. Increased Focus on Rural Connectivity and Development of Smart Manufacturing: Wireless Connectivity Suppliers and vendors of technology can find a lot of chances for growth in the attempts to lessen the digital divide by spreading wireless connections to the countryside and underserved places. Wireless connectivity manufacturing for applications such as remote monitoring, predictive maintenance, and automation has great potential for market expansion. Smart manufacturing needs strong wireless solutions to improve operational efficiency and productivity. Global Wireless Connectivity Market Segment Analysis Based on application, the segmentation of the wireless connectivity market is divided into Healthcare, IT and telecommunication, Automotive & Transportation, Wearable devices, Consumer electronics, Agriculture, and Industrial. In 2023 the market was dominated by the consumer electronics segment. During the forecast period (2024-2030), the IT & telecom segment was predicted to grow with the highest CAGR due to the increasing use of data-intensive applications like video streaming or remote collaboration tools; this has led to an increased requirement for high-speed as well as dependable wireless connectivity solutions in these sectors. Moreover, the continuous advancement of 5G networks along with more use of IoT devices and smart city projects, are also driving expansion in the IT & Telecom part. This is because businesses and telecommunication providers put money into growing or improving their wireless structure to keep up with changing connection needs.

Wireless Connectivity Market Regional Insights:

The Wireless Connectivity Market in the Asia-Pacific region, with major participation from China, Japan, and South Korea among others, has become a dominant force. China's leading role is largely due to its status as a major hub for electronics manufacturing. The country's strong supply chain abilities and widespread production capacities along with initiatives by the government to encourage technological advancement make it stand out. This is a crucial advantage for China Wireless Connectivity Manufacturers. When the production is more, it lowers the cost of each unit and makes goods more competitive. The market also benefits from having big Wireless Connectivity Suppliers located nearby. These are key companies that have a considerable share of the market and offer products like integrated circuits (ICs), and printed circuit boards (PCBs) among others; many such substantial players are located across China's wireless connectivity manufacturing sector helps to maintain competitiveness on national as well as global levels. South Korea and Japan, play important roles too because these countries have a good technology base plus a strong focus on research development area.Another important region is North America, majorly led by the United States. This area is a crucial player in the wireless connectivity market because it has many technology innovators who invest greatly in research and development activities; this promotes an environment suitable for Wireless Connectivity Manufacturers. The advancement of wireless technologies is also spurred by prominent tech firms as well as start-ups present here. Also, the area's focus on IoT (Internet of Things) and smart technologies increases the need for wireless connection solutions. In Wireless Connectivity Import and Export, the United States is a big participant with a robust environment for producing as well as using it within their country boundaries. Wireless Connectivity Manufacturers are achieving significant growth in the European market due to increasing demand for smart devices and Internet of Things (IoT) applications. Countries like Germany, Italy, France, and the United Kingdom have a notable influence on the regional Wireless Connectivity Market.

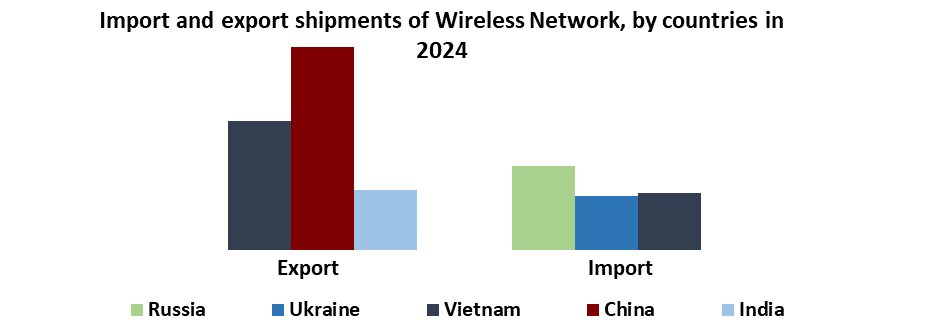

Top 3 Importers of the Wireless Network (No. of Shipments) (2024) Russia 57,000+ Vietnam 39,000+ Ukraine 37,000+

Top 3 Exporters of the Wireless Network (No. of Shipments) (2024) China 138,000+ Vietnam 88,000+ India 41,000+ Competitive Landscape:

In April 2024, A set of products from Qualcomm was introduced, featuring their fresh ultra-low-power Wi-Fi SoC named QCC730. The company mentioned that this new Wi-Fi SoC symbolizes a different class of silicon platforms that will compete with Bluetooth for battery-operated IoT devices across an array of market segments. The new chip works at 88% less power use than chips from the last generation. In January 2024, Ceva Inc. is a company that licenses silicon and software IP for Smart Edge devices to connect, sense, and infer data efficiently. Sunplus Technology Co. Ltd provides chips in the field of multimedia as well as automotive applications with its collaboration with Ceva now being extended by integrating Ceva's latest generation RivieraWaves Bluetooth audio solution into the Sunplus Airlyra family of HD audio processors which are made for wireless speakers, soundbars besides other high-end wireless audio tools. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which gives a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Wireless Connectivity Market dynamic, and structure by analyzing the market segments and projecting the Global Wireless Connectivity Market size. Clear representation of competitive analysis of key players By Price Range, price, financial position, product portfolio, growth strategies, and regional presence in the Global Wireless Connectivity Market make the report an investor’s guide.Wireless Connectivity Market Scope: Inquire before buying

Wireless Connectivity Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 95.29 Bn. Forecast Period 2024 to 2030 CAGR: 13.10% Market Size in 2030: US $ 225.57 Bn. Segments Covered: By Technology Wi-Fi Bluetooth Z-wave ZigBee GPS Cellular Others by Type WLAN WPAN LPWAN by Application Healthcare IT and telecommunication Automotive & Transportation Wearable devices Consumer electronics Agriculture Industrial Others Wireless Connectivity Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, and the Rest of APAC) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina Rest of South America)Wireless Connectivity Market Key Players

1. Qualcomm 2. Intel 3. Broadcom 4. MediaTek 5. Murata Manufacturing 6. Quantenna Communications 7. Renesas Electronics 8. Nordic Semiconductor 9. Espressif Systems 10. Peraso Technologies 11. Texas Instruments 12. Cypress Semiconductor 13. NXP Semiconductors 14. STMicroelectronics 15. Microchip technology 16. EnOcean 17. Ceva Inc. 18. AT&TFrequently Asked Questions:

1. Which region has the largest share in the Global Wireless Connectivity Market? Ans: The Asia Pacific region held the highest share in 2023. 2. What is the growth rate of the Global Wireless Connectivity Market? Ans: The Global Market is expected to grow at a CAGR of 13.10% during the forecast period 2024-2030. 3. What is the scope of the Global Wireless Connectivity Market report? Ans: The Global Wireless Connectivity Market report helps with the PESTEL, PORTER, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in the Global Wireless Connectivity Market? Ans: The important key players in the Global Wireless Connectivity Market are – Qualcomm, Intel, Broadcom, MediaTek, Murata Manufacturing, etc. 5. What is the study period of this market? Ans: The Global Wireless Connectivity Market is studied from 2023 to 2030.

1. Wireless Connectivity Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Wireless Connectivity Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Product Segment 2.3.3. End-user Segment 2.3.4. Revenue (2023) 2.4. Leading Wireless Connectivity Market Companies, by Market Capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Wireless Connectivity Market: Dynamics 3.1. Wireless Connectivity Market Trends by Region 3.1.1. North America Wireless Connectivity Market Trends 3.1.2. Europe Wireless Connectivity Market Trends 3.1.3. Asia Pacific Wireless Connectivity Market Trends 3.1.4. Middle East & Africa Wireless Connectivity Market Trends 3.1.5. South America Wireless Connectivity Market Trends 3.2. Wireless Connectivity Market Dynamics by Global 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Value Chain Analysis 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East & Africa 3.6.5. South America 3.7. Analysis of Government Schemes and Initiatives for the Wireless Connectivity Industry 3.8. Import and Export data by region 3.8.1. North America 3.8.2. Europe 3.8.3. China 3.8.4. Rest of APAC 3.8.5. Middle East & Africa 3.8.6. South America 4. Wireless Connectivity Market: Global Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030) 4.1. Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 4.1.1. Wi-Fi 4.1.2. Bluetooth 4.1.3. Z-wave 4.1.4. ZigBee 4.1.5. GPS 4.1.6. Cellular 4.1.7. Others 4.2. Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 4.2.1. WLAN 4.2.2. WPAN 4.2.3. LPWAN 4.3. Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 4.3.1. Healthcare 4.3.2. IT and telecommunication 4.3.3. Automotive & Transportation 4.3.4. Wearable devices 4.3.5. Consumer electronics 4.3.6. Agriculture 4.3.7. Industrial 4.3.8. Others 4.4. Wireless Connectivity Market Size and Forecast, By Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East & Africa 4.4.5. South America 5. North America Wireless Connectivity Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 5.1. North America Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 5.1.1. Wi-Fi 5.1.2. Bluetooth 5.1.3. Z-wave 5.1.4. ZigBee 5.1.5. GPS 5.1.6. Cellular 5.1.7. Others 5.2. North America Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 5.2.1. WLAN 5.2.2. WPAN 5.2.3. LPWAN 5.3. North America Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 5.3.1. Healthcare 5.3.2. IT and telecommunication 5.3.3. Automotive & Transportation 5.3.4. Wearable devices 5.3.5. Consumer electronics 5.3.6. Agriculture 5.3.7. Industrial 5.3.8. Others 5.4. North America Wireless Connectivity Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 5.4.1.1.1. Wi-Fi 5.4.1.1.2. Bluetooth 5.4.1.1.3. Z-wave 5.4.1.1.4. ZigBee 5.4.1.1.5. GPS 5.4.1.1.6. Cellular 5.4.1.1.7. Others 5.4.1.2. United States United States Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 5.4.1.2.1. WLAN 5.4.1.2.2. WPAN 5.4.1.2.3. LPWAN 5.4.1.3. United States Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 5.4.1.3.1. Healthcare 5.4.1.3.2. IT and telecommunication 5.4.1.3.3. Automotive & Transportation 5.4.1.3.4. Wearable devices 5.4.1.3.5. Consumer electronics 5.4.1.3.6. Agriculture 5.4.1.3.7. Industrial 5.4.1.3.8. Others 5.4.2. Canada 5.4.2.1. Canada Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 5.4.2.1.1. Wi-Fi 5.4.2.1.2. Bluetooth 5.4.2.1.3. Z-wave 5.4.2.1.4. ZigBee 5.4.2.1.5. GPS 5.4.2.1.6. Cellular 5.4.2.1.7. Others 5.4.2.2. Canada Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 5.4.2.2.1. WLAN 5.4.2.2.2. WPAN 5.4.2.2.3. LPWAN 5.4.2.3. Canada Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 5.4.2.3.1. Healthcare 5.4.2.3.2. IT and telecommunication 5.4.2.3.3. Automotive & Transportation 5.4.2.3.4. Wearable devices 5.4.2.3.5. Consumer electronics 5.4.2.3.6. Agriculture 5.4.2.3.7. Industrial 5.4.2.3.8. Others 5.4.3. Mexico 5.4.3.1. Mexico Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 5.4.3.1.1. Wi-Fi 5.4.3.1.2. Bluetooth 5.4.3.1.3. Z-wave 5.4.3.1.4. ZigBee 5.4.3.1.5. GPS 5.4.3.1.6. Cellular 5.4.3.1.7. Others 5.4.3.2. Mexico Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 5.4.3.2.1. WLAN 5.4.3.2.2. WPAN 5.4.3.2.3. LPWAN 5.4.3.3. Mexico Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 5.4.3.3.1. Healthcare 5.4.3.3.2. IT and telecommunication 5.4.3.3.3. Automotive & Transportation 5.4.3.3.4. Wearable devices 5.4.3.3.5. Consumer electronics 5.4.3.3.6. Agriculture 5.4.3.3.7. Industrial 5.4.3.3.8. Others 6. Europe Wireless Connectivity Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 6.1. Europe Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 6.2. Europe Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 6.3. Europe Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 6.4. Europe Wireless Connectivity Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 6.4.1.2. United Kingdom Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 6.4.1.3. United Kingdom Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 6.4.2. France 6.4.2.1. France Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 6.4.2.2. France Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 6.4.2.3. France Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 6.4.3.2. Germany Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 6.4.3.3. Germany Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 6.4.4.2. Italy Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 6.4.4.3. Italy Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 6.4.5.2. Spain Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 6.4.5.3. Spain Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 6.4.6.2. Sweden Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 6.4.6.3. Sweden Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 6.4.7.2. Austria Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 6.4.7.3. Austria Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 6.4.8.2. Rest of Europe Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 6.4.8.3. Rest of Europe Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 7. Asia Pacific Wireless Connectivity Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 7.1. Asia Pacific Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 7.2. Asia Pacific Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 7.3. Asia Pacific Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 7.4. Asia Pacific Wireless Connectivity Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 7.4.1.2. China Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 7.4.1.3. China Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 7.4.2.2. S Korea Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 7.4.2.3. S Korea Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 7.4.3.2. Japan Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 7.4.3.3. Japan Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 7.4.4. India 7.4.4.1. India Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 7.4.4.2. India Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 7.4.4.3. India Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 7.4.5.2. Australia Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 7.4.5.3. Australia Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 7.4.6. ASEAN 7.4.6.1. ASEAN Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 7.4.6.2. ASEAN Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 7.4.6.3. ASEAN Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 7.4.7. Rest of Asia Pacific 7.4.7.1. Rest of Asia Pacific Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 7.4.7.2. Rest of Asia Pacific Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 7.4.7.3. Rest of Asia Pacific Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 8. Middle East and Africa Wireless Connectivity Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 8.1. Middle East and Africa Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 8.2. Middle East and Africa Wireless Connectivity Market Size and Forecast, By Type Model (2023-2030) 8.3. Middle East and Africa Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 8.4. Middle East and Africa Wireless Connectivity Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 8.4.1.2. South Africa Wireless Connectivity Market Size and Forecast, By Type Model (2023-2030) 8.4.1.3. South Africa Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 8.4.2.2. GCC Wireless Connectivity Market Size and Forecast, By Type Model (2023-2030) 8.4.2.3. GCC Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 8.4.3.2. Nigeria Wireless Connectivity Market Size and Forecast, By Type Model (2023-2030) 8.4.3.3. Nigeria Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 8.4.4.2. Rest of ME&A Wireless Connectivity Market Size and Forecast, By Type Model (2023-2030) 8.4.4.3. Rest of ME&A Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 9. South America Wireless Connectivity Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn.) (2023-2030) 9.1. South America Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 9.2. South America Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 9.3. South America Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 9.4. South America Wireless Connectivity Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 9.4.1.2. Brazil Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 9.4.1.3. Brazil Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 9.4.2.2. Argentina Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 9.4.2.3. Argentina Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Wireless Connectivity Market Size and Forecast, By Technology (2023-2030) 9.4.3.2. Rest Of South America Wireless Connectivity Market Size and Forecast, By Type (2023-2030) 9.4.3.3. Rest Of South America Wireless Connectivity Market Size and Forecast, By Application (2023-2030) 10. Company Profile: Key Players 10.1. Qualcomm 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Intel 10.3. Broadcom 10.4. MediaTek 10.5. Murata Manufacturing 10.6. Quantenna Communications 10.7. Renesas Electronics 10.8. Nordic Semiconductor 10.9. Espressif Systems 10.10. Peraso Technologies 10.11. Texas Instruments 10.12. Cypress Semiconductor 10.13. NXP Semiconductors 10.14. STMicroelectronics 10.15. Microchip technology 10.16. EnOcean 10.17. Ceva Inc. 10.18. AT&T 11. Key Findings & Analyst Recommendations 12. Wireless Connectivity Market: Research Methodology