Global Visible Light Range Scientific Camera Market size expected to hit USD 730.37 Mn by 2029 from USD 470 Mn in 2022 at a CAGR of 6.5% during the forecast periodVisible Light Range Scientific Camera Market Overview

Visible Light Range Scientific Camera possesses a wavelength of light from 400 to 700nm that is similar to human eyesight. These devices are designed to create images with high resolution and crystal clarity as per human vision. It captures objects with accurate color representation. The growing demand for high-speed and resolution cameras and the increased surgical operations are expected to propel the growth of the Visible Light Range Scientific Camera Market.To know about the Research Methodology :- Request Free Sample Report

Visible Light Range Scientific Camera Market Dynamics

The Increased Demand from Healthcare and Life Sciences Industries and Research to Boost Visible Light Range Scientific Camera Market Visible light-range scientific cameras have emerged as important devices in research activities that offer high-resolution imaging, sensitivity and spectral range capabilities. Researchers from healthcare, space and other industries require advanced camera systems for proper research. Also, the continuous investment in innovation and scientific developments by the Visible Light Range Scientific Camera Key Companies is expected to drive the demand for these Visible Light Range Scientific Camera Market. The continuous technological innovations in the Visible Light Range Scientific Camera Industry are expected to drive the adoption of visible light range scientific cameras. Visible light range scientific cameras have multiple applications in various end-use industries apart from the research sector into various industrial domains. The demand for scientific cameras in industrial applications increased due to their ability to provide HD and reliable imaging results. The industries such as biotechnology, semiconductor manufacturing and automotive and pharmaceuticals require scientific cameras for the analysis of product quality, product development and quality inspection. These factors are expected to drive the global Visible Light Range Scientific Camera Market. Visible Light Range Scientific Cameras have a lucrative demand from the healthcare and life sciences sectors. Also, in life sciences & healthcare research, these cameras are used for studying cellular structures, protein interactions and DNA studies. The growing need for precise and detailed imaging in healthcare and life sciences is expected to propel the demand for visible light range scientific cameras, which is expected to drive the Market. The growing adoption of machine vision systems is widely adopted across various industries for automation and robotics. Visible light range scientific cameras play a major role in machine vision systems by providing high-resolution imaging capabilities and accurate color representation. Governments across the world are encouraging major Visible Light Range Scientific Camera Key Players to invest in technologically improved equipment to help scientific activities in the space industry and other relevant industries. This is expected to drive the Market. Presence of Alternative Technologies, High-Cost Associated with and Technical Limits Expected to Impede the Market The high cost associated with scientific cameras is expected to limit the Visible Light Range Scientific Camera Market. Advanced scientific cameras with high-resolution sensors, sophisticated imaging capabilities and specialized features are expensive in nature. This is expected to be a problem for small and medium research institutions. The Visible Light Range Scientific Camera Market is expected to face competition from alternative technologies that offer similar imaging capabilities. The availability and adoption of these alternative scientific cameras limit the demand for visible light range scientific cameras, which is anticipated to limit the overall growth of the Visible Light Range Scientific Camera Industry. Even with the progress in sensor development, cameras are facing challenges in terms of noise levels, dynamic range and sensitivity. Researchers often require cameras with improved performance and specifications to capture precise data in various scientific experiments. Technological limitations are limiting the use of these cameras.Regional Insights

Asia Pacific is expected to grow at the highest CAGR of 7.3 percent during the forecast period (2023-2029). China is enforcing to development and use of visible light range scientific cameras for the improvements in healthcare infrastructure with better visible medical cameras to improve the treatment and diagnosis and attract global patients from worldwide. These factors are expected to drive the Asia Pacific Market. China is partnering with some of the Visible Light Range Scientific Camera Key Companies for manufacturing. North America is expected to hold the largest share of the market throughout the forecast period. The region’s growth is supported by the presence of the world’s biggest Space Industry agency NASA in the region and Canada’s increased space missions are driving the demand for high-quality scientific cameras. The Visible Light Range Scientific Camera Key Players in the United States such as Teledyne Technologies and Thorlabs are developing the newest and improved scientific cameras. This is expected to propel the growth of the North America Visible Light Range Scientific Camera Market.Visible Light Range Scientific Camera Market Competitive Landscape

Hamamatsu Photonics, Teledyne Technologies, Thorlabs, Inc., XIMEA GmbH and Photonic Science are some of the major Visible Light Range Scientific Camera Key Players. The report provides the competitive landscape of the major Visible Light Range Scientific Camera Key Companies based on their Market Size, Market Share and Market Penetration in the major geographic regions such as North America, South America, Middle East and Africa, Asia Pacific and Europe. Recently, on October 26, 2022, Teledyne Technologies Incorporated announced today that a wholly-owned subsidiary has entered into an agreement to acquire ETM-Electromatic, Inc. ETM, headquartered in Newark, California, designs and manufactures high-power microwave and high-energy X-ray subsystems for cancer radiotherapy, defense and X-ray security applications. Teledyne will also acquire ETM's purpose-built manufacturing facility from an affiliate of ETM and its owners. The ETM is expected to complement the healthcare imaging and defense electronics businesses of Teledyne Technologies. This acquisition is expected to present new opportunities for the Visible Light Range Scientific Camera company. Photonic Science is one of the Visible Light Range Scientific Camera Key Companies that launched a new Hawkeye 4123 sCMOS camera on Jun 14, 2021. The Hawkeye 4123 sCMOS camera features a state-of-the-art BAE Fairchild sCMOS 4123 sensor with 0.5 electron readout noise, very low dark current and low defective pixel count. The camera allows uncompromised low-light-level imaging performances down to starlight conditions. This is expected to be used widely across the world and to drive the Market.

Visible Light Range Scientific Camera Market Segment Analysis

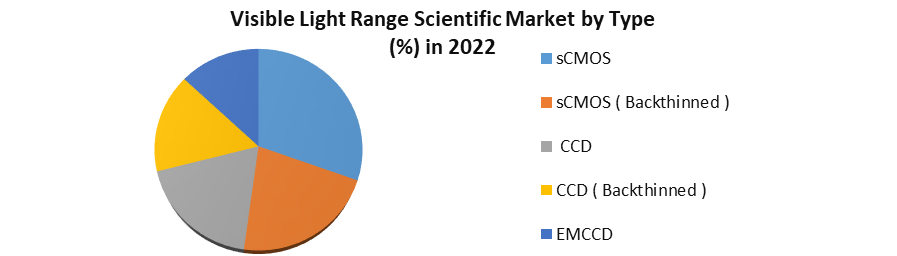

Based on Type sCMOS segment is expected to hold the largest revenue share of the Visible Light Range Scientific Camera Market during the forecast period. These sCMOS cameras have specifications such as less noise, fast speed, large viewing field and wide dynamic range with high resolution. These factors made sCMOS cameras more applicable in various industrial applications such as microscopy and astrophysics and the satellite industry. This is expected to drive the sCMOS segment to grow significantly. According to the MMR report the sCMOS segment held an 18.7 percent share in 2022. Based on Resolution The less than 4 MP camera segment is expected to hold the largest revenue Visible Light Range Scientific Camera Market share of around 147.80 Mn. The segment’s growth is supported by technological advancements and the rising demand for high-resolution imaging, the growing penetration of artificial intelligence in every sector of the industry and increased automation. These factors are driving the less than 4 MP segment in Visible Light Range Scientific Camera Industry. The megapixels are mostly used to estimate still images’ resolution. Based on Application The life sciences segment is expected to dominate the market over the forecast period (2023-2029). Visible light range scientific cameras are most useful in various life sciences applications and diagnoses such as microscopy, imaging, spectroscopy and others. These cameras changed the healthcare industry upside down. Visible light-range scientific cameras are used in microscopy to capture images of cells and other human specimens that are useful in the diagnosis and treatment of diseases. Due to these applications of scientific cameras, the Market is expected to grow.Visible Light Range Scientific Camera Market Scope: Inquire before buying

Visible Light Range Scientific Camera Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 470 Mn Forecast Period 2023 to 2029 CAGR: 6.5% Market Size in 2029: USD 730.37 Mn Segments Covered: by Type sCMOS sCMOS ( Backthinned ) CCD CCD ( Backthinned ) EMCCD by Resolution Less than 4 MP 4 MP to 5 MP 6 MP to 9 MP More than 9 MP by Price Range 1. Less than US$ 15,000 2. US$ 15,000 to US$ 30,000 3. US$ 31,000 to US$ 50,000 4. More than US$ 50,000 by Applications 1. Life Sciences 2. Industrial Sector 3. Security and Surveillance 4. Space Industry Visible Light Range Scientific Camera Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players

1. Hamamatsu Photonics 2. Teledyne Technologies 3. Thorlabs, Inc. 4. XIMEA GmbH 5. Photonic Science 6. Excelitas PCO GmbH 7. Oxford Instruments 8. Atik Cameras 9. Diffraction Limited 10. Spectral Instruments, Inc. 11. Hubbell 12. Keysight Technologies Frequently Asked Questions: 1] What is the growth rate of the Market? Ans. The Visible Light Range Scientific Camera Market is growing at a CAGR of 6.5% during the forecast period. 2] Which region is expected to dominate the Visible Light Range Scientific Camera Market? Ans. North America is expected to dominate the Visible Light Range Scientific Camera Market during the forecast period from 2023 to 2029. 3] What is the expected Visible Light Range Scientific Camera Market size by 2029? Ans. The size of the Market by 2029 is expected to reach USD 730.37 Mn. 4] Who are the top players in the Visible Light Range Scientific Camera Market? Ans. The major key players in the Market are Hamamatsu Photonics, Teledyne Technologies, Thorlabs, Inc., XIMEA GmbH and Photonic Science 5] Which factors contributed to the growth of the Visible Light Range Scientific Camera Market in 2022? Ans. The Market is expected to grow due to the rising demand for HD imaging cameras.

1. Visible Light Range Scientific Camera Market: Research Methodology 2. Visible Light Range Scientific Camera Market: Executive Summary 3. Visible Light Range Scientific Camera Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Visible Light Range Scientific Camera Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Visible Light Range Scientific Camera Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Visible Light Range Scientific Camera Market Size and Forecast, by Type (2022-2029) 5.1.1. SCMOS 5.1.2. SCMOS ( Backthinned ) 5.1.3. CCD 5.1.4. CCD ( Backthinned ) 5.1.5. EMCCD 5.2. Visible Light Range Scientific Camera Market Size and Forecast, by Resolution (2022-2029) 5.2.1. Less than 4 MP 5.2.2. 4 MP to 5 MP 5.2.3. 6 MP to 9 MP 5.2.4. More than 9 MP 5.3. Visible Light Range Scientific Camera Market Size and Forecast, by Price Range (2022-2029) 5.3.1. Less than US$ 15,000 5.3.2. US$ 15,000 to US$ 30,000 5.3.3. US$ 31,000 to US$ 50,000 5.3.4. More than US$ 50,000 5.4. Visible Light Range Scientific Camera Market Size and Forecast, by Applications (2022-2029) 5.4.1. Life Sciences 5.4.2. Industrial Sector 5.4.3. Security and Surveillance 5.4.4. Healthcare 5.4.5. Space Industry 5.5. Visible Light Range Scientific Camera Market Size and Forecast, by Region (2022-2029) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Visible Light Range Scientific Camera Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Visible Light Range Scientific Camera Market Size and Forecast, by Type (2022-2029) 6.1.1. SCMOS 6.1.2. SCMOS ( Backthinned ) 6.1.3. CCD 6.1.4. CCD ( Backthinned ) 6.1.5. EMCCD 6.2. North America Visible Light Range Scientific Camera Market Size and Forecast, by Resolution (2022-2029) 6.2.1. Less than 4 MP 6.2.2. 4 MP to 5 MP 6.2.3. 6 MP to 9 MP 6.2.4. More than 9 MP 6.3. North America Visible Light Range Scientific Camera Market Size and Forecast, by Price Range (2022-2029) 6.3.1. Less than US$ 15,000 6.3.2. US$ 15,000 to US$ 30,000 6.3.3. US$ 31,000 to US$ 50,000 6.3.4. More than US$ 50,000 6.4. North America Visible Light Range Scientific Camera Market Size and Forecast, by Applications (2022-2029) 6.4.1. Life Sciences 6.4.2. Industrial Sector 6.4.3. Security and Surveillance 6.4.4. Healthcare 6.4.5. Space Industry 6.5. North America Visible Light Range Scientific Camera Market Size and Forecast, by Country (2022-2029) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Visible Light Range Scientific Camera Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe Visible Light Range Scientific Camera Market Size and Forecast, by Type (2022-2029) 7.1.1. SCMOS 7.1.2. SCMOS ( Backthinned ) 7.1.3. CCD 7.1.4. CCD ( Backthinned ) 7.1.5. EMCCD 7.2. Europe Visible Light Range Scientific Camera Market Size and Forecast, by Resolution (2022-2029) 7.2.1. Less than 4 MP 7.2.2. 4 MP to 5 MP 7.2.3. 6 MP to 9 MP 7.2.4. More than 9 MP 7.3. Europe Visible Light Range Scientific Camera Market Size and Forecast, by Price Range (2022-2029) 7.3.1. Less than US$ 15,000 7.3.2. US$ 15,000 to US$ 30,000 7.3.3. US$ 31,000 to US$ 50,000 7.3.4. More than US$ 50,000 7.4. Europe Visible Light Range Scientific Camera Market Size and Forecast, by Applications (2022-2029) 7.4.1. Life Sciences 7.4.2. Industrial Sector 7.4.3. Security and Surveillance 7.4.4. Healthcare 7.4.5. Space Industry 7.5. Europe Visible Light Range Scientific Camera Market Size and Forecast, by Country (2022-2029) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe 8. Asia Pacific Visible Light Range Scientific Camera Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Visible Light Range Scientific Camera Market Size and Forecast, by Type (2022-2029) 8.1.1. SCMOS 8.1.2. SCMOS ( Backthinned ) 8.1.3. CCD 8.1.4. CCD ( Backthinned ) 8.1.5. EMCCD 8.2. Asia Pacific Visible Light Range Scientific Camera Market Size and Forecast, by Resolution (2022-2029) 8.2.1. Less than 4 MP 8.2.2. 4 MP to 5 MP 8.2.3. 6 MP to 9 MP 8.2.4. More than 9 MP 8.3. Asia Pacific Visible Light Range Scientific Camera Market Size and Forecast, by Price Range (2022-2029) 8.3.1. Less than US$ 15,000 8.3.2. US$ 15,000 to US$ 30,000 8.3.3. US$ 31,000 to US$ 50,000 8.3.4. More than US$ 50,000 8.4. Asia Pacific Visible Light Range Scientific Camera Market Size and Forecast, by Applications (2022-2029) 8.4.1. Life Sciences 8.4.2. Industrial Sector 8.4.3. Security and Surveillance 8.4.4. Healthcare 8.4.5. Space Industry 8.5. Asia Pacific Visible Light Range Scientific Camera Market Size and Forecast, by Country (2022-2029) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Indonesia 8.5.7. Malaysia 8.5.8. Vietnam 8.5.9. Taiwan 8.5.10. Bangladesh 8.5.11. Pakistan 8.5.12. Rest of Asia Pacific 9. Middle East and Africa Visible Light Range Scientific Camera Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Visible Light Range Scientific Camera Market Size and Forecast, by Type (2022-2029) 9.1.1. SCMOS 9.1.2. SCMOS ( Backthinned ) 9.1.3. CCD 9.1.4. CCD ( Backthinned ) 9.1.5. EMCCD 9.2. Middle East and Africa Visible Light Range Scientific Camera Market Size and Forecast, by Resolution (2022-2029) 9.2.1. Less than 4 MP 9.2.2. 4 MP to 5 MP 9.2.3. 6 MP to 9 MP 9.2.4. More than 9 MP 9.3. Middle East and Africa Visible Light Range Scientific Camera Market Size and Forecast, by Price Range (2022-2029) 9.3.1. Less than US$ 15,000 9.3.2. US$ 15,000 to US$ 30,000 9.3.3. US$ 31,000 to US$ 50,000 9.3.4. More than US$ 50,000 9.4. Middle East and Africa Visible Light Range Scientific Camera Market Size and Forecast, by Applications (2022-2029) 9.4.1. Life Sciences 9.4.2. Industrial Sector 9.4.3. Security and Surveillance 9.4.4. Healthcare 9.4.5. Space Industry 9.5. Middle East and Africa Visible Light Range Scientific Camera Market Size and Forecast, by Country (2022-2029) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America Visible Light Range Scientific Camera Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Visible Light Range Scientific Camera Market Size and Forecast, by Type (2022-2029) 10.1.1. SCMOS 10.1.2. SCMOS ( Backthinned ) 10.1.3. CCD 10.1.4. CCD ( Backthinned ) 10.1.5. EMCCD 10.2. South America Visible Light Range Scientific Camera Market Size and Forecast, by Resolution (2022-2029) 10.2.1. Less than 4 MP 10.2.2. 4 MP to 5 MP 10.2.3. 6 MP to 9 MP 10.2.4. More than 9 MP 10.3. South America Visible Light Range Scientific Camera Market Size and Forecast, by Price Range (2022-2029) 10.3.1. Less than US$ 15,000 10.3.2. US$ 15,000 to US$ 30,000 10.3.3. US$ 31,000 to US$ 50,000 10.3.4. More than US$ 50,000 10.4. South America Visible Light Range Scientific Camera Market Size and Forecast, by Applications (2022-2029) 10.4.1. Life Sciences 10.4.2. Industrial Sector 10.4.3. Security and Surveillance 10.4.4. Healthcare 10.4.5. Space Industry 10.5. South America Visible Light Range Scientific Camera Market Size and Forecast, by Country (2022-2029) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. Hamamatsu Photonics 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Teledyne Technologies 11.3. Thorlabs, Inc. 11.4. XIMEA GmbH 11.5. Photonic Science 11.6. Excelitas PCO GmbH 11.7. Oxford Instruments 11.8. Atik Cameras 11.9. Diffraction Limited 11.10. Spectral Instruments, Inc. 11.11. Hubbell 11.12. Keysight Technologies 12. Key Findings 13. Industry Recommendation