Global Vegan Chocolate Market size was valued at USD 1.33 Billion in 2023 and the total Vegan Chocolate Market revenue is expected to grow at 12.3 % from 2024 to 2030, reaching nearly USD 3.00 Billion by 2030. Vegan chocolate is a type of chocolate that does not contain any ingredients derived from animals, such as dairy milk, butter, cream, or other animal-based additives. Instead, it is created using plant-based alternatives like almond milk, soy milk, oat milk, coconut milk, or rice milk, alongside ethically sourced cocoa. Common types of vegan chocolate include vegan milk chocolate, vegan dark chocolate, and vegan white chocolate. With an average annual chocolate consumption of just under 2 pounds per person, it's no surprise that worldwide chocolate consumption in 2024 is up to 7.5 million tons. That's 16 billion pounds of chocolate per year. The vegan Chocolate market is influenced by more several factors such as the Rising Adoption of Vegan and Plant-Based Diets, Health Consciousness and Clean Ingredients, Environmental Awareness and Innovation, and Product Development. However, the major driver for the Vegan Chocolate market is the Growing Popularity of Veganism. The vegan chocolate market growth is hindered by some of the challenges like its Taste and Texture of Vegan Chocolate, Limited Availability of Plant-Based Ingredients, Consumer Misconceptions and Higher Cost Compared to Traditional Chocolates. The Vegan Chocolate market is segmented by Product, Sampling Method, Component, Application, and End-User. Between Jan 2022 and Dec 2023, vegan chocolate confectionery innovation rose from 2.3% to 5-4% in ME&A. In Europe, it increased from 5.9% to 9.7%. A deep dive into the region the majority of chocolate innovations occurred in the UK (34%), Germany (24%), and the Netherlands (16%) during the same period. In 2023, 29% of the population already buy vegan sweets, and 17% of the population buy chocolate. This is seen in major brands, such as Mars, launching dairy-free versions of popular products including Galaxy bars. Similarly, Nestlé and Cadbury have also jumped on the trend. For instance, Hershey Co. began a limited U.S. distribution of “Oat Made” bars in September, on the heels of its USD 450 million acquisition of better-for-you chocolate brand Lily’s Sweets.To know about the Research Methodology :- Request Free Sample Report

Vegan Chocolate Market Dynamics:

The Growing Popularity of Veganism Drives the Vegan Market The increasing awareness of the various benefits of veganism and plant-based diets is driving significant demand for vegan chocolate alternatives. The trend has been expected to continue in the future. Veganism has been attracting health-conscious consumers to explore vegan options exploring Health Benefits like reduced risk of heart disease, type 2 diabetes, and certain cancers. Rising Ethical concern for animal welfare is pushing consumers towards alternatives like vegan chocolate, which avoid dairy-derived ingredients. The top three fastest-growing, chocolate-confectionery ingredient launches are all plant-based, with oats up 78%, coconut fat up 74%, and erythritol up 64% (Global CAGR October 2021–September 2022 vs October 2022–September 2023). The Asia Pacific region is expected to lead the vegan market growth by raising purchasing power to enable consumers to discover premium vegan options. Countries like China and India are perceiving a surge in veganism, driving the demand for vegan chocolate. Major chocolate companies are taking advantage of this trend for instance, in 2023, Hershey's introduced its "Not Milk Chocolate" bar, catering to the growing demand for vegan dairy alternatives. New vegan chocolate companies are also emerging, offering innovative and diverse products to meet evolving consumer preferences. For instance, The Veganuary campaign, encouraging people to try veganism for January, saw a record 2 million participants globally in 2023, indicating a growing interest in vegan alternatives, including chocolate. The Taste and Texture of Vegan Chocolate make a challenge for the market The popularity of vegan chocolate is rising, but overcoming consumer perception regarding taste and texture remains a significant challenge for the vegan chocolate market. Consumers have an average annual chocolate consumption of just under 2 pounds per person, so it's no surprise that worldwide chocolate consumption in 2023 has been up to 7.5 million tons. Perceive a difference compared to traditional chocolate, potentially hindering further adoption and constant innovation by key players is narrowing this gap. Ingredient Differences in Vegan chocolate are typically found by using plant-based alternatives for dairy ingredients, which can lead to subtle differences in flavor and texture compared to traditional chocolate, and the taste and texture of traditional chocolate might be hesitant to try vegan alternatives if they anticipate a significant difference. Key players in the vegan chocolate market are actively investing in research and development efforts to create vegan chocolate that mimics the taste and texture of conventional chocolate. For instance, Barry Callebaut introduced its Plant-Based Magnum ice cream in 2023. In this product, they utilize Ruby chocolate, a novel alternative crafted from ruby cocoa beans, to achieve a taste and texture similar to the traditional counterpart. Manufacturers are exploring various ingredients and flavor profiles to address diverse consumer preferences and introduce innovative vegan chocolate choices. Important Vegan Chocolate Market TrendsAcceptance of Sustainability in the Vegan Chocolate Market The growing focus on sustainability has been a significant opportunity for the vegan chocolate market. Consumers are increasingly seeking products aligned with their environmental concerns, and vegan chocolate companies can influence by emphasizing sustainable practices during their operations. Environmental Responsibility seeks products from companies, committed to sustainable practices. The sourcing of ingredients, packaging materials, and production processes highlighting sustainable practices can offer a competitive advantage in the marketplace, and attract environmentally conscious consumers. vegan chocolate currently accounts for 40 % of the entire vegan confectionery sector, with the potential to secure even more. The annual global chocolate consumption in 2023 has been 7.98 million tons and vegan chocolate has a total of 3.14 million tons of total consumption. Europe is come forward for sustainability initiatives in the chocolate industry. Regulations encourage sustainable practices in the European food industry, including chocolate production, and consumers are environmentally conscious and actively search for sustainable products. Many companies are working with farmers and suppliers who prioritize sustainable practices, such as organic farming and fairtrade principles. For instance, Lindt & Sprüngli, a chocolate manufacturer, announced its commitment to 100% sustainably sourced cocoa by 2025, demonstrating a strong focus on sustainable sourcing practices.

Vegan Chocolate Market Segment Analysis:

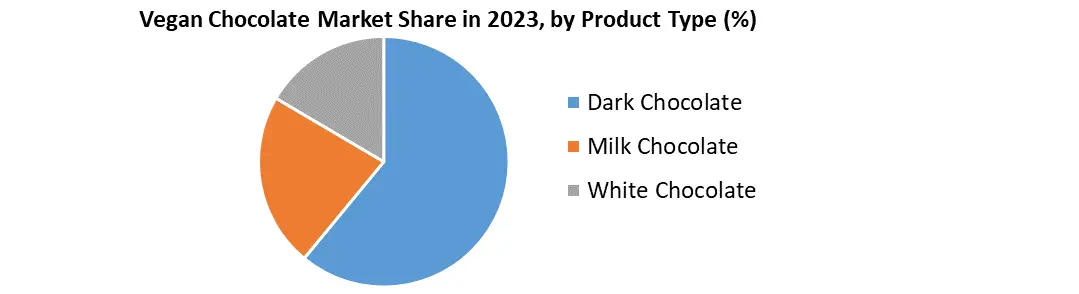

By Product Form, the vegan chocolate market is segmented into various product forms like Bar, chips, and Bites and others (Powder, Whole, Blended, etc.), each catering to specific consumer preferences and offering diverse consumption. Bars hold the largest market share, estimated to be around 61.08% in 2023, and are expected to maintain their dominance in the forecast period. Bars have generated the highest revenue in 2023, almost USD 270 million because of their popularity, convenience, and wider availability compared to other product types. Vegan chocolate chips and bites generated around USD 90 million in revenue in 2023 due to their rising demand and growing adoption in various applications. This category is experiencing growth because of its convenient size and appeal for snacking. Increased product innovation by manufacturers, vegan chocolate products across different categories, catering to evolving consumer preferences, and added functional ingredients like probiotics or protein are emerging to cater to consumers seeking additional health benefits and this recent development has been witnessing the vegan chocolate market growth.By Product Type, Dark chocolate has been associated with health benefits like antioxidants and lower sugar content compared to other chocolate types, appealing to health-conscious consumers. It also prefers a less sweet and more complex flavor profile, compared to milk chocolate, and to this demand, Dark chocolate holds the largest market share within the vegan chocolate market, estimated to be around 59.36% in 2023, and is expected to maintain its lead in the forecast period. Lindt & Sprüngli, Tony's Chocolonely, Theo Chocolate, and Hu Chocolate are the major key players in vegan dark chocolate with significant market share. Vegan milk chocolate alternatives use plant-based milk substitutes like almond milk or oat milk, Milk Chocolate is experiencing growth with increasing availability and improved taste. Hershey's, Moo Free Chocolates, Galaxy Vegan by Mars, and Nestlé Vegan Milk Chocolate are making vegan milk chocolate, and they are successful to improved taste and texture of chocolate.

Vegan Chocolate Market Regional Insights:

Vegan milk chocolate alternatives use plant-based milk substitutes like almond milk or oat milk, Milk Chocolate is experiencing growth with increasing availability and improved taste. The vegan chocolate market is experiencing significant growth globally, with various regions exhibiting distinct dynamics and trends and also driven by rising consumer awareness and demand for plant-based alternatives. MMR research found that 55% of chocolate consumers in Spain, 53% of chocolate consumers in France and Poland, 48% of chocolate consumers in Italy, and 44% of chocolate consumers in Germany are interested in plant-based chocolate and Europe currently holds the largest market share of 46.85 % within the global vegan chocolate market in 2023 and is expected to continue its dominance in the forecast period. Strong consumer awareness, health, and sustainability, factors leading to a higher adoption rate of vegan products. The European key players like Lindt & Sprüngli, Tony's Chocolonely, and Veganz Group have a significant share in the vegan chocolate market. Asia Pacific is expected to witness the fastest growth in the vegan chocolate market in the coming years, with a projected CAGR of 10.2% from 2024 to 2030. Rising disposable income led purchasing power consumers to purchase premium vegan options, including chocolate.Vegan Chocolate Market Competitive Landscapes:

The Vegan Chocolate Market is fragmented, allowing smaller, specialized brands to compete effectively based on their unique product offerings and targeted marketing efforts. The vegan chocolate market is characterized by a combination of established players as well with specialized brands focused on meeting the growing demand for plant-based confections. Some notable competitors include- Lindt & Sprüngli, Tony's Chocolonely, Theo Chocolate, and Hu Chocolate Hershey's, Moo Free Chocolates, Galaxy Vegan by Mars, and Nestlé Vegan Milk Chocolate. These companies operate across multiple regions, with Europe dominating the global market in terms of revenue share. They employ various strategies to maintain and expand their market shares, for instance- Lindt & Sprüngli- Lindt & Sprüngli's strategic decisions have focused on global diversification and continuous brand strengthening, proving to be forward-thinking choices. The company's emphasis on expanding its presence in various regions and enhancing brand recognition reflects a long-term vision for sustained growth and market leadership. To maintain success, Lindt & Sprüngli has prioritized product and service differentiation as a strategic goal to set itself apart from competitors. Tony's Chocolonely- Some recent investments done by the Tony's Chocolonely include- • Securing an additional €20 million funding commitment from existing shareholders, Verlinvest and JamJar, to accelerate the company's mission of ending exploitation in the cocoa industry. • Introduction of "Tony's Mission Lock," a future-proof legal structure designed to ensure the company's sustainability commitments remain intact over time. • Appointment of three "mission guardians" to monitor compliance with the company's values and ethics, using a "golden share" mechanism to veto changes to its ethical strategy if necessary. Nestlé Vegan Milk Chocolate- Nestlé has been expanding its plant-based portfolio, including the addition of dairy-free chocolate chips under the Toll House brand. The company's plant-based offerings span various brands like Garden Gourmet, Natural Bliss, Vuna, and Sweet Earth, indicating a strategic focus on catering to the growing demand for vegan alternatives across different product categories. Nestlé has committed to investing over USD 1.4 billion USD to address child labor issues in its cocoa supply chain. The company's efforts to enhance sustainability and transparency in its supply chain align with consumer expectations for ethical sourcing practices in the chocolate industry.Vegan Chocolate Market Scope: Inquiry Before Buying

Vegan Chocolate Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.33 Bn. Forecast Period 2024 to 2030 CAGR: 12.3% Market Size in 2030: US $ 3 Bn. Segments Covered: by Product Type Dark Milk White by Product Form Bar Granules chips and Bites Liquid Others (Powder, Whole, Blended, Etc.) by Distribution Channel Supermarkets/Hypermarkets Convenience stores Online Stores Vegan Chocolate Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Vegan Chocolate Key Players:

North America Vegan Chocolate Market Key Players 1. Theo Chocolate (Seattle, Washington, USA) 2. Follow Your Heart (Canoga Park, California, USA) 3. Lake Champlain Chocolates (Shelburne, Vermont, USA) 4. Go Max Green (Boulder, Colorado, USA) 5. Pascha Chocolate (Woodland, California, USA) 6. Plamil (Los Angeles, California, USA) 7. No Whey! Foods (Anaheim, California, USA) 8. Hip Chocolate (Portland, Oregon, USA) 9. Enjoy Life Foods (Oak Brook, Illinois, USA) 10. Verb Chocolate (Vancouver, Canada) 11. Nucao (Chicago, Illinois, USA) 12. Goodio Chocolate (San Rafael, California, USA) 13. Conscious Chocolate (Seattle, Washington, USA) 14. Vegan Supply (Oakland, California, USA) Europe Vegan Chocolate Market Key Players 1. Tony's Chocolonely (Amsterdam, Netherlands) 2. Moo Free Chocolates (Dorset, England) 3. Sunspire (Burton upon Trent, England) 4. Green & Black's (York, England) 5. Doisy & Dam (Amsterdam, Netherlands) 6. Lindt & Sprüngli (Kilchberg, Switzerland)FAQs:

1. Which region is expected to lead the global Vegan Chocolate Market during the forecast period? Ans. Europe is expected to lead the global Vegan Chocolate Market during the forecast period. 2. What is the projected market size and growth rate of the Vegan Chocolate Market? Ans. The Vegan Chocolate Market size was valued at USD 1.33 Billion in 2023 and the total Vegan Chocolate revenue is expected to grow at a CAGR of 12.3 % from 2024 to 2030, reaching nearly USD 3.00 Billion by 2030. 3. What segments are covered in the Vegan Chocolate Market report? Ans. The segments covered in the Vegan Chocolate Market report are Product Type, Product Form, Distribution Channel, and Region. 4. What is the study period of the Vegan Chocolate Market? Ans: The Global Vegan Chocolate Market is studied from 2023 to 2030.

1. Vegan Chocolate Market: Research Methodology 2. Vegan Chocolate Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Vegan Chocolate Market: Dynamics 3.1 Vegan Chocolate Market Trends by Region 3.1.1 North America Vegan Chocolate Market Trends 3.1.2 Europe Vegan Chocolate Market Trends 3.1.3 Asia Pacific Vegan Chocolate Market Trends 3.1.4 Middle East and Africa Vegan Chocolate Market Trends 3.1.5 South America Vegan Chocolate Market Trends 3.2 Vegan Chocolate Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Vegan Chocolate Market Drivers 3.2.1.2 North America Vegan Chocolate Market Restraints 3.2.1.3 North America Vegan Chocolate Market Opportunities 3.2.1.4 North America Vegan Chocolate Market Challenges 3.2.2 Europe 3.2.2.1 Europe Vegan Chocolate Market Drivers 3.2.2.2 Europe Vegan Chocolate Market Restraints 3.2.2.3 Europe Vegan Chocolate Market Opportunities 3.2.2.4 Europe Vegan Chocolate Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Vegan Chocolate Market Drivers 3.2.3.2 Asia Pacific Vegan Chocolate Market Restraints 3.2.3.3 Asia Pacific Vegan Chocolate Market Opportunities 3.2.3.4 Asia Pacific Vegan Chocolate Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Vegan Chocolate Market Drivers 3.2.4.2 Middle East and Africa Vegan Chocolate Market Restraints 3.2.4.3 Middle East and Africa Vegan Chocolate Market Opportunities 3.2.4.4 Middle East and Africa Vegan Chocolate Market Challenges 3.2.5 South America 3.2.5.1 South America Vegan Chocolate Market Drivers 3.2.5.2 South America Vegan Chocolate Market Restraints 3.2.5.3 South America Vegan Chocolate Market Opportunities 3.2.5.4 South America Vegan Chocolate Market Challenges 3.3 PORTER’s Five Forces Analysis 3.4 PESTLE Analysis 3.5 Regulatory Landscape by Region 3.5.1 North America 3.5.2 Europe 3.5.3 Asia Pacific 3.5.4 Middle East and Africa 3.5.5 South America 3.6 Analysis of Government Schemes and Initiatives for the Vegan Chocolate Industry 4. Global Vegan Chocolate Market: Global Market Size and Forecast by Segmentation (By Value and Volume) (2023-2030) 4.1 Global Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 4.1.1 Dark 4.1.2 Milk 4.1.3 White 4.2 Global Vegan Chocolate Market Size and Forecast, By Product Form (2023-2030) 4.2.1 Bar 4.2.2 Granules 4.2.3 chips and Bites 4.2.4 Liquid 4.2.5 Others (Powder, Whole, Blended, Etc.) 4.3 Global Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 4.3.1 Supermarkets/Hypermarkets 4.3.2 Convenience stores 4.3.3 Online Stores 4.4 Global Vegan Chocolate Market Size and Forecast, by region (2023-2030) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Vegan Chocolate Market Size and Forecast by Segmentation (By Value and Volume) (2023-2030) 5.1 North America Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 5.1.1 Dark 5.1.2 Milk 5.1.3 White 5.2 North America Vegan Chocolate Market Size and Forecast, By Product Form (2023-2030) 5.2.1 Bar 5.2.2 Granules 5.2.3 chips and Bites 5.2.4 Liquid 5.2.5 Others (Powder, Whole, Blended, Etc.) 5.3 North America Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 5.3.1 Supermarkets/Hypermarkets 5.3.2 Convenience stores 5.3.3 Online Stores 5.4 North America Vegan Chocolate Market Size and Forecast, by Country (2023-2030) 5.4.1 United States 5.4.1.1 United States Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 5.4.1.1.1 Dark 5.4.1.1.2 Milk 5.4.1.1.3 White 5.4.1.2 United States Vegan Chocolate Market Size and Forecast, By Product Form (2023-2030) 5.4.1.2.1 Bar 5.4.1.2.2 Granules 5.4.1.2.3 chips and Bites 5.4.1.2.4 Liquid 5.4.1.2.5 Others (Powder, Whole, Blended, Etc.) 5.4.1.3 United States Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 5.4.1.3.1 Supermarkets/Hypermarkets 5.4.1.3.2 Convenience stores 5.4.1.3.3 Online Stores 5.4.2 Canada 5.4.2.1 Canada Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 5.4.2.1.1 Dark 5.4.2.1.2 Milk 5.4.2.1.3 White 5.4.2.2 Canada Vegan Chocolate Market Size and Forecast, By Product Form (2023-2030) 5.4.2.2.1 Bar 5.4.2.2.2 Granules 5.4.2.2.3 chips and Bites 5.4.2.2.4 Liquid 5.4.2.2.5 Others (Powder, Whole, Blended, Etc.) 5.4.2.3 Canada Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 5.4.2.3.1 Supermarkets/Hypermarkets 5.4.2.3.2 Convenience stores 5.4.2.3.3 Online Stores 5.4.3 Mexico 5.4.3.1 Mexico Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 5.4.3.1.1 Dark 5.4.3.1.2 Milk 5.4.3.1.3 White 5.4.3.2 Mexico Vegan Chocolate Market Size and Forecast, By Product Form (2023-2030) 5.4.3.2.1 Bar 5.4.3.2.2 Granules 5.4.3.2.3 chips and Bites 5.4.3.2.4 Liquid 5.4.3.2.5 Others (Powder, Whole, Blended, Etc.) 5.4.3.3 Mexico Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 5.4.3.3.1 Supermarkets/Hypermarkets 5.4.3.3.2 Convenience stores 5.4.3.3.3 Online Stores 6. Europe Vegan Chocolate Market Size and Forecast by Segmentation (By Value and Volume) (2023-2030) 6.1 Europe Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 6.2 Europe Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 6.3 Europe Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 6.4 Europe Vegan Chocolate Market Size and Forecast, by Country (2023-2030) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 6.4.1.2 United Kingdom Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 6.4.1.3 United Kingdom Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 6.4.2 France 6.4.2.1 France Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 6.4.2.2 France Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 6.4.2.3 France Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 6.4.3 Germany 6.4.3.1 Germany Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 6.4.3.2 Germany Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 6.4.3.3 Germany Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 6.4.4 Italy 6.4.4.1 Italy Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 6.4.4.2 Italy Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 6.4.4.3 Italy Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 6.4.5 Spain 6.4.5.1 Spain Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 6.4.5.2 Spain Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 6.4.5.3 Spain Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 6.4.6 Sweden 6.4.6.1 Sweden Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 6.4.6.2 Sweden Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 6.4.6.3 Sweden Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 6.4.7 Austria 6.4.7.1 Austria Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 6.4.7.2 Austria Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 6.4.7.3 Austria Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 6.4.8.2 Rest of Europe Vegan Chocolate Market Size and Forecast, By Consumer Demographic (2023-2030). 6.4.8.3 Rest of Europe Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 7. Asia Pacific Vegan Chocolate Market Size and Forecast by Segmentation (By Value and Volume) (2023-2030) 7.1 Asia Pacific Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 7.2 Asia Pacific Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 7.3 Asia Pacific Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 7.4 Asia Pacific Vegan Chocolate Market Size and Forecast, by Country (2023-2030) 7.4.1 China 7.4.1.1 China Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 7.4.1.2 China Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 7.4.1.3 China Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 7.4.2 South Korea 7.4.2.1 South Korea Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 7.4.2.2 South Korea Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 7.4.2.3 South Korea Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 7.4.3 Japan 7.4.3.1 Japan Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 7.4.3.2 Japan Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 7.4.3.3 Japan Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 7.4.4 India 7.4.4.1 India Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 7.4.4.2 India Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 7.4.4.3 India Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 7.4.5 Australia 7.4.5.1 Australia Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 7.4.5.2 Australia Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 7.4.5.3 Australia Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 7.4.6 Indonesia 7.4.6.1 Indonesia Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 7.4.6.2 Indonesia Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 7.4.6.3 Indonesia Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 7.4.7 Malaysia 7.4.7.1 Malaysia Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 7.4.7.2 Malaysia Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 7.4.7.3 Malaysia Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 7.4.8 Vietnam 7.4.8.1 Vietnam Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 7.4.8.2 Vietnam Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 7.4.8.3 Vietnam Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 7.4.9 Taiwan 7.4.9.1 Taiwan Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 7.4.9.2 Taiwan Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 7.4.9.3 Taiwan Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 7.4.10.2 Bangladesh Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 7.4.10.3 Bangladesh Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 7.4.11 Pakistan 7.4.11.1 Pakistan Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 7.4.11.2 Pakistan Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 7.4.11.3 Pakistan Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 7.4.12.2 Rest of Asia Pacific Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 7.4.12.3 Rest of Asia Pacific Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 8. Middle East and Africa Vegan Chocolate Market Size and Forecast by Segmentation (By Value and Volume) (2023-2030) 8.1 Middle East and Africa Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 8.2 Middle East and Africa Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 8.3 Middle East and Africa Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 8.4 Middle East and Africa Vegan Chocolate Market Size and Forecast, by Country (2023-2030) 8.4.1 South Africa 8.4.1.1 South Africa Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 8.4.1.2 South Africa Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 8.4.1.3 South Africa Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 8.4.2 GCC 8.4.2.1 GCC Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 8.4.2.2 GCC Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 8.4.2.3 GCC Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 8.4.3 Egypt 8.4.3.1 Egypt Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 8.4.3.2 Egypt Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 8.4.3.3 Egypt Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 8.4.4 Nigeria 8.4.4.1 Nigeria Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 8.4.4.2 Nigeria Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 8.4.4.3 Nigeria Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 8.4.5.2 Rest of ME&A Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 8.4.5.3 Rest of ME&A Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 9. South America Vegan Chocolate Market Size and Forecast by Segmentation (By Value and Volume) (2023-2030) 9.1 South America Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 9.2 South America Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 9.3 South America Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 9.4 South America Vegan Chocolate Market Size and Forecast, by Country (2023-2030) 9.4.1 Brazil 9.4.1.1 Brazil Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 9.4.1.2 Brazil Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 9.4.1.3 Brazil Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 9.4.2 Argentina 9.4.2.1 Argentina Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 9.4.2.2 Argentina Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 9.4.2.3 Argentina Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Vegan Chocolate Market Size and Forecast, By Product Type (2023-2030) 9.4.3.2 Rest Of South America Vegan Chocolate Market Size and Forecast, By Product Form(2023-2030) 9.4.3.3 Rest Of South America Vegan Chocolate Market Size and Forecast, By Distribution Channel (2023-2030) 10. Global Vegan Chocolate Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 Distribution Channel Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Market Structure 10.5.1 Market Leaders 10.5.2 Market Followers 10.5.3 Emerging Players 10.6 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Theo Chocolate 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Product Form 11.2 Follow Your Heart 11.3 Lake Champlain Chocolates 11.4 Go Max Green 11.5 Pascha Chocolate 11.6 Plamil 11.7 No Whey! Foods 11.8 Hip Chocolate 11.9 Enjoy Life Foods 11.10 Verb Chocolate 11.11 Nucao 11.12 Goodio Chocolate 11.13 Conscious Chocolate 11.14 Vegan Supply 11.15 Tony's Chocolonely 11.16 Moo Free Chocolates 11.17 Sunspire 11.18 Green & Black's 11.19 Doisy & Dam 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary