US Artificial Meat Market size is expected to reach nearly US$ 2788.4 Mn by 2026 with the CAGR of 94.7% during the forecast period.To know about the Research Methodology :- Request Free Sample Report

US Artificial Meat Market Overview:

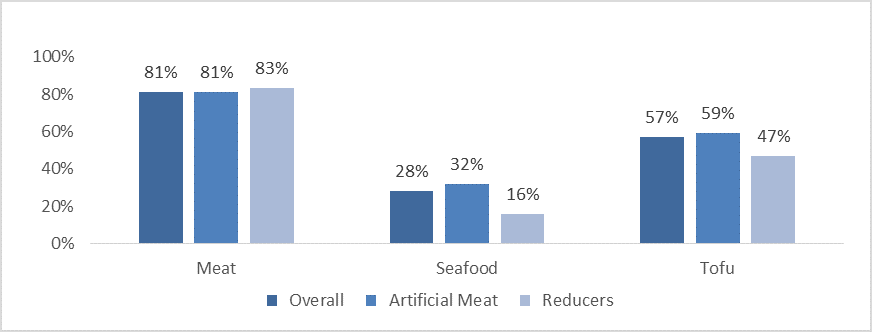

The market for artificial meat is forecast to double during the forecast period. According to MMR report, the US artificial meat market was valued at 12.1 Bn US dollars in the year 2019 & is expected to grow at a GAGR of around 15 percent, reaching almost 28 Bn dollars by 2026. In the year 2030, artificial meat & cultured meat will have a market share of approximately 30 percent of the USD 1.4 Tr. The artificial fish & seafood market is now in its beginning, with annual sales of only USD 10 Mn in the United States. Also, the quality, variety, & accessibility of these products is greater to cheese although not to milk. Publics’ robust motivation to eat substitutes to animal meat signifies an opportunity for businesses wanting to take benefit of gaps in the market & progress on participants’ products. On the other hand, seafood substitute products have a lesser penetration rate (28 percent for the total sample) compared to meat substitutes which mimic meat, & there is an extensive difference between reducers & artificial meat eaters (16 percent). There is also an important difference between the consumption rate of tofu & tempeh for artificial meat eaters (59 percent) versus reducers (47 percent).Consumption rates of meat alternatives:

Causes why customers would like to see more meat substitutes:

There is a shortage of choices in terms of meat substitutes, artificial meat seafood, and tofu or tempeh, as showed by both reducers & artificial meat eaters. Respondents think that there are not sufficient choices on supermarket shelves, mainly in the case of (Artificial meat) seafood, with 85 percent of (artificial meat) eaters stating that they would like to see more seafood choices. In comparison to meat substitutes, the selection of (artificial meat) seafood generally available is very partial & mostly contains of fish fingers or crumbed fish burgers. MMR report suggest manufacturers to develop & launch fish fillets & other popular fish products in order to fill the unmet request in the market. Price is also a significant motivator when it comes to meat substitutes, with 12 percent of respondents stating that meat substitutes are too expensive.Vegans in the U.S:

Across the US, there are growing numbers of vegan & vegetarian restaurants while most supermarkets usually offer substitutes to meat & dairy products on their shelves. The number of social media societies catering to vegetarians & vegans has also ballooned while most individuals know at least one friend or family member who has ditched animal-products & taken up a virtuously artificial meat diet. Despite the vegetarians & vegans are actually pretty rare in American consumption circles today. When it arises to income, both diets are more common among individuals earning less than USD 30,000 while they are rarest among high earners. Politically, substantial Americans are far more likely than moderates or traditionalists to ditch meat. MMR report found that 11 % of liberals are vegetarian while 5 % are vegan. By comparison, only 2 % of conservatives are either vegan or vegetarian.Big Meat Companies:

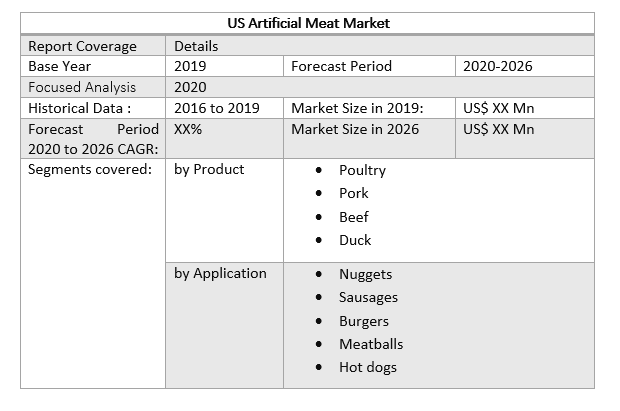

Beyond Meat & Difficult Foods, new companies that share a penchant for superlatives & a promise to caring the environment, have dominated the relatively new market for vegetarian food which looks & tastes like meat. But with artificial meat burgers, sausages & chicken progressively popular & available in fast-food restaurants & grocery stores through the US, a new group of firms has started making meatless meat: the food corporations & meat producers that Beyond Meat & Impossible Foods initially set out to disrupt. In new months, main food firms such as Tyson, Smithfield, Perdue, and Hormel & Nestlé have rolled out their own meat substitutes, filling supermarket shelves with artificial meat burgers, meatballs & chicken nuggets. Once mainly the domain of vegans & vegetarians, artificial meat is fast becoming an essential of more people’s diets, as customers look to decrease their meat intake amid worries about its health effects & contribution to climate change. Over the past 5 months, Beyond Meat’s stock price has soared & Impossible Foods’ deal to deliver plant-based Whoppers at Burger King has encouraged a wave of fast-food chains to examination similar products. MMR Analysts project that the market for plant-based protein & lab-created meat substitutes could be worth as much as USD 85 Bn by 2030. The report covers Poultry, Pork, Beef, Duck with detailed analysis US Artificial Meat Market industry with the classifications of the market on the, Product, Application & region. Analysis of past market dynamics from 2016 to 2019 is given in the report, which will help readers to benchmark the past trends with current market scenarios with the key players' contribution in it. The report has profiled fifteen key players in the market from different regions. However, the report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different and focus is given on the regional impact on the cost of manufacturing, supply chain, availability of raw Products, labor cost, availability of advanced Type, trusted vendors are analyzed and the report has come up with recommendations for a future hot spot in five regions. The major country’s policies about manufacturing & Covid 19 impact on demand side are covered in the report.Scope of the US Artificial Meat Market: Inquire before buying

US Artificial Meat Market Key Players

• MosaMeat • Just, Inc • SuperMeat • Aleph Farms Ltd • Finless Foods Inc • Integriculture • Balletic Foods • Future Meat Technologies Ltd • Avant Meats Company Limited • Higher Steaks • Appleton Meats • Fork & Goode • Biofood Systems LTD • Mission Barns • BlueNalu, Inc. • Mutable.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: US Artificial Meat Market Size, by Market Value (US$ Mn) 3.1. US Market Segmentation 3.2. US Market Segmentation Share Analysis, 2019 3.3. Geographical Snapshot of the Artificial Meat Market 3.4. Geographical Snapshot of the Artificial Meat Market, By Manufacturer share 4. US Artificial Meat Market Overview, 2019-2026 4.1. Market Dynamics 4.1.1. Drivers 4.1.2. Restraints 4.1.3. Opportunities 4.1.4. Challenges 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the US Artificial Meat Market 5. Supply Side and Demand Side Indicators 6. US Artificial Meat Market Analysis and Forecast, 2019-2026 6.1. US Artificial Meat Market Size & Y-o-Y Growth Analysis. 7. US Artificial Meat Market Analysis and Forecasts, 2019-2026 7.1. Market Size (Value) Estimates & Forecast By Product, 2019-2026 7.1.1. Poultry 7.1.2. Pork 7.1.3. Beef 7.1.4. Duck 7.2. Market Size (Value) Estimates & Forecast By Application, 2019-2026 7.2.1. Nuggets 7.2.2. Sausages 7.2.3. Burgers 7.2.4. Meatballs 7.2.5. Hot dogs 8. Competitive Landscape 8.1. Geographic Footprint of Major Players in the US Artificial Meat Market 8.2. Competition Matrix 8.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 8.2.2. New Product Launches and Product Enhancements 8.2.3. Market Consolidation 8.2.3.1. M&A by Regions, Investment and Verticals 8.2.3.2. M&A, Forward Integration and Backward Integration 8.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 8.3. Company Profile : Key Players 8.3.1. MosaMeat. 8.3.1.1. Company Overview 8.3.1.2. Financial Overview 8.3.1.3. Geographic Footprint 8.3.1.4. Product Portfolio 8.3.1.5. Business Strategy 8.3.1.6. Recent Developments 8.3.2. Just, Inc 8.3.3. SuperMeat 8.3.4. Aleph Farms Ltd 8.3.5. Finless Foods Inc 8.3.6. Integriculture 8.3.7. Balletic Foods 8.3.8. Future Meat Technologies Ltd 8.3.9. Avant Meats Company Limited 8.3.10. Higher Steaks 8.3.11. Appleton Meats 8.3.12. Fork & Goode 8.3.13. Biofood Systems LTD 8.3.14. Mission Barns 8.3.15. BlueNalu, Inc. 8.3.16. Mutable 8.3.17. Seafuture Sustainable Biotech 8.3.18. Shiok Meats 8.3.19. Wild Type 8.3.20. Lab farm Foods 8.3.21. Kiran Meats 8.3.22. Cubiq Foods 8.3.23. Cell Farm FOOD Tech 8.3.24. Granjua Celular S.A. 9. Primary Key Insights