The Carotenoids Market size was valued at USD 4.7 Billion in 2023 and the total Carotenoids revenue is expected to grow at a CAGR of 4.5 % from 2024 to 2030, reaching nearly USD 6.4 Billion by 2030.Carotenoids Market Overview:

The Carotenoids market is a dynamic sector driven by the increasing demand for natural colorants, nutritional supplements, and functional ingredients. Carotenoids, natural pigments present in plants and microorganisms, play a pivotal role in the vibrant colors of fruits and vegetables while offering notable antioxidant properties. The global Carotenoids market experiences robust growth, fueled by rising awareness of health benefits and the surging demand for clean-label products in the food and beverage industry. These natural pigments find applications not only in the food sector but also in pharmaceuticals, cosmetics, animal feed, and the nutraceutical industry. Factors contributing to the growth of the Carotenoids market include the expanding application scope, the trend towards natural and organic products, and increasing consumer preference for health-conscious choices. The market is further propelled by the regulatory landscape, with stringent regulations favoring natural ingredients over synthetic additives. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Carotenoids Market.To know about the Research Methodology :- Request Free Sample Report

Carotenoids Market Dynamics

Growing Demand for Natural Food Products to Favor Growth The all-natural trend that is echoing throughout the world is essentially driving the global carotenoid market. The rising aversion to the use of synthetic feed additives and chemicals due to their negative effects on animal health is expected to fuel demand for natural carotenoids in the future years. Consumer preference for goods using all-natural components over synthetic tetraterpenoids has increased in the worldwide food and beverage and cosmetics sectors because to their potential health and aesthetic advantages. For example, Peach & Lily, a Korean skincare and cosmetic goods firm, will release Pure Peach Retinoic Eye Cream in August 2020, which combines beta-carotene and vitamin A. The lotion is useful for addressing issues such as dark circles, fine wrinkles, and loose skin around the eyes. Increasing Adoption of Nutraceutical Products to Propel Market Growth Aside from allelopathic medications, alternative therapy options for diabetes, eye ailments, and other lifestyle diseases are gaining favor. Preventive medicine is a catchphrase that has prompted manufacturers and processors to develop nutraceuticals like nutritional supplements and functional meals made from natural components. Geriatric nutrition is an important use for carotenes due to their strong antioxidant capacity, since they give protection against oxidative stress, which is mostly caused by ageing processes, pollution, and so on. All of these variables contribute to the global sales of this industry. Growing Demand for Natural Skincare Cosmetics to Surge Demand Consumers' awareness of aesthetics and appearance has grown dramatically in tandem with the development in health and wellness concerns. This has increased global demand for effective skincare and cosmetics products. Carotenoids have been found as potent antioxidants that may be employed in the composition of skin care products to improve skin tone, preserve skin firmness, and protect against UV radiation exposure. The increase in consumer expenditure on natural skin brightening and anti-aging treatments is predicted to create several application opportunities for new tetraterpenoids, boosting their market growth. For example, naturally occurring colourless carotenoids found in tomatoes, according to Lucas Meyers Cosmetics, an Asian cosmetic ingredient firm, may be simply utilised in the development of natural cosmetics products. High Price of Natural Pigments to Hamper Market Growth The huge price gap between synthetic carotenoids and natural tetraterpenoids is expected to be a key impediment to market expansion, particularly among low-income or emerging nations. Furthermore, the uncontrolled and excessive use of carotene in industrialised markets is linked to health hazards. This is anticipated to be one of the major problems in the global market.

Fig: General scheme of biotechnological processes for carotenoids production.

Carotenoids Market Segment Analysis

Based on Type, the Carotenoids market is segmented into Astaxanthin, Beta-carotene, Lutein, Lycopene, Canthaxanthin, Zeaxanthin, and Other types (capsanthin, annatto, alpha-carotene, and apocarotenal). Beta-carotene and astaxanthin are currently dominant, and their Carotenoids market demand is exceptionally strong. The possible function of the aforementioned pigments in strengthening immunity and producing a variety of substantial health advantages is one of the main reasons for their appeal. The global Carotenoids market is ripe for novel pigments that are supplied responsibly and deliver better functions. For example, the US Food and Drug Administration authorised Arthrospira and Phycocyanin extracts for use in chewing gum, candy, and other forms of sweets in 2013-2014. Such regulatory support and enabling policy frameworks are likely to accelerate market expansion. Microalga extraction sources have grown in economic relevance in recent years. Additionally, the cost-effective methods to extract the tetraterpenoids from various types of microalga sources are anticipated to offer immense opportunities to the market players operating in the industry. Based on Application, the Carotenoids market is segmented into Feed, Food & and beverages, Dietary supplements, Cosmetics, and Pharmaceuticals. Carotenoids are widely utilized in animal feed products for chicken, fish, and shrimp because of their coloring qualities. As a result, animal feed is the product's most popular use. Externally adding the substance in their diet enhances and improves the color of egg yolks, broiler skin, fish, and crustaceans. They can increase reproduction and enhance animal health. According to several field research, feeding beta-carotene has a good influence on increasing the fertility of cattle, pigs, and horses. Within the food and beverage market (food colourants), applications range from processed food items such as bread, dairy, drinks, and so on to nutritional supplements. As consumers become more aware of the health advantages of foods containing natural hues, there has been a continuous and noticeable increase in demand for organic and natural food options. A noteworthy increase in the demand, manufacture, and consumption of functional food items and dietary supplements due to their health-promoting features has given natural ingredients a boost. Based on Source, the Carotenoids market is segmented into Natural and Synthetic. The availability sourced from synthetic sources is currently high and they hold the major carotenoids market revenue share owing to their low cost and ease of extraction. However, the demand for pigments sourced from natural sources is amplifying as consumers are inclining towards food, cosmetics and pharmaceuticals with other products that are produced by adopting natural ingredients. The segment is expected to grow at a substantial CAGR during the forecast period as consumer's preferences are changing rapidly and the demand for organic products is rising at a steady pace. Based on Formulations, the Carotenoids market has been segmented as follows oil suspension, powder, beadlet, and emulsion. During the forecast period, the beadlet segment is expected to dominate the carotenoids market. Carotenoid beadlets are free-flowing spherical particles created by spray drying. They are often wrapped in aluminium foil and stored in a cold, dry location away from direct light, oxygen, and heat. Other significant advantages of utilising beadlet formulations include improved stability, cold water dispersion, and shelf life extension.Carotenoids Market Regional Insights

Because of the increased use of these additives in feed, supplement, food, pharmaceutical, and cosmetic applications, Asia Pacific is estimated to witness significant growth. Technological developments, industrial expansion, economic growth, and cheap manufacturing costs in nations such as China, Japan, and India are expected to fuel the sector. The region's expanding middle-class population, educational growth, and rising disposable incomes have increased consumer knowledge of the health advantages of dietary supplements. Furthermore, the existence of major pharmaceutical firms such as Dr. Reddy's Laboratories, Cipla, Sun Pharmaceutical, GSK, Roche, and Novo Nordisk would contribute to market expansion. Europe was the biggest Carotenoids market, with revenue estimated to expand at a CAGR of 4.9 percent from 2022 to 2029 due to growing demand for health supplements and animal feed. The presence of significant manufacturers such as L'Oréal, Unilever, Beiersdorf, Koninklijke DSM (Netherlands), BASF (Germany), Chr. Hansen (Denmark), and Dohler Group (Germany) and Henkel, as well as a well-established cosmetics sector, is expected to be a major factor affecting growth in the region. Furthermore, the region's ageing population has increased demand for lutein, lycopene, and beta-carotene to cure cataracts and lower the risk of diabetes, cancer, and other heart-related diseases. Despite the fact that synthetic carotenoids have a large market share, consumers prefer natural and clean label goods, which is expected to support the expansion of the naturally sourced carotenoids market in this area. Organic and natural have risen to the top of the priority list for food processors worldwide, owing to their contribution to food quality, safety, social convenience, and sustainability. Consumers are becoming more sensitive of their purchasing habits, as food labelling is frequently scrutinized for the origin of components, manufacturing procedures, and the influence of the supply chain on the entire environment. Such characteristics are pushing demand for natural tetraterpenoids over GMO and other synthetic analogues in North American developed Carotenoids markets. Tetraterpenoids are becoming more popular owing to their protective function in the treatment of Vitamin A insufficiency, which is a major public health problem, particularly among young children and pregnant women in low-income African and Southeast Asian nations. In poor nations, vitamin A deficiency is also a major cause of infant death. The increased desire of multinational market participants to extend their company across quickly emerging Asian economies is expected to boost regional market expansion. The rapidly rising animal feed sector in South America, as well as the increasing need for specialized feed, are expected to drive demand for this product in the area. Furthermore, the active engagement of key manufacturing organisations in countries such as Brazil and Chile is expected to boost Carotenoids market growth.Carotenoids Industry Ecosystem: -

Carotenoids Market Competitive Landscape: With the influx of private enterprises from China, India, and other rising nations, the global market remains fiercely competitive. The global market's leading players are pursuing industry consolidation through agreements/partnerships as well as acquisitions. Furthermore, a focus on new product development is one of the leading corporations' chosen tactics for driving market growth. End-use industries are seeking not just high specificity but also improved bioavailability of products, and Kemin Industries is one of the pioneers in the food and feed ingredients Carotenoids market, aggressively capitalising on research and development as well as the launch of natural and organic ingredients. Kemin Animal Nutrition and Health, a division of Kemin Industries, added Organic KEM GLO to its line of carotenoids products in March 2020. The novel carotenoid/pigment is USDA-certified and has the ability to use paprika's normal qualities to evenly distribute colour throughout the meal, delivering uniform density, and egg colour pigmentation. Algatech announced the release of AstaPure-EyeQ, a natural astaxanthin powder to improve eye and brain health, in May 2020. The newly announced product is a scientifically backed and microencapsulated powder with double the bioavailability of regular Carotenoids market goods. ExcelVite, a reputable palm carotene manufacturer, cooperated with the United States Pharmacopeia (USP) in April 2020 to publish a new Plant Carotenes Monograph.

Carotenoids Market Scope: Inquire before buying

Global Carotenoids Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US 4.7 Bn. Forecast Period 2024 to 2030 CAGR: 4.5 % Market Size in 2030: US 6.4 Bn. Segments Covered: by Type Astaxanthin Beta-carotene Lutein Lycopene Canthaxanthin Zeaxanthin Other types Capsanthin Annatto Alpha-carotene Apocarotenal by Application Feed Food & beverages Dietary supplements Cosmetics Pharmaceuticals by Formulations Oil suspension Powder Beadlet Emulsion by Source Natural Synthetic Carotenoids Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Carotenoids Market Key Players:

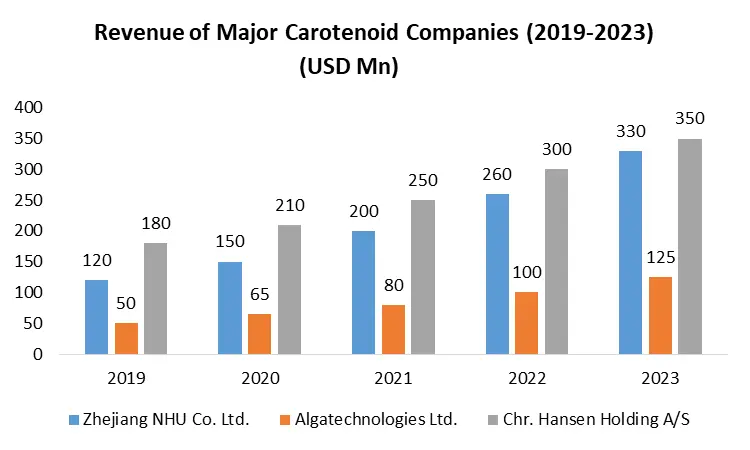

Major Global Key Players: 1. Zhejiang NHU Co. Ltd. (China) - Global 2. Algatechnologies Ltd. (Israel) – Global 3. Chr. Hansen Holding A/S (Denmark) - Global Leading Key Players in North America: 1. DSM Nutritional Products, LLC (USA) 2. BASF Corporation (USA) 3. Kemin Industries, Inc. (USA) 4. FMC Corporation (USA) 5. DDW The Colour House (USA) - North America 6. Novus International Inc. (USA) - North America 7. Sensient Technologies Corporation (USA) - North America 8. Novus International Inc. (USA) - North America 9. Cyanotech Corporation (USA) - North America Market Follower key Players in Europe: 1. BASF SE(Germany) - Global 2. Naturex SA (Givaudan SA) (France) 3. Lycored Limited (Israel) 4. Döhler Group (Germany) - Europe 5. Deinove SAS (France) - Europe Prominent Key player Asia Pacific: 1. Kemin Industries, Inc. (USA) 2. Vidya Europe SAS (France) – Europe 3. Excelvite (Malaysia) - Asia-Pacific 4. Divi's Laboratories Limited (India) - Asia-Pacific 5. Allied Biotech Corporation (Taiwan) - Asia-Pacific 6. Synthite Industries Ltd. (India) - Asia-Pacific 7. Zhejiang NHU Co. Ltd. (China) - Asia-Pacific FAQ’s: 1. What are Carotenoids? Ans: Carotenoids are natural pigments found in plants and microorganisms, imparting vibrant colors to fruits, vegetables, and other organisms. They are known for their antioxidant properties. 2. What Applications do Carotenoids Have in the Market? Ans: Carotenoids find extensive applications in the food and beverage industry as natural colorants, nutritional supplements, and functional ingredients due to their health benefits. 3. Which Regions Contribute Significantly to the Carotenoids Market? Ans: Major contributors to the Carotenoids market include North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. 4. What Factors Drive the Growth of the Carotenoids Market? Ans: Growing awareness of health benefits, increasing demand for natural colorants in the food industry, and the rising trend of clean-label products drive the market growth. 5. Which Key Players Dominate the Carotenoids Market? Ans: Key players in the Carotenoids market include BASF SE, Koninklijke DSM N.V., Chr. Hansen A/S, FMC Corporation, Cyanotech Corporation, and others.

1. Carotenoids Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Carotenoids Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Products specific analysis 2.4.1. Main suppliers and their market positioning 2.4.2. Key customers and adoption rates across different sectors 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Product Segment 2.5.3. End-user Segment 2.5.4. Revenue (2023) 2.5.5. Geographic distribution of major customers 2.6. Market Structure 2.6.1. Market Leaders 2.6.2. Market Followers 2.6.3. Emerging Players 2.7. Mergers and Acquisitions Details 3. Market Size Estimation Methodology 3.1.1. Bottom-Up Approach 3.1.2. Top-Down Approach 4. Market Dynamics 4.1. Carotenoids Market Trends By Region 4.1.1. North America Carotenoids Market Trends 4.1.2. Europe Carotenoids Market Trends 4.1.3. Asia Pacific Carotenoids Market Trends 4.1.4. South America Carotenoids Market Trends 4.1.5. Middle East & Africa (MEA) Carotenoids Market Trends 4.2. Carotenoids Market Dynamics By Region 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.3.1. Threat of New Entrants 4.3.2. Threat of Substitutes 4.3.3. Bargaining Power of Suppliers 4.3.4. Bargaining Power of Buyers 4.3.5. Intensity of Competitive Rivalry 4.4. PESTLE Analysis 4.5. Regulatory Landscape By Region 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. South America 4.5.5. MEA 4.6. Analysis of Government Schemes and Initiatives For the Carotenoids Market Industry 4.7. Supply Chain Analysis 4.7.1. Raw Materials 4.7.2. Manufactures 4.7.3. Distributors 4.7.4. End-Use Industries 4.8. Pricing Analysis 4.8.1. Average Selling Price Trend of Key Players, By Type 4.8.2. Average Selling Price Trend, By Region 4.8.3. Average Selling Price Trend, By Type 4.9. Carotenoids Market Industry Ecosystem 4.9.1. Key players in the Carotenoids Market ecosystem 4.9.2. Role of companies in the Carotenoids Market ecosystem 4.10. Patent Analysis 4.10.1. Key Companies with the Highest number of Patents 4.10.2. Patent Registration Analysis 4.10.3. Number of Patents Granted Still 2024 5. Trade Analysis of Carotenoids Market By Region (2018-2023) 6. Technology Analysis 6.1. Carotenoids and Microencapsulation 6.2. Artificial Intelligence and Machine Learning 7. Investment and Funding Scenario 8. Carotenoids Market: Global Market Size and Forecast By Segmentation (By Value USD Bn) (2023-2030) 8.1. Carotenoids Market Size and Forecast, By Type (2023-2030) 8.1.1. Astaxanthin 8.1.2. Beta-carotene 8.1.3. Lutein 8.1.4. Lycopene 8.1.5. Canthaxanthin 8.1.6. Zeaxanthin 8.1.7. Others 8.2. Carotenoids Market Size and Forecast, By Application(2023-2030) 8.2.1. Feed 8.2.2. Food & beverages 8.2.3. Dietary supplements 8.2.4. Cosmetics 8.2.5. Pharmaceuticals 8.2.6. Others 8.3. Carotenoids Market Size and Forecast, By Formulations(2023-2030) 8.3.1. Oil suspension 8.3.2. Powder 8.3.3. Beadlet 8.3.4. Emulsion 8.4. Carotenoids Market Size and Forecast, By Source(2023-2030) 8.4.1. Natural 8.4.2. Synthetic 8.5. Carotenoids Market Size and Forecast, By Region (2023-2030) 8.5.1. North America 8.5.2. Europe 8.5.3. Asia Pacific 8.5.4. South America 8.5.5. MEA 9. North America Carotenoids Market Size and Forecast By Segmentation (By Value USD Bn) (2023-2030) 9.1. North America Carotenoids Market Size and Forecast, By Type (2023-2030) 9.1.1. Astaxanthin 9.1.2. Beta-carotene 9.1.3. Lutein 9.1.4. Lycopene 9.1.5. Canthaxanthin 9.1.6. Zeaxanthin 9.1.7. Others 9.2. North America Carotenoids Market Size and Forecast, By Application(2023-2030) 9.2.1. Feed 9.2.2. Food & beverages 9.2.3. Dietary supplements 9.2.4. Cosmetics 9.2.5. Pharmaceuticals 9.2.6. Others 9.3. North America Carotenoids Market Size and Forecast, By Formulations(2023-2030) 9.3.1. Oil suspension 9.3.2. Powder 9.3.3. Beadlet 9.3.4. Emulsion 9.4. North America Carotenoids Market Size and Forecast, By Source (2023-2030) 9.4.1. Natural 9.4.2. Synthetic 9.5. North America Carotenoids Market Size and Forecast, By Country (2023-2030) 9.5.1. United States 9.5.1.1. United States Carotenoids Market Size and Forecast, By Type (2023-2030) 9.5.1.1.1. Astaxanthin 9.5.1.1.2. Beta-carotene 9.5.1.1.3. Lutein 9.5.1.1.4. Lycopene 9.5.1.1.5. Canthaxanthin 9.5.1.1.6. Zeaxanthin 9.5.1.1.7. Others 9.5.1.2. United States Carotenoids Market Size and Forecast, By Application(2023-2030) 9.5.1.2.1. Feed 9.5.1.2.2. Food & beverages 9.5.1.2.3. Dietary supplements 9.5.1.2.4. Cosmetics 9.5.1.2.5. Pharmaceuticals 9.5.1.2.6. Others 9.5.1.3. United States Carotenoids Market Size and Forecast, By Formulations(2023-2030) 9.5.1.3.1. Oil suspension 9.5.1.3.2. Powder 9.5.1.3.3. Beadlet 9.5.1.3.4. Emulsion 9.5.1.4. United States Carotenoids Market Size and Forecast By Source (2023-2030) 9.5.1.4.1. Natural 9.5.1.4.2. Synthetic 9.5.2. Canada 9.5.2.1. Canada Carotenoids Market Size and Forecast, By Type (2023-2030) 9.5.2.1.1. Astaxanthin 9.5.2.1.2. Beta-carotene 9.5.2.1.3. Lutein 9.5.2.1.4. Lycopene 9.5.2.1.5. Canthaxanthin 9.5.2.1.6. Zeaxanthin 9.5.2.1.7. Others 9.5.2.2. Canada Carotenoids Market Size and Forecast, By Application(2023-2030) 9.5.2.2.1. Feed 9.5.2.2.2. Food & beverages 9.5.2.2.3. Dietary supplements 9.5.2.2.4. Cosmetics 9.5.2.2.5. Pharmaceuticals 9.5.2.2.6. Others 9.5.2.3. Canada Carotenoids Market Size and Forecast, By Formulations(2023-2030) 9.5.2.3.1. Oil suspension 9.5.2.3.2. Powder 9.5.2.3.3. Beadlet 9.5.2.3.4. Emulsion 9.5.2.4. Canada Carotenoids Market Size and Forecast, By Source (2023-2030) 9.5.2.4.1. Bioplastics 9.5.2.4.2. Natural 9.5.2.4.3. Synthetic 9.5.3. Mexico 9.5.3.1. Mexico Carotenoids Market Size and Forecast, By Type (2023-2030) 9.5.3.1.1. Astaxanthin 9.5.3.1.2. Beta-carotene 9.5.3.1.3. Lutein 9.5.3.1.4. Lycopene 9.5.3.1.5. Canthaxanthin 9.5.3.1.6. Zeaxanthin 9.5.3.1.7. Others 9.5.3.2. Mexico Carotenoids Market Size and Forecast, By Application(2023-2030) 9.5.3.2.1. Feed 9.5.3.2.2. Food & beverages 9.5.3.2.3. Dietary supplements 9.5.3.2.4. Cosmetics 9.5.3.2.5. Pharmaceuticals 9.5.3.2.6. Others 9.5.3.3. Mexico Carotenoids Market Size and Forecast, By Formulations(2023-2030) 9.5.3.3.1. Oil suspension 9.5.3.3.2. Powder 9.5.3.3.3. Beadlet 9.5.3.3.4. Emulsion 9.5.3.4. Mexico Carotenoids Market Size and Forecast, By Source (2023-2030) 9.5.3.4.1. Natural 9.5.3.4.2. Synthetic 10. Europe Carotenoids Market Size and Forecast By Segmentation (By Value USD Bn) (2023-2030) 10.1. Europe Carotenoids Market Size and Forecast, By Type (2023-2030) 10.2. Europe Carotenoids Market Size and Forecast, By Application(2023-2030) 10.3. Europe Carotenoids Market Size and Forecast, By Formulations(2023-2030) 10.4. Europe Carotenoids Market Size and Forecast, By Source (2023-2030) 10.5. Europe Carotenoids Market Size and Forecast, By Country (2023-2030) 10.5.1. United Kingdom 10.5.1.1. United Kingdom Carotenoids Market Size and Forecast, By Type (2023-2030) 10.5.1.2. United Kingdom Carotenoids Market Size and Forecast, By Application(2023-2030) 10.5.1.3. United Kingdom Carotenoids Market Size and Forecast, By Formulations(2023-2030) 10.5.1.4. United Kingdom Carotenoids Market Size and Forecast By Source (2023-2030) 10.5.2. France 10.5.2.1. France Carotenoids Market Size and Forecast, By Type (2023-2030) 10.5.2.2. France Carotenoids Market Size and Forecast, By Application(2023-2030) 10.5.2.3. France Carotenoids Market Size and Forecast, By Formulations(2023-2030) 10.5.2.4. France Carotenoids Market Size and Forecast, By Source (2023-2030) 10.5.3. Germany 10.5.3.1. Germany Carotenoids Market Size and Forecast, By Type (2023-2030) 10.5.3.2. Germany Carotenoids Market Size and Forecast, By Application(2023-2030) 10.5.3.3. Germany Carotenoids Market Size and Forecast, By Formulations(2023-2030) 10.5.3.4. Germany Carotenoids Market Size and Forecast, By Source (2023-2030) 10.5.4. Italy 10.5.4.1. Italy Carotenoids Market Size and Forecast, By Type (2023-2030) 10.5.4.2. Italy Carotenoids Market Size and Forecast, By Application(2023-2030) 10.5.4.3. Italy Carotenoids Market Size and Forecast, By Formulations(2023-2030) 10.5.4.4. Italy Carotenoids Market Size and Forecast, By Source (2023-2030) 10.5.5. Spain 10.5.5.1. Spain Carotenoids Market Size and Forecast, By Type (2023-2030) 10.5.5.2. Spain Carotenoids Market Size and Forecast, By Application(2023-2030) 10.5.5.3. Spain Carotenoids Market Size and Forecast, By Formulations(2023-2030) 10.5.5.4. Spain Carotenoids Market Size and Forecast, By Source (2023-2030) 10.5.6. Sweden 10.5.6.1. Sweden Carotenoids Market Size and Forecast, By Type (2023-2030) 10.5.6.2. Sweden Carotenoids Market Size and Forecast, By Application(2023-2030) 10.5.6.3. Sweden Carotenoids Market Size and Forecast, By Formulations(2023-2030) 10.5.6.4. Sweden Carotenoids Market Size and Forecast, By Source (2023-2030) 10.5.7. Austria 10.5.7.1. Austria Carotenoids Market Size and Forecast, By Type (2023-2030) 10.5.7.2. Austria Carotenoids Market Size and Forecast, By Application(2023-2030) 10.5.7.3. Austria Carotenoids Market Size and Forecast, By Formulations(2023-2030) 10.5.7.4. Austria Carotenoids Market Size and Forecast, By Source (2023-2030) 10.5.8. Rest of Europe 10.5.8.1. Rest of Europe Carotenoids Market Size and Forecast, By Type (2023-2030) 10.5.8.2. Rest of Europe Carotenoids Market Size and Forecast, By Application(2023-2030) 10.5.8.3. Rest of Europe Carotenoids Market Size and Forecast, By Formulations(2023-2030) 10.5.8.4. Rest of Europe Carotenoids Market Size and Forecast, By Source (2023-2030) 11. Asia Pacific Carotenoids Market Size and Forecast By Segmentation (By Value USD Bn) (2023-2030) 11.1. Asia Pacific Carotenoids Market Size and Forecast, By Type (2023-2030) 11.2. Asia Pacific Carotenoids Market Size and Forecast, By Application(2023-2030) 11.3. Asia Pacific Carotenoids Market Size and Forecast, By Formulations(2023-2030) 11.4. Asia Pacific Carotenoids Market Size and Forecast, By Source (2023-2030) 11.5. Asia Pacific Carotenoids Market Size and Forecast, By Country (2023-2030) 11.5.1. China 11.5.1.1. China Carotenoids Market Size and Forecast, By Type (2023-2030) 11.5.1.2. China Carotenoids Market Size and Forecast, By Application(2023-2030) 11.5.1.3. China Carotenoids Market Size and Forecast, By Formulations(2023-2030) 11.5.1.4. China Carotenoids Market Size and Forecast, By Source (2023-2030) 11.5.2. S Korea 11.5.2.1. S Korea Carotenoids Market Size and Forecast, By Type (2023-2030) 11.5.2.2. S Korea Carotenoids Market Size and Forecast, By Application(2023-2030) 11.5.2.3. S Korea Carotenoids Market Size and Forecast, By Formulations(2023-2030) 11.5.2.4. S Korea Carotenoids Market Size and Forecast, By Source (2023-2030) 11.5.3. Japan 11.5.3.1. Japan Carotenoids Market Size and Forecast, By Type (2023-2030) 11.5.3.2. Japan Carotenoids Market Size and Forecast, By Application(2023-2030) 11.5.3.3. Japan Carotenoids Market Size and Forecast, By Formulations(2023-2030) 11.5.3.4. Japan Carotenoids Market Size and Forecast, By Source (2023-2030) 11.5.4. India 11.5.4.1. India Carotenoids Market Size and Forecast, By Type (2023-2030) 11.5.4.2. India Carotenoids Market Size and Forecast, By Application(2023-2030) 11.5.4.3. India Carotenoids Market Size and Forecast, By Formulations(2023-2030) 11.5.4.4. India Carotenoids Market Size and Forecast, By Source (2023-2030) 11.5.5. Australia 11.5.5.1. Australia Carotenoids Market Size and Forecast, By Type (2023-2030) 11.5.5.2. Australia Carotenoids Market Size and Forecast, By Application(2023-2030) 11.5.5.3. Australia Carotenoids Market Size and Forecast, By Formulations(2023-2030) 11.5.5.4. Australia Carotenoids Market Size and Forecast, By Source (2023-2030) 11.5.6. ASEAN 11.5.6.1. ASEAN Carotenoids Market Size and Forecast, By Type (2023-2030) 11.5.6.2. ASEAN Carotenoids Market Size and Forecast, By Application(2023-2030) 11.5.6.3. ASEAN Carotenoids Market Size and Forecast, By Formulations(2023-2030) 11.5.6.4. ASEAN Carotenoids Market Size and Forecast, By Source (2023-2030) 11.5.7. Rest of Asia Pacific 11.5.7.1. Rest of Asia Pacific Carotenoids Market Size and Forecast, By Type (2023-2030) 11.5.7.2. Rest of Asia Pacific Carotenoids Market Size and Forecast, By Application(2023-2030) 11.5.7.3. Rest of Asia Pacific Carotenoids Market Size and Forecast, By Formulations(2023-2030) 11.5.7.4. Rest of Asia Pacific Carotenoids Market Size and Forecast, By Source (2023-2030) 12. South America Carotenoids Market Size and Forecast By Segmentation (By Value USD Bn) (2023-2030) 12.1. South America Carotenoids Market Size and Forecast, By Type (2023-2030) 12.2. South America Carotenoids Market Size and Forecast, By Application(2023-2030) 12.3. South America Carotenoids Market Size and Forecast, By Formulations(2023-2030) 12.4. South America Carotenoids Market Size and Forecast, By Source (2023-2030) 12.5. South America Carotenoids Market Size and Forecast, By Country (2023-2030) 12.5.1. Brazil 12.5.1.1. Brazil Carotenoids Market Size and Forecast, By Type (2023-2030) 12.5.1.2. Brazil Carotenoids Market Size and Forecast, By Application(2023-2030) 12.5.1.3. Brazil Carotenoids Market Size and Forecast, By Formulations(2023-2030) 12.5.1.4. Brazil Carotenoids Market Size and Forecast, By Source (2023-2030) 12.5.2. Argentina 12.5.2.1. Argentina Carotenoids Market Size and Forecast, By Type (2023-2030) 12.5.2.2. Argentina Carotenoids Market Size and Forecast, By Application(2023-2030) 12.5.2.3. Argentina Carotenoids Market Size and Forecast, By Formulations(2023-2030) 12.5.2.4. Argentina Carotenoids Market Size and Forecast, By Source (2023-2030) 12.5.3. Rest Of South America 12.5.3.1. Rest Of South America Carotenoids Market Size and Forecast, By Type (2023-2030) 12.5.3.2. Rest Of South America Carotenoids Market Size and Forecast, By Application(2023-2030) 12.5.3.3. Rest Of South America Carotenoids Market Size and Forecast, By Formulations(2023-2030) 12.5.3.4. Rest Of South America Carotenoids Market Size and Forecast, By Source (2023-2030) 13. Middle East and Africa Carotenoids Market Size and Forecast By Segmentation (By Value USD Bn) (2023-2030) 13.1. Middle East and Africa Carotenoids Market Size and Forecast, By Type (2023-2030) 13.2. Middle East and Africa Carotenoids Market Size and Forecast, By Application(2023-2030) 13.3. Middle East and Africa Carotenoids Market Size and Forecast, By Formulations(2023-2030) 13.4. Middle East and Africa Carotenoids Market Size and Forecast, By Source (2023-2030) 13.5. Middle East and Africa Carotenoids Market Size and Forecast, By Country (2023-2030) 13.5.1. South Africa 13.5.1.1. South Africa Carotenoids Market Size and Forecast, By Type (2023-2030) 13.5.1.2. South Africa Carotenoids Market Size and Forecast, By Application(2023-2030) 13.5.1.3. South Africa Carotenoids Market Size and Forecast, By Formulations(2023-2030) 13.5.1.4. South Africa Carotenoids Market Size and Forecast, By Source (2023-2030) 13.5.2. GCC 13.5.2.1. GCC Carotenoids Market Size and Forecast, By Type (2023-2030) 13.5.2.2. GCC Carotenoids Market Size and Forecast, By Application(2023-2030) 13.5.2.3. GCC Carotenoids Market Size and Forecast, By Formulations(2023-2030) 13.5.2.4. GCC Carotenoids Market Size and Forecast, By Source (2023-2030) 13.5.3. Rest Of MEA 13.5.3.1. Rest Of MEA Carotenoids Market Size and Forecast, By Type (2023-2030) 13.5.3.2. Rest Of MEA Carotenoids Market Size and Forecast, By Application(2023-2030) 13.5.3.3. Rest Of MEA Carotenoids Market Size and Forecast, By Formulations(2023-2030) 13.5.3.4. Rest Of MEA Carotenoids Market Size and Forecast, By Source (2023-2030) 14. Company Profile: Key Players 14.1. Algatechnologies Ltd. 14.1.1. Company Overview 14.1.2. Business Portfolio 14.1.3. Financial Overview 14.1.4. SWOT Analysis (Technological strengths and weaknesses) 14.1.5. Strategic Analysis (Recent strategic moves) 14.1.6. Recent Developments 14.2. Zhejiang NHU Co. Ltd. 14.3. Chr. Hansen Holding A/S 14.4. DSM Nutritional Products, LLC 14.5. BASF Corporation 14.6. Kemin Industries, Inc. 14.7. FMC Corporation 14.8. DDW The Colour House 14.9. Novus International Inc. 14.10. Sensient Technologies 14.11. Novus International Inc. 14.12. Cyanotech Corporation 14.13. Kemin Industries, Inc. 14.14. Vidya Europe SAS 14.15. Excelvite 14.16. Divi's Laboratories Limited 14.17. Allied Biotech Corporation 14.18. Synthite Industries Ltd 14.19. Zhejiang NHU Co. Ltd. 15. Key Findings 16. Analyst Recommendations 16.1. Attractive Opportunities for Players in the Carotenoids Market 16.2. Future Outlooks 17. Carotenoids Market: Research Methodology