The United States Cotton Textile Market size was valued at USD 28.26 Bn in 2022 and is expected to reach USD 49.06 Bn by 2029, at a CAGR of 8.2 %. The United States Cotton Textile Market is undergoing a constant transformation which is being shaped by an array of factors. The resurgence of the "Made in USA" movement signifies a notable shift in consumer preferences, helping local industries, particularly within the cotton textile sector. This movement underscores exceptional quality and bolsters the growth of the U.S. textile industry, with notable examples such as Grown & Sewn exemplifying a steadfast commitment to domestically produced cotton textiles.To know about the Research Methodology :- Request Free Sample Report Sustainability and personalization trends are integral to the market, mirroring a global shift toward responsible consumerism. U.S. cotton textiles align seamlessly with these values, adhering to eco-friendly production processes and meeting consumer demands for customized products. The fusion of these trends not only meets consumer expectations for uniqueness but also positions U.S. cotton textiles as innovative and consumer-centric. Innovative applications of cotton in technical textiles are propelling transformative growth in the U.S. Cotton Textile Market. Technological advancements, such as moisture-activated microcell batteries in cotton fabric, showcase the diverse potential of cotton textiles in healthcare and beyond. The industry's embrace of wearables and smart garments underscores its commitment to being at the forefront of technological innovation. The regulatory landscape, with industry fluctuations, economic factors, and technological advancements, plays a pivotal role in shaping the U.S. Cotton Textile Market. A nuanced understanding of these dynamics is crucial for stakeholders to navigate market volatility and capitalize on emerging opportunities. Global trade dynamics and their impact on the U.S. Cotton Textile Industry shows the industry's resilience amid challenges. The United States assumes a pivotal role in the global cotton market, with fluctuations in trade dynamics between the U.S. and China influencing market trends. Despite challenges, the U.S. Cotton Textile Market retains its significance, with retail prices for apparel indicating sustained demand in 2022.

Cotton Textile Market Dynamics

Resurgence of "Made in USA" Movement The revitalization of the "Made in USA" movement reflects a notable shift in consumer preferences, emphasizing the support for local industries, particularly within the United States Cotton Textile Market. This movement has gathered momentum, driven by an increasing awareness of the profound impact that consumer choices wield on the domestic economy. Presently, consumers actively seek products that bear the label of being manufactured within the United States, with causes like job growth and nurturing a collective sense of national pride. Within the United States cotton textile dynamics, this resurgence has translated into a heightened demand for products that not only boast exceptional quality but also actively contribute to the growth of the U.S. cotton textile industry. Despite a significant portion of apparel being sourced overseas, there persists a notable trend among American designers and brands proudly flaunting their garments as 'Made in the US'. This intriguing paradox portrays a concerted effort to counter the substantial decline in domestic manufacturing activities. American apparel makers and retailers are anticipated to redirect their focus towards manufacturing, driven by a deep-rooted sense of pride in the superior quality of American-made cotton textiles. For instance, family-owned businesses like Grown & Sewn, led by Founder and Lead Designer Rob Magness in Brooklyn, NY, exemplify this sentiment. Magness, driven by the aspiration to provide American quality, founded the brand over a decade ago, underscoring the enduring commitment to domestically produced cotton textiles in the U.S. market.Sustainable and Personalization Trends

The intertwining of sustainability and personalization trends shows a significant shift in consumer values within the United States Cotton Textile Market. This shift is emblematic of a larger global movement towards responsible consumerism, as individuals increasingly prioritize environmentally conscious and socially aware choices. The production of U.S. cotton textiles aligns with this ethos, as manufacturers adhere to stringent standards that encompass both environmental impact and labor practices. By committing to eco-friendly production processes that minimize harm to the environment and prioritize fair treatment and conditions for workers, U.S. cotton textiles emerge as a beacon of responsible and ethical choices in the market. Simultaneously, the United States Cotton Textile Market is witnessing a surge in the demand for personalized and customized products, indicative of a consumer base that seeks unique and individualized experiences. In the realm of U.S. cotton textiles, manufacturers are quick to respond to this demand by harnessing advanced technologies, such as digital printing and textile design software, to deliver customizable products. This trend caters to consumers with specific preferences, allowing them to personalize products based on design, color, or texture. The marriage of customization and personalization not only fulfills consumer expectations for uniqueness but also enables manufacturers to carve a distinct identity in a competitive market. This, in turn, fosters brand loyalty and enhances overall customer satisfaction, positioning U.S. cotton textiles as both innovative and consumer-centric. Innovative Cotton Applications in Technical Textiles The innovative applications of cotton in technical textiles are steering the U.S. Cotton Textile Market growth, underlining a transformative phase driven by advancements in cotton technology. The conventional perceptions of cotton as a material confined to traditional uses are evolving, and the market is growing into new dimensions with the introduction of high-performance cotton fibers tailored for technical and industrial applications. These fibers mark a significant stride, enhancing the versatility of cotton textiles and rendering them suitable for a broader spectrum of industrial purposes. From medical textiles to geotextiles and automotive textiles, these innovations are propelling the diversification of the U.S. cotton textile industry, bolstering its resilience and competitiveness. A notable example of this innovation is evident in Vomaris, which integrates moisture-activated microcell batteries, known as V DOX Technology, into cotton fabric performance apparel. These batteries wirelessly generate a microcurrent, simulating the skin's electrical energy, a crucial element for skin health and regeneration. Furthermore, V DOX Technology powers non-antibiotic antimicrobial wound care products, inspired by the skin's natural electrical healing process. This groundbreaking application showcases the United States Cotton Textile Market potential in addressing crucial areas such as healthcare and wound care. The constant technological advancement has resulted in the increased applications of cotton for making protective clothing, specifically for firefighters, military, biological protective garments and face masks, This contributes significantly to saving lives, as the enhanced usability increases the likelihood of correct usage by first responders and soldiers. The tailored design of each garment addresses specific mission needs, highlighting the industry's commitment to precision and functionality. Moreover, the exploration of wearables, or smart garments, represents a newer research frontier. These textiles are equipped with embedded sensors and functionalities that enable them to perceive and respond, ushering in a new era of interactive and responsive clothing. This intersection of technology and textiles holds promising prospects for applications that go beyond conventional expectations, paving the way for innovative solutions in diverse sectors. The U.S. cotton textile industry's embrace of these cutting-edge advancements showcases a commitment to staying at the forefront of technological innovation and addressing evolving United States Cotton Textile Market demands. Regulatory landscape for US Cotton Textile Industry In the regulatory landscape of the U.S. Cotton Textile Industry, key considerations come into play. Cotton cultivation is predominantly concentrated in the southern-tiered "Cotton Belt" States, spanning from Virginia to California. Within the cities, Texas is the leading producer of cotton in the US, accounting for almost 40 percent of the U.S. Cotton Textile market share. Other significant contributors include Georgia, Mississippi, and Arkansas, with the High Plains region of Texas serving as a focal point due to its favorable climate for cotton cultivation. Regulation of cotton quality and grading falls under the jurisdiction of the U.S. Department of Agriculture (USDA). Industry organizations, such as the National Cotton Council, actively advocate for the interests of cotton growers and other industry participants. Government legislation is a critical aspect of the cotton landscape, exemplified by the 2018 Bipartisan Budget Act, which brought seed cotton (unginned cotton) under coverage in the Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC) programs. The continuity of these programs was ensured through the passage of the 2018 Farm Act, known as the Agricultural Improvement Act of 2018. This legislative framework, detailed in Farm Policy, is instrumental in providing support to cotton farmers and managing risks associated with catastrophic events and weather-related losses. This regulatory framework displays the intricate relationship between governmental policies, industry advocacy, and the overall health of the U.S. Cotton Textile Market. As the industry navigates fluctuations and strives for growth, a comprehensive understanding of these regulatory dynamics is crucial for stakeholders to make informed decisions and capitalize on emerging opportunities. The U.S. Cotton Textile Market is intricately linked to a robust local supply chain that prioritizes sustainability, giving rise to the production of eco-friendly cotton textiles. This trend is part of the broader U.S. Cotton Industry Trends, where a renewed focus on the domestic textile manufacturing sector is evident, signaling the Resurgence of U.S. CottonTextile Manufacturing.Global Trade outlook and Impact on United States Cotton Textile Industry Examining the Global Trade outlook and its Impact on the United States Cotton Textile Industry reveals that cotton is a global commodity with extensive trading in both raw and finished products. As a crucial component of China's economic development, textile manufacturing has been pivotal since its entry into the World Trade Organization in 2001. China's strategic stockpiling of cotton in 2010 led to a surge in demand for foreign cotton, making China the dominant global cotton importer. While China's subsequent policy changes in 2014 impacted import levels, other major importers such as Bangladesh and Vietnam expanded their cotton textile and apparel manufacturing. The trade dynamics between the United States and China have historically positioned them as key partners in the global cotton market. In the 2017–18 marketing year, the United States supplied 45 percent of China's total import volume. However, the threat of tariffs by the United States resulted in significant fluctuations, reducing the U.S. share of China's cotton imports to 11.2 percent in the 2018–19 marketing year. Furthermore, the United States plays a vital role in the global trade of cotton goods, exporting a considerable quantity of raw cotton fiber and importing the majority of its textile and apparel products. China, India, and Bangladesh collectively account for over 50 percent of U.S. cotton product imports, while U.S. cotton product exports, mainly yarn and fabric, contribute to global trade. Despite the challenges and fluctuations in the global market, the U.S. Cotton Textile Market remains resilient. Retail prices for apparel in the U.S. have seen consecutive monthly increases, indicating the continued significance and demand for cotton textiles in 2022.

United States Cotton Textile Market Segment Analysis

The Cotton Textile Market is divided into 3 major segments, namely: Product Type, Distribution Channel and End User Industry. Product types stand as pivotal facets in market segmentation. Three major categories define the landscape: Cotton Apparel, holding a significant United States Cotton Textile Market share by appealing to the fashion-conscious with its blend of comfort and sustainability; Home Textiles, extending the reach of cotton into bedding, towels, and household items, with a focus on comfort and sustainability in home furnishing; and Industrial Textiles, playing a crucial role in applications spanning automotive, agriculture, and healthcare, leveraging the versatility and durability of cotton in industrial settings. The Distribution Channel dimension witnesses a confluence of traditional and modern approaches. Offline channels, represented by brick-and-mortar retail stores, contribute significantly, offering consumers a tactile experience with cotton textiles and the ability to assess quality. In parallel, the Online distribution channel has experienced remarkable growth, fueled by e-commerce platforms, aligning with the increasing preference for the convenience of online shopping. The End-User Industry perspective unfolds a diverse panorama. In Apparel and Fashion, cotton's breathable and comfortable characteristics make it a staple, spanning everyday wear to high-end fashion products. Home Furnishing benefits from cotton's natural and eco-friendly features, particularly in bedding and curtains. Healthcare and Medical applications leverage cotton's hypoallergenic properties, contributing to medical apparel, bandages, and healthcare textiles. Automotive applications see the use of industrial textiles made from cotton in components like seat covers and interior linings, enhancing both comfort and aesthetics. Sports and Outdoor segments benefit from cotton's breathability and comfort, encompassing activewear, outdoor gear, and related products. Agriculture and Farming leverage cotton for protective clothing for farmers and various agricultural textiles. The Others category encapsulates additional niche applications and emerging segments, fostering diversity and innovation within the U.S. Cotton Textile Market.United States Cotton Textile Market Scope: Inquire Before Buying

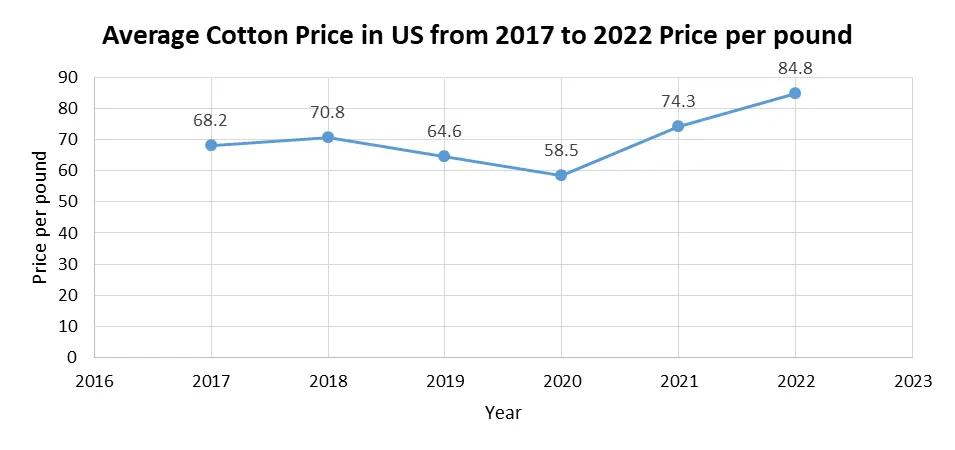

United States Cotton Textile Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 28.26 Bn. Forecast Period 2023 to 2029 CAGR: 8.2% Market Size in 2029: US $ 49.06 Bn. Segments Covered: by Product Type Cotton Apparel Home Textiles Industrial Textiles by Distribution Channel Offline Online by End User Industry Apparel and Fashion Home Furnishing Healthcare and Medical Automotive Sports and Outdoor Agriculture and Farming Others Key Players in the United States Cotton Textile Market

1. TVF 2. Leigh Fibers 3. Delaware Valley Corp. 4. Tabb Textile Company Inc. 5. Hanesbrands Inc (United States) 6. Cotton Incorporated 7. Parkdale Mills 8. VF Corporation 9. Fruit of the Loom: 10. Buhler Quality Yarns 11. Cone Denim 12. U.S. Cotton Frequently Asked Questions and Answers about United States Cotton Textile Market 1. What factors are driving the growth of the United States Cotton Textile market? Ans: The growth of the United States Cotton Textile market is driven by factors such the growing trend of sustainability and the resurgence of Made in USA. 2. Which State is witnessing significant growth in the United States Cotton Textile market? Ans: Texas is expected to witness growth over the forecast period. 3. What is the market size of United States Cotton Textile market? Ans: The United States Cotton Textile Market size was valued at USD 28.26 Bn in 2022 and is expected to reach USD 49.06 Bn by 2029, at a CAGR of 8.2 % over the forecast period. 4. What role does sustainability play in the United States Cotton Textile market? Ans: Sustainability is a significant concern in the United States Cotton Textile market, influencing buying decisions of consumers and recyclability for manufacturers. 5. Which segment held the largest market share in the United States Cotton Textile Market? Ans: The product type segment held the largest market share accounting for more than half of the market.

1. United States Cotton Textile Market: Research Methodology 2. United States Cotton Textile Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. United States Cotton Textile Market: Dynamics 3.1. United States Cotton Textile Market Trends 3.2. United States Cotton Textile Market Drivers 3.3. United States Cotton Textile Market Restraints 3.4. United States Cotton Textile Market Opportunities 3.5. United States Cotton Textile Market Challenges 3.6. PORTER’s Five Forces Analysis 3.7. PESTLE Analysis 3.8. United States Regulatory Landscape 3.9. Key Opinion Leader Analysis For United States Cotton Textile Market 3.10. Technological Advancement in Cotton Textile Industry 3.11. Analysis of Government Schemes and Initiatives For United States Cotton Textile Market 3.12. United States Cotton Textile Industry: Price Trend Analysis 3.13. United States Cotton Textile Industry: Import-Export Dynamics 3.14. The Global Pandemic Impact on United States Cotton Textile Market 4. United States Cotton Textile Market: United States Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2022-2029) 4.1. United States Cotton Textile Market Size and Forecast, by Product Type (2022-2029) 4.1.1. Cotton Apparel 4.1.2. Home Textiles 4.1.3. Industrial Textiles 4.2. United States Cotton Textile Market Size and Forecast, by Distribution channel (2022-2029) 4.2.1. Offline 4.2.2. Online 4.3. United States Cotton Textile Market Size and Forecast, by End-User Industry (2022-2029) 4.3.1. Apparel and Fashion 4.3.2. Home Furnishing 4.3.3. Healthcare and Medical 4.3.4. Automotive 4.3.5. Sports and Outdoor 4.3.6. Agriculture and Farming 4.3.7. Others 5. United States Cotton Textile Market: Competitive Landscape 5.1. MMR Competition Matrix 5.2. Competitive Landscape 5.3. Key Players Benchmarking 5.3.1. Company Name 5.3.2. Service Segment 5.3.3. End-user Segment 5.3.4. Revenue (2022) 5.3.5. Company Locations 5.4. Leading United States Cotton Textile Market Companies, by Market Capitalization 5.5. Market Structure 5.5.1. Market Leaders 5.5.2. Market Followers 5.5.3. Emerging Players 5.6. Mergers and Acquisitions Details 6. Company Profile: Key Players 6.1. TVF 6.1.1. Company Overview 6.1.2. Business Portfolio 6.1.3. Financial Overview 6.1.4. SWOT Analysis 6.1.5. Strategic Analysis 6.1.6. Recent Developments 6.2. Leigh Fibers 6.3. Delaware Valley Corp. 6.4. Tabb Textile Company Inc. 6.5. Hanesbrands Inc (United States) 6.6. Cotton Incorporated 6.7. Parkdale Mills 6.8. VF Corporation 6.9. Fruit of the Loom: 6.10. Buhler Quality Yarns 6.11. Cone Denim 6.12. U.S. Cotton 7. Key Findings 8. Industry Recommendations 9. Terms and Glossary