The global targeted sequencing and resequencing market size was valued at USD 6.17 billion in 2023 and is expected to grow at CAGR of 22.59% from 2024 to 2030, reaching a market size of approximately US$ 25.67 billion by 2030. Targeted sequencing is one of the effective and powerful techniques that allow the selective modification and sequencing of specific genomic regions or sequences for identifying different mutations, rare variants and structural rearrangements associated with diseases and therapeutic responses.To know about the Research Methodology :- Request Free Sample Report The Targeted Sequencing and Resequencing Market has witnessed sufficient growth, driven by the increase in demand for genomic analysis and variant detection and also by the rise in adoption of next-generation sequencing (NGS) technologies in research and clinical diagnostics. The nonstop technological developments and increase in adoption of NGS technology are expected to drive the market share. The report provides a comprehensive analysis of the global targeted sequencing and resequencing market, which includes the current market size, overall segmentation analysis (Technology, Types, Applications, Product, End-users, and Regions), market trends, drivers, restraints, opportunities, scope, and key players.

Global Targeted Sequencing and Resequencing Market Dynamics

The market is analysed and expected to grow as continuous progress in the utilization of Targeted sequencing and resequencing technology has been seen globally. The rise in the use of precision medicine and targeted sequencing in molecular diagnostics generates new opportunities in the market for growth. Potential drivers for the growth of targeted sequencing and resequencing market: The surged awareness and demand for personalized medicine have increased as the risk and cases of genetic disorders increased. The growing uptake of NGS (Next Generation Sequencing) technology helps to propel the targeted sequencing and resequencing market. The rise in the need for precision medicine and the accessibility of high-tech sequencing technologies increases, the market will expand in the next years. As of 2023, the global market for personalized medicine therapeutics was expected to be worth US$ 900.67 Bn. at a CAGR of 6.21% during the forecast period 2030. The advancement in high-throughput sequencing platforms and sequencing technologies transformed the field of genomics. The development has significantly reduced the cost per base and time requirement, this makes targeted sequencing and resequencing accessible and affordable for researchers. Impact of restraints on global targeted sequencing and resequencing market: The targeted sequencing and resequencing market faces a particular challenge with regulatory and ethical concerns involving three main ethical factors: identity privacy, transparent consent, and return of results. Regulatory authorities like in the U.S the Food and Drug Administration (FDA) inspects and assures the validity, quality, and safety majors of sequencing techniques before approval so that they will be effective and safe to utilize for various applications. The high cost of sequencing and data analysis is one of challenge that targeted sequencing and resequencing market is facing. Efficient bioinformatics tools and expertise are required to process, analyse, and interpret the giant genomic sequencing data accurately, which is difficult to manage and control for researchers. The lack of skilled professionals is also one of the restraints to the market. There are very few professionals available who are proficient in handling advanced sequencing technologies. This affects the financial factors as payments for skilled professionals are high. Potential growth opportunities for targeted sequencing and resequencing market: Targeted sequencing and resequencing methods are expanding in the research and diagnostics fields like agriculture, infectious disease monitoring and detection, and forensics. The discovery of GMO crops, diagnosis of infectious disease, and forensic DNA examination are the present fresh opportunities for market expansion. Law enforcement is extensively using genomics in support of criminal investigations and for related purposes, such as the identification of human remains. The integration of AI and Machine Learning in the field of Bioinformatics helps to develop AI-powered bioinformatics tools that hold promising opportunities in the Targeted Sequencing and Resequencing Market for improving the process of data analysis and decision-making process. Recent trends and development in targeted sequencing and resequencing market: The recent trends in the Targeted Sequencing and Resequencing market include the expansion of clinical applications, advancements in data analysis tools, increasing awareness and adoption of long-read sequencing, and the utilization of advanced sequencing techniques in fields like oncology, rare disease and genetic disease diagnostics, and driving its continuous development and demand. Illumina and Geneseeq collaborated in March 2021 to form IVD NGS kits using Illumina's NextSeq 550Dx sequencing equipment (authorized by China's NMPA) in China, which is used for cancer treatment. In September 2022 Illumina Inc. released the NovaSeq X series, which improves the turnaround times and also simplifies the data with DRAGEN onboard. The new production scale helps to get the result faster with up to 2.5X Throughput compared to the NovaSeq 6000 System.Targeted Sequencing and Resequencing Market Segment Analysis

The Targeted Sequencing and Resequencing Market is segmented by different factors. By analyzing the market of these segments, we can identify which segment is the largest in the market which segment has the highest growth rate, and segment which offers the opportunity in the future. The market is segmented by technology, by type, by product, by application, by End use and also by region. By Technology The technology segment for Targeted Sequencing and Resequencing contributed largest maximum revenue share in 2023. This involves: 1. Sequencing 2. Re-sequencingBy Product By product, the Targeted Sequencing and Resequencing market is segmented into instruments, reagents, and software. Instruments required in the techniques such as sequencing platforms, components for sample preparation and other essential materials. Reagents that are used for sequencing includes various kits, enzymes, chemicals and buffers. Researchers use different software and services for interpretation and analysis of genomic data like bioinformatics and data analysis tools.

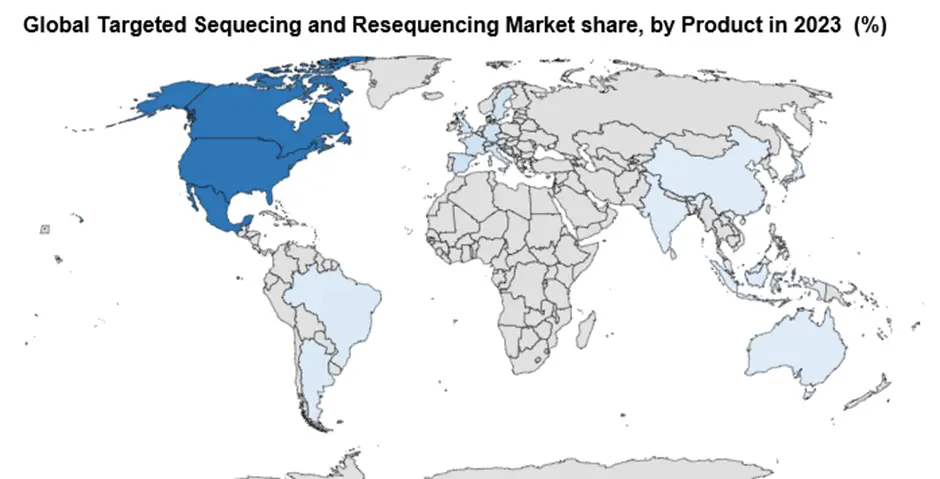

By Application By Application, the Targeted Sequencing and Resequencing market is segmented as clinical application, plant & animal sciences, drug development and others. In that the clinical segment dominated and generated maximum revenue share in 2023. The clinical segment further segments into oncology, genetic screening and testing, infectious diseases applications. In that also, as sequencing techniques are broadly used to identify or diagnose the cancer-related genetic mutations, oncology represents the signification application segment in the market. By End Users By End-use, the Targeted Sequencing and Resequencing market is segmented as academic and research institutes, pharmaceutical and biotechnology companies, hospitals and clinics, and others. As the academic study actively involved conduct genomic research and development the segment generated maximum revenue share in 2023. By Region The Targeted Sequencing and Resequencing Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA region is North American region, the market generated maximum revenue share in 2023.

Targeted Sequencing and Resequencing Market Regional analysis:

North America dominated the Targeted Sequencing and Resequencing market, generated maximum revenue share in 2023. The region has large and well developed academic and research institutions and also has strong presence of pharmaceutical and biotechnology market, this promotes the demand of sequencing and resequencing technologies. The region majorly focuses on quality medicines, personalized genomics, and development in next-generation sequencing (NGS) technologies. The key market players like Illumina, Roche, and Life Technologies have contributed in the market growth of market. Europe held a significant market share in Targeted Sequencing and Resequencing Market in 2023. The region focuses on genomics studies, genetic diagnostics, and the use of sequencing technologies in clinical applications with respect to population, this leads increase in the demand for sequencing techniques. The market in Asia Pacific is expected as one of market to witness the fastest growth rate in the coming years focusing on increasing R&D expenditure and increasing the availability of advanced technology for drug discovery and development. The countries in the region like India, China, Japan and Australia have significant growth for use of sequencing technologies in pharmaceutical, agriculture, and forensic sectors. The global market of targeted sequencing and resequencing is increasing as we focus more on awareness, advancements in technologies, increase demand for quality and personalized medicine, increase use for genetic diagnostics and forensic applications. The trajectory of growth depends on cost effectiveness, innovations and collaboration and merging. Targeted Sequencing and Resequencing Market Competitive landscape: The key players in market, such as Illumina, Roche, and Life Technologies are involved in the development of faster and high-throughput sequencing technology which make them at the top of market. The key strategy employed by Illumina or most of the companies is strategic collaborations with other compatible academic institutions and companies to expand their market presence and to explore new opportunities. In March 2021, Illumina and Geneseeq collaborated together to create and market the IVD NGS kits for cancer treatment in China. Thermo Fisher and Mayo Clinic collaborated in April 2021, to provide novel solutions by accelerating clinical validation and commercialization of selected NGS, immunology diagnostic tools, and mass spectrometry. In 2023, Aglent Technologies acquired Avida Biomed to develop the new NGS genomic tools which are used in cancer research. The Companies together assists in diagnosis and prognosis, clinical trials, therapy selections, and biomarkers synthesis.Targeted Sequencing and Resequencing Market Scope: Inquire before buying

Global Targeted Sequencing and Resequencing Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 6.17 Bn. Forecast Period 2024 to 2030 CAGR: 22.59% Market Size in 2030: US $ 25.67 Bn. Segments Covered: by Technology Sequencing Re-sequencing by Type DNA-based targeted sequencing RNA-based targeted sequencing by Product Instruments Reagents Software by Application Clinical Application (Oncology, Disorders, Infectious Diseases) Plant & Animal Sciences (Agricultural Research) Drug development (Pharmacogenomics and Forensics) Others by End User Research Institutes and Academic Centres. Pharmaceutical and Biotechnology Companies Hospitals and Clinics Contract Research Organizations (CROs) Others (Forensic Labs, Government Agencies) Targeted Sequencing and Resequencing Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Targeted Sequencing and Resequencing Market, Key Players:

The players covered in the report are selected on the basis of certain criteria are: 1. Illumina, Inc. (North America) 2. Thermo Fisher Scientific, Inc. (North America) 3. Pacific Biosciences of California, Inc. (North America) 4. Oxford Nanopore Technologies Ltd. (Europe) 5. Agilent Technologies, Inc. (North America) 6. Qiagen N.V. (Europe) 7. PerkinElmer, Inc. (North America) 8. BGI Genomics Co., Ltd. (Asia-Pacific) 9. Eurofins Scientific (Europe) 10. 10x Genomics, Inc. (North America) 11. Macrogen, Inc. (Asia-Pacific) 12. Roche Sequencing Solutions, Inc. (North America) 13. PierianDx (North America) 14. MGI Tech Co., Ltd. (Asia-Pacific) 15. Myriad Genetics, Inc. (North America) 16. Novogene Corporation (Asia-Pacific) 17. Agendia NV (Europe) Frequently Asked Questions: 1. Which region has the largest share in the Global Market? Ans: The North America region held the largest share in 2023. 2. What is the growth rate of the Global Targeted Sequencing and Resequencing Market? Ans: The Global Market is expected to grow at a CAGR of 22.59 % during the forecast period 2024-2030. 3. What is the scope of the Global Targeted Sequencing and Resequencing Market report? Ans: The Global Targeted Sequencing and Resequencing Market report helps with the PESTLE, PORTER, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in the Global Targeted Sequencing and Resequencing Market? Ans: The important key players in the Global Targeted Sequencing and Resequencing Market are . Illumina, Inc., Thermo Fisher Scientific, Inc., Pacific Biosciences of California, Inc., Oxford Nanopore Technologies Ltd., Agilent Technologies, Inc. etc. 5. What is the study period of this market? Ans: The Global Market is studied from 2023 to 2030.

1. Targeted Sequencing and Resequencing Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Targeted Sequencing and Resequencing Market: Dynamics 2.1. Targeted Sequencing and Resequencing Market Trends by Region 2.1.1. North America Targeted Sequencing and Resequencing Market Trends 2.1.2. Europe Targeted Sequencing and Resequencing Market Trends 2.1.3. Asia Pacific Targeted Sequencing and Resequencing Market Trends 2.1.4. Middle East and Africa Targeted Sequencing and Resequencing Market Trends 2.1.5. South America Targeted Sequencing and Resequencing Market Trends 2.2. Targeted Sequencing and Resequencing Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Targeted Sequencing and Resequencing Market Drivers 2.2.1.2. North America Targeted Sequencing and Resequencing Market Restraints 2.2.1.3. North America Targeted Sequencing and Resequencing Market Opportunities 2.2.1.4. North America Targeted Sequencing and Resequencing Market Challenges 2.2.2. Europe 2.2.2.1. Europe Targeted Sequencing and Resequencing Market Drivers 2.2.2.2. Europe Targeted Sequencing and Resequencing Market Restraints 2.2.2.3. Europe Targeted Sequencing and Resequencing Market Opportunities 2.2.2.4. Europe Targeted Sequencing and Resequencing Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Targeted Sequencing and Resequencing Market Drivers 2.2.3.2. Asia Pacific Targeted Sequencing and Resequencing Market Restraints 2.2.3.3. Asia Pacific Targeted Sequencing and Resequencing Market Opportunities 2.2.3.4. Asia Pacific Targeted Sequencing and Resequencing Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Targeted Sequencing and Resequencing Market Drivers 2.2.4.2. Middle East and Africa Targeted Sequencing and Resequencing Market Restraints 2.2.4.3. Middle East and Africa Targeted Sequencing and Resequencing Market Opportunities 2.2.4.4. Middle East and Africa Targeted Sequencing and Resequencing Market Challenges 2.2.5. South America 2.2.5.1. South America Targeted Sequencing and Resequencing Market Drivers 2.2.5.2. South America Targeted Sequencing and Resequencing Market Restraints 2.2.5.3. South America Targeted Sequencing and Resequencing Market Opportunities 2.2.5.4. South America Targeted Sequencing and Resequencing Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Targeted Sequencing and Resequencing Industry 2.8. Analysis of Government Schemes and Initiatives For Targeted Sequencing and Resequencing Industry 2.9. Targeted Sequencing and Resequencing Market Trade Analysis 2.10. The Global Pandemic Impact on Targeted Sequencing and Resequencing Market 3. Targeted Sequencing and Resequencing Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 3.1.1. Sequencing 3.1.2. Re-sequencing 3.2. Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 3.2.1. DNA-based targeted sequencing 3.2.2. RNA-based targeted sequencing 3.3. Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 3.3.1. Instruments 3.3.2. Reagents 3.3.3. Software 3.4. Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 3.4.1. Clinical Application (Oncology, Disorders, Infectious Diseases) 3.4.2. Plant & Animal Sciences (Agricultural Research) 3.4.3. Drug development (Pharmacogenomics and Forensics) 3.4.4. Others 3.5. Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 3.5.1. Research Institutes and Academic Centres. 3.5.2. Pharmaceutical and Biotechnology Companies 3.5.3. Hospitals and Clinics Contract Research Organizations (CROs) 3.5.4. Others (Forensic Labs, Government Agencies) 3.6. Targeted Sequencing and Resequencing Market Size and Forecast, by Region (2023-2030) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Targeted Sequencing and Resequencing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 4.1.1. Sequencing 4.1.2. Re-sequencing 4.2. North America Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 4.2.1. DNA-based targeted sequencing 4.2.2. RNA-based targeted sequencing 4.3. North America Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 4.3.1. Instruments 4.3.2. Reagents 4.3.3. Software 4.4. North America Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 4.4.1. Clinical Application (Oncology, Disorders, Infectious Diseases) 4.4.2. Plant & Animal Sciences (Agricultural Research) 4.4.3. Drug development (Pharmacogenomics and Forensics) 4.4.4. Others 4.5. North America Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 4.5.1. Research Institutes and Academic Centres. 4.5.2. Pharmaceutical and Biotechnology Companies 4.5.3. Hospitals and Clinics Contract Research Organizations (CROs) 4.5.4. Others (Forensic Labs, Government Agencies) 4.6. North America Targeted Sequencing and Resequencing Market Size and Forecast, by Country (2023-2030) 4.6.1. United States 4.6.1.1. United States Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 4.6.1.1.1. Sequencing 4.6.1.1.2. Re-sequencing 4.6.1.2. United States Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 4.6.1.2.1. DNA-based targeted sequencing 4.6.1.2.2. RNA-based targeted sequencing 4.6.1.3. United States Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 4.6.1.3.1. Instruments 4.6.1.3.2. Reagents 4.6.1.3.3. Software 4.6.1.4. United States Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 4.6.1.4.1. Clinical Application (Oncology, Disorders, Infectious Diseases) 4.6.1.4.2. Plant & Animal Sciences (Agricultural Research) 4.6.1.4.3. Drug development (Pharmacogenomics and Forensics) 4.6.1.4.4. Others 4.6.1.5. United States Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 4.6.1.5.1. Research Institutes and Academic Centres. 4.6.1.5.2. Pharmaceutical and Biotechnology Companies 4.6.1.5.3. Hospitals and Clinics Contract Research Organizations (CROs) 4.6.1.5.4. Others (Forensic Labs, Government Agencies) 4.6.2. Canada 4.6.2.1. Canada Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 4.6.2.1.1. Sequencing 4.6.2.1.2. Re-sequencing 4.6.2.2. Canada Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 4.6.2.2.1. DNA-based targeted sequencing 4.6.2.2.2. RNA-based targeted sequencing 4.6.2.3. Canada Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 4.6.2.3.1. Instruments 4.6.2.3.2. Reagents 4.6.2.3.3. Software 4.6.2.4. Canada Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 4.6.2.4.1. Clinical Application (Oncology, Disorders, Infectious Diseases) 4.6.2.4.2. Plant & Animal Sciences (Agricultural Research) 4.6.2.4.3. Drug development (Pharmacogenomics and Forensics) 4.6.2.4.4. Others 4.6.2.5. Canada Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 4.6.2.5.1. Research Institutes and Academic Centres. 4.6.2.5.2. Pharmaceutical and Biotechnology Companies 4.6.2.5.3. Hospitals and Clinics Contract Research Organizations (CROs) 4.6.2.5.4. Others (Forensic Labs, Government Agencies) 4.6.3. Mexico 4.6.3.1. Mexico Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 4.6.3.1.1. Sequencing 4.6.3.1.2. Re-sequencing 4.6.3.2. Mexico Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 4.6.3.2.1. DNA-based targeted sequencing 4.6.3.2.2. RNA-based targeted sequencing 4.6.3.3. Mexico Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 4.6.3.3.1. Instruments 4.6.3.3.2. Reagents 4.6.3.3.3. Software 4.6.3.4. Mexico Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 4.6.3.4.1. Clinical Application (Oncology, Disorders, Infectious Diseases) 4.6.3.4.2. Plant & Animal Sciences (Agricultural Research) 4.6.3.4.3. Drug development (Pharmacogenomics and Forensics) 4.6.3.4.4. Others 4.6.3.5. Mexico Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 4.6.3.5.1. Research Institutes and Academic Centres. 4.6.3.5.2. Pharmaceutical and Biotechnology Companies 4.6.3.5.3. Hospitals and Clinics Contract Research Organizations (CROs) 4.6.3.5.4. Others (Forensic Labs, Government Agencies) 5. Europe Targeted Sequencing and Resequencing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 5.2. Europe Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 5.3. Europe Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 5.4. Europe Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 5.5. Europe Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 5.6. Europe Targeted Sequencing and Resequencing Market Size and Forecast, by Country (2023-2030) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 5.6.1.2. United Kingdom Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 5.6.1.3. United Kingdom Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 5.6.1.4. United Kingdom Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 5.6.1.5. United Kingdom Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 5.6.2. France 5.6.2.1. France Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 5.6.2.2. France Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 5.6.2.3. France Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 5.6.2.4. France Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 5.6.2.5. France Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 5.6.3. Germany 5.6.3.1. Germany Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 5.6.3.2. Germany Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 5.6.3.3. Germany Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 5.6.3.4. Germany Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 5.6.3.5. Germany Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 5.6.4. Italy 5.6.4.1. Italy Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 5.6.4.2. Italy Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 5.6.4.3. Italy Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 5.6.4.4. Italy Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 5.6.4.5. Italy Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 5.6.5. Spain 5.6.5.1. Spain Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 5.6.5.2. Spain Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 5.6.5.3. Spain Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 5.6.5.4. Spain Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 5.6.5.5. Spain Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 5.6.6. Sweden 5.6.6.1. Sweden Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 5.6.6.2. Sweden Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 5.6.6.3. Sweden Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 5.6.6.4. Sweden Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 5.6.6.5. Sweden Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 5.6.7. Austria 5.6.7.1. Austria Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 5.6.7.2. Austria Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 5.6.7.3. Austria Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 5.6.7.4. Austria Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 5.6.7.5. Austria Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 5.6.8.2. Rest of Europe Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 5.6.8.3. Rest of Europe Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 5.6.8.4. Rest of Europe Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 5.6.8.5. Rest of Europe Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Targeted Sequencing and Resequencing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 6.2. Asia Pacific Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 6.3. Asia Pacific Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 6.4. Asia Pacific Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 6.5. Asia Pacific Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 6.6. Asia Pacific Targeted Sequencing and Resequencing Market Size and Forecast, by Country (2023-2030) 6.6.1. China 6.6.1.1. China Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 6.6.1.2. China Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 6.6.1.3. China Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 6.6.1.4. China Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 6.6.1.5. China Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 6.6.2. S Korea 6.6.2.1. S Korea Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 6.6.2.2. S Korea Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 6.6.2.3. S Korea Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 6.6.2.4. S Korea Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 6.6.2.5. S Korea Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 6.6.3. Japan 6.6.3.1. Japan Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 6.6.3.2. Japan Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 6.6.3.3. Japan Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 6.6.3.4. Japan Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 6.6.3.5. Japan Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 6.6.4. India 6.6.4.1. India Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 6.6.4.2. India Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 6.6.4.3. India Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 6.6.4.4. India Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 6.6.4.5. India Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 6.6.5. Australia 6.6.5.1. Australia Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 6.6.5.2. Australia Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 6.6.5.3. Australia Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 6.6.5.4. Australia Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 6.6.5.5. Australia Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 6.6.6. Indonesia 6.6.6.1. Indonesia Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 6.6.6.2. Indonesia Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 6.6.6.3. Indonesia Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 6.6.6.4. Indonesia Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 6.6.6.5. Indonesia Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 6.6.7. Malaysia 6.6.7.1. Malaysia Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 6.6.7.2. Malaysia Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 6.6.7.3. Malaysia Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 6.6.7.4. Malaysia Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 6.6.7.5. Malaysia Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 6.6.8. Vietnam 6.6.8.1. Vietnam Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 6.6.8.2. Vietnam Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 6.6.8.3. Vietnam Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 6.6.8.4. Vietnam Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 6.6.8.5. Vietnam Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 6.6.9. Taiwan 6.6.9.1. Taiwan Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 6.6.9.2. Taiwan Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 6.6.9.3. Taiwan Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 6.6.9.4. Taiwan Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 6.6.9.5. Taiwan Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 6.6.10.2. Rest of Asia Pacific Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 6.6.10.3. Rest of Asia Pacific Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 6.6.10.4. Rest of Asia Pacific Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 6.6.10.5. Rest of Asia Pacific Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Targeted Sequencing and Resequencing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 7.2. Middle East and Africa Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 7.3. Middle East and Africa Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 7.4. Middle East and Africa Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 7.5. Middle East and Africa Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 7.6. Middle East and Africa Targeted Sequencing and Resequencing Market Size and Forecast, by Country (2023-2030) 7.6.1. South Africa 7.6.1.1. South Africa Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 7.6.1.2. South Africa Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 7.6.1.3. South Africa Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 7.6.1.4. South Africa Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 7.6.1.5. South Africa Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 7.6.2. GCC 7.6.2.1. GCC Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 7.6.2.2. GCC Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 7.6.2.3. GCC Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 7.6.2.4. GCC Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 7.6.2.5. GCC Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 7.6.3. Nigeria 7.6.3.1. Nigeria Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 7.6.3.2. Nigeria Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 7.6.3.3. Nigeria Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 7.6.3.4. Nigeria Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 7.6.3.5. Nigeria Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 7.6.4.2. Rest of ME&A Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 7.6.4.3. Rest of ME&A Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 7.6.4.4. Rest of ME&A Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 7.6.4.5. Rest of ME&A Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 8. South America Targeted Sequencing and Resequencing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 8.2. South America Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 8.3. South America Targeted Sequencing and Resequencing Market Size and Forecast, by Product(2023-2030) 8.4. South America Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 8.5. South America Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 8.6. South America Targeted Sequencing and Resequencing Market Size and Forecast, by Country (2023-2030) 8.6.1. Brazil 8.6.1.1. Brazil Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 8.6.1.2. Brazil Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 8.6.1.3. Brazil Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 8.6.1.4. Brazil Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 8.6.1.5. Brazil Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 8.6.2. Argentina 8.6.2.1. Argentina Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 8.6.2.2. Argentina Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 8.6.2.3. Argentina Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 8.6.2.4. Argentina Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 8.6.2.5. Argentina Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 8.6.3. Rest Of South America 8.6.3.1. Rest Of South America Targeted Sequencing and Resequencing Market Size and Forecast, by Technology (2023-2030) 8.6.3.2. Rest Of South America Targeted Sequencing and Resequencing Market Size and Forecast, by Type (2023-2030) 8.6.3.3. Rest Of South America Targeted Sequencing and Resequencing Market Size and Forecast, by Product (2023-2030) 8.6.3.4. Rest Of South America Targeted Sequencing and Resequencing Market Size and Forecast, by Application (2023-2030) 8.6.3.5. Rest Of South America Targeted Sequencing and Resequencing Market Size and Forecast, by End User (2023-2030) 9. Global Targeted Sequencing and Resequencing Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Targeted Sequencing and Resequencing Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Illumina, Inc. (North America) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Thermo Fisher Scientific, Inc. (North America) 10.3. Pacific Biosciences of California, Inc. (North America) 10.4. Oxford Nanopore Technologies Ltd. (Europe) 10.5. Agilent Technologies, Inc. (North America) 10.6. Qiagen N.V. (Europe) 10.7. PerkinElmer, Inc. (North America) 10.8. BGI Genomics Co., Ltd. (Asia-Pacific) 10.9. Eurofins Scientific (Europe) 10.10. 10x Genomics, Inc. (North America) 10.11. Macrogen, Inc. (Asia-Pacific) 10.12. Roche Sequencing Solutions, Inc. (North America) 10.13. PierianDx (North America) 10.14. MGI Tech Co., Ltd. (Asia-Pacific) 10.15. Myriad Genetics, Inc. (North America) 10.16. Novogene Corporation (Asia-Pacific) 10.17. Agendia NV (Europe) 11. Key Findings 12. Industry Recommendations 13. Targeted Sequencing and Resequencing Market: Research Methodology 14. Terms and Glossary