Global Clinical Laboratory Service Market size was valued at USD 250.48 Bn. in 2023 and the total Clinical Laboratory Service revenue is expected to grow by 6.1 % from 2024 to 2030, reaching nearly USD 379.12 Bn.Clinical Laboratory Service Market Overview:

Clinical Laboratory Science is known as Medical Laboratory Science or Medical Technology, is the healthcare discipline dedicated to offering essential laboratory information and services essential for the identification and management of diseases. The Clinical Laboratory Service Market presents a comprehensive overview of the evolving landscape in diagnostic healthcare services. Shaped by a multitude of market forces and external influences, this sector is highly responsive to economic indicators and undergoes continual industry evolution. The Clinical Laboratory Service Industry is characterized by its adaptability to external market influences, navigating strategic market changes with resilience. Market segmentation shifts reflect the changing dynamics in customer engagement, highlighting the importance of industry responsiveness.To know about the Research Methodology :- Request Free Sample Report The sector exhibits a robust adaptability to fluctuating market conditions, leveraging growth catalysts to counter market volatility. However, careful market fluctuation analysis becomes imperative to identify potential gaps and strategically position the Clinical Laboratory Service Market for sustained growth. The competitive landscape shifts dynamically as consumer preferences evolve, driven by advancements in technology and regulatory changes. Innovations impact the market significantly, reflecting ongoing technology trends and emphasizing the need for market responsiveness.

Clinical Laboratory Service Market Dynamics

The dynamics of the Clinical Laboratory Service Market are fueled by the escalating occurrences of chronic and infectious illnesses, coupled with the growing imperative for precise and early disease diagnosis procedures. This sector operates within the framework of intricate market dynamics, responding to fluctuations in global health patterns and economic factors. Clinical diagnostic tests emerge as a cornerstone in the identification and characterization of biomarkers for chronic diseases and the detection of microorganisms, aligning with the surging burden of diseases like cancer and tuberculosis (TB). As indicated by the World Health Organization's October 2022 report, the global prevalence of TB reached alarming figures, with 10 million individuals contracting the disease in 2022, further stratified into 5.6 million men, 3.3 million women, and 1.1 million children. The growing prevalence of these disorders establishes a direct correlation with the escalating demand for clinical services, thus driving the market forward. Certain regions, particularly emerging and underdeveloped countries, grapple with market challenges due to the absence of favorable reimbursement policies and the looming risk of erroneous findings. The global market faces obstacles driven by shifting consumer behavior trends, with an increasing preference for point-of-care or home-based testing methods. The mounting pricing pressure on healthcare payers further contributes to market challenges, influencing the trajectory of the Clinical Laboratory Service Market. Among these challenges, market opportunities arise from the escalating demand witnessed in hospital-based laboratories and physician office-based laboratories. This surge in demand counters some of the hindrances, contributing to the overall growth of the global clinical laboratory services market during the forecast period. The industry navigates a landscape shaped by competitive forces, technological advancements, and regulatory influences, showcasing its adaptability to emerging trends and fostering innovation. The dynamics within the Clinical Laboratory Service Market are characterized by an intricate interplay of market drivers, challenges, and opportunities, emphasizing the importance of continual innovation in the industry. Market Trends Within the dynamic landscape of the Clinical Laboratory Service Market, major players are strategically navigating market forces through partnership and cooperation tactics to enhance their product portfolios. An illustrative instance is a collaboration between Laboratory Corporation of America Holdings (LabCorp) and Philips, Inc. in June 2021, focusing on digital pathology to elevate pathology diagnostic efficiency. This aligns with the overarching market dynamics, where industry fluctuations and economic factors shape the strategies adopted by key market participants. Simultaneously, major market players are actively engaged in the introduction of new products, a strategic move contributing to the evolution of the industry. The emphasis on partnership and cooperation tactics reflects the industry's responsiveness to emerging trends and consumer behavior shifts. Major market participants strategically position themselves to address market challenges while capitalizing on the dynamic demand and supply dynamics. This strategic approach not only drives innovation in the industry but also opens avenues for market opportunities, fostering continual growth in the Clinical Laboratory Service Market. The dynamics within this market are characterized by a proactive response to industry fluctuations and a strategic alignment with emerging trends, showcasing the adaptability and resilience of key players in this evolving landscape.Clinical Laboratory Service Market Segment Analysis

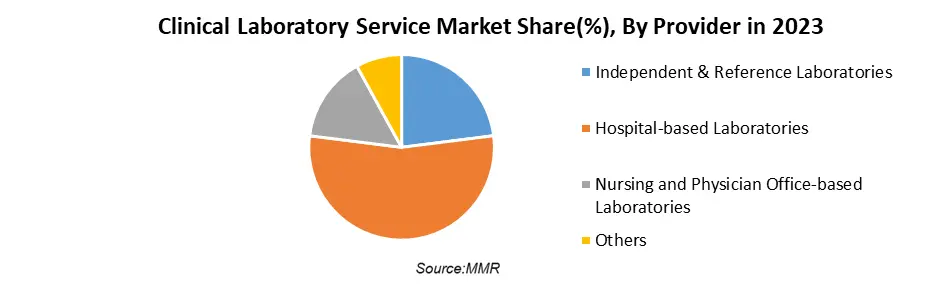

Based on the Type, Clinical chemistry testing emerges as a focal point, poised to experience significant growth at a CAGR of 4.4 percent between 2023 and 2030. This dynamic growth is attributed to the extensive utilization of serum, plasma, urine, and cerebrospinal fluid testing, aligning with the broader industry segmentation. Clinical chemistry encompasses a spectrum of methods, including spectrophotometry, immunoassays, and electrophoresis, utilized for the analysis of various chemicals present in biological samples. This involves the determination of glucose, lipids, enzymes, electrolytes, hormones, proteins, and other metabolic products present in both blood and urine. This comprehensive product segmentation within clinical chemistry testing reflects the nuanced approach to industry segmentation, catering to the diverse needs of the target market. The growth analysis within this specific segment unfolds through the lens of emerging market segments, evaluating their attractiveness and potential impact on the Clinical Laboratory Service Market. Behavioral segmentation is integral to understanding consumer preferences within clinical chemistry testing, shaping the segment-based marketing strategies employed by key industry players. The dynamics within this market segment highlight the adaptability and responsiveness to industry fluctuations, reinforcing the significance of segment-based marketing in ensuring sustained growth and competitiveness.Based on the Provider, Within the Clinical Laboratory Service Market segment, hospital-based laboratories take the lead, claiming a substantial revenue share exceeding 54% in 2023 and demonstrating the swiftest Compound Annual Growth Rate (CAGR) throughout the forecast period. This dominance is attributed to the high volume of patient tests, particularly for intricate and severe medical conditions, which tend to be more cost-intensive. The segment is poised to maintain its supremacy, fueled by the increasing integration of laboratories within hospital premises. The surge in outreach programs and a substantial influx of patients grappling with complex diseases contribute to the segment's growth, facilitating enhanced patient access to laboratory services. The Independent & Reference Laboratories segment is expected to exhibit a steady CAGR of 2.6% over the forecast period, driven by initiatives to enhance patient outcomes through diagnostic facilities at the retail level. The Center for Breakthrough Medicines (CBM) features a standalone safety testing facility distinct from GMP activities on a single campus. Standalone lab's capacity to handle substantial diagnostic test volumes efficiently, delivering superior results at comparatively lower costs, offers service providers economies of scale. The standalone market has experienced rapid growth, particularly post-COVID-19, with emerging players in Independent and reference laboratory services expected to significantly contribute to the segment's growth.

Clinical Laboratory Service Market Regional Insights:

North America dominated the Clinical Laboratory Service Market in the year 2023 and is expected to dominate the market during the forecast period. The market is shaped by a dedicated focus on healthcare infrastructure, continuous technological advancements, and a pronounced commitment to preventive healthcare measures. This region boasts a mature market characterized by well-established laboratory services that actively embrace cutting-edge practices, including molecular diagnostics and personalized medicine. Europe emerges as a prominent player in the Clinical Laboratory Service Market, showcasing distinctive regional market trends. The continent is marked by a sophisticated healthcare system, stringent regulatory standards, and a growing emphasis on research and development. Influenced by an aging population, an upswing in chronic diseases, and a proactive healthcare management approach, Europe plays a significant role in shaping the trajectory of the clinical laboratory services sector. The Asia-Pacific region unfolds as a rapidly growing market for clinical laboratory services, driven by increased healthcare expenditure, a rising awareness of preventive healthcare practices, and a burgeoning population. Across countries in Asia-Pacific, diverse healthcare systems influence market dynamics, with certain regions experiencing a notable shift towards the adoption of advanced diagnostic technologies.Competitive Landscape: Quest Diagnostics, Inc., a major contender in the U.S. clinical laboratory services market, demonstrates a robust competitive landscape. With a comprehensive competitor analysis, Quest Diagnostics evaluates industry rivals, engaging in competitive strategy reviews to enhance its market positioning. Arup Laboratories, based in the United States, positions itself as a prominent player in the clinical laboratory services sector. The company's competitive landscape is shaped by a focus on innovation and a commitment to providing high-quality services. OPKO Health, Inc. navigates a competitive landscape marked by industry rivals examination and competitor benchmarking. The company's focus on competitive intelligence and competitive strategy reviews positions it strategically within the clinical laboratory services market. OPKO Health, Inc. evaluates competitor dynamics, conducts competitor evaluations, and adapts its competitive positioning to address the intensity of market rivalry. Abbott, operating in the U.S. clinical laboratory services sector, establishes a competitive landscape characterized by market rivalry intensity and competitive positioning. The company's competitor analysis and competitor benchmarking contribute to a comprehensive understanding of industry dynamics. Charles River Laboratories International, Inc., as a key industry player, engages in competitor evaluations and competitive landscape trends. The company's competitive intelligence and competitor benchmarking contribute to a nuanced understanding of industry dynamics. Charles River Laboratories International, Inc. strategically positions itself through competitive strategy reviews, adapting to emerging market challenges. The objective of the report is to present a comprehensive analysis of the Global Clinical Laboratory Service Market to the stakeholders in the industry. The past and current status of the industry with the forecast market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which gives a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Market dynamic, and structure by analyzing the market segments and projecting the Global Clinical Laboratory Service Market size. Clear representation of competitive analysis of key players by Type, price, financial position, product portfolio, growth strategies, and regional presence in the Global Clinical Laboratory Service Market make the report investor’s guide.

Clinical Laboratory Service Market Scope : Inquire before buying

Global Clinical Laboratory Service Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 250.48 Bn. Forecast Period 2024 to 2030 CAGR: 6.1% Market Size in 2030: US $ 379.12 Bn. Segments Covered: by Type Clinical Chemistry Testing Microbiology Testing Hematology Testing Immunology Testing Cytology Testing Genetic Testing Drugs Abuse of Testing by Provider Independent & Reference Laboratories Hospital-based Laboratories Nursing and Physician Office-based Laboratories Others by Application Bioanalytical& Lab Chemistry Services Toxicology Testing Services Cell & Gene Therapy Related Services Preclinical & Clinical Trial Related Services Drug Discovery & Development Related Services Others Clinical Laboratory Service Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America) Clinical Laboratory Service Market Key Players For North America 1. Arup Laboratories - United States 2. Quest Diagnostics, Inc. - United States 3. OPKO Health, Inc. - United States 4. Abbott - United States 5. Charles River Laboratories International, Inc. - United States 6. Laboratory Corporation of America Holdings (LabCorp) - United States 7. NeoGenomics Laboratories, Inc. - United States 8. DaVita, Inc. - United States Clinical Laboratory Service Market Key Players For Europe 1. Qiagen - Netherlands 2. Cinven - United Kingdom 3. Fresenius Medical Care - Germany 4. Siemens Healthcare GmbH - Germany 5. Viapath Group LLP - United Kingdom 6. SGS SA - Switzerland 7. Almac Group - United Kingdom Clinical Laboratory Service Market Key Players For Asia Pacific 1. Sonic Healthcare - Australia Frequently Asked Questions: 1] What segments are covered in the Global Clinical Laboratory Service Market report? Ans. The segments covered in the Clinical Laboratory Service Market report are based on Type, Provider, Application, and Region. 2] Which region is expected to hold the largest share of the Global Market? Ans. The North American region is expected to hold the largest share of the Market. The United States and Canada feature a well-developed market known for its established laboratory services that enthusiastically adopt advanced practices, such as molecular diagnostics and personalized medicine. 3] What is the market size of the Global Clinical Laboratory Service Market by 2030? Ans. The market size of the Clinical Laboratory Service Market by 2030 is expected to reach US$ 379.12 Bn. 4] What is the forecast period for the Global Clinical Laboratory Service Market? Ans. The forecast period for the Clinical Laboratory Service Market is 2024-2030. 5] What was the market size of the Global Clinical Laboratory Service Market in 2023? Ans. The market size of the Clinical Laboratory Service Market in 2023 was valued at US$ 250.48 Bn.

1. Clinical Laboratory Service Market: Research Methodology 2. Clinical Laboratory Service Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Clinical Laboratory Service Market: Dynamics 3.1. Clinical Laboratory Service Market Trends by Region 3.1.1. North America Clinical Laboratory Service Market Trends 3.1.2. Europe Clinical Laboratory Service Market Trends 3.1.3. Asia Pacific Clinical Laboratory Service Market Trends 3.1.4. Middle East and Africa Clinical Laboratory Service Market Trends 3.1.5. South America Clinical Laboratory Service Market Trends 3.2. Clinical Laboratory Service Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Clinical Laboratory Service Market Drivers 3.2.1.2. North America Clinical Laboratory Service Market Restraints 3.2.1.3. North America Clinical Laboratory Service Market Opportunities 3.2.1.4. North America Clinical Laboratory Service Market Challenges 3.2.2. Europe 3.2.2.1. Europe Clinical Laboratory Service Market Drivers 3.2.2.2. Europe Clinical Laboratory Service Market Restraints 3.2.2.3. Europe Clinical Laboratory Service Market Opportunities 3.2.2.4. Europe Clinical Laboratory Service Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Clinical Laboratory Service Market Drivers 3.2.3.2. Asia Pacific Clinical Laboratory Service Market Restraints 3.2.3.3. Asia Pacific Clinical Laboratory Service Market Opportunities 3.2.3.4. Asia Pacific Clinical Laboratory Service Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Clinical Laboratory Service Market Drivers 3.2.4.2. Middle East and Africa Clinical Laboratory Service Market Restraints 3.2.4.3. Middle East and Africa Clinical Laboratory Service Market Opportunities 3.2.4.4. Middle East and Africa Clinical Laboratory Service Market Challenges 3.2.5. South America 3.2.5.1. South America Clinical Laboratory Service Market Drivers 3.2.5.2. South America Clinical Laboratory Service Market Restraints 3.2.5.3. South America Clinical Laboratory Service Market Opportunities 3.2.5.4. South America Clinical Laboratory Service Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Clinical Laboratory Service Market 3.8. Analysis of Government Schemes and Initiatives For the Clinical Laboratory Service Market 3.9. The Global Pandemic Impact on the Clinical Laboratory Service Market 4. Clinical Laboratory Service Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2030) 4.1. Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 4.1.1. Clinical Chemistry Testing 4.1.2. Microbiology Testing 4.1.3. Hematology Testing 4.1.4. Immunology Testing 4.1.5. Cytology Testing 4.1.6. Genetic Testing 4.1.7. Drugs Abuse of Testing 4.2. Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 4.2.1. Independent & Reference Laboratories 4.2.2. Hospital-based Laboratories 4.2.3. Nursing and Physician Office-based Laboratories 4.2.4. Others 4.3. Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 4.3.1. Bioanalytical& Lab Chemistry Services 4.3.2. Toxicology Testing Services 4.3.3. Cell & Gene Therapy Related Services 4.3.4. Preclinical & Clinical Trial Related Services 4.3.5. Drug Discovery & Development Related Services 4.3.6. Others 4.4. Clinical Laboratory Service Market Size and Forecast, by Region (2024-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Clinical Laboratory Service Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2030) 5.1. North America Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 5.1.1. Clinical Chemistry Testing 5.1.2. Microbiology Testing 5.1.3. Hematology Testing 5.1.4. Immunology Testing 5.1.5. Cytology Testing 5.1.6. Genetic Testing 5.1.7. Drugs Abuse of Testing 5.2. North America Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 5.2.1. Independent & Reference Laboratories 5.2.2. Hospital-based Laboratories 5.2.3. Nursing and Physician Office-based Laboratories 5.2.4. Others 5.3. North America Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 5.3.1. Bioanalytical& Lab Chemistry Services 5.3.2. Toxicology Testing Services 5.3.3. Cell & Gene Therapy Related Services 5.3.4. Preclinical & Clinical Trial Related Services 5.3.5. Drug Discovery & Development Related Services 5.3.6. Others 5.4. North America Clinical Laboratory Service Market Size and Forecast, by Country (2024-2030) 5.4.1. United States 5.4.1.1. United States Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 5.4.1.1.1. Clinical Chemistry Testing 5.4.1.1.2. Microbiology Testing 5.4.1.1.3. Hematology Testing 5.4.1.1.4. Immunology Testing 5.4.1.1.5. Cytology Testing 5.4.1.1.6. Genetic Testing 5.4.1.1.7. Drugs Abuse of Testing 5.4.1.2. United States Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 5.4.1.2.1. Independent & Reference Laboratories 5.4.1.2.2. Hospital-based Laboratories 5.4.1.2.3. Nursing and Physician Office-based Laboratories 5.4.1.2.4. Others 5.4.1.3. United States Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 5.4.1.3.1. Bioanalytical& Lab Chemistry Services 5.4.1.3.2. Toxicology Testing Services 5.4.1.3.3. Cell & Gene Therapy Related Services 5.4.1.3.4. Preclinical & Clinical Trial Related Services 5.4.1.3.5. Drug Discovery & Development Related Services 5.4.1.3.6. Others 5.4.2. Canada 5.4.2.1. Canada Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 5.4.2.1.1. Clinical Chemistry Testing 5.4.2.1.2. Microbiology Testing 5.4.2.1.3. Hematology Testing 5.4.2.1.4. Immunology Testing 5.4.2.1.5. Cytology Testing 5.4.2.1.6. Genetic Testing 5.4.2.1.7. Drugs Abuse of Testing 5.4.2.2. Canada Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 5.4.2.2.1. Independent & Reference Laboratories 5.4.2.2.2. Hospital-based Laboratories 5.4.2.2.3. Nursing and Physician Office-based Laboratories 5.4.2.2.4. Others 5.4.2.3. Canada Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 5.4.2.3.1. Bioanalytical& Lab Chemistry Services 5.4.2.3.2. Toxicology Testing Services 5.4.2.3.3. Cell & Gene Therapy Related Services 5.4.2.3.4. Preclinical & Clinical Trial Related Services 5.4.2.3.5. Drug Discovery & Development Related Services 5.4.2.3.6. Others 5.4.3. Mexico 5.4.3.1. Mexico Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 5.4.3.1.1. Clinical Chemistry Testing 5.4.3.1.2. Microbiology Testing 5.4.3.1.3. Hematology Testing 5.4.3.1.4. Immunology Testing 5.4.3.1.5. Cytology Testing 5.4.3.1.6. Genetic Testing 5.4.3.1.7. Drugs Abuse of Testing 5.4.3.2. Mexico Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 5.4.3.2.1. Independent & Reference Laboratories 5.4.3.2.2. Hospital-based Laboratories 5.4.3.2.3. Nursing and Physician Office-based Laboratories 5.4.3.2.4. Others 5.4.3.3. Mexico Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 5.4.3.3.1. Bioanalytical& Lab Chemistry Services 5.4.3.3.2. Toxicology Testing Services 5.4.3.3.3. Cell & Gene Therapy Related Services 5.4.3.3.4. Preclinical & Clinical Trial Related Services 5.4.3.3.5. Drug Discovery & Development Related Services 5.4.3.3.6. Others 6. Europe Clinical Laboratory Service Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2030) 6.1. Europe Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 6.2. Europe Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 6.3. Europe Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 6.4. Europe Clinical Laboratory Service Market Size and Forecast, by Country (2024-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 6.4.1.2. United Kingdom Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 6.4.1.3. United Kingdom Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 6.4.2. France 6.4.2.1. France Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 6.4.2.2. France Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 6.4.2.3. France Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 6.4.3. Germany 6.4.3.1. Germany Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 6.4.3.2. Germany Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 6.4.3.3. Germany Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 6.4.4. Italy 6.4.4.1. Italy Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 6.4.4.2. Italy Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 6.4.4.3. Italy Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 6.4.5. Spain 6.4.5.1. Spain Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 6.4.5.2. Spain Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 6.4.5.3. Spain Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 6.4.6. Sweden 6.4.6.1. Sweden Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 6.4.6.2. Sweden Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 6.4.6.3. Sweden Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 6.4.7. Austria 6.4.7.1. Austria Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 6.4.7.2. Austria Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 6.4.7.3. Austria Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 6.4.8.2. Rest of Europe Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 6.4.8.3. Rest of Europe Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 7. Asia Pacific Clinical Laboratory Service Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2030) 7.1. Asia Pacific Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 7.2. Asia Pacific Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 7.3. Asia Pacific Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 7.4. Asia Pacific Clinical Laboratory Service Market Size and Forecast, by Country (2024-2030) 7.4.1. China 7.4.1.1. China Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 7.4.1.2. China Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 7.4.1.3. China Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 7.4.2. S Korea 7.4.2.1. S Korea Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 7.4.2.2. S Korea Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 7.4.2.3. S Korea Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 7.4.3. Japan 7.4.3.1. Japan Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 7.4.3.2. Japan Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 7.4.3.3. Japan Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 7.4.4. India 7.4.4.1. India Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 7.4.4.2. India Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 7.4.4.3. India Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 7.4.5. Australia 7.4.5.1. Australia Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 7.4.5.2. Australia Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 7.4.5.3. Australia Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 7.4.6.2. Indonesia Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 7.4.6.3. Indonesia Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 7.4.7.2. Malaysia Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 7.4.7.3. Malaysia Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 7.4.8.2. Vietnam Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 7.4.8.3. Vietnam Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 7.4.9.2. Taiwan Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 7.4.9.3. Taiwan Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 7.4.10.2. Rest of Asia Pacific Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 7.4.10.3. Rest of Asia Pacific Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 8. Middle East and Africa Clinical Laboratory Service Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2030 8.1. Middle East and Africa Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 8.2. Middle East and Africa Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 8.3. Middle East and Africa Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 8.4. Middle East and Africa Clinical Laboratory Service Market Size and Forecast, by Country (2024-2030) 8.4.1. South Africa 8.4.1.1. South Africa Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 8.4.1.2. South Africa Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 8.4.1.3. South Africa Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 8.4.2. GCC 8.4.2.1. GCC Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 8.4.2.2. GCC Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 8.4.2.3. GCC Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 8.4.3.2. Nigeria Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 8.4.3.3. Nigeria Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 8.4.4.2. Rest of ME&A Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 8.4.4.3. Rest of ME&A Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 9. South America Clinical Laboratory Service Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2030 9.1. South America Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 9.2. South America Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 9.3. South America Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 9.4. South America Clinical Laboratory Service Market Size and Forecast, by Country (2024-2030) 9.4.1. Brazil 9.4.1.1. Brazil Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 9.4.1.2. Brazil Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 9.4.1.3. Brazil Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 9.4.2. Argentina 9.4.2.1. Argentina Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 9.4.2.2. Argentina Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 9.4.2.3. Argentina Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Clinical Laboratory Service Market Size and Forecast, By Type (2024-2030) 9.4.3.2. Rest Of South America Clinical Laboratory Service Market Size and Forecast, By Provider (2024-2030) 9.4.3.3. Rest Of South America Clinical Laboratory Service Market Size and Forecast, By Application (2024-2030) 10. Global Clinical Laboratory Service Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Market Structure 10.4.1. Market Leaders 10.4.2. Market Followers 10.4.3. Emerging Players 10.5. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Arup Laboratories - United States 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Quest Diagnostics, Inc. - United States 11.3. OPKO Health, Inc. - United States 11.4. Abbott - United States 11.5. Charles River Laboratories International, Inc. - United States 11.6. Laboratory Corporation of America Holdings (LabCorp) - United States 11.7. NeoGenomics Laboratories, Inc. - United States 11.8. DaVita, Inc. - United States 11.9. Qiagen - Netherlands 11.10. Cinven - United Kingdom 11.11. Fresenius Medical Care - Germany 11.12. Siemens Healthcare GmbH - Germany 11.13. Viapath Group LLP - United Kingdom 11.14. SGS SA - Switzerland 11.15. Almac Group - United Kingdom 11.16. Sonic Healthcare – Australia 12. Key Findings 13. Industry Recommendations