The Global Steam Methane Reforming Hydrogen Generation Market size was valued at USD 141.11 Bn in 2023 and Steam methane reforming hydrogen generation Market revenue is expected to reach USD 213.58 Bn by 2030, at a CAGR of 6.1 % over the forecast period.Steam Methane Reforming Hydrogen Generation Overview

Steam methane reforming (SMR) hydrogen generation is extensively used for the generation of hydrogen. It is a thermochemical process that converts methane (CH4) and steam (H2O) into hydrogen (H2), carbon monoxide (CO), and carbon dioxide (CO2) in the presence of a catalyst. The MMR estimated that USD 25 billion globally of public money has been budgeted towards the hydrogen RD&D until 2030. However, USD 90 billion is required to fulfil the necessary requirements of RD&D 2030. Research and development on hydrogen is crucial for achieving both the global net zero targets and the additional goals that underpin national programs. Most of the Countries want to create clean hydrogen from electrolysis or fossil fuels with carbon control by the year 2050. Australia, Canada, and China are the top players in providing fossil fuels and CCS. The US, Canada, and France have also considered producing hydrogen using nuclear energy. Around the world, C40 towns have committed to lowering greenhouse gas emissions while developing net-zero buildings and have established net-zero objectives. The Steam methane reforming hydrogen generation market has witnessed Rapid market growth and innovation in recent years. The Steam methane reforming hydrogen generation market is dynamic, with continuous advancements in technology and applications. The Steam Methane Reforming hydrogen generation market leads the global energy transition. While facing challenges related to emissions and competition from alternative technologies, SMR remains a vital and established method for hydrogen production. Its role is set to expand as hydrogen takes centre stage in the pursuit of a cleaner and more sustainable energy future. Industry stakeholders, governments, and investors can collaborate to address challenges and capitalize on the abundant opportunities in the Steam methane reforming (SMR) hydrogen generation market.To know about the Research Methodology :- Request Free Sample Report Recent trends in the Steam methane reforming hydrogen generation market Growing focus on green hydrogen Growing focus on green hydrogen is one of the significant trends in the Steam methane reforming hydrogen generation market. It represents a fundamental shift in the hydrogen market, driven by a strong commitment to reducing carbon environmental concerns and carbon emissions. This trend has increased due to interest in SMR with carbon capture and utilization (CCUS) to produce low-carbon hydrogen. Government Policy and Investments are investing heavily in greenhouse projects such as electrolysis and renewable energy integrations. The government can explore integrating hydrogen into existing energy and industrial partnerships globally. Recently many government initiatives helping the financial support to hydrogen generation have increased. Globally, governments are moving towards supporting commercialization and demonstration of entire value chains, often through public-private partnerships. Almost 41.14 billion in national government subsidies per year have become available for hydrogen projects directly or indirectly. Integrating Carbon Capture and Storage (CCS) CCS technologies with steam methane reforming is indeed a noteworthy strategy to address the environmental impact of hydrogen production through SMR. Environmental mitigation significantly reduces the carbon footprint of SMR-produced hydrogen. CCS can enhance the hydrogen purity that is produced in SMR by reducing the amount of CO and CO2 in the product gas. This is applicable to high-purity hydrogen

Opportunities for Steam methane reforming hydrogen generation market

Steam methane reforming (SMR) hydrogen generation is the most scalable and readily available technology in the market today, and it is estimated that over 95% of the world’s hydrogen is currently produced via SMR. By integrating carbon capture and utilization of CCUS technologies, SMR can produce low-carbon blue hydrogen, aligning with sustainability goals. With the demand for hydrogen increasing, the production of blue hydrogen is expected to grow to a capacity of 3.3m metric tonnes per year by 2028. Through continuous development and innovation, our new generation of blue SMR technology provides a greater economic and efficient alternative for production needs at large capacities. The H2 sector is moving through exceptional growth, and finding the right solution to produce low-carbon H2 while achieving energy demand is critical in realizing the potential. SMR hydrogen generation market offers numerous opportunities, from producing low-carbon hydrogen to serving various industries and applications, all while contributing to the global transition to cleaner energy sources.Restraints of Steam methane reforming hydrogen generation market

Steam methane reforming (SMR) is widely used for hydrogen generation it also faces several restraints and challenges that need to be considered. Carbon emission is one of the significant restraints of carbon dioxide emissions during the SMR process. Influence of the environment on greenhouse gas emissions, the main cause of global warming and climate change. Numerous nations have established challenging climate objectives, which include cutting greenhouse gas emissions. France, the United States, and the United Kingdom have set goals for their emissions of greenhouse gases. With more than 110 countries committing to a net zero emissions target by 2050, China is expected to surpass the United States as the largest emitter by 2060. More than 110 countries have pledged to reaching net zero emissions in line with the Paris Agreement, but they haven't yet put in place enough laws and regulations to address climate change. A number of variables make achieving high efficiency in SMR difficult, however this is an area on which continuous research and development efforts are concentrated. SMR will become more competitive and sustainable as its efficiency increases, especially when coupled with carbon capture and utilization (CCUS) technologies to produce hydrogen.Steam Methane Reforming Hydrogen Generation Market Segment Analysis

By Technology, Convectional Steam methane reforming hydrogen generation market are widely used in technology for hydrogen generation. Methane reforming begins with a reaction of methane with steam in the presence of a nickel-based catalyst. This technology finds extensive application in diverse industrial sectors, including petrochemicals, ammonia production, and refineries. Conventional Steam methane reforming (SMR) serves as a primary method for producing hydrogen, which is crucial for various industrial processes in these sectors. It plays a vital role in supplying hydrogen for chemical reactions and serves as a foundational process in the hydrogen economy. Auto thermal Reforming, or ATR, is a process that integrates partial oxidation and steam reforming. This technology utilizes a combination of oxygen and steam to reform natural gas. Over this process, it produces hydrogen, carbon monoxide (CO), and a limited amount of carbon dioxide (CO2). ATR is frequently applied in industrial processes that demand a mixture of hydrogen and carbon monoxide, often referred to as synthesis gas or syngas. One notable application of ATR is in methanol production, where syngas is a key component for the synthesis of methanol and other chemicals. Membrane-Assisted Reforming, known as MAR, is an innovative technology that combines Steam Methane Reforming (SMR) with hydrogen separation membranes. This unique approach significantly improves the efficiency of hydrogen separation during the reforming process, making it highly suitable for the production of high-purity hydrogen. By Application, The Steam methane reforming (SMR) hydrogen generation market is segmented by various industries, considering the various industries and sectors that utilize hydrogen produced through SMR. It is mostly used in the petrochemical industry, Refineries, and ammonia production. Each application has specific purity and volume requirements, as well as distinct environmental and economic considerations. SMR is extensively employed in the petrochemical industry to produce hydrogen for various chemical processes. It is an essential component for processes like hydrocracking, hydrodesulphurization, and ammonia synthesis. 95% of the hydrogen produced in the United States is made by natural gas reforming in large central plants. Ammonia production relies heavily on hydrogen. SMR provides the hydrogen necessary for the synthesis of ammonia, a crucial component in fertilizers and various chemical products. Asia-Pacific is the leading consumer of ammonia, approximately in 2023 this region has consumed 45% of ammonia. Refineries utilize hydrogen in processes such as hydrocracking and hydrotreating to improve the quality of fuels and reduce sulfur content. SMR is a common method for hydrogen production in refineries.Steam Methane Reforming (SMR) Hydrogen Generation Market Regional Insights

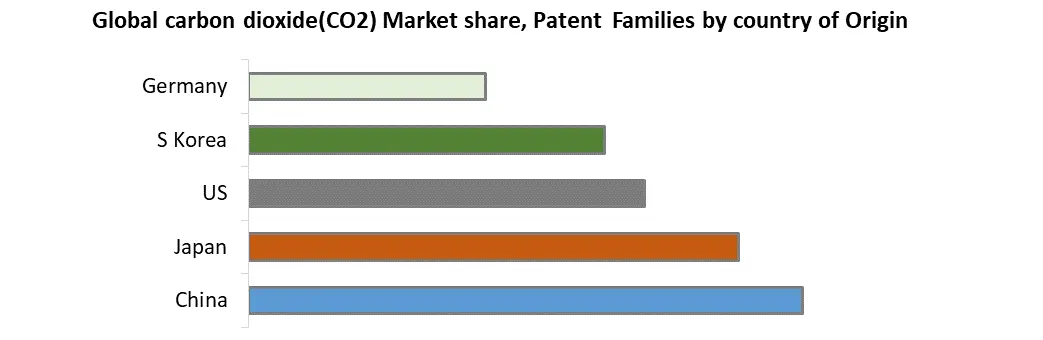

North America held the largest market share of 38.45% for the global Steam methane reforming hydrogen generation market in 2023. Canada is a key player in the Steam methane reforming (SMR) hydrogen generation market, its focus on carbon capture and utilization (CCUS) is growing, aiming to produce low-carbon hydrogen. MMR research revealed that the US held 8,955 patents in hydrogen-related technologies. The United States and Canada are actively investing in hydrogen technologies, and there is a growing presence of hydrogen production facilities, especially in regions with access to natural gas reserves. This investment trend showcases a growing interest in hydrogen as an alternative energy source in the North American market. In Europe, actively pursued the development of a sustainable hydrogen economy. Countries including Germany and the Netherlands have well-established SMR facilities. European Union has promoted clean hydrogen production, leading to the integration of SMR and CCUSs. Germany has included public funding and several elements until 2030. European countries often collaborate on hydrogen initiatives. For instance, the European Clean Hydrogen Alliance is a platform that brings together industry, research, and public authorities to promote the deployment of clean hydrogen technologies. This collaborative effort helps share knowledge and resources to advance hydrogen production and reduce carbon emissions. Europe, including countries like Germany and the Netherlands, is actively investing in hydrogen as a clean energy source, and SMR plants are being adapted to incorporate carbon capture and storage/utilization technologies to minimize carbon emissions and contribute to a more sustainable and low-carbon energy future. In the region of Asia-Pacific, Countries such as Japan and South Korea are key players of SMR for the hydrogen generation market. Petrochemicals and electronics applications are widely used in this region. Japan has made substantial investments in SMR technology to produce hydrogen for various industrial applications. Hydrogen is used in sectors such as petrochemicals, electronics, and metallurgy. Japan is at the forefront of fuel cell vehicle development. Steam methane reforming (SMR) produced hydrogen is a key source for fuelling these vehicles, offering a cleaner alternative to conventional internal combustion engine vehicles. Automakers like Toyota and Honda have introduced FCVs in the Japanese market. Both Japan and South Korea are actively collaborating with other nations to advance hydrogen technology and establish a global hydrogen supply chain. This cooperation is crucial for creating a stable and interconnected hydrogen market, which is essential for hydrogen's success as an energy carrier.

Competitive landscape of steam methane reforming (SMR) hydrogen generation

In June 2021, Air Liquide and Siemens Energy created a joint venture dedicated to the production of industrial-scale renewable hydrogen electrolyzers. Air Liquide is one of the leading industries in the hydrogen market, offering several hydrogen production services and SMR technologies. Linde is also one of the major players in the market offering industrial gases and engineering components, with a 2022 sale of $33 billion. Linde is focusing on providing clean hydrogen. In October 2023, Linde plc declared a quarterly dividend of $1.275 per market share. Airproducts Inc. has signed the 1$ billion investment agreement Republic of Uzbekistan and Uzbekneftegaz JSC to acquire, own, and operate a natural gas-to-syngas. While established companies dominate the market, there is a growing number of emerging players entering the industry. These companies often bring innovation and novel approaches to SMR technology. For example, startups like Nikola Power and Monolith Materials are gaining attention. The competitive landscape of Steam methane reforming (SMR) hydrogen generation is shaped by established industry leaders, emerging players, regional competitors, technological advancements, green hydrogen producers, end-use markets, CCS integration, global collaboration, supply chain integration, and the regulatory and policy environment. This industry is evolving as the demand for clean hydrogen continues to grow.Steam Methane Reforming Hydrogen Generation Market Scope: Inquiry Before Buying

Steam Methane Reforming Hydrogen Generation Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 141.11 Bn. Forecast Period 2024 to 2030 CAGR: 6.1% Market Size in 2030: US $ 213.58 Bn. Segments Covered: by Technology Steam Methane Reforming (SMR) Molten Salt Reactor (MSR) High-Temperature Electrolysis (HTE) by Application Industrial Hydrogen Clean Energy and Power Generation Petrochemical Industry Steam Methane Reforming Hydrogen Generation Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Steam Methane Reforming Hydrogen Generation Key players

1. Air Liquide (France) 2. Linde plc (Ireland) 3. Air Products and Chemicals Inc. 4. (US), Shell plc (UK) 5. Saudi Arabian Oil Co. 6. OthersFrequently Asked Questions:

1] What is the growth rate of the Steam methane reforming hydrogen generation Market? Ans. The Steam methane reforming hydrogen generation Market is growing at a significant rate of over the forecast period. 2] Which region is expected to dominate the Steam methane reforming hydrogen generation Market? Ans. North America region is expected to dominate the Steam methane reforming hydrogen generation Market over the forecast period. 3] What is the expected Steam methane reforming hydrogen generation Market size by 2030? Ans. The market size of the Steam methane reforming hydrogen generation Market is expected to reach USD Bn by 2030. 4] Who are the top players in the Steam methane reforming hydrogen generation Industry? Ans. The major key players in the Steam methane reforming hydrogen generation Market are Air Liquide (France), Linde plc (Ireland), Air Products and Chemicals Inc., (US), Shell plc (UK), Saudi Arabian Oil Co. 5] Which factors are expected to drive the Steam methane reforming hydrogen generation Market growth by 2030? Ans. Increasing Demand for Increasing Demand for Hydrogen and Energy Transition is growing demand for market Steam methane reforming hydrogen generation.

1. Steam Methane Reforming Hydrogen Generation Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Steam Methane Reforming Hydrogen Generation Market: Dynamics 2.1. Steam Methane Reforming Hydrogen Generation Market Trends by Region 2.1.1. North America Steam Methane Reforming Hydrogen Generation Market Trends 2.1.2. Europe Steam Methane Reforming Hydrogen Generation Market Trends 2.1.3. Asia Pacific Steam Methane Reforming Hydrogen Generation Market Trends 2.1.4. Middle East and Africa Steam Methane Reforming Hydrogen Generation Market Trends 2.1.5. South America Steam Methane Reforming Hydrogen Generation Market Trends 2.2. Steam Methane Reforming Hydrogen Generation Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Steam Methane Reforming Hydrogen Generation Market Drivers 2.2.1.2. North America Steam Methane Reforming Hydrogen Generation Market Restraints 2.2.1.3. North America Steam Methane Reforming Hydrogen Generation Market Opportunities 2.2.1.4. North America Steam Methane Reforming Hydrogen Generation Market Challenges 2.2.2. Europe 2.2.2.1. Europe Steam Methane Reforming Hydrogen Generation Market Drivers 2.2.2.2. Europe Steam Methane Reforming Hydrogen Generation Market Restraints 2.2.2.3. Europe Steam Methane Reforming Hydrogen Generation Market Opportunities 2.2.2.4. Europe Steam Methane Reforming Hydrogen Generation Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Steam Methane Reforming Hydrogen Generation Market Drivers 2.2.3.2. Asia Pacific Steam Methane Reforming Hydrogen Generation Market Restraints 2.2.3.3. Asia Pacific Steam Methane Reforming Hydrogen Generation Market Opportunities 2.2.3.4. Asia Pacific Steam Methane Reforming Hydrogen Generation Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Steam Methane Reforming Hydrogen Generation Market Drivers 2.2.4.2. Middle East and Africa Steam Methane Reforming Hydrogen Generation Market Restraints 2.2.4.3. Middle East and Africa Steam Methane Reforming Hydrogen Generation Market Opportunities 2.2.4.4. Middle East and Africa Steam Methane Reforming Hydrogen Generation Market Challenges 2.2.5. South America 2.2.5.1. South America Steam Methane Reforming Hydrogen Generation Market Drivers 2.2.5.2. South America Steam Methane Reforming Hydrogen Generation Market Restraints 2.2.5.3. South America Steam Methane Reforming Hydrogen Generation Market Opportunities 2.2.5.4. South America Steam Methane Reforming Hydrogen Generation Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Steam Methane Reforming Hydrogen Generation Industry 2.8. Analysis of Government Schemes and Initiatives For Steam Methane Reforming Hydrogen Generation Industry 2.9. Steam Methane Reforming Hydrogen Generation Market Trade Analysis 2.10. The Global Pandemic Impact on Steam Methane Reforming Hydrogen Generation Market 3. Steam Methane Reforming Hydrogen Generation Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 3.1.1. Steam Methane Reforming (SMR) 3.1.2. Molten Salt Reactor (MSR) 3.1.3. High-Temperature Electrolysis (HTE) 3.2. Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 3.2.1. Industrial Hydrogen 3.2.2. Clean Energy and Power Generation 3.2.3. Petrochemical Industry 3.3. Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Steam Methane Reforming Hydrogen Generation Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 4.1.1. Steam Methane Reforming (SMR) 4.1.2. Molten Salt Reactor (MSR) 4.1.3. High-Temperature Electrolysis (HTE) 4.2. North America Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 4.2.1. Industrial Hydrogen 4.2.2. Clean Energy and Power Generation 4.2.3. Petrochemical Industry 4.3. North America Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 4.3.1.1.1. Steam Methane Reforming (SMR) 4.3.1.1.2. Molten Salt Reactor (MSR) 4.3.1.1.3. High-Temperature Electrolysis (HTE) 4.3.1.2. United States Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 4.3.1.2.1. Industrial Hydrogen 4.3.1.2.2. Clean Energy and Power Generation 4.3.1.2.3. Petrochemical Industry 4.3.2. Canada 4.3.2.1. Canada Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 4.3.2.1.1. Steam Methane Reforming (SMR) 4.3.2.1.2. Molten Salt Reactor (MSR) 4.3.2.1.3. High-Temperature Electrolysis (HTE) 4.3.2.2. Canada Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 4.3.2.2.1. Industrial Hydrogen 4.3.2.2.2. Clean Energy and Power Generation 4.3.2.2.3. Petrochemical Industry 4.3.3. Mexico 4.3.3.1. Mexico Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 4.3.3.1.1. Steam Methane Reforming (SMR) 4.3.3.1.2. Molten Salt Reactor (MSR) 4.3.3.1.3. High-Temperature Electrolysis (HTE)\ 4.3.3.2. Mexico Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 4.3.3.2.1. Industrial Hydrogen 4.3.3.2.2. Clean Energy and Power Generation 4.3.3.2.3. Petrochemical Industry 5. Europe Steam Methane Reforming Hydrogen Generation Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 5.2. Europe Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 5.3. Europe Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 5.3.1.2. United Kingdom Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 5.3.2. France 5.3.2.1. France Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 5.3.2.2. France Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 5.3.3.2. Germany Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 5.3.4.2. Italy Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 5.3.5.2. Spain Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 5.3.6.2. Sweden Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 5.3.7.2. Austria Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 5.3.8.2. Rest of Europe Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Steam Methane Reforming Hydrogen Generation Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 6.2. Asia Pacific Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 6.3.1.2. China Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 6.3.2.2. S Korea Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 6.3.3.2. Japan Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 6.3.4. India 6.3.4.1. India Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 6.3.4.2. India Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 6.3.5.2. Australia Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 6.3.6.2. Indonesia Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 6.3.7.2. Malaysia Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 6.3.8.2. Vietnam Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 6.3.9.2. Taiwan Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 6.3.10.2. Rest of Asia Pacific Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Steam Methane Reforming Hydrogen Generation Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 7.2. Middle East and Africa Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 7.3.1.2. South Africa Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 7.3.2.2. GCC Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 7.3.3.2. Nigeria Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 7.3.4.2. Rest of ME&A Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 8. South America Steam Methane Reforming Hydrogen Generation Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 8.2. South America Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 8.3. South America Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 8.3.1.2. Brazil Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 8.3.2.2. Argentina Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Technology (2023-2030) 8.3.3.2. Rest Of South America Steam Methane Reforming Hydrogen Generation Market Size and Forecast, by Application (2023-2030) 9. Global Steam Methane Reforming Hydrogen Generation Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Steam Methane Reforming Hydrogen Generation Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Air Liquide (France) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Linde plc (Ireland) 10.3. Air Products and Chemicals Inc. 10.4. Shell plc (UK) 10.5. Saudi Arabian Oil Co. 11. Key Findings 12. Industry Recommendations 13. Steam Methane Reforming Hydrogen Generation Market: Research Methodology 14. Terms and Glossary