Solar Tracker Market was valued at USD 18.89 Bn. in 2024 and the total Global Solar Tracker Market revenue is Expected to grow at a CAGR of 19.2% from 2025 to 2032 reaching nearly USD 76.99 Bn. by 2032.Overview

The solar trackers adjust the direction of the solar panels according to the movement of the sun. When the panel is oriented perpendicular to the sun, more sunlight reaches the panels, and more energy is absorbed, which is then converted into electricity. Solar trackers produce more electricity in about the same amount of space which makes them ideal for land optimization. Solar trackers are usually combined with ground-mount solar systems but recently, rooftop-mounted trackers have come into the market. Solar energy tracking systems beneficial for commercial solar plants but solar trackers might not be a worthwhile investment for residential installations. PV cells, inverters, batteries, and panel-holding equipment are just some of the components of a solar power system. The Solar Tracker market is driven by the rising demand for energy, growing environmental concern, and awareness coupled with the depleting fossil fuel around the world.To know about the Research Methodology :- Request Free Sample Report

Solar Tracker Market Dynamics:

The rising adoption of Artificial Intelligence is expected to offer new growth opportunities for the solar tracker manufacturers Artificial intelligence is one of the latest technologies that has been merged with renewable energy, resulting in a variety of operational advantages and cost-effectiveness. Controls powered by artificial intelligence (AI) and machine learning provide better returns and give projects a competitive edge for the Solar Tracker players. Integrating these technologies helps in tracking control strategy under real-world conditions and control strategy based on real-time weather data. Intelligent tracker software utilizes data and algorithms to enhance performance, boost energy output, and reduce downtime. Adaptive machine learning may account for changes in day length throughout the year by gathering data to develop a projection of where the row should be at different times of the day, then optimizing the module locations to gain maximum sunlight exposure. For example, Arctech Solar has developed a new generation of Artificial Intelligence (AI) solar tracking technologies that allow PV tracking power plants to adapt to changing weather conditions. The Al control system can perform algorithm optimization on the tracker angle, as well as weather sampling, feedback distribution, and constant information comparison, which might help improve the power output of solar power plants by up to 7%. Therefore, the advanced technology has boosted the demand for Solar Tracker Market during the forecast period. Green Energy initiative to Fuel Investments in Solar Industry The growing emphasis on clean and green energy is propelling the global Solar Tracker Market to new heights. Because of rising environmental concerns, the global market for solar trackers is growing. Carbon reduction has encouraged the use of renewable energies as the world advances towards a clean energy transition. Solar and other clean energy technologies have advanced significantly, enabling quick deployment and offering cost-effective choices for decarbonizing the energy industry. As a modular technology that is easily adaptable for big and small projects, inequitable adoption of a solar tracking system has become more prominent as an energy justice issue. Mahindra Sustain chose NEXTracker to be the supplier for Sakaka Solar Park. The project is part of Saudi Arabia's national clean energy development program. The project's overall capacity is planned to be 9.5 GW by 2023 and 56.7 GW by 2029. The huge increase in the number of solar panel installations throughout the world is one of the primary drivers of the solar tracker market growth. Solar trackers aim to save energy and enhance efficiency Solar panel efficiency is a good indication of performance and many high-efficiency panels employ higher-grade N-type silicon cells with a lower temperature coefficient and less power degradation over time. Another important purpose of a solar tracker is to save energy and boost operational efficiency. This is because of the fact that solar trackers are distinct energy-consuming organizations that are attached to solar panels to boost their effectiveness. Furthermore, solar trackers must be operationally reliable throughout a wide range of operating conditions, since any influence on tracker application performance have a major impact on the overall performance of solar panels or power systems. Several manufacturers such as LG, Panasonic, and SunPower offer warranties with 90% or greater retained power output. Bifacial Solar Panels are an example of a high-energy solar panel, with power output ratings often exceeding 500W. They work perfectly with solar trackers, significantly increasing efficiency. Solar tracker research and development is a major differentiator for companies in this sector. Companies are working on developing advanced technology-based solutions in response to the growing industrial need for advanced tracking technology. Therefore, the Solar Tracker Market is expected to grow during the forecast period. Solar trackers can significantly raise the cost of a photovoltaic solar installation. A standard 4-kilowatt ground-mounted solar system will cost around $13,000 to install. Tracking equipment can range in price from $500 to more than $1,000 per panel. Trina has more than 20 years of expertise in the solar sector and has become a pioneer in commercial and utility-scale solar. The company is fully committed to all of its global markets, including the United States. For instance, the Indian government is executing a major initiative to become a leading solar power contributor by 2025. Such initiatives are expected to increase the demand for the Solar Tracker Market in this region during the forecast period.High investment and a lack of necessary infrastructure to pose a threat to Solar Trackers Market growth Solar trackers increase the efficiency of a solar panel, but the installation of a solar tracker requires a high cost of investment. The cost of labor and space gets added to the installation of a solar tracker. One of the primary issues hampering the growth of the Solar Tracker Market is the rise in steel costs, which raises the cost of the tracking systems utilized in most utility-scale projects. Steel accounts for more than 65% of the entire cost of solar tracking systems, making solar trackers more expensive. Furthermore, the overall cost of the solar tracking system is higher than the cost of installing conventional solar panels, which restricts its use in residential applications where energy consumption is often less. For instance, the installation of 15 ground-mounted solar panels with a power rating of 300 watts would cost USD 14,625. The installation would cost an extra USD 500 per solar module. This increase in initial cost leads to less adoption of the solar tracking system. Another issue limiting market investment is a lack of required infrastructure. Lack of understanding about the benefits of fixed-tilt installations over tracker installations has hampered growth in the Asia Pacific and Europe.

Solar system type System cost Annual energy savings Estimated payback period Fixed ground-mounted system $14,625 $1,100 13 years Single-axis Tracker System $22,125 $1,430 15.5 years Double-axis Tracker System $29,625 $1,540 19 years Solar Tracker Market Segment Analysis

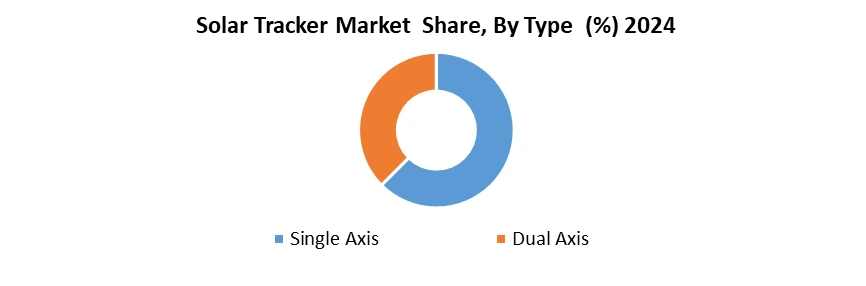

Based on the Drive type, the Dual axis trackers are significantly costlier than single-axis trackers. Dual-axis trackers require more complex technology, as well as high-maintenance motors and control systems, resulting in high O&M costs and higher land requirements. These problems are significant restraints for the widespread adoption of dual-axis trackers. A dual-axis tracker can add up to 50% to the overall cost of your PV plant over a fixed tilt installation. Two-axis trackers have yield gains of 30-40%, which means the cost is higher than the yields, making dual-axis trackers unattractive for most types of installations. Dual-axis trackers are typically employed on highly specialized installations such as farms for dual land use since the poles with dual-axis tracking may be high enough for crops, animal grazing beneath the panels, and farm equipment to pass underneath the panels. Based on Application, the Utility segment is expected to grow at the highest CAGR during the forecast period in Solar Tracker Market. Increasing power costs, along with increased demand for renewable energy sources, are likely to boost the usage of solar trackers in utility applications. This trend is expected to continue over the forecast period. Because utility solar systems are ground-mounted, single-axis trackers may be utilized to track the sun throughout the day. Trackers are being utilized extensively in utility applications due to rising government subsidies and feed-in tariff programs, notably in North America and Europe.

Solar Tracker Market Regional Analysis

In North America, the Solar Tracker market accounted for the highest revenue share in 2023, exceeding 25%, and this trend is expected to continue until 2030. The increasing focus on renewable energy and the Paris Agreement on Climate Change, which recommends the use of renewable energy as the nation's primary source of energy is responsible for the growth. The United States government aims to increase the use of solar energy in the economy through a variety of initiatives. The dual-axis-based solar tracker segment is expected to acquire significant traction throughout the forecast period because of its better power durability and widespread application in distributed utilities. Furthermore, rising infrastructure investment, rising energy security, and power consumption as well as continuous urbanization in Mexico are some of the major key drivers which have increased the Solar Tracker Market demand in this region. Key manufacturers in the North American Solar Tracker Market are investing heavily in R&D to develop improved technologies and get a competitive advantage over the competition. Nextracker, Soltec America LLP, Array Technologies, Inc, Nielsen-Kellerman Co., All Earth Renewables, Arctech, Optical Scientific Inc, Trina Solar, Campbell Scientific, In, and PVHardware are among the industry's major players. The Asia-Pacific region dominated the worldwide Solar Tracker market share in 2022. A paradigm shifts toward renewable energy production, followed by increased solar technology installation is the key driver for the Solar Tracker Industry growth. India and China launched 40 extensive solar technology contracts, including single-axis solar trackers and advanced PV panel installations. Furthermore, a growing preference for solar-based energy sources to meet rising power demand in the manufacturing sectors is expected to increase the business landscape. The India solar tracker market is expected to increase as energy demand rises and consumer awareness of renewable energy sources rises. Rapid industrialization and commercialization, followed by increased installation of solar-based technologies are the main reasons for the market growth. Competitive Landscape Analysis The competitive landscape of this Solar Tracker Market shows key players domination by major solar tracker manufacturers such as NEXTracker, PV Hardware, Array Technologies, and Soltec. NEXTracker has the largest market share in the world, acquiring contracts from countries throughout the globe. A well-established supply chain, customer preference, and an established brand name have all contributed to the company's success. Other industry participants, such as Array Technologies, Trina Solar, and Solar Steel, are extending their customer reach and establishing a significant market footprint. This is expected to result in a competitive market for solar tracker sales in the coming years.Solar Tracker Market Scope: Inquire before buying

Solar Tracker Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 18.89 Bn. Forecast Period 2025 to 2032 CAGR: 19.2 % Market Size in 2032: USD 76.99 Bn. Segments Covered: by Type Single Axis Dual Axis by Application Residential Commercial Utility by Technology Solar Photovoltaic (PV) Concentrated Solar Power (CSP) Concentrated Photovoltaic (CPV) Solar Tracker Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A)Solar Tracker Key Players are:

1. Array Technologies, Inc. (U.S.) 2. NEXTracker (U.S.) 3. Array Technologies (U.S.) 4. Trina Solar (China) 5. SunPower Corporation (U.S.) 6. ArcelorMittal Projects (Luxemburg) 7. Soltec (Spain) 8. Convert Italia (Italy) 9. PV Hardware (Spain) 10. Arctech Solar (U.S.) 11. Solar Steel (Spain) 12. Ideematec (Germany) 13. Scorpius Trackers (India) 14. Sun Action Trackers (U.S.) 15. DEGERENERGIE GMBH & CO. KG (Germany) 16. GameChange Solar (New York) 17. STI Norland (Spain) 18. MECASOLAR (Spain) 19. Mechatron (India) 20. OPTIMUM TRACKER (France) 21. Powerway Renewable Energy Co. Ltd. (China) 22. Schletter (Germany)Frequently Asked Questions:

1] What is the growth rate of the Global Solar Tracker Market? Ans. The Global Solar Tracker Market is growing at a significant rate of 19.2 % during the forecast period. 2] Which region is expected to dominate the Global Solar Tracker Market? Ans. North America is expected to dominate the Solar Tracker Market during the forecast period. 3] What is the expected Global Solar Tracker Market size by 2029? Ans. The Solar Tracker Market size is expected to reach USD 76.99 Bn by 2032. 4] Which are the top players in the Global Solar Tracker Market? Ans. The major top players in the Global Solar Tracker Market Are Array Technologies, Inc. (U.S.), NEXTracker (U.S.) and others. 5] What are the factors driving the Global Solar Tracker Market growth? Ans. Consumers are increasingly concerned about animal welfare and deforestation, pushing them towards choices that align with their ethical principles and are expected to drive the market. 6] Which is the leading country for the sale of Solar Tracker? Ans. The United States is a key country that has influenced the market growth.

1. Solar Tracker Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Solar Tracker Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Solar Tracker Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Solar Tracker Market: Dynamics 3.1. Solar Tracker Market Trends by Region 3.1.1. North America Solar Tracker Market Trends 3.1.2. Europe Solar Tracker Market Trends 3.1.3. Asia Pacific Solar Tracker Market Trends 3.1.4. Middle East and Africa Solar Tracker Market Trends 3.1.5. South America Solar Tracker Market Trends 3.2. Solar Tracker Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Solar Tracker Market Drivers 3.2.1.2. North America Solar Tracker Market Restraints 3.2.1.3. North America Solar Tracker Market Opportunities 3.2.1.4. North America Solar Tracker Market Challenges 3.2.2. Europe 3.2.2.1. Europe Solar Tracker Market Drivers 3.2.2.2. Europe Solar Tracker Market Restraints 3.2.2.3. Europe Solar Tracker Market Opportunities 3.2.2.4. Europe Solar Tracker Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Solar Tracker Market Drivers 3.2.3.2. Asia Pacific Solar Tracker Market Restraints 3.2.3.3. Asia Pacific Solar Tracker Market Opportunities 3.2.3.4. Asia Pacific Solar Tracker Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Solar Tracker Market Drivers 3.2.4.2. Middle East and Africa Solar Tracker Market Restraints 3.2.4.3. Middle East and Africa Solar Tracker Market Opportunities 3.2.4.4. Middle East and Africa Solar Tracker Market Challenges 3.2.5. South America 3.2.5.1. South America Solar Tracker Market Drivers 3.2.5.2. South America Solar Tracker Market Restraints 3.2.5.3. South America Solar Tracker Market Opportunities 3.2.5.4. South America Solar Tracker Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Solar Tracker Industry 3.8. Analysis of Government Schemes and Initiatives For Solar Tracker Industry 3.9. Solar Tracker Market Trade Analysis 3.10. The Global Pandemic Impact on Solar Tracker Market 4. Solar Tracker Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Solar Tracker Market Size and Forecast, by Type (2024-2032) 4.1.1. Single Axis 4.1.2. Dual Axis 4.2. Solar Tracker Market Size and Forecast, by Application (2024-2032) 4.2.1. Residential 4.2.2. Commercial 4.2.3. Utility 4.3. Solar Tracker Market Size and Forecast, by Technology (2024-2032) 4.3.1. Solar Photovoltaic (PV) 4.3.2. Concentrated Solar Power (CSP) 4.3.3. Concentrated Photovoltaic (CPV) 4.4. Solar Tracker Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Solar Tracker Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Solar Tracker Market Size and Forecast, by Type (2024-2032) 5.1.1. Single Axis 5.1.2. Dual Axis 5.2. North America Solar Tracker Market Size and Forecast, by Application (2024-2032) 5.2.1. Residential 5.2.2. Commercial 5.2.3. Utility 5.3. North America Solar Tracker Market Size and Forecast, by Technology (2024-2032) 5.3.1. Solar Photovoltaic (PV) 5.3.2. Concentrated Solar Power (CSP) 5.3.3. Concentrated Photovoltaic (CPV) 5.4. North America Solar Tracker Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Solar Tracker Market Size and Forecast, by Type (2024-2032) 5.4.1.1.1. Single Axis 5.4.1.1.2. Dual Axis 5.4.1.2. United States Solar Tracker Market Size and Forecast, by Application (2024-2032) 5.4.1.2.1. Residential 5.4.1.2.2. Commercial 5.4.1.2.3. Utility 5.4.1.3. United States Solar Tracker Market Size and Forecast, by Technology (2024-2032) 5.4.1.3.1. Solar Photovoltaic (PV) 5.4.1.3.2. Concentrated Solar Power (CSP) 5.4.1.3.3. Concentrated Photovoltaic (CPV) 5.4.2. Canada 5.4.2.1. Canada Solar Tracker Market Size and Forecast, by Type (2024-2032) 5.4.2.1.1. Single Axis 5.4.2.1.2. Dual Axis 5.4.2.2. Canada Solar Tracker Market Size and Forecast, by Application (2024-2032) 5.4.2.2.1. Residential 5.4.2.2.2. Commercial 5.4.2.2.3. Utility 5.4.2.3. Canada Solar Tracker Market Size and Forecast, by Technology (2024-2032) 5.4.2.3.1. Solar Photovoltaic (PV) 5.4.2.3.2. Concentrated Solar Power (CSP) 5.4.2.3.3. Concentrated Photovoltaic (CPV) 5.4.3. Mexico 5.4.3.1. Mexico Solar Tracker Market Size and Forecast, by Type (2024-2032) 5.4.3.1.1. Single Axis 5.4.3.1.2. Dual Axis 5.4.3.2. Mexico Solar Tracker Market Size and Forecast, by Application (2024-2032) 5.4.3.2.1. Residential 5.4.3.2.2. Commercial 5.4.3.2.3. Utility 5.4.3.3. Mexico Solar Tracker Market Size and Forecast, by Technology (2024-2032) 5.4.3.3.1. Solar Photovoltaic (PV) 5.4.3.3.2. Concentrated Solar Power (CSP) 5.4.3.3.3. Concentrated Photovoltaic (CPV) 6. Europe Solar Tracker Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Solar Tracker Market Size and Forecast, by Type (2024-2032) 6.2. Europe Solar Tracker Market Size and Forecast, by Application (2024-2032) 6.3. Europe Solar Tracker Market Size and Forecast, by Technology (2024-2032) 6.4. Europe Solar Tracker Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Solar Tracker Market Size and Forecast, by Type (2024-2032) 6.4.1.2. United Kingdom Solar Tracker Market Size and Forecast, by Application (2024-2032) 6.4.1.3. United Kingdom Solar Tracker Market Size and Forecast, by Technology (2024-2032) 6.4.2. France 6.4.2.1. France Solar Tracker Market Size and Forecast, by Type (2024-2032) 6.4.2.2. France Solar Tracker Market Size and Forecast, by Application (2024-2032) 6.4.2.3. France Solar Tracker Market Size and Forecast, by Technology (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Solar Tracker Market Size and Forecast, by Type (2024-2032) 6.4.3.2. Germany Solar Tracker Market Size and Forecast, by Application (2024-2032) 6.4.3.3. Germany Solar Tracker Market Size and Forecast, by Technology (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Solar Tracker Market Size and Forecast, by Type (2024-2032) 6.4.4.2. Italy Solar Tracker Market Size and Forecast, by Application (2024-2032) 6.4.4.3. Italy Solar Tracker Market Size and Forecast, by Technology (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Solar Tracker Market Size and Forecast, by Type (2024-2032) 6.4.5.2. Spain Solar Tracker Market Size and Forecast, by Application (2024-2032) 6.4.5.3. Spain Solar Tracker Market Size and Forecast, by Technology (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Solar Tracker Market Size and Forecast, by Type (2024-2032) 6.4.6.2. Sweden Solar Tracker Market Size and Forecast, by Application (2024-2032) 6.4.6.3. Sweden Solar Tracker Market Size and Forecast, by Technology (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Solar Tracker Market Size and Forecast, by Type (2024-2032) 6.4.7.2. Austria Solar Tracker Market Size and Forecast, by Application (2024-2032) 6.4.7.3. Austria Solar Tracker Market Size and Forecast, by Technology (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Solar Tracker Market Size and Forecast, by Type (2024-2032) 6.4.8.2. Rest of Europe Solar Tracker Market Size and Forecast, by Application (2024-2032) 6.4.8.3. Rest of Europe Solar Tracker Market Size and Forecast, by Technology (2024-2032) 7. Asia Pacific Solar Tracker Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Solar Tracker Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Solar Tracker Market Size and Forecast, by Application (2024-2032) 7.3. Asia Pacific Solar Tracker Market Size and Forecast, by Technology (2024-2032) 7.4. Asia Pacific Solar Tracker Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Solar Tracker Market Size and Forecast, by Type (2024-2032) 7.4.1.2. China Solar Tracker Market Size and Forecast, by Application (2024-2032) 7.4.1.3. China Solar Tracker Market Size and Forecast, by Technology (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Solar Tracker Market Size and Forecast, by Type (2024-2032) 7.4.2.2. S Korea Solar Tracker Market Size and Forecast, by Application (2024-2032) 7.4.2.3. S Korea Solar Tracker Market Size and Forecast, by Technology (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Solar Tracker Market Size and Forecast, by Type (2024-2032) 7.4.3.2. Japan Solar Tracker Market Size and Forecast, by Application (2024-2032) 7.4.3.3. Japan Solar Tracker Market Size and Forecast, by Technology (2024-2032) 7.4.4. India 7.4.4.1. India Solar Tracker Market Size and Forecast, by Type (2024-2032) 7.4.4.2. India Solar Tracker Market Size and Forecast, by Application (2024-2032) 7.4.4.3. India Solar Tracker Market Size and Forecast, by Technology (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Solar Tracker Market Size and Forecast, by Type (2024-2032) 7.4.5.2. Australia Solar Tracker Market Size and Forecast, by Application (2024-2032) 7.4.5.3. Australia Solar Tracker Market Size and Forecast, by Technology (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Solar Tracker Market Size and Forecast, by Type (2024-2032) 7.4.6.2. Indonesia Solar Tracker Market Size and Forecast, by Application (2024-2032) 7.4.6.3. Indonesia Solar Tracker Market Size and Forecast, by Technology (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Solar Tracker Market Size and Forecast, by Type (2024-2032) 7.4.7.2. Malaysia Solar Tracker Market Size and Forecast, by Application (2024-2032) 7.4.7.3. Malaysia Solar Tracker Market Size and Forecast, by Technology (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Solar Tracker Market Size and Forecast, by Type (2024-2032) 7.4.8.2. Vietnam Solar Tracker Market Size and Forecast, by Application (2024-2032) 7.4.8.3. Vietnam Solar Tracker Market Size and Forecast, by Technology (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Solar Tracker Market Size and Forecast, by Type (2024-2032) 7.4.9.2. Taiwan Solar Tracker Market Size and Forecast, by Application (2024-2032) 7.4.9.3. Taiwan Solar Tracker Market Size and Forecast, by Technology (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Solar Tracker Market Size and Forecast, by Type (2024-2032) 7.4.10.2. Rest of Asia Pacific Solar Tracker Market Size and Forecast, by Application (2024-2032) 7.4.10.3. Rest of Asia Pacific Solar Tracker Market Size and Forecast, by Technology (2024-2032) 8. Middle East and Africa Solar Tracker Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Solar Tracker Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Solar Tracker Market Size and Forecast, by Application (2024-2032) 8.3. Middle East and Africa Solar Tracker Market Size and Forecast, by Technology (2024-2032) 8.4. Middle East and Africa Solar Tracker Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Solar Tracker Market Size and Forecast, by Type (2024-2032) 8.4.1.2. South Africa Solar Tracker Market Size and Forecast, by Application (2024-2032) 8.4.1.3. South Africa Solar Tracker Market Size and Forecast, by Technology (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Solar Tracker Market Size and Forecast, by Type (2024-2032) 8.4.2.2. GCC Solar Tracker Market Size and Forecast, by Application (2024-2032) 8.4.2.3. GCC Solar Tracker Market Size and Forecast, by Technology (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Solar Tracker Market Size and Forecast, by Type (2024-2032) 8.4.3.2. Nigeria Solar Tracker Market Size and Forecast, by Application (2024-2032) 8.4.3.3. Nigeria Solar Tracker Market Size and Forecast, by Technology (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Solar Tracker Market Size and Forecast, by Type (2024-2032) 8.4.4.2. Rest of ME&A Solar Tracker Market Size and Forecast, by Application (2024-2032) 8.4.4.3. Rest of ME&A Solar Tracker Market Size and Forecast, by Technology (2024-2032) 9. South America Solar Tracker Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Solar Tracker Market Size and Forecast, by Type (2024-2032) 9.2. South America Solar Tracker Market Size and Forecast, by Application (2024-2032) 9.3. South America Solar Tracker Market Size and Forecast, by Technology(2024-2032) 9.4. South America Solar Tracker Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Solar Tracker Market Size and Forecast, by Type (2024-2032) 9.4.1.2. Brazil Solar Tracker Market Size and Forecast, by Application (2024-2032) 9.4.1.3. Brazil Solar Tracker Market Size and Forecast, by Technology (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Solar Tracker Market Size and Forecast, by Type (2024-2032) 9.4.2.2. Argentina Solar Tracker Market Size and Forecast, by Application (2024-2032) 9.4.2.3. Argentina Solar Tracker Market Size and Forecast, by Technology (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Solar Tracker Market Size and Forecast, by Type (2024-2032) 9.4.3.2. Rest Of South America Solar Tracker Market Size and Forecast, by Application (2024-2032) 9.4.3.3. Rest Of South America Solar Tracker Market Size and Forecast, by Technology (2024-2032) 10. Company Profile: Key Players 10.1. Array Technologies, Inc. (U.S.) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. NEXTracker (U.S.) 10.3. Array Technologies (U.S.) 10.4. Trina Solar (China) 10.5. SunPower Corporation (U.S.) 10.6. ArcelorMittal Projects (Luxemburg) 10.7. Soltec (Spain) 10.8. Convert Italia (Italy) 10.9. PV Hardware (Spain) 10.10. Arctech Solar (U.S.) 10.11. Solar Steel (Spain) 10.12. Ideematec (Germany) 10.13. Scorpius Trackers (India) 10.14. Sun Action Trackers (U.S.) 10.15. DEGERENERGIE GMBH & CO. KG (Germany) 10.16. GameChange Solar (New York) 10.17. STI Norland (Spain) 10.18. MECASOLAR (Spain) 10.19. Mechatron (India) 10.20. OPTIMUM TRACKER (France) 10.21. Powerway Renewable Energy Co. Ltd. (China) 10.22. Schletter (Germany) 11. Key Findings 12. Industry Recommendations 13. Solar Tracker Market: Research Methodology 14. Terms and Glossary