The South America Frozen Food Market size was valued at USD 26.76 Billion in 2022 and the total South America Frozen Food Market revenue is expected to grow at a CAGR of 3.44 % from 2023 to 2029, reaching nearly USD 35.07 Billion.South America Frozen Food Market

Consumers in South America have spent more income on varieties of foods. The economic growth of South America is leading to an improvement in lifestyle. As the South American working population is busier than before it makes them unable to make food, which drives the frozen food market demand in the region. The frozen food market is driven by the growing popularity of fast food and ready-to-eat food among women and the young generation who are live alone or for studies and jobs which directly or indirectly increases consumption of frozen foods. The growing popularity of frozen vegetables creates a major opportunity for market players in developing countries in South America. Argentina and Brazil are key regions for market growth. The emerging economies in South America are contributing growth opportunities for frozen vegetables. Increasing no of quick-service restaurants and food service outlets in the region has been one of the key opportunities for the frozen food market. The growing popularity of online shopping e-commerce plays an important role to drive market demand. The customers are getting their product more accurately which they desire like a cube, peeled, baked, cooked, half cooked or sliced. The market players are providing a variety of products for industrial as well as household uses with innovation and advanced packaging solutions to improve quality and shelf life.To know about the Research Methodology :- Request Free Sample Report

South America Frozen Food Market Market Dynamics:

Growing demand for convenience food drives the market demand due to busy lifestyles. Increasing Convenience food does not require any preparation to consume or cook. This category includes canned food, packaged food, and frozen food with instant products, among others. With technological advancement in the food industry, the range of convenience food has expanded from frozen, chilled, shelf-stable, prepared mixes and others. Frozen food holds a huge share in this segment due to changing lifestyles. The market is driven due to the adoption of products with longer shelf lives, the increasing demand for ready-to-eat foods due to limited-time cooking of fresh meals, and other factors. Also, a major factor in driving the market due to growing demand for fast food such as McDonald's, Pizza Hut, KFC, and Subway as well as hotels, cafeterias, and resorts. The South American frozen food market is in increasing demand for ready-to-eat frozen food and convenience. Busy lifestyles and changing consumer habits have led to an increased preference for convenient food options that require minimal preparation. This trend has fuelled the demand for a variety of frozen products, including frozen-ready meals, snacks, and appetizers. Manufacturers have an increasing focus on advancement in products and the introduction of safe and healthier frozen food options in South America. Customers are becoming more health-conscious and are looking for frozen foods that are not only useful but also beneficial. This has led to the growth of healthier frozen food substitutions, such as organic products, plant-based options and products with compact levels of additives and preservatives. Furthermore, the growth of retail channels and the penetration of modern retail organisations, such as supermarkets and hypermarkets, have contributed to the growth of the South American frozen food market. These modern selling formats offer a wider range of frozen food products and provide better visibility and accessibility to customers.South America Frozen Food Market Regional Insights:

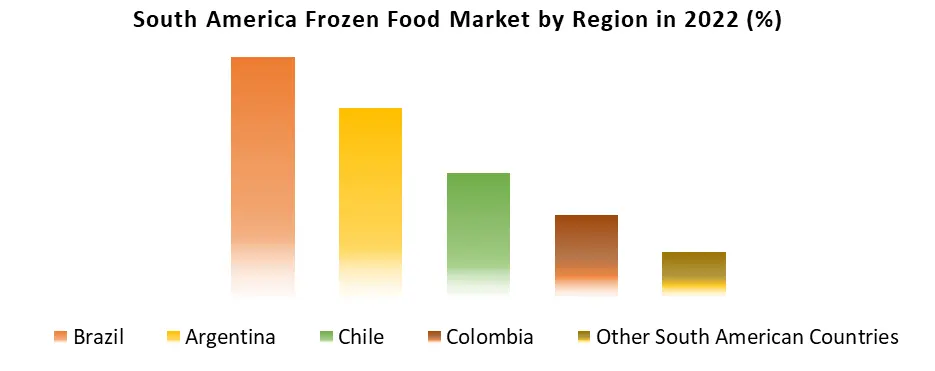

Brazil is expected to dominate the South America Frozen Food Market during the forecast period. Brazil has a large population and a well-developed retail organisation, making it a significant customer of frozen food products. The Brazilian Frozen food industry for offers opportunities for many frozen food categories, including ready-to-eat meals, vegetables, meat products, and frozen fruits. Argentina is another important frozen food market in South America. The country has a strong agricultural region and is known for its meat exports. This has led to a significant presence of frozen meat products in the market. Ready-to-eat meals and frozen vegetables and fruits are also popular among Argentine consumers.South America Frozen Food Market Scope: Inquire before buying

South America Frozen Food Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 26.76 Bn. Forecast Period 2023 to 2029 CAGR: 3.44% Market Size in 2029: US $ 35.07 Bn. Segments Covered: by Offering Fruits Vegetables Potato Products Frozen Potato Products Seafood by End-User Food Service Industry Retail Customers by Product Category Ready-to-eat Ready-to-cook Ready-to-drink Other Product Categories by Freezing Technique Individual Quick Freezing (IQF) Blast Freezing Belt Freezing Other Freezing Techniques South America Frozen Food Market Key Players:

1. BRF - Brazil 2. Alimentos Polar - Venezuela 3. Alimentos Catalina - Argentina 4. Alimentos Nutresa - Colombia 5. Frigorífico Chapecó - Brazil 6. Alimentos San Jorge - Argentina 7. Alimentos Tres Cruces - Uruguay 8. Alimentos Montevideo - Uruguay 9. Alimentos Marfrig - Brazil 10. Alimentos Sadia – BrazilFAQs:

1. What are the growth drivers for the South America Frozen Food Market? Ans. The increasing prevalence of cold chain infrastructure is expected to be the major driver for the market. 2. What is the major restraint for the South America Frozen Food Market growth? Ans. Growing demand for natural food products are expected to be the major restraining factor for the South America Frozen Food Market growth. 3. Which country is expected to lead the global South America Frozen Food Market during the forecast period? Ans. U.A.E is expected to lead the market during the forecast period. 4. What is the projected market size & growth rate of the South America Frozen Food Market? Ans. The market size was valued at USD 26.76 Billion in 2022 and the total Anime revenue is expected to grow at a CAGR of 3.44% from 2023 to 2029, reaching nearly USD 35.07 Billion. 5. What segments are covered in the South America Frozen Food Market report? Ans. The segments covered in the market report are Offering, Product type, Application, and Region

1. South America Frozen Food Market: Research Methodology 2. South America Frozen Food Market: Executive Summary 3. South America Frozen Food Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. South America Frozen Food Market: Dynamics 4.1. Market Trends 4.2. Market Drivers 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Country 5. South America Frozen Food Market: Segmentation (by Value USD and Volume Units) 5.1. South America Frozen Food Market, by Offering (2022-2029) 5.1.1. Fruits 5.1.2. Vegetables 5.1.3. Potato Products 5.1.4. Frozen Potato Products 5.1.5. Seafood 5.2. South America Frozen Food Market, by End-User (2022-2029) 5.2.1. Food Service Industry 5.2.2. Retail Customers 5.3. South America Frozen Food Market, by Product Category (2022-2029) 5.3.1. Ready-to-eat 5.3.2. Ready-to-cook 5.3.3. Ready-to-drink 5.3.4. Other Product Categories 5.4. South America Frozen Food Market, by Freezing Technique (2022-2029) 5.4.1. Individual Quick Freezing (IQF) 5.4.2. Blast Freezing 5.4.3. Belt Freezing 5.4.4. Other Freezing Techniques 5.5. South America Frozen Food Market, by Country (2022-2029) 5.5.1. Brazil 5.5.2. Argentina 5.5.3. Rest of South America 6. Company Profile: Key players 6.1.1. Al Kabeer Group - Riyadh, Saudi Arabia 6.1.2. Company Overview 6.1.3. Financial Overview 6.1.4. Business Portfolio 6.1.5. SWOT Analysis 6.1.6. Business Strategy 6.1.7. Recent Developments 6.2. Sunbulah Group - Jeddah, Saudi Arabia 6.3. Kraft Heinz Company - Chicago, Illinois, USA 6.4. Tyson Foods, Inc. - Springdale, Arkansas, USA 6.5. Grupo Bimbo S.A.B. De C.V. - Mexico City, Mexico 6.6. BRF S.A. - Sao Paulo, Brazil 6.7. Americana Group, Inc. - São Paulo, Brazil 6.8. Avi Ltd. - Tel Aviv, Israel 7. Key Findings 8. Industry Recommendation