The Solar Power Plant Market size was valued at USD 170.23 Billion in 2025 and the total Solar Power Plant revenue is expected to grow at a CAGR of 11.90% from 2025 to 2032, reaching nearly USD 373.98 Billion by 2032. The Solar Power Plant Market has witnessed significant growth and transformation in recent years. With the global push towards sustainable energy sources and the reduction of greenhouse gas emissions, solar power has emerged as a pivotal player in the renewable energy sector. The market is experiencing rapid expansion, driven by several key growth factors. The decreasing cost of solar technology, coupled with advancements in photovoltaic cells and energy storage systems, has made solar power more affordable and efficient. Governments worldwide are offering incentives, subsidies, and favorable policies to promote solar power adoption.To know about the Research Methodology :- Request Free Sample Report Increasing environmental consciousness and corporate sustainability initiatives have also fueled demand for solar power, with businesses and individuals seeking to reduce their carbon footprint. In terms of recent developments by market key players, one notable example is Tesla's foray into solar energy with its innovative solar roof tiles. This technology integrates into residential and commercial buildings, making it aesthetically appealing and energy-efficient. Companies like SunPower and First Solar continue to push the boundaries of solar panel efficiency, contributing to the market's growth. The Solar Power Plant Market is growing due to cost reductions, policy support, growing environmental awareness, and pioneering innovations by industry leaders, positioning it as a critical component of the global transition towards clean and sustainable energy sources.

Solar Power Plant Market Scope and Research Methodology:

The scope of the Solar Power Plant Market encompasses an in-depth analysis of the global solar power generation industry. Factors driving market growth, challenges, and opportunities, such as cost reductions, government incentives, environmental concerns, and technological advancements, are analyzed. Additionally, the report examines the competitive landscape, investment trends, and regulatory frameworks impacting the industry. The research methodology employed for this market analysis involves a combination of primary and secondary research. Key market growth drivers and restraints, recent developments, and emerging trends are evaluated using a qualitative and quantitative approach. Market data, statistics, and forecasts are derived from rigorous analysis, modeling, and industry expertise. The report aims to deliver valuable insights for businesses, investors, policymakers, and other stakeholders interested in the solar power generation industry, enabling them to make informed decisions and strategic investments in this rapidly evolving and critical sector.Market Dynamics:

Government incentives and environmental awareness drive solar growth: The continuous decline in solar panel prices has been a primary growth driver for the Solar Power Plant Market. For instance, the cost of photovoltaic panels has plummeted, making solar energy more accessible for consumers and businesses. This price reduction has been exemplified by companies like JinkoSolar, which consistently achieves economies of scale, contributing to lower costs. Favorable government incentives and policies, such as tax credits have boosted the adoption of solar power. In the United States, the Investment Tax Credit (ITC) and the Solar Investment Tax Credit (SITC) have spurred solar project development and investment. Growing awareness of environmental issues and the need for cleaner energy sources has encouraged individuals and businesses to invest in solar power. Google committed to running on 100% renewable energy, showcasing the influence of environmental consciousness on driving solar market growth. Tesla's Powerwall is a prime example, as it allows homeowners to store excess solar energy for later use, making solar more reliable and attractive. Many corporations are adopting renewable energy as part of their sustainability strategies. Apple's commitment to powering its facilities with 100% renewable energy, including solar power plants, illustrates how corporate initiatives are driving market expansion. Ongoing advancements in solar technology have improved efficiency and output. Companies like SunPower are renowned for producing high-efficiency solar panels, which offer better performance and greater energy production, contributing to market growth. The achievement of grid parity, where the cost of solar power equals or falls below conventional grid electricity, has made solar energy economically competitive. For instance, India has reached grid parity in several regions, driving substantial growth in solar power installations. Solar power plants are vital in bringing electricity to remote and off-grid areas, serving as a growth driver in regions where traditional power infrastructure is lacking. The success of projects like the Solar Sahelis initiative in India highlights the potential of solar for rural electrification.Top 10 Largest Solar Power Plants In The World: The emergence of the top 10 largest installations showcases a paradigm shift towards renewable energy. India and China have taken the lead in this transition, with the Asia Pacific region experiencing a significant surge in solar photovoltaic installations, surpassing 70GW in. Bhadla Solar Park in Rajasthan, India, stands out as the largest operating solar power plant, producing 2.2GW across its expansive 5700-hectare expanse. It has achieved a remarkable cost efficiency of ₹2.44 (3.4¢ US) per kWh. Huanghe Hydropower's Golmud Solar Park in Qinghai, China, with 2.2GW output, is a testament to the staggering growth of solar projects.

Type Description Country and Regional Highlights Ambitious policies and targets in major solar PV markets are driving capacity growth. Energy Solar PV electricity generation saw a substantial increase in 2022, aligning with 2030 Net Zero Scenario milestones. Technology Deployment Distributed systems are increasingly crucial in global solar PV deployment. Technology Manufacturing Solar PV manufacturing capacity expansion is set to surpass 2030 demand as per the Net Zero Scenario Innovation Crystalline silicon technology continues to dominate the PV market, with new, more efficient designs gaining ground. Policy Strong policy support is a key driver of the acceleration in solar PV capacity growth. Investment In 2022, solar PV solidified its position as the most invested power generation technology. International Collaboration Various global and bilateral collaboration initiatives are advancing technological development and policy support. Private Sector Strategies Solar PV is the primary renewable technology choice in the private sector. Furthermore, the Pavagada Solar Park in Karnataka, India, Benban Solar Park in Egypt, and Tengger Desert Solar Park in China contribute to the solar energy revolution, driving a greener, more sustainable future. Mohammed bin Rashid Al Maktoum Solar Park in Dubai, with its ambitious 5GW capacity and Noor Abu Dhabi Solar Plant in the UAE, exemplifies the global commitment to harnessing solar power. While these mega-projects are taking the solar industry by storm, the world is observing a shift towards cleaner and more abundant energy sources, ultimately reducing our carbon footprint and fostering a greener planet.

Grid Integration Complexities and Energy Storage Limitations Impact Solar Power Plants: One significant challenge for the Solar Power Plant Market is the intermittent nature of solar energy generation. Solar power relies on sunlight, making it inconsistent at nighttime and under adverse weather conditions. This intermittentity can affect grid stability and necessitate backup power sources, like batteries. For example, the state of California experienced rolling blackouts due to over-reliance on solar power during an extended heatwave, highlighting the need for effective energy storage solutions. The upfront costs of building solar power plants can be substantial. While the price of solar panels has decreased, overall installation, land, and infrastructure expenses can still be a barrier to entry. India's Bhadla Solar Park, despite being one of the largest solar facilities, required a substantial $1.4 billion investment, underlining the capital required for such projects. Large solar power plants require vast land areas, which can lead to concerns about land use, habitat disruption, and ecological impact. For example, the Ivanpah Solar Electric Generating System in the Mojave Desert faced criticism for affecting local wildlife and habitat, highlighting the need for responsible site selection and environmental mitigation. Energy storage systems are crucial for ensuring a continuous energy supply. However, current battery technologies have limitations in terms of capacity, efficiency, and cost. The Hornsdale Power Reserve in Australia, while a remarkable energy storage facility, also highlights the need for continued advancements in storage technology to meet the demands of solar power plants. Integrating large-scale solar power plants into existing electrical grids can be complex. Grids must be upgraded to handle intermittent renewable energy inputs. The integration of Desert Sunlight Solar Farm in California faced grid challenges, emphasizing the necessity for grid modernization and smart grid solutions. Solar power plant output is heavily reliant on geographical location and weather conditions. Regions with extended periods of cloudy or rainy weather may experience lower energy production. Germany, despite its commitment to solar energy, faces reduced output during its often overcast winters. The production of solar panels relies on critical materials like rare earth elements. Limited availability and geopolitical tensions surrounding these resources can impact the solar power industry. For instance, China's dominance in rare earth production raises concerns about supply chain stability. Frequent changes in government policies, subsidies, and tariffs can create uncertainty for investors in the solar power sector. The solar industry in the United States experiences fluctuations due to shifting policies, affecting long-term planning and investments. As solar power plants age, maintenance and efficiency become concerns. Older facilities may require upgrades and repairs to remain competitive. The challenges faced by the Mount Signal Solar facility in California underscore the need for continuous maintenance and optimization. Batteries and Grid Reliability Enhancing Solar's Potential. The Solar Power Plant Market is currently witnessing a remarkable transformation, with solar energy emerging as a shining star, accounting for approximately half of the new planned capacity in. This surge in solar power's prominence signifies a significant opportunity for the industry. Solar energy generation, while abundant, is not constant, which has led to an increased focus on energy storage solutions. Batteries are being widely adopted to store surplus solar energy for later use, enhancing overall reliability and grid stability. Unlike some other energy sources, batteries do not burn fossil fuels on-site and can be charged from the grid, reducing emissions elsewhere. Solar's rise is impressive, but it is essential to recognize that the pace of clean energy power-plant construction must increase significantly to meet ambitious targets, such as President Biden's goal of reducing greenhouse gas emissions by half compared to levels. The industry's opportunity is further magnified by government incentives and funding. The Inflation Reduction Act, which allocated $369 billion to promote clean energy adoption, has made clean energy portfolios more economically attractive. In fact, recent analysis indicates that armed with these incentives, clean energy projects are expected to be more cost-effective than nearly every new gas plant planned for construction through.

Solar Power Plant Location Capacity (GW) Area (hectares) Main Technology Bhadla Solar Park Bhadla, Rajasthan, India 2.2 5,700 Flat panel PV Huanghe Hydropower Golmud Solar Park Golmud, Qinghai, China 2.2 N/A Flat panel PV Pavagada Solar Park Pavagada, Karnataka, India 2 13,000 Flat panel Benban Solar Park Benban, Aswan, Egypt 1.8 37.2 Various Tengger Desert Solar Park Zhongwei, Ningxia, China 1.547 4,300,000 sq. m. N/A Noor Abu Dhabi Solar Plant Sweihan, Abu Dhabi, UAE 1.2 8 N/A Mohammed Bin Rashid Al Maktoum Solar Park Saih Al Dahal, Dubai 5 77 N/A Kurnool Ultra Mega Solar Park Kurnool, Andhra Pradesh, India 1 2,400,000 sq. m. N/A Datong Solar Power Top Runner Base Datong City, Shanxi, China 1.0 (3.0 planned) N/A N/A NP Kunta N/A 1.0 (3.0 planned) 3,200,000 sq. m. N/A Solar Power Plant Market Segment Analysis:

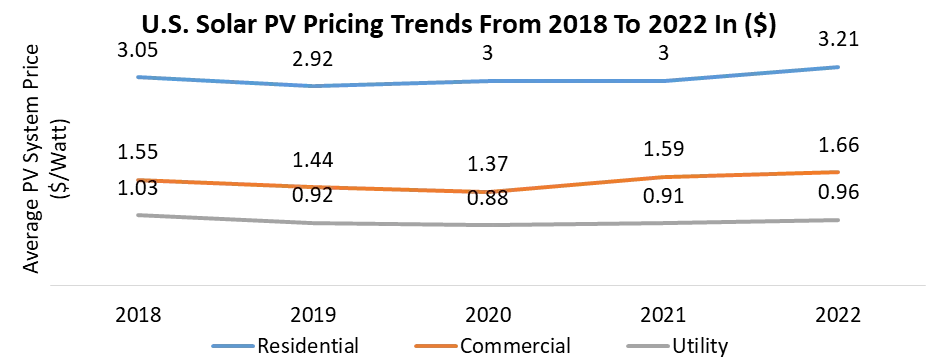

Based on Application, The Solar Power Plant Market, segmented by application into Residential, Commercial, and Industrial sectors, exhibits distinct adoption patterns and challenges. Residential solar installations face the dual challenge of rising hardware prices and increasing soft costs, including installation labor and permitting/inspection/interconnection expenses. Despite price fluctuations, residential solar saw a 40% growth in 2024, driven by household electricity bill concerns and power outages, with Net Metering changes posing potential threats. On the other hand, the Commercial solar market, traditionally dominated by a few states like California, Massachusetts, New Jersey, and New York, is undergoing a shift. The Infrastructure Investment and Jobs Act (IRA) is poised to drive growth in emerging commercial markets with provisions like transferability, direct pay, and adder credits. However, market stability is sensitive to policy changes in dominant states, which could impact national growth. Industrial applications also play a crucial role in the overall market landscape.

Solar Power Plant Market Regional Insights:

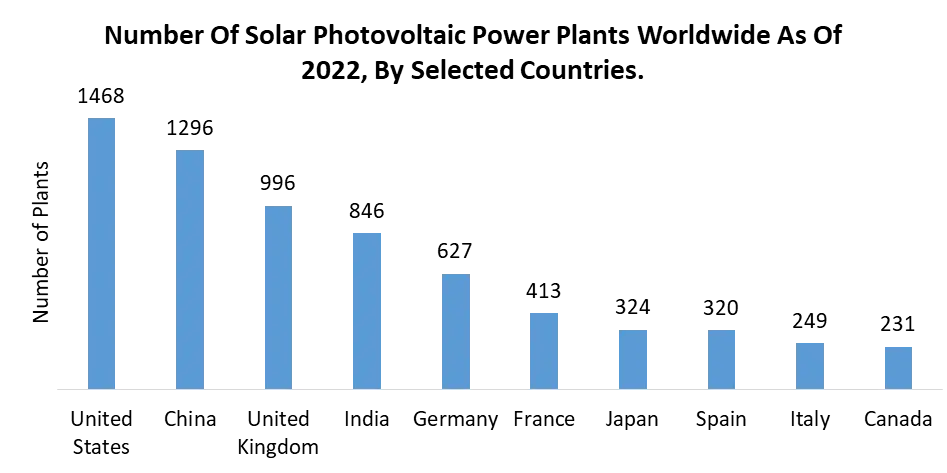

The Solar Power Plant Market exhibits dynamic regional insights, with variations in large producing and consuming regions, as well as regional import and export data. Large producing regions, such as China, the United States, and India, play pivotal roles in the global solar energy landscape. China, renowned for its vast solar manufacturing capabilities, leads in solar panel production, fostering global supply chains. The United States, particularly states like California and Texas, boasts substantial solar power generation capacity, contributing significantly to clean energy production. India, with its ambitious solar energy initiatives and projects like the Bhadla Solar Park, stands as a rising solar production hub. On the consumption front, Europe, particularly countries like Germany and Spain, showcases a robust appetite for solar power. Germany's commitment to renewable energy, despite its often overcast weather, positions it as a key solar market. Spain, too, with its solar irradiance, drives solar adoption. In contrast, the Middle East, represented by the United Arab Emirates and Saudi Arabia, represents the surging adoption of solar energy for diversifying their energy mix, given their abundant sunlight. When examining regional import and export data, Europe often emerges as a net importer of solar panels, relying on countries like China for its solar equipment needs. Conversely, the United States exports a considerable volume of solar products, benefiting from its manufacturing and technological prowess. These regional dynamics underscore the complex interplay between production, consumption, and trade, shaping the Solar Power Plant Market's global landscape. As nations align with sustainability goals and seek energy independence, these regional trends will continue to evolve, impacting the future of solar power generation and utilization.

Competitive Landscape

Key Players of the Solar Power Plant Market profiled in the report are Darling Ingredients Abengoa Se, Acciona S.A., Adani Enterprises Ltd, Azure Power Global Limited, Canadian Solar, Delta Electronics, Inc., Emmvee Photovoltaic Power Private Limited, Fimer Group, First Solar Inc., General Electric Company (U.S.), JA SOLAR Technology Co., Ltd, Jinko Solar Holdings Co. Ltd, LONGi, Qcells, Risen Energy Co., Ltd. This provides huge opportunities to serve many End-users and customers and expand the Solar Power Plant Market. In May 2023, First Solar, Inc. made a significant announcement by acquiring Evolar AB, a prominent European company specializing in perovskite technology for thin film photovoltaics (PV). This strategic move firmly cements First Solar's position as a global thin-film PV market leader. The acquisition involves an initial purchase price of approximately USD 38 million, payable upon the deal's closure, with the potential for an additional USD 42 million contingent on achieving specific technical milestones in the future. This acquisition is expected to impact First Solar's operating expenses for the year 2023, estimated at around USD 2-4 million, excluding any effects related to purchase price accounting. It underscores First Solar's commitment to advancing its technological capabilities and expanding its presence in the ever-evolving solar energy sector. In November 2022, Canadian Solar Inc. proudly announced that its Azuma Kofuji solar project, boasting 100 MWp capacity in Japan's Fukushima Prefecture, has achieved commercial operation, making it the largest operational solar project in the region. Powered by Canadian Solar's HiKu modules, this project is anticipated to generate approximately 106,800 MWh of clean energy annually, powering around 31,000 households and reducing CO2 emissions by over 50,000 metric tons per year. Additionally, a portion of the project's electricity sales revenues will be contributed to Fukushima City to support local agricultural sector activities, showcasing Canadian Solar's commitment to sustainable energy and local community support.

Country/Region Notable Progress and Highlights China - Led in solar PV capacity additions with 100 GW in 2022, a 60% increase from 2021. - Ambitious targets in the 14th Five-Year Plan for Renewable Energy. European Union - Accelerated solar PV deployment with 38 GW added in 2022, a 50% increase from 2021. - New policies and targets in the REPowerEU Plan and The Green Deal Industrial Plan. United States - Generous funding for solar PV in the Inflation Reduction Act (IRA) introduced in 2022. - Investment and production tax credits to boost PV capacity. India - Installed 18 GW of solar PV in 2022, a 40% increase from 2021. - New target to increase PV capacity auctioned to 40 GW annually. Brazil - Added almost 11 GW of solar PV capacity in 2022, doubling 2021 growth. - Continuous demand for renewable energy. Solar Power Plant Market Scope: Inquire before buying

Solar Power Plant Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 170.23 Bn. Forecast Period 2026 to 2032 CAGR: 11.90% Market Size in 2032: USD 373.98 Bn. Segments Covered: by Product Solar panel Batteries Inverters by Source New Installation MRO (Maintenance, Repair & Operations) by Application Residential Commercial Industrial by End-User Electricity generation Lighting Heating Charging Solar Power Plant Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Solar Power Plant Market, Key Players are

1. Adani Green Energy Limited (India) 2. JinkoSolar Holding Co., Ltd. (China) 3. Tongwei Solar Co., Ltd. (China) 4. JA Solar Technology Co., Ltd. (China) 5. LONGi Green Energy Technology Co., Ltd. (China) 6. Trina Solar Limited (China) 7. Canadian Solar Inc. (Canada) 8. First Solar, Inc. (USA) 9. Vikram Solar Limited (India) 10. Risen Energy Co., Ltd. (China) 11. Hanwha Q CELLS USA, Inc. (USA) 12. GCL-Poly Energy Holdings Limited (China) 13. Sungrow Power Supply Co., Ltd. (China) 14. SolarEdge Technologies, Inc. (Israel) 15. REC Group (Norway) 16. ReneSola Ltd. (China) 17. Talesun Solar Technologies Co., Ltd. (China) 18. Karma Energy Limited (India) 19. Meyer Burger Technology AG (Switzerland) 20. Suntech Power Holdings Co., Ltd. (China) 21. Wuxi Suntech Power Co., Ltd. (China) 22. Seraphim Solar System Co., Ltd. (China) 23. First Solar Malaysia Sdn Bhd (Malaysia) 24. Sungrow Power Supply Co., Ltd. (Vietnam) 25. GCL-Poly Energy Holdings Limited (USA) 26. Aiko Solar Co., Ltd. (China) 27. Solaria Energía y Medio Ambiente S.A.U.(Spain) 28. Silfab Solar Inc. (Canada) 29. Tata Power Solar Systems Ltd (India) 30. Waaree Energies Ltd. (India) FAQs: 1. What are the growth drivers for the Solar Power Plant Market? Ans. Government incentives and environmental awareness drive solar growth and are expected to be the major driver for the Solar Power Plant Market. 2. What is the major opportunity for the Solar Power Plant Market growth? Ans. Batteries and Grid Reliability Enhancing Solar's Potential is expected to be a major Opportunity in the Solar Power Plant Market. 3. Which country is expected to lead the global Solar Power Plant Market during the forecast period? Ans. Asia Pacific is expected to lead the Solar Power Plant Market during the forecast period. 4. What is the projected market size and growth rate of the Solar Power Plant Market? Ans.The Solar Power Plant Market size was valued at USD 170.23 Billion in 2025 and the total Solar Power Plant revenue is expected to grow at a CAGR of 11.90% from 2025 to 2032, reaching nearly USD 373.98 Billion by 2032. 5. What segments are covered in the Solar Power Plant Market report? Ans. The segments covered in the Solar Power Plant Market report are by Product, Source, Application, End-Use, and Region.

1. Solar Power Plant Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2025) & Forecast (2025-2032), 1.1.2. Market Size (Value in USD Billion) and Market Share (%) - By Segments, Regions and Country 2. Solar Power Plant Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Business Portfolio 2.3.4. End-User 2.3.5. Revenue (2025) 2.3.6. Market Share (%) 2025 2.3.7. Technology Integration 2.3.8. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. Research and Development 3. Solar Power Plant Market: Dynamics 3.1. Market Trends 3.2. Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Global Industry 4. Technology Advancements & Integration 4.1. Smart Solar Panels & AI-Based Optimization 4.2. Energy Storage Integration (Battery & Grid-Scale Storage) 4.3. Internet of Things (IoT) in Solar Power Plants 4.4. Blockchain for Solar Energy Trading 4.5. Floating Solar Farms & Offshore Solar Developments 4.6. Hybrid Renewable Energy Systems (Solar-Wind, Solar-Hydro) 5. Pricing Analysis 5.1. Solar Module Price Trends, By Region, (2019-2025) 5.2. Pricing Trends of Solar Inverters, Trackers, and BOS (Balance of System) Components 5.3. Installation Cost Analysis for Utility-Scale, C&I, and Residential Solar Plants 5.4. Levelized Cost of Energy (LCOE) Analysis for Solar Power Generation 5.5. Impact of Raw Material Prices on Solar Power Plant Costs 6. Supply Chain Analysis 6.1. Raw Material Sourcing 6.2. Solar Module Manufacturing Process 6.3. Inverter, Battery, and Balance of System (BOS) Supply Chain 6.4. Logistics & Distribution Networks 6.5. Supply Chain Disruptions and Risk Factors 6.6. Key Suppliers & Strategic Partnerships 7. Regulatory Landscape 7.1. Government Policies and Incentives for Solar Power 7.2. Renewable Energy Targets & Net-Zero Commitments 7.3. Subsidies, Tax Credits, and Feed-in Tariffs (FiTs) 7.4. Environmental and Safety Regulations for Solar Projects 7.5. Grid Connection & Net Metering Policies 7.6. International Standards and Compliance (IEC, UL, ISO) 8. Solar Power Plant Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2025 -2032) 8.1. Solar Power Plant Market Size and Forecast, By Product 8.1.1. Solar panel 8.1.2. Batteries 8.1.3. Inverters 8.2. Solar Power Plant Market Size and Forecast, By Source 8.2.1. New Installation 8.2.2. MRO (Maintenance, Repair & Operations) 8.3. Solar Power Plant Market Size and Forecast, By Application 8.3.1. Residential 8.3.2. Commercial 8.3.3. Industrial 8.4. Solar Power Plant Market Size and Forecast, By End-User 8.4.1. Electricity generation 8.4.2. Lighting 8.4.3. Heating 8.4.4. Charging 8.5. Solar Power Plant Market Size and Forecast, By Region 8.5.1. North America 8.5.2. Europe 8.5.3. Asia Pacific 8.5.4. Middle East and Africa 8.5.5. South America 9. North America Solar Power Plant Market Size and Forecast by Segmentation (by Value in USD Billion) (2025 -2032) 9.1. North America Solar Power Plant Market Size and Forecast, By Product 9.2. North America Solar Power Plant Market Size and Forecast, By Source 9.3. North America Solar Power Plant Market Size and Forecast, By Application 9.4. North America Solar Power Plant Market Size and Forecast, By End-User 9.5. North America Solar Power Plant Market Size and Forecast, By Country 9.5.1. United States 9.5.1.1. United States Solar Power Plant Market Size and Forecast, By Product 9.5.1.2. United States Solar Power Plant Market Size and Forecast, By Source 9.5.1.3. United States Solar Power Plant Market Size and Forecast, By Application 9.5.1.4. United States Solar Power Plant Market Size and Forecast, By End-User 9.5.2. Canada 9.5.3. Mexico 10. Europe Solar Power Plant Market Size and Forecast by Segmentation (by Value in USD Billion) (2025 -2032) 10.1. Europe Solar Power Plant Market Size and Forecast, By Product 10.2. Europe Solar Power Plant Market Size and Forecast, By Source 10.3. Europe Solar Power Plant Market Size and Forecast, By Application 10.4. Europe Solar Power Plant Market Size and Forecast, By End-User 10.5. Europe Solar Power Plant Market Size and Forecast, By Country 10.5.1. United Kingdom 10.5.2. France 10.5.3. Germany 10.5.4. Italy 10.5.5. Spain 10.5.6. Sweden 10.5.7. Russia 10.5.8. Switzerland (Zurich) 10.5.9. Rest of Europe 11. Asia Pacific Solar Power Plant Market Size and Forecast by Segmentation (by Value in USD Billion) (2025 -2032) 11.1. Asia Pacific Solar Power Plant Market Size and Forecast, By Product 11.2. Asia Pacific Solar Power Plant Market Size and Forecast, By Source 11.3. Asia Pacific Solar Power Plant Market Size and Forecast, By Application 11.4. Asia Pacific Solar Power Plant Market Size and Forecast, By End-User 11.5. Asia Pacific Solar Power Plant Market Size and Forecast, By Country 11.5.1. China 11.5.2. S. Korea 11.5.3. India 11.5.4. Japan 11.5.5. Australia 11.5.6. Indonesia 11.5.7. Philippines 11.5.8. Malaysia 11.5.9. Vietnam 11.5.10. Thailand 11.5.11. Rest of Asia Pacific 12. Middle East and Africa Solar Power Plant Market Size and Forecast by Segmentation (by Value in USD Billion) (2025 -2032) 12.1. Middle East and Africa Solar Power Plant Market Size and Forecast, By Product 12.2. Middle East and Africa Solar Power Plant Market Size and Forecast, By Source 12.3. Middle East and Africa Solar Power Plant Market Size and Forecast, By Application 12.4. Middle East and Africa Solar Power Plant Market Size and Forecast, By End-User 12.5. Middle East and Africa Solar Power Plant Market Size and Forecast, By Country 12.5.1. South Africa 12.5.2. GCC 12.5.3. Egypt 12.5.4. Nigeria 12.5.5. Rest of ME&A 13. South America Solar Power Plant Market Size and Forecast by Segmentation (by Value in USD Billion) (2025 -2032) 13.1. South America Solar Power Plant Market Size and Forecast, By Product 13.2. South America Solar Power Plant Market Size and Forecast, By Source 13.3. South America Solar Power Plant Market Size and Forecast, By Application 13.4. South America Solar Power Plant Market Size and Forecast, By End-User 13.5. South America Solar Power Plant Market Size and Forecast, By Country 13.5.1. Brazil 13.5.2. Argentina 13.5.3. Chile 13.5.4. Colombia 13.5.5. Rest Of South America 14. Company Profile: Key Players 14.1. Adani Green Energy Limited (India) 14.1.1. Company Overview 14.1.2. Business Portfolio 14.1.3. Financial Overview 14.1.4. SWOT Analysis 14.1.5. Strategic Analysis 14.1.6. Recent Developments 14.02. JinkoSolar Holding Co., Ltd. (China) 14.03. Tongwei Solar Co., Ltd. (China) 14.04. JA Solar Technology Co., Ltd. (China) 14.05. LONGi Green Energy Technology Co., Ltd. (China) 14.06. Trina Solar Limited (China) 14.07. Canadian Solar Inc. (Canada) 14.08. First Solar, Inc. (USA) 14.09. Vikram Solar Limited (India) 14.10. Risen Energy Co., Ltd. (China) 14.11. Hanwha Q CELLS USA, Inc. (USA) 14.12. GCL-Poly Energy Holdings Limited (China) 14.13. Sungrow Power Supply Co., Ltd. (China) 14.14. SolarEdge Technologies, Inc. (Israel) 14.15. REC Group (Norway) 14.16. ReneSola Ltd. (China) 14.17. Talesun Solar Technologies Co., Ltd. (China) 14.18. Karma Energy Limited (India) 14.19. Meyer Burger Technology AG (Switzerland) 14.20. Suntech Power Holdings Co., Ltd. (China) 14.21. Wuxi Suntech Power Co., Ltd. (China) 14.22. Seraphim Solar System Co., Ltd. (China) 14.23. First Solar Malaysia Sdn Bhd (Malaysia) 14.24. Sungrow Power Supply Co., Ltd.(Vietnam) 14.25. GCL-Poly Energy Holdings Limited(USA) 14.26. Aiko Solar Co., Ltd.(China) 14.27. Solaria Energía y Medio Ambiente S.A.U.(Spain) 14.28 .Silfab Solar Inc.(Canada) 14.29. Tata Power Solar Systems Ltd(India) 14.30. Waaree Energies Ltd.(India) 15. Key Findings 16. Analyst Recommendations 17. Solar Power Plant Market – Research Methodology