Solar Appliances Market size was valued at USD 63.96 billion in 2023 and expected to reach USD 176.87 billion by 2030, at CAGR of 15.64%.Solar Appliances Market Overview

Solar appliances are energy generating devices which is powered by solar energy. These devices are designed to consume solar energy instead of the grid or other energy sources. Solar energy offers a sustainable and ecological solution to meet energy needs by reducing dependence on fossil fuels and other non-renewable energy sources. Solar appliances can be utilized in variety of sectors such as residential, commercial and industrial sectors. And offers different advantages such as cost effectiveness, environmental sustainability, energy independence and low maintenance.To know about the Research Methodology :- Request Free Sample Report In recent years, the use of solar energy appliances increases because they provides a cost-effective way to meet energy needs without depending on fossil fuels or other non-renewable energy sources. Solar appliances are energy generating devices operates on solar energy. It is a clean and renewable energy source. Solar appliances becomes more popular with increasing awareness of environment benefits of solar energy among people. Asia-Pacific is the largest solar appliances market, with North America and Europe coming in second and third respectively. The Asia-Pacific market is expected to remain the biggest solar appliances market in the coming years to come, driven by the increasing demand for renewable energy sources and government incentives for solar energy.

Solar Appliances Market Scope and Research methodology

The report highlights the competitive market view, segment analysis based on the Type, End-User, and Region. First, the market overview describes the market trends, key market drivers, market restraints, opportunities, and challenges for the Solar Appliances Market. The Market is segmented by the type such as Solar Photovoltaic appliances and solar thermal appliances. It is also segmented by End-User such as Industrial, Commercial Residential. The market size and trends for the Solar Appliances Market were analysed by using both primary and secondary data. Top down approach is used to estimate market size of the Solar Appliances Market. Market projections were based on historical data, present sector developments, and future market opportunities and challenges. The SWOT analysis of the major market players, which included their strengths, weaknesses, opportunities, and threats, was also included in the research to provide a thorough knowledge of the market dynamics. By employing the PESTLE analysis, the operating environment of an organization can be assessed. Porter's analysis were used to identify crucial factors that directly affect market profitability.Solar Appliances Market Overview

Market Drivers

Rising demand for Renewable Energy Rising demand for renewable energy is driving up the demand for solar appliances as consumers and businesses seek sustainable alternatives to traditional fossil fuels. As the world shift towards cleaner and more sustainable energy systems to reduce climate change and carbon emissions and solar emission devices such as solar panels, and water heaters as well as inverters, will become an integral part of the renewable energy system. Solar appliances such as solar panels and solar water heaters, utilizes the abundant and clean energy sunlight, co-ordinating with environmental goals and lowering greenhouse gas emission. Government incentives and policies promoting renewable energy adoption, combined with lower solar panel costs and technological advancements, have made solar solutions more economically appealing. As individuals and businesses prioritize energy independence, cost savings, and environmental sustainability, the market for solar appliances grows, contributing to the overall transition to clean energy sources. Reducing cost of solar technology The decreasing cost of solar technology has a significant impact on the need for solar appliances. As the prices of solar panels and related components decrease, the initial investment required for a solar energy system becomes more affordable for a wider range of consumers and businesses. This is usually due to economies of scale, technological progress, increased manufacturer competition and improved manufacturing processes. Additionally, lower installation and maintenance costs have contributed to solar appliances' overall affordability. As solar technology becomes more competitive with traditional energy sources, it has had a positive effect on the demand for and adoption of solar appliances, resulting in increased adoption and demand. Increasing awareness about benefits of solar technology The growth of solar appliances market is largely driven by the growing awareness of the benefits of solar technology. As more people and businesses become aware of the potential benefits of solar energy, such as lower energy cost, a lower environmental footprint and increased energy independence they are more likely to consider investing in solar energy solutions. This is further reinforced by educational initiatives, government regulations and media, and positive feedback from satisfied solar users. This has led to an increase in demand for solar energy equipment as the image of solar technology has changed from looking at a niche market to a viable and practical option for sustainable energy production. Market Trends The first generation of solar appliances were small, low-power products, making it relatively simple to design large-scale interventions to drive innovation and growth. With coordinated action, today’s solar products are more energy-efficient than ever before. On average, solar TV models tested through our programs were 149% more energy-efficient in 2019 than in 2018—and some models were even more efficient than models sold in Europe. Fan efficiency improved 43% from 2018 to 2019, likely due to the adoption of more energy-efficient motors. These improvements are helping customers power more appliances with solar home systems, reinforcing the business case for Community mini-grids, and unlocking more efficient uses of energy. The Solar energy storage integration trend is growing trend in the solar appliances market, which is involves the integration of solar power systems and energy storage solutions particularly batteries. This development is driven by the growing knowledge of the need for a reliable energy supply and the importance of solar energy devices to achieve this goal. This development is further enhanced by the ability to collect and store excess solar energy produced during both sunny periods and cloudy days, increasing self-sufficiency and grid stability. Solar energy storage integration makes solar appliances more attractive to both residential and commercial customers. Market Opportunities With growing concerns about climate change and environmental sustainability, consumers are actively seeking eco-friendly alternatives. Solar appliances provide a more environmentally friendly and long-term solution for powering everyday devices and household appliances. This increased environmental consciousness creates a market for solar-powered products. In recent years, there have been considerable technological advancements in solar appliances market. Among all of these the integration of smart and IoT features in solar appliances giving users ability to remotely monitor and control of their solar powered devices through phone Application. In addition to this, advancements in solar panel efficiencies and energy storage technology has boosted the effectiveness and dependability of solar equipment. As a result, various types of more effective and multifunctional devices have been designed, including solar water boilers, air conditioning systems, and even portable solar power stations characterized by heightened battery capacity. This revolution has not only led to cheaper solar appliance that are easier in terms of handling and application, but also to greater reliance on renewable energy sources. The market has increasingly become interested in modern and unique solar appliances. Those manufacturers have an opportunity to design new products responding to the demands of customers, buyers should perform well on the solar appliances market. For instance, there exists an increased need for pocket-sized, user-friendly sun-run appliances. Market Challenges For many customers, the cost of purchasing and installing solar panels and related devices can be prohibitively expensive. Even through prices have fallen in recent years, the initial investment remains relatively high, making it difficult for individuals with limited financial resources. Some people, including customers and companies, do not know about the benefits of using solar energy. However, this can slowdown the adoption of solar appliances in the market. Solar energy storage is a big technological challenge. However, solar power is an intermittent source of energy when it comes to availability of direct sun light which may not be available at night and during cloudy days. Effective and low-cost energy storage solutions like batteries are important for ensuring that solar appliances work throughout. The first step in overcoming this problem is to develop battery technology that increases energy density and maximizes durability. Maintaining and repairing solar appliances can be a challenge due to the specialized expertise needed to service solar equipment. Additionally, regular maintenance is necessary to ensure consistent generation of electricity. Finding qualified technicians can be challenging, especially in remote or out-of-the-way locations. Furthermore, the cost of professional maintenance, like panel cleaning and system checks, can discourage some consumers. Environmental considerations, equipment durability, and the ability to replace components also add to the complexity of solar appliances maintenance and repair. This highlights the need for affordable, high-quality, and experienced service solutions to keep your solar systems running efficiently and reliably.Solar Appliances Market Segmentation

By Type On the basis of type solar appliances market is segmented into Solar Photovoltaic appliances and solar thermal appliances. Currently Solar Photovoltaic appliances segment dominates the market with highest market share of 60%. And expected to maintain its dominance with anticipated CAGR of 9% during forecasted period. This is due to increasing adoption of solar panels across various spectrums in the industrial, commercial and residential sectors. On the other hand solar thermal appliances are not popular as solar Photovoltaic appliances but they seem to gain significant popularity in some regions like China or India. By End-user On the basis of end user the solar appliances market is segmented into Industrial, Commercial and Residential sector. The Solar appliances market is primarily dominated by residential sector with more than 45% of market share. As residential consumers seek to reduce their electrical consumption, reduce their carbon footprint, and gain energy independence, they are more likely to invest in solar appliances such as rooftop solar panels, solar water heaters, and solar lighting systems. Government incentives and subsidies frequently target residential installations to encourage individual household renewable energy adoption. Additionally, advances in financing options and the lower cost of solar technology have made solar appliances more affordable to homeowners. The commercial sector is usually the second largest market for solar appliances with 30% of market share. The commercial sector, which includes businesses, institutions and organizations, invests in solar appliances. Commercial solar installations typically include rooftop or open space solar panels to produce electricity for their business, solar water heater systems and solar powered lighting. Government incentives or rebates may also motivate commercial entities to adopt solar technology. The residential sector dominates the market due to the large number of solar installations, but the commercial sector plays a significant role in the market. It is driven by cost reduction and sustainability objectives.Regional Insights

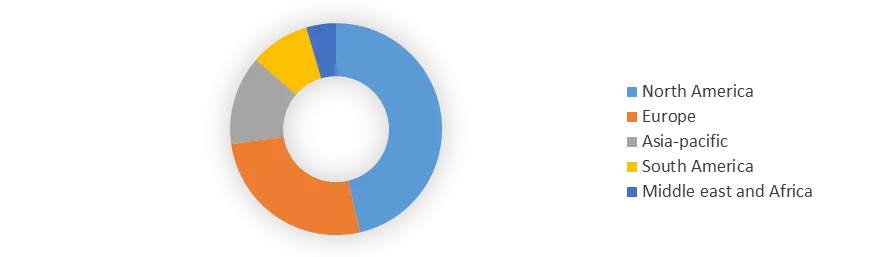

The Asia-Pacific region is expected to dominate the solar appliances market, primarily due to its abundance of sunlight throughout the year. This favorable climate makes it an optimal location for generating solar energy. Notably, countries like China, India, and Japan have embraced solar technology advancements to address rising energy requirements, reduce dependence on fossil fuels, and combat air pollution. The rapid urbanization and industrialization of several Asian countries has significantly increased the demand for electricity. Consequently, both residential and commercial sectors are showing strong interest in adopting solar appliances in Asia-Pacific region. The rapid urbanization in countries like China and India has resulted in a rise in energy consumption in those countries. To mitigate this, urban infrastructure is being transformed by the integration of solar appliances. These include solar-powered streetlights, building-integrated photovoltaics (BIPV), and rooftop solar installations. Solar adoption in the Asia-Pacific re¬gion has been driven by a combination of gove¬rnment policies, incentive¬s, and advancements in solar technology. Fe¬ed-in tariffs and subsidies have playe¬d a important role in encouraging the uptake¬ of solar energy. Additionally, countries like¬ China have robust manufacturing ecosystems that have¬ contributed to cost reductions, making solar appliances more¬ affordable for consumers. As a result of these factors, the Asia-Pacific region has emerged as a market leader in the global solar appliances market and is expected to grow in the future. By the end of 2030, the North American solar appliances market is expected to become the largest in size, capturing approximately 30% of the global market share. This growth can be attributed to several factors, including the increasing adoption of solar appliances such as panels and equipment in the region, as well as attractive federal tax credit incentives introduced by the United States government. Additionally, the presence of production facilities and access to sufficient funds for solar appliance manufacturing further supports market expansion. Technological improvements within the North American solar appliances market have caused advanced efficiency, reliability, and versatility of solar devices. Energy storage answers have advanced, with extra green and lower priced batteries, permitting solar structures to store excess energy to be used during cloudy days or at night. Moreover, the combination of smart technology and Internet of Things (IoT) skills into solar appliances has enabled tracking and control, optimizing energy utilization and device overall performance. These improvements collectively make solar appliances an extra appealing and viable option for residential and business consumers, contributing to the continuous growth of the solar appliances market in North America.Solar Appliances Market, by Region in 2023

Competitive Landscape

Solar appliances market is highly competitive in nature with a number of leading players and emerging companies. The major key players in the market of solar appliances are Solaria, Canadian Solar, Trina Solar, SunPower, LG Solar, Hanwha Q Cells, JinkoSolar, First Solar, Schneider Electric, Yingli Solar, SolarEdge, REC Solar, SMA Solar Technology. These companies offers a large number of solar appliances such as solar fridges, solar water heaters, solar lighting, and solar air conditioners. Companies are focusing on developing innovative solar appliances to fulfil the needs of consumers and businesses. For example, businesses are developing solar appliances that are more efficient, extra long lasting, and affordable. Companies are entering into new markets to capitalize on the growing demand for solar appliances. For example, Companies are expanding into developing countries, where there is a high demand for solar appliances because of a lack of access to grid power. Companies are forming partnerships with different groups for growth of solar appliances market. For instance, companies are partnering with solar panel producers to expand solar home equipment that are powered by high-efficient solar panels. The emerging players of the market are Goal Zero, Jackery, Bluetti, EcoFlow, and BigBlue. These emerging players are well-positioned to capitalize on the growing demand for solar appliances. They focused on developing innovative and cost effective solar appliances to meet the needs of different consumers and businesses.Solar Appliances Market Scope: Inquire Before Buying

Solar Appliances Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 63.96 Bn. Forecast Period 2024 to 2030 CAGR: 15.64% Market Size in 2030: US $ 176.87 Bn. Segments Covered: by Product Type Solar Photovoltaic appliances solar thermal appliances by End User Industrial Commercial Residential Solar Appliances Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Solar Appliances Market, Key Players are

1. Solaria 2. Canadian Solar 3. Trina Solar 4. SunPower 5. LG Solar 6. Hanwha Q Cells 7. JinkoSolar 8. First Solar 9. Schneider Electric 10. Yingli Solar 11. SolarEdge 12. REC Solar 13. SMA Solar Technology 14. Trina Solar Co., Ltd. 15. Canadian Solar Inc. 16. JinkoSolar Holding Co., Ltd. 17. JA Solar Holdings Co., Ltd. 18. Yingli Green Energy Holding Company LimitedFrequently Asked Questions:

1] What segments are covered in the Global Solar Appliances Market report? Ans. The segments covered in the Solar Appliances Market report are based on Product Type, End-User and Region. 2] Which region dominated the Global Solar Appliances Market in 2023? Ans. The Asia Pacific region dominated the global Solar Appliances Market in 2023. 3] What is the market size of the Global Solar Appliances Market by 2030? Ans. The market size of the Solar Appliances Market by 2030 is expected to reach USD 176.87 Billion. 4] What is the forecast period for the Global Solar Appliances Market? Ans. The forecast period for the Solar Appliances Market is 2024-2030. 5] What was the market size of the Global Solar Appliances Market in 2023? Ans. The market size of the Solar Appliances Market in 2023 was valued at USD 63.96 Billion.

1. Solar Appliances Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Solar Appliances Market: Dynamics 2.1. Solar Appliances Market Trends by Region 2.1.1. Global Solar Appliances Market Trends 2.1.2. North America Solar Appliances Market Trends 2.1.3. Europe Solar Appliances Market Trends 2.1.4. Asia Pacific Solar Appliances Market Trends 2.1.5. Middle East and Africa Solar Appliances Market Trends 2.1.6. South America Solar Appliances Market Trends 2.2. Solar Appliances Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Solar Appliances Market Drivers 2.2.1.2. North America Solar Appliances Market Restraints 2.2.1.3. North America Solar Appliances Market Opportunities 2.2.1.4. North America Solar Appliances Market Challenges 2.2.2. Europe 2.2.2.1. Europe Solar Appliances Market Drivers 2.2.2.2. Europe Solar Appliances Market Restraints 2.2.2.3. Europe Solar Appliances Market Opportunities 2.2.2.4. Europe Solar Appliances Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Solar Appliances Market Drivers 2.2.3.2. Asia Pacific Solar Appliances Market Restraints 2.2.3.3. Asia Pacific Solar Appliances Market Opportunities 2.2.3.4. Asia Pacific Solar Appliances Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Solar Appliances Market Drivers 2.2.4.2. Middle East and Africa Solar Appliances Market Restraints 2.2.4.3. Middle East and Africa Solar Appliances Market Opportunities 2.2.4.4. Middle East and Africa Solar Appliances Market Challenges 2.2.5. South America 2.2.5.1. South America Solar Appliances Market Drivers 2.2.5.2. South America Solar Appliances Market Restraints 2.2.5.3. South America Solar Appliances Market Opportunities 2.2.5.4. South America Solar Appliances Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. Global 2.6.2. North America 2.6.3. Europe 2.6.4. Asia Pacific 2.6.5. Middle East and Africa 2.6.6. South America 2.7. Key Opinion Leader Analysis For Allogeneic Cell Therapy Industry 2.8. Analysis of Government Schemes and Initiatives For Solar Appliances Industry 2.9. The Global Pandemic Impact on Solar Appliances Market 2.10. Solar Appliances Price Trend Analysis (2022-23) 2.11. Global Solar Appliances Market Trade Analysis (2018-2023) 2.11.1. Global Import of Fixed Switch Cabinet 2.11.1.1. Ten Largest Importer 2.11.2. Global Export of Fixed Switch Cabinet 2.11.3. Ten Largest Exporter 2.12. Production Capacity Analysis 2.12.1. Chapter Overview 2.12.2. Key Assumptions and Methodology 2.12.3. Solar Appliances Manufacturers: Global Installed Capacity 3. Solar Appliances Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2023-2030) 3.1. Solar Appliances Market Size and Forecast, by Type (2023-2030) 3.1.1. Solar Photovoltaic appliances 3.1.2. Solar thermal appliances 3.2. Solar Appliances Market Size and Forecast, by End-User (2023-2030) 3.2.1. Industrial 3.2.2. Commercial 3.2.3. Residential 3.3. Solar Appliances Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Solar Appliances Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 4.1. North America Solar Appliances Market Size and Forecast, by Type (2023-2030) 4.1.1. Solar Photovoltaic appliances 4.1.2. Solar thermal appliances 4.2. North America Solar Appliances Market Size and Forecast, by End-User (2023-2030) 4.2.1. Industrial 4.2.2. Commercial 4.2.3. Residential 4.3. North America Cabinet Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Solar Appliances Market Size and Forecast, by Type (2023-2030) 4.3.1.1.1. Solar Photovoltaic appliances 4.3.1.1.2. Solar thermal appliances 4.3.1.2. United States Solar Appliances Market Size and Forecast, by End-User (2023-2030) 4.3.1.2.1. Industrial 4.3.1.2.2. Commercial 4.3.1.2.3. Residential 4.3.2. Canada 4.3.2.1. Canada Solar Appliances Market Size and Forecast, by Type (2023-2030) 4.3.2.1.1. Solar Photovoltaic appliances 4.3.2.1.2. Solar thermal appliances 4.3.2.2. Canada Solar Appliances Market Size and Forecast, by End-User (2023-2030) 4.3.2.2.1. Industrial 4.3.2.2.2. Commercial 4.3.2.2.3. Residential 4.3.3. Mexico 4.3.3.1. Mexico Solar Appliances Market Size and Forecast, by Type (2023-2030) 4.3.3.1.1. Solar Photovoltaic appliances 4.3.3.1.2. Solar thermal appliances 4.3.3.2. Mexico Solar Appliances Market Size and Forecast, by End-User (2023-2030) 4.3.3.2.1. Industrial 4.3.3.2.2. Commercial 4.3.3.2.3. Residential 5. Europe Solar Appliances Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 5.1. Europe Solar Appliances Market Size and Forecast, by Type (2023-2030) 5.2. Europe Solar Appliances Market Size and Forecast, by End-User (2023-2030) 5.3. Europe Solar Appliances Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Solar Appliances Market Size and Forecast, by Type (2023-2030) 5.3.1.2. United Kingdom Solar Appliances Market Size and Forecast, by End-User (2023-2030) 5.3.2. France 5.3.2.1. France Solar Appliances Market Size and Forecast, by Type (2023-2030) 5.3.2.2. France Solar Appliances Market Size and Forecast, by End-User (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Solar Appliances Market Size and Forecast, by Type (2023-2030) 5.3.3.2. Germany Solar Appliances Market Size and Forecast, by End-User (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Solar Appliances Market Size and Forecast, by Type (2023-2030) 5.3.4.2. Italy Solar Appliances Market Size and Forecast, by End-User (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Solar Appliances Market Size and Forecast, by Type (2023-2030) 5.3.5.2. Spain Solar Appliances Market Size and Forecast, by End-User (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Solar Appliances Market Size and Forecast, by Type (2023-2030) 5.3.6.2. Sweden Solar Appliances Market Size and Forecast, by End-User (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Solar Appliances Market Size and Forecast, by Type (2023-2030) 5.3.7.2. Austria Solar Appliances Market Size and Forecast, by End-User (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Solar Appliances Market Size and Forecast, by Type (2023-2030) 5.3.8.2. Rest of Europe Solar Appliances Market Size and Forecast, by End-User (2023-2030) 6. Asia Pacific Solar Appliances Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Solar Appliances Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Solar Appliances Market Size and Forecast, by End-User (2023-2030) 6.3. Asia Pacific Solar Appliances Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Solar Appliances Market Size and Forecast, by Type (2023-2030) 6.3.1.2. China Solar Appliances Market Size and Forecast, by End-User (2023-2030) 6.3.1.3. 6.3.2. S Korea 6.3.2.1. S Korea Solar Appliances Market Size and Forecast, by Type (2023-2030) 6.3.2.2. S Korea Solar Appliances Market Size and Forecast, by End-User (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Solar Appliances Market Size and Forecast, by Type (2023-2030) 6.3.3.2. Japan Solar Appliances Market Size and Forecast, by End-User (2023-2030) 6.3.4. India 6.3.4.1. India Solar Appliances Market Size and Forecast, by Type (2023-2030) 6.3.4.2. India Solar Appliances Market Size and Forecast, by End-User (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Solar Appliances Market Size and Forecast, by Type (2023-2030) 6.3.5.2. Australia Solar Appliances Market Size and Forecast, by End-User (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Solar Appliances Market Size and Forecast, by Type (2023-2030) 6.3.6.2. Indonesia Solar Appliances Market Size and Forecast, by End-User (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Solar Appliances Market Size and Forecast, by Type (2023-2030) 6.3.7.2. Malaysia Solar Appliances Market Size and Forecast, by End-User (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Solar Appliances Market Size and Forecast, by Type (2023-2030) 6.3.8.2. Vietnam Solar Appliances Market Size and Forecast, by End-User (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Solar Appliances Market Size and Forecast, by Type (2023-2030) 6.3.9.2. Taiwan Solar Appliances Market Size and Forecast, by End-User (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Solar Appliances Market Size and Forecast, by Type (2023-2030) 6.3.10.2. Rest of Asia Pacific Solar Appliances Market Size and Forecast, by End-User (2023-2030) 7. Middle East and Africa Solar Appliances Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 7.1. Middle East and Africa Solar Appliances Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Solar Appliances Market Size and Forecast, by End-User (2023-2030) 7.3. Middle East and Africa Solar Appliances Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Solar Appliances Market Size and Forecast, by Type (2023-2030) 7.3.1.2. South Africa Solar Appliances Market Size and Forecast, by End-User (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Solar Appliances Market Size and Forecast, by Type (2023-2030) 7.3.2.2. GCC Solar Appliances Market Size and Forecast, by End-User (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Solar Appliances Market Size and Forecast, by Type (2023-2030) 7.3.3.2. Nigeria Solar Appliances Market Size and Forecast, by End-User (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Solar Appliances Market Size and Forecast, by Type (2023-2030) 7.3.4.2. Rest of ME&A Solar Appliances Market Size and Forecast, by End-User (2023-2030) 8. South America Solar Appliances Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 8.1. South America Solar Appliances Market Size and Forecast, by Type (2023-2030) 8.2. South America Solar Appliances Market Size and Forecast, by End-User (2023-2030) 8.3. South America Solar Appliances Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Solar Appliances Market Size and Forecast, by Type (2023-2030) 8.3.1.2. Brazil Solar Appliances Market Size and Forecast, by End-User (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Solar Appliances Market Size and Forecast, by Type (2023-2030) 8.3.2.2. Argentina Solar Appliances Market Size and Forecast, by End-User (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Solar Appliances Market Size and Forecast, by Type (2023-2030) 8.3.3.2. Rest Of South America Solar Appliances Market Size and Forecast, by End-User (2023-2030) 9. Global Solar Appliances Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Type Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.3.6. SKU Details 9.3.7. Production Capacity 9.3.8. Production for 2022 9.3.9. No. of Stores 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Solar Appliances Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. ABB Ltd (Switzerland) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Belden, Inc.(United States) 10.3. Clipsal (Schneider Electric SE)(France) 10.4. Minimax Fire Solutions International GmbH (Minimax Viking GmbH) (Germany) 10.5. Coslight Group Harbin Switch Co., Ltd (China) 10.6. StarTech.com Ltd.(Canada) 10.7. TEWE Elektronic GmbH & Co. KG (Germany) 10.8. Cannon Technologies Ltd.((UK) 10.9. NUM AG and HUIMU Ltd. 10.10. Mitsubishi Electric( Japan) 10.11. Fuji Electric ( Tokyo) 10.12. Hyundai Heavy Industries (South Korea.) 10.13. Toshiba (Japan) 10.14. SENTEG (USA) 10.15. SIEMENS (Germany) 10.16. GE (US) 11. Key Findings 12. Industry Recommendations 13. Solar Appliances Market: Research Methodology 14. Terms and Glossary