The Global Software Market size was valued at USD 592.87 Billion in 2022 and the total Software revenue is expected to grow at a CAGR of 12.2% from 2023 to 2029, reaching nearly USD 1327.12 Billion. The software industry encompasses enterprises engaged in software development, upkeep, and distribution. These businesses adopt distinct business models such as the "license/maintenance" approach (on-site) and the "Cloud-based" approach (like SaaS, PaaS, IaaS, MBaaS, MSaaS, DCaaS, etc.). The sector also offers software services like training, documentation, consultation, and data restoration. The software and computer services domain allocates more than 15% of its net revenue for Research and development, standing as the second-highest proportion among industries, surpassed only by pharmaceuticals & and biotechnology. Business intelligence (BI) and data analytics platforms are evolving and emerging rapidly to meet the needs of an expanding user base, which includes both technical and non-technical users. An increase in adoption due to the pandemic, more accessible pricing models, cloud-based offerings, and low-code or no-code technologies are driving the continued momentum for BI and data analytics tools. This factor drives the software market growth. While dashboards and descriptive reports remain the key features, advanced functionalities such as the ability to connect to a range of data sources, interactive visualizations, and self-service data preparation are steadily gaining importance among BI and data analytics software buyers.Key Highlights:

1. About 80% of the businesses use BI and data analytics software with marketing/PR, distribution/inventory management, and advertising being the industries with the highest adoption rates, supporting software market growth. 2. When planning investment in analytics technology, businesses have different concerns depending on where they are located. In the United States, Japan, and South Africa, security issues dominate buyers’ concerns, whereas compatibility with existing systems is the primary challenge for buyers in Germany, Spain, and India. This factor is expected to restrain the software industry's growth during the forecast period. 3. Buyers have a preference for better user experience, training support, and reporting capabilities. Thus, more than 80% of the population looks for these features when selecting software. Software market key players need to update their offerings as per the buyer's needs. 4. Building a business case around the top business objectives helps buyers justify software investment and get buy-in from multiple stakeholders. Expanding the customer base and maintaining relationships with existing customers are the top priorities for today’s buyers.To know about the Research Methodology :- Request Free Sample Report

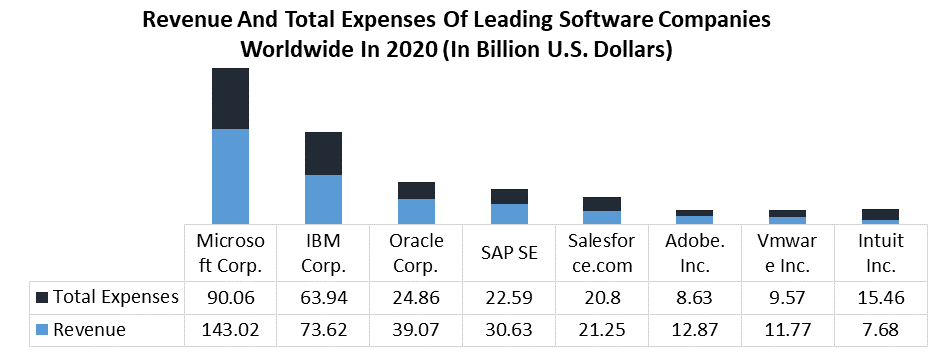

Competitive Landscapes:

The global software industry is highly fragmented and poses high competition in the market. The industry includes a wide range of software areas, attracting both startups and well-established companies, thus contributing to the high market rivalry among market players. Additionally, the constant emergence of startups and innovative companies creates niche software solutions, further diversifying the competitive landscape. The global reach facilitated by the internet and cloud computing allows software firms to access a worldwide audience, encouraging entrepreneurs and businesses worldwide to join the market, intensifying competition. The open-source software movement adds to the fragmentation, with various independent projects and communities developing software across different categories. The market players are actively focusing on organic and inorganic strategies including mergers and acquisitions, product launches, geographical expansions, etc. For instance, 1. IBM announced the acquisition of Apptio Inc., a financial and operational management software company, in June 2023 to expand its IT automation capabilities and assure the capacity to generate business value. 2. Norton LifeLock announced a merger with Avast in September 2022 to reconsider and reimagine cyber security for organizations throughout the world. 3. Microsoft Corp. announced the acquisition of Nuance Communications Inc. in March 2022 with the goal of delivering inexpensive and accessible healthcare and assisting enterprises in offering tailored customer experiences. In addition, emerging and innovative companies are involved in upgrading existing software offerings, as well as establishing partnerships to increase their industry share. 1. In October 2022, Oracle announced the introduction of Oracle Alloy, a new cloud platform to provide cloud services to its customers and provide full control of operations to address regulatory needs.

Software Market Trends

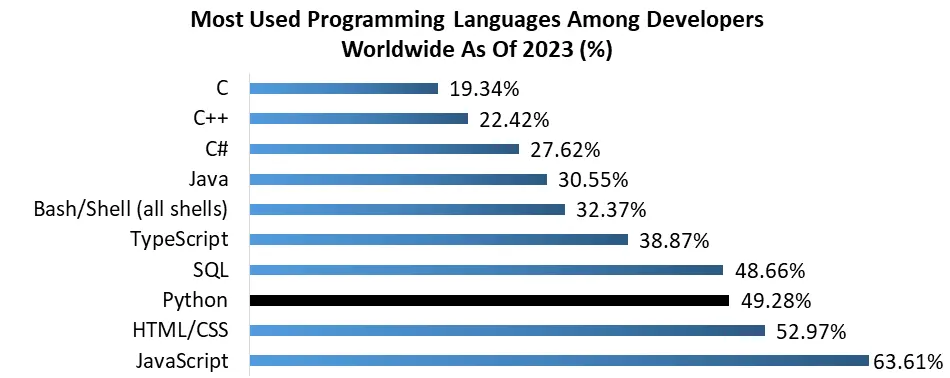

The Rise of Python The increasing popularity of Python is expected to be a key trend in the software market. Python has evolved from a versatile programming language to a dominant force across various industries and use cases. Python's rise is expected to be attributed to its versatility and simplicity. It's renowned for its ease of learning and readability, making it accessible to both novice and experienced developers. Python's rich ecosystem of libraries and frameworks, such as TensorFlow for machine learning and Django for web development, further augments its demand. In data science and machine learning, Python has emerged as the go-to language. Its libraries, including NumPy, pandas, and sci-kit-learn, facilitate data manipulation, analysis, and the creation of powerful machine-learning models. This has led to Python's widespread adoption in industries like finance, healthcare, and e-commerce, where data-driven decision-making is vital. Python's versatility extends to web development, where frameworks like Flask and Django simplify the process of building robust, scalable web applications. Startups and enterprises alike leverage Python's rapid development capabilities to bring products to market faster. Moreover, Python's compatibility with emerging technologies like artificial intelligence, IoT, and blockchain positions it at the forefront of innovation. Its seamless integration with these technologies enables developers to create cutting-edge solutions, from AI-driven chatbots to blockchain-based smart contracts. Python's community-driven development model and extensive documentation have cultivated a vibrant ecosystem. As a result, it continually evolves to meet the evolving needs of the software market.

Software Market Dynamics:

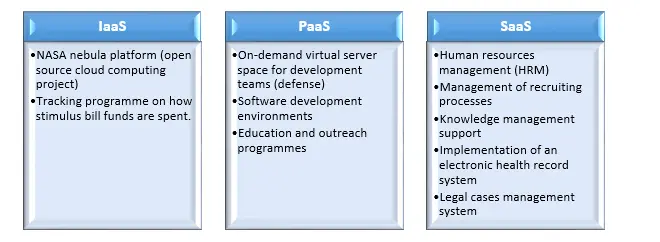

Increasing Adoption of Digitalization in Businesses The increasing adoption of digitalization in businesses across the globe is expected to be the major factor driving the global software market growth. As organizations recognize the transformative potential of digital technologies, they are investing heavily in software solutions to streamline operations, enhance customer experiences, and remain competitive in an ever-evolving marketplace. For instance, 1. Many large enterprises including Procter & Gamble, General Electric, Ford Motor Company, The Hershey Company, etc. adopted ERP software like SAP and Oracle to streamline their operations, integrate business processes, and improve efficiency. 2. The rise of e-commerce platforms like Shopify and Magento, has allowed businesses to enhance customer experiences through online shopping and personalized recommendations. 3. In recent years, AI and ML adoption has surged, with companies integrating these technologies into various applications to automate tasks, provide chatbots for customer support, and make predictive recommendations. 4. In response to the COVID-19 pandemic 2020, businesses rapidly invested in remote work software such as Zoom, Microsoft Teams, and Slack to maintain operations and enable employees to work from home. Businesses are increasingly relying on software to optimize processes, manage data, and harness the power of analytics and artificial intelligence. This digitalization trend spans various sectors, from finance and healthcare to manufacturing and retail. Cloud computing and Software as a Service (SaaS) offerings are also playing a pivotal role, making it easier for companies to access and deploy software solutions rapidly and cost-effectively. Moreover, the ongoing shift towards remote work and the need for robust cybersecurity measures are driving demand for software solutions that support remote collaboration and safeguard sensitive information. This factor is further expected to boost the global software market during the forecast period.High Demand for Cloud Computing Cloud computing is ranked as the top technology priority for companies around the world. The emergence of cloud computing, which includes software as a service (SaaS), the rise of cloud-based platforms for both external "public cloud" services and internal use in the data center as "private clouds," and the concept of vendor-provided application/service "streams" on demand are among the most pervasive influences on the software industry. Adopting cloud computing is expected to potentially allow organizations to reduce costs and increase flexibility, efficiency, and quality. As a result, the demand for cloud computing has been on the rise in recent years, driving the software market growth. Cloud service providers have responded by integrating parallel data processing frameworks into their services, facilitating user access to cloud resources and the deployment of their programs. Cloud computing, defined as a model for ubiquitous, convenient, and on-demand network access to configured computing resources, brings numerous advantages. It addresses economic and technological barriers, offering organizations a focus on core business activities without the burden of infrastructure management. Additionally, the synergy between the utility model of cloud computing and a rich array of computation, infrastructure, and storage services creates an attractive environment for scientific experimentation. The rise of wireless networks and mobile devices has elevated cloud computing to new heights, leading to the emergence of mobile cloud computing. This paradigm enables users to outsource tasks to external service providers, alleviating processing, and storage limitations inherent in mobile devices. Mobile cloud applications like Gmail, iCloud, and Dropbox have gained widespread popularity, significantly enhancing mobile cloud performance and user experiences. Examples of cloud computing applications used by governments

Software Market Segment Analysis:

Based on Application, the Application Software segment held the largest market share of more than 40% and dominated the global software market in 2022. The segment is further expected to grow at a CAGR of 11.45% and maintain its dominance during the forecast period. The rising demand for various software applications designed to accelerate and streamline business processes using cutting-edge IoT technologies and cloud-based solutions are expected to be the major factors driving the segment growth. In addition, digital transformation initiatives, the need for remote work solutions, and the demand for software-as-a-service (SaaS) models are further expected to boost the segment growth. As businesses increasingly rely on technology to remain competitive and efficient, the Application Software segment continues to dominate the software market and shape the way organizations operate in the digital age. Its adaptability and relevance across various industries and sectors distinguish the Application Software category. Whether in healthcare, finance, manufacturing, or entertainment, businesses rely on these applications to meet their unique needs. As technology continues to advance, the Application Software segment evolves to incorporate emerging trends like cloud computing, artificial intelligence, and Internet of Things (IoT) integration, ensuring its continued relevance and growth. The Enterprise resource planning (ERP) sub-segment held a significant market share in 2022 owing to the increase in demand for data-driven decisions, higher usage of mobile and cloud applications, and a growing requirement for transparency and operational efficiency in corporate operations.In addition, the development and deployment software segment is expected to grow at a significant CAGR during the forecast period. It encompasses a wide range of software tools and solutions that are primarily intended to make the development, administration, and delivery of software applications and systems easier. This category is fundamental to the software industry, providing the necessary tools and infrastructure for software development and deployment. The continuous innovation and adaptation to emerging technologies, including cloud computing, microservices architecture, and serverless computing is expected to drive the segment growth during the forecast period. The Enterprise Data Management (EDM) sub-segment held the highest share in 2022. The rapid shift from manual to automated systems for carrying out business activities, growing security concerns, increased usage of parallel processing architecture, and rising data volume are some of the factors driving the segment's growth. Businesses recognize the strategic value of data and are increasingly investing in EDM solutions to harness its potential. Effective data management is essential for improving operational efficiency, and customer experiences, and gaining an edge over the competition. Besides that, as data privacy guidelines become more stringent, EDM solutions play a crucial role in ensuring data compliance and safeguarding sensitive information.

Software Market Regional Insights:

North America led the global software market with the highest market share of 42% in 2022. The region is further expected to grow at a CAGR of 12.4% and maintain its dominance throughout the forecast period. The strong adoption of various software across the business is expected to be the major factor driving the regional market growth. In addition, the region is further expected to continue to maintain its dominance throughout the forecast period due to the presence of a substantial number of small and medium-sized firms (SMEs), a high adoption rate for cutting-edge technology, and the availability of competent workforce with appropriate domain expertise. The United States is expected to be the lucrative region for the global software market vendors with a diverse landscape that includes established tech giants and a vibrant startup ecosystem. Significant investments in software solutions by major firms and SMEs in the country contributed extensively to software market revenue growth. As a result, the rising stringency of data privacy and security regulations and rules are further contributing factors to the North American software market growth. Silicon Valley, situated in California, stands as an internationally acclaimed epicenter of technological innovation. This region boasts a constellation of industry giants, including Apple, Google, and Facebook, and has emerged as a crucible for software development, particularly in the realms of mobile applications, cloud computing, and artificial intelligence (AI). In addition, American companies are at the forefront of emerging technologies, such as artificial intelligence and blockchain. For instance, 1. IBM's Watson is an AI system renowned for its natural language processing and machine learning capabilities, used in various industries, including healthcare and finance, to analyze vast datasets and make data-driven decisions. 2. Ripple, founded in 2012, is a prominent American company in the blockchain space. It offers blockchain-based solutions for cross-border payments, enabling faster and more cost-effective international transactions through its digital asset XRP and blockchain technology. Besides that, Cities like San Francisco, New York, and Boston host numerous tech startups that contribute to the software ecosystem. Companies like Uber and Airbnb originated in the U.S. and have disrupted traditional industries. These all factors are expected to contribute to regional revenue generation, thereby driving the software market growth.Canada region is expected to experience steady growth, attributed to its innovation hubs and a strong emphasis on artificial intelligence (AI) and fintech. The country is globally recognized for its AI leadership, with AI research centers in Toronto, Montreal, and Edmonton driving the development of AI-driven software solutions across various sectors. Notably, Canadian software companies in Toronto and Vancouver are making significant advancements in fintech, offering innovative financial software and services. Additionally, Canada boasts a thriving video game industry, with companies like Ubisoft, Electronic Arts (EA), and Shopify actively contributing to the gaming and e-commerce software market. Asia Pacific region is expected to be the potential market for software market vendors during the forecast period. The region held a market share of more than 25% in 2022 and is expected to grow at a CAGR of 13.47% during the forecast period. With the rapidly expanding economies, burgeoning tech-savvy population, and growing digital infrastructure, the region offers immense opportunities. The increasing demand for software solutions across diverse industries, coupled with digital transformation initiatives in countries like China and India, is further expected to drive the Asia Pacific software market growth. China is expected to be an emerging country in the global software market. The Chinese government strategically positioned its IT industry as one of the seven key industries, shifting away from low-cost manufacturing outsourcing towards innovation-driven high technology. China's IT landscape encompasses a wide range of sectors, with four main areas of focus: telecom, hardware, software, and IT services. While telecom remains somewhat restricted to foreign participation, the other sectors offer opportunities for foreign companies, often through partnerships with local entities. China has the most internet users in the world, with over 900 million, as well as a billion mobile phone users. This immense user base presents significant opportunities for software and internet-related businesses. Besides that, the country's IT market is ranked fourth globally in terms of spending, and it is the second-largest software outsourcing destination after India. China's IT industry is expected to grow at an annual rate of more than 15% over the next five years, making it an attractive destination for technology investment.

Key growth areas within China's IT sector include artificial intelligence (AI), fintech, video game development, and government-backed initiatives supporting innovation and competitiveness. Additionally, China is leveraging its IT capabilities to expand into outsourcing, designating 20 cities as China Outsourcing Model Cities, focusing on high-end markets as labor costs rise. Prominent regions for IT development include Guangdong, known for industry giants like Huawei, Jiangsu, home to academic centers and a skilled workforce, Shanghai, investing in data centers and cloud computing, Shandong, offering cost advantages and talent pools, and Zhejiang, a hub for e-commerce and IoT industries. China's commitment to advancing IT technologies, coupled with its vast consumer base and lower costs, presents ample opportunities for foreign investors and tech companies to engage and thrive in the country's burgeoning software and IT sector. In addition, Technological revolutions sometimes bring unexpected opportunities for countries. India, a relative laggard among developing countries in terms of economic growth, seems to have found such an opportunity in the information technology revolution as an increasingly favored location for customized software development. India’s success with software has led to speculation about whether other developing countries can emulate its example, as well as whether this constitutes a competitive challenge to software industries in the developed world.

Software Market Scope: Inquire before buying

Software Market by Region: North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)

Software Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 592.87 Bn. Forecast Period 2023 to 2029 CAGR: 12.2% Market Size in 2029: US $ 1327.12 Bn. Segments Covered: by Type Application Software Enterprise resource planning (ERP) Customer Relationship Management (CRM) Supply Chain Management (SCM) Enterprise Collaboration Software Enterprise Content Management (ECM) Software Education Software Others System Infrastructure Software Network Management Systems (NMS) Storage Software Security Software Development and Deployment of Software Enterprise Data Management (EDM) Business Analytics & Reporting Tools Application Servers Integration & Orchestration Middleware Data Quality Tools Productivity Software Office Software Creative Software Others Others by Deployment On-premises Cloud by Enterprise Size Small & Medium Enterprises Large Enterprises by Vertical IT & Telecom BFSI Retail Government/Public Sector Energy & Utilities Healthcare Others Software Market Key Players:

1. IBM Corporation - Armonk, New York, USA 2. McAfee Corporation - San Jose, California, USA 3. NortonLifeLock Inc. - Tempe, Arizona, USA 4. Microsoft - Redmond, Washington, USA 5. Oracle - Redwood City, California, USA 6. SAP SE - Walldorf, Germany 7. Adobe Inc. - San Jose, California, USA 8. VMware Inc. - Palo Alto, California, USA 9. Block, Inc. - New York City, New York, USA 10. Intuit Inc. - Mountain View, California, USA 11. Apple - Cupertino, California, USA 12. Amazon Web Services (AWS) - Seattle, Washington, USA 13. Google - Mountain View, California, USA 14. Salesforce - San Francisco, California, USA 15. Intel - Santa Clara, California, USA 16. Cisco Systems - San Jose, California, USA 17. Dell Technologies - Round Rock, Texas, USA 18. Autodesk - San Rafael, California, USA 19. ServiceNow - Santa Clara, California, USA 20. Workday - Pleasanton, California, USA 21. Tencent - Shenzhen, China 22. Red Hat, Inc. - Raleigh, North Carolina, USA 23. CA Technologies - New York City, New York, USA 24. Dassault Systèmes SE - Vélizy-Villacoublay, France 25. Splunk Inc. - San Francisco, California, USA 26. Ansys, Inc. - Canonsburg, Pennsylvania, USA 27. Synopsys, Inc. - Mountain View, California, USA 28. Open Text Corporation - Waterloo, Ontario, Canada 29. Alibaba Cloud - Hangzhou, China 30. Fortinet - Sunnyvale, California, USAFAQs:

1. What are the growth drivers for the Software market? Ans. The increasing Digital Transformation, high adoption of cloud computing services, Emerging Technologies, etc. are expected to be the major driver for the Software market. 2. What is the major restraint on the Software market growth? Ans. Cybersecurity Concerns and Data Privacy are expected to be the major restraining factor for the Software market growth. 3. Which region is expected to lead the global Software market during the forecast period? Ans. North America is expected to lead the global Software market during the forecast period. 4. What is the projected market size & and growth rate of the Software Market? Ans. The Software Market size was valued at USD 592.87 Billion in 2022 and the total Software revenue is expected to grow at a CAGR of 12.2% from 2023 to 2029, reaching nearly USD 1327.12 Billion. 5. What segments are covered in the Software Market report? Ans. The segments covered in the Software market report are Type, Deployment, Enterprise Size, Vertical, and Region.

1. Software Market: Research Methodology 2. Software Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Software Market: Dynamics 3.1. Software Market Trends by Region 3.1.1. North America Software Market Trends 3.1.2. Europe Software Market Trends 3.1.3. Asia Pacific Software Market Trends 3.1.4. Middle East and Africa Software Market Trends 3.1.5. South America Software Market Trends 3.2. Software Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Software Market Drivers 3.2.1.2. North America Software Market Restraints 3.2.1.3. North America Software Market Opportunities 3.2.1.4. North America Software Market Challenges 3.2.2. Europe 3.2.2.1. Europe Software Market Drivers 3.2.2.2. Europe Software Market Restraints 3.2.2.3. Europe Software Market Opportunities 3.2.2.4. Europe Software Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Software Market Drivers 3.2.3.2. Asia Pacific Software Market Restraints 3.2.3.3. Asia Pacific Software Market Opportunities 3.2.3.4. Asia Pacific Software Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Software Market Drivers 3.2.4.2. Middle East and Africa Software Market Restraints 3.2.4.3. Middle East and Africa Software Market Opportunities 3.2.4.4. Middle East and Africa Software Market Challenges 3.2.5. South America 3.2.5.1. South America Software Market Drivers 3.2.5.2. South America Software Market Restraints 3.2.5.3. South America Software Market Opportunities 3.2.5.4. South America Software Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technological Roadmap 3.6. Deployment Roadmap 3.7. Regulatory Landscape by Region 3.7.1. Global 3.7.2. North America 3.7.3. Europe 3.7.4. Asia Pacific 3.7.5. Middle East and Africa 3.7.6. South America 3.8. Key Opinion Leader Analysis For the Software Industry 3.9. Analysis of Government Schemes and Initiatives For the Software Industry 3.10. The Global Pandemic's Impact on Software Market 4. Software Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 4.1. Software Market Size and Forecast, by Type (2022-2029) 4.1.1. Application Software 4.1.1.1. Enterprise resource planning (ERP) 4.1.1.2. Customer Relationship Management (CRM) 4.1.1.3. Supply Chain Management (SCM) 4.1.1.4. Enterprise Collaboration Software 4.1.1.5. Enterprise Content Management (ECM) Software 4.1.1.6. Education Software 4.1.1.7. Others 4.1.2. System Infrastructure Software 4.1.2.1. Network Management Systems (NMS) 4.1.2.2. Storage Software 4.1.2.3. Security Software 4.1.3. Development and Deployment of Software 4.1.3.1. Enterprise Data Management (EDM) 4.1.3.2. Business Analytics & Reporting Tools 4.1.3.3. Application Servers 4.1.3.4. Integration & Orchestration Middleware 4.1.3.5. Data Quality Tools 4.1.4. Productivity Software 4.1.4.1. Office Software 4.1.4.2. Creative Software 4.1.4.3. Others 4.1.5. Others 4.2. Software Market Size and Forecast, by Deployment (2022-2029) 4.2.1. On-premises 4.2.2. Cloud 4.3. Software Market Size and Forecast, by Enterprise Size (2022-2029) 4.3.1. Small & Medium Enterprises 4.3.2. Large Enterprises 4.4. Software Market Size and Forecast, by Vertical (2022-2029) 4.4.1. IT & Telecom 4.4.2. BFSI 4.4.3. Retail 4.4.4. Government/Public Sector 4.4.5. Energy & Utilities 4.4.6. Healthcare 4.4.7. Others 4.5. Software Market Size and Forecast, by Region (2022-2029) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Software Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 5.1. North America Software Market Size and Forecast, by Type (2022-2029) 5.1.1. Application Software 5.1.1.1. Enterprise resource planning (ERP) 5.1.1.2. Customer Relationship Management (CRM) 5.1.1.3. Supply Chain Management (SCM) 5.1.1.4. Enterprise Collaboration Software 5.1.1.5. Enterprise Content Management (ECM) Software 5.1.1.6. Education Software 5.1.1.7. Others 5.1.2. System Infrastructure Software 5.1.2.1. Network Management Systems (NMS) 5.1.2.2. Storage Software 5.1.2.3. Security Software 5.1.3. Development and Deployment of Software 5.1.3.1. Enterprise Data Management (EDM) 5.1.3.2. Business Analytics & Reporting Tools 5.1.3.3. Application Servers 5.1.3.4. Integration & Orchestration Middleware 5.1.3.5. Data Quality Tools 5.1.4. Productivity Software 5.1.4.1. Office Software 5.1.4.2. Creative Software 5.1.4.3. Others 5.1.5. Others 5.2. North America Software Market Size and Forecast, by Deployment (2022-2029) 5.2.1. On-premises 5.2.2. Cloud 5.3. North America Software Market Size and Forecast, by Enterprise Size (2022-2029) 5.3.1. Small & Medium Enterprises 5.3.2. Large Enterprises 5.4. North America Software Market Size and Forecast, by Vertical (2022-2029) 5.4.1. IT & Telecom 5.4.2. BFSI 5.4.3. Retail 5.4.4. Government/Public Sector 5.4.5. Energy & Utilities 5.4.6. Healthcare 5.4.7. Others 5.5. North America Software Market Size and Forecast, by Country (2022-2029) 5.5.1. United States 5.5.1.1. United States Software Market Size and Forecast, by Type (2022-2029) 5.5.1.1.1. Application Software 5.5.1.1.1.1. Enterprise resource planning (ERP) 5.5.1.1.1.2. Customer Relationship Management (CRM) 5.5.1.1.1.3. Supply Chain Management (SCM) 5.5.1.1.1.4. Enterprise Collaboration Software 5.5.1.1.1.5. Enterprise Content Management (ECM) Software 5.5.1.1.1.6. Education Software 5.5.1.1.1.7. Others 5.5.1.1.2. System Infrastructure Software 5.5.1.1.2.1. Network Management Systems (NMS) 5.5.1.1.2.2. Storage Software 5.5.1.1.2.3. Security Software 5.5.1.1.3. Development and Deployment of Software 5.5.1.1.3.1. Enterprise Data Management (EDM) 5.5.1.1.3.2. Business Analytics & Reporting Tools 5.5.1.1.3.3. Application Servers 5.5.1.1.3.4. Integration & Orchestration Middleware 5.5.1.1.3.5. Data Quality Tools 5.5.1.1.4. Productivity Software 5.5.1.1.4.1. Office Software 5.5.1.1.4.2. Creative Software 5.5.1.1.4.3. Others 5.5.1.1.5. Others 5.5.1.2. United States Software Market Size and Forecast, by Deployment (2022-2029) 5.5.1.2.1. On-premises 5.5.1.2.2. Cloud 5.5.1.3. United States Software Market Size and Forecast, by Enterprise Size (2022-2029) 5.5.1.3.1. Small & Medium Enterprises 5.5.1.3.2. Large Enterprises 5.5.1.4. United States Software Market Size and Forecast, by Vertical (2022-2029) 5.5.1.4.1. IT & Telecom 5.5.1.4.2. BFSI 5.5.1.4.3. Retail 5.5.1.4.4. Government/Public Sector 5.5.1.4.5. Energy & Utilities 5.5.1.4.6. Healthcare 5.5.1.4.7. Others 5.5.2. Canada 5.5.2.1. Canada Software Market Size and Forecast, by Type (2022-2029) 5.5.2.1.1. Application Software 5.5.2.1.1.1. Enterprise resource planning (ERP) 5.5.2.1.1.2. Customer Relationship Management (CRM) 5.5.2.1.1.3. Supply Chain Management (SCM) 5.5.2.1.1.4. Enterprise Collaboration Software 5.5.2.1.1.5. Enterprise Content Management (ECM) Software 5.5.2.1.1.6. Education Software 5.5.2.1.1.7. Others 5.5.2.1.2. System Infrastructure Software 5.5.2.1.2.1. Network Management Systems (NMS) 5.5.2.1.2.2. Storage Software 5.5.2.1.2.3. Security Software 5.5.2.1.3. Development and Deployment of Software 5.5.2.1.3.1. Enterprise Data Management (EDM) 5.5.2.1.3.2. Business Analytics & Reporting Tools 5.5.2.1.3.3. Application Servers 5.5.2.1.3.4. Integration & Orchestration Middleware 5.5.2.1.3.5. Data Quality Tools 5.5.2.1.4. Productivity Software 5.5.2.1.4.1. Office Software 5.5.2.1.4.2. Creative Software 5.5.2.1.4.3. Others 5.5.2.1.5. Others 5.5.2.2. Canada Software Market Size and Forecast, by Deployment (2022-2029) 5.5.2.2.1. On-premises 5.5.2.2.2. Cloud 5.5.2.3. Canada Software Market Size and Forecast, by Enterprise Size (2022-2029) 5.5.2.3.1. Small & Medium Enterprises 5.5.2.3.2. Large Enterprises 5.5.2.4. Canada Software Market Size and Forecast, by Enterprise Size (2022-2029) 5.5.2.4.1. IT & Telecom 5.5.2.4.2. BFSI 5.5.2.4.3. Retail 5.5.2.4.4. Government/Public Sector 5.5.2.4.5. Energy & Utilities 5.5.2.4.6. Healthcare 5.5.2.4.7. Others 5.5.3. Mexico 5.5.3.1. Mexico Software Market Size and Forecast, by Type (2022-2029) 5.5.3.1.1. Application Software 5.5.3.1.1.1. Enterprise resource planning (ERP) 5.5.3.1.1.2. Customer Relationship Management (CRM) 5.5.3.1.1.3. Supply Chain Management (SCM) 5.5.3.1.1.4. Enterprise Collaboration Software 5.5.3.1.1.5. Enterprise Content Management (ECM) Software 5.5.3.1.1.6. Education Software 5.5.3.1.1.7. Others 5.5.3.1.2. System Infrastructure Software 5.5.3.1.2.1. Network Management Systems (NMS) 5.5.3.1.2.2. Storage Software 5.5.3.1.2.3. Security Software 5.5.3.1.3. Development and Deployment of Software 5.5.3.1.3.1. Enterprise Data Management (EDM) 5.5.3.1.3.2. Business Analytics & Reporting Tools 5.5.3.1.3.3. Application Servers 5.5.3.1.3.4. Integration & Orchestration Middleware 5.5.3.1.3.5. Data Quality Tools 5.5.3.1.4. Productivity Software 5.5.3.1.4.1. Office Software 5.5.3.1.4.2. Creative Software 5.5.3.1.4.3. Others 5.5.3.1.5. Others 5.5.3.2. Mexico Software Market Size and Forecast, by Deployment (2022-2029) 5.5.3.2.1. On-premises 5.5.3.2.2. Cloud 5.5.3.3. Mexico Software Market Size and Forecast, by Enterprise Size (2022-2029) 5.5.3.3.1. Small & Medium Enterprises 5.5.3.3.2. Large Enterprises 5.5.3.4. Mexico Software Market Size and Forecast, by Vertical (2022-2029) 5.5.3.4.1. IT & Telecom 5.5.3.4.2. BFSI 5.5.3.4.3. Retail 5.5.3.4.4. Government/Public Sector 5.5.3.4.5. Energy & Utilities 5.5.3.4.6. Healthcare 5.5.3.4.7. Others 6. Europe Software Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 6.1. Europe Software Market Size and Forecast, by Type (2022-2029) 6.2. Europe Software Market Size and Forecast, by Deployment (2022-2029) 6.3. Europe Software Market Size and Forecast, by Enterprise Size (2022-2029) 6.4. Europe Software Market Size and Forecast, by Vertical (2022-2029) 6.5. Europe Software Market Size and Forecast, by Country (2022-2029) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Software Market Size and Forecast, by Type (2022-2029) 6.5.1.2. United Kingdom Software Market Size and Forecast, by Deployment (2022-2029) 6.5.1.3. United Kingdom Software Market Size and Forecast, by Enterprise Size (2022-2029) 6.5.1.4. United Kingdom Software Market Size and Forecast, by Vertical (2022-2029) 6.5.2. France 6.5.2.1. France Software Market Size and Forecast, by Type (2022-2029) 6.5.2.2. France Software Market Size and Forecast, by Deployment (2022-2029) 6.5.2.3. France Software Market Size and Forecast, by Enterprise Size (2022-2029) 6.5.2.4. France Software Market Size and Forecast, by Vertical (2022-2029) 6.5.3. Germany 6.5.3.1. Germany Software Market Size and Forecast, by Type (2022-2029) 6.5.3.2. Germany Software Market Size and Forecast, by Deployment (2022-2029) 6.5.3.3. Germany Software Market Size and Forecast, by Enterprise Size (2022-2029) 6.5.3.4. Germany Software Market Size and Forecast, by Vertical (2022-2029) 6.5.4. Italy 6.5.4.1. Italy Software Market Size and Forecast, by Type (2022-2029) 6.5.4.2. Italy Software Market Size and Forecast, by Deployment (2022-2029) 6.5.4.3. Italy Software Market Size and Forecast, by Enterprise Size (2022-2029) 6.5.4.4. Italy Software Market Size and Forecast, by Vertical (2022-2029) 6.5.5. Spain 6.5.5.1. Spain Software Market Size and Forecast, by Type (2022-2029) 6.5.5.2. Spain Software Market Size and Forecast, by Deployment (2022-2029) 6.5.5.3. Spain Software Market Size and Forecast, by Enterprise Size (2022-2029) 6.5.5.4. Spain Software Market Size and Forecast, by Vertical (2022-2029) 6.5.6. Sweden 6.5.6.1. Sweden Software Market Size and Forecast, by Type (2022-2029) 6.5.6.2. Sweden Software Market Size and Forecast, by Deployment (2022-2029) 6.5.6.3. Sweden Software Market Size and Forecast, by Enterprise Size (2022-2029) 6.5.6.4. Sweden Software Market Size and Forecast, by Vertical (2022-2029) 6.5.7. Austria 6.5.7.1. Austria Software Market Size and Forecast, by Type (2022-2029) 6.5.7.2. Austria Software Market Size and Forecast, by Deployment (2022-2029) 6.5.7.3. Austria Software Market Size and Forecast, by Enterprise Size (2022-2029) 6.5.7.4. Austria Software Market Size and Forecast, by Vertical (2022-2029) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Software Market Size and Forecast, by Type (2022-2029) 6.5.8.2. Rest of Europe Software Market Size and Forecast, by Deployment (2022-2029) 6.5.8.3. Rest of Europe Software Market Size and Forecast, by Enterprise Size (2022-2029) 6.5.8.4. Rest of Europe Software Market Size and Forecast, by Vertical (2022-2029) 7. Asia Pacific Software Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 7.1. Asia Pacific Software Market Size and Forecast, by Type (2022-2029) 7.2. Asia Pacific Software Market Size and Forecast, by Deployment (2022-2029) 7.3. Asia Pacific Software Market Size and Forecast, by Enterprise Size (2022-2029) 7.4. Asia Pacific Software Market Size and Forecast, by Vertical (2022-2029) 7.5. Asia Pacific Software Market Size and Forecast, by Country (2022-2029) 7.5.1. China 7.5.1.1. China Software Market Size and Forecast, by Type (2022-2029) 7.5.1.2. China Software Market Size and Forecast, by Deployment (2022-2029) 7.5.1.3. China Software Market Size and Forecast, by Enterprise Size (2022-2029) 7.5.1.4. China Software Market Size and Forecast, by Vertical (2022-2029) 7.5.2. S Korea 7.5.2.1. S Korea Software Market Size and Forecast, by Type (2022-2029) 7.5.2.2. S Korea Software Market Size and Forecast, by Deployment (2022-2029) 7.5.2.3. S Korea Software Market Size and Forecast, by Enterprise Size (2022-2029) 7.5.2.4. S Korea Software Market Size and Forecast, by Vertical (2022-2029) 7.5.3. Japan 7.5.3.1. Japan Software Market Size and Forecast, by Type (2022-2029) 7.5.3.2. Japan Software Market Size and Forecast, by Deployment (2022-2029) 7.5.3.3. Japan Software Market Size and Forecast, by Enterprise Size (2022-2029) 7.5.3.4. Japan Software Market Size and Forecast, by Vertical (2022-2029) 7.5.4. India 7.5.4.1. India Software Market Size and Forecast, by Type (2022-2029) 7.5.4.2. India Software Market Size and Forecast, by Deployment (2022-2029) 7.5.4.3. India Software Market Size and Forecast, by Enterprise Size (2022-2029) 7.5.4.4. India Software Market Size and Forecast, by Vertical (2022-2029) 7.5.5. Australia 7.5.5.1. Australia Software Market Size and Forecast, by Type (2022-2029) 7.5.5.2. Australia Software Market Size and Forecast, by Deployment (2022-2029) 7.5.5.3. Australia Software Market Size and Forecast, by Enterprise Size (2022-2029) 7.5.5.4. Australia Software Market Size and Forecast, by Vertical (2022-2029) 7.5.6. Indonesia 7.5.6.1. Indonesia Software Market Size and Forecast, by Type (2022-2029) 7.5.6.2. Indonesia Software Market Size and Forecast, by Deployment (2022-2029) 7.5.6.3. Indonesia Software Market Size and Forecast, by Enterprise Size (2022-2029) 7.5.6.4. Indonesia Software Market Size and Forecast, by Vertical (2022-2029) 7.5.7. Malaysia 7.5.7.1. Malaysia Software Market Size and Forecast, by Type (2022-2029) 7.5.7.2. Malaysia Software Market Size and Forecast, by Deployment (2022-2029) 7.5.7.3. Malaysia Software Market Size and Forecast, by Enterprise Size (2022-2029) 7.5.7.4. Malaysia Software Market Size and Forecast, by Vertical (2022-2029) 7.5.8. Vietnam 7.5.8.1. Vietnam Software Market Size and Forecast, by Type (2022-2029) 7.5.8.2. Vietnam Software Market Size and Forecast, by Deployment (2022-2029) 7.5.8.3. Vietnam Software Market Size and Forecast, by Enterprise Size (2022-2029) 7.5.8.4. Vietnam Software Market Size and Forecast, by Vertical (2022-2029) 7.5.9. Taiwan 7.5.9.1. Taiwan Software Market Size and Forecast, by Type (2022-2029) 7.5.9.2. Taiwan Software Market Size and Forecast, by Deployment (2022-2029) 7.5.9.3. Taiwan Software Market Size and Forecast, by Enterprise Size (2022-2029) 7.5.9.4. Taiwan Software Market Size and Forecast, by Vertical (2022-2029) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Software Market Size and Forecast, by Type (2022-2029) 7.5.10.2. Rest of Asia Pacific Software Market Size and Forecast, by Deployment (2022-2029) 7.5.10.3. Rest of Asia Pacific Software Market Size and Forecast, by Enterprise Size (2022-2029) 7.5.10.4. Rest of Asia Pacific Software Market Size and Forecast, by Vertical (2022-2029) 8. Middle East and Africa Software Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 8.1. Middle East and Africa Software Market Size and Forecast, by Type (2022-2029) 8.2. Middle East and Africa Software Market Size and Forecast, by Deployment (2022-2029) 8.3. Middle East and Africa Software Market Size and Forecast, by Enterprise Size (2022-2029) 8.4. Middle East and Africa Software Market Size and Forecast, by Vertical (2022-2029) 8.5. Middle East and Africa Software Market Size and Forecast, by Country (2022-2029) 8.5.1. South Africa 8.5.1.1. South Africa Software Market Size and Forecast, by Type (2022-2029) 8.5.1.2. South Africa Software Market Size and Forecast, by Deployment (2022-2029) 8.5.1.3. South Africa Software Market Size and Forecast, by Enterprise Size (2022-2029) 8.5.1.4. South Africa Software Market Size and Forecast, by Vertical (2022-2029) 8.5.2. GCC 8.5.2.1. GCC Software Market Size and Forecast, by Type (2022-2029) 8.5.2.2. GCC Software Market Size and Forecast, by Deployment (2022-2029) 8.5.2.3. GCC Software Market Size and Forecast, by Enterprise Size (2022-2029) 8.5.2.4. GCC Software Market Size and Forecast, by Vertical (2022-2029) 8.5.3. Nigeria 8.5.3.1. Nigeria Software Market Size and Forecast, by Type (2022-2029) 8.5.3.2. Nigeria Software Market Size and Forecast, by Deployment (2022-2029) 8.5.3.3. Nigeria Software Market Size and Forecast, by Enterprise Size (2022-2029) 8.5.3.4. Nigeria Software Market Size and Forecast, by Vertical (2022-2029) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Software Market Size and Forecast, by Type (2022-2029) 8.5.4.2. Rest of ME&A Software Market Size and Forecast, by Deployment (2022-2029) 8.5.4.3. Rest of ME&A Software Market Size and Forecast, by Enterprise Size (2022-2029) 8.5.4.4. Rest of ME&A Software Market Size and Forecast, by Vertical (2022-2029) 9. South America Software Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 9.1. South America Software Market Size and Forecast, by Type (2022-2029) 9.2. South America Software Market Size and Forecast, by Deployment (2022-2029) 9.3. South America Software Market Size and Forecast, by Enterprise Size (2022-2029) 9.4. South America Software Market Size and Forecast, by Vertical (2022-2029) 9.5. South America Software Market Size and Forecast, by Country (2022-2029) 9.5.1. Brazil 9.5.1.1. Brazil Software Market Size and Forecast, by Type (2022-2029) 9.5.1.2. Brazil Software Market Size and Forecast, by Deployment (2022-2029) 9.5.1.3. Brazil Software Market Size and Forecast, by Enterprise Size (2022-2029) 9.5.1.4. Brazil Software Market Size and Forecast, by Vertical (2022-2029) 9.5.2. Argentina 9.5.2.1. Argentina Software Market Size and Forecast, by Type (2022-2029) 9.5.2.2. Argentina Software Market Size and Forecast, by Deployment (2022-2029) 9.5.2.3. Argentina Software Market Size and Forecast, by Enterprise Size (2022-2029) 9.5.2.4. Brazil Software Market Size and Forecast, by Vertical (2022-2029) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Software Market Size and Forecast, by Type (2022-2029) 9.5.3.2. Rest Of South America Software Market Size and Forecast, by Deployment (2022-2029) 9.5.3.3. Rest Of South America Software Market Size and Forecast, by Enterprise Size (2022-2029) 9.5.3.4. Brazil Software Market Size and Forecast, by Vertical (2022-2029) 10. Global Software Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Software Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. IBM Corporation - Armonk, New York, USA 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (small, medium, and large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. McAfee Corporation - San Jose, California, USA 11.3. NortonLifeLock Inc. - Tempe, Arizona, USA 11.4. Microsoft - Redmond, Washington, USA 11.5. Oracle - Redwood City, California, USA 11.6. SAP SE - Walldorf, Germany 11.7. Adobe Inc. - San Jose, California, USA 11.8. VMware Inc. - Palo Alto, California, USA 11.9. Block, Inc. - New York City, New York, USA 11.10. Intuit Inc. - Mountain View, California, USA 11.11. Apple - Cupertino, California, USA 11.12. Amazon Web Services (AWS) - Seattle, Washington, USA 11.13. Google - Mountain View, California, USA 11.14. Salesforce - San Francisco, California, USA 11.15. Intel - Santa Clara, California, USA 11.16. Cisco Systems - San Jose, California, USA 11.17. Dell Technologies - Round Rock, Texas, USA 11.18. Autodesk - San Rafael, California, USA 11.19. ServiceNow - Santa Clara, California, USA 11.20. Workday - Pleasanton, California, USA 11.21. Tencent - Shenzhen, China 11.22. Red Hat, Inc. - Raleigh, North Carolina, USA 11.23. CA Technologies - New York City, New York, USA 11.24. Dassault Systèmes SE - Vélizy-Villacoublay, France 11.25. Splunk Inc. - San Francisco, California, USA 11.26. Ansys, Inc. - Canonsburg, Pennsylvania, USA 11.27. Synopsys, Inc. - Mountain View, California, USA 11.28. Open Text Corporation - Waterloo, Ontario, Canada 11.29. Alibaba Cloud - Hangzhou, China 11.30. Fortinet - Sunnyvale, California, USA 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary