The Sodium Ion Battery Market size was valued at USD 0.70 Billion in 2025 and the total Sodium Ion Battery revenue is expected to grow at a CAGR of 21.2% from 2025 to 2032, reaching nearly USD 2.70 Billion by 2032.Sodium Ion Battery Market Overview:

Sodium-ion batteries are gaining recognition as a promising alternative in the realm of energy storage. The easy accessibility and abundant availability of sodium contribute to the increasing demand for these batteries. They find suitability in applications where compactness is not the primary concern. The energy at the anode is stored in the form of chemical bonds. During the charging process, sodium ions de-intercalate from the cathode and migrate to the anode. Positioning itself as a large-scale and cost-effective substitute for lithium-ion batteries globally, the sodium-ion battery boasts distinct advantages. The larger ionic radius of sodium metal in comparison to lithium metal in lithium-ion batteries results in fewer material property alterations during electrochemical cycling, ensuring greater stability. Sodium-ion batteries offer excellent features such as low cost, comparable energy densities and power storage to their counterparts, heightened thermal stability, and extended cycle life, among other benefits. In contrast to their application in mobile devices, sodium-ion batteries prove more suitable for stationary applications.To know about the Research Methodology :- Request Free Sample Report

Sodium Ion Battery Market Dynamics:

Market Drivers: Increased demand for electric vehicles: Increased demand for an electric vehicle is the main driver of the Sodium Ion Battery Market. In recent years, there has been a significant drive to electrify transport to lower carbon emissions from fuel use. As climate change continues to endanger our planet’s natural resources, governments have responded by lowering dependency on fossil fuels through efforts such as pushing sales of Electric Vehicles or implementing stronger environmental rules related to alternative energy sources. The growing emphasis on renewable energy solutions will surely result in an increase in sodium-ion batteries which is a technology that has the potential to give far greater capacities than typical lithium-ion cells while being more ecologically friendly. More preferred by Telecom Companies and Data Centres: Fuel expenses account for around 30% of telecom tower running costs, thus companies are actively searching for energy-efficient alternatives. The telecom sector is being affected by rising fuel prices. In terms of data design and operation centers, recent advances in battery chemistry are opening up new opportunities. They have a low internal resistance, a high cycle rate, a high peak energy potential, are non-flammable, and do not have any thermal chambers by design. Because of these characteristics, sodium-ion batteries are preferred by telecom and data centers. This factor is driving the Sodium Ion Battery Market. Cheaper than Lithium-ion batteries: Lithium-ion batteries are costly to manufacture, and lithium is becoming increasingly rare. While a sodium-ion battery can store the same amount of energy as a lithium-ion battery, it has the potential to be cheaper and produced in greater quantity. Because of the availability of sodium in all scientific communities, Sodium-ion battery technology has now gained public attention as a potential and eco-friendly substitute for Lithium-ion batteries. This benefit of sodium-ion batteries is driving the growth of the sodium-ion battery market. Market Restraints: Lack of strong industrial supply chain: The lack of a solid industrial supply chain does not support the active use of sodium-ion batteries and restrains the growth of the sodium-ion battery market. More weight as compared to Lithium-Ion Batteries: When compared to lithium metal, sodium metal has a higher weight. As a result, sodium batteries have limitations in terms of their use in electric vehicles. This factor is restraining the growth of the Sodium Ion Battery Industry. In March 2022, Blackstone Resources, a Swiss commodities company, claimed that its German battery subsidiary, Blackstone Technology, might put 3D-printed sodium-ion batteries to market as early as 2025. In July 2021, Contemporary Amperex Technology Co. Ltd (CATL) announced the release of its first-generation sodium-ion battery, as well as its AB battery pack solution, which can combine sodium-ion and lithium-ion cells into a single pack. Market Opportunities: Environmental factors and socioeconomic influences further underscore the viability of sodium-ion batteries as a market trend, with demand and supply dynamics playing a crucial role. Sodium-ion batteries present enticing market opportunities, particularly in the realm of energy storage systems for renewable sources like solar and wind. This market aligns with macroeconomic factors favoring sustainable energy solutions. The sodium-ion battery market holds promise for enhanced cost competitiveness, positioning itself attractively across various applications. Ongoing innovation in the industry, marked by continuous research and development, contributes to advancements in performance, energy density, and cycle life. These innovations act as industry disruptors which are opening up new opportunities. In the automotive sector, sodium-ion batteries emerge as a cost-effective and environmentally friendly alternative to traditional lithium-ion batteries, showcasing potential Sodium Ion Battery Market growth factors.Sodium Ion Battery Market Segment Analysis:

Based on Type, the sodium sulphur batteries segment dominated the market with a 46% share in 2025. Sodium sulphur (NAS) batteries are a subtype of sodium-ion batteries with a lithium sulphide cathode and a sodium anode. A sodium sulphur battery is a molten-salt battery with a high energy density, excellent discharge and charge efficiency, and a long lifespan. These factors are responsible for the growth of the Sodium-Sulphur batteries segment in the Sodium Ion Battery Market. The robust performance of sodium-salt batteries, coupled with ongoing research and development efforts aimed at enhancing their efficiency, has positioned this segment at the forefront of the Sodium-Ion Battery Market. As industries and consumers increasingly prioritize sustainable energy options, the Sodium-Salt Battery segment continues to experience substantial growth, solidifying its dominance within the market landscape.Based on End User, the market is categorized into Energy Storage Systems (ESS), Consumer Electronics, Transportation and Logistics, Automotive, Industrial Applications and Others. Energy Storage Systems is expected to dominate the Sodium-Ion Batteries Market during the forecast period. These systems benefit from the cost-effectiveness, safety, and large-scale storage capabilities of sodium-ion technology. ESS applications include grid energy storage, renewable energy integration, and backup power solutions. The push towards renewable energy sources and the need for grid stability drive significant demand.

Sodium Ion Battery Market Regional Insights:

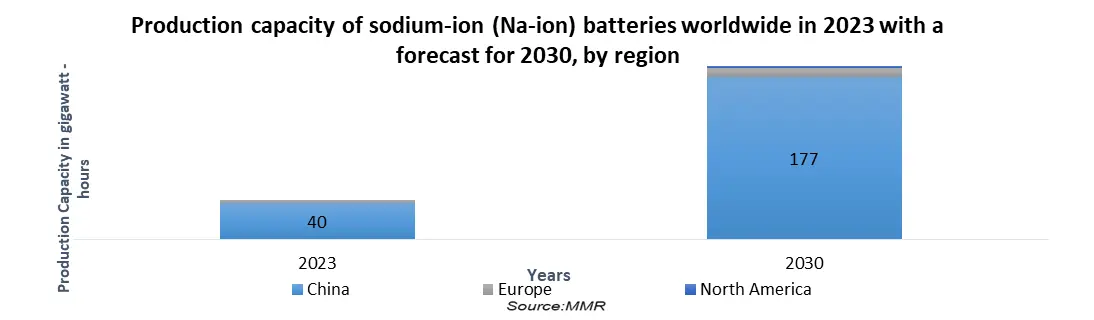

The Europe region dominated the market with a 39 % share in 2025. Because more companies were involved in producing and commercializing sodium-ion batteries. In partnership with Williams Advanced Engineering and Oxford University, Faradion, an English business, produced the world’s first sodium-ion battery-powered vehicle. In January 2022, the company focused on the Low-Cost Storage of Renewable Energy project, which was financed by Innovate UK, to showcase Na-ion technology for solar energy storage. The potential of the Na-ion battery was shown by NAIADES, a European Union-funded initiative in France. The basic goal of the project was to create a battery technology based on sodium-ion technology for long-term Electric Energy Storage (EES) that would significantly reduce the cost of lithium-ion technology while assuring long-term safety, cycle life, and energy density. The North American region is expected to witness significant growth at a CAGR of 9.4% through the forecast period. Due to the rising adoption of electric cars and solar and wind power projects in this area, North America is expected to see significant growth during the forecast period. One of the fastest-growing renewable energy technologies is wind power.

Competitive Landscape:

The competitive landscape of the Sodium-Ion Battery Market featuring companies such as BLUETTI Power Inc., CleanTechnica, Aquion Energy, NEI Corporation, and Nrgtek Inc. is marked by rigorous competitor analysis and industry rivals examination. In terms of company revenue and net sales, these entities engage in continuous competitive intelligence practices, undertaking competitor benchmarking and competitive strategy reviews. The dynamics among industry players are subject to constant evaluation, with a thorough market rivalry assessment considering factors like competitive landscape trends and competitive positioning. The Sodium-Ion Battery Market witnesses intense rivalry impact analysis, and competitors are consistently evaluated to determine their competitive advantage. The examination of industry player dynamics is integral to understanding the evolving market landscape. Each company, including BLUETTI Power Inc., CleanTechnica, Aquion Energy, NEI Corporation, and Nrgtek Inc., undergoes competitor profiling to assess strengths and weaknesses, contributing to a holistic competitive advantage assessment. The market rivalry intensity is evident as these players strive to position themselves strategically, adapting to market trends and gaining a competitive edge. The objective of the report is to present a comprehensive analysis of the global Sodium Ion Battery Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Sodium Ion Battery Market dynamic, structure by analyzing the market segments and projecting the Sodium Ion Battery Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Sodium Ion Battery Market make the report investor’s guide.Sodium Ion Battery Industry Ecosystem:

Sodium Ion Battery Market Scope: Inquire before buying

Sodium Ion Battery Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 0.70 Billion. Forecast Period 2026 to 2032 CAGR: 21.2% Market Size in 2032: USD 2.70 Billion Segments Covered: By Type Sodium-Sulphur Battery Sodium-Salt Battery Sodium-Air Battery Others By Technology Aqueous Non-Aqueous Others By End User Energy Storage Systems (ESS) Consumer Electronics Transportation and Logistics Automotive Industrial Applications Others Sodium Ion Battery Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Sodium Ion Battery Market Key Players for North America

North America 1. BLUETTI Power Inc. 2. CleanTechnica 3. Natron 4. 24M 5. Tesla 6. EnerSys 7. Sionic Energy 8. American Battery Technology Company Europe 9. LiNa Energy 10. Tiamat 11. Altris 12. Solarbio 13. Blue Solutions Asia-Pacific 14. NGK Insulators 15. Zhejiang Lvming Energy Company 16. HiNa Battery 17. Indi Energy 18. Li-Fun Technology 19. Adani Power MEA 20. EnergyNest 21. alfenFrequently Asked Questions:

1. Which region has the largest share in the Global Sodium Ion Battery Market? Ans: The Asia Pacific region held the highest share in 2025. 2. What was the Global Sodium Ion Battery Market size in 2025? Ans: The Global Sodium Ion Battery Market size was USD 0.70 Billion in 2025. 3. What is the scope of the Global Sodium Ion Battery market report? Ans: The Global market report helps with the PESTEL, PORTER, and COVID-19 Impact analysis, Recommendations for Investors and leaders, and market estimation for the forecast period. 4. Who are the key players in the Global Sodium Ion Battery market? Ans: The key players in the Global Sodium Ion Battery Market are BLUETTI Power Inc., CleanTechnica, Natron, 24M, Tesla, EnerSys, Sionic Energy, American Battery Technology Company and Others. 5. What is the study period of this market? Ans: The Global Sodium Ion Battery Market is studied from 2025 to 2032.

1. Sodium Ion Battery Market: Research Methodology 2. Sodium Ion Battery Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Sodium Ion Battery Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Type Segment 3.3.3. End-user Segment 3.3.4. Revenue (2023) 3.3.5. Headquarter 4. Sodium Ion Battery Market: Dynamics 4.1. Sodium Ion Battery Market Trends 4.2. Sodium Ion Battery Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Technological Roadmap 4.6. Investment Analysis 4.6.1. Key Investment Opportunities in the Sodium Ion Battery Market 4.7. Key Opinion Leader Analysis For Sodium Ion Battery Market 4.8. Regulatory Landscape 5. Sodium Ion Battery Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 5.1. Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 5.1.1. Sodium-Sulphur Battery 5.1.2. Sodium-Salt Battery 5.1.3. Sodium-Air Battery 5.1.4. Others 5.2. Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 5.2.1. Aqueous 5.2.2. Non-Aqueous 5.2.3. Others 5.3. Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 5.3.1. Energy Storage Systems (ESS) 5.3.2. Consumer Electronics 5.3.3. Transportation and Logistics 5.3.4. Automotive 5.3.5. Industrial Applications 5.3.6. Others 5.4. Sodium Ion Battery Market Size and Forecast, by Region (2025-2032) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Sodium Ion Battery Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 6.1. North America Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 6.1.1. Sodium-Sulphur Battery 6.1.2. Sodium-Salt Battery 6.1.3. Sodium-Air Battery 6.1.4. Others 6.2. North America Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 6.2.1. Aqueous 6.2.2. Non-Aqueous 6.2.3. Others 6.3. North America Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 6.3.1. Energy Storage Systems (ESS) 6.3.2. Consumer Electronics 6.3.3. Transportation and Logistics 6.3.4. Automotive 6.3.5. Industrial Applications 6.3.6. Others 6.4. North America Sodium Ion Battery Market Size and Forecast, by Country (2025-2032) 6.4.1. United States 6.4.1.1. United States Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 6.4.1.1.1. Sodium-Sulphur Battery 6.4.1.1.2. Sodium-Salt Battery 6.4.1.1.3. Sodium-Air Battery 6.4.1.1.4. Others 6.4.1.2. United States Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 6.4.1.2.1. Aqueous 6.4.1.2.2. Non-Aqueous 6.4.1.2.3. Others 6.4.1.3. United States Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 6.4.1.3.1. Energy Storage Systems (ESS) 6.4.1.3.2. Consumer Electronics 6.4.1.3.3. Transportation and Logistics 6.4.1.3.4. Automotive 6.4.1.3.5. Industrial Applications 6.4.1.3.6. Others 6.4.2. Canada 6.4.2.1. Canada Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 6.4.2.1.1. Sodium-Sulphur Battery 6.4.2.1.2. Sodium-Salt Battery 6.4.2.1.3. Sodium-Air Battery 6.4.2.1.4. Others 6.4.2.2. Canada Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 6.4.2.2.1. Aqueous 6.4.2.2.2. Non-Aqueous 6.4.2.2.3. Others 6.4.2.3. Canada Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 6.4.2.3.1. Energy Storage Systems (ESS) 6.4.2.3.2. Consumer Electronics 6.4.2.3.3. Transportation and Logistics 6.4.2.3.4. Automotive 6.4.2.3.5. Industrial Applications 6.4.2.3.6. Others 6.4.3. Mexico 6.4.3.1. Mexico Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 6.4.3.1.1. Halogenated Sodium Ion Battery 6.4.3.1.2. Non-Halogenated Sodium Ion Battery 6.4.3.2. Mexico Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 6.4.3.2.1. Plastics & Polymers 6.4.3.2.2. Textiles 6.4.3.2.3. Electronics & Electrical Equipment 6.4.3.2.4. Coatings & Adhesives 6.4.3.2.5. Others 6.4.3.3. Mexico Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 6.4.3.3.1. Energy Storage Systems (ESS) 6.4.3.3.2. Consumer Electronics 6.4.3.3.3. Transportation and Logistics 6.4.3.3.4. Automotive 6.4.3.3.5. Industrial Applications 6.4.3.3.6. Others 7. Europe Sodium Ion Battery Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 7.1. Europe Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 7.2. Europe Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 7.3. Europe Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 7.4. Europe Sodium Ion Battery Market Size and Forecast, by Country (2025-2032) 7.4.1. United Kingdom 7.4.1.1. United Kingdom Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 7.4.1.2. United Kingdom Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 7.4.1.3. United Kingdom Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 7.4.2. France 7.4.2.1. France Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 7.4.2.2. France Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 7.4.2.3. France Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 7.4.3. Germany 7.4.3.1. Germany Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 7.4.3.2. Germany Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 7.4.3.3. Germany Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 7.4.4. Italy 7.4.4.1. Italy Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 7.4.4.2. Italy Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 7.4.4.3. Italy Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 7.4.5. Spain 7.4.5.1. Spain Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 7.4.5.2. Spain Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 7.4.5.3. Spain Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 7.4.6. Sweden 7.4.6.1. Sweden Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 7.4.6.2. Sweden Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 7.4.6.3. Sweden Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 7.4.7. Russia 7.4.7.1. Russia Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 7.4.7.2. Russia Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 7.4.7.3. Russia Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 7.4.8. Rest of Europe 7.4.8.1. Rest of Europe Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 7.4.8.2. Rest of Europe Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 7.4.8.3. Rest of Europe Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 8. Asia Pacific Sodium Ion Battery Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 8.1. Asia Pacific Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 8.2. Asia Pacific Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 8.3. Asia Pacific Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 8.4. Asia Pacific Sodium Ion Battery Market Size and Forecast, by Country (2025-2032) 8.4.1. China 8.4.1.1. China Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 8.4.1.2. China Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 8.4.1.3. China Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 8.4.2. S Korea 8.4.2.1. S Korea Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 8.4.2.2. S Korea Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 8.4.2.3. S Korea Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 8.4.3. Japan 8.4.3.1. Japan Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 8.4.3.2. Japan Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 8.4.3.3. Japan Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 8.4.4. India 8.4.4.1. India Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 8.4.4.2. India Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 8.4.4.3. India Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 8.4.5. Australia 8.4.5.1. Australia Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 8.4.5.2. Australia Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 8.4.5.3. Australia Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 8.4.6. ASEAN 8.4.6.1. ASEAN Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 8.4.6.2. ASEAN Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 8.4.6.3. ASEAN Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 8.4.7. Rest of Asia Pacific 8.4.7.1. Rest of Asia Pacific Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 8.4.7.2. Rest of Asia Pacific Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 8.4.7.3. Rest of Asia Pacific Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 9. Middle East and Africa Sodium Ion Battery Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 9.1. Middle East and Africa Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 9.2. Middle East and Africa Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 9.3. Middle East and Africa Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 9.4. Middle East and Africa Sodium Ion Battery Market Size and Forecast, by Country (2025-2032) 9.4.1. South Africa 9.4.1.1. South Africa Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 9.4.1.2. South Africa Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 9.4.1.3. South Africa Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 9.4.2. GCC 9.4.2.1. GCC Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 9.4.2.2. GCC Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 9.4.2.3. GCC Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 9.4.3. Nigeria 9.4.3.1. Nigeria Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 9.4.3.2. Nigeria Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 9.4.3.3. Nigeria Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 9.4.4. Rest of ME&A 9.4.4.1. Rest of ME&A Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 9.4.4.2. Rest of ME&A Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 9.4.4.3. Rest of ME&A Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 10. South America Sodium Ion Battery Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 10.1. South America Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 10.2. South America Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 10.3. South America Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 10.4. South America Sodium Ion Battery Market Size and Forecast, by Country (2025-2032) 10.4.1. Brazil 10.4.1.1. Brazil Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 10.4.1.2. Brazil Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 10.4.1.3. Brazil Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 10.4.2. Argentina 10.4.2.1. Argentina Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 10.4.2.2. Argentina Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 10.4.2.3. Argentina Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 10.4.3. Rest Of South America 10.4.3.1. Rest Of South America Sodium Ion Battery Market Size and Forecast, by Type (2025-2032) 10.4.3.2. Rest Of South America Sodium Ion Battery Market Size and Forecast, by Technology (2025-2032) 10.4.3.3. Rest Of South America Sodium Ion Battery Market Size and Forecast, by End User (2025-2032) 11. Company Profile: Key Players 11.1. BLUETTI Power Inc. 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.2. CleanTechnica 11.3. Natron 11.4. 24M 11.5. Tesla 11.6. EnerSys 11.7. Sionic Energy 11.8. American Battery Technology Company 11.9. LiNa Energy 11.10. Tiamat 11.11. Altris 11.12. Solarbio 11.13. Blue Solutions 11.14. NGK Insulators 11.15. Zhejiang Lvming Energy Company 11.16. HiNa Battery 11.17. Indi Energy 11.18. Li-Fun Technology 11.19. Adani Power 11.20. EnergyNest 11.21. alfen 12. Key Findings 13. Analyst Recommendations