Simulator Gaming Machines Market was valued at USD 5.06 Billion in 2021, and it is expected to reach USD 13.08 Billion by 2029, exhibiting a CAGR of 12.6% during the forecast period (2022-2029) In the gaming world, game simulation is a technology that recreates real-life situations. It is made up of components such as system entities, input variables, performance metrics, and functional connections, all of which work together to improve the feeling in games and give users with the finest movement experience possible. Numerous organisations are using gaming simulations to reduce the operational costs associated with staff training, which is driving Simulator Gaming Machines market growth. Gaming simulators are hardware and software systems that are used to recreate the experience of a game using real or fictitious themes. Simulators allow gamers to experience settings and circumstances in great detail, providing a completely immersive and realistic gaming experience. They are also utilised for training, academic, predictive, and analytical objectives, and they employ game panels, wheels, boxing gloves, demo guns, paddles, and other components in a variety of racing, business, and war-based gaming situations. Simulation games help in the investigation of important circumstances, the improvement of critical thinking, physical and social skills, and the deepening of learning and comprehension of complicated subjects. Because of the rising movement toward the usage of virtual and augmented reality based simulators across a lot of enterprises for working remotely and offering better training to their staff, the COVID-19 pandemic has greatly aided the simulation gaming machines market growth rate. For example, in June 2020, CXC Simulations announced a Certified Pre-Owned programme that offers a fantastic opportunity to purchase a Motion Pro II simulator at a significantly discounted price.To know about the Research Methodology :- Request Free Sample Report

Simulator Gaming Machines Market Dynamics

Increase of Simulator Gaming Machines in Defence & Military

Hundreds of thousands of service members are safe from loss or harm as a result of the military's capacity to drill and train in conflicts with great efficiency and effectiveness. People must be well-trained in order for high-tech platforms and systems to work securely and successfully. Due to ineffective operational performance, simulated defence training diminishes the value of the platform or weapon system. As a result, simulations are becoming an integral aspect of defence training since operating genuine equipment is too dangerous, and simulated equipment delivers higher training quality outcomes. Simulator video games are a broad genre of video games that are aimed to simulate real-world activities. It tries to mimic diverse real-life events for various goals such as training, analysis, prediction, or amusement. Most defence game strategies lack clearly stated goals, leaving the player free to control characters or settings as they see fit. Well-known examples include military games, corporate simulations, and role-playing simulations. Officially called as a war game, a military simulation explains war theory without engaging in actual conflict. Although military simulation is used to generate tactical, strategic, and doctrinal answers, some argue that the findings gained from such models are intrinsically untrustworthy. It is because the models utilised are imprecise. As war games are generally considered civilian hobbies, many analysts prefer the term simulation.Increase in Acceptance of 360-Degree Camera as Next-Generation Technology

The continued incorporation of cutting-edge technology, such as Virtual Reality (VR), in gaming simulators to provide realistic gaming experiences is expected to create new possibilities for market players over the forecast period. Vendors have begun producing portable gaming sets after realising that the younger generation is still interested in trying out complex games with rotating platforms and 360-degree cameras. For example, in September 2017, Roto VR Ltd. debuted the Roto VR Chair at the VR Summit in Seoul, South Korea. Roto VR Chair is a motorised chair that can auto-rotate to allow for 360-degree viewing. The global simulation gaming machines market is growing due to increased usage of gaming simulation for training and analysis in many sectors, as well as increased demand for virtual reality (VR) headsets. Increased adoption of 360-degree cameras as next-generation technology across various emerging nations favourably influences market growth. However, the security and privacy concerns connected with VR headsets, as well as the expensive cost of VR headsets, are impeding the growth of the game simulation industry. On the contrary, adoption of AI and cloud computing for better experience, as well as increased collaboration between the entertainment industry and gaming simulator companies around the world, are expected to provide lucrative opportunities for simulation gaming machines market growth during the forecast period.Changing Gamers Preferences & Developing Game Zones

The need for gaming simulators is increasing as gamers desire more immersive and realistic games. Gaming simulators have the capacity to respond to gamers' shifting preferences. Simultaneously, new platforms are being established to bring fresh and unique games. This is motivating industry participants to create sophisticated game simulations. For example, in March 2019, Next Level Racing released the F-GT Lite, a compact racing cockpit that simulates Formula or GT racing. The number of gaming zones that provide a better gaming experience via the use of gaming simulators is also increasing. Simultaneously, many e-sports competitions being held in various regions of the world are drawing players. Market participants are responding to the problem by developing novel game simulators for gaming zones and e-sports tournaments. For example, in September 2019, Next Level Racing supplied 20 GTultimate cockpits to the Toyota Velocity Esports Championship, which was held in Malaysia. The ongoing implementation of high-speed internet networks, as well as the growing popularity of network sharing and cloud computing, are further increasing demand for game simulators.Increasing Popularity of Simulation Games in Education

Because simulation games require additional engagement rather than simply reading about or debating concepts and ideas, they may alleviate the tedium associated with more traditional modalities of training (like discrimination, culture, stratification, and norms). Students will get an understanding of them by "living" them. As a result, using simulation games may boost students' enthusiasm and interest in studying. Simulation games can reveal deeper insights on how people perceive the world, such as their moral and intellectual quirks. They may also assist improve awareness of personal and interpersonal values by helping players to recognise the moral and ethical repercussions of their decisions. As such, they may be utilised to influence and enhance students' attitudes about themselves, their surroundings, and classroom learning. Many games are intended to modify and improve certain decision-making, problem-solving, and critical thinking abilities (such as those involved in survey sampling, perception and communication).

Collaboration Between Gaming Simulator Companies and Entertainment Industry

Amusement and theme parks, gaming hubs, and other locations are implementing gaming simulators to give end users with shows and real-life gaming experiences at affordable rates, which is likely to present a lucrative potential for the industry. For example, the New York production Sleep No More is an Immersive theatre performance in which the audience is participating in the action, and it uses VR and other simulator technology, which receives favourable feedback from end users. More than 66% of end users are interested in attending such a concert. As a result, the market is likely to benefit from an increase in the number of such initiatives. Large theme parks are investing in VR and gaming simulators in order to recover from the COVID-19 pandemic and give customers with a better experience. For example, in 2020, Universal Studios announced the development of Super Nintendo World area at Universal Studios Hollywood, as well as the introduction of a dark ride that employs virtual reality technology to transport visitors inside a real-life Mario Kart race. This surge in VR acceptance is not only propelling the game simulation sector, but also reviving businesses who have lost audience owing to the COVID-19 lockout. As a result, all of these variables are likely to provide lucrative prospects for global market advancement over the forecast period.High Prices of Gaming Simulators are Anticipated to Restrain the Growth

Manufacturers of game simulators usually rely on third-party component providers for sensors and microcontrollers, as well as third-party distributors and merchants to distribute their goods globally. At this point, any interruption or shortage in the supply of components, inability to procure components from alternate sources at reasonable prices, disruptions in the operations of distributors and sellers, and disagreements with distributors and sellers over business terms can all threaten market growth. The COVID-19 pandemic is having an impact on the creation and supply of gaming simulators, since manufacturing facilities are closing owing to lockdowns imposed in various regions of the world to stop the disease's spread. All these factors are expected to restrain the growth of the market over the forecast period.Simulator Gaming Machines Market Segment Analysis

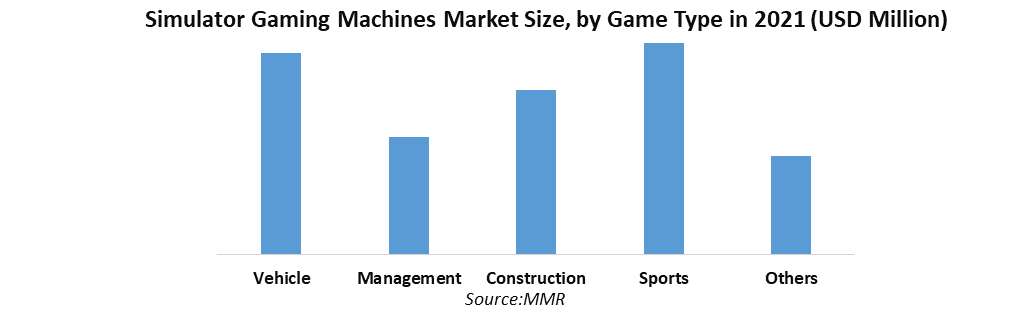

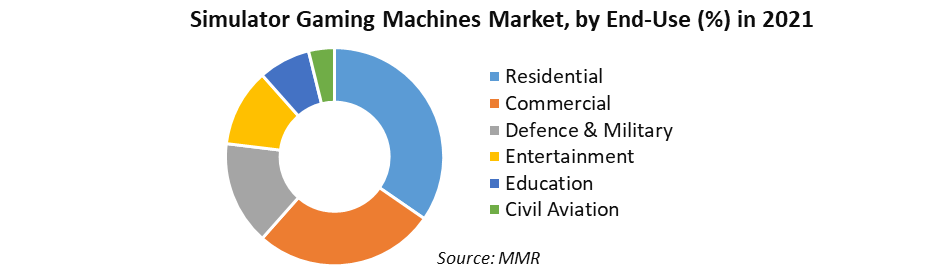

Based on Game Type, the market is segmented into Vehicle Simulation, Sports Management, Construction Simulation, Management Simulation, Others. In 2021, the Vehicle Simulation segment dominated the market and held a market share of more than 57.3%. Over the forecast period, rising use of virtual training solutions for racing drivers to improve their driving abilities is likely to fuel demand for vehicle (race) simulators. Visualization advancements such as multi-screen displays and VR-enabled displays would also play a significant role in growing demand for racing simulations. The increasing demand for lightweight and small racing simulators, as well as manufacturer attempts to respond favourably to changing gamers' tastes, auger well for the expansion of the vehicle simulation segment over the forecast period. For example, during the 2019 Consumer Electronics Show (CES), Arozzi North America debuted the Velocità Racing Simulator, a race driving simulator. Velocità Racing Simulator is a lightweight and portable simulator with a steering wheel, gear change, and pedals. It is compatible with any gaming chair. Based on Components, the market is segmented into Hardware and Software. With a revenue share of more than 56.02% in 2021, the hardware segment dominated the market. Hardware components are critical in enhancing the game experience. The rising popularity of virtual reality headsets, which aid in gaming experience enhancement, is expected to motivate industry players to build superior gaming simulator gear. Game simulator hardware manufacturers are aggressively promoting and advertising their simulators gaming machines and components. These marketing activities, which allow firms to raise consumer knowledge of hardware components, are likely to contribute to the hardware segment's growth over the forecast period. Market players are concentrating their efforts on producing innovative and cost-effective hardware components that may aid in the enhancement of the gaming experience. For example, Logitech released the Logitech G29, a racing wheel attachment that can improve the racing gaming experience, in January 2020. Based on End-Use, the market is segmented into Residential, Commercial, Defence & Security, Civil Aviation, Education and Entertainment. As gaming became more popular among individuals, the residential segment dominated the market with a market share of more than 61.7% in 2021. Over the forecast period, the increased demand for advanced simulators gaming machines for a better gaming experience is likely to boost the growth of the residential segment. The addition of features such as gesture-based gaming and high-quality visuals to enhance the gaming experience are also expected to help to the residential segment's growth. Over the forecast period, the commercial segment is expected to increase significantly. While gaming hubs are expected to play an important role in boosting demand for simulators gaming machines, gaming tournaments being held around the world are also expected to spark demand for simulators gaming machines and help to the growth of the commercial market. Various sports event organisers are collaborating with gaming simulator makers to provide players with immersive virtual practising and playing experiences. For example, PGA TOUR, Inc. established a relationship with Full Swing Golf, a manufacturer of home and commercial golf simulators, in January 2020. The collaboration envisions PGA TOUR, Inc. providing an off-course golf experience to gamers via the golf simulator built by Full Swing.

Simulator Gaming Machines Market Regional Insights

With a market share of more than 37.9% in 2021, North America dominated the global Simulators Gaming Machines market and is expected to dominate the market during the forecast period. Some of the major market players are based in North America, including D-BOX TECHNOLOGIES INC., CXC Simulations, and Razer Inc. The installation of racing platforms in several North American theatres to support motorsports and e-sports is also expected to boost demand for simulator gaming equipment in the region. In April 2018, for example, VRX collaborated with NAGRA to launch the SIM racing programme in cinemas utilising the myCinema platform. The growing number of e-sport events held in North America is expected to fuel the region's demand for simulator gaming machines. For example, in June 2019, VRX erected racing simulators in the ESPORTS CENTRAL e-sports centre in Montreal, Canada. The expanding popularity of online games, as well as the availability of custom-made simulator gaming machines, are likely to move the regional industry forward. Changing consumer trends, such as a growing preference for simulator-based video games over other entertainment platforms is driving the North American regional market's growth. The Asia Pacific Simulators Gaming Machines market is expected to grow at a significant CAGR during the forecast period, thanks to growth in the number of gaming zones based on virtual reality and simulation systems in the area. Demand for Simulators Gaming Machines is expected to rise due to an increase in demand for individual usage of simulators gaming machines for amusement in various Asian nations such as Japan, China, and India. Initiatives being made by market players in the Asia-Pacific region to implement virtual reality to provide real-life gaming experiences for gamers are expected to boost market growth. The increasing use of gaming simulators for training and analysis in many sectors and industrial verticals is also likely to boost market development. The utilisation of gaming simulators as possible stress relievers bodes well for the region's expansion of simulator gaming machines.Research Methodology

Primary and secondary methods are used for collecting the data in the research report. The research process involves the investigation of various factors affecting the industry, such as government policy, market environment, competitive landscape, historical data, current market trends, technological innovation, upcoming technologies, and technical progress in related industries, as well as market risks, opportunities, market barriers, and challenges. All conceivable elements influencing the markets included in this research study have been considered, examined in depth, validated through primary research, and evaluated to provide the final quantitative and qualitative data. The market size for top-level markets and sub-segments is normalised, and the impact of inflation, economic downturns, regulatory & policy changes, and other variables is factored into the market forecast. This data is combined and added with detailed inputs and analysis, and presented in the report. Extensive primary research was conducted to acquire information and verify and confirm the crucial numbers arrived at after comprehensive market engineering and calculations for market statistics; market size estimations; market forecasts; market breakdown; and data triangulation. Bottom-up technique is widely employed in the whole market engineering process, along with multiple data triangulation methodologies, to perform market estimation and forecasting for the overall market segments and sub-segments covered in this research.Report Scope:

The Simulator Gaming Machines Market research report includes product categorization, product application, development trend, product technology, competitive landscape, industrial chain structure, industry overview, national policy and planning analysis of the industry, and the most recent dynamic analysis, among other things. The study discusses the global market's drivers, opportunities, and limitations. It discusses the influence of various drivers, trends, and constraints on market demand during the forecast period. The research also outlines market potential on a global scale. The research includes the production time, base distribution, technical characteristics, research and development trends, technology sources, and raw material sources of significant Simulator Gaming Machines Market firms in terms of production bases and technologies. The more precise research also contains the key application areas of market and consumption, significant regions and consumption, major producers, distributors, raw material suppliers, equipment providers, and their contact information, as well as an analysis of the industry chain relationship. This report's study also contains product specifications, manufacturing processes, cost structure, and data information organised by area, technology, and application.Simulator Gaming Machines Market Scope: Inquire before buying

Simulator Gaming Machines Market Report Coverage Details Base Year: 2021 Forecast Period: 2022-2029 Historical Data: 2017 to 2021 Market Size in 2021: US $ 5.06 Bn. Forecast Period 2022 to 2029 CAGR: 12.6% Market Size in 2029: US $ 13.08 Bn. Segments Covered: by Game Type 1. Vehicle Simulation 2. Sports Management 3. Construction Simulation 4. Management Simulation 5. Others by Components 1. Hardware 2. Software by End-Use 1. Residential 2. Commercial 3. Defence & Security 4. Civil Aviation 5. Education 6. Entertainment Simulator Gaming Machines Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Simulator Gaming Machines Market, Key Players are

1. Longcheng Electronic Co.,Ltd 2. 9D VR Cinema 3. 6 Seats 9D VR 4. VR Arcade Machine 5. VR Flight Simulator 6. VR Bike 7. VR Horse Riding 8. F1 Driving Simulator 9. VR Standing Platform 10. VR Racing Simulator products 11. Vesaro 12. Hammacher Schlemmer and Company Inc 13. Eleetus 14. D-Box Technologies Inc 15. Sony Interactive Entertainment Inc 16. Cruden 17. CXC Simulations 18. Aeonsim 19. Norman Design Frequently Asked Questions: 1] What segments are covered in the Global Simulator Gaming Machines Market report? Ans. The segments covered in the Simulator Gaming Machines Market report are based on Game Type, Component, End-Use. 2] Which region is expected to hold the highest share in the Global Simulator Gaming Machines Market? Ans. The North America region is expected to hold the highest share in the Simulator Gaming Machines Market. 3] What is the market size of the Global Simulator Gaming Machines Market by 2029? Ans. The market size of the Simulator Gaming Machines Market by 2029 is expected to reach USD 13.08 Bn. 4] What is the forecast period for the Global Simulator Gaming Machines Market? Ans. The forecast period for the Simulator Gaming Machines Market is 2021-2029. 5] What was the market size of the Global Simulator Gaming Machines Market in 2021? Ans. The market size of the Simulator Gaming Machines Market in 2021 was valued at USD 5.06 Bn.

1. Global Simulator Gaming Machines Market Size: Research Methodology 2. Global Simulator Gaming Machines Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Simulator Gaming Machines Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Simulator Gaming Machines Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Simulator Gaming Machines Market Size Segmentation 4.1. Global Simulator Gaming Machines Market Size, by Game Type (2021-2029) • Vehicle Simulation • Sports Management • Construction Simulation • Management Simulation • Others 4.2. Global Simulator Gaming Machines Market Size, by Component (2021-2029) • Hardware • Software 4.3. Global Simulator Gaming Machines Market Size, by End-Use (2021-2029) • Residential • Commercial • Defence & Security • Civil Aviation • Education • Entertainment 5. North America Simulator Gaming Machines Market (2021-2029) 5.1. North America Simulator Gaming Machines Market Size, by Game Type (2021-2029) • Vehicle Simulation • Sports Management • Construction Simulation • Management Simulation • Others 5.2. North America Simulator Gaming Machines Market Size, by Component (2021-2029) • Hardware • Software 5.3. North America Simulator Gaming Machines Market Size, by End-Use (2021-2029) • Residential • Commercial • Defence & Security • Civil Aviation • Education • Entertainment 5.4. North America Simulator Gaming Machines Market, by Country (2021-2029) • United States • Canada 6. European Simulator Gaming Machines Market (2021-2029) 6.1. Europe Simulator Gaming Machines Market, by Game Type (2021-2029) 6.2. Europe Simulator Gaming Machines Market, by Component (2021-2029) 6.3. Europe Simulator Gaming Machines Market, by End-Use (2021-2029) 6.4. Europe Simulator Gaming Machines Market, by Country (2021-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest of Europe 7. Asia Pacific Simulator Gaming Machines Market (2021-2029) 7.1. Asia Pacific Simulator Gaming Machines Market, by Game Type (2021-2029) 7.2. Asia Pacific Simulator Gaming Machines Market, by Component (2021-2029) 7.3. Asia Pacific Simulator Gaming Machines Market, by End-Use (2021-2029) 7.4. Asia Pacific Simulator Gaming Machines Market, by Country (2021-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest of APAC 8. Middle East and Africa Simulator Gaming Machines Market (2021-2029) 8.1. Middle East and Africa Simulator Gaming Machines Market, by Game Type (2021-2029) 8.2. Middle East and Africa Simulator Gaming Machines Market, by Component (2021-2029) 8.3. Middle East and Africa Simulator Gaming Machines Market, by End-Use (2021-2029) 8.4. Middle East and Africa Simulator Gaming Machines Market, by Country (2021-2029) • South Africa • GCC • Egypt • Nigeria • Rest of ME&A 9. South America Simulator Gaming Machines Market (2021-2029) 9.1. South America Simulator Gaming Machines Market, by Game Type (2021-2029) 9.2. South America Simulator Gaming Machines Market, by Component (2021-2029) 9.3. South America Simulator Gaming Machines Market, by End-Use (2021-2029) 9.4. South America Simulator Gaming Machines Market, by Country (2021-2029) • Brazil • Mexico • Argentina • Rest of South America 10. Company Profile: Key players 10.1. Longcheng Electronic Co.,Ltd 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. 9D VR Cinema 10.3. 6 Seats 9D VR 10.4. VR Arcade Machine 10.5. VR Flight Simulator 10.6. VR Bike 10.7. VR Horse Riding 10.8. F1 Driving Simulator 10.9. VR Standing Platform 10.10. VR Racing Simulator products 10.11. Vesaro 10.12. Hammacher Schlemmer and Company Inc 10.13. Eleetus 10.14. D-Box Technologies Inc 10.15. Sony Interactive Entertainment Inc 10.16. Cruden 10.17. CXC Simulations 10.18. Aeonsim 10.19. Norman Design