The Semolina Market size was valued at USD 2.55 Bn in 2022 and is expected to reach USD 3.03 Bn by 2029, at a CAGR of 2.5 %Overview of the Semolina Market

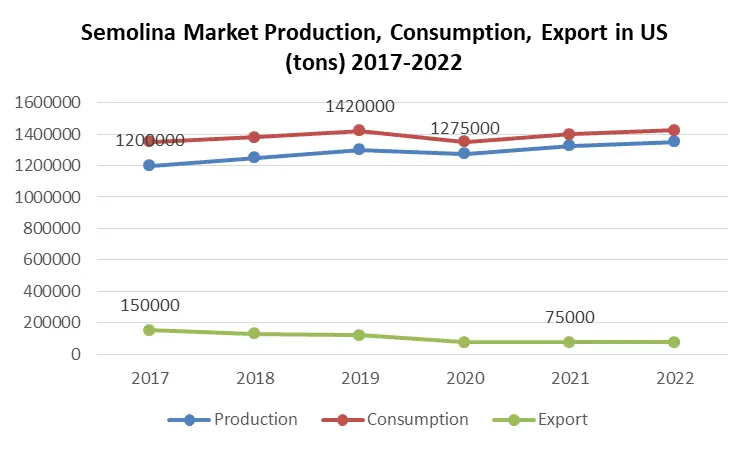

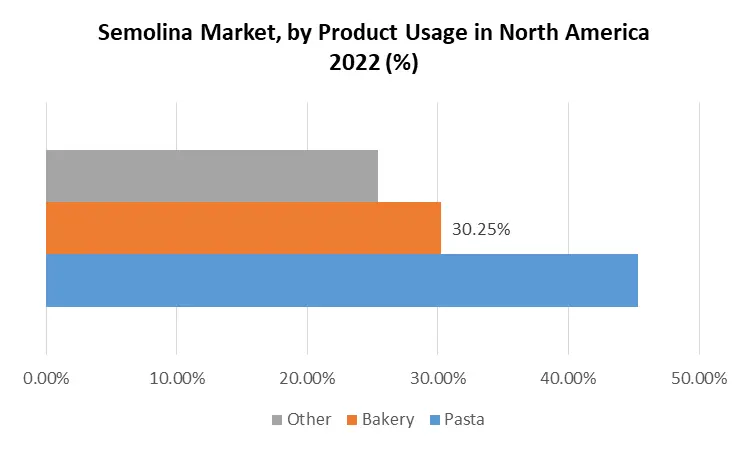

Semolina is a coarse flour, usually derived from durum wheat, recognized for its robust texture and elevated protein content. The milling process entails grinding the endosperm of durum wheat into granular particles, imparting semolina with its distinctive coarseness. Widely employed in culinary endeavors, semolina finds applications in the creation of pasta, couscous, bread, and specific desserts. The organic semolina segment is witnessing significant growth, propelled by health-conscious consumers with a focus on sustainability. Leading retail establishments, serving as major hubs, provide a diverse consumer base with a broad array of semolina products, catering to those seeking both convenience and variety. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Semolina Market.To know about the Research Methodology :- Request Free Sample Report The global semolina market is witnessing heightened demand driven by the increasing global population and evolving consumer preferences for convenient food products. This trend underscores the pivotal role semolina plays in a diverse range of global food products, showcasing its adaptability to changing consumer needs. Positioned as a healthier alternative to refined grains, semolina is gaining prominence amid a global shift towards heightened health consciousness. Consumers are progressively seeking nutritious, whole-grain options, leading to a rising demand for semolina-based food products that align with healthier lifestyle choices. Semolina's versatility in culinary applications, particularly in pasta and bakery products, serves as a significant driver for market growth. Its unique attributes contribute to shaping the texture and flavor of a variety of semolina-based food items, establishing it as a fundamental ingredient in kitchens worldwide. The global semolina market size is experiencing consistent growth, driven by a confluence of factors including increasing demand across various regions, the expansion of the food industry, and the diverse applications of semolina in various cuisines. The size of the market reflects the indispensable role of semolina in the food sector, highlighting its significance as a key ingredient on a global scale. Significant potential for the semolina market is identified in East Asian countries, including China, South Korea, and Japan. As these nations undergo economic growth, there is a strategic opportunity for semolina to establish a prominent presence in their respective food industries. This potential is fuelled by the rise in middle-class populations, increasing disposable incomes, and a growing interest in diverse and convenient food options. In the Japanese market, semolina is gradually gaining penetration, driven by factors such as the diversification of culinary preferences and an increasing interest in global cuisines. Semolina's versatility in creating a variety of food products aligns seamlessly with the evolving tastes of Japanese consumers, contributing to its progressive integration and growing presence in the market. Innovation in Product Development and Adaptation to Health and Wellness Trends upgrading the opportunities in the Semolina Market The semolina market offers opportunities for innovative product development, encouraging the creation of novel semolina-based products. This involves developing items that cater to shifting consumer preferences, introduce convenient options, and enhance overall market appeal, thereby fostering sustained growth and relevance. With economic growth in emerging markets, the semolina market holds the potential to expand by tapping into increasing disposable incomes and growing middle-class populations. Regions like China, South Korea, and Japan present promising opportunities for the semolina industry to establish a foothold and thrive in burgeoning markets. Prevailing health and wellness trends create opportunities for the semolina industry to develop specialized products aligned with evolving dietary needs and preferences. This includes the creation of gluten-free or high-protein semolina flour, providing consumers with healthier options and contributing to the industry's overall growth. The semolina market in the United States is witnessing substantial growth, propelled by the increasing popularity of pasta and bakery products. As consumers actively seek diverse and high-quality food options, semolina's versatility and its role in enhancing the texture and flavor of these products contribute significantly to its growth within the US market. The semolina industry is currently undergoing a wave of innovation in product development. Manufacturers are actively exploring new formulations and enhancing existing products to meet evolving consumer preferences. This innovation includes the introduction of semolina-based products featuring added nutritional benefits, convenience features, and unique flavor profiles, all contributing to the industry's adaptability and overall growth. Vulnerability to Supply Chain Disruptions and Impact of Fluctuating Raw Material Prices are the Restraining the Semolina Market Semolina faces a significant challenge due to the fluctuating prices of its primary raw material, wheat. These fluctuations impact the cost structure of the global semolina market, potentially affecting profit margins for businesses engaged in semolina-based food product production on a global scale. The availability of substitutes poses a restraint on the growth potential of semolina. In a competitive landscape with alternative flours and grains, strategic positioning and differentiation are imperative for semolina to maintain and expand its market share, addressing consumer preferences for a diverse range of options. The stability of the semolina market is vulnerable to supply chain disruptions stemming from natural disasters, geopolitical events, and other factors. These disruptions can have far-reaching effects on the production, distribution, and overall availability of semolina globally, posing challenges to market stability. Regulatory challenges, particularly those related to compliance with food safety and labelling regulations, present obstacles for semolina businesses. Navigating through frequent changes and stringent requirements is essential for maintaining operational efficiency and market share in the face of evolving regulatory landscapes.

Semolina Market Segment Analysis

Source: In the semolina market, the choice of source exhibits distinct trends, portraying a dynamic landscape. Wheat retains its predominant position, serving as the traditional and widely accepted base for semolina. Simultaneously, rice emerges as a notable alternative, addressing the demand for gluten-free options, while corn establishes a niche market with its unique flavor profile and nutritional composition. The existence of niche semolina markets is exemplified by corn-derived semolina, catering to consumers seeking diversity in their food products. This niche segment offers unique characteristics, attracting individuals with specific taste preferences and contributing to the broader understanding of the potential for specialization within the semolina market. Serving as the traditional and dominant source, wheat-derived semolina remains a staple in the market, offering a familiar and widely accepted base for a range of culinary applications. Representing a specialized segment, rice-derived semolina caters to the increasing demand for gluten-free options. This source appeals to consumers with dietary preferences or sensitivities seeking alternative choices in semolina-based products. Carving a niche in the market, corn-derived semolina introduces a unique flavor profile and distinct nutritional composition. This specialized source caters to consumers looking for diversity and specific characteristics in their semolina products.Category: The micro-segmentation of the semolina market into organic and conventional categories reflects the evolving consumer consciousness. The organic segment experiences notable growth, driven by health-conscious and sustainability-focused consumers seeking products cultivated without synthetic pesticides and fertilizers. Meanwhile, the conventional category, rooted in traditional farming practices, maintains widespread accessibility and usage. Consumer demographics play a pivotal role in shaping preferences within the semolina market. The organic segment attracts health-conscious consumers who prioritize products aligned with their well-being and sustainability values. In contrast, the conventional category appeals to a broader consumer base, emphasizing affordability and accessibility as key factors influencing purchasing decisions. The organic semolina segment responds to the growing demand from health-conscious consumers and those prioritizing sustainable agricultural practices. This category witnesses increased popularity due to the absence of synthetic pesticides and fertilizers. Maintaining its stronghold in the market, conventional semolina, produced through traditional farming practices, remains accessible and widely used. This category caters to a broader consumer base, emphasizing affordability and conventional farming methods.

Table 1: Overview of protein types, forms and sources Distribution Channel: Effective segment-based marketing strategies are evident in the semolina market, utilizing various distribution channels to reach a diverse consumer base. Supermarkets and hypermarkets play a crucial role by offering a wide array of semolina products, catering to the general consumer preferences. Conventional stores address specific niche preferences, while online platforms provide convenience for a digitally inclined audience. Additionally, unconventional channels like farmer's markets and co-operatives serve niche markets, presenting untapped opportunities for expansion and diversification. While supermarkets and hypermarkets dominate the distribution landscape, untapped semolina market areas present growth opportunities. Niche markets, characterized by unique preferences and demands, as well as unconventional channels like farmer's markets and co-operatives, offer avenues for expansion, diversification, and connecting with consumers seeking specialized semolina products. As major retail hubs, supermarkets and hypermarkets play a pivotal role in the semolina market, offering a wide variety of products to a diverse consumer base seeking convenience and variety. Local and specialty stores contribute significantly to the distribution of semolina, providing personalized shopping experiences and catering to specific consumer preferences. The online distribution channel has gained prominence, offering consumers the convenience of purchasing semolina products from the comfort of their homes. E-commerce platforms provide a broader reach and access to a diverse range of semolina options. This category includes unconventional channels such as farmer's markets and co-operatives, serving as niche outlets that contribute to the diversification of the market by connecting with consumers seeking unique and locally sourced semolina products.

Types Forms Plant-based Source Available Flours Powder, Semolina Soy, lupin, Faba Bean, Pea, Rice, Lentil, Chickpea Texturized (Flakes, pellets) Soy, Faba beans, Peas Concentrate Powder, Semolina Soy, lupin, Faba Bean, Pea, Rice, Lentil, Chickpea Texturized (Flakes, pellets, crisps) Soy, Peas Isolates Powder Soy, Pea, Rice, Wheat, Potato Semolina Market Regional Analysis

In the Asia-Pacific region, the semolina market undergoes a thorough geographic analysis, showcasing robust demand driven by diverse culinary traditions in countries like India, China, and Southeast Asian nations. Regional semolina market trends are influenced by traditional dishes such as noodles and dumplings, where semolina plays a key role, contributing to the market's popularity. The region's area-specific semolina market dynamics are shaped by the growing disposable income of the middle-class population and a preference for convenience foods, leading to potential innovation in response to health and wellness trends. The North American semolina market share demonstrates steady performance, with geographic analysis revealing a stronghold in the widespread consumption of pasta and bakery products. Semolina's versatility significantly enhances the texture and flavor of these popular items, and regional market trends show a growing inclination towards whole grain and specialty semolina products driven by health-conscious consumer behaviour. The region presents opportunities for semolina-based products to cater to evolving consumer preferences, contributing to its dynamic and diverse food landscape. In Europe, the semolina market is deeply influenced by local semolina market influences rooted in culinary traditions, especially in pasta-centric countries like Italy. Consistent demand is observed due to semolina's integral role in pasta and bakery products. The region's semolina market segmentation reflects a preference for quality and authenticity in European cuisine, with health and wellness trends driving demand for semolina as a whole grain option. Innovations in product development align with changing dietary preferences, contributing to the region's semolina market growth. The Middle East and Africa witness notable regional semolina market segmentation driven by demand for traditional dishes like couscous and various types of bread. The market is deeply entrenched in the region's rich culinary heritage, and area-specific opportunities arise from increasing urbanization and changing lifestyles, contributing to the consumption of convenience foods and positively impacting market growth. Economic development and rising disposable incomes in specific areas further contribute to the growing semolina market in this region. In Latin America, the semolina market responds to unique regional semolina market challenges influenced by diverse cuisines. Traditional dishes like arepas and various pasta types contribute to market growth, and the region's expanding food industry, along with a growing middle-class population, creates area-specific opportunities for semolina incorporation into a variety of products. Cultural preferences for hearty and filling foods enhance local semolina market stability and indicate potential for further growth.Semolina Market Competitive Landscape The global semolina market is characterized by robust competition, with key players employing diverse strategies to gain a competitive edge. Aashirvaad Atta, known for its customer-centric approach, has made strategic moves to enhance its market presence. Aashirvaad's entry into the D2C market reflects a strategic move to establish a direct connection with consumers, enabling insights into market rival scrutiny. Aashirvaad Atta has introduced its direct-to-consumer (D2C) offering, 'Namma Chakki,' in Bengaluru, signaling a strategic move to become a comprehensive flour solution for consumers. Known for its customer-centric approach, Aashirvaad continually brings innovations to the market. 'Namma Chakki' is a testament to the brand's commitment to meeting evolving customer needs. This initiative aims to provide personalized, high-quality Atta directly to consumers' doorsteps, showcasing Aashirvaad's strategy to enhance customer experience. In the competitive landscape, Aashirvaad Atta launches 'Namma Chakki' with a focus on scrutinizing market rivals and understanding their strategies. By directly reaching consumers with a D2C model, Aashirvaad seeks to gain insights into the market rival scrutiny, allowing the brand to adapt and respond effectively to the dynamic market environment. To gain a competitive edge and increase its market share, Aashirvaad expands its product range with the introduction of the AASHIRVAAD RAVA series in January 2023. This diversification aligns with market player strategies that aim to offer a broader array of products to cater to various consumer preferences. The RAVA range, including Double Roasted Suji Rava, Bansi Rava, and Samba Rava, demonstrates Aashirvaad's commitment to providing nutritious and tasty options to its customers. In the realm of market rival scrutiny, Aashirvaad positions its RAVA range as versatile, easy to cook, and nutritious, addressing the ever-changing demands of consumers. The brand strategically leverages its years of experience and expertise in wheat to introduce products that are not only innovative but also align with health and wellness trends. As part of its market player strategies, Aashirvaad ensures that its RAVA products undergo careful processing, thorough cleaning, and hygienic packaging. The introduction of Double Roasted Suji Rava, made from high-quality MP wheat, showcases the brand's commitment to quality, preventing infestation, and extending product shelf life. Aashirvaad's Bansi Rava, made from durum wheat, emphasizes nutritional goodness, including protein, iron, and magnesium. The incorporation of Special Colour Sorter Technology in the manufacturing process demonstrates the brand's dedication to providing quality and purity, thereby influencing market rival scrutiny. AASHIRVAAD Samba Rava, made from 100% Khapli wheat grains, targets specific consumer preferences and regional influences. By sourcing wheat from select fields in Maharashtra, Aashirvaad taps into area-specific opportunities, aligning with its market player strategies for regional growth. The semolina market's competitive landscape is characterized by dynamic strategies, innovation, and a keen focus on understanding and responding to consumer preferences. Key players, including Aashirvaad Atta, are pivotal in shaping the industry's trajectory through strategic moves and product innovations.

Semolina Market Scope:Inquire Before Buying

Global Semolina Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 2.55 Bn. Forecast Period 2023 to 2029 CAGR: 2.5% Market Size in 2029: US $ 3.03 Bn. Segments Covered: by Source Wheat Rice Corn by Category Organic Conventional by Distribution Channel Supermarkets and hypermarkets Conventional stores Online Others Semolina Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players of the Semolina Market

1. Aashirvaad (Inida) 2. ITC Ltd. (India) 3. LT Foods (Inida) 4. Samrat (Inida) 5. General Mills Inc. (US) 6. Conagra Brands (US) 7. ARDENT MILLS (US) 8. Gilchester Organics (UK) 9. Shree Kailash Grain Mills Pvt. Ltd (India) 10. SADAF FOODS (US) 11. MISKO (Greece) 12. Kupiec (Poland) 13. Honeywell Flour Mills (Nigeria) 14. Europasta SE (Czech Republic) 15. Others Frequently Asked Questions and Answers about Semolina Market 1. What is Semolina? Ans: Semolina is a coarse flour made from durum wheat, known for its high protein content and versatile culinary applications. 2. What are the Key Drivers of the Semolina Market? Ans: Growing global population, changing consumer preferences, rising health consciousness, versatility in culinary applications, and the expansion of the food industry are key drivers. 3. What Opportunities Exist in the Semolina Market? Ans: Opportunities include innovation in product development, expansion in emerging markets, and aligning with health and wellness trends through specialized products. 4. What Challenges Does the Semolina Market Face? Ans: Challenges include fluctuating raw material prices, competition from substitutes, supply chain disruptions, and regulatory hurdles related to food safety and labeling. 5. Which Regions Contribute Significantly to the Semolina Market? Ans: Asia-Pacific, North America, Europe, Middle East and Africa, and Latin America are key regions influencing the global semolina market

1. Semolina Market: Research Methodology 2. Semolina Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Semolina Market: Dynamics 3.1. Semolina Market Trends by Region 3.1.1. Global Semolina Market Trends 3.1.2. North America Semolina Market Trends 3.1.3. Europe Semolina Market Trends 3.1.4. Asia Pacific Semolina Market Trends 3.1.5. Middle East and Africa Semolina Market Trends 3.1.6. South America Semolina Market Trends 3.2. Semolina Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Semolina Market Drivers 3.2.1.2. North America Semolina Market Restraints 3.2.1.3. North America Semolina Market Opportunities 3.2.1.4. North America Semolina Market Challenges 3.2.2. Europe 3.2.2.1. Europe Semolina Market Drivers 3.2.2.2. Europe Semolina Market Restraints 3.2.2.3. Europe Semolina Market Opportunities 3.2.2.4. Europe Semolina Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Semolina Market Drivers 3.2.3.2. Asia Pacific Semolina Market Restraints 3.2.3.3. Asia Pacific Semolina Market Opportunities 3.2.3.4. Asia Pacific Semolina Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Semolina Market Drivers 3.2.4.2. Middle East and Africa Semolina Market Restraints 3.2.4.3. Middle East and Africa Semolina Market Opportunities 3.2.4.4. Middle East and Africa Semolina Market Challenges 3.2.5. South America 3.2.5.1. South America Semolina Market Drivers 3.2.5.2. South America Semolina Market Restraints 3.2.5.3. South America Semolina Market Opportunities 3.2.5.4. South America Semolina Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Semolina Market 3.8. Analysis of Government Schemes and Initiatives For Semolina Market 3.9. The Global Pandemic Impact on Semolina Market 4. Semolina Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 4.1. Semolina Market Size and Forecast, by Source (2022-2029) 4.1.1. Wheat 4.1.2. Rice 4.1.3. Corn 4.2. Semolina Market Size and Forecast, by Category (2022-2029) 4.2.1. Organic 4.2.2. Conventional 4.3. Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.1. Supermarkets and hypermarkets 4.3.2. Conventional stores 4.3.3. Online 4.3.4. Others 4.4. Semolina Market Size and Forecast, by Region (2022-2029) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Semolina Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 5.1. North America Semolina Market Size and Forecast, by Source (2022-2029) 5.1.1. Wheat 5.1.2. Rice 5.1.3. Corn 5.2. North America Semolina Market Size and Forecast, by Category (2022-2029) 5.2.1. Organic 5.2.2. Conventional 5.3. North America Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.1. Supermarkets and hypermarkets 5.3.2. Conventional stores 5.3.3. Online 5.3.4. Others 5.4. North America Semolina Market Size and Forecast, by Country (2022-2029) 5.4.1. United States 5.4.1.1. United States Semolina Market Size and Forecast, by Source (2022-2029) 5.4.1.1.1. Wheat 5.4.1.1.2. Rice 5.4.1.1.3. Corn 5.4.1.2. United States Semolina Market Size and Forecast, by Category (2022-2029) 5.4.1.2.1. Organic 5.4.1.2.2. Conventional 5.4.1.3. United States Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.1.3.1. Supermarkets and hypermarkets 5.4.1.3.2. Conventional stores 5.4.1.3.3. Online 5.4.1.3.4. Others 5.4.2. Canada 5.4.2.1. Canada Semolina Market Size and Forecast, by Source (2022-2029) 5.4.2.1.1. Wheat 5.4.2.1.2. Rice 5.4.2.1.3. Corn 5.4.2.2. Canada Semolina Market Size and Forecast, by Category (2022-2029) 5.4.2.2.1. Organic 5.4.2.2.2. Conventional 5.4.2.3. Canada Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.2.3.1. Supermarkets and hypermarkets 5.4.2.3.2. Conventional stores 5.4.2.3.3. Online 5.4.2.3.4. Others 5.4.3. Mexico 5.4.3.1. Mexico Semolina Market Size and Forecast, by Source (2022-2029) 5.4.3.1.1. Wheat 5.4.3.1.2. Rice 5.4.3.1.3. Corn 5.4.3.2. Mexico Semolina Market Size and Forecast, by Category (2022-2029) 5.4.3.2.1. Organic 5.4.3.2.2. Conventional 5.4.3.3. Mexico Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.3.3.1. Supermarkets and hypermarkets 5.4.3.3.2. Conventional stores 5.4.3.3.3. Online 5.4.3.3.4. Others 6. Europe Semolina Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 6.1. Europe Semolina Market Size and Forecast, by Source (2022-2029) 6.2. Europe Semolina Market Size and Forecast, by Category (2022-2029) 6.3. Europe Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 6.4. Europe Semolina Market Size and Forecast, by Country (2022-2029) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Semolina Market Size and Forecast, by Source (2022-2029) 6.4.1.2. United Kingdom Semolina Market Size and Forecast, by Category (2022-2029) 6.4.1.3. United Kingdom Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.2. France 6.4.2.1. France Semolina Market Size and Forecast, by Source (2022-2029) 6.4.2.2. France Semolina Market Size and Forecast, by Category (2022-2029) 6.4.2.3. France Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.3. Germany 6.4.3.1. Germany Semolina Market Size and Forecast, by Source (2022-2029) 6.4.3.2. Germany Semolina Market Size and Forecast, by Category (2022-2029) 6.4.3.3. Germany Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.4. Italy 6.4.4.1. Italy Semolina Market Size and Forecast, by Source (2022-2029) 6.4.4.2. Italy Semolina Market Size and Forecast, by Category (2022-2029) 6.4.4.3. Italy Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.5. Spain 6.4.5.1. Spain Semolina Market Size and Forecast, by Source (2022-2029) 6.4.5.2. Spain Semolina Market Size and Forecast, by Category (2022-2029) 6.4.5.3. Spain Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.6. Sweden 6.4.6.1. Sweden Semolina Market Size and Forecast, by Source (2022-2029) 6.4.6.2. Sweden Semolina Market Size and Forecast, by Category (2022-2029) 6.4.6.3. Sweden Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.7. Austria 6.4.7.1. Austria Semolina Market Size and Forecast, by Source (2022-2029) 6.4.7.2. Austria Semolina Market Size and Forecast, by Category (2022-2029) 6.4.7.3. Austria Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Semolina Market Size and Forecast, by Source (2022-2029) 6.4.8.2. Rest of Europe Semolina Market Size and Forecast, by Category (2022-2029) 6.4.8.3. Rest of Europe Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 7. Asia Pacific Semolina Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 7.1. Asia Pacific Semolina Market Size and Forecast, by Source (2022-2029) 7.2. Asia Pacific Semolina Market Size and Forecast, by Category (2022-2029) 7.3. Asia Pacific Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 7.4. Asia Pacific Semolina Market Size and Forecast, by Country (2022-2029) 7.4.1. China 7.4.1.1. China Semolina Market Size and Forecast, by Source (2022-2029) 7.4.1.2. China Semolina Market Size and Forecast, by Category (2022-2029) 7.4.1.3. China Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.2. S Korea 7.4.2.1. S Korea Semolina Market Size and Forecast, by Source (2022-2029) 7.4.2.2. S Korea Semolina Market Size and Forecast, by Category (2022-2029) 7.4.2.3. S Korea Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.3. Japan 7.4.3.1. Japan Semolina Market Size and Forecast, by Source (2022-2029) 7.4.3.2. Japan Semolina Market Size and Forecast, by Category (2022-2029) 7.4.3.3. Japan Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.4. India 7.4.4.1. India Semolina Market Size and Forecast, by Source (2022-2029) 7.4.4.2. India Semolina Market Size and Forecast, by Category (2022-2029) 7.4.4.3. India Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.5. Australia 7.4.5.1. Australia Semolina Market Size and Forecast, by Source (2022-2029) 7.4.5.2. Australia Semolina Market Size and Forecast, by Category (2022-2029) 7.4.5.3. Australia Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.6. Indonesia 7.4.6.1. Indonesia Semolina Market Size and Forecast, by Source (2022-2029) 7.4.6.2. Indonesia Semolina Market Size and Forecast, by Category (2022-2029) 7.4.6.3. Indonesia Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.7. Malaysia 7.4.7.1. Malaysia Semolina Market Size and Forecast, by Source (2022-2029) 7.4.7.2. Malaysia Semolina Market Size and Forecast, by Category (2022-2029) 7.4.7.3. Malaysia Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.8. Vietnam 7.4.8.1. Vietnam Semolina Market Size and Forecast, by Source (2022-2029) 7.4.8.2. Vietnam Semolina Market Size and Forecast, by Category (2022-2029) 7.4.8.3. Vietnam Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.9. Taiwan 7.4.9.1. Taiwan Semolina Market Size and Forecast, by Source (2022-2029) 7.4.9.2. Taiwan Semolina Market Size and Forecast, by Category (2022-2029) 7.4.9.3. Taiwan Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Semolina Market Size and Forecast, by Source (2022-2029) 7.4.10.2. Rest of Asia Pacific Semolina Market Size and Forecast, by Category (2022-2029) 7.4.10.3. Rest of Asia Pacific Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 8. Middle East and Africa Semolina Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 8.1. Middle East and Africa Semolina Market Size and Forecast, by Source (2022-2029) 8.2. Middle East and Africa Semolina Market Size and Forecast, by Category (2022-2029) 8.3. Middle East and Africa Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 8.4. Middle East and Africa Semolina Market Size and Forecast, by Country (2022-2029) 8.4.1. South Africa 8.4.1.1. South Africa Semolina Market Size and Forecast, by Source (2022-2029) 8.4.1.2. South Africa Semolina Market Size and Forecast, by Category (2022-2029) 8.4.1.3. South Africa Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.2. GCC 8.4.2.1. GCC Semolina Market Size and Forecast, by Source (2022-2029) 8.4.2.2. GCC Semolina Market Size and Forecast, by Category (2022-2029) 8.4.2.3. GCC Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.3. Nigeria 8.4.3.1. Nigeria Semolina Market Size and Forecast, by Source (2022-2029) 8.4.3.2. Nigeria Semolina Market Size and Forecast, by Category (2022-2029) 8.4.3.3. Nigeria Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Semolina Market Size and Forecast, by Source (2022-2029) 8.4.4.2. Rest of ME&A Semolina Market Size and Forecast, by Category (2022-2029) 8.4.4.3. Rest of ME&A Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 9. South America Semolina Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 9.1. South America Semolina Market Size and Forecast, by Source (2022-2029) 9.2. South America Semolina Market Size and Forecast, by Category (2022-2029) 9.3. South America Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 9.4. South America Semolina Market Size and Forecast, by Country (2022-2029) 9.4.1. Brazil 9.4.1.1. Brazil Semolina Market Size and Forecast, by Source (2022-2029) 9.4.1.2. Brazil Semolina Market Size and Forecast, by Category (2022-2029) 9.4.1.3. Brazil Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 9.4.2. Argentina 9.4.2.1. Argentina Semolina Market Size and Forecast, by Source (2022-2029) 9.4.2.2. Argentina Semolina Market Size and Forecast, by Category (2022-2029) 9.4.2.3. Argentina Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Semolina Market Size and Forecast, by Source (2022-2029) 9.4.3.2. Rest Of South America Semolina Market Size and Forecast, by Category (2022-2029) 9.4.3.3. Rest Of South America Semolina Market Size and Forecast, by Distribution Channel (2022-2029) 10. Global Semolina Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Semolina Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Aashirvaad (India) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. LT Foods (India) 11.3. ITC Ltd. (India) 11.4. Samrat (India) 11.5. General Mills Inc. (US) 11.6. Conagra Brands (US) 11.7. ARDENT MILLS (US) 11.8. Gilchester Organics (UK) 11.9. Shree Kailash Grain Mills Pvt. Ltd (India) 11.10. SADAF FOODS (US) 11.11. MISKO (Greece) 11.12. Kupiec (Poland) 11.13. Honeywell Flour Mills (Nigeria) 11.14. Europasta SE (Czech Republic) 11.15. Others 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary