The Savory Ingredients Market size was valued at USD 8.89 Bn in 2022 and is expected to reach USD 13.02 Bn by 2029, at a CAGR of 5.6 %Overview of the Savory Ingredients Market

Traditional savory ingredients include hydrolyzed proteins (animal and plant), monosodium glutamate (MSG) and yeast extracts. By far, MSG is the most cost-effective flavor enhancer and dominates the savory ingredients market. Protein and sodium are also important components of savory taste. Protein-rich foods such as meat and fish contain high levels of amino acids, including glutamate. Sodium enhances the perception of savory taste by activating specific receptors on the tongue. The graphical representation and structural exclusive information showed the dominating region of the Savory Ingredients Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Savory Ingredients Market.To know about the Research Methodology :- Request Free Sample Report

Savory Ingredients Market Dynamics

Globalization of Food Culture and Rise of Plant-Based Diets are the key drivers for Savory Ingredients Market Shifting consumer tastes and preferences, characterized by a desire for diverse and globally inspired cuisines, are fuelling the demand for a broad range of savory ingredients. This shift is particularly influential in shaping the savory ingredients market in India, where consumers seek variety and international flavors. The heightened awareness of health and wellness is driving a demand for savory ingredients perceived as healthier options. This includes the preference for natural flavor enhancers and reduced-sodium alternatives, contributing significantly to the regional development of the savory ingredients market. The increasing adoption of plant-based diets is creating opportunities for the development of savory ingredients sourced from plants. This trend caters to the needs of vegetarian and vegan consumers, influencing both the production of savory ingredients and the overall landscape of dietary choices. The globalization of food culture has given rise to a broader market for savory ingredients in India. Consumers, seeking authentic and diverse flavors from various culinary traditions, are fostering the growth of savory flavors and expanding the market for these ingredients. Ongoing advances in food processing technologies play a pivotal role in the creation of novel savory ingredients. These innovations contribute to improved textures, flavors, and functionalities, shaping the production of savory ingredients, including the development of savory flavors and extracts. Natural and Clean Label Products and Increasing Demand for Functional Ingredients are the growth opportunities in the Savory Ingredients Market The increasing demand for natural and clean-label products in India offers a significant opportunity for companies. There is a rising consumer preference for transparency and natural sourcing, creating space for innovation and product development, ultimately contributing to the growth of the savory ingredients market in the US. The incorporation of functional ingredients, with health-promoting properties, presents a unique opportunity to tap into the wellness-focused market segment. This trend not only aligns with consumer preferences but also highlights the potential of the savory ingredients market in India to cater to health-conscious consumers. The growing prevalence of e-commerce and online retail platforms provides an avenue for companies to extend their reach to a broader consumer base. This shift in consumer purchasing behaviour influences the penetration of savory ingredients in Indonesia and opens up new distribution channels. Meeting consumer demand for unique and personalized flavor experiences presents an exciting opportunity for companies in the savory ingredients market. Offering customizable savory ingredient blends and products can have a significant impact on market share, particularly in Latin America where diverse taste preferences abound. Exploring and expanding into emerging markets presents a lucrative opportunity for savory ingredient manufacturers. With the culinary diversity and rising consumer interest in novel flavors, companies can tap into unexplored potential, contributing to the savory ingredients market size in the US, Canada, and Mexico. Sustainability Concerns and Supply Chain Disruptions are the restraining factors in the Savory Ingredients Market Evolving regulations and compliance issues related to food safety, labelling, and ingredient sourcing pose challenges for companies operating in the market, especially in regions like Japan, China, Germany, and South Korea. Disruptions in the supply chain, such as those stemming from natural disasters, geopolitical events, or pandemics, can significantly impact the availability and cost of key savory ingredients. Such disruptions affect the production processes and overall stability of savory ingredient markets. The increasing awareness of sustainability and environmental issues presents challenges for companies relying on resource-intensive or environmentally impactful sourcing practices. This concern extends to the production of savoury flavours and extracts, prompting the need for more sustainable practices in the industry. Fluctuations in the prices of key ingredients, such as spices or natural extracts, have the potential to impact production costs and profit margins for companies in the savory ingredients market, particularly in India, where cost dynamics can be influenced by various factors. The intense competitiveness of the market poses challenges for new entrants and smaller players attempting to establish a strong presence. This challenge is particularly evident in regions dominated by well-established companies, impacting the regional development of the savory ingredients market.

Savory Ingredients Market Segment Analysis

Source: The organic segment within the savory ingredients market in India is witnessing a notable surge in demand. Consumers, increasingly drawn to natural and sustainably sourced products, are propelling the growth of organic savory ingredients. This trend is particularly pronounced among health-conscious individuals seeking clean-label options, and the segment is anticipated to experience steady expansion in the Indian market. Despite facing scrutiny amidst the preference for natural options, synthetic savory ingredients maintain a significant market share, not only in India but globally. The convenience and cost-effectiveness of synthetic sources render them valuable, especially in the processed food industry, contributing to the overall regional and international market dynamics. Type: Yeast extracts emerge as a cornerstone in the savory ingredients market, celebrated for their rich umami flavor. Widely utilized in applications such as soups, sauces, and snacks, yeast extracts contribute substantially to the overall flavor profile of the final products, making them a key player not only in India but also in the global savory ingredients market. Starch, known for its versatility, acts as a texturizing and thickening agent in many savory food products. Its role in enhancing the sensory attributes of these products makes it a significant and integral segment within the savory ingredients market, impacting both regional and international consumer preferences. Hydrolized vegetable protein is gaining prominence as a plant-based alternative, addressing the escalating demand for vegetarian and vegan options, not only in India but across the globe. Its ability to impart savory notes positions it as a preferred choice in plant-based and meat analog products, marking a noteworthy trend in the industry with implications for regional and international markets. Nucleotides, contributing to the savory taste profile, serve as crucial flavor enhancers. Their application is particularly notable in the production of savory snacks and ready meals, where the emphasis is on enhancing and intensifying flavors to meet consumer expectations. This trend holds significance not only in India but also in shaping global preferences. MSG remains a stalwart in the savory ingredients market, recognized for its well-established role as a flavor enhancer. Widely used in Asian cuisines and processed foods, MSG enhances the umami taste, contributing significantly to the overall savory experience. Its influence extends beyond regional markets to impact the global savory ingredients industry. The "Others" category encompasses a spectrum of specialty savory ingredients, ranging from natural extracts to spice blends and proprietary flavor formulations. This segment underscores the industry's constant innovation to align with evolving consumer preferences and diversify product offerings, influencing both regional and international markets.Application: The ready meals segment, influenced by the savory ingredients market potential in India, holds a substantial market share, propelled by the convenience sought by busy consumers. Savory ingredients play a vital role in elevating the taste, texture, and overall palatability of ready-to-eat meals, reflecting a consumer trend towards time-efficient and flavourful meal solutions in India and beyond. Savory snacks, including chips, crackers, and nuts, form a cornerstone of the market, relying heavily on flavourful ingredients. The snacks segment is a key driver for the savory ingredients industry, with a strategic focus on delivering indulgent and satisfying taste experiences to meet the demands of snack-loving consumers, not only in India but also contributing to the savory ingredients market growth in the US and other global regions. While a niche application, the use of savory ingredients in animal feed is crucial for regional and international markets. These ingredients contribute to the palatability of pet and livestock feed, ensuring animals receive a well-balanced and appetizing diet, aligning with the broader emphasis on animal well-being globally. The "Others" category encompasses diverse applications, including sauces, condiments, and culinary preparations, influencing both regional and international markets. Savory ingredients play a versatile role in enhancing the taste and sensory attributes of a wide range of food products, demonstrating their adaptability across various culinary applications and impacting savory ingredients market share in Latin America and other global regions.

Savory Ingredients Market Regional Analysis

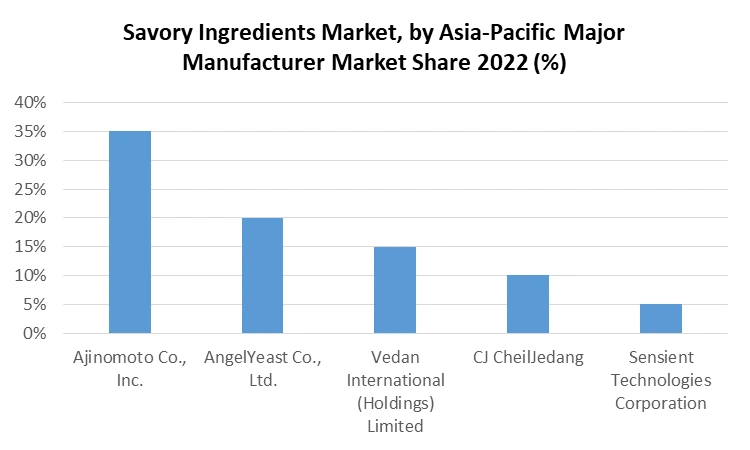

Asia-Pacific stands as a pivotal region in the global savory ingredients industry, driven by a rich culinary heritage and a vast consumer base. In countries like India, the market experiences substantial growth, propelled by the rising demand for authentic flavors and the incorporation of savory ingredients in traditional cuisines. This growth is further fuelled by the surge in the production of plant-based savory ingredients, catering to the preferences of vegetarian and vegan populations. Additionally, the influence of savory flavors extends to the snack industry, contributing to the overall growth of the market in Asia-Pacific and emphasizing the region's role as a key player in the global savory ingredients landscape. The savory ingredients market share in North America is characterized by a robust and mature landscape, with a particular emphasis on consumer preferences for diverse and innovative flavors that drive the demand for savory ingredients. This demand significantly impacts the region's market growth, aligning with health-conscious trends and influencing the adoption of organic and plant-based savory ingredients. The dynamic nature of the market is further fuelled by the strong presence of well-established players, ongoing product innovations, and a burgeoning interest in premium and gourmet food products, reflecting a multifaceted approach to meeting consumer demands. Europe's savory ingredients market reflects a harmonious blend of tradition and innovation, driven by a diverse food culture that fosters a demand for a wide array of savory flavors. Clean-label trends take center stage, propelling the growth of natural and organic savory ingredients. European consumers' appreciation for quality and authenticity stimulates the market, with a focused approach on unique blends and specialty ingredients. Regulatory standards and sustainability considerations also play a significant role, shaping the savory ingredients landscape in Europe and emphasizing the region's commitment to responsible and high-quality food practices. Latin America showcases a dynamic and evolving savory ingredients market penetration, influenced by a rich culinary heritage and changing consumer preferences. The region experiences a surge in demand for savory flavors and ingredients, particularly in popular local dishes, indicating a strong connection between traditional culinary preferences and market dynamics. The market is characterized by a growing interest in convenience foods and snacks, driving the demand for savory ingredients in these categories. Furthermore, the expansion of the food and beverage industry in countries like Brazil and Mexico fuels the market's growth, offering opportunities for both local and international players to explore and highlighting Latin America as an exciting and expanding market for savory ingredients. Savory Ingredients Market Competitive Landscape Kerry announces new partnerships to consolidate distribution network in Europe. Kerry, a prominent player in the savory ingredients market, has recently revealed new partnerships aimed at consolidating its distribution network in Europe. The company has selected Azelis and Caldic as distribution partners for Kerry products, strategically covering regions such as South Europe, the United Kingdom, Ireland, the Nordics, Benelux, Germany, Austria, Switzerland, and Eastern Europe. This move reflects Kerry's commitment to extending its reach and supplying a broader customer base with its industry-leading savory flavors and technologies. Kerry and Concern Worldwide partnership delivering improved nutrition, health access, and farm productivity for Niger communities. In a partnership with Concern Worldwide, Kerry, a leading taste and nutrition company, has made significant contributions to improving nutrition, health access, and farm productivity for communities in Niger. Through the Realigning Agriculture to Nutrition (RAIN) program, nearly 500 farmers have been trained, resulting in tangible improvements such as clean water access, increased food production, and enhanced health and nutrition practices. This partnership showcases Kerry's dedication to making a positive impact on global nutrition and well-being. DSM announces launch of Vertis CanolaPRO, the complete plant protein that’s free from major allergens. DSM, a global science-based company, has recently announced the launch of Vertis™ CanolaPRO, a high-quality canola protein isolate. After more than 10 years of research and development, DSM has unlocked the healthy protein from canola seeds, providing the food industry with a plant-based protein that is free from major allergens. CanolaPRO addresses the demand for complete proteins, meeting the needs of consumers who identify as flexitarians and seek plant-based options without compromising on taste, texture, or health attributes. The launch aligns with the growing trend of consumers scrutinizing labels for high-quality complete protein and avoiding major allergens such as soy, gluten, and dairy.

Savory Ingredients Market Scope Table: Inquire Before Buying

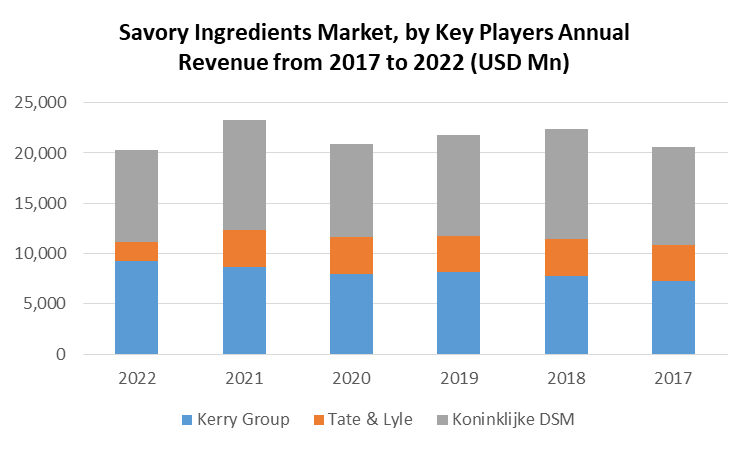

Global Savory Ingredients Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 8.89 Bn. Forecast Period 2023 to 2029 CAGR: 5.6% Market Size in 2029: US $ 13.02 Bn. Segments Covered: by Source Organic Synthetic by Type Yeast Extracts Starch Hydrolyzed Vegetable Protein Nucleotides Monosodium Glutamate Others by Application Ready Meals Snacks Animal Feed Others Savory Ingredients Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players of the Savory Ingredients Market

1. Kerry Group PLC (Ireland) 2. Tate & Lyle PLC (United Kingdom) 3. Koninklijke DSM N.V. (Netherlands) 4. Ajinomoto Co., Inc. (Japan) 5. Givaudan S.A. (Switzerland) 6. Symrise AG (Germany) 7. ABF Ingredients (United Kingdom) 8. AngelYeast Co. Ltd. (China) 9. Sensient Technologies Corporation (United States) 10. Diana Group (France) 11. Lesaffre Group (France) 12. Archer Daniels Midland Company (United States) 13. Vedan International (Holdings) Limited (Taiwan) 14. Associated British Foods (United Kingdom) 15. Sensient Technologies Corporation (United States) 16. Archer Daniels Midland Company (United States) Frequently Asked Questions and Answers 1. What factors are driving the growth of the market? Ans: The growth of the savory ingredients market is driven by factors such as changing consumer preferences, health and wellness trends, the rise of plant-based diets, globalization of food culture, and innovation in food technology. 2. Which regions are witnessing significant growth in the market? Ans: Key regions experiencing significant growth in the savory ingredients market include Asia-Pacific, particularly India, and North America. These regions are marked by a surge in demand for diverse flavors and innovative savory products. 3. What are the key opportunities in the market? Ans: Opportunities in the market include the demand for natural and clean-label products, the incorporation of functional ingredients, the influence of e-commerce and online retail, customization and personalization trends, and exploring emerging markets with a focus on culinary diversity. 4. What role does sustainability play in the market? Ans: Sustainability is a significant concern in the savory ingredients market, influencing sourcing practices. Increasing awareness of environmental issues prompts the industry to adopt more sustainable practices in ingredient production. 5. What challenges does the market face in terms of supply chain? Ans: Supply chain disruptions, stemming from natural disasters, geopolitical events, or pandemics, can significantly impact the availability and cost of key savory ingredients, affecting production processes and overall market stability.

1. Savory Ingredients Market: Research Methodology 2. Savory Ingredients Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Savory Ingredients Market: Dynamics 3.1. Savory Ingredients Market Trends by Region 3.1.1. Global Savory Ingredients Market Trends 3.1.2. North America Savory Ingredients Market Trends 3.1.3. Europe Savory Ingredients Market Trends 3.1.4. Asia Pacific Savory Ingredients Market Trends 3.1.5. Middle East and Africa Savory Ingredients Market Trends 3.1.6. South America Savory Ingredients Market Trends 3.2. Savory Ingredients Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Savory Ingredients Market Drivers 3.2.1.2. North America Savory Ingredients Market Restraints 3.2.1.3. North America Savory Ingredients Market Opportunities 3.2.1.4. North America Savory Ingredients Market Challenges 3.2.2. Europe 3.2.2.1. Europe Savory Ingredients Market Drivers 3.2.2.2. Europe Savory Ingredients Market Restraints 3.2.2.3. Europe Savory Ingredients Market Opportunities 3.2.2.4. Europe Savory Ingredients Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Savory Ingredients Market Drivers 3.2.3.2. Asia Pacific Savory Ingredients Market Restraints 3.2.3.3. Asia Pacific Savory Ingredients Market Opportunities 3.2.3.4. Asia Pacific Savory Ingredients Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Savory Ingredients Market Drivers 3.2.4.2. Middle East and Africa Savory Ingredients Market Restraints 3.2.4.3. Middle East and Africa Savory Ingredients Market Opportunities 3.2.4.4. Middle East and Africa Savory Ingredients Market Challenges 3.2.5. South America 3.2.5.1. South America Savory Ingredients Market Drivers 3.2.5.2. South America Savory Ingredients Market Restraints 3.2.5.3. South America Savory Ingredients Market Opportunities 3.2.5.4. South America Savory Ingredients Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Savory Ingredients Market 3.8. Analysis of Government Schemes and Initiatives For Savory Ingredients Market 3.9. The Global Pandemic Impact on Savory Ingredients Market 4. Savory Ingredients Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 4.1. Savory Ingredients Market Size and Forecast, by Source (2022-2029) 4.1.1. Organic 4.1.2. Synthetic 4.2. Savory Ingredients Market Size and Forecast, by Type (2022-2029) 4.2.1. Yeast Extracts 4.2.2. Starch 4.2.3. Hydrolyzed Vegetable Protein 4.2.4. Nucleotides 4.2.5. Monosodium Glutamate 4.2.6. Others 4.3. Savory Ingredients Market Size and Forecast, by Application (2022-2029) 4.3.1. Ready Meals 4.3.2. Snacks 4.3.3. Animal Feed 4.3.4. Others 4.4. Savory Ingredients Market Size and Forecast, by Region (2022-2029) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Savory Ingredients Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 5.1. North America Savory Ingredients Market Size and Forecast, by Source (2022-2029) 5.1.1. Organic 5.1.2. Synthetic 5.2. North America Savory Ingredients Market Size and Forecast, by Type (2022-2029) 5.2.1. Yeast Extracts 5.2.2. Starch 5.2.3. Hydrolyzed Vegetable Protein 5.2.4. Nucleotides 5.2.5. Monosodium Glutamate 5.2.6. Others 5.3. North America Savory Ingredients Market Size and Forecast, by Application (2022-2029) 5.3.1. Ready Meals 5.3.2. Snacks 5.3.3. Animal Feed 5.3.4. Others 5.4. North America Savory Ingredients Market Size and Forecast, by Country (2022-2029) 5.4.1. United States 5.4.1.1. United States Savory Ingredients Market Size and Forecast, by Source (2022-2029) 5.4.1.1.1. Organic 5.4.1.1.2. Synthetic 5.4.1.2. United States Savory Ingredients Market Size and Forecast, by Type (2022-2029) 5.4.1.2.1. Yeast Extracts 5.4.1.2.2. Starch 5.4.1.2.3. Hydrolyzed Vegetable Protein 5.4.1.2.4. Nucleotides 5.4.1.2.5. Monosodium Glutamate 5.4.1.2.6. Others 5.4.1.3. United States Savory Ingredients Market Size and Forecast, by Application (2022-2029) 5.4.1.3.1. Ready Meals 5.4.1.3.2. Snacks 5.4.1.3.3. Animal Feed 5.4.1.3.4. Others 5.4.2. Canada 5.4.2.1. Canada Savory Ingredients Market Size and Forecast, by Source (2022-2029) 5.4.2.1.1. Organic 5.4.2.1.2. Synthetic 5.4.2.2. Canada Savory Ingredients Market Size and Forecast, by Type (2022-2029) 5.4.2.2.1. Yeast Extracts 5.4.2.2.2. Starch 5.4.2.2.3. Hydrolyzed Vegetable Protein 5.4.2.2.4. Nucleotides 5.4.2.2.5. Monosodium Glutamate 5.4.2.2.6. Others 5.4.2.3. Canada Savory Ingredients Market Size and Forecast, by Application (2022-2029) 5.4.2.3.1. Ready Meals 5.4.2.3.2. Snacks 5.4.2.3.3. Animal Feed 5.4.2.3.4. Others 5.4.3. Mexico 5.4.3.1. Mexico Savory Ingredients Market Size and Forecast, by Source (2022-2029) 5.4.3.1.1. Organic 5.4.3.1.2. Synthetic 5.4.3.2. Mexico Savory Ingredients Market Size and Forecast, by Type (2022-2029) 5.4.3.2.1. Yeast Extracts 5.4.3.2.2. Starch 5.4.3.2.3. Hydrolyzed Vegetable Protein 5.4.3.2.4. Nucleotides 5.4.3.2.5. Monosodium Glutamate 5.4.3.2.6. Others 5.4.3.3. Mexico Savory Ingredients Market Size and Forecast, by Application (2022-2029) 5.4.3.3.1. Ready Meals 5.4.3.3.2. Snacks 5.4.3.3.3. Animal Feed 5.4.3.3.4. Others 6. Europe Savory Ingredients Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 6.1. Europe Savory Ingredients Market Size and Forecast, by Source (2022-2029) 6.2. Europe Savory Ingredients Market Size and Forecast, by Type (2022-2029) 6.3. Europe Savory Ingredients Market Size and Forecast, by Application (2022-2029) 6.4. Europe Savory Ingredients Market Size and Forecast, by Country (2022-2029) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Savory Ingredients Market Size and Forecast, by Source (2022-2029) 6.4.1.2. United Kingdom Savory Ingredients Market Size and Forecast, by Type (2022-2029) 6.4.1.3. United Kingdom Savory Ingredients Market Size and Forecast, by Application (2022-2029) 6.4.2. France 6.4.2.1. France Savory Ingredients Market Size and Forecast, by Source (2022-2029) 6.4.2.2. France Savory Ingredients Market Size and Forecast, by Type (2022-2029) 6.4.2.3. France Savory Ingredients Market Size and Forecast, by Application (2022-2029) 6.4.3. Germany 6.4.3.1. Germany Savory Ingredients Market Size and Forecast, by Source (2022-2029) 6.4.3.2. Germany Savory Ingredients Market Size and Forecast, by Type (2022-2029) 6.4.3.3. Germany Savory Ingredients Market Size and Forecast, by Application (2022-2029) 6.4.4. Italy 6.4.4.1. Italy Savory Ingredients Market Size and Forecast, by Source (2022-2029) 6.4.4.2. Italy Savory Ingredients Market Size and Forecast, by Type (2022-2029) 6.4.4.3. Italy Savory Ingredients Market Size and Forecast, by Application (2022-2029) 6.4.5. Spain 6.4.5.1. Spain Savory Ingredients Market Size and Forecast, by Source (2022-2029) 6.4.5.2. Spain Savory Ingredients Market Size and Forecast, by Type (2022-2029) 6.4.5.3. Spain Savory Ingredients Market Size and Forecast, by Application (2022-2029) 6.4.6. Sweden 6.4.6.1. Sweden Savory Ingredients Market Size and Forecast, by Source (2022-2029) 6.4.6.2. Sweden Savory Ingredients Market Size and Forecast, by Type (2022-2029) 6.4.6.3. Sweden Savory Ingredients Market Size and Forecast, by Application (2022-2029) 6.4.7. Austria 6.4.7.1. Austria Savory Ingredients Market Size and Forecast, by Source (2022-2029) 6.4.7.2. Austria Savory Ingredients Market Size and Forecast, by Type (2022-2029) 6.4.7.3. Austria Savory Ingredients Market Size and Forecast, by Application (2022-2029) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Savory Ingredients Market Size and Forecast, by Source (2022-2029) 6.4.8.2. Rest of Europe Savory Ingredients Market Size and Forecast, by Type (2022-2029) 6.4.8.3. Rest of Europe Savory Ingredients Market Size and Forecast, by Application (2022-2029) 7. Asia Pacific Savory Ingredients Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 7.1. Asia Pacific Savory Ingredients Market Size and Forecast, by Source (2022-2029) 7.2. Asia Pacific Savory Ingredients Market Size and Forecast, by Type (2022-2029) 7.3. Asia Pacific Savory Ingredients Market Size and Forecast, by Application (2022-2029) 7.4. Asia Pacific Savory Ingredients Market Size and Forecast, by Country (2022-2029) 7.4.1. China 7.4.1.1. China Savory Ingredients Market Size and Forecast, by Source (2022-2029) 7.4.1.2. China Savory Ingredients Market Size and Forecast, by Type (2022-2029) 7.4.1.3. China Savory Ingredients Market Size and Forecast, by Application (2022-2029) 7.4.2. S Korea 7.4.2.1. S Korea Savory Ingredients Market Size and Forecast, by Source (2022-2029) 7.4.2.2. S Korea Savory Ingredients Market Size and Forecast, by Type (2022-2029) 7.4.2.3. S Korea Savory Ingredients Market Size and Forecast, by Application (2022-2029) 7.4.3. Japan 7.4.3.1. Japan Savory Ingredients Market Size and Forecast, by Source (2022-2029) 7.4.3.2. Japan Savory Ingredients Market Size and Forecast, by Type (2022-2029) 7.4.3.3. Japan Savory Ingredients Market Size and Forecast, by Application (2022-2029) 7.4.4. India 7.4.4.1. India Savory Ingredients Market Size and Forecast, by Source (2022-2029) 7.4.4.2. India Savory Ingredients Market Size and Forecast, by Type (2022-2029) 7.4.4.3. India Savory Ingredients Market Size and Forecast, by Application (2022-2029) 7.4.5. Australia 7.4.5.1. Australia Savory Ingredients Market Size and Forecast, by Source (2022-2029) 7.4.5.2. Australia Savory Ingredients Market Size and Forecast, by Type (2022-2029) 7.4.5.3. Australia Savory Ingredients Market Size and Forecast, by Application (2022-2029) 7.4.6. Indonesia 7.4.6.1. Indonesia Savory Ingredients Market Size and Forecast, by Source (2022-2029) 7.4.6.2. Indonesia Savory Ingredients Market Size and Forecast, by Type (2022-2029) 7.4.6.3. Indonesia Savory Ingredients Market Size and Forecast, by Application (2022-2029) 7.4.7. Malaysia 7.4.7.1. Malaysia Savory Ingredients Market Size and Forecast, by Source (2022-2029) 7.4.7.2. Malaysia Savory Ingredients Market Size and Forecast, by Type (2022-2029) 7.4.7.3. Malaysia Savory Ingredients Market Size and Forecast, by Application (2022-2029) 7.4.8. Vietnam 7.4.8.1. Vietnam Savory Ingredients Market Size and Forecast, by Source (2022-2029) 7.4.8.2. Vietnam Savory Ingredients Market Size and Forecast, by Type (2022-2029) 7.4.8.3. Vietnam Savory Ingredients Market Size and Forecast, by Application (2022-2029) 7.4.9. Taiwan 7.4.9.1. Taiwan Savory Ingredients Market Size and Forecast, by Source (2022-2029) 7.4.9.2. Taiwan Savory Ingredients Market Size and Forecast, by Type (2022-2029) 7.4.9.3. Taiwan Savory Ingredients Market Size and Forecast, by Application (2022-2029) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Savory Ingredients Market Size and Forecast, by Source (2022-2029) 7.4.10.2. Rest of Asia Pacific Savory Ingredients Market Size and Forecast, by Type (2022-2029) 7.4.10.3. Rest of Asia Pacific Savory Ingredients Market Size and Forecast, by Application (2022-2029) 8. Middle East and Africa Savory Ingredients Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 8.1. Middle East and Africa Savory Ingredients Market Size and Forecast, by Source (2022-2029) 8.2. Middle East and Africa Savory Ingredients Market Size and Forecast, by Type (2022-2029) 8.3. Middle East and Africa Savory Ingredients Market Size and Forecast, by Application (2022-2029) 8.4. Middle East and Africa Savory Ingredients Market Size and Forecast, by Country (2022-2029) 8.4.1. South Africa 8.4.1.1. South Africa Savory Ingredients Market Size and Forecast, by Source (2022-2029) 8.4.1.2. South Africa Savory Ingredients Market Size and Forecast, by Type (2022-2029) 8.4.1.3. South Africa Savory Ingredients Market Size and Forecast, by Application (2022-2029) 8.4.2. GCC 8.4.2.1. GCC Savory Ingredients Market Size and Forecast, by Source (2022-2029) 8.4.2.2. GCC Savory Ingredients Market Size and Forecast, by Type (2022-2029) 8.4.2.3. GCC Savory Ingredients Market Size and Forecast, by Application (2022-2029) 8.4.3. Nigeria 8.4.3.1. Nigeria Savory Ingredients Market Size and Forecast, by Source (2022-2029) 8.4.3.2. Nigeria Savory Ingredients Market Size and Forecast, by Type (2022-2029) 8.4.3.3. Nigeria Savory Ingredients Market Size and Forecast, by Application (2022-2029) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Savory Ingredients Market Size and Forecast, by Source (2022-2029) 8.4.4.2. Rest of ME&A Savory Ingredients Market Size and Forecast, by Type (2022-2029) 8.4.4.3. Rest of ME&A Savory Ingredients Market Size and Forecast, by Application (2022-2029) 9. South America Savory Ingredients Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 9.1. South America Savory Ingredients Market Size and Forecast, by Source (2022-2029) 9.2. South America Savory Ingredients Market Size and Forecast, by Type (2022-2029) 9.3. South America Savory Ingredients Market Size and Forecast, by Application (2022-2029) 9.4. South America Savory Ingredients Market Size and Forecast, by Country (2022-2029) 9.4.1. Brazil 9.4.1.1. Brazil Savory Ingredients Market Size and Forecast, by Source (2022-2029) 9.4.1.2. Brazil Savory Ingredients Market Size and Forecast, by Type (2022-2029) 9.4.1.3. Brazil Savory Ingredients Market Size and Forecast, by Application (2022-2029) 9.4.2. Argentina 9.4.2.1. Argentina Savory Ingredients Market Size and Forecast, by Source (2022-2029) 9.4.2.2. Argentina Savory Ingredients Market Size and Forecast, by Type (2022-2029) 9.4.2.3. Argentina Savory Ingredients Market Size and Forecast, by Application (2022-2029) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Savory Ingredients Market Size and Forecast, by Source (2022-2029) 9.4.3.2. Rest Of South America Savory Ingredients Market Size and Forecast, by Type (2022-2029) 9.4.3.3. Rest Of South America Savory Ingredients Market Size and Forecast, by Application (2022-2029) 10. Global Savory Ingredients Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Savory Ingredients Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Kerry Group PLC (Ireland) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Tate & Lyle PLC (United Kingdom) 11.3. Koninklijke DSM N.V. (Netherlands) 11.4. Ajinomoto Co., Inc. (Japan) 11.5. Givaudan S.A. (Switzerland) 11.6. Symrise AG (Germany) 11.7. ABF Ingredients (United Kingdom) 11.8. AngelYeast Co. Ltd. (China) 11.9. Sensient Technologies Corporation (United States) 11.10. Diana Group (France) 11.11. Lesaffre Group (France) 11.12. Archer Daniels Midland Company (United States) 11.13. Vedan International (Holdings) Limited (Taiwan) 11.14. Associated British Foods (United Kingdom) 11.15. Sensient Technologies Corporation (United States) 11.16. Archer Daniels Midland Company (United States) 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary