Global Satellite IoT Market size was valued at USD 1.88 Bn in 2023 and is expected to reach USD 7.95 Bn. by 2030, at a CAGR of 22.7%.Satellite IoT Market Overview

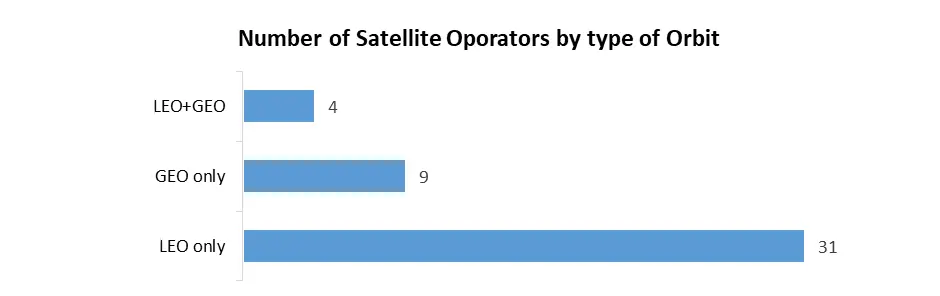

Satellite IoT (Internet of Things) is used in industries such as agriculture, environmental monitoring, transportation, maritime, and asset tracking. This service monitors and facilitates data, and assets and collects them through a remote location. Satellite IoT provides a unique connectivity solution it is the main option where the infrastructure is in space, orbiting the Earth. Depending on the orbit, the satellites change position over time while maintaining the same general blanket coverage, or stay in the same position relative to the Earth. Satellite IoT Market is driven by the increasing use of satellite networks to facilitate global connectivity. It often relies on Low Earth Orbit (LEO) satellite networks, which give high bandwidth and low latency but require a greater number of satellites to maintain coverage. Satellite IoT is used as a standalone solution or a complement to “terrestrial networks” such as cellular connectivity.To know about the Research Methodology :- Request Free Sample Report The satellite-based Internet of Things (IoT) industry is gaining traction, offering unique advantages in specific scenarios. While Wi-Fi and cellular networks are preferable where available, satellites become invaluable in areas lacking terrestrial infrastructure, such as tracking cargo containers across the ocean or monitoring agricultural networks. Additionally, for logistics crossing multiple networks, like truck deliveries spanning several countries, satellite IoT eliminates the complexity of dealing with various carriers. Common in smart metering, IoT technologies feature low-power, long-range capabilities, and resilience to interference—qualities aligning well with satellite requirements. The rise of CubeSat technology further facilitates satellite IoT, streamlining construction and lowering entry barriers. Ongoing advancements, such as optical communication with lasers, hold promise for future improvements in satellite IoT capabilities. Increasing use of Satellite IoT for various industrial sectors, including agriculture, oil and gas, mining, maritime, and transportation driving the Satellite IoT Market growth. These industries use this satellite connectivity service and to monitor and manage assets, track vehicles, collect environmental data, and improve operational efficiency across the world. Satellite IoT Market Dynamics: Growth Driver, Opportunities, Challenges and Restrain Factors Technology Development in Satellite IoT Services and Wireless Technology to Drive Market Growth Satellite IoT is the integration of Internet of Things devices and applications with satellite networks. IoT devices are small, low-power devices equipped with sensors and connectivity capabilities to gather data and communicate with other devices or systems. The Internet of Things (IoT) and Machine-to-machine (M2M) communication a responsible factor for the growth of revenue strategies of the Satellite IoT Market. The MMR analysts estimate according to a study of Statistics, that more than 6,000 satellites orbit the Earth. Around 3,000 of them are in LEO and many of these satellites are owned by the same entities, enabling corporations and government agencies to network them together. While most people are familiar with satellite applications such as GPS tracking, this technology has only recently been leveraged for other networking applications by Internet access. Satellite technology already has a proven reliability in the Industrial IoT ecosystem, and as IoT grows it continues to be a valuable resource to cities, communities, farming and manufacturers as they become more interconnected. Currently, around 2.7 million devices are supported through satellite IoT.4 These devices include infrastructure, smart grid, oil and gas, disaster monitoring, and environmental monitoring. The broad coverage of satellite services means that these devices are reliably supported anywhere in the world. The three main reasons to consider satellite IoT are that it works in remote locations where there’s no other coverage, it works as a backup when another solution has gaps in coverage, and it is extend the coverage of certain networks. The Internet of Things (IoT) has changed industries, and businesses with remote monitoring, analysis, and control devices. The use cases for IoT are constantly increasing, and there are now billions of connected devices worldwide. The Satellite IoT can manage satellite connectivity with the help of cellular IoT services and devices and has huge potential to drive the Satellite IoT Market growth. Growth of Global Connectivity to Drive Market: A key factor for the Satellite IoT Market is due to satellite IoT provides global coverage, enabling connectivity in remote and unallocated areas, in which terrestrial networks are unavailable or unreliable. Also, it allows businesses and organizations to increase their IoT deployments into a wider geographic area and is expected to create new market opportunities. Satellite IoT plays a key role in the emergency and disaster management industry. During natural disasters or emergencies, terrestrial networks become unreliable or completely disrupted. Defense and aerospace industries are increasingly adopting this technology to take control of the enemy before the attack. Satellite IoT Innovation to Create Lucrative Opportunity for the Satellite Iot Market Growth Satellite IoT devices are smaller, cheaper, more powerful, and smarter, with the ability to compute the least cost routing with dual-mode cellular satellite connectivity, which automatically chooses the most cost-effective messaging option at the time. Research and development innovation activities have driven improvements in efficiency, power optimization and satellite message delivery. Most satellite IoT services use packet data, an extremely efficient data exchange method that has none of the overhead an IP transaction would, particularly for simple reporting such as GPS location. In some cases, based on regularly scheduled reporting, the overhead in IP traffic can cause an increase of more than 20 times the data used by satellites. Satellite providers have taken steps to simplify integration of this protocol for users, by including parsing, compression, expansion and offering multiple access methods at the data gateways. All such factors are expected to influence the satellite IoT market growth during the forecast period. For example, ORBCOMM’s DeviceCloud abstracts data from devices to have messages presented identically whether they originate from satellite or cellular.

Table: Top 13 Satellite IoT Companies: Revolutionizing Connectivity in Remote Areas

Company Country Key Offerings Inmarsat UK ELERA satellite IoT service leveraging GEO constellations. Fleet Connect and Fleet Data solutions for maritime insights. Astrocast Switzerland 18 LEO nano-satellites offering IoT connectivity, with goals of 80 satellites. Partnered with Avirtech for precision farming. Eutelsat France IoT FIRST solution using GEO satellite constellation. Catering to retail, energy, agriculture, and telecom industries. Lacuna Space UK LoRaWAN protocol for ground-based IoT devices. Partnered with Wyld Networks for satellite IoT solutions. FOSSA Systems Spain Satellite IoT services with 13 pico-satellites, targeting 80 satellites by 2024. Backward compatible with LoRa protocols. Globalstar United States Provides two-way duplex and one-way transmission. Key player in emergency messaging services, supporting Apple. ORBCOMM United States Offers satellite IoT services via LEO-oriented ORBCOMM OG2 and GEO-oriented IsatData Pro (IDP). Wyld Networks Sweden DTS LoRaWAN connectivity through Lacuna Space, Eutelsat, and other LEO operators. Plans to integrate 5G NB-IoT. HEAD Aerospace Group China Utilizes 48 planned nano-satellites in LEO/SSO constellation. Supports LoRaWAN standards for low-cost IoT connectivity. Iridium United States Provides satellite IoT connectivity over 66 satellites in the L-band. Known for supporting a variety of applications. Myriota Australia Satellite IoT services over 20 deployed nano-satellites, targeting 50 in the future. Focus on power-efficient solutions. eSAT Global United States Leverages GEO satellites (L-band) from Thuraya for DTS connectivity with sub-2-second latencies. IoT M2M Council member. Hiber Netherlands Shifted to satellite IoT services in 2020. Acquired by Astrocast, uses Inmarsat’s ELERA network. Known for water supply CBM. Rise in IoT Security Concerns to Restrain the Market Growth

IoT devices often have a limited power supply and need to last for years in the field on a single charge. As a result, they need to transmit and receive data with little power. Adding encryption, authentication, and security protocols can significantly increase the power consumption of basic transmissions, so many IoT devices don’t have these capabilities. IoT devices are distributed for manufacturers to perform on-site updates and directly access the device. Remote firmware updates can consume significant power if the device doesn’t have enough data throughput and rely on the end users’ network infrastructure (such as WiFi), and have a perfect storm. The device becomes increasingly vulnerable to cyber-attacks and can be used to access other devices and applications on the network. The increasing IoT security, coverage, scalability, interoperability, bandwidth availability, shorter battery life and require remote access are some challenging factors for the Satellite Iot Market growth. However, Satellite IoT devices increase in need to be compact, lightweight, and power-efficient to function optimally in space. The hardware and size constraints are expected to hinder the capabilities and features of satellite IoT devices compared to their terrestrial counterparts. The high cost of deploying and maintaining satellite IoT networks is expected to create a major challenge for market growth. Launching and maintaining a satellite is an expensive endeavor, and the cost of the equipment and services needed to operate a satellite IoT network can be prohibitive for many businesses. To address this issue, companies are developing more cost-effective solutions such as low-cost satellites and small-scale networks. The latency of the signal due to the delay in the data transmission and reliability of the satellite IoT network is another restraining factor for the Satellite IoT market growth. Satellite IoT Market Key Trends to Drive the Market Growth Increasing Demand for Environmental Monitoring Devices to Boost the Market: With growing environmental safety concerns regarding climate change conditions and the rise in need for environmental monitoring devices, satellite IoT work a crucial role. It gives real-time tracking of weather patterns data. Also, it detects tsunamis and cyclones in oceanic as well as gives alerts about the conditions. Increasing such harmful environmental activities is expected to drive the Satellite IoT Market growth potential.New Integration with 5G Networks Trend to Push Satellite IoT Market Forward: The integration of satellite IoT with 5G networks to create growth opportunities for the Satellite IoT industry. 5G networks provide ultra-low frequency and high-bandwidth capabilities. In autonomous vehicles, smart cities, and defense and space launching programs integration is the leading responsible factor for market growth. Increasing Low Earth Orbit (LEO) Satellites technological advancement is expected to grow the potential applications and scalability of satellite IoT. Satellite orbits used for IoT/M2M services.

Satellite IoT Market Segment Analysis

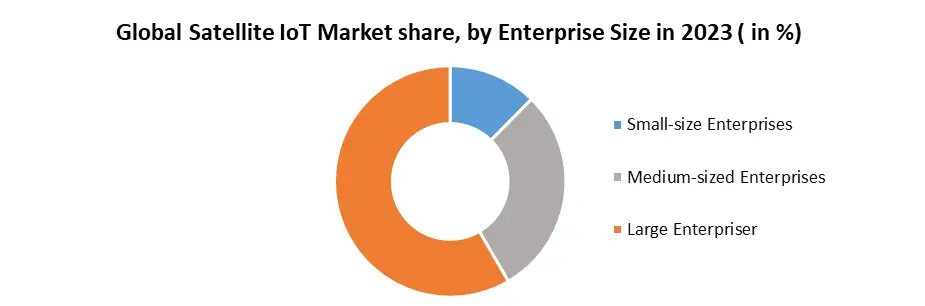

The Global Satellite IoT Market is segmented into service type, frequency band, application, end user and region. By region, the market is analyzed into North America, South America, Europe, Asia Pacific and MEA with respective their corresponding countries. By Frequency Band Based on the frequency band, ku and ka band segments dominated the largest Satellite IoT Market share in 2023. The ku band has a frequency from 12 GHz to 18 GHz and ka band frequency is 26.5 GHz to 40 GHz. Increasing this bandwidth frequency means it gives a higher data transfer rate. The Ku-band has short-range and high-resolution imaging power and is used for satellite communications, especially downlink. The Ku-band frequency spectrum for satellite communication is primarily used for maritime VSAT services. This band is a more economical and flexible means for obtaining a high throughput on smaller reflector dishes due to its wider capacity and high availability. Eutelsat Communications Paris launched a satellite-based IoT connectivity service named ‘Eutelsat IoT FIRST’ operating in Ku-band via Eutelsat’s geostationary satellites. However, In the Ka-band, is used for identified in the CoRaSat project and analyzed for potential flexible spectrum usage from CR techniques based on their relevance. Such factors are expected to drive ku and ka brand segment growth in the market.By Enterprise Size: Based on enterprise size, the Satellite IoT Market is segmented into small-sized, medium-sized and large-sized enterprises. The large enterprise segment held the largest market size share in 2023 and is expected to grow at a significant CAGR over the forecast period. The increasing adoption of satellite IoT in large-scale businesses is expected to create great opportunities for market growth. These satellites are very useful for high-precision and complex space missions. It easily navigates by remote by sensing and navigation system with the help of the internet. Continuously innovative and advanced strategies and techniques in IoT electronics are expected to drive segment growth during the forecast period. However, the small-sized and medium-sized enterprise segment is expected to hold its position in the global market during the forecast period. Factors such as digital transformation and an increase in government initiatives by various digital small and medium-sized enterprise campaigns throughout the world are expected to drive the segment growth in the market.

Satellite IoT Market Regional Analysis

North America held the largest market share in 2023 and is expected to maintain its position over the forecast period. Growth of digitalization in various industries and increasing space and earth observation activities, which provide high-resolution images and videos nearly 1 meter or less from the earth’s surface. Expansion of the space industry in the US and Canada and huge investments for launching various CubeSats and small satellites, large –medium satellites into LEO for applications for earth observations, entertainment and communications are expected to drive the regional market growth during the forecast period. There are several applications for Satellite IoT networks. Some of them are the existing ones and the rest are emerging in the changing scenarios. Right now the major focus is on the critical applications where the availability of the network has to be more than 99%. In addition to that other advantages of satellite networks such as larger coverage play the main roles in Satellite IoT applications. Satellite IoT Market Competitive Landscape The Satellite IoT Market report provides a strategic analysis of key players such as Inmarsat, Iridium Communications, Globalstar, Orbcomm, Kepler Communications, and others. These companies have end-to-end IoT solutions, advanced satellite technology and a focus on global connectivity. More companies contribute to the space industry’s growth with the reduced costs of satellite and rocket fuel. They differentiate themselves from various factors such as network infrastructure, low-latency communications, affordability, low-power solutions, and tailored offerings for specific industries. With strategies including partnerships, research and development investments, and competitive pricing, they strive to meet the growing demand for reliable and scalable satellite IoT connectivity. The dynamic competitive landscape fosters innovation, boost their network coverage, and enhances the value proposition for customers in the satellite IoT market.Satellite IoT Market Scope: Inquire before buying

Global Satellite IoT Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.88 Bn. Forecast Period 2024 to 2030 CAGR: 22.7% Market Size in 2030: US $ 7.95 Bn. Segments Covered: by Service Type Satellite IoT backhaul Direct-to-Satellite by Frequency Band L-band Ku and Ka-band S-band other by Application Marine telematics Smart agriculture Remote oil rigs Mining Energy and Utilities Construction Military and defense Transportation by Organization Size Small-size Enterprises Medium-sizedEnterprises Large Enterpriser Satellite IoT Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Satellite IoT Key Players are:

North America 1. Iridium Communication (US) 2. Global star (US) 3. Intelsat Corporation (USA) 4. Orbcomm (USA) 5. Viasat (US) 6. EchoStar Corporation (US) 7. Hughes Network Systems (US) 8. Space Exploration Technologies Corp. (SpaceX) (US) 9. Kepler Communications (Canada) 10. Helios Wire (Canada) 11. Intelsat (US) Europe 12. Inmarsat Global Limited (UK) 13. Astrocast (Switzerland) 14. Airbus S.A.S (Netherlands) 15. Inmarsat (UK) 16. SES S.A. (Luxembourg) 17. Eutelsat (France) 18. Hispasat (Spain) 19. Kongsberg Satellite Services (KSAT) (Norway) 20. Astrocast (Switzerland) 21. Hiber (Netherlands) Asia Pacific 22. Myriota (Australia) 23. Fleet Space Technologies (Australia) 24. other Middle East Africa 25. Thuraya (UAE) 26. iDirect (Dubai) 27. YahClick (Abu Dhabi, United Arab Emirates) Frequently Asked Questions: 1] What is the growth rate of the Global Satellite IoT Market? Ans. The Global Satellite IoT Market is growing at a significant rate of 22.7% during the forecast period. 2] Which region is expected to dominate the Global Satellite IoT Market? Ans. North America is expected to dominate the Satellite IoT Market during the forecast period. 3] What is the expected Global Satellite IoT Market size by 2030? Ans. The Satellite IoT Market size is expected to reach USD 7.95 Bn. by 2030. 4] Which are the top players in the Global Satellite IoT Market? Ans. The major top players in the Global Satellite IoT Market are Iridium Communication, Global Star, Inmarsat Global Limited and others. 5] What are the factors driving the Global Satellite IoT Market growth? Ans. The Satellite IoT manages satellite connectivity with the help of cellular IoT services and devices and is the primary factor in driving the Satellite IoT Market growth. 6] Which country is expected to dominate the Global Satellite IoT Market? Ans. The United States is expected to dominate the Satellite IoT Market during the forecast period.

1. Satellite IoT Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Satellite IoT Market: Dynamics 2.1. Satellite IoT Market Trends by Region 2.1.1. North America Satellite IoT Market Trends 2.1.2. Europe Satellite IoT Market Trends 2.1.3. Asia Pacific Satellite IoT Market Trends 2.1.4. Middle East and Africa Satellite IoT Market Trends 2.1.5. South America Satellite IoT Market Trends 2.2. Satellite IoT Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Satellite IoT Market Drivers 2.2.1.2. North America Satellite IoT Market Restraints 2.2.1.3. North America Satellite IoT Market Opportunities 2.2.1.4. North America Satellite IoT Market Challenges 2.2.2. Europe 2.2.2.1. Europe Satellite IoT Market Drivers 2.2.2.2. Europe Satellite IoT Market Restraints 2.2.2.3. Europe Satellite IoT Market Opportunities 2.2.2.4. Europe Satellite IoT Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Satellite IoT Market Drivers 2.2.3.2. Asia Pacific Satellite IoT Market Restraints 2.2.3.3. Asia Pacific Satellite IoT Market Opportunities 2.2.3.4. Asia Pacific Satellite IoT Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Satellite IoT Market Drivers 2.2.4.2. Middle East and Africa Satellite IoT Market Restraints 2.2.4.3. Middle East and Africa Satellite IoT Market Opportunities 2.2.4.4. Middle East and Africa Satellite IoT Market Challenges 2.2.5. South America 2.2.5.1. South America Satellite IoT Market Drivers 2.2.5.2. South America Satellite IoT Market Restraints 2.2.5.3. South America Satellite IoT Market Opportunities 2.2.5.4. South America Satellite IoT Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For the Satellite IoT Industry 2.8. Analysis of Government Schemes and Initiatives For Satellite IoT Industry 2.9. The Global Pandemic Impact on Satellite IoT Market 3. Satellite IoT Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2023-2030) 3.1. Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 3.1.1. Satellite IoT backhaul 3.1.2. Direct-to-Satellite 3.2. Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 3.2.1. L-band 3.2.2. Ku and Ka-band 3.2.3. S-band 3.2.4. Other 3.3. Satellite IoT Market Size and Forecast, by Application (2023-2030) 3.3.1. Marine telematics 3.3.2. Smart agriculture 3.3.3. Remote oil rigs 3.3.4. Mining 3.3.5. Energy and Utilities 3.3.6. Construction 3.3.7. Military and defense 3.3.8. Transportation 3.4. Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 3.4.1. Small-size Enterprises 3.4.2. Medium-sized Enterprises 3.4.3. Large Enterpriser 3.5. Satellite IoT Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Satellite IoT Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 4.1.1. Satellite IoT backhaul 4.1.2. Direct-to-Satellite 4.2. North America Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 4.2.1. L-band 4.2.2. Ku and Ka-band 4.2.3. S-band 4.2.4. Other 4.3. North America Satellite IoT Market Size and Forecast, by Application (2023-2030) 4.3.1. Marine telematics 4.3.2. Smart agriculture 4.3.3. Remote oil rigs 4.3.4. Mining 4.3.5. Energy and Utilities 4.3.6. Construction 4.3.7. Military and defense 4.3.8. Transportation 4.4. North America Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 4.4.1. Small-size Enterprises 4.4.2. Medium-sized Enterprises 4.4.3. Large Enterpriser 4.5. North America Satellite IoT Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 4.5.1.1.1. Satellite IoT backhaul 4.5.1.1.2. Direct-to-Satellite 4.5.1.2. United States Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 4.5.1.2.1. L-band 4.5.1.2.2. Ku and Ka-band 4.5.1.2.3. S-band 4.5.1.2.4. Other 4.5.1.3. United States Satellite IoT Market Size and Forecast, by Application (2023-2030) 4.5.1.3.1. Marine telematics 4.5.1.3.2. Smart agriculture 4.5.1.3.3. Remote oil rigs 4.5.1.3.4. Mining 4.5.1.3.5. Energy and Utilities 4.5.1.3.6. Construction 4.5.1.3.7. Military and defense 4.5.1.3.8. Transportation 4.5.1.4. United States Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 4.5.1.4.1. Small-size Enterprises 4.5.1.4.2. Medium-sized Enterprises 4.5.1.4.3. Large Enterpriser 4.5.2. Canada 4.5.2.1. Canada Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 4.5.2.1.1. Satellite IoT backhaul 4.5.2.1.2. Direct-to-Satellite 4.5.2.2. Canada Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 4.5.2.2.1. L-band 4.5.2.2.2. Ku and Ka-band 4.5.2.2.3. S-band 4.5.2.2.4. Other 4.5.2.3. Canada Satellite IoT Market Size and Forecast, by Application (2023-2030) 4.5.2.3.1. Marine telematics 4.5.2.3.2. Smart agriculture 4.5.2.3.3. Remote oil rigs 4.5.2.3.4. Mining 4.5.2.3.5. Energy and Utilities 4.5.2.3.6. Construction 4.5.2.3.7. Military and defense 4.5.2.3.8. Transportation 4.5.2.4. Canada Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 4.5.2.4.1. Small-size Enterprises 4.5.2.4.2. Medium-sized Enterprises 4.5.2.4.3. Large Enterpriser 4.5.3. Mexico 4.5.3.1. Mexico Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 4.5.3.1.1. Satellite IoT backhaul 4.5.3.1.2. Direct-to-Satellite 4.5.3.2. Mexico Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 4.5.3.2.1. L-band 4.5.3.2.2. Ku and Ka-band 4.5.3.2.3. S-band 4.5.3.2.4. Other 4.5.3.3. Mexico Satellite IoT Market Size and Forecast, by Application (2023-2030) 4.5.3.3.1. Marine telematics 4.5.3.3.2. Smart agriculture 4.5.3.3.3. Remote oil rigs 4.5.3.3.4. Mining 4.5.3.3.5. Energy and Utilities 4.5.3.3.6. Construction 4.5.3.3.7. Military and defense 4.5.3.3.8. Transportation 4.5.3.4. Mexico Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 4.5.3.4.1. Small-size Enterprises 4.5.3.4.2. Medium-sized Enterprises 4.5.3.4.3. Large Enterpriser 5. Europe Satellite IoT Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 5.2. Europe Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 5.3. Europe Satellite IoT Market Size and Forecast, by Application (2023-2030) 5.4. Europe Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 5.5. Europe Satellite IoT Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 5.5.1.2. United Kingdom Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 5.5.1.3. United Kingdom Satellite IoT Market Size and Forecast, by Application (2023-2030) 5.5.1.4. United Kingdom Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 5.5.2. France 5.5.2.1. France Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 5.5.2.2. France Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 5.5.2.3. France Satellite IoT Market Size and Forecast, by Application (2023-2030) 5.5.2.4. France Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 5.5.3.2. Germany Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 5.5.3.3. Germany Satellite IoT Market Size and Forecast, by Application (2023-2030) 5.5.3.4. Germany Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 5.5.4.2. Italy Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 5.5.4.3. Italy Satellite IoT Market Size and Forecast, by Application (2023-2030) 5.5.4.4. Italy Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 5.5.5.2. Spain Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 5.5.5.3. Spain Satellite IoT Market Size and Forecast, by Application (2023-2030) 5.5.5.4. Spain Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 5.5.6.2. Sweden Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 5.5.6.3. Sweden Satellite IoT Market Size and Forecast, by Application (2023-2030) 5.5.6.4. Sweden Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 5.5.7.2. Austria Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 5.5.7.3. Austria Satellite IoT Market Size and Forecast, by Application (2023-2030) 5.5.7.4. Austria Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 5.5.8.2. Rest of Europe Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 5.5.8.3. Rest of Europe Satellite IoT Market Size and Forecast, by Application (2023-2030) 5.5.8.4. Rest of Europe Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 6. Asia Pacific Satellite IoT Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 6.2. Asia Pacific Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 6.3. Asia Pacific Satellite IoT Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 6.5. Asia Pacific Satellite IoT Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 6.5.1.2. China Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 6.5.1.3. China Satellite IoT Market Size and Forecast, by Application (2023-2030) 6.5.2. China Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) S Korea 6.5.2.1. S Korea Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 6.5.2.2. S Korea Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 6.5.2.3. S Korea Satellite IoT Market Size and Forecast, by Application (2023-2030) 6.5.2.4. S Korea Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 6.5.3.2. Japan Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 6.5.3.3. Japan Satellite IoT Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Japan Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 6.5.4. India 6.5.4.1. India Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 6.5.4.2. India Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 6.5.4.3. India Satellite IoT Market Size and Forecast, by Application (2023-2030) 6.5.4.4. India Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 6.5.5.2. Australia Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 6.5.5.3. Australia Satellite IoT Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Australia Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 6.5.6.2. Indonesia Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 6.5.6.3. Indonesia Satellite IoT Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Indonesia Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 6.5.7.2. Malaysia Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 6.5.7.3. Malaysia Satellite IoT Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Malaysia Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 6.5.8.2. Vietnam Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 6.5.8.3. Vietnam Satellite IoT Market Size and Forecast, by Application (2023-2030) 6.5.8.4. Vietnam Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 6.5.9.2. Taiwan Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 6.5.9.3. Taiwan Satellite IoT Market Size and Forecast, by Application (2023-2030) 6.5.9.4. Taiwan Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 6.5.10.2. Rest of Asia Pacific Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 6.5.10.3. Rest of Asia Pacific Satellite IoT Market Size and Forecast, by Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 7. Middle East and Africa Satellite IoT Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 7.1. Middle East and Africa Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 7.2. Middle East and Africa Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 7.3. Middle East and Africa Satellite IoT Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 7.5. Middle East and Africa Satellite IoT Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 7.5.1.2. South Africa Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 7.5.1.3. South Africa Satellite IoT Market Size and Forecast, by Application (2023-2030) 7.5.2. South Africa Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) GCC 7.5.2.1. GCC Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 7.5.2.2. GCC Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 7.5.2.3. GCC Satellite IoT Market Size and Forecast, by Application (2023-2030) 7.5.2.4. GCC Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 7.5.3.2. Nigeria Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 7.5.3.3. Nigeria Satellite IoT Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Nigeria Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 7.5.4.2. Rest of ME&A Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 7.5.4.3. Rest of ME&A Satellite IoT Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Rest of ME&A Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 8. South America Satellite IoT Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 8.1. South America Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 8.2. South America Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 8.3. South America Satellite IoT Market Size and Forecast, by Application (2023-2030) 8.4. South America Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 8.5. South America Satellite IoT Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 8.5.1.2. Brazil Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 8.5.1.3. Brazil Satellite IoT Market Size and Forecast, by Application (2023-2030) 8.5.1.4. Brazil Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 8.5.2.2. Argentina Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 8.5.2.3. Argentina Satellite IoT Market Size and Forecast, by Application (2023-2030) 8.5.2.4. Argentina Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Satellite IoT Market Size and Forecast, by Service Type (2023-2030) 8.5.3.2. Rest Of South America Satellite IoT Market Size and Forecast, by Frequency Band (2023-2030) 8.5.3.3. Rest Of South America Satellite IoT Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Rest Of South America Satellite IoT Market Size and Forecast, by Organization Size (2023-2030) 9. Global Satellite IoT Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Satellite IoT Market Companies, by Market Capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Iridium Communication (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Global star (US) 10.3. Intelsat Corporation (USA) 10.4. Orbcomm (USA) 10.5. Viasat (US) 10.6. EchoStar Corporation (US) 10.7. Hughes Network Systems (US) 10.8. Space Exploration Technologies Corp. (SpaceX) (US) 10.9. Kepler Communications (Canada) 10.10. Helios Wire (Canada) 10.11. Intelsat (US) 10.12. Inmarsat Global Limited (UK) 10.13. Astrocast (Switzerland) 10.14. Airbus S.A.S (Netherlands) 10.15. Inmarsat (UK) 10.16. SES S.A. (Luxembourg) 10.17. Eutelsat (France) 10.18. Hispasat (Spain) 10.19. Kongsberg Satellite Services (KSAT) (Norway) 10.20. Astrocast (Switzerland) 10.21. Hiber (Netherlands) 10.22. Asia Pacific 10.23. Myriota (Australia) 10.24. Fleet Space Technologies (Australia) 10.25. Thuraya (UAE) 10.26. iDirect (Dubai) 10.27. YahClick (Abu Dhabi, United Arab Emirates) 11. Key Findings 12. Industry Recommendations 13. Satellite IoT Market: Research Methodology